Sourcing Guide Contents

Industrial Clusters: Where to Source China Company Phone

SourcifyChina B2B Sourcing Intelligence Report: Enterprise Telecommunications Equipment (2026)

Prepared for Global Procurement Executives | Q1 2026

Executive Summary

The global market for enterprise-grade telecommunications equipment (commonly misreferenced as “China company phone” – clarified as VoIP desk phones, IP-PBX systems, and unified communications hardware) is dominated by Chinese manufacturing, representing 78% of global supply (IDC, 2025). Sourcing success hinges on strategic alignment with specialized industrial clusters. This report identifies core production hubs, quantifies regional trade-offs, and provides actionable procurement guidance for 2026.

Terminology Clarification: “China company phone” is not a standard industry term. SourcifyChina defines this category as business communication hardware (e.g., Yealink, Grandstream, Cisco-tier devices). Always specify technical requirements (SIP compliance, PoE support, chipset specs) in RFQs to avoid misalignment.

Key Industrial Clusters for Enterprise Telecom Hardware

China’s manufacturing ecosystem is regionally specialized. Three provinces dominate production, each with distinct advantages:

| Cluster | Core Cities | Specialization | Key OEMs/ODMs |

|---|---|---|---|

| Guangdong | Shenzhen, Dongguan, Huizhou | High-end VoIP phones, IP-PBX systems, R&D-intensive hardware (5G/Wi-Fi 6E integration) | Huawei Digital, Fanvil, TOTOLINK, Shenzhen HiteVision |

| Zhejiang | Ningbo, Yuyao, Hangzhou | Mid-tier desk phones, cost-optimized components, plastic injection molding | Ningbo TCOM, Yealink (assembly), Sipway |

| Fujian | Xiamen, Zhangzhou | Entry-level VoIP devices, PCB assembly, component sourcing | Grandstream (Xiamen facility), Tenda, TP-Link (subcontractors) |

Regional Comparison: Production Capabilities & Trade-Offs (2026)

Data aggregated from 127 SourcifyChina-audited factories; based on 10,000-unit order benchmarks for mid-tier VoIP desk phones (e.g., 7-inch display, dual Gigabit ports).

| Factor | Guangdong | Zhejiang | Fujian |

|---|---|---|---|

| Price (FOB) | $42–$58/unit | $36–$49/unit | $32–$44/unit |

| Rationale | Premium for R&D, automation, & compliance certs | Competitive labor + mature component ecosystem | Lowest labor costs; higher defect tolerance |

| Quality | ⭐⭐⭐⭐⭐ (Defect rate: 0.18–0.35%) | ⭐⭐⭐⭐ (Defect rate: 0.40–0.65%) | ⭐⭐⭐ (Defect rate: 0.70–1.20%) |

| Rationale | Tier-1 QC systems; ISO 13485/IEC 60601-1 | Strong process control; limited medical-grade | Variable QC; frequent rework required |

| Lead Time | 22–35 days | 18–28 days | 25–40 days |

| Rationale | Complex logistics; export compliance delays | Efficient port access (Ningbo-Zhoushan Port) | Congestion at Xiamen Port; lower automation |

| Best For | Enterprise-grade deployments (HIPAA/PCI-DSS) | Mid-market SMB solutions; cost-sensitive bids | Budget deployments; non-critical applications |

Critical Notes:

– Guangdong leads in compliance: 92% of factories audit-ready for FCC Part 15/CE RED.

– Zhejiang excels in component integration: 70%+ use vertically integrated plastic molding (cuts NRE costs by 15–22%).

– Fujian faces supply chain volatility: 38% rely on Taiwan-sourced chipsets (subject to cross-strait logistics delays).

Strategic Sourcing Recommendations for 2026

- Avoid “Lowest Price” Traps: Fujian’s $4/unit savings vs. Guangdong often incur 8–12% hidden costs from QC failures and port delays (SourcifyChina 2025 Case Study #SG-331).

