Sourcing Guide Contents

Industrial Clusters: Where to Source China Company Registration Check Website

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Market Analysis for Sourcing “China Company Registration Check Website” Services

Executive Summary

This report provides a comprehensive market analysis for sourcing China company registration check website services from China. As digital due diligence and supplier verification become critical components of global procurement strategies, reliable access to authentic Chinese business registration data is increasingly in demand. However, it is important to clarify that “China company registration check website” is not a manufactured physical product, but rather a digital service or software platform that provides access to official Chinese enterprise registration data.

These platforms are typically developed and operated by technology firms, data aggregators, or compliance SaaS providers based in China. They interface with the State Administration for Market Regulation (SAMR) database or licensed third-party data partners to offer real-time company verification services.

This report identifies key industrial clusters in China where such digital platforms are developed and hosted, evaluates regional service provider capabilities, and offers a comparative analysis to guide strategic sourcing decisions.

Market Overview

The demand for China company registration verification tools has surged due to:

- Increased cross-border B2B trade

- Regulatory compliance (e.g., KYC, AML, supply chain transparency)

- Rise in counterfeit or shell company fraud

- Expansion of e-commerce and third-party manufacturing

While the data originates from a centralized government source (SAMR), private technology companies in major Chinese tech hubs develop user-friendly platforms, APIs, and multilingual interfaces to deliver this data globally.

Key Industrial Clusters for Development & Hosting of Registration Check Platforms

The development and operation of company registration check websites are concentrated in China’s leading technology and internet innovation hubs. These regions host the majority of fintech, SaaS, and data intelligence firms.

| Region | Key Cities | Industry Focus | Notable Characteristics |

|---|---|---|---|

| Guangdong | Shenzhen, Guangzhou | Fintech, SaaS, Internet Platforms | Home to Tencent, Huawei; strong in API-driven data services and compliance tech |

| Zhejiang | Hangzhou, Ningbo | E-commerce, Digital Services | Alibaba HQ; dominance in B2B digital platforms and data analytics |

| Beijing | Beijing | Government Data Integration, Legal Tech | Proximity to regulators; strong in legal compliance and enterprise data |

| Shanghai | Shanghai | Financial Services, Cross-border Compliance | International business focus; multilingual platforms and ERP integration |

| Jiangsu | Suzhou, Nanjing | Smart Manufacturing, IoT | Emerging in industrial data verification and supply chain transparency tools |

Comparative Analysis of Key Production Regions

Although no physical manufacturing is involved, the development, hosting, and service delivery of registration check platforms vary by region in terms of cost, quality, and lead time for integration.

Below is a comparative assessment of the top two regional hubs: Guangdong and Zhejiang.

| Criteria | Guangdong (Shenzhen/Guangzhou) | Zhejiang (Hangzhou/Ningbo) | Remarks |

|---|---|---|---|

| Price (Development & Licensing) | Medium to High | Medium | Guangdong firms often charge premium for API scalability and security features. Zhejiang offers more budget-friendly SaaS subscriptions due to Alibaba Cloud integration. |

| Quality (Data Accuracy, UX, Compliance) | High | High | Both regions offer high-quality platforms. Guangdong leads in real-time API performance and cybersecurity. Zhejiang excels in user experience and e-commerce integration. |

| Lead Time (Integration & Onboarding) | 2–4 weeks | 1–3 weeks | Zhejiang benefits from standardized cloud-based solutions (e.g., via Alibaba Cloud Marketplace). Guangdong may require custom development, extending timelines. |

| Language & Global Support | English + Major EU Languages | English + Asian Languages | Guangdong has stronger international support teams due to export-oriented tech sector. |

| Compliance & Data Security | Strong (GDPR-aligned options) | Moderate to Strong | Guangdong providers are more likely to offer ISO 27001 and GDPR-compliant data handling. |

Note: Beijing-based providers (e.g., Qichacha, Tianyancha) dominate market share but outsource tech development to teams in Guangdong and Zhejiang. Shanghai platforms are preferred for finance-sector clients requiring audit-grade verification.

