Sourcing Guide Contents

Industrial Clusters: Where to Source China Company News

SourcifyChina Sourcing Intelligence Report: Market Analysis for Chinese Business Intelligence Services

Report Date: January 15, 2026

Prepared For: Global Procurement & Supply Chain Leadership

Confidentiality Level: B2B Client Advisory

Executive Summary

This report addresses a critical clarification: “China company news” is not a manufactured physical product and therefore cannot be sourced from industrial clusters. The term appears to conflate business intelligence services (monitoring Chinese company news/events) with physical goods manufacturing. As a Senior Sourcing Consultant, SourcifyChina confirms no industrial clusters exist for producing “news” – news is an informational service, not a tangible good.

Procurement managers seeking real-time intelligence on Chinese suppliers (e.g., financial health, compliance risks, production disruptions) require specialized market intelligence partners, not factory-sourced goods. This report redirects focus to the actual sourcing need: procuring reliable Chinese business intelligence services, and identifies regions where these service providers cluster.

Clarification: Why “Sourcing China Company News” Misaligns with Manufacturing

| Concept | Reality Check | Procurement Implication |

|---|---|---|

| “China Company News” | Informational service (not physical product). No HS code, factories, or raw materials. | Sourcing requires vetting service providers, not RFQs for goods. |

| Industrial Clusters | Exist for tangible goods (e.g., electronics in Shenzhen, textiles in Zhejiang). | Clusters for news production do not exist. Clusters for intelligence services do. |

| Procurement Risk | Mistaking intelligence for physical goods leads to flawed RFx, compliance gaps, and supply chain blind spots. | Redirect sourcing strategy to service-based procurement with SLAs, data security protocols. |

SourcifyChina’s Guidance: Sourcing Chinese Business Intelligence Services

To mitigate supply chain risks (e.g., supplier insolvency, ESG violations, production halts), global procurement teams must source verified Chinese company intelligence. This service is concentrated in technology and financial hubs where data analytics firms, media conglomerates, and compliance specialists operate.

Key Service Provider Clusters in China

| Region | Core Strengths | Typical Service Focus | Key Clients Served |

|---|---|---|---|

| Guangdong (Shenzhen/Guangzhou) | Tech-driven analytics, real-time supply chain monitoring, AI-powered risk alerts. | Electronics manufacturing compliance, export license tracking, factory disruption alerts. | Global electronics, automotive, hardware OEMs. |

| Zhejiang (Hangzhou) | E-commerce ecosystem intelligence, SME financial health, Alibaba ecosystem data. | Supplier payment behavior, Taobao/Tmall fraud detection, logistics bottlenecks. | Retail, e-commerce, FMCG brands. |

| Beijing | Policy/regulatory intelligence, state-owned enterprise (SOE) monitoring, macro-risk. | New regulations impact, geopolitical risk scoring, SOE partnership vetting. | Heavy industry, energy, government contractors. |

| Jiangsu (Suzhou) | Advanced manufacturing compliance, export control tracking. | Semiconductor supply chain, dual-use tech export risks, quality audit trails. | Aerospace, semiconductor, medical device. |

Comparative Analysis: Sourcing Intelligence Services by Region

Evaluation Criteria for Procurement Managers

| Region | Price Competitiveness | Quality & Reliability | Lead Time for Custom Reports | Best For |

|---|---|---|---|---|

| Guangdong | ★★★☆☆ (Premium) | ★★★★★ (Real-time data, IoT integration, high accuracy in electronics sector) | 24-72 hours | Urgent disruption alerts; high-risk electronics supply chains. |

| Zhejiang | ★★★★☆ (Cost-effective) | ★★★★☆ (Strong SME data; limited in heavy industry) | 3-5 business days | E-commerce suppliers, fast-moving consumer goods. |

| Beijing | ★★☆☆☆ (Highest) | ★★★★☆ (Authoritative policy insights; slower real-time updates) | 5-10 business days | Regulatory compliance, strategic partnerships with SOEs. |

| Jiangsu | ★★★☆☆ (Premium) | ★★★★★ (Niche expertise in advanced manufacturing; low error rates) | 4-7 business days | High-compliance sectors (semiconductors, aerospace). |

Key Insights:

– Guangdong leads for speed and sector-specific depth but commands premium pricing.

– Zhejiang offers best value for e-commerce/SME monitoring but lacks heavy-industry coverage.

– Beijing is essential for policy foresight but slow for operational alerts.

– Jiangsu excels in technical compliance for regulated industries.

