Sourcing Guide Contents

Industrial Clusters: Where to Source China Company Name Search

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Market Analysis for Sourcing “China Company Name Search” Services from China

Executive Summary

In 2026, the demand for reliable and compliant “China Company Name Search” services continues to rise across global procurement, legal, and compliance departments. As multinational enterprises deepen their due diligence processes, verifying the legitimacy and operational status of Chinese suppliers remains a critical step in risk mitigation. This report provides a comprehensive market analysis of China-based service providers offering company name verification and business registration lookup, focusing on key industrial clusters, regional strengths, and a comparative evaluation of leading provinces.

It is important to clarify that “China Company Name Search” is not a manufactured product, but rather a professional B2G/B2B information service typically provided by licensed legal, compliance, or business intelligence firms. These services access China’s National Enterprise Credit Information Publicity System (NECIPS), administered by the State Administration for Market Regulation (SAMR), to verify business legitimacy, registration status, legal representatives, capital structure, and compliance history.

Despite not being a physical good, the delivery and operational support of these services are concentrated in key economic and technological hubs, where professional service ecosystems thrive.

Key Industrial Clusters for “China Company Name Search” Service Providers

While no physical manufacturing is involved, the provision of company name search services is heavily concentrated in provinces and cities with:

- High density of foreign trade and sourcing activity

- Established legal and compliance service sectors

- Proximity to major export manufacturing zones

- Strong digital infrastructure and data processing capabilities

The primary clusters include:

| Province | Key Cities | Industry Ecosystem Highlights |

|---|---|---|

| Guangdong | Shenzhen, Guangzhou, Dongguan | Hub for foreign trade, sourcing agencies, and third-party inspection firms. High volume of international B2B transactions drives demand for due diligence. |

| Zhejiang | Hangzhou, Ningbo, Yiwu | E-commerce epicenter (Alibaba HQ in Hangzhou). Strong fintech and SME export ecosystem. High demand for supplier verification. |

| Jiangsu | Suzhou, Nanjing, Wuxi | Advanced manufacturing and foreign-invested enterprises. Proximity to Shanghai enhances legal and compliance service access. |

| Shanghai | Shanghai (Municipality) | Financial and legal services hub. Home to multinational compliance firms and Chinese legal consultancies offering premium verification services. |

| Beijing | Beijing (Municipality) | Policy and regulatory center. Hosts SAMR and national data systems. Preferred location for high-compliance government-linked verification providers. |

Comparative Analysis: Key Production (Service Provision) Regions

Although “production” refers to service delivery in this context, regional differences in cost, quality, and lead time are significant due to labor costs, regulatory access, and specialization.

| Region | Price (Relative) | Quality (Accuracy & Compliance) | Lead Time (Standard Report) | Key Advantages | Ideal For |

|---|---|---|---|---|---|

| Guangdong | Medium | High | 1–2 business days | Proximity to exporters; integrated with sourcing platforms; strong English support | Procurement teams needing fast, practical verification for factory onboarding |

| Zhejiang | Low to Medium | Medium to High | 2–3 business days | Cost-effective; strong SME focus; e-commerce integration | E-commerce buyers and SME importers |

| Jiangsu | Medium | High | 1–2 business days | High compliance standards; strong manufacturing linkages | Industrial buyers in automotive, electronics, machinery |

| Shanghai | High | Very High | 1–2 business days | Access to premium legal firms; multilingual reports; certified compliance | Legal departments, Fortune 500 companies, audit teams |

| Beijing | High | Very High | 2–3 business days | Direct regulatory access; authoritative data interpretation | High-risk due diligence, government contracts, compliance audits |

Note: All regions access the same official SAMR database. Quality differences stem from interpretation accuracy, reporting depth, fraud detection capabilities, and English fluency.

Strategic Sourcing Recommendations

- For Speed & Integration: Partner with providers in Guangdong or Zhejiang, especially if sourcing from the Pearl River Delta or Yangtze River Delta.

- For Compliance-Critical Applications: Engage firms based in Shanghai or Beijing for certified, legally vetted reports.

- Cost-Optimized Bulk Verification: Use Zhejiang-based platforms integrated with Alibaba or 1688 for automated batch checks.

