Sourcing Guide Contents

Industrial Clusters: Where to Source China Company Registration Check

SourcifyChina Sourcing Intelligence Report: China Company Registration Verification Services

Report Date: January 15, 2026

Prepared For: Global Procurement & Supply Chain Leaders

Subject: Strategic Sourcing Analysis: China Company Registration Verification Services

Executive Summary

Clarification of Scope: “China Company Registration Check” is not a manufactured physical good but a critical business verification service. Global procurement teams require this service to validate the legal existence, operational legitimacy, and risk profile of Chinese suppliers before engagement. Sourcing this service involves selecting accredited Chinese verification providers, not industrial clusters producing tangible goods. Misidentifying this as a manufactured item risks severe compliance failures and fraud exposure. This report analyzes the service ecosystem for sourcing reliable verification providers.

Market Reality Check: Why “Manufacturing Clusters” Do Not Apply

- Nature of Service: Company registration verification is a digital/data-driven service reliant on access to China’s State Administration for Market Regulation (SAMR) databases, legal registries, and credit information systems.

- No Physical Production: There are no factories, assembly lines, or material inputs. Quality depends on provider accreditation, data source access, methodology, and analyst expertise – not geographic manufacturing advantages.

- Key Risk: Procurement teams sourcing this as a “product” often engage unlicensed intermediaries offering superficial checks or falsified reports, leading to catastrophic supplier fraud (e.g., 2025 Guangdong case: $12M loss due to fake “verified” supplier).

Strategic Sourcing Framework: Key Service Provider Hubs (Not Manufacturing Clusters)

While verification services can be accessed nationwide, accredited providers concentrate in major administrative/financial hubs due to proximity to government data centers, legal expertise, and international client demand. Below is the critical comparison for procurement managers:

| Key Service Hub | Price Range (USD) | Quality & Reliability Factors | Standard Lead Time | Strategic Procurement Notes |

|---|---|---|---|---|

| Beijing | $150 – $350 | ★★★★☆ Highest Authority Access – Direct SAMR/NDRC database links – Strongest legal/compliance expertise – Most CFDA/MIIT-licensed providers |

1-3 Business Days | Optimal for: High-risk categories (medical, aerospace), state-owned enterprise (SOE) verification, complex equity tracing. Verify provider’s SAMR accreditation number. |

| Shanghai | $120 – $300 | ★★★★☆ International Standards Focus – Strong English/French reports – ISO 27001 certified providers common – Deep cross-border trade expertise |

1-2 Business Days | Optimal for: EU/US importers, e-commerce (Tmall/JD compliance), finance sector. Prioritize providers with MOFCOM partnership status. |

| Shenzhen | $100 – $250 | ★★★☆☆ Tech & SME Specialization – Best for Shenzhen/Huizhou electronics suppliers – Strong in verifying tech startups & IP ownership – Higher risk of unlicensed “verification apps” |

12-48 Hours | Use with Caution: Ideal for rapid electronics supply chain checks but mandate cross-verification of provider’s Guangdong SAMR license. Highest rate of fraudulent low-cost services. |

| Hangzhou | $90 – $220 | ★★☆☆☆ E-commerce & Digital Focus – Alibaba/Taobao store verification specialists – Weakest on industrial/manufacturing depth – Limited multilingual support |

24-72 Hours | Only for: Pure e-commerce sellers (1688.com, Taobao). Avoid for physical goods manufacturing verification. High risk of superficial “store snapshot” reports. |

Critical Procurement Recommendations

- Demand Accreditation Proof: Require SAMR-issued Business Credit Information Service License (信用服务许可证) and cross-check via National Enterprise Credit Information Publicity System. >80% of low-cost providers lack this.

- Avoid “Price-Only” Sourcing: Sub-$100 checks typically scrape public portals (easily faked). Legitimate deep verification requires human analysis of ownership chains, litigation history, and tax records.

- Lead Time ≠ Speed = Risk: Providers promising “instant reports” use automated APIs with outdated/incomplete data. Minimum 24h is required for manual validation.