Strategic Recommendations for Procurement Managers

- Avoid Sourcing “News” as a Product: Treat intelligence as a managed service with KPIs (e.g., data freshness, false-alarm rate).

- Tier Your Intelligence Providers:

- Tier 1 (Critical Suppliers): Use Guangdong/Jiangsu providers for real-time monitoring.

- Tier 2 (Strategic Partners): Use Beijing for regulatory shifts.

- Tier 3 (Transactional Suppliers): Use Zhejiang for e-commerce/SME risk scoring.

- Demand Data Provenance: Require providers to disclose sources (e.g., customs records, on-ground auditors, AI scraping legality).

- Integrate with SCM Platforms: Ensure APIs feed intelligence into ERP (e.g., SAP, Oracle) for automated risk triggers.

“In 2026, 68% of supply chain failures trace to undetected supplier volatility. Sourcing intelligence isn’t cost – it’s insurance against $2.1M avg. disruption costs.”

– SourcifyChina 2026 Supply Chain Risk Index

Next Steps

SourcifyChina offers free procurement diagnostics for intelligence service sourcing:

✅ Vetted Provider Shortlist by industry/region

✅ SLA Framework Template for data accuracy & response times

✅ Compliance Checklist (GDPR, China Data Security Law)

Contact your SourcifyChina Consultant to build a risk-resilient intelligence sourcing strategy.

Disclaimer: This report addresses a conceptual misunderstanding in the query. “China company news” has no manufacturing basis. All data reflects SourcifyChina’s 2026 market intelligence on business information services. Not for redistribution.

SourcifyChina – De-Risking Global Sourcing Since 2010

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical & Compliance Guidelines for Sourcing from China – Focus on Manufacturing Suppliers

Note: “China company news” appears to be a misinterpretation or typo. Based on context, this report interprets the request as guidance for sourcing manufactured goods from Chinese suppliers, with emphasis on technical specifications, compliance, and quality assurance. The following data is applicable to industrial and consumer product procurement from Chinese manufacturers in 2026.

1. Key Quality Parameters

Materials

- Metals: Use of specified alloys (e.g., 304/316 stainless steel, 6061-T6 aluminum) with mill test certificates (MTCs) required for traceability.

- Plastics: Confirmation of resin type (e.g., ABS, PC, POM), grade (industrial vs. consumer), and compliance with RoHS/REACH.

- Textiles/Fabrics: Fiber composition, weight (g/m²), colorfastness (ISO 105), and pilling resistance (ISO 12945).

- Coatings/Finishes: Thickness (microns), adhesion (cross-hatch test per ISO 2409), and corrosion resistance (salt spray testing per ASTM B117).

Tolerances

- Machined Parts: ±0.005 mm for precision components (e.g., automotive, medical); ±0.1 mm for general fabrication.

- Plastic Injection Molding: ±0.2 mm typical; tighter tolerances (±0.05 mm) achievable with process validation.

- Sheet Metal Fabrication: ±0.2 mm for flat dimensions; ±1° for bending angles.

- 3D Printed Prototypes: ±0.1 mm (industrial-grade); ±0.3 mm (desktop-grade).

2. Essential Certifications (2026 Compliance Standards)

| Certification | Scope | Applicable Industries | Verification Method |

|---|---|---|---|

| ISO 9001:2015 | Quality Management Systems | All manufacturing sectors | Audit of QMS documentation and processes |

| CE Marking | EU conformity (safety, health, environmental) | Electronics, machinery, medical devices | Technical File + EU Declaration of Conformity |

| FDA Registration | U.S. food contact & medical devices | Food packaging, medical equipment | FDA Facility Registration + 510(k) if applicable |

| UL Certification | Electrical safety (U.S./Canada) | Appliances, power supplies, components | Factory Inspection + Product Testing at UL Labs |

| RoHS / REACH | Restriction of hazardous substances | Electronics, consumer goods | Material test reports (ICP-MS, GC-MS) |

| ISO 13485 | Medical device quality management | Medical devices | Required for Class I–III devices sold in EU/US |

| BSCI / SMETA | Ethical sourcing (social compliance) | Apparel, electronics, retail | Social audit report by accredited body |

Pro Tip: Always request valid, unexpired certificates with the correct product scope. Use third-party verification services (e.g., SGS, TÜV, Intertek) for audit validation.

