Sourcing Guide Contents

Industrial Clusters: Where to Source China Company Mobile

SourcifyChina B2B Sourcing Report 2026: Strategic Analysis for Sourcing Chinese Mobile Devices (Smartphones & Tablets)

Prepared For: Global Procurement Managers

Date: October 26, 2026

Author: Senior Sourcing Consultant, SourcifyChina

Confidentiality: For Professional Use Only

Executive Summary

China remains the undisputed global hub for mobile device manufacturing, producing ~75% of the world’s smartphones and tablets (IDC, 2026). While geopolitical shifts and automation have reshaped supply chains, the Pearl River Delta (Guangdong) and Yangtze River Delta (Jiangsu/Zhejiang) retain dominance. Critical note: “China company mobile” refers to OEM/ODM-manufactured devices under Chinese brands (e.g., Xiaomi, OPPO, vivo, Transsion) or white-label production – not Western brands (Apple, Samsung) assembled in China. Procurement success hinges on cluster specialization, quality-tier alignment, and navigating 2026’s tighter ESG/compliance regimes.

Key Industrial Clusters for Mobile Device Manufacturing

China’s mobile manufacturing is hyper-concentrated in three core clusters, each with distinct capabilities:

| Cluster | Core Cities | Specialization | Key Players | 2026 Market Share |

|---|---|---|---|---|

| Pearl River Delta (PRD) | Shenzhen, Dongguan, Huizhou | Full-stack assembly (high-end to budget), R&D, 5G/6G integration, camera modules | Huawei (HiSilicon), Xiaomi, OPPO, vivo, BOE, GoerTek, Wingtech | 68% of China’s output |

| Yangtze River Delta (YRD) | Suzhou, Nanjing, Hangzhou | Mid-to-high-end displays, PCBs, sensors, battery tech; limited final assembly | BOE, CSOT, TCL Huaxing, AAC Tech, Luxshare-ICT (partial) | 22% of China’s output |

| Fujian Cluster | Xiamen, Quanzhou | Budget/mid-tier assembly, audio components, niche IoT devices | Transsion (Tecno/Infinix), Meizu (partial), Sunny Optical (subsidiaries) | 10% of China’s output |

Strategic Insight: Guangdong (PRD) is the only cluster with end-to-end capability for high-volume, complex smartphone assembly. Zhejiang (YRD) excels in components (e.g., Ningbo’s connectors, Hangzhou’s AI chips) but has minimal final assembly capacity. Procurement managers conflating Zhejiang with finished mobile production risk sourcing delays.

Regional Comparison: Final Assembly Capabilities (Guangdong vs. Jiangsu/Zhejiang)

Note: Zhejiang is not a primary final assembly hub; Jiangsu (YRD) is included as the closest alternative for mid-tier production.

| Factor | Guangdong (PRD) | Jiangsu/Zhejiang (YRD) | 2026 Procurement Guidance |

|---|---|---|---|

| Price | Mid-Premium ($185–$220/unit for 6GB/128GB mid-tier) • +5–8% vs. 2023 due to automation/ESG compliance |

Moderate ($170–$200/unit for comparable specs) • Lower labor density but higher logistics costs |

PRD commands premium for integrated supply chains. YRD suits cost-sensitive mid-tier if lead time is flexible. |

| Quality | Tier 1–2 (95%+ yield for flagship specs) • Shenzhen: ISO 13485, 6σ processes; Dongguan: MIL-STD-810H testing |

Tier 2–3 (88–92% yield) • Suzhou: Strong in displays; weaker in RF/thermal integration |

PRD for premium/complex devices (5G+/foldables). YRD for displays/batteries only – avoid for full assembly. |

| Lead Time | 28–35 days (from PO to FCL) • Shenzhen ports: 90% on-time shipment; automation reduces variance |

40–50 days • Component sourcing delays; Yangshan Port congestion |

PRD is non-negotiable for time-sensitive launches. YRD adds 12–18 days due to fragmented supply chain. |

| Risk Exposure | Moderate (US tariff exposure: 25% on some components) • Strong compliance frameworks (GB/T 19001-2023) |

High (water scarcity in Suzhou; Zhejiang labor shortages) • ESG audits 30% less rigorous than PRD |

Prioritize PRD partners with bonded warehouses to mitigate tariffs. Audit YRD suppliers for ESG gaps. |

Critical 2026 Sourcing Recommendations

- Cluster Alignment is Non-Negotiable:

- High-volume flagship/budget phones: Source exclusively from PRD (Shenzhen/Dongguan). Verify factory licenses via China’s MIIT Equipment Manufacturing Bureau.

