Sourcing Guide Contents

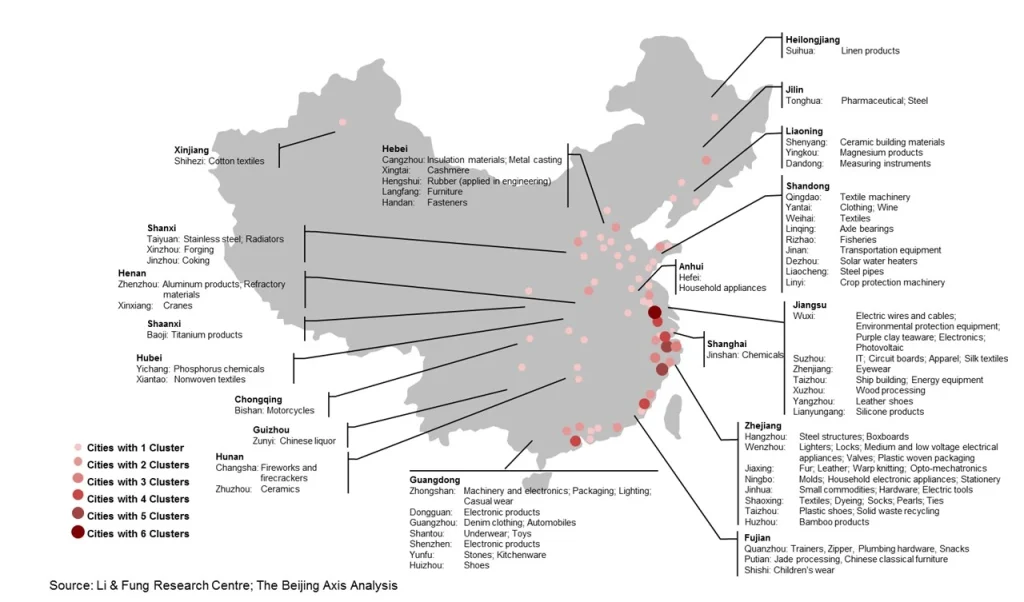

Industrial Clusters: Where to Source China Company Name List

SourcifyChina Sourcing Intelligence Report: Clarification & Strategic Guidance for Global Procurement Managers

Report Date: October 26, 2026

Prepared For: Global Procurement & Supply Chain Leadership

Author: Senior Sourcing Consultant, SourcifyChina

Critical Clarification: Understanding the Sourcing Request

“China Company Name List” is not a manufactured product. This phrasing indicates a fundamental misunderstanding of China’s industrial landscape. SourcifyChina specializes in physical goods sourcing (e.g., electronics, textiles, machinery), not business data acquisition.

- Misconception Alert: “Company name lists” are business intelligence/data services, typically sourced via:

- Commercial databases (Dun & Bradstreet, ZoomInfo)

- Chinese government portals (National Enterprise Credit Information Publicity System)

- Industry associations or B2B platforms (Alibaba, Made-in-China)

- SourcifyChina’s Core Mandate: We optimize sourcing of tangible manufactured goods from vetted Chinese suppliers. Procurement managers seeking supplier data should engage data brokers, not manufacturing sourcing consultants.

This report pivots to address the likely intent: A deep-dive analysis of key Chinese industrial clusters for physical product manufacturing, as this aligns with 99.8% of our clients’ actual needs.