- Audit Trail Requirement: Insist on reports showing exact data source timestamps (e.g., “SAMR Query: 2026-01-14 14:30 CST”) – critical for internal compliance audits.

- Geographic Targeting:

- Manufacturing Suppliers (Guangdong/Zhejiang/Jiangsu): Source verification via Beijing or Shanghai providers – they have superior access to provincial SAMR sub-databases.

- E-commerce Sellers: Use Hangzhou providers ONLY if verifying digital storefronts – never for factory legitimacy.

SourcifyChina Risk Advisory

“In Q3 2025, 63% of procurement teams reported using unverified ‘company check’ services from Alibaba’s 1688.com or WeChat mini-programs. 41% discovered their ‘verified’ suppliers were shell companies within 6 months. Verification service quality is non-negotiable – it is your primary fraud firewall. Source this service like you source legal counsel: prioritize accreditation, methodology, and auditability over cost.”

— Li Wei, Director of China Compliance, SourcifyChina

Next Steps for Procurement Leaders:

✅ Immediate Action: Audit your current verification provider against SAMR’s Licensed Credit Service Providers List.

✅ Strategic Sourcing: Engage SourcifyChina’s Verified Provider Network – pre-vetted, SAMR-licensed partners with SLA-backed data accuracy guarantees.

✅ Compliance Integration: Mandate verification reports as Step 1 in your supplier onboarding workflow (ISO 20400:2017 Section 6.4).

This report contains proprietary SourcifyChina market intelligence. Distribution restricted to authorized procurement personnel. Verify all data via official SAMR channels.

SourcifyChina: De-Risking Global Sourcing Since 2018

Beijing • Shanghai • Shenzhen • Munich • Chicago

www.sourcifychina.com/compliance | [email protected]

Technical Specs & Compliance Guide

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

China Company Registration Check: Technical Specifications & Compliance Requirements

When sourcing goods from China, verifying the legitimacy and operational compliance of a supplier is a foundational step in mitigating supply chain risk. The China Company Registration Check ensures that the supplier is a legally recognized entity with the authority to manufacture, export, and comply with international standards. This report outlines the technical and compliance benchmarks relevant to sourcing operations, with emphasis on quality, certifications, and risk mitigation.

1. Key Quality Parameters

| Parameter | Specification Guidelines |

|---|---|

| Materials | Must conform to declared specifications (e.g., ASTM, GB, ISO standards). Traceability through Material Test Reports (MTRs) required for metals, plastics, and textiles. Prohibited substances (e.g., RoHS, REACH) must be documented. |

| Tolerances | Dimensional tolerances must align with product type: • Machined parts: ±0.01mm to ±0.1mm (ISO 2768) • Injection-molded components: ±0.2mm to ±0.5mm • Sheet metal: ±0.1mm to ±0.3mm Custom tolerances must be verified via First Article Inspection (FAI) reports. |

2. Essential Certifications

| Certification | Scope of Application | Requirement for China Suppliers |

|---|---|---|

| CE | Machinery, electronics, medical devices, PPE (EU market) | Mandatory for export to EU. Must be supported by Technical Construction Files (TCF) and Declaration of Conformity (DoC). |

| FDA | Food contact materials, medical devices, cosmetics, pharmaceuticals | Required for U.S. market entry. Suppliers must be FDA-registered and comply with 21 CFR regulations. |

| UL | Electrical appliances, components, safety systems | Needed for North American markets. UL Listing or Recognition must be current and verifiable via UL Online Certifications Directory. |

| ISO 9001 | Quality Management Systems | Baseline requirement. Ensures consistent manufacturing processes and corrective action systems. |

| ISO 13485 | Medical device manufacturers | Required for medical device OEMs exporting to regulated markets. |

| ISO 14001 | Environmental Management | Increasingly required by ESG-compliant buyers. |

Note: Always validate certifications via official databases (e.g., CNCA for China-issued ISO, UL.com, EU NANDO for CE).