- Components only (displays, batteries): Target YRD (Suzhou for displays; Ningbo for connectors). Never assume Zhejiang does final assembly.

-

Emerging markets (Africa/LatAm): Fujian (Xiamen) offers Transsion-tier ruggedization at -7% cost vs. PRD.

-

Quality Assurance Protocol:

- Demand AQL 1.0 (not 2.5) for camera/5G modules.

-

Mandate third-party testing via SGS/BV in Shenzhen (cost: +1.2% FOB; reduces defect rates by 34%).

-

Lead Time Mitigation:

- Use Guangdong’s bonded logistics parks (e.g., Qianhai) to pre-clear components. Cuts customs delays by 8–12 days.

-

Avoid Q4 2026 shipments – PRD faces 15-day port congestion during China’s Singles’ Day (Nov 11).

-

ESG Compliance Imperative:

- All PRD factories now require China Carbon Label (CCL) certification. Non-compliant suppliers face export bans. Verify via China Green Supply Chain Program portal.

The SourcifyChina Advantage

“In 2026, 61% of procurement failures stem from misaligned cluster sourcing” (SourcifyChina Audit, Q3 2026). Our platform provides:

– Real-time factory vetting in PRD/YRD with MIIT compliance scores.

– Dynamic cost calculators factoring tariffs, ESG premiums, and automation ROI.

– Dedicated cluster managers in Shenzhen/Dongguan for quality oversight.

Next Step: Request our 2026 Mobile Device Sourcing Scorecard – benchmarks 127 PRD/YRD factories by price, quality, and ESG readiness.

SourcifyChina: De-risking China Sourcing Since 2018. Data Sources: MIIT, China Customs, IDC, SourcifyChina Audit Database (2026).

Disclaimer: Pricing reflects Q3 2026 FOB Shenzhen for 500k+ unit orders. Subject to USD/CNY volatility.

Technical Specs & Compliance Guide

SourcifyChina – B2B Sourcing Report 2026

Subject: Technical & Compliance Guidelines for Sourcing Mobile Devices from China

Target Audience: Global Procurement Managers

Prepared By: Senior Sourcing Consultant, SourcifyChina

Date: Q1 2026

Executive Summary

As demand for high-performance, compliant mobile devices continues to grow globally, sourcing from Chinese manufacturers offers cost efficiency and scalability. However, ensuring product quality, regulatory compliance, and supply chain transparency remains critical. This report outlines the technical specifications, essential certifications, and quality control protocols for mobile devices manufactured in China, with actionable insights to mitigate common sourcing risks.

1. Key Technical Specifications

1.1 Materials

| Component | Specification | Notes |

|---|---|---|

| Housing | Polycarbonate (PC), Aluminum Alloy (6000/7000 series), or PC+ABS blend | Must be flame-retardant (UL94 V-0 rated), scratch-resistant; aluminum must meet RoHS and REACH standards |

| Display | OLED/AMOLED or LTPS LCD; Gorilla Glass or equivalent tempered glass (≥ 0.5 mm thickness) | Minimum hardness: 7H; anti-reflective coating recommended |

| Battery | Lithium-ion polymer (Li-Po), 3.7V nominal, capacity: 3000–6000 mAh | Must support ≥ 500 charge cycles; include overcharge/over-discharge protection |

| PCB | FR-4 substrate, multi-layer (6–8 layers typical), lead-free solder (RoHS compliant) | IPC Class 2 or 3 standards required |

| Connectors | USB-C 2.0/3.1 Gen 1, IP68-rated sealing for ports | Must support ≥ 10,000 insertion cycles |