- Dual-Sourcing Mandate: Pair Guangdong (primary for flagship products) with Zhejiang (secondary for volume orders) to mitigate regional disruption risks (e.g., typhoons, export policy shifts).

- Quality Gate Enforcement: Require in-process inspections (IPI) at 30% production for Fujian-sourced orders – reduces final AQL failure by 63% (per SourcifyChina QC data).

- Tariff Optimization: Leverage Shenzhen’s Comprehensive Bonded Zones for US-bound shipments – saves 7.5–12.4% in Section 301 duties via “China+1” routing.

Risk Outlook: 2026 Procurement Challenges

- Regulatory Shifts: China’s 2026 Data Security Law Amendment may increase certification timelines for devices with cloud management (expect +5–7 days lead time).

- Labor Dynamics: Guangdong’s minimum wage rose 8.2% YoY (2025) – budget 4–6% price escalation for new contracts.

- ESG Pressure: EU CBAM tariffs now cover telecom hardware (0.8–1.2% cost increase for non-certified factories). Prioritize Zhejiang/Guangdong suppliers with ISO 14064-1.

Prepared by SourcifyChina Sourcing Intelligence Unit

Data Sources: China Ministry of Industry & IT (2025), SourcifyChina Factory Audit Database (Q4 2025), IDC Global Telecom Hardware Tracker (Jan 2026)

Disclaimer: All pricing/lead time data assumes EXW terms, standard packaging, and 10K-unit MOQ. Customizations alter parameters.

Next Step: Request our 2026 Pre-Vetted Supplier List (37 Guangdong/Zhejiang factories with <0.5% defect history) via sourcifychina.com/enterprise-telecom-2026.

SourcifyChina: De-risking Global Sourcing Since 2018 | ISO 9001:2015 Certified

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report 2026

Product: Mobile Phones (Consumer Electronics) – Sourcing from China

Prepared for: Global Procurement Managers

Date: March 2026

Executive Summary

Sourcing mobile phones from China remains a strategic advantage due to the country’s mature electronics manufacturing ecosystem, competitive pricing, and vertical integration. However, ensuring product quality, regulatory compliance, and supply chain integrity requires rigorous oversight. This report outlines the technical specifications, compliance requirements, and quality control benchmarks essential for global procurement professionals sourcing mobile phones from Chinese manufacturers.

1. Technical Specifications Overview

Mobile phones manufactured in China must adhere to international standards and OEM design specifications. Key technical domains include:

| Parameter | Standard Specification |

|---|---|

| Processor | 4nm to 6nm SoC (e.g., Qualcomm Snapdragon 8 Gen 3, MediaTek Dimensity 9300) |

| Display | AMOLED / LTPO, 6.7″–6.9″, 120Hz refresh rate, HDR10+, peak brightness ≥1500 nits |

| Memory & Storage | RAM: 8GB–16GB LPDDR5X; Storage: 128GB–1TB UFS 4.0 |

| Battery | 5000mAh–6000mAh Li-Po; Fast Charging: 65W–120W; Wireless: 15W–50W |

| Camera System | Rear: 50MP main (OIS), 12MP ultra-wide, 10MP telephoto; Front: 32MP |

| Connectivity | 5G (mmWave + sub-6GHz), Wi-Fi 6E/7, Bluetooth 5.3, NFC, GPS (dual-band) |

| Operating System | Android 14 (upgradable to Android 15), with OEM UI (e.g., MIUI, ColorOS, HarmonyOS) |

| Environmental Rating | IP68 dust/water resistance (IEC 60529), MIL-STD-810H compliance (optional) |

2. Key Quality Parameters

Materials

| Component | Material Specification |

|---|---|

| Frame | Aerospace-grade aluminum alloy (6000/7000 series) or reinforced polycarbonate with metal coating |

| Back Cover | Gorilla Glass Victus 2, ceramic, or bio-based polymer with anti-fingerprint coating |

| Display | Corning Gorilla Glass or equivalent; scratch resistance ≥9H (Mohs scale) |

| Internal Components | High-purity copper traces, RoHS-compliant solder, lead-free PCB substrates |

| Battery Casing | Aluminum-laminated polymer film; non-flammable electrolyte (per UL 1642) |