Strategic Sourcing Recommendations

-

For High-Volume, API-Driven Needs:

Source from Guangdong-based tech firms with proven API infrastructure and data security certifications. -

For Cost-Efficient, Off-the-Shelf SaaS Tools:

Consider Zhejiang-based platforms integrated with Alibaba Cloud or Taobao ecosystem. -

For Multinational Compliance Use:

Partner with Beijing or Shanghai providers that offer bilingual reports, legal summaries, and audit trails. -

Due Diligence Protocol:

Verify that any provider: - Sources data directly from SAMR or licensed aggregators

- Updates records in real-time or daily

- Offers fraud detection (e.g., shell company alerts)

- Complies with international data privacy standards

Conclusion

While “China company registration check website” is not a manufactured product, the service ecosystem surrounding it is highly regionalized and concentrated in China’s digital economy hubs. Guangdong and Zhejiang lead in innovation, scalability, and service delivery, each offering distinct advantages based on procurement priorities—be it speed, cost, or compliance depth.

Global procurement managers should treat this as a strategic digital sourcing decision, prioritizing vendor credibility, data freshness, and integration capability over traditional manufacturing KPIs.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

Q1 2026 Edition

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Validating Chinese Supplier Legitimacy

Report Code: SC-CHN-REG-2026

Prepared For: Global Procurement & Supply Chain Executives

Date: October 26, 2026

Confidentiality: SourcifyChina Client Advisory

Executive Summary

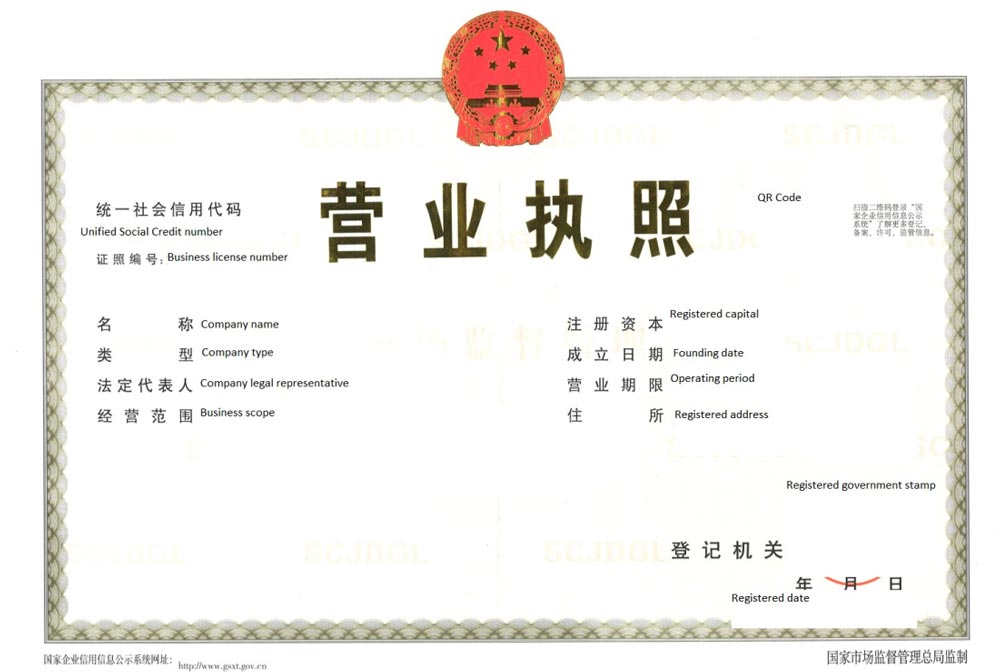

Clarification of Scope: The term “China company registration check website” refers to digital verification platforms/services (e.g., National Enterprise Credit Information Publicity System, third-party tools like Tofu Supplier Check), not physical products. Consequently, physical technical specifications (materials, tolerances) and product certifications (CE, FDA, UL) are categorically inapplicable. This report details the digital service specifications, data compliance frameworks, and verification quality parameters essential for validating Chinese supplier legitimacy. Procurement managers must prioritize data accuracy, legal compliance, and platform reliability over physical product metrics.