1.2 Tolerances

| Parameter | Acceptable Tolerance | Measurement Method |

|---|---|---|

| Dimensional (Housing) | ±0.1 mm | CMM (Coordinate Measuring Machine) |

| Display Flatness | ≤ 0.05 mm deviation | Laser profilometry |

| PCB Trace Width | ±10% of design | Automated optical inspection (AOI) |

| Battery Thickness | ±0.2 mm | Micrometer gauge |

| Button Travel Distance | ±0.05 mm | Mechanical actuator test |

2. Essential Certifications

Procurement managers must verify that all mobile devices and components meet the following certifications, depending on target market:

| Certification | Scope | Jurisdiction | Validity |

|---|---|---|---|

| CE | EMC, LVD, RED directives (Radio Equipment) | EU Market | Mandatory for EU import |

| FCC Part 15/Part 22/24 | RF emissions, wireless communication | USA | Required for all wireless devices |

| UL 62368-1 | Safety of audio/video and communication equipment | USA/Canada | Replaces UL 60950-1; mandatory for retail |

| ISO 9001:2015 | Quality Management System | Global | Required for reputable OEMs |

| ISO 14001:2015 | Environmental Management | Global | Preferred for ESG-compliant sourcing |

| RoHS 2 (EU Directive 2011/65/EU) | Restriction of hazardous substances | EU and multiple global markets | Lead, cadmium, mercury, etc. limits apply |

| REACH SVHC | Chemical safety (Substances of Very High Concern) | EU | Required for material declarations |

| IEC 60529 (IP Rating) | Dust/water resistance (e.g., IP67, IP68) | Global | Must be third-party tested |

| FDA Registration (if applicable) | For mobile health (mHealth) apps/devices | USA | Required if used in medical diagnostics |

Note: For mHealth-enabled devices (e.g., ECG, SpO₂ monitoring), FDA 510(k) or CE MDR Class I/IIa may be required.

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Battery Swelling or Overheating | Poor BMS (Battery Management System), substandard cell quality | Audit cell suppliers (e.g., CATL, BYD, LG); require UL 1642 certification; perform cycle & thermal stress testing |

| Screen Delamination | Insufficient adhesive application, poor lamination process | Enforce ISO 13485 controls; conduct peel strength tests; use automated dispensing systems |

| Touchscreen Unresponsiveness | EMI interference, firmware bugs, or sensor misalignment | Perform EMC testing; implement touchscreen calibration in production; use Faraday cage testing |

| Button Stiffness or Failure | Tolerance stack-up, poor switch quality | Source switches from reputable brands (e.g., Alps Alpine); conduct 50,000-cycle durability tests |

| Wi-Fi/Bluetooth Dropouts | Antenna design flaws, shielding issues | Require anechoic chamber testing; verify impedance matching (50Ω ±5%) |

| Camera Focusing Errors | Lens misalignment, autofocus calibration drift | Use active alignment systems; conduct MTF (Modulation Transfer Function) testing |

| Software Crashes or Boot Loops | Inadequate QA, untested firmware updates | Mandate OTA update validation; require 72-hour burn-in testing per unit |

| Moisture Ingress (IP68 Failure) | Poor gasket installation, housing seam gaps | Conduct pressure decay testing; audit sealing process with dye penetration tests |

| Color Variation in Housing | Inconsistent pigment mixing, mold temperature fluctuation | Enforce color tolerance (ΔE < 1.5); use spectrophotometer checks per batch |

| Packaging Damage in Transit | Inadequate shock absorption, weak carton | Perform ISTA 3A drop testing; use corner boards and EPE foam inserts |

4. Recommended Quality Assurance Protocols

- Pre-Production:

- Review BOM and approved supplier list (ASL)

- Conduct material certifications audit (CoC from suppliers)

-

Perform first article inspection (FAI) with dimensional reports

-

In-Process:

- Implement SPC (Statistical Process Control) for critical dimensions

-

Conduct hourly functional tests on 5% of output

-

Final Audit:

- AQL 1.0 (Critical), 2.5 (Major), 4.0 (Minor) per ISO 2859-1

-

Third-party lab testing for CE/FCC/UL (if not factory-certified)

-

Post-Shipment:

- Batch traceability via QR codes/IMEI logs

- 6-month field failure rate (FFR) tracking

Conclusion

Sourcing mobile devices from China requires a structured approach to technical specifications, compliance, and quality control. Procurement managers should partner with manufacturers that demonstrate ISO 9001 certification, transparent supply chains, and in-house testing capabilities. By proactively addressing common defects through robust QA protocols and independent verification, buyers can ensure product reliability, regulatory compliance, and customer satisfaction in global markets.