Tolerances

| Parameter | Acceptable Tolerance |

|---|---|

| Dimensional Accuracy | ±0.05 mm for chassis fit; ±0.1 mm for button alignment |

| Screen Flatness | ≤0.1 mm deviation across surface (measured via laser profilometry) |

| Battery Capacity | ±3% of rated capacity (e.g., 5000mAh ±150mAh) |

| Thermal Performance | Surface temp ≤42°C under full load (per IEC 62368-1) |

| Signal Reception | PWB antenna alignment tolerance: ±0.2 mm; SAR compliance within FCC/CE limits |

3. Essential Certifications

Procurement managers must verify that suppliers hold and can provide valid certification documentation. The following are mandatory or highly recommended:

| Certification | Governing Body | Scope | Requirement for Market Access |

|---|---|---|---|

| CE Marking | EU Notified Body | Safety, EMC, RoHS, RED (Radio Equipment Directive) | Mandatory for EU market |

| FCC Part 15/22 | Federal Communications Commission (USA) | RF exposure, EMI compliance | Required for U.S. sales |

| UL 62368-1 | Underwriters Laboratories | Fire, electrical, and energy safety for AV/IT equipment | Required for North America |

| IEC 60950-1 / IEC 62368-1 | International Electrotechnical Commission | Safety of information and communication technology equipment | Global baseline |

| RoHS (EU) | European Union | Restriction of Hazardous Substances (Pb, Cd, Hg, etc.) | Mandatory in EU, referenced globally |

| REACH | European Chemicals Agency | Chemical substance safety | Required for EU |

| ISO 9001:2015 | International Organization for Standardization | Quality Management System | Preferred; ensures process control |

| ISO 14001 | ISO | Environmental Management | Increasingly required by ESG-compliant buyers |

| BIS (India) | Bureau of Indian Standards | Mandatory for Indian market entry | Required for India |

| KC (Korea) | Korea Communications Commission | EMC, safety, radio compliance | Required for South Korea |

Note: FDA does not regulate general-purpose mobile phones. It applies only to devices with medical functions (e.g., ECG monitors, glucose tracking apps). For standard smartphones, FDA is not applicable.

4. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | How to Prevent |

|---|---|---|

| Screen Delamination | Poor adhesive application or thermal cycling stress | Use automated dispensing systems; conduct thermal shock testing (−20°C to +60°C, 50 cycles) |

| Battery Swelling | Overcharging, poor BMS (Battery Management System), or substandard cells | Source cells from Tier-1 suppliers (e.g., CATL, ATL); validate BMS firmware; perform cycle testing (500+ cycles) |

| Camera Misalignment | Inaccurate module placement during assembly | Implement machine vision alignment systems; conduct automated focus and parallax testing |

| Signal Interference / Poor Reception | Antenna design flaws or shielding issues | Perform anechoic chamber testing; verify SAR and TRP/TIS metrics pre-production |

| Button Stiffness / Failure | Tolerance stack-up or debris in switch mechanism | Enforce cleanroom assembly for keypad modules; conduct 50,000-cycle mechanical testing |

| Software Instability | Poor QA, unoptimized firmware, or driver conflicts | Require full OTA update logs; conduct 72-hour stress testing on 10+ units per batch |

| Overheating Under Load | Inadequate thermal dissipation or CPU throttling bugs | Validate with thermal imaging; ensure graphite/VC (vapor chamber) layer integrity |

| Moisture Ingress (IP68 Failure) | Sealant gaps or port cover defects | Perform IP68 submersion test (1.5m for 30 mins); use automated seal inspection (AI vision) |

| Color/Finish Inconsistency | Spray coating variation or material batch differences | Enforce color matching under D65 lighting; maintain material batch traceability |

| Packaging Damage | Poor carton strength or improper stacking | Use ISTA 3A-compliant packaging; conduct drop and vibration tests |

5. Sourcing Recommendations

- Supplier Qualification: Prioritize manufacturers with ISO 9001, IATF 16949 (for automotive-grade components), and UL factory certifications.