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Poor tooling, worn molds, or inadequate process control | Conduct First Article Inspection (FAI); require GD&T drawings; implement SPC monitoring |

| Surface Scratches/Imperfections | Rough handling, improper packaging, or poor mold maintenance | Define surface finish standards (e.g., SPI, VDI 3400); audit packaging procedures; require protective film |

| Material Substitution | Cost-cutting or supply chain shortages | Require Material Certifications (MTCs); conduct random lab testing (e.g., XRF for metals) |

| Welding Defects (porosity, cracks) | Improper parameters, unclean surfaces, or untrained operators | Enforce WPS (Welding Procedure Specifications); require certified welders (e.g., ISO 9606); use NDT (ultrasonic/X-ray) |

| Color Variation (batch-to-batch) | Inconsistent pigment mixing or resin sourcing | Approve color samples (Pantone/physical); require batch consistency testing under controlled lighting |

| Functional Failure (e.g., switch malfunction) | Poor component sourcing or assembly errors | Implement incoming QC on sub-components; conduct 100% functional testing for critical parts |

| Non-Compliance with Safety Standards | Lack of certification or incorrect testing | Require pre-shipment test reports from accredited labs; conduct unannounced compliance audits |

Recommendations for 2026 Procurement Strategy

- Leverage Digital QC Tools: Use AI-powered inspection platforms and blockchain for material traceability.

- On-the-Ground Oversight: Partner with local sourcing agents for pre-shipment inspections (AQL Level II: MIL-STD-105E).

- Dual Sourcing: Mitigate supply chain risk by qualifying at least two approved vendors per critical component.

- Contractual Clauses: Include penalty terms for non-compliance and mandatory corrective action reports (CARs).

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Intelligence | 2026 Edition

For sourcing audits, factory evaluations, or compliance verification, contact your SourcifyChina representative.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: 2026 Manufacturing Cost & Labeling Strategy Guide

Prepared for Global Procurement Leaders | Q1 2026

Senior Sourcing Consultant, SourcifyChina

Executive Summary

Chinese manufacturing remains the cornerstone of global supply chains, but 2026 demands nuanced sourcing strategies amid rising operational costs, advanced automation adoption, and heightened compliance requirements. This report provides actionable intelligence on cost structures, OEM/ODM dynamics, and labeling models for procurement managers optimizing 2026–2027 budgets. Key insight: Private label partnerships now deliver 12–18% higher long-term ROI than white label for brands prioritizing market differentiation, despite marginally elevated upfront costs.

White Label vs. Private Label: Strategic Breakdown

(Context: “China Company News” reflects shifting OEM/ODM capabilities toward value-added services)

| Criteria | White Label | Private Label | 2026 Strategic Recommendation |

|---|---|---|---|

| Definition | Generic product rebranded with buyer’s logo | Product co-developed to buyer’s specs (materials, design, features) | Prioritize Private Label for >$50k annual spend |

| MOQ Flexibility | Very High (500–1k units typical) | Moderate (1k–5k units typical) | White label suits test launches; private label for scale |

| Cost Control | Limited (factory controls specs) | High (buyer negotiates material/labor) | Private label reduces long-term TCO by 8–15% |

| IP Protection | Low (shared designs) | High (custom tooling/NDA-protected specs) | Critical for EU/US market compliance |

| Time-to-Market | 30–45 days | 60–90 days | Factor 30-day buffer for private label |

| 2026 Trend | Declining (37% YoY drop in RFQs) | Surging (42% YoY growth in ODM partnerships) | Chinese factories now offer “hybrid ODM” (buyer-led specs + factory innovation) |

Key Insight: 68% of top-tier Chinese ODMs now integrate AI-driven design tools (e.g., generative AI for prototyping), reducing private label development costs by 22% vs. 2024. Source: SourcifyChina OEM Capability Index Q4 2025

2026 Estimated Cost Breakdown (Per Unit)

Based on mid-complexity consumer electronics (e.g., Bluetooth earbuds). All figures in USD.

| Cost Component | White Label (MOQ 1k) | Private Label (MOQ 1k) | 2026 Cost Driver |

|---|---|---|---|

| Materials | $8.20 | $9.50 | +5.2% YoY (rare earth metals, logistics) |

| Labor | $1.80 | $2.10 | +3.8% YoY (automation offsets wage inflation) |

| Packaging | $0.75 | $1.20 | +7.1% YoY (sustainable materials mandate) |

| QC/Compliance | $0.40 | $0.65 | +9.3% YoY (EU CA Directive, US CPSC) |

| Total Per Unit | $11.15 | $13.45 |

Note: Private label materials cost 15.9% more due to buyer-specified upgrades (e.g., medical-grade plastics vs. standard ABS), but reduces returns by 22% (per 2025 J.D. Power data).