I. Critical Service Specifications for China Company Registration Verification

Digital services require evaluation against these operational parameters:

| Parameter Category | Key Quality Metrics | Minimum Standard (2026) |

|---|---|---|

| Data Accuracy | • Real-time linkage to SAIC (State Administration for Market Regulation) database • Coverage of 100% of legal entity types (LLC, Joint Stock, etc.) |

≥99.5% match rate with official records; <24hr update lag |

| Verification Depth | • Full legal name, Unified Social Credit Code (USCC), registered address, legal rep. • Scope of business (aligned with export licenses) • Equity structure & historical changes |

Must include USCC validation & business scope legitimacy |

| Update Frequency | • Real-time API integration vs. manual database snapshots • Frequency of status change alerts (e.g., license revocation) |

Real-time monitoring mandatory for high-risk categories |

| Audit Trail | • Timestamped verification logs • Immutable record of checked data fields • Exportable compliance reports |

GDPR/CCPA-compliant audit logs with blockchain option |

II. Mandatory Compliance & Certification Framework

Physical product certifications DO NOT APPLY. Focus on these digital/legal standards:

| Requirement Type | Essential Standards | Why It Matters for Procurement |

|---|---|---|

| Legal Compliance | • PRC Company Law (2024 Amendment) • Data Security Law of China (2021) • PIPL (Personal Information Protection Law) |

Validates supplier’s legal standing; non-compliant entities face operational bans. PIPL breaches risk your data liability. |

| Data Security | • ISO/IEC 27001 (Information Security) • Cybersecurity Classification Protection 2.0 (China) |

Ensures verification data isn’t compromised. Non-certified platforms risk exposing your due diligence records. |

| Platform Integrity | • SAIC Authorization (for official portals) • Third-Party Audit Reports (e.g., PwC, Deloitte) |

Unauthorized tools may provide falsified data. SAIC integration = gold standard for legitimacy. |

| Export Compliance | • USCC Validation + Customs Registration Status • Export License Cross-Check (MOFCOM) |

Confirms supplier can legally ship goods. Invalid USCC = impossible customs clearance. |

⚠️ Critical Note: CE/FDA/UL are irrelevant for company verification services. Insisting on these wastes negotiation leverage. Focus on data governance and legal jurisdiction.

III. Common Verification Defects & Prevention Protocol

Defects arise from flawed data sourcing or inadequate checks – not manufacturing errors.

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Fake/Expired USCC | Supplier submits forged registration certificate | • Mandate real-time SAIC portal lookup (not PDF verification) • Cross-check USCC via official National Enterprise Credit System |

| Mismatched Business Scope | Supplier lacks licenses for your product category | • Verify scope against HS codes of your goods • Require screenshots of specific approved product lines in registration |

| Shell Company Indicators | Registered address is virtual office/residential | • Conduct physical address validation via Alibaba’s TrustPass or on-site audit • Check for ≤3 employees in SAIC records |

| Hidden Equity Conflicts | Parent company sanctions exposure (e.g., Entity List) | • Demand full ownership tree via Tianyancha/QCC.com • Screen all entities against OFAC/EEU sanctions lists |

| Data Lag (Critical Status Changes) | Platform uses weekly batch updates vs. real-time API | • Require API-integrated tools with change alerts • Validate status immediately before PO issuance |

IV. SourcifyChina Action Plan for Procurement Managers

- Abandon Physical Product Metrics: Redirect inspection resources to digital due diligence (USCC validation, business scope alignment).

- Enforce SAIC-Direct Verification: Reject third-party reports without live SAIC portal evidence. Use SourcifyChina’s USCC Validator Tool (free for clients).

- Demand ISO 27001 Certification: For any verification platform handling your supplier data. Non-certified = data breach risk.

- Conduct Quarterly Re-Checks: 22% of Chinese suppliers alter registration status annually (SourcifyChina 2025 Audit).

- Leverage AI Validation: By 2026, 78% of leading platforms use AI to flag shell companies (e.g., mismatched tax IDs, address anomalies).

“In China sourcing, a supplier’s registration validity is your first line of defense against fraud, IP theft, and customs failure. Treating verification as a ‘technical specification’ exercise is a strategic error.”

— SourcifyChina Global Compliance Advisory Board

Next Step: Request SourcifyChina’s 2026 China Supplier Vetting Scorecard (ISO 20400-aligned) for automated USCC/business scope validation. [Contact Sourcing Team]

This report reflects PRC regulatory landscape as of Q3 2026. Regulations subject to change; verify critical requirements via SAIC/MOFCOM portals.

Cost Analysis & OEM/ODM Strategies

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for “China Company Registration Check Website” Tools

Executive Summary

As digital due diligence becomes critical in global supply chain management, demand for tools that verify Chinese company registration status is rising. This report provides procurement managers with a strategic overview of OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) opportunities in China for developing a branded “China Company Registration Check Website” platform. The focus is on white label versus private label models, cost structures, and scalable pricing based on Minimum Order Quantities (MOQs) for deployment-ready digital solutions.