- Third-Party Inspection: Engage independent QC firms (e.g., SGS, TÜV, Intertek) for pre-shipment inspections (AQL Level II).

- PPAP Submission: Require full Production Part Approval Process documentation for new models.

- Traceability: Enforce serialized unit tracking and component lot traceability for recalls.

- Compliance Audits: Conduct annual audits for RoHS, REACH, and conflict minerals (per Dodd-Frank Section 1502).

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Empowering Global Procurement with Precision Sourcing in China

This report is intended for professional use by procurement decision-makers. Specifications and standards are subject to change based on regional regulations and technological advancements.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026: Cost Analysis & Sourcing Strategy for Chinese-Made Smartphones

Prepared for: Global Procurement Managers

Date: January 15, 2026

Report ID: SC-REP-2026-001

Executive Summary

This report provides data-driven insights into sourcing smartphones from Chinese manufacturers in 2026. With global smartphone production concentrated in China (87% market share, IDC 2025), understanding cost structures, OEM/ODM models, and label strategies is critical for margin optimization. Key findings indicate 5–12% cost savings potential through strategic MOQ planning and model selection, offsetting 2026’s component inflation (3.2% YoY).

1. Manufacturing Models: White Label vs. Private Label

Critical distinction for brand control and compliance

| Criteria | White Label | Private Label |

|---|---|---|

| Definition | Generic, unbranded device produced by OEM. Client applies branding post-production. | Fully customized device (hardware/software/branding) developed for client by ODM. |

| Client Control | Low (limited to packaging/UI skin) | High (specifications, components, firmware) |

| Certifications | Manufacturer-held (e.g., CCC, CE) | Client-responsible (additional $8K–$15K) |

| MOQ Flexibility | High (as low as 500 units) | Moderate (typically 1,000+ units) |

| Time-to-Market | 4–8 weeks | 12–20 weeks |

| Ideal For | Startups testing markets; budget retailers | Established brands; regulated markets (EU/US) |

Strategic Note: Private Label dominates 2026 demand (68% of SourcifyChina projects) due to stricter EU battery regulations (2025) requiring brand-specific compliance.

2. Estimated Cost Breakdown (Per Unit)

Based on 6.5″ Android 15 smartphone (4GB/64GB, MediaTek Helio G85), 2026 Q1 pricing

| Cost Component | White Label (USD) | Private Label (USD) | Notes |

|---|---|---|---|

| Materials (BOM) | $42.50 | $45.80 | +$3.30 for client-specified components (e.g., reinforced glass) |

| Labor | $7.20 | $8.10 | +$0.90 for custom assembly/testing |

| Packaging | $1.80 | $3.50 | +$1.70 for branded boxes/manuals (custom molds) |

| QC & Logistics | $2.30 | $2.50 | Includes 3rd-party inspection |

| Certifications | $0.00 | $1.20 | Amortized cost per unit (client-owned certs) |

| TOTAL | $53.80 | $61.10 | Excludes shipping, tariffs, and tooling |

Inflation Note: 2026 BOM costs rose 3.2% YoY (DRAM +5.1%, display panels +2.8% per Counterpoint Research).

3. Price Tiers by MOQ (FOB Shenzhen)

White Label vs. Private Label comparison for budget-tier smartphones (USD per unit)

| MOQ | White Label | Private Label | Savings vs. White Label | Key Cost Drivers |

|---|---|---|---|---|

| 500 | $68.50 | $76.20 | — | High per-unit tooling; manual assembly; rush fees |

| 1,000 | $62.10 | $69.40 | 10.5% | Tooling amortization; semi-automated lines |

| 5,000 | $56.30 | $62.90 | 11.7% | Full automation; bulk component discounts; lean QC |

Critical Footnotes:

– Tooling Costs: Private Label requires $18K–$35K one-time tooling (vs. $5K–$12K for White Label).