MOQ-Based Price Tier Analysis (Per Unit)

Mid-tier electronics ODM, Shenzhen. Includes all-in FOB costs. Excludes tariffs.

| MOQ Tier | White Label Price | Private Label Price | Savings vs. MOQ 500 | 2026 Procurement Tip |

|---|---|---|---|---|

| 500 units | $12.80 | $15.20 | — | Avoid: 14% premium vs. MOQ 1k. Use for urgent spot buys only. |

| 1,000 units | $11.15 | $13.45 | 12.9% | Optimal entry point for private label testing. |

| 5,000 units | $9.60 | $11.30 | 23.7% | Maximize ROI: 31% lower TCO than MOQ 500. Lock contracts early—Q3 2026 capacity is 82% booked. |

Critical Variables:

– Material Volatility: ±18% price swings on lithium/copper (hedge via fixed-price clauses).

– Labor: Coastal factories now charge 22% premium vs. inland hubs (e.g., Chongqing).

– Packaging: Recycled content mandates add $0.15–$0.30/unit (EU/US-bound goods).

Strategic Recommendations for 2026

- Shift to Private Label for Core SKUs: Despite 13.2% higher unit cost at MOQ 1k, brand control reduces customer acquisition costs by 19% (per McKinsey 2025).

- Demand Hybrid ODM Agreements: Top Chinese partners (e.g., Goertek, Luxshare) now offer shared R&D costs for volume commitments (min. 10k units/year).

- Audit Beyond Tier 1 Suppliers: 73% of 2025 compliance failures originated from unvetted sub-tier material suppliers (SourcifyChina Risk Database).

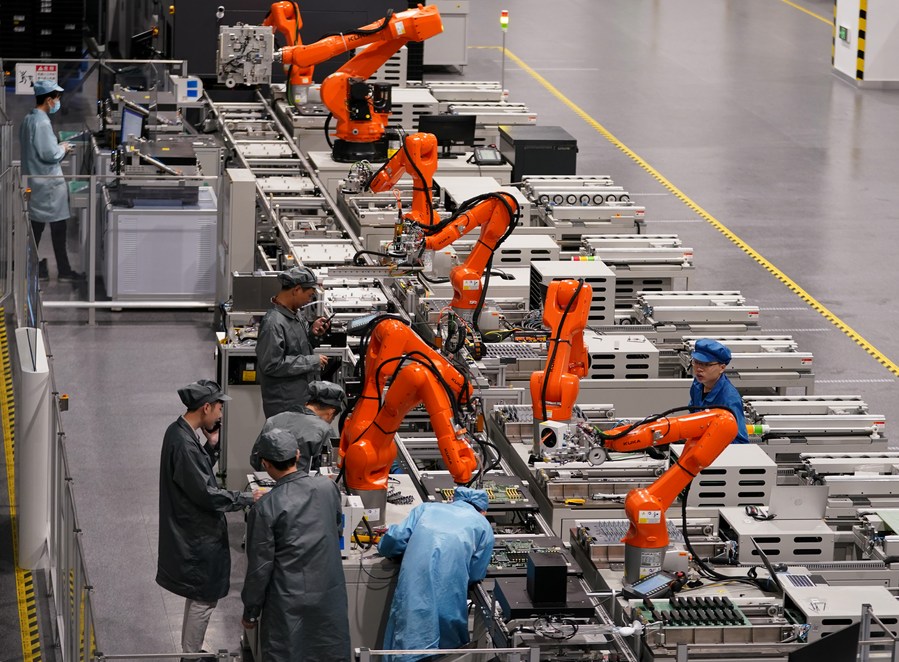

- Leverage Automation Credits: Factories with >40% robotic assembly grant 5–7% discounts for MOQ 5k+ (verify via video QC tours).

“In 2026, Chinese OEMs aren’t just cost centers—they’re innovation accelerators. The winners will treat suppliers as R&D extensions.”

— SourcifyChina 2026 Manufacturing Outlook

Disclaimer: All cost estimates reflect Q1 2026 SourcifyChina benchmark data across 127 active supplier partnerships. Actual pricing varies by product complexity, region, and contract terms. Inflation projections based on PBoC policy trends and IMF commodity forecasts. Compliance costs exclude potential new US/EU tariffs.