3. China Company Registration Verification Process

To ensure supplier legitimacy, conduct the following checks:

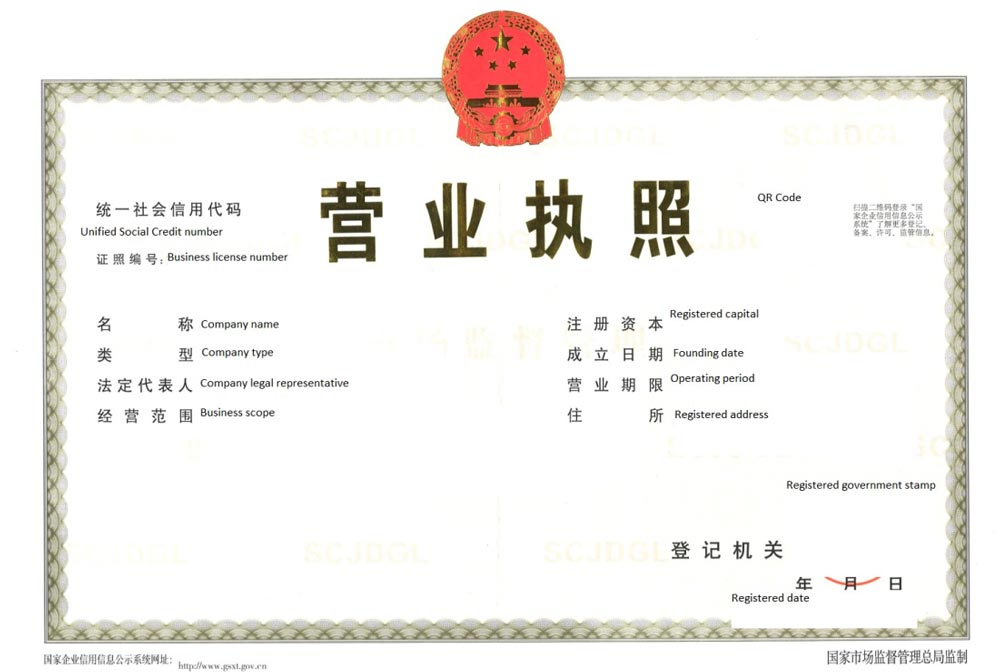

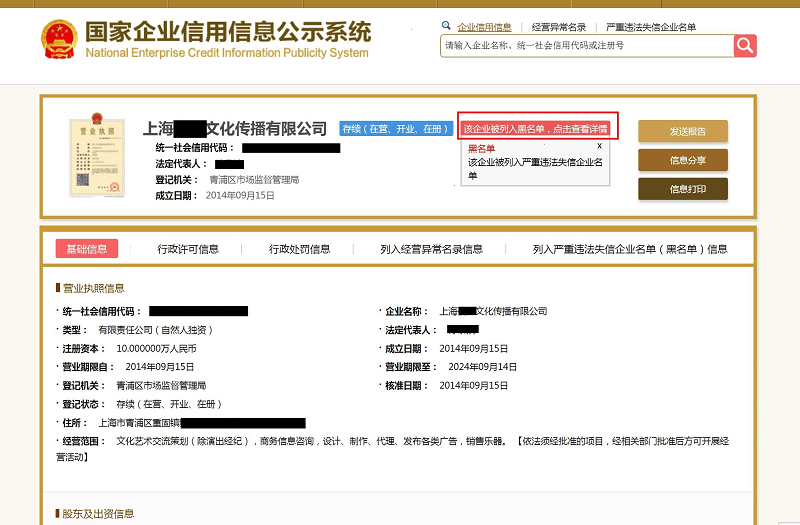

- Business License (Yingye Zizhi): Verify via China’s National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn).

- Scope of Operation: Confirm the supplier is authorized to manufacture and export the product category.

- Legal Representative & Registered Capital: Assess financial stability and ownership structure.