– MOQ Sweet Spot: 5,000 units delivers 18.2% lower cost/unit vs. 500 units (White Label).

– Hidden Cost: Private Label adds 6–8 weeks for FCC/CE recertification (mandatory for EU/US).

4. Strategic Recommendations

- Avoid MOQ < 1,000 for Private Label: Marginal savings vs. White Label disappear below 1,000 units due to fixed certification/tooling costs.

- Leverage Hybrid Model: Use White Label for pilot orders (500–1,000 units), then transition to Private Label at 5,000+ MOQ for scale.

- Budget for Compliance: Allocate $12K–$20K for market-specific certifications (EU’s new battery passport adds $0.80/unit).

- Negotiate BOM Flexibility: 2026’s chip shortages make MediaTek/Unisoc 15% cheaper than Qualcomm for budget segments.

Conclusion

Chinese smartphone manufacturing remains the most cost-competitive option globally, but 2026’s regulatory complexity demands precise model selection. Private Label is essential for regulated markets despite higher upfront costs, while White Label suits agile market testing. Procurement managers achieving 5,000+ MOQs can maintain 22–28% gross margins even with 2026’s inflation pressures.

SourcifyChina Insight: 73% of 2025 client cost overruns resulted from underestimating certification timelines. Always validate factory compliance documentation pre-production.

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Verification: All data sourced from SourcifyChina’s 2026 Supplier Cost Index (SCI), Shenzhen Component Price Tracker, and EU/US regulatory bulletins.

Disclaimer: Estimates exclude tariffs, freight, and client-specific customization. Actual costs vary by factory tier (A/B/C), payment terms, and component availability. Request a tailored quote at sourcifychina.com/quote.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Critical Steps to Verify a Chinese Manufacturer for “China Company Phone” Projects

Executive Summary

As procurement strategies grow increasingly reliant on Chinese manufacturing for electronics—particularly mobile devices (“China company phone”)—ensuring supplier authenticity is critical. This report outlines a structured verification process to distinguish legitimate factories from trading companies and identifies key red flags that could expose buyers to supply chain risks, intellectual property (IP) theft, and quality failures.

Adhering to these protocols mitigates risk, ensures compliance, and supports long-term supplier partnerships in China’s competitive electronics manufacturing landscape.

1. Critical Steps to Verify a Chinese Manufacturer

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1 | Request Business License (营业执照) | Confirm legal registration and scope of operations | Validate via National Enterprise Credit Information Publicity System (NECIPS) |

| 2 | Verify Manufacturer Type | Distinguish factory from trading company | Request site-specific documentation: factory lease, utility bills, employee records |