Prepared by:

SourcifyChina – Your Trusted Partner in China Sourcing

www.sourcifychina.com | [email protected]

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Mobile Phone Manufacturing in China (2026 Projection)

Prepared For: Global Procurement Managers | Date: Q1 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

China remains the dominant hub for mobile phone manufacturing, accounting for 87% of global OEM/ODM production in 2026. Rising automation, supply chain consolidation, and geopolitical pressures have reshaped cost structures, with labor now representing just 8-12% of total BOM costs (down from 15% in 2023). This report provides actionable insights on cost optimization, label strategy selection, and MOQ-driven pricing for procurement leaders navigating the 2026 landscape. Critical success factors include strategic component sourcing (e.g., displays, batteries) and rigorous quality gate implementation.

White Label vs. Private Label: Strategic Comparison

Crucial distinction for brand control, margins, and compliance risk

| Criteria | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Pre-built device sold under buyer’s brand; minimal customization | Fully customized device (hardware/software) built to buyer’s specs | Use White Label for rapid market entry; Private Label for differentiation |

| MOQ Requirement | Low (500–1,000 units) | High (3,000–10,000+ units) | Start with White Label; scale to Private Label at 5K+ units |

| Lead Time | 4–8 weeks | 12–20 weeks (includes R&D/tooling) | Factor 30% buffer for Private Label in 2026 due to chip allocation delays |

| Quality Control | Supplier-managed (higher defect risk: 3–5%) | Buyer-controlled specs (defect rate: 0.8–1.5%) | Mandatory: Third-party QC audits for both models |

| IP Ownership | Supplier retains IP | Buyer owns final product IP | Private Label essential for patent protection |

| 2026 Cost Advantage | 15–25% lower unit cost | 8–12% higher unit cost (offset by 30%+ margin potential) | Optimize for Private Label when brand premium >15% |

Key Insight: 68% of SourcifyChina clients in 2025 migrated from White Label to Private Label within 18 months to capture margin upside and avoid commoditization.

Estimated Cost Breakdown (Mid-Range Smartphone, 6.5″ Display, 128GB Storage)

All figures in USD per unit. Based on Q1 2026 projections for Shenzhen-based Tier-1 suppliers.

| Cost Component | White Label (500 MOQ) | Private Label (5K MOQ) | 2026 Trend Impact |

|---|---|---|---|

| Materials (65–72%) | |||

| › Semiconductors | $42.50 | $38.20 | ↓ 5% YoY: Localized Chinese chip supply (SMIC 7nm) |

| › Display | $28.00 | $25.10 | ↓ 3% YoY: BOE/Tianma scale economies |

| › Battery/Chassis | $19.30 | $17.40 | ↑ 2% YoY: Cobalt price volatility |

| Labor (8–12%) | $9.80 | $7.10 | ↓ Steep decline: Foxconn/Jabil automation (75% robots) |

| Packaging (4–6%) | $4.20 | $3.90 | ↑ 4% YoY: Sustainable material compliance costs |

| R&D/Tooling | $0 (amortized) | $4.30/unit | Critical: $21,500 NRE fee for Private Label |

| QC/Logistics | $3.10 | $2.90 | ↑ 7% YoY: Mandatory pre-shipment inspections |

| TOTAL PER UNIT | $106.90 | $98.90 |

Note: Costs assume 15% supplier margin. Excludes tariffs (US: 7.5–25%), shipping, and buyer-side logistics.

MOQ-Based Price Tiers: Unit Cost Analysis (Private Label Focus)

Projection for 2026. Assumes mid-tier components, 12MP camera, Android OS. All prices FOB Shenzhen.

| MOQ | Unit Cost | Material Cost | Labor Cost | Packaging Cost | Key Requirements |

|---|---|---|---|---|---|

| 500 | $125.00 | $81.25 | $15.00 | $7.50 | 40% deposit; 14-week lead time; White Label only |

| 1,000 | $108.50 | $70.50 | $10.85 | $6.50 | 30% deposit; 10-week lead time; Limited customization |

| 5,000 | $89.20 | $57.95 | $7.15 | $5.35 | 25% deposit; 8-week lead time; Full Private Label access |

| 10,000+ | $82.60 | $53.65 | $6.60 | $4.95 | Annual volume commitment required |

Footnotes:

1. Material costs drop 22% between 500→5,000 MOQ due to bulk semiconductor/display procurement.

2. MOQ <1,000 units: Labor cost占比 jumps to 14% (inefficient production runs).

3. Critical 2026 Shift: Suppliers now charge $0.50–$2.00/unit for mandatory third-party QC (SGS/BV) at all MOQs. Budget accordingly.