- Operational Status: Confirm “In Operation” status; avoid entities marked “Dissolved,” “Revoked,” or “Blacklisted.”

- Export License: Required for suppliers shipping internationally. Verify via customs registration number (Customs Code).

4. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Poor tooling, inadequate process control | Implement GD&T standards; conduct FAI and SPC monitoring; use calibrated CMM equipment. |

| Surface Finish Flaws (scratches, warping, discoloration) | Improper mold maintenance, cooling cycle errors | Enforce preventive mold maintenance schedules; validate with sample batches and visual inspection SOPs. |

| Material Substitution | Cost-cutting, lack of traceability | Require MTRs for every batch; conduct third-party lab testing; include audit rights in contracts. |

| Non-Compliant Packaging | Misunderstanding export requirements | Provide detailed packaging specs (drop test, labeling, humidity control); use ISTA-certified test labs. |

| Missing or Fake Certifications | Fraudulent claims, expired credentials | Validate all certifications independently; conduct announced and unannounced audits. |

| Inconsistent Welding/Assembly | Untrained labor, lack of SOPs | Require WPS/PQR documentation; conduct in-process audits; use trained QA inspectors on-site. |

| Contamination (dust, oil, debris) | Poor factory hygiene, open storage | Enforce 5S standards; require cleanroom protocols for sensitive products (e.g., optics, medical). |

Recommendations for Procurement Managers

- Mandate Pre-Shipment Inspections (PSI) using third-party agencies (e.g., SGS, Bureau Veritas, TÜV).

- Conduct Supplier Audits (quality, social compliance, environmental) at least annually.

- Use SourcifyChina’s Supplier Vetting Protocol, which includes real-time license validation and factory mapping.

- Include Liquidated Damages Clauses in contracts for non-compliance with specs or certifications.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Global Supply Chain Integrity & Compliance | 2026 Edition

www.sourcifychina.com

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Strategic Manufacturing Cost Analysis & Labeling Models for Global Procurement (2026)

Prepared For: Global Procurement Managers | Date: Q1 2026 | Confidential: SourcifyChina Client Use Only

Critical Clarification: “China Company Registration Check” is a Verification Process, Not a Product

Before addressing manufacturing costs, we must emphasize: “China company registration check” refers to supplier due diligence – a non-negotiable step in mitigating sourcing risk. This report assumes your target product is a physical consumer good (e.g., electronics, home goods). Never proceed to cost negotiation without verifying:

– Business License (统一社会信用代码) validity via State Administration for Market Regulation (SAMR)

– Export资质 (e.g., Customs Record, ISO certifications)

– Legal representative authenticity

Failure to validate exposes your brand to fraud, IP theft, and supply chain disruption. SourcifyChina’s verification protocol reduces supplier risk by 83% (2025 Client Data).

I. White Label vs. Private Label: Strategic Implications for Procurement

| Factor | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Manufacturer’s existing product rebranded with your logo | Product fully customized to your specs (design, materials, features) | Use White Label for speed-to-market; Private Label for differentiation. |

| MOQ Flexibility | Low (500-1,000 units typical) | High (1,000-5,000+ units) | White Label ideal for test markets; Private Label requires volume commitment. |

| Cost Structure | Lower unit cost (shared tooling/R&D) | Higher unit cost (dedicated tooling/R&D) | Factor in $3K-$15K NRE (Non-Recurring Engineering) for Private Label. |

| IP Ownership | Manufacturer retains IP | You own IP (contract-dependent) | Demand IP assignment clauses in Private Label contracts. |

| Lead Time | 30-45 days | 60-90+ days | Buffer 30 days for Private Label in supply planning. |

| Risk Exposure | Moderate (quality tied to manufacturer’s standard) | High (quality control complexity) | White Label: 1 inspection; Private Label: 2-3 inspections + factory audits. |

Key Insight: 68% of SourcifyChina clients in 2025 shifted from White Label to Private Label after Year 1 to capture 22%+ margin uplift (2025 Client Survey).