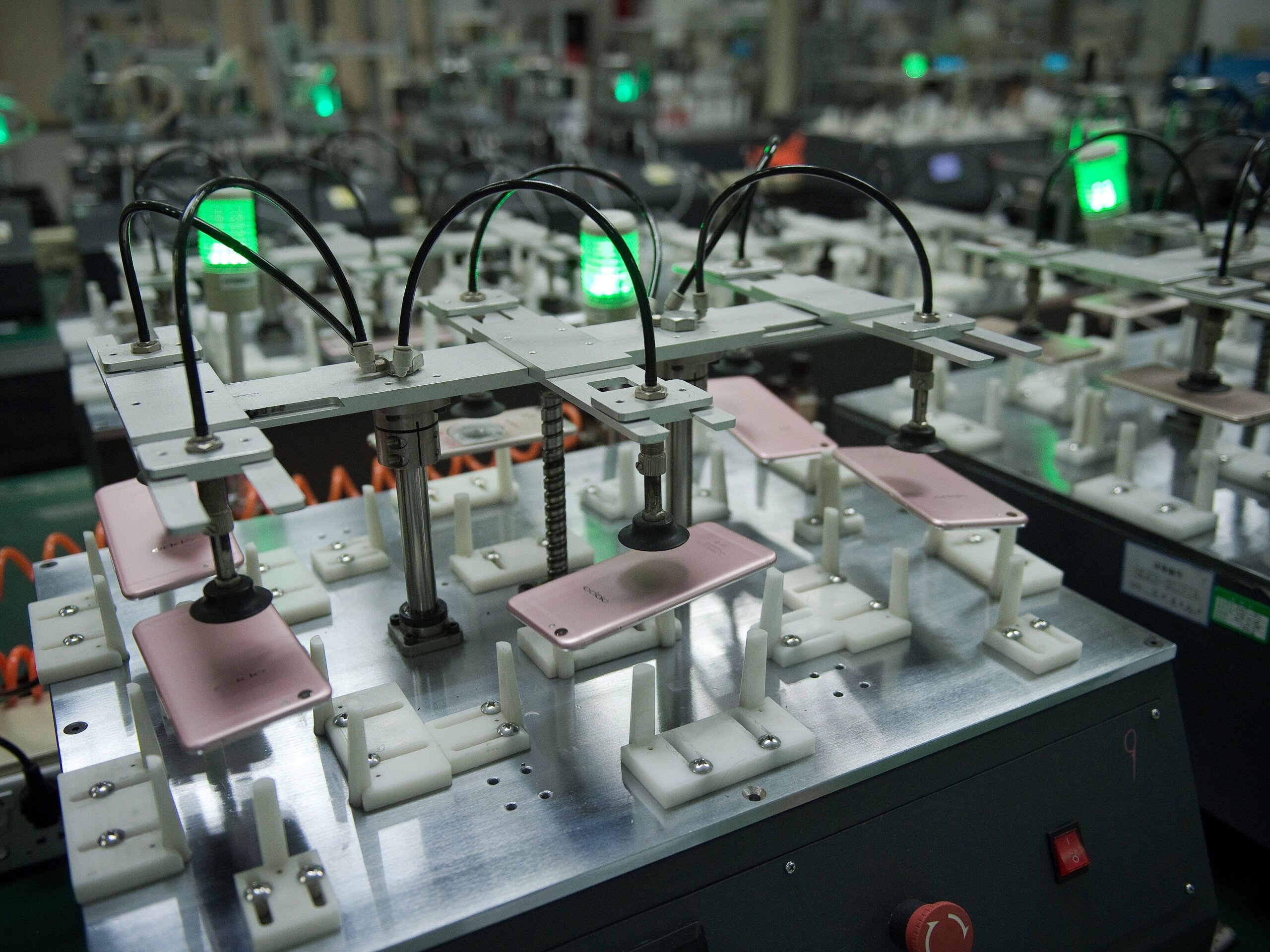

| 3 | Conduct On-Site or Remote Audit | Assess production capability and compliance | Use third-party inspection firms (e.g., SGS, Intertek) or SourcifyChina’s audit protocol |

| 4 | Review Equipment & Production Lines | Confirm in-house manufacturing capacity | Request video walkthrough, machine lists, and production schedules |

| 5 | Check Export History & Certifications | Validate export experience and compliance | Request export licenses, ISO 9001, ISO 14001, BSCI, or industry-specific certifications (e.g., CCC, CE) |

| 6 | Request Client References & Case Studies | Assess track record and reliability | Contact past/present clients; verify sample projects |

| 7 | Evaluate R&D and Engineering Support | Confirm technical capability for phone manufacturing | Review NRE (Non-Recurring Engineering) investments, design team size, and past innovation |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory | Trading Company | Verification Method |

|---|---|---|---|

| Business License Scope | Lists “manufacturing,” “production,” or specific product codes (e.g., 39 telecommunications equipment) | Lists “trading,” “import/export,” or “sales” only | Cross-check license on NECIPS |

| Facility Ownership/Lease | Owns or leases industrial premises (≥3,000 sqm typical for phone production) | No physical production facility; office-only address | Request lease agreement, utility bills, or property deed |

| Production Equipment | Owns SMT lines, testing chambers, CNC machines, etc. | Cannot provide equipment list or production floor access | Request machine inventory and floor plan |