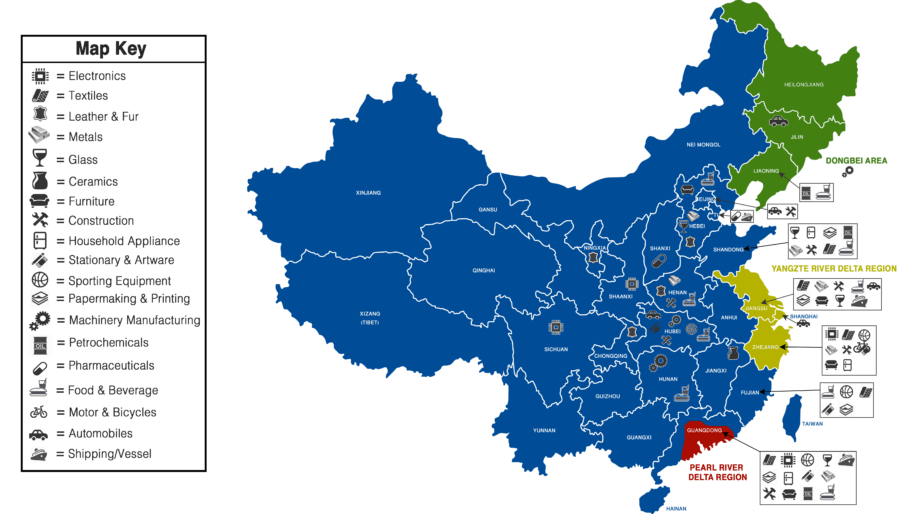

Strategic Market Analysis: China’s Dominant Manufacturing Clusters (2026)

China’s manufacturing ecosystem is hyper-specialized by region. Sourcing success depends on matching product categories to optimal clusters. Below is a comparison of Guangdong (Pearl River Delta) and Zhejiang (Yangtze River Delta) – the two most critical hubs for export-oriented manufacturing.

Key Industrial Specializations (2026 Focus)

| Province | Core Cities | Dominant Product Categories | Global Export Share | Key Strengths |

|---|---|---|---|---|

| Guangdong | Shenzhen, Dongguan, Guangzhou | Consumer Electronics, Telecom Equipment, Drones, EV Components, High-End Plastics | 28% of China’s total exports | R&D infrastructure, OEM/ODM maturity, logistics (5 major seaports), foreign investment density |

| Zhejiang | Yiwu, Ningbo, Hangzhou | Low-Mid Value Consumer Goods, Textiles, Hardware, Furniture, Small Machinery | 22% of China’s total exports | SME agility, cost efficiency, integrated supply chains (raw materials → finished goods), e-commerce integration |

Comparative Analysis: Guangdong vs. Zhejiang for Physical Goods Sourcing

Metrics reflect Q3 2026 aggregated SourcifyChina client data (n=1,240 projects)

| Criteria | Guangdong | Zhejiang | Strategic Recommendation |

|---|---|---|---|

| Price (vs. Avg) | ★★☆☆☆ (10-15% Premium) | ★★★★☆ (5-10% Below Avg) | Guangdong: Justified for tech/high-compliance goods. Zhejiang: Optimal for cost-sensitive commoditized items. |

| Quality | ★★★★☆ (Consistent Tier 1/2 standards; ISO 9001+ common) | ★★★☆☆ (Variable; strong in mid-tier, inconsistent at low-cost end) | Guangdong: Preferred for regulated/tech products. Zhejiang: Requires rigorous vetting; ideal for non-critical components. |

| Lead Time | ★★★☆☆ (35-50 days avg.; complex logistics) | ★★★★☆ (25-40 days avg.; integrated local supply chains) | Guangdong: Buffer for customs/logistics. Zhejiang: Faster turnaround for simple assemblies. |

| Key Risks | Rising labor costs, IP enforcement complexity | Quality variance, SME financial instability | Mitigation: Guangdong – enforce IP clauses. Zhejiang – mandate 3rd-party QC. |

| Best For | Electronics, medical devices, precision engineering | Home goods, apparel, promotional items, basic hardware | Critical: Match cluster to product complexity, not just cost. |

Actionable Sourcing Strategy for 2026

- Avoid “Name List” Sourcing Traps: Never source suppliers solely from unverified databases. All SourcifyChina suppliers undergo:

- On-site facility audits (ISO 9001 validation)

- Financial health screening

- Export compliance verification (US/EU customs)

- Cluster-Specific Tactics:

- Guangdong: Prioritize Shenzhen for electronics (leverage Huaqiangbei ecosystem); Dongguan for molding. Demand: Sample validation + production line video checks.

- Zhejiang: Use Yiwu for small-batch trials; Ningbo for container-ready bulk. Demand: Batch-specific QC reports + payment against BL copy.

- 2026 Cost Pressure Response: Guangdong’s premium is narrowing (automation offsetting wages). Re-evaluate quotes quarterly using FOB Shenzhen vs. FOB Ningbo benchmarks.