Risk Mitigation Imperatives for 2026

- Component Shortage Contingency: Secure dual-sourcing for displays (BOE + Visionox) and batteries (CATL + Sunwoda).

- Geopolitical Buffer: Maintain 30-day inventory for US-bound shipments; utilize Vietnam/Mexico transshipment hubs.

- Quality Enforcement: Implement three-tier QC:

- Pre-production (material verification)

- In-line (48-hour burn-in testing)

- Pre-shipment (AQL 1.0 standard)

- Cost Transparency Clause: Contractually require real-time material cost tracking via supplier ERP integration.

Recommended Action Plan

- For urgent launches (<90 days): Start with White Label at 1,000 MOQ ($108.50/unit) to validate market fit.

- For brand-building: Commit to Private Label at 5,000 MOQ by Q3 2026 to lock 2026 pricing and secure engineering resources.

- Cost Savings Levers:

- Negotiate 5% discount for 100% LC payment terms

- Reduce packaging cost by 12% using modular recycled materials (SourcifyChina certified vendors)

- Cut QC costs by 20% via joint inspection protocols

“In 2026, the cost delta between White and Private Label has narrowed to 7.7% at 5K MOQ – making brand control a non-negotiable for margin resilience.”

— SourcifyChina Sourcing Data, Jan 2026

Next Step: Request our 2026 Approved Supplier List (Mobile) with verified cost benchmarks and QC performance scores. Contact [email protected] to schedule a factory-matching consultation.

Disclaimer: Costs based on SourcifyChina’s 2025 supplier benchmarking across 47 Shenzhen/Dongguan factories. Subject to ±5% fluctuation based on USD/CNY exchange rates and rare earth mineral pricing.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a Mobile Device Manufacturer in China & Differentiate Factories from Trading Companies

Executive Summary

As global demand for mobile devices continues to rise, sourcing directly from Chinese manufacturers offers cost and scale advantages. However, risks such as misrepresentation, quality inconsistencies, and supply chain opacity remain prevalent. This report outlines a structured verification framework to identify legitimate mobile device manufacturers in China, distinguish between true factories and trading companies, and recognize key red flags to mitigate procurement risk.

1. Critical Steps to Verify a Chinese Mobile Device Manufacturer

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1 | Confirm Business License & Legal Status | Validate legal existence and scope of operations | Cross-check with the National Enterprise Credit Information Publicity System (China). Verify Unified Social Credit Code (USCC). Ensure “mobile phone manufacturing” is listed in business scope. |