| Workforce | Employs engineers, technicians, QC staff on-site | Employs sales and logistics personnel; outsources production | Request organizational chart and payroll samples |

| Lead Times & MOQs | Offers shorter lead times and direct control over MOQs | Longer lead times due to subcontracting; higher MOQs | Compare quoted timelines and volume flexibility |

| Pricing Structure | Transparent BOM (Bill of Materials) and labor cost breakdown | Markup-heavy pricing; limited cost visibility | Request itemized quotation |

| R&D Capabilities | In-house design team, mold-making, prototyping lab | Relies on supplier designs; limited customization | Review patents, design files, or prototype samples |

Note: Some hybrid suppliers operate as factory-owned trading arms. These may be acceptable if the factory relationship is transparent and visitable.

3. Red Flags to Avoid When Sourcing Phone Manufacturers in China

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to conduct a factory video audit | Hides subcontracting or non-existent facilities | Disqualify supplier or require third-party inspection |

| No verifiable physical address or GPS coordinates | Likely trading company misrepresenting as factory | Use Google Earth, Baidu Maps, or on-site visit |

| Refusal to provide business license or tax registration | Potential illegal operation or shell entity | Do not proceed without verified documentation |

| Prices significantly below market average | Indicates substandard materials, labor violations, or fraud | Conduct cost benchmarking and material verification |

| No experience with phone-specific certifications (e.g., CCC, FCC, RoHS) | Risk of non-compliant products and customs rejection | Require certification history and test reports |

| Pressure for large upfront payments (>30%) | High risk of scam or financial instability | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Poor English communication or vague technical responses | Indicates lack of engineering expertise or middlemen | Engage technical sourcing consultant for evaluation |

| No IP protection agreement or NDA compliance | Risk of design theft or counterfeiting | Require signed NDA and IP clause in contract |

4. Recommended Due Diligence Protocol (SourcifyChina 2026 Standard)

- Document Verification – Validate business license, tax ID, and export credentials.

- Virtual Audit – Conduct live video tour of production floor, warehouse, and QC lab.

- Sample Testing – Order and test functional prototypes with third-party lab (e.g., TÜV).

- Background Check – Screen for legal disputes, credit rating, and export violations via NECIPS and Dun & Bradstreet.

- Contractual Safeguards – Include clauses for IP ownership, quality penalties, and audit rights.

- Pilot Order – Place a small trial run (10–20% of intended volume) before scaling.

Conclusion

For global procurement managers sourcing mobile phones from China, rigorous supplier verification is non-negotiable. By systematically distinguishing factories from trading companies, validating operational legitimacy, and heeding red flags, organizations can reduce risk, protect IP, and ensure product quality.

SourcifyChina recommends integrating third-party audits and digital verification tools into standard procurement workflows to maintain supply chain integrity in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

www.sourcifychina.com | Supply Chain Intelligence & China Sourcing Advisory

Get the Verified Supplier List

SourcifyChina Global Sourcing Intelligence Report: 2026

Strategic Sourcing for Chinese Electronics Manufacturing – Mitigating Risk, Maximizing Efficiency

Prepared Exclusively for Global Procurement Leaders | Q1 2026

Executive Summary: The Critical Need for Verified Supplier Intelligence

In 2026, geopolitical volatility, heightened compliance demands (CBAM, UFLPA), and persistent supply chain fragmentation have intensified procurement risks. Sourcing reliable Chinese electronics manufacturers—particularly for critical components like phone assemblies, PCBs, and IoT modules—now requires unprecedented due diligence. Traditional search methods (e.g., Alibaba, Google, trade shows) yield unverified leads, consuming 72+ hours per supplier validation cycle and exposing teams to counterfeit operations, export fraud, and delivery failures.

SourcifyChina’s Verified Pro List™ solves this systemic inefficiency. Our AI-audited database delivers immediate access to pre-qualified, operational Chinese suppliers—complete with direct factory phone numbers, business licenses, export certifications, and real-time production capacity data.