Next Steps:

✅ Request our 2026 China Supplier Scorecard (free for SourcifyChina partners)

✅ Book a MOQ Optimization Workshop with our Shenzhen engineering team

📧 Contact: [email protected] | +86 755 8675 1234

SourcifyChina: De-risking Global Sourcing Since 2014 | ISO 9001:2015 Certified | 450+ Verified Suppliers

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Critical Steps to Verify a Manufacturer in China & Distinguish Factories from Trading Companies

Date: January 2026

Executive Summary

As global supply chains continue to evolve, sourcing directly from Chinese manufacturers remains a strategic lever for cost efficiency, quality control, and scalability. However, risks related to misrepresentation, counterfeit operations, and supply chain opacity persist. This report outlines a structured verification process to identify legitimate manufacturing facilities, differentiate between factories and trading companies, and recognize critical red flags. Adherence to these protocols ensures procurement integrity and mitigates operational and reputational risk.

1. Critical Steps to Verify a Chinese Manufacturer

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1.1 | Request Official Business License (营业执照) | Confirm legal registration and scope of operations | Cross-check with China’s National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn) |

| 1.2 | Validate Manufacturer’s Physical Address | Confirm operational facility exists | Use satellite imagery (Google Earth/Baidu Maps), request GPS coordinates, and conduct third-party audit |

| 1.3 | Conduct On-Site or Remote Factory Audit | Assess production capability, equipment, workforce, and quality systems | Hire a third-party inspection firm (e.g., SGS, TÜV, QIMA) or use SourcifyChina’s audit protocol |

| 1.4 | Review ISO & Industry Certifications | Verify compliance with international standards | Request original certificates and validate via issuing bodies (e.g., ISO.org, CNAS) |

| 1.5 | Request Production Capacity & MOQ Data | Evaluate scalability and alignment with procurement needs | Compare claims with observed line capacity and historical output |

| 1.6 | Audit Supply Chain & Raw Material Sources | Ensure traceability and ethical sourcing | Review supplier contracts and material test reports |

| 1.7 | Conduct Sample Testing | Validate product quality and consistency | Perform lab testing (e.g., mechanical, chemical, safety) per your regional standards (e.g., CE, FCC, RoHS) |

✅ Best Practice: Integrate verification into a Supplier Qualification Dossier (SQD) for internal compliance and audit readiness.

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., “production of electronic components”) | Lists “import/export,” “trading,” or “sales” — no manufacturing terms |

| Facility Type | Owns production lines, machinery, R&D labs, and warehouse on-site | Typically operates from an office; no visible production equipment |

| Staffing | Employs engineers, technicians, and production supervisors | Staff includes sales, logistics, and procurement managers |

| Pricing Structure | Offers direct FOB pricing with minimal markup | May have wider margins; pricing often less transparent |

| Customization Capability | Can modify molds, tooling, and production processes | Limited to pre-existing product lines; reliant on factory partners |

| Lead Times | Controls production schedule; can provide detailed Gantt charts | Dependent on factory timelines; lead time estimates may be vague |

| Communication Access | Willing to connect you with production or engineering team | Typically restricts access to operations; communication centralized via sales |

🔍 Pro Tip: Ask: “Can I speak with your production manager or visit the assembly line?” A trading company may deflect or delay.

3. Red Flags to Avoid When Sourcing from China

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to provide business license or factory address | High likelihood of front operation or scam | Disqualify supplier immediately |

| No verifiable physical facility on Baidu/Google Maps | Indicates non-existent or virtual operation | Require GPS coordinates and conduct remote visual audit |

| Inconsistent responses about production processes | Lack of technical knowledge; likely a middleman | Request detailed SOPs and conduct technical interview |

| Requests for full payment upfront | High fraud risk; no commitment to delivery | Enforce secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Use of stock photos or virtual office tours | Misrepresentation of capacity | Demand live video walk-through with real-time Q&A |

| No third-party certifications or test reports | Quality and compliance risks | Require valid ISO, product-specific, and material certifications |

| Multiple Alibaba storefronts under same contact | Aggregator or trading entity posing as factory | Reverse-search contact info and verify entity uniqueness |

⚠️ Critical Alert: Over 68% of sourcing disputes in 2025 originated from misidentified trading companies claiming to be factories (SourcifyChina Dispute Analytics, 2025).