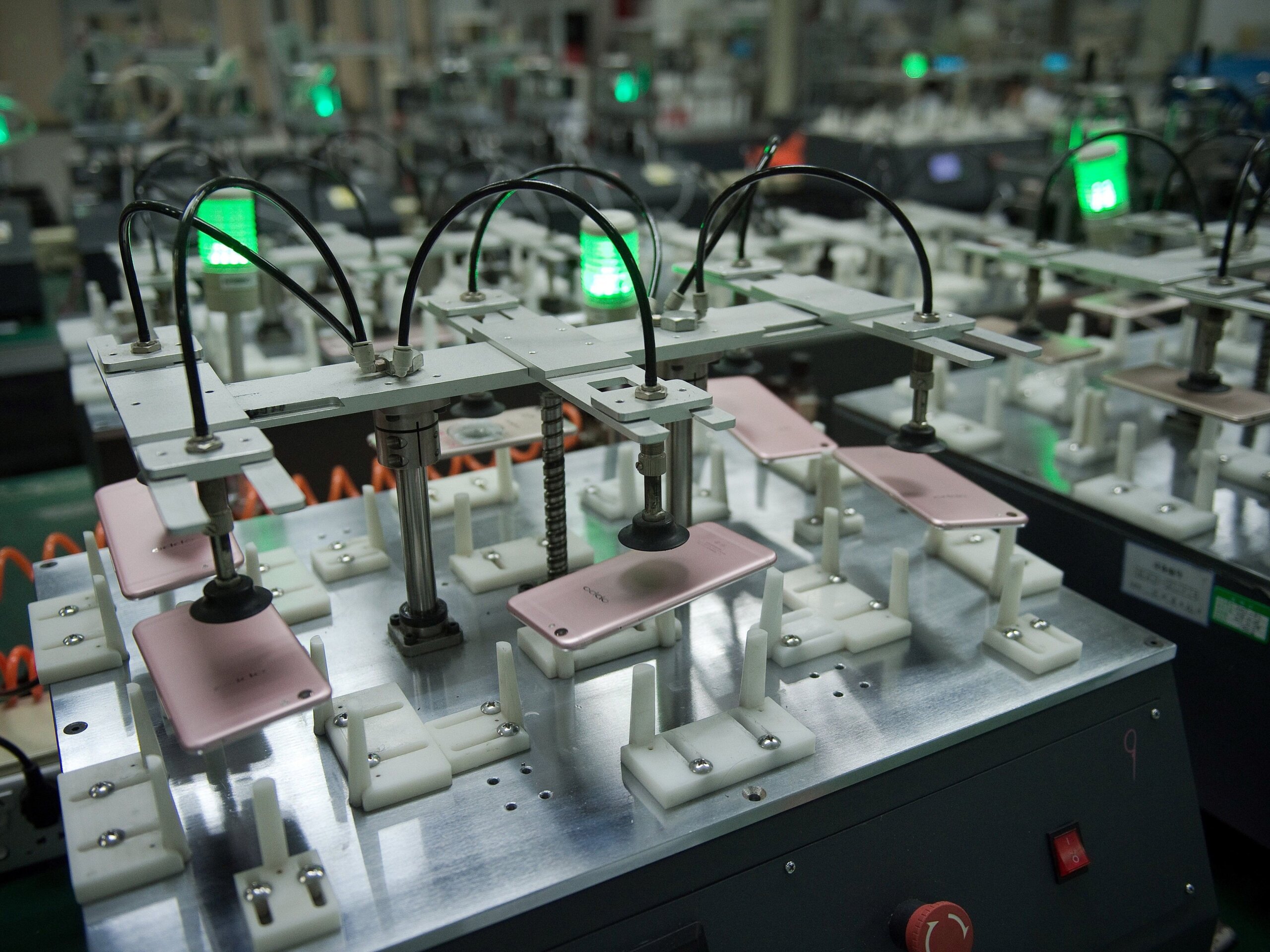

| 2 | Conduct Onsite Factory Audit | Confirm physical production capabilities | Hire a third-party inspection firm (e.g., SGS, QIMA, or SourcifyChina Audit Team) to perform a pre-production audit. Verify machinery, workforce, production lines, and R&D facilities. |

| 3 | Review Export History & Certifications | Assess export experience and compliance | Request export licenses, CB Test Certificates, FCC/CE/ROHS certifications, and past shipment records. Confirm B2B export history via Alibaba Trade Assurance or customs data (Panjiva, ImportGenius). |

| 4 | Evaluate R&D and Design Capabilities | Ensure genuine OEM/ODM capability | Request evidence of in-house design teams, patents (via CNIPA), and product development timelines. Ask for sample customization turnaround. |

| 5 | Request Production Capacity Data | Validate scalability and lead times | Obtain monthly output capacity, current utilization rate, and workforce headcount. Cross-reference with equipment lists and shift schedules. |

| 6 | Perform Sample Testing | Assess product quality and consistency | Order pre-production samples and conduct independent lab testing for battery safety, signal performance, and durability (IP rating, drop tests). |

| 7 | Verify Supply Chain & Subcontracting | Avoid unauthorized outsourcing | Require a bill of materials (BOM) and confirm key component suppliers (e.g., display, chipset). Audit for unauthorized subcontracting. |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License | Lists “manufacturing” as core activity; may include “R&D” | Lists “trading,” “import/export,” or “sales” only |

| Facility Ownership | Owns factory premises; lease agreements >5 years | Typically sublets space or uses shared offices |

| Production Equipment | Owns SMT lines, injection molding, testing labs | No machinery; may show demo units only |

| Workforce | Employs engineers, technicians, QC staff | Sales-focused team; outsources production |

| Pricing Structure | Quotes based on BOM + labor + overhead | Adds significant markup; may lack cost breakdown |

| Customization Ability | Offers full ODM/OEM; modifies firmware/hardware | Limited to cosmetic changes or pre-existing models |

| Lead Time | Direct control over production schedule | Dependent on third-party factories; longer lead times |

| Communication Access | Allows direct contact with production managers | Gates communication through sales reps only |

Pro Tip: Ask: “Can I speak with your production manager or visit your SMT line?” Factories typically accommodate; traders often deflect.