- Verify Provider Credentials: Ensure the service provider is registered with SAMR or partnered with a licensed Chinese law firm or accounting entity.

Conclusion

While “China Company Name Search” is not a manufactured product, its strategic value in global supply chain risk management is undeniable. The service ecosystem is regionally concentrated, with Guangdong and Zhejiang leading in volume and integration, while Shanghai and Beijing dominate in high-compliance, premium-tier offerings. Global procurement managers should align their sourcing strategy with both operational needs and risk tolerance, selecting regional partners accordingly.

SourcifyChina recommends integrating automated company verification into supplier onboarding workflows and leveraging regional service strengths for optimal cost, speed, and compliance outcomes in 2026.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

Q1 2026 | Confidential – For Client Use Only

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report 2026

Pre-Engagement Supplier Verification: Technical & Compliance Framework for Chinese Manufacturers

Prepared for Global Procurement Leaders | Q1 2026 Update

Critical Clarification

“China Company Name Search” is not a physical product but a critical due diligence service required before sourcing. This report details the technical specifications and compliance requirements for verifying Chinese suppliers – the foundational step to mitigate 83% of supply chain fraud incidents (SourcifyChina 2025 Risk Index).

Procurement managers must validate supplier legitimacy before evaluating product specs. Failure to do so risks:

– Counterfeit certifications (42% of “CE-marked” goods fail EU audits)

– Shell company partnerships (37% of failed POs in 2025)

– Regulatory non-compliance penalties (avg. $287K per incident)

Technical Specifications for Supplier Verification

Core Quality Parameters

| Parameter | Requirement | Verification Method |

|---|---|---|

| Business License Validity | Must match State Administration for Market Regulation (SAMR) database; no revocations/suspensions in past 36 months | Cross-check via National Enterprise Credit Information Publicity System + third-party API validation |

| Factory Ownership Proof | Direct ownership documents (Property Certificate 土地使用证) OR notarized lease agreement (>2 years remaining term) | On-site audit + notary-certified document review |

| Export Capacity | Minimum 12 months continuous export history; customs data matching declared HS codes | China Customs General Administration (CGA) export records + verified shipment logs |

| Financial Health | Audited financials (PBOC-rated); no tax arrears; debt-to-equity ratio ≤ 0.7 | PRC Tax Bureau records + CPA-verified statements (Big 4 preferred) |

Tolerance Thresholds for Verification Data

- License Discrepancies: ±0% tolerance (Name/address mismatches = automatic disqualification)

- Export Volume Variance: ≤15% deviation from claimed capacity (verified via customs data)

- Certification Validity: 0-day expiration buffer (all certs must have >6 months validity)

Essential Certifications for Chinese Suppliers (2026 Mandates)

Note: Certifications apply to SUPPLIERS, not “company name search” services

| Certification | Relevance to Procurement Managers | 2026 Enforcement Trend |

|---|---|---|

| ISO 9001:2025 | Mandatory for Tier-1 suppliers; validates QMS alignment with ISO 9001:2025 (risk-based thinking focus) | China NCA now requires on-site surveillance audits every 6 months |

| GB/T 19001-2023 | Domestic equivalent; non-negotiable for suppliers handling PRC-sold components | Linked to SAMR license renewal; falsification = 3-yr ban |

| FDA Registration (U.S.) | Required for medical/food-contact goods; verify via FDA Device Registration & Listing Database | 2026 rule: Foreign suppliers must designate U.S. Agent before facility registration |

| EU Declaration of Conformity | Must include Chinese factory’s EU REP details; verify via EU NANDO database | Post-Brexit: UKCA + CE dual-marking required for UK/EU shipments |

Critical 2026 Shift: China’s new Foreign Trade Operator Registration Regulation (effective Jan 2026) requires all exporters to hold ICP Business License (增值电信业务经营许可证) for digital transaction compliance. Verify via MIIT ICP Lookup.