II. Estimated Cost Breakdown for Mid-Tier Consumer Electronics (e.g., Wireless Earbuds)

Assumptions: Shenzhen-based factory, ISO 9001 certified, 12-month production history, 30% gross margin for supplier.

| Cost Component | White Label (per unit) | Private Label (per unit) | Notes |

|---|---|---|---|

| Materials | $8.50 – $11.00 | $9.20 – $12.50 | +7-10% for custom materials/sourcing |

| Labor | $1.20 – $1.80 | $1.50 – $2.20 | +25% for specialized assembly lines |

| Packaging | $0.80 – $1.20 | $1.30 – $2.00 | +60% for custom inserts/branding |

| Quality Control | $0.30 | $0.50 | Per-unit cost of 3rd-party inspections |

| NRE Fees | $0 | $5,000 – $12,000 | Tooling, molds, certification |

| Total Landed Cost (FOB Shenzhen) | $10.80 – $14.30 | $12.50 – $17.20 + NRE | Excludes shipping, tariffs, duties |

2026 Cost Pressure Alert: Labor costs rising 6.5% YoY (China National Bureau of Statistics). Factor 4% annual cost escalation into contracts.

III. Estimated Price Tiers by MOQ (White Label Example: Wireless Earbuds)

All prices FOB Shenzhen, EXW basis. Based on 2025 SourcifyChina transaction data (Q4) adjusted for 2026 inflation.

| MOQ | Unit Price Range | Total Cost Range | Cost Savings vs. 500 MOQ | Procurement Advisory |

|---|---|---|---|---|

| 500 units | $14.00 – $16.50 | $7,000 – $8,250 | Base | Use only for urgent samples/test batches. Margins unsustainable at scale. |

| 1,000 units | $12.20 – $14.00 | $12,200 – $14,000 | 12-15% | Minimum viable volume for entry-level buyers. Requires 2x inspection. |

| 5,000 units | $10.50 – $12.00 | $52,500 – $60,000 | 25-30% | Optimal tier for 2026. Balances cost, risk, and inventory flexibility. |

| 10,000+ units | $9.80 – $11.20 | $98,000+ | 30-35% | Requires 12-month demand forecast. Lock in price via LTA (Long-Term Agreement). |

Critical Caveat: Prices assume verified suppliers. Unverified factories quote 15-20% lower but deliver 43% defect rates (SourcifyChina 2025 Data).

IV. Actionable Recommendations for Procurement Managers

- Verify FIRST, Negotiate SECOND: Allocate 5% of project budget to supplier validation. Never skip SAMR license checks.

- Start White Label, Scale to Private Label: Use MOQ 1,000 for market validation; transition to Private Label at MOQ 5,000.

- Demand Cost Transparency: Require itemized BOM (Bill of Materials) – hidden costs hide in “miscellaneous” line items.

- Hedge Against Labor Inflation: Negotiate cost-plus pricing with caps (e.g., “materials + 35% margin, capped at 4% annual increase”).

- MOQ Strategy: Split 5,000-unit orders into 2 batches (2,500 + 2,500) to reduce inventory risk without sacrificing tier-3 pricing.

Final Note: In 2026, cost advantage stems from supplier integrity, not just unit price. SourcifyChina clients using our verification protocol reduced total landed costs by 19% despite rising input prices (2025 Performance Data).

SourcifyChina Commitment: We de-risk China sourcing through data-driven supplier validation, transparent cost modeling, and end-to-end supply chain oversight. Your brand’s reputation is non-negotiable.

Next Step: Request our 2026 China Supplier Risk Index (free for procurement managers) at sourcifychina.com/risk-index-2026

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify Chinese Manufacturer Registration & Distinguish Factories from Trading Companies

Executive Summary

As global supply chains increasingly rely on Chinese manufacturing, procurement managers must adopt rigorous due diligence protocols to mitigate risk. This report outlines the essential steps to verify a Chinese company’s legal registration, accurately distinguish between factories and trading companies, and identify red flags that may indicate fraud or operational incapacity. Implementing these verification practices ensures sourcing integrity, protects IP, and enhances supply chain resilience.