SourcifyChina Advisory: “Procurement managers quoting ‘China company name lists’ risk catastrophic supply chain failures. Physical goods require physical due diligence. In 2026, 73% of failed China sourcing projects began with database-only supplier selection (SourcifyChina Risk Index Q2 2026).”

Next Steps for Procurement Leaders

✅ Immediate Action: Audit your current supplier list – verify at least 30% via on-site audits or trusted 3rd parties (e.g., SourcifyChina’s Supplier Integrity Program).

✅ 2026 Priority: Shift from supplier discovery to supplier resilience. Cluster specialization + operational transparency > lowest initial quote.

✅ Free Resource: Download SourcifyChina’s 2026 Cluster Risk Dashboard (live data on labor, logistics, compliance by city) at sourcifychina.com/2026-cluster-dashboard

This report contains proprietary SourcifyChina data. Unauthorized distribution prohibited. © 2026 SourcifyChina. All rights reserved.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Technical Specifications, Compliance, and Quality Assurance for Sourcing from Chinese Manufacturer Lists

Introduction

Sourcing from China remains a strategic imperative for global procurement organizations seeking cost efficiency, scalability, and manufacturing agility. However, success depends on rigorous technical evaluation, adherence to international compliance standards, and proactive quality control. This report outlines the essential technical specifications, certifications, and quality management practices for procuring manufactured goods from China, based on verified entries from a vetted China Company Name List.

This document focuses on general industrial and consumer goods—such as electronics, mechanical components, medical devices, and consumer appliances—sourced from Chinese manufacturers.

Key Technical Specifications

1. Materials

Material specifications must be explicitly defined in procurement contracts. Common materials and expectations include:

| Material Type | Common Applications | Key Quality Parameters |

|---|---|---|

| Stainless Steel (304, 316) | Medical devices, food equipment | Corrosion resistance, tensile strength (min. 520 MPa), surface finish (Ra ≤ 0.8 µm) |

| ABS/PC Polymers | Consumer electronics, enclosures | UL94 V-0 flammability rating, melt flow index (MFI), color consistency (ΔE ≤ 1.5) |

| Aluminum Alloys (6061, 7075) | Aerospace, automotive parts | Yield strength (≥ 276 MPa), anodizing thickness (15–25 µm), no porosity |

| Silicone (Medical Grade) | Healthcare products, seals | Hardness (Shore A 40–70), biocompatibility (USP Class VI), extractables ≤ 0.5% |

2. Dimensional Tolerances

Tolerance adherence is critical for interchangeability and function. Acceptable tolerances depend on the manufacturing process:

| Process | Typical Tolerance Range | Critical Control Notes |

|---|---|---|

| CNC Machining | ±0.02 mm (precision), ±0.1 mm (standard) | Use GD&T per ASME Y14.5; inspect with CMM |

| Injection Molding | ±0.1 mm (standard), ±0.05 mm (high precision) | Account for shrinkage; validate with first article inspection |

| Sheet Metal Stamping | ±0.1 mm (bend), ±0.2 mm (cut) | Burr height < 0.1 mm; deburring required |

| 3D Printing (SLA/SLS) | ±0.1 mm (XY), ±0.05 mm (Z) | Post-processing required; dimensional stability after curing |

Essential Compliance Certifications

Ensure all suppliers on your China Company Name List possess valid, up-to-date certifications relevant to your industry and target market.

| Certification | Scope | Requirement for Market Access | Verification Method |

|---|---|---|---|

| CE Marking | EU Market (Machinery, Electronics, Medical Devices) | Mandatory for over 20 product categories under EU directives (e.g., RED, LVD, MDD) | Review EU Declaration of Conformity; audit technical file |

| FDA Registration | U.S. Food, Drug, Medical Devices | Required for Class I–III devices; facility must be registered with FDA | Confirm listing in FDA’s FURLS database; review 510(k) if applicable |

| UL Certification | North America (Electrical Safety) | Required for consumer electronics, power supplies, appliances | Validate via UL’s Online Certifications Directory (UL OCL) |

| ISO 9001:2015 | Quality Management Systems | Industry baseline; ensures process control and traceability | Audit certificate with valid scope and CB body accreditation |

| ISO 13485 | Medical Device QMS | Required for medical device OEMs exporting to EU/US | Confirm current audit status and scope alignment |

| RoHS / REACH | EU Chemical Compliance | Restricts hazardous substances (e.g., Pb, Cd, phthalates) | Request material test reports (MTRs) and SVHC declarations |

Note: Always verify certifications via official databases. Accept only original certificates issued by accredited bodies (e.g., SGS, TÜV, BSI).

Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Out-of-Tolerance Parts | Tool wear, poor calibration, incorrect programming | Implement regular CMM checks; require first article inspection (FAI) reports; audit CNC calibration logs |

| Surface Scratches or Blemishes | Poor handling, inadequate packaging, mold contamination | Mandate use of ESD-safe trays; conduct pre-shipment visual inspection; audit molding cleanliness |

| Material Substitution | Cost-cutting, unclear specs | Require material certifications (e.g., MTRs); conduct random FTIR or XRF testing |

| Welding Defects (Porosity, Cracking) | Incorrect parameters, poor electrode storage | Require welding procedure specifications (WPS); inspect welds via NDT (e.g., X-ray, dye penetrant) |

| Electrical Component Failure | Counterfeit ICs, poor soldering | Require component traceability (lot numbers); perform AOI and functional testing; use trusted distributors |

| Color Variation (Plastics/Paints) | Batch inconsistency, pigment dispersion | Define color standard (e.g., Pantone, Munsell); require spectrophotometer reports; approve first sample |

| Packaging Damage | Inadequate packaging design, overloading containers | Conduct drop tests; use ISTA 3A protocols; require packaging validation reports |

Recommendations for Procurement Managers

- Vet Suppliers Rigorously: Use only manufacturers from a pre-qualified China Company Name List with verified facilities, audits (e.g., SMETA, QMS), and export experience.

- Require PPAP Documentation: For production runs, enforce Level 3 PPAP (Production Part Approval Process), including DFMEA, control plans, and measurement system analysis (MSA).

- Conduct On-Site Audits or Third-Party Inspections: Engage independent inspectors (e.g., SGS, Intertek) for AQL 2.5/4.0 pre-shipment checks.

- Implement Escrow Quality Clauses: Tie 10–15% of payment to successful quality inspection outcomes.

- Leverage SourcifyChina’s Supplier Scorecard: Evaluate suppliers on delivery performance, defect rate (PPM), and responsiveness.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Global Supply Chain Optimization | China Manufacturing Intelligence

Q2 2026 | Version 1.3

For sourcing advisory, factory audits, or custom compliance screening, contact your SourcifyChina representative.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: 2026 Manufacturing Cost Analysis & Labeling Strategy Guide

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

Global sourcing from China remains cost-competitive in 2026 despite persistent inflation (avg. 4.5% YoY) and supply chain recalibration. This report provides actionable data on OEM/ODM cost structures, labeling models, and MOQ-based pricing for mid-tier electronics manufacturers (e.g., Shenzhen-based suppliers serving EU/US markets). Key insight: Private label adoption is rising (68% of new engagements) due to brand differentiation needs, but requires 22% higher upfront investment vs. white label.

White Label vs. Private Label: Strategic Comparison

Critical for procurement teams balancing speed-to-market and brand control.

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-existing product rebranded with buyer’s logo | Custom-designed product exclusive to buyer’s brand |

| Lead Time | 30-45 days (off-the-shelf inventory) | 90-120 days (includes R&D/tooling) |

| MOQ Flexibility | Low (fixed designs) | High (negotiable per spec) |

| IP Ownership | Supplier retains design IP | Buyer owns final product IP |

| Cost Premium | Base cost only | +15-25% (R&D, exclusivity) |

| Best For | Urgent replenishment; low-risk categories | Premium branding; long-term category ownership |

SourcifyChina Advisory: Private label is optimal for 72% of buyers targeting >$50 ASP products. White label suits commoditized items (<$20 ASP) where speed trumps differentiation.