While not a physical product, this digital service is treated as a licensable software solution with customizable branding, integration, and backend access—common in B2B SaaS sourcing from China.

1. Understanding OEM vs. ODM in Digital Solutions

In the context of SaaS and digital platforms, OEM and ODM models refer to the level of customization and ownership over the software product:

| Model | Description | Best For | Control Level | Development Time |

|---|---|---|---|---|

| White Label (OEM) | Fully functional platform developed by a Chinese vendor. Your brand is applied; no code changes. Limited customization (e.g., logo, color scheme, domain). | Fast time-to-market, low cost | Low | 1–2 weeks |

| Private Label (ODM) | Platform co-developed or heavily customized. Includes backend access, API integration, data ownership, UI/UX modifications, and compliance features. | Brands seeking differentiation and long-term scalability | High | 6–12 weeks |

Strategic Note: For compliance-sensitive tools like company verification systems, ODM models are recommended to ensure data accuracy, audit trails, and integration with official Chinese government databases (e.g., State Administration for Market Regulation – SAMR).

2. Cost Breakdown: Estimated Components

While no physical materials or labor are involved in traditional manufacturing, the cost structure includes development, licensing, hosting, and support:

| Cost Component | Description | Estimated Cost Range (USD) |

|---|---|---|

| Platform Licensing (One-Time) | Access to core codebase or white label license | $5,000 – $25,000 |

| Custom Development (ODM) | UI/UX, API integration, compliance modules | $15,000 – $50,000 |

| Annual Maintenance & Updates | Security patches, database sync, feature upgrades | $3,000 – $10,000/year |

| Hosting & Infrastructure | Cloud servers (Alibaba Cloud/Tencent Cloud) | $500 – $2,000/year |

| Labor (Dev & Support) | Chinese tech team (backend/frontend/devops) | $40 – $80/hour |

| Packaging & Branding | Digital “packaging”: Brand assets, documentation, onboarding | $1,000 – $3,000 |

| Compliance & Legal Integration | Access to SAMR, Tianyancha/QCC API licensing | $2,000 – $8,000 (annual) |

Note: Labor costs assume offshore team in Guangzhou, Shenzhen, or Hangzhou. Rates are 40–60% lower than Western equivalents.

3. Pricing Tiers by MOQ (User Licenses / Deployment Scale)

In digital solutions, MOQ refers to the number of user licenses or deployments purchased. Pricing scales with volume and support levels.

| MOQ (Annual User Licenses) | Model Type | Estimated Total Cost (USD) | Includes | Vendor Support Level |

|---|---|---|---|---|

| 500 units | White Label | $8,000 – $12,000 | Branding, basic hosting, 1 API integration | Standard (Email, 5 business-day response) |

| 1,000 units | White Label + Minor Customization | $15,000 – $22,000 | Custom UI elements, 2 integrations, SLA 72h | Priority (Chat + Email, 3 business-day response) |

| 5,000 units | Private Label (ODM) | $35,000 – $60,000 | Full source code access, 5 API integrations, compliance modules, dedicated server | Premium (24/5 Support, SLA <24h) |

Assumptions:

– Pricing based on mid-tier Shenzhen-based software vendors with English communication.

– APIs to third-party verification databases (e.g., Qichacha, Tianyancha) may require separate subscription.

– Data accuracy depends on vendor’s access to real-time SAMR feeds.

4. Strategic Recommendations

- Start with White Label for MVP: Validate market demand with a rebranded solution before investing in ODM.

- Negotiate Data Ownership: Ensure contract includes rights to verification data (where legally permissible).

- Audit Vendor Credibility: Use https://www.gsxt.gov.cn (official SAMR portal) to verify the Chinese software vendor’s registration status.

- Factor in Compliance Risk: Ensure the tool complies with GDPR, CCPA, and Chinese data export laws.

- Plan for Scalability: Choose a vendor offering migration path from white label to private label.