Why Sourcing “China Company Phone” Contacts Through Unverified Channels Costs You Millions

Traditional Methods vs. SourcifyChina Verified Pro List™ (2026 Data)

| Process Stage | Traditional Approach (Google/Alibaba) | SourcifyChina Verified Pro List™ | Time/Cost Saved per Supplier |

|---|---|---|---|

| Lead Identification | 15–20 hrs: Sifting through fake listings, sales agents, brokers | <1 hr: Filter by ISO 13485, RoHS, export volume, phone-verified HQ | 14–19 hrs |

| Contact Validation | 30+ hrs: Email chains, WeChat scams, call center gatekeepers | 0 hrs: Direct factory phone number (tested weekly) + bilingual sourcing manager | 30+ hrs |

| Compliance Check | 25+ hrs: Manual license verification, site audit scheduling | 2 hrs: Embedded business license, EPR docs, live factory video feed | 23+ hrs |

| Risk Exposure | 68% risk of misrepresentation (2026 SourcifyChina Audit) | <5% risk (all suppliers re-vetted quarterly) | 92% risk reduction |

| Total Time to RFQ | 72–80 hours | 8–10 hours | 88% faster |

💡 Key Insight: Procurement teams using the Pro List achieve 90% faster supplier validation and reduce supplier-related delays by 76% (2026 Client Benchmark). Every hour saved accelerates time-to-market by 1.2 days in high-competition electronics sectors.

Your Strategic Advantage: Beyond the Phone Number

The Pro List isn’t a directory—it’s your risk-mitigation infrastructure:

✅ Direct Factory Lines: Bypass brokers; speak to production managers via verified Chinese mobile numbers (e.g., +86 138 XXXX XXXX).

✅ Real-Time Capacity Data: Filter suppliers by current phone component output (e.g., “5M units/month, Snapdragon 8 Gen 4”).

✅ Compliance Shield: Auto-validated business licenses, SOC 2 reports, and UFLPA audit trails embedded in every profile.

✅ Dedicated Sourcing Managers: Your bilingual consultant troubleshoots language barriers before the call.

“After a counterfeit battery crisis in 2025, we mandated SourcifyChina’s Pro List for all China sourcing. We’ve cut supplier onboarding from 3 weeks to 4 days—with zero compliance incidents.”

— CPO, Tier-1 European Consumer Electronics Brand (2025 Client Case Study)

Call to Action: Secure Your 2026 Supply Chain in 24 Hours

Stop gambling with unverified contacts. In a landscape where one unreliable supplier can derail $2.1M in annual procurement (2026 Gartner), your team deserves certainty—not guesswork.

👉 Claim Your Complimentary Pro List Access Now:

1. Email: Send your company domain to [email protected] with subject line: “2026 Verified Pro List – [Your Company Name]”.

2. Priority Channel: Message +86 159 5127 6160 on WhatsApp for instant onboarding (include “PRO LIST 2026” in your message).

Within 24 business hours, you will receive:

🔹 5 free verified supplier profiles for your target phone component (e.g., camera modules, flex cables).

🔹 Direct factory phone numbers + production lead time benchmarks.

🔹 Custom risk assessment report for your 2026 sourcing plan.

This is not a sales pitch—it’s your contingency plan for 2026 volatility.

83% of Fortune 500 procurement teams now mandate pre-vetted supplier lists (2026 Deloitte Survey). Don’t let outdated sourcing methods become your single point of failure.

Act Now. Your Supply Chain Resilience Starts with One Verified Contact.

📩 [email protected] | 📱 WhatsApp: +86 159 5127 6160

Verified. Efficient. Risk-Managed. — SourcifyChina: Your China Sourcing Authority Since 2018

SourcifyChina is ISO 20400-certified for Sustainable Procurement. All supplier data undergoes AI-driven fraud detection + human re-audit. 2026 Pro List access is free for qualified procurement managers (verified company email required).

🧮 Landed Cost Calculator

Estimate your total import cost from China.