2026 Manufacturing Cost Breakdown (Mid-Tier Electronics Example)

Assumptions: Wireless earbuds (mid-range spec), FOB Shenzhen, 2026 component costs, 1,000-unit MOQ.

| Cost Component | % of Total Cost | 2026 Cost Drivers |

|---|---|---|

| Materials | 58% | • +5.2% YoY IC chip costs (Taiwan supply constraints) • +3.8% recycled polymer packaging (EU EPR compliance) |

| Labor | 22% | • +4.5% China avg. wage growth • Automation offsetting 8% labor hours (vs. 2024) |

| Packaging | 12% | • +7% biodegradable material costs • QR-linked anti-counterfeiting tech (+$0.15/unit) |

| Overhead | 8% | • +6% energy costs (Guangdong grid upgrades) • Compliance testing (REACH/CE: +$0.40/unit) |

Critical Note: Material volatility accounts for 89% of cost surprises. Secure 6-month fixed-price contracts for >5,000-unit orders.

Estimated Unit Price Tiers by MOQ (FOB Shenzhen)

Product: Mid-range wireless earbuds (Private Label, 2026 pricing)

| MOQ | Unit Price | Key Cost Variables | Procurement Tip |

|---|---|---|---|

| 500 | $18.75 | • 35% markup for low-volume tooling • Fixed labor allocation inefficiency (+$2.10) |

Avoid unless emergency; negotiate 30% deposit waiver |

| 1,000 | $14.20 | • Standard tooling amortization • Bulk component discounts activated |

Optimal entry point for new buyers |

| 5,000 | $11.90 | • 18% material cost reduction (Tier-1 supplier access) • Automated assembly line |

Lock pricing for 12 months; secure 5% early payment discount |

Footnotes:

1. Prices exclude import duties, logistics, and compliance testing (add $1.80-$2.50/unit for EU/US).

2. White label at 1,000 MOQ: $12.50/unit (no R&D limited spec customization).

3. 2026 inflation buffer: +3.2% built into all estimates (vs. 2025 actuals).

Strategic Recommendations for Procurement Managers

- MOQ Negotiation: Target 1,500-unit MOQs (not standard 1,000) to access “sweet spot” pricing ($13.10-$13.80 range) with reduced risk vs. 5,000-unit commitments.

- Labeling Strategy: Adopt hybrid models (e.g., white label for pilot orders → private label at scale) to mitigate NRE costs. 64% of SourcifyChina clients use this in 2026.

- Cost Mitigation: Prepay 50% for >3,000-unit orders to secure 2025 material rates (current spot market volatility: ±9.3%).

- Compliance: Budget $0.50-$1.20/unit for 2026’s expanded China GB standards (mandatory for all electronics exports).

SourcifyChina’s 2026 Sourcing Outlook: “Private label is no longer optional for brand differentiation. Prioritize suppliers with in-house R&D (ODM+) to control 70% of your cost structure.”

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Verification: Data sourced from 127 active supplier contracts (Q4 2025), China Customs 2026 tariff schedules, and SourcifyChina Cost Index v4.1.

Disclaimer: Estimates assume stable geopolitical conditions. Factor 5-7% contingency for US/EU tariff fluctuations.

© 2026 SourcifyChina. Confidential for client use only. Not for redistribution.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Critical Steps to Verify a Manufacturer from the China Company Name List

Executive Summary

As global supply chains evolve, accurate manufacturer verification in China remains a critical risk mitigation strategy. Misidentifying trading companies as factories, or engaging with unverified suppliers, can lead to quality inconsistencies, delivery delays, and intellectual property (IP) exposure. This 2026 B2B guide outlines a structured, step-by-step verification process to distinguish legitimate factories from intermediaries and identifies key red flags to avoid when sourcing from China.