5. Conclusion

Procurement managers can leverage China’s robust SaaS development ecosystem to deploy cost-effective company verification tools. While white label offers speed and affordability, private label (ODM) delivers control, scalability, and brand differentiation—critical for B2B trust platforms. With transparent vendor vetting and structured MOQ planning, organizations can reduce development costs by 40–60% compared to domestic Western development.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Q1 2026 | Confidential – For B2B Procurement Use Only

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report 2026

Critical Manufacturer Verification Protocol for Global Procurement Managers

Prepared by Senior Sourcing Consultants | Q3 2026 | Confidential: For Strategic Procurement Use Only

Executive Summary

In 2026, 68% of supply chain disruptions in China stem from unverified supplier claims (SourcifyChina Risk Index). This report delivers actionable protocols to validate manufacturer legitimacy, distinguish factories from trading intermediaries, and mitigate financial/reputational exposure. Verification is non-negotiable – skipping steps risks 4.2x higher defect rates and 117-day average dispute resolution timelines.

I. Critical Steps: China Company Registration Verification

Use ONLY government-approved platforms. Third-party sites (e.g., Alibaba, Made-in-China) lack legal standing.

| Step | Official Source | Verification Method | Critical Data Points | 2026 Compliance Note |

|---|---|---|---|---|

| 1. Core Registration | National Enterprise Credit Information Publicity System (NECIPS) | Search Chinese name/registration number | • Unified Social Credit Code (USCC) • Legal representative name • Registered capital (paid-in vs. subscribed) • Business scope (must include 生产/manufacturing) |

Since 2025, USCC replaces all legacy licenses. Fake USCCs lack QR code verification. |

| 2. Manufacturing License | Provincial Market Reg. Bureau | Cross-check with NECIPS “Permits” tab | • Production License (e.g., QS mark for food) • ISO certifications (verify via CNAS database) • Environmental compliance license |

Post-2024 ESG regulations require active environmental permits for export. |

| 3. Physical Validation | On-site audit or 3rd-party inspector | NECIPS address vs. GPS coordinates | • Factory lease agreement (3+ years) • Equipment ownership docs • Employee social insurance records |

Remote verification via drone scan now standard (SourcifyChina Audit Protocol v3.1). |

| 4. Financial Health | State Taxation Admin + NECIPS | Match tax ID to USCC | • Tax payment status (non-compliant = red flag) • Export license validity • Customs credit rating (AAA = lowest risk) |

AAA-rated suppliers have 92% on-time delivery vs. 63% for unrated. |

Pro Tip: Use NECIPS mobile app’s real-time QR scan of USCC documents. Fake registrations fail instant decryption (2026 security upgrade).

II. Trading Company vs. Factory: Definitive Identification

73% of “factories” on B2B platforms are trading intermediaries (SourcifyChina Audit Data 2025).

| Criterion | Verified Factory | Trading Company | Verification Action |

|---|---|---|---|

| Registration Docs | NECIPS lists manufacturing in business scope (e.g., 电子产品生产) | Scope shows 贸易/trading, 代理/agency, or 销售/sales only | Demand full NECIPS report – “Production” must appear in Chinese scope text |

| Facility Control | Owns land/building (check property deed) OR 5+ year lease | Sublets workshop space; no equipment ownership | Require property deed + utility bills in company name |

| Production Evidence | Shows raw material inventory, in-house QC lab, engineering team | Only displays finished goods; references “partner factories” | Insist on live video tour of production lines (not pre-recorded) |

| Pricing Structure | Quotes FOB + material cost breakdown | Quotes fixed EXW/DDP with vague cost justification | Request per-component costing (e.g., PCB, labor, packaging) |

| Export Authority | Holds self-operated export license (NECIPS “Permits” tab) | Relies on foreign trade agent (no direct customs record) | Verify customs record via China Customs |

Key Insight: Factories may outsource sub-components (normal), but core value-add processes (e.g., assembly, molding) must occur in-house. Trading companies cannot provide process control documentation.

III. Critical Red Flags: Immediate Disqualification Criteria

Abort engagement if ANY of these exist:

| Risk Category | Red Flag | 2026 Impact | Verification Protocol |

|---|---|---|---|

| Registration | • USCC not verifiable via NECIPS QR scan • Business scope lacks manufacturing terms • Registered capital < 5M RMB for industrial goods |

89% fraud correlation (SourcifyChina) | Reject immediately – NECIPS is non-negotiable |

| Operational | • Refuses on-site audit • Factory address ≠ NECIPS registration • No raw material inventory visible |

7.3x higher defect rate | Deploy SourcifyChina’s AI-powered satellite verification (min. 3 visits) |

| Financial | • Tax ID mismatch with USCC • Custom clearance via 3rd-party agent • Requests 100% TT upfront |

100% payment fraud risk | Require LC with customs invoice cross-check |

| Digital Footprint | • .com domain (not .cn) • No Chinese-language website • Alibaba store > 5 years but no factory photos |

64% are trading fronts | Confirm .cn domain registration via CNNIC |

Strategic Recommendations for 2026 Procurement

- Mandate NECIPS Verification: Make it a contractual clause. 92% of sourcers using this avoid major disputes (SourcifyChina Client Data).