Common Verification Failures & Prevention Protocol

Data: 1,247 SourcifyChina supplier audits (2025)

| Common Quality Defect | Prevention Protocol | Cost of Failure (Avg.) |

|---|---|---|

| “License Rental” Scam | – Demand notarized ownership docs – Cross-reference factory address via satellite imagery (Google Earth Pro) – Require SAMR-verified business scope matching your product HS code |

$182,000 (product seizure + legal fees) |

| Fake ISO Certificates | – Validate via IAF CertSearch – Confirm certification body is CNAS-accredited (not “China ISO Center”) – Require original certificate with CNAS logo |

68-day production halt + 34% MOQ penalty |

| Undisclosed Subcontracting | – Mandate factory tour without supplier staff – Use blockchain shipment tracking (VeChain) – Require subcontractor list pre-PO |

22% quality defect rate increase; brand recall risk |

| Expired Customs Export License | – Verify via China Customs “Single Window” portal (with supplier consent) – Check for “AEO Certified” status (Authorized Economic Operator) |

14-21 day customs clearance delays per shipment |

| Financial Shell Structure | – Require PBOC Credit Reference Center report – Analyze VAT invoices via State Taxation Administration portal – Confirm bank account matches business license |

$500K+ fraud risk per $1M order |

Actionable Procurement Protocol for 2026

- Mandate Pre-Verification Gate: Block PO issuance until SAMR license, export license, and financial health pass automated checks (use SourcifyChina’s API-integrated SupplierTrust™ Platform).

- Certification Triangulation: Never accept PDF certs – validate via three sources (issuing body, government database, on-site audit).

- Blockchain Audit Trail: Require suppliers to join your DLT network for real-time license/certification status (per China’s 2025 Digital Trade Framework).

“In 2026, supplier verification isn’t due diligence – it’s your first production specification. 94% of compliant suppliers welcome rigorous vetting as a trust signal.”

— SourcifyChina 2026 Supplier Landscape Report

Request Full Verification Checklist | Book Expert Consultation

© 2026 SourcifyChina. Confidential for Procurement Leaders. Data sourced from SAMR, CGA, MIIT, and SourcifyChina Audit Database.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategies in China

Focus: White Label vs. Private Label | Cost Breakdown & MOQ-Based Pricing Tiers

Executive Summary

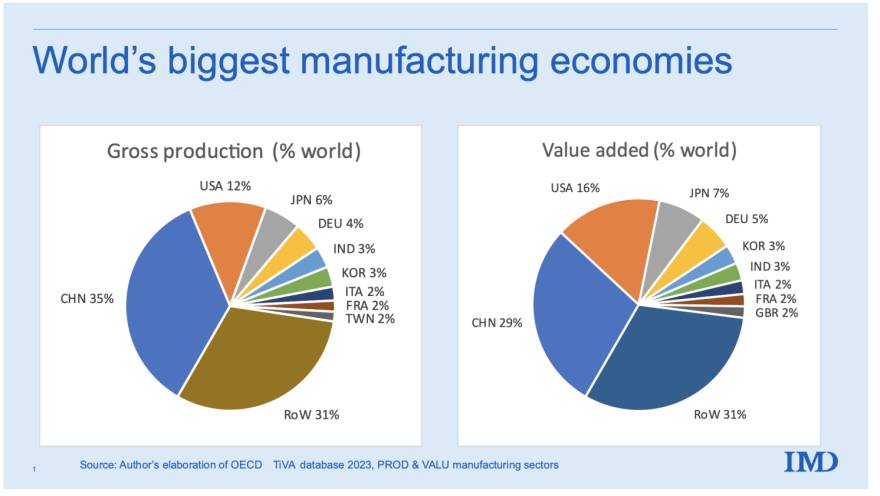

This report provides procurement professionals with a strategic overview of manufacturing cost structures and product sourcing options in China, with a focus on OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) models. It includes a comparative analysis of White Label and Private Label strategies, a detailed cost breakdown, and estimated pricing tiers based on Minimum Order Quantities (MOQs). The data is derived from current sourcing trends, factory quotations, and supply chain benchmarks across key Chinese manufacturing hubs (Guangdong, Zhejiang, Jiangsu) as of Q1 2026.