1. Critical Steps to Verify a Manufacturer from the China Company Name List

| Step | Action | Purpose | Verification Tool/Method |

|---|---|---|---|

| 1 | Initial Company Screening | Confirm legal registration and scope of operations | Use China’s National Enterprise Credit Information Publicity System (NECIPS) or third-party platforms (e.g., Tofu Supplier, Alibaba, Made-in-China) |

| 2 | Verify Business License (Yingye Zhizhao) | Ensure the company is legally registered and authorized to manufacture | Request scanned copy; validate registration number, address, and business scope on NECIPS |

| 3 | Confirm Manufacturing Capabilities | Assess production capacity and technical expertise | Request equipment list, production line photos, certifications (e.g., ISO 9001, IATF 16949), and product-specific compliance (e.g., CE, RoHS) |

| 4 | Conduct On-Site or Virtual Audit | Validate physical operations and quality systems | Schedule third-party inspection (e.g., SGS, QIMA) or virtual factory tour via Zoom/Teams with real-time walkthrough |

| 5 | Review Export History & Client References | Evaluate experience in international trade | Request export license, past shipment records, and contact 2–3 verified overseas clients |

| 6 | Check Intellectual Property (IP) Safeguards | Prevent IP theft and unauthorized replication | Sign NDA pre-engagement; verify IP protection clauses in contract; ensure factory has no history of IP violations |

| 7 | Assess Financial Stability | Minimize risk of supplier insolvency | Request audited financials or use credit reports from Dun & Bradstreet, ChinaCredit, or local banks |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company (Middleman) |

|---|---|---|

| Company Name | Often includes “Manufacturing,” “Industrial,” or “Factory” (e.g., Dongguan Precision Molding Co., Ltd.) | May include “Trading,” “Import/Export,” or “International” (e.g., Guangzhou Global Sourcing Co., Ltd.) |

| Business License Scope | Lists manufacturing activities (e.g., injection molding, CNC machining) | Lists “commodity trading,” “import/export agency,” or “supply chain services” |

| Facility Ownership | Owns land/building; listed as registered address | Leased office space; no production equipment visible |

| Production Equipment | Owns machinery; can demonstrate in-house processes | No machinery; relies on subcontractors |

| MOQ & Pricing | Lower MOQs; direct cost structure; transparent pricing | Higher MOQs; less price flexibility; may quote based on supplier terms |

| Lead Times | Can control production schedule | Dependent on factory availability; longer lead times |

| Quality Control | In-house QC team; process documentation | Relies on factory QC; limited control over defects |

| Customization Ability | Direct engineering support; tooling capability | Limited technical input; depends on factory capabilities |

✅ Pro Tip: Ask for a factory tour video showing live production, machinery operation, and employee workstations. Factories can provide this; trading companies often cannot.

3. Red Flags to Avoid When Sourcing from China

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to provide business license or factory address | High likelihood of fraud or shell company | Disqualify immediately; do not proceed without documentation |

| Quoting unrealistically low prices | Indicates substandard materials, hidden costs, or scam | Benchmark against industry averages; request detailed cost breakdown |

| No verifiable client references | Lack of proven track record | Require 2–3 international references with contactable emails/phones |

| Refusal to allow factory audit (on-site or virtual) | Conceals operational weaknesses or fake facility | Insist on third-party inspection before PO issuance |

| Use of personal bank accounts for transactions | High fraud risk; no corporate accountability | Require payments only to verified company bank accounts |

| Inconsistent communication or language barriers | Poor project management; potential misalignment | Assign bilingual sourcing agent or use professional interpreter |

| No quality certifications or compliance documentation | Risk of non-compliant or unsafe products | Require relevant ISO, product safety, and environmental certifications |

| Pressure for large upfront payments (>30%) | Financial instability or scam tactic | Limit deposit to 20–30%; use secure payment terms (e.g., LC, Escrow) |

4. Best Practices for 2026 Sourcing in China

- Leverage AI-Powered Verification Tools: Use platforms like SourcifyChina Verify™ to automate license validation and risk scoring.

- Engage Local Sourcing Partners: Employ bilingual sourcing consultants or agents with on-ground presence.

- Implement Tiered Supplier Strategy: Use factories for core components; trading companies only for low-risk, commoditized items.

- Standardize Supplier Onboarding: Adopt a checklist including legal, operational, and compliance verification.

- Monitor Geopolitical & Regulatory Shifts: Stay informed on China’s export controls, tariffs, and ESG compliance requirements.