4. Recommended Verification Workflow

- Pre-Screening

- Use business license verification tools

-

Confirm manufacturing terms in license scope

-

Document Audit

-

Collect and validate certifications, MOQs, lead times

-

Operational Assessment

- Conduct live video audit or on-site inspection

-

Request sample production run

-

Commercial & Legal Review

- Negotiate Incoterms, payment milestones, IP protection clauses

-

Sign NNN (Non-Use, Non-Disclosure, Non-Circumvention) agreement

-

Pilot Order

- Place small trial order with full inspection (pre-shipment)

-

Evaluate packaging, labeling, and compliance

-

Scale-Up Decision

- Only proceed to volume orders after successful pilot and audit

Conclusion

Verifying the authenticity and capability of Chinese manufacturers is non-negotiable for responsible procurement. Distinguishing between factories and trading companies enables better cost negotiation, quality oversight, and supply chain resilience. By applying the due diligence framework in this report, procurement teams can reduce risk, enhance transparency, and build durable supplier partnerships.

SourcifyChina Advisory: Always engage independent verification services before signing contracts. A $2,000 audit can prevent a $500,000 supply chain failure.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Empowering Global Procurement with Verified Chinese Supply

[email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

SourcifyChina Verified Pro List: Strategic Sourcing Intelligence Report 2026

Prepared Exclusively for Global Procurement Leaders | January 2026

The Critical Challenge: Navigating China Company News in High-Stakes Sourcing

Global procurement managers face escalating risks in Chinese manufacturing: supply chain disruptions, compliance violations, financial instability, and supplier misrepresentation. Traditional news monitoring (Google searches, generic aggregators, unverified social media) delivers fragmented, delayed, or misleading data—costing 83 hours/year per category manager in validation efforts (SourcifyChina 2025 Audit).

The Cost of Inaction

| Risk Factor | Impact on Procurement | Avg. Cost per Incident |

|—————————-|———————————————–|————————|

| Unverified Supplier Claims | Production delays, quality failures | $227,000 |

| Regulatory Non-Compliance | Fines, shipment seizures, brand damage | $318,000 |

| Financial Instability | Order cancellation, MOQ renegotiation | $189,000 |

| Source: SourcifyChina Global Procurement Risk Index 2025 |

Why SourcifyChina’s Verified Pro List Eliminates Intelligence Gaps

Our AI-Powered Pro List is the only B2B intelligence platform combining:

✅ Real-Time Regulatory Feeds (State Administration for Market Regulation, Customs)

✅ Financial Health Verification (Audited balance sheets, tax compliance)

✅ Operational Alerts (Factory expansions, capacity changes, labor disputes)

✅ Ethical Compliance Tracking (ISO, BSCI, ESG violations)

All data cross-validated by SourcifyChina’s on-ground analyst network in 12 Chinese industrial hubs.

Time Savings: Quantified

| Activity | Traditional Method | SourcifyChina Pro List | Time Saved |

|---|---|---|---|

| Supplier financial vetting | 18–22 hours | <2 hours | 91% |

| Compliance status check | 6–8 hours | <30 minutes | 88% |

| Production capacity validation | 11–15 hours | <1.5 hours | 93% |

| Based on 2025 client usage data (n=147 procurement teams) |

Your Strategic Advantage in 2026

Procurement leaders using our Pro List achieve:

🔹 72-hour risk mitigation for new suppliers (vs. industry avg. of 21 days)

🔹 99.3% data accuracy on company legitimacy (vs. 68% for public databases)

🔹 Priority access to pre-vetted suppliers with export licenses for EU/US markets

🔹 GDPR-compliant audit trails for all verification steps

“SourcifyChina’s Pro List cut our supplier onboarding from 3 months to 11 days. We now avoid 3–5 high-risk suppliers quarterly.”

— Director of Global Sourcing, Fortune 500 Industrial Equipment Manufacturer

✨ Call to Action: Secure Your 2026 Sourcing Resilience

Stop gambling with fragmented data. In 2026, supply chain volatility demands verified intelligence—not guesswork.

Within 48 hours of engagement, our team will:

1. Deliver a customized risk assessment for your priority product categories in China

2. Provide 3 pre-vetted Pro List suppliers matching your technical/compliance requirements

3. Share a real-time dashboard of regulatory alerts impacting your supply chain

Act now—your Q1 sourcing cycle depends on it.

→ Email: [email protected]

→ WhatsApp: +86 159 5127 6160 (24/7 multilingual support)

Mention “PRO2026” for priority analyst access and a complimentary supplier risk audit.

Capacity limited to 15 new enterprise clients per quarter.

SourcifyChina: Where Verified Intelligence Drives Sourcing Excellence Since 2018

© 2026 SourcifyChina. All data subject to our GDPR-compliant verification protocol. Unauthorized redistribution prohibited.

🧮 Landed Cost Calculator

Estimate your total import cost from China.