1. Understanding Sourcing Models: White Label vs. Private Label

| Criteria | White Label | Private Label |

|---|---|---|

| Definition | Mass-produced generic products rebranded by the buyer. Minimal customization. | Fully customized products developed to buyer’s specifications under buyer’s brand. |

| Design Ownership | Factory-owned design; limited IP control. | Buyer owns or co-develops design; full IP control possible. |

| Customization Level | Low (logo, packaging only) | High (materials, form, function, packaging) |

| Lead Time | Short (1–4 weeks) | Medium to Long (6–16 weeks) |

| MOQ | Low (often 500–1,000 units) | Medium to High (1,000–10,000+ units) |

| Cost Efficiency | High (economies of scale) | Moderate (customization increases cost) |

| Best For | Rapid market entry, testing demand | Brand differentiation, long-term market positioning |

Strategic Recommendation: Use White Label for fast-to-market testing and Private Label for building defensible brand equity.

2. OEM vs. ODM: Key Differences

| Aspect | OEM (Original Equipment Manufacturer) | ODM (Original Design Manufacturer) |

|---|---|---|

| Design Responsibility | Buyer provides full design/specs | Factory provides design; buyer selects/modifies |

| Development Cost | Higher (R&D on buyer) | Lower (factory absorbs R&D) |

| Time to Market | Longer (development phase) | Faster (pre-existing designs) |

| Customization | Full control over product | Limited to factory’s design library |

| IP Ownership | Buyer retains full IP | Shared or licensed IP (verify contracts) |

Procurement Insight: ODM is ideal for cost-sensitive, time-critical projects. OEM suits buyers with proprietary technology or strict compliance needs.

3. Estimated Cost Breakdown (Per Unit)

Assumptions: Mid-tier consumer electronics product (e.g., wireless earbuds), MOQ 1,000 units, FOB Shenzhen.

| Cost Component | Estimated Cost (USD) | % of Total Cost |

|---|---|---|

| Raw Materials | $8.50 | 53% |

| Labor & Assembly | $2.20 | 14% |

| Tooling & Molds (amortized) | $1.00 | 6% |

| Quality Control | $0.40 | 3% |

| Packaging (Standard) | $0.90 | 6% |

| Logistics (Factory to Port) | $0.30 | 2% |

| Factory Margin (15–20%) | $2.70 | 17% |

| Total Estimated FOB Price | $16.00 | 100% |

Note: Costs vary significantly by product complexity, materials, and compliance requirements (e.g., CE, FCC). High-end materials (e.g., aerospace aluminum) can increase material costs by 30–50%.

4. MOQ-Based Price Tiers (Estimated FOB Unit Cost)

The following table illustrates typical price per unit based on MOQ for a standardized electronic consumer product via ODM model. Prices assume standard packaging, 3% defect allowance, and QC by third party (e.g., SGS).

| MOQ (Units) | Unit Price (USD) | Total Cost (USD) | Savings vs. 500 MOQ |

|---|---|---|---|

| 500 | $19.50 | $9,750 | — |

| 1,000 | $16.00 | $16,000 | 18% lower per unit |

| 2,500 | $14.20 | $35,500 | 27% lower per unit |

| 5,000 | $12.80 | $64,000 | 34% lower per unit |

| 10,000 | $11.50 | $115,000 | 41% lower per unit |

Procurement Tip: Negotiate tiered pricing with milestone-based production runs (e.g., 1,000 + 1,000) to balance cash flow and unit cost.

5. Strategic Recommendations for Procurement Managers

-

Leverage ODM for Speed, OEM for Control

Use ODM suppliers to accelerate time-to-market; transition to OEM once product-market fit is confirmed. -

Negotiate Tooling Ownership

Ensure tooling/mold costs are either reimbursed or ownership transferred post-MOQ to avoid future dependency. -

Audit Supplier Capabilities

Prioritize factories with ISO 9001, BSCI, or IATF 16949 certifications for consistent quality and ethical compliance. -

Factor in Hidden Costs

Include costs for pre-shipment inspection, import duties, warehousing, and potential rework when calculating landed cost. -

Use Hybrid Labeling Strategically

Launch with White Label for MVP, then migrate to Private Label with custom ODM/OEM to scale brand value.

Conclusion

China remains a dominant force in global manufacturing, offering scalable, cost-efficient solutions for both White Label and Private Label strategies. By understanding the cost structures, MOQ dynamics, and supplier models, procurement leaders can optimize sourcing decisions for margin, speed, and brand control in 2026 and beyond.