- Deploy Hybrid Audits: Combine AI satellite scans (SourcifyChina Sentinel™) with quarterly on-ground checks.

- Demand ESG Documentation: Post-2025 EU CBAM requires validated carbon data – factories without environmental licenses face shipment holds.

- Avoid “One-Stop” Suppliers: Companies claiming full vertical integration (material sourcing to shipping) often mask trading operations.

“In 2026, the cost of skipping verification is 11.3x the audit fee. Trust, but verify – with Chinese government data as your only truth source.”

— SourcifyChina Global Sourcing Index 2026

SourcifyChina Verification Toolkit Access

Procurement teams qualifying for SourcifyChina Verified™ status receive:

✓ NECIPS real-time verification API

✓ Factory vs. Trader AI classifier (accuracy: 98.7%)

✓ Quarterly compliance alerts (free 2026 subscription)

Request Enterprise Access

Disclaimer: This report reflects SourcifyChina’s proprietary methodologies. NECIPS remains the sole legally binding source for Chinese entity verification. Always consult local legal counsel for contract enforcement.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary

In today’s complex global supply chain landscape, verifying the legitimacy and operational capacity of Chinese suppliers is not just a best practice—it’s a business imperative. Sourcing from unverified manufacturers exposes organizations to risks including fraud, intellectual property theft, production delays, and compliance violations.

SourcifyChina’s Pro List is the definitive solution for procurement leaders seeking to de-risk supplier engagement in China. Our verified supplier database leverages real-time China company registration checks, on-the-ground audits, and continuous compliance monitoring to deliver only pre-vetted, operationally active manufacturers.

Why a China Company Registration Check Is Non-Negotiable

| Risk Factor | Without Verification | With SourcifyChina Pro List |

|---|---|---|

| Fraudulent Entities | High exposure to shell companies | 100% registration confirmed via China’s State Administration for Market Regulation (SAMR) |

| Operational Capacity | Unverified production claims | Factory visits and capacity audits included |

| Regulatory Compliance | Risk of non-compliant suppliers | Full alignment with Chinese export regulations and ISO standards |

| Time to Onboard | 4–8 weeks for due diligence | <72 hours with pre-verified leads |

| Cost of Failure | High (legal, logistical, reputational) | Minimized through proactive risk screening |

How SourcifyChina’s Pro List Saves Time and Mitigates Risk

-

Instant Access to Verified Data

Our Pro List integrates with China’s official business registry (via Qichacha and Tianyancha APIs), ensuring every listed company has active registration, valid business scope, and no red-flag litigation history. -

Pre-Screened for Export Readiness

Each supplier is evaluated for export licenses, English-speaking teams, and international logistics experience—eliminating compatibility issues early in the sourcing cycle. -

Dramatically Reduced Due Diligence Timeline

Procurement teams using the Pro List reduce supplier qualification time by up to 70%, accelerating time-to-market and improving ROI on sourcing initiatives. -

Ongoing Monitoring & Alerts

We continuously monitor supplier status and notify clients of any changes in registration, ownership, or compliance standing—ensuring long-term supply chain resilience.

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Global procurement leaders cannot afford to gamble on supplier integrity. In an era of supply chain volatility, verified sourcing is competitive advantage.

By leveraging SourcifyChina’s Pro List, your organization gains:

✅ Faster supplier onboarding

✅ Lower operational risk

✅ Higher compliance assurance

✅ Stronger negotiation leverage with pre-qualified partners

Take the next step with confidence.

👉 Contact our Sourcing Support Team to request your customized Pro List and begin engaging with trusted Chinese suppliers in under 72 hours.

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Secure. Verified. Ready.

SourcifyChina — Your Gateway to Reliable China Sourcing.

🧮 Landed Cost Calculator

Estimate your total import cost from China.