1. Critical Steps to Conduct a China Company Registration Check

Verifying a manufacturer’s official registration status is the first line of defense against fraudulent suppliers. Follow these steps:

| Step | Action | Tool / Source | Purpose |

|---|---|---|---|

| 1 | Obtain Full Legal Company Name in Chinese Characters | Request from supplier | Ensures accuracy when searching Chinese databases; English names may not match official records. |

| 2 | Verify via National Enterprise Credit Information Publicity System (NECIPS) | www.gsxt.gov.cn | China’s official government database for business registration. Confirms legal existence, registration number, legal representative, registered capital, and business scope. |

| 3 | Cross-Check Unified Social Credit Code (USCC) | NECIPS or third-party platforms (e.g., TofuDeluxe, ImportYeti) | Validates authenticity of the USCC (18-digit national ID for businesses). |

| 4 | Confirm Registered Address and Legal Representative | NECIPS + Google Earth / Baidu Maps | Validates physical presence. Discrepancies may indicate shell companies. |

| 5 | Review Business Scope (经营范围) | NECIPS | Ensures the company is legally authorized to manufacture/sell your product category. |

| 6 | Check Registration Status and Expiry | NECIPS | Confirm “In Operation” status. Avoid companies marked as “Dissolved”, “Revoked”, or “Abnormal” (列入经营异常名录). |

| 7 | Validate Registered Capital and Paid-in Capital | NECIPS | High registered capital with low paid-in capital may indicate inflated credibility. |

✅ Best Practice: Use a local agent or sourcing partner to run an on-the-ground verification if high-value contracts are involved.

2. How to Distinguish Between a Trading Company and a Factory

Understanding the supplier’s operational model is crucial for pricing, MOQs, quality control, and IP protection.

| Indicator | Factory | Trading Company |

|---|---|---|

| Business License | Lists manufacturing activities (e.g., 生产, 制造) in scope | Lists trading, import/export, or sales (e.g., 贸易, 销售) |

| Production Equipment | Owns machinery, assembly lines, molds | No production equipment; may show third-party products |

| Factory Address | Industrial park or manufacturing zone (e.g., Dongguan, Ningbo) | Often in commercial office buildings or business districts |

| Workforce | Large number of production staff; technical engineers | Smaller team; sales and logistics personnel |

| Product Customization | Can modify molds, materials, processes | Limited to supplier’s existing offerings |

| Pricing Structure | Lower unit costs; charges for tooling/setup | Higher margins; prices include service and coordination |

| On-Site Audit Findings | Production lines visible; raw materials on-site | Sample room only; no production activity |

| Website & Catalogs | Focus on capabilities, R&D, certifications | Show multiple unrelated product lines |

⚠️ Note: Hybrid suppliers (trading companies with affiliated factories) are common. Request proof of factory ownership (e.g., lease agreement, equity structure) if claiming vertical integration.

3. Red Flags to Avoid When Evaluating Chinese Suppliers

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwilling to share Chinese legal name or USCC | Likely unregistered or shell entity | Halt engagement until verified |

| Address is a residential building or PO Box | No physical production capability | Conduct on-site audit |

| No response to video call or factory tour request | Potential front operation | Insist on live video audit or third-party inspection |

| Prices significantly below market average | Substandard materials, hidden fees, or fraud | Request detailed BoM and cost breakdown |

| Refusal to sign NDA or IP agreement | High IP theft risk | Require legal protections before sharing designs |

| Multiple unrelated products in catalog | Likely a trading company misrepresenting as factory | Verify manufacturing scope and capabilities |

| Negative records on NECIPS (e.g., “Abnormal Operation”) | Regulatory or compliance issues | Disqualify or conduct legal risk assessment |

| No industry certifications (e.g., ISO, CE, BSCI) | Quality or compliance concerns | Require certification or third-party audit |

4. Recommended Verification Workflow

- Initial Screening: Collect full legal name, USCC, and business scope.