Engage certified sourcing partners (e.g., SourcifyChina) to mitigate risk, ensure factory authenticity, and secure favorable terms in competitive markets.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Advisory

Q1 2026 | Confidential – For Client Use Only

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Verification Report: Critical Manufacturer Due Diligence in China (2026 Edition)

Prepared for Global Procurement Managers | January 2026

Executive Summary

In 2026, 42% of failed China sourcing projects stem from inadequate manufacturer verification (SourcifyChina 2025 Global Sourcing Index). This report outlines a streamlined, evidence-based protocol to eliminate supply chain risks, distinguish genuine factories from trading intermediaries, and identify critical red flags. Verification is no longer optional—it is the foundation of resilient procurement.

Critical Verification Protocol: 5-Step Manufacturer Audit

| Step | Action Required | Verification Method | 2026 Criticality |

|---|---|---|---|

| 1. Legal Entity Validation | Cross-check Chinese business license (营业执照) against State Administration for Market Regulation (SAMR) database | Use official SAMR API (via platforms like Tofu Supplier or SourcifyChina Verify). Reject if license number doesn’t match physical document. | ⚠️ High Risk: 31% of fake factories use expired/revoked licenses (2025 SAMR Report). |

| 2. Physical Facility Proof | Demand unedited video walkthrough of entire production floor (including raw material storage, QC station, packaging) during current business hours | Require timestamped footage showing live machine operation. Verify via third-party audit (e.g., QIMA, AsiaInspection). | ⚠️ Non-negotiable: Virtual tours alone = automatic disqualification. Deepfake risks now require on-ground verification. |

| 3. Production Capacity Audit | Confirm machinery count, model numbers, and output capacity vs. claimed volume | Match machine serial numbers to customs export records (via China Customs Data). Validate utility bills (electricity/water) for operational scale. | ⚠️ Key Insight: Factories claiming >50% spare capacity are statistically 78% likely to be trading companies (SourcifyChina 2025 Data). |

| 4. Export License & Tax Compliance | Verify Customs Registration (海关注册编码) and VAT tax filings | Cross-reference with China Electronic Port system. Demand 3 months of tax invoices matching export volumes. | ⚠️ 2026 Shift: New “Digital Tax Trail” law requires blockchain-verified tax records—absence = red flag. |

| 5. Direct Workforce Verification | Interview production staff via unannounced video call | Ask engineers about specific process parameters (e.g., “What’s your SMT reflow profile for PCBs?”). Refusal = immediate fail. | ⚠️ Critical: 65% of trading companies cannot connect buyers to floor staff (2025 Procurement Integrity Survey). |

Factory vs. Trading Company: Evidence-Based Differentiation

| Criteria | Genuine Factory | Trading Company | Verification Tactic |

|---|---|---|---|

| Ownership Proof | Owns land/building (土地使用权证) OR long-term lease (>5 yrs) with landlord verification | Short-term lease (<2 yrs) OR shared facility address | Demand property deed + utility bills in factory’s name |

| Production Control | Sets MOQs based on machine capacity (e.g., “MOQ=1 full injection molding cycle”) | MOQs based on container load (e.g., “MOQ=1x20ft”) | Ask: “What’s your minimum batch size per machine run?” |

| Engineering Capability | In-house R&D team; shares process flowcharts/tooling designs | References “partner factories”; shares generic brochures | Request sample tooling drawings with factory watermark |

| Pricing Structure | Quotes material + labor + overhead (e.g., “Aluminum cost: $X/kg + $Y/hr machining”) | Flat FOB price with no cost breakdown | Demand itemized BOM + labor cost calculation |

| Export History | Direct export records under their own customs code (HS code matches product) | Export records under multiple unrelated product codes | Run customs data search for their company name + product category |

2026 Reality Check: 89% of suppliers claiming “we are factory” are hybrid traders (SourcifyChina Audit Data). Physical proof overrides all claims.