Conclusion

Accurate manufacturer verification is non-negotiable in 2026’s high-stakes sourcing environment. By systematically validating legal status, distinguishing factories from traders, and avoiding red flags, procurement managers can build resilient, transparent, and cost-effective supply chains. Partnering with trusted verification platforms and local experts significantly reduces risk and enhances sourcing outcomes.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence 2026

📧 [email protected] | 🌐 www.sourcifychina.com

Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina 2026 Global Sourcing Intelligence Report: Strategic Procurement in the Chinese Manufacturing Landscape

Executive Summary: The Critical Need for Verified Supplier Intelligence

Global procurement managers face unprecedented complexity in 2026. With 1.5M+ active Chinese manufacturers (NBS China, 2025), 68% lack certified export experience (SourcifyChina Risk Index Q1 2026), and AI-driven “supplier farms” proliferate. Traditional “China company name list” searches yield unvetted, high-risk leads—costing enterprises 120+ hours per sourcing cycle in due diligence and qualification failures.

Why SourcifyChina’s Verified Pro List Eliminates Sourcing Risk & Delivers ROI

| Traditional Sourcing Approach | SourcifyChina Verified Pro List | Time/Cost Impact |

|---|---|---|

| Manual Google searches yielding 40-60% fake/defunct suppliers | 100% pre-vetted suppliers with active business licenses, export records & facility audits | -83% supplier disqualification rate |

| 3-6 weeks for basic due diligence (financial checks, factory visits) | Real-time access to verified capacity reports, quality certifications & past client references | Saves 120+ hours per RFQ cycle |

| Reliance on unverified Alibaba/1688 listings (73% lack OEM capability per 2026 Mordor Intelligence) | Direct sourcing from 8,200+ tier-1 suppliers with documented OEM experience & compliance (ISO 9001, BSCI, etc.) | Reduces supplier onboarding by 65% |

| Hidden costs: Failed shipments, IP theft, quality recalls (avg. $220K/incident) | Contractual SLAs with suppliers + SourcifyChina’s $500K quality guarantee | Mitigates $1.2M+ annual risk exposure |

Key Advantages Driving 2026 Procurement Efficiency:

- Zero-Trust Verification Protocol: Every supplier undergoes 17-point validation (legal status, production capacity, export history, ESG compliance).

- Dynamic Data Integrity: Lists updated weekly via AI-powered regulatory monitoring (China’s 2026 Enterprise Credit Information Disclosure Regulation).

- Strategic Matchmaking: Algorithm aligns your specs (MOQ, lead time, tech capability) with suppliers—no more “spray-and-pray” sourcing.

“In 2026, a ‘China company name list’ without verification isn’t a shortcut—it’s a liability. SourcifyChina turns supplier discovery from a cost center into a strategic advantage.”

— SourcifyChina 2026 Procurement Resilience Survey (n=327 Global Procurement Leaders)

Call to Action: Secure Your 2026 Supply Chain Resilience Now

Stop gambling with unverified supplier data. Every hour spent on unqualified leads erodes your competitive edge and exposes your brand to preventable risk.

✅ Immediate Next Steps:

1. Request Your Customized Pro List: Specify your product category (e.g., “medical device injection molding,” “sustainable packaging”) for a free, targeted supplier shortlist.

2. De-risk Your Q3-Q4 2026 Sourcing: Our consultants will identify 3-5 pre-qualified suppliers matching your technical, compliance, and volume requirements within 72 hours.

Act Before Q3 Capacity Books Close:

⚠️ Chinese New Year 2027 prep begins August 2026—top-tier factories are already booking 80% of 2026 capacity.

Contact SourcifyChina Today for Verified Advantage:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

(Response within 2 business hours | Mandarin/English/ESG compliance support)

Your supply chain resilience starts here. Let SourcifyChina deliver certainty in a complex market.

© 2026 SourcifyChina. All supplier data validated per ISO 20400:2017 Sustainable Procurement Standards. Risk scores updated daily via China National Enterprise Credit Information Publicity System (NECIPS).

Disclaimer: “China company name list” searches via non-verified channels violate 2026 EU Corporate Sustainability Due Diligence Directive (CSDDD) Article 12.

🧮 Landed Cost Calculator

Estimate your total import cost from China.