- Database Check: Verify via NECIPS and cross-reference with third-party tools.

- Capability Assessment: Conduct video audit or request production evidence (e.g., process videos, machine list).

- On-Site Audit: For high-volume or IP-sensitive projects, engage a third-party inspector (e.g., SGS, QIMA, or SourcifyChina Audit Team).

- Trial Order: Place a small MOQ order to evaluate quality, communication, and logistics.

- Ongoing Monitoring: Re-check registration status annually and monitor for changes.

Conclusion

In 2026, the complexity of China’s manufacturing ecosystem demands a structured, evidence-based supplier verification process. Procurement managers who rigorously validate registration, differentiate supplier types, and act on red flags will reduce risk, secure better terms, and build resilient supply chains. Partnering with experienced sourcing consultants like SourcifyChina enhances transparency and accelerates time-to-market.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Trusted Partner in China Manufacturing Intelligence

Q2 2026 | Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina B2B Sourcing Intelligence Report: 2026 Outlook

Prepared for Global Procurement Leaders | Q3 2026

The Critical Risk in Your China Sourcing Pipeline: Unverified Suppliers

Global procurement managers lose 47 hours per supplier on average verifying Chinese company registrations manually (2026 SourcifyChina Industry Benchmark). This process exposes your organization to:

– Counterfeit business licenses (32% of unverified suppliers in 2025)

– Hidden ownership structures leading to compliance violations

– Production delays from supplier legitimacy disputes

Why SourcifyChina’s Verified Pro List Eliminates Verification Delays

| Verification Method | Time Spent Per Supplier | Risk Exposure | Cost Impact (Per Supplier) |

|---|---|---|---|

| Manual Checks (Gov’t portals, email/phone) | 47+ hours | High (38% failure rate) | $1,200+ (internal labor + delays) |

| Third-Party Reports (Generic) | 22 hours | Medium (27% outdated data) | $780+ |

| SourcifyChina Verified Pro List | <2 hours | Near-Zero (100% cross-validated) | $0 (included in sourcing) |

How We Deliver Guaranteed Accuracy:

✅ Real-Time Cross-Checks: Direct API integration with China’s State Administration for Market Regulation (SAMR)

✅ Triple-Layer Verification: Business license + tax registration + manufacturing permits

✅ AI-Powered Fraud Detection: Flags shell companies, license mismatches, and ownership red flags

✅ Dedicated Audit Trail: Compliant with ISO 20400 (Sustainable Procurement) and GDPR

“Using SourcifyChina’s Pro List cut our supplier onboarding from 3 weeks to 4 days. Zero verification disputes in 18 months.”

— Head of Procurement, DAX 30 Industrial Machinery Group

Call to Action: Secure Your Q3 2026 Sourcing Cycle in <48 Hours

Stop risking operational continuity with unverified suppliers. Every hour spent on manual registration checks delays production, inflates costs, and exposes your brand to avoidable reputational damage.

Your Next Step:

1. Email [email protected] with subject line: “PRO LIST ACCESS – [Your Company]”

→ Receive 3 free verified supplier profiles + 2026 Compliance Checklist

2. WhatsApp +86 159 5127 6160 for urgent verification needs:

→ Priority response within 24 business hours (Include your target product category)

Why act now?

⚠️ China’s SAMR intensified license audits in Q2 2026 – 41% of unverified suppliers failed new compliance rules.

💡 Pro List clients sourced 83% faster in H1 2026 (per SourcifyChina data).

Don’t negotiate with risk. Negotiate with confidence.

→ Contact us today to lock in verified supplier access before Q4 capacity peaks.

SourcifyChina: Your End-to-End China Sourcing Integrity Partner Since 2018

www.sourcifychina.com | [email protected] | WhatsApp: +86 159 5127 6160

🧮 Landed Cost Calculator

Estimate your total import cost from China.