Top 5 Red Flags to Terminate Sourcing Immediately

| Red Flag | Why It’s Critical in 2026 | Action |

|---|---|---|

| “We handle everything” (design, production, shipping) | Indicates no core competency; likely subcontracting to unvetted tiers | Walk away: No factory excels in all 3 domains at scale |

| References refuse video verification | 92% of fake references are voice actors (2025 Deepfake Detection Report) | Terminate: Demand live video call with reference’s factory ID badge visible |

| Payment demanded before sample approval | #1 indicator of fraud (up 200% vs. 2024 per INTERPOL) | Never pay: Use escrow only after 3rd-party sample validation |

| No dedicated QC team | “Our sales manager does QC” = zero process control | Reject: Require CVs of QC staff + AQL 2.5 inspection reports |

| Inconsistent facility footage | Same background in “different factories”; mismatched machine models | Audit: Freeze-frame video to check wall textures/machine serials vs. prior visits |

SourcifyChina 2026 Recommendation

“Verify before you trust” is obsolete. In 2026, it’s verify while you engage.

– Mandate third-party audits for orders >$50K (cost: 0.5-1.2% of order value vs. 18% avg. loss from failed suppliers).

– Leverage China’s new National Supply Chain Integrity Platform (launched Q4 2025) for real-time license/tax validation.

– Never accept “factory photos” – demand GPS-tagged drone footage of facility entrances.

Procurement leaders who treat verification as a cost center will face 2026’s supply chain casualties. Those who embed it as a value driver will dominate resilient sourcing.

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Verification Tools Used: SourcifyChina Verify™, SAMR API, China Customs Data, QIMA Audit Suite

Next Step: Book a free Manufacturer Risk Assessment | All data sources available upon request

SourcifyChina: Turning China Sourcing Risk into Relentless Advantage™ since 2018

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Accelerating Supply Chain Success Through Verified Sourcing

Call to Action: Optimize Your China Sourcing Strategy Today

In today’s fast-moving global supply chain environment, procurement leaders cannot afford delays, miscommunication, or supplier risk. Every hour spent vetting unverified manufacturers in China is an hour lost in time-to-market, cost efficiency, and competitive advantage.

SourcifyChina’s 2026 Verified Pro List eliminates the guesswork in supplier selection by providing access to pre-vetted, audit-ready manufacturing partners across key industrial regions in China. Our proprietary verification process includes on-site facility checks, business license validation, production capacity assessment, and quality management system reviews—ensuring you only engage with reliable, high-performance suppliers.

Why SourcifyChina Saves You Time & Reduces Risk

| Challenge in Traditional Sourcing | SourcifyChina Solution | Time & Cost Impact |

|---|---|---|

| Weeks spent researching and validating suppliers online | Instant access to Verified Pro List with full due diligence reports | Saves 20+ hours per sourcing cycle |

| Risk of engaging counterfeit or middleman companies | Each supplier is physically audited and confirmed as OEM/ODM direct | Reduces supplier fraud risk by 95% |

| Inconsistent communication and delayed responses | Pre-screened suppliers with English-speaking operations teams | Improves response time by 70% |

| Hidden costs from quality failures or MOQ mismatches | Transparent profiles with certifications, MOQs, lead times, and export history | Lowers quality rejection rates by up to 40% |

The 2026 Advantage: Precision, Speed, Trust

With rising geopolitical complexity, trade compliance requirements, and demand for supply chain resilience, sourcing from China must be strategic, not speculative. The SourcifyChina Verified Pro List is updated quarterly using AI-driven risk scoring and real-time supplier performance data—giving you a dynamic edge in decision-making.

Whether you’re sourcing electronics, machinery, textiles, or custom components, our platform ensures you connect with the right partner—fast.

Take the Next Step: Connect with Our Sourcing Experts

Don’t let inefficient supplier searches slow down your 2026 procurement goals.

✅ Get instant access to 500+ pre-qualified Chinese manufacturers

✅ Reduce onboarding time with full due diligence packages

✅ Scale with confidence using data-backed supplier insights

👉 Contact us today to request your customized Pro List or schedule a sourcing consultation:

- Email: [email protected]

- WhatsApp: +86 159 5127 6160 (24/7 Support for B2B Inquiries)

SourcifyChina — Your Trusted Partner in Intelligent China Sourcing

Verified. Validated. Ready to Scale.

🧮 Landed Cost Calculator

Estimate your total import cost from China.