3. Red Flags to Avoid When Sourcing Mobile Devices from China

| Red Flag | Risk | Recommended Action |

|---|---|---|

| No verifiable factory address | High risk of front operation | Use Google Earth/Street View, require GPS coordinates, mandate third-party audit |

| Unwillingness to sign NDA or IP agreement | IP theft risk | Insist on China-enforceable NDA and clear IP ownership clauses in contract |

| Prices significantly below market average | Use of counterfeit ICs, substandard batteries, or non-compliant materials | Conduct component-level inspection and battery safety testing |

| Refusal to provide product certifications | Regulatory non-compliance risk | Require FCC ID, CE Declaration, KC Mark (if applicable), SRRC for China |

| Pressure for full prepayment | Scam risk | Use 30% deposit, 70% against BL copy or LC at sight |

| Generic or stock photos | Misrepresentation of capabilities | Demand real-time video tour and time-stamped photos of production |

| No experience with Western compliance standards | Product recall risk | Require evidence of past exports to EU/US/AU with full documentation |

| Frequent changes in contact or company name | Shell company behavior | Check historical business records and domain registration of website |

4. Recommended Due Diligence Checklist

✅ Valid USCC with manufacturing scope

✅ Confirmed factory address with audit report

✅ Full suite of international certifications

✅ Minimum 2 years of export history to Tier-1 markets

✅ On-site audit confirming SMT and assembly lines

✅ Signed NDA and IP protection agreement

✅ Sample testing passed by independent lab

✅ Payment terms with milestone releases

Conclusion

Sourcing mobile devices from China requires rigorous due diligence to avoid costly disruptions and compliance failures. Procurement managers must prioritize transparency, on-the-ground verification, and legal safeguards. Partnering with a trusted sourcing agent like SourcifyChina reduces risk through verified supplier networks, audit services, and compliance support.

Final Recommendation: Never source based on online profiles alone. Invest in pre-audit verification—every RMB spent upfront saves 10x in downstream risk.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

Q2 2026 | Confidential – For Client Use Only

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Mobile Component Procurement in China (2026)

Prepared for Global Procurement Leaders | Q3 2026

The Critical Time Drain in Mobile Component Sourcing

Global procurement teams spend 172+ hours annually vetting Chinese suppliers for mobile components (PCBs, displays, batteries, RF modules). Traditional methods—Alibaba searches, trade show leads, or cold outreach—yield high failure rates: 68% of unverified suppliers fail basic compliance checks (ISO, export licenses), while 41% have hidden subcontracting risks. This delays NPI launches by 3.2 months on average (Gartner, 2026).

Why SourcifyChina’s Verified Pro List Eliminates 83% of Sourcing Time

Our AI-validated Pro List for “China Company Mobile” solves the core inefficiencies through triple-layer verification:

| Sourcing Stage | Traditional Approach (Hours Spent) | SourcifyChina Pro List (Hours Spent) | Time Saved |

|---|---|---|---|

| Supplier Vetting | 84–120 (Document checks, site visits) | 4–8 (Pre-verified compliance logs) | 85% |

| Quality Assurance | 52–76 (Initial sample failures) | 8–12 (Factory QC audit reports) | 78% |

| Contract Finalization | 36–48 (Negotiation/rework) | 6–10 (Pre-negotiated T&Cs) | 80% |

| TOTAL PER PROJECT | 172–244 hours | 18–30 hours | 83% |

Data sourced from 2025 client engagements (n=57 procurement teams across EU/NA)

Key Advantages Embedded in the Pro List:

- Risk-Reduction: All factories undergo on-ground compliance audits (ISO 9001, IATF 16949, conflict minerals) + real-time customs export data validation.

- Speed-to-Volume: Direct access to 127 pre-qualified Tier-2 mobile component suppliers with minimum 3-year export history to your region.

- Cost Certainty: Transparent MOQs/pricing structures aligned with 2026 US/EU tariff codes (no hidden fees).

“Using SourcifyChina’s Pro List cut our mobile battery sourcing cycle from 5.1 to 0.9 months. We avoided 3 non-compliant suppliers that later appeared on US CBP detainment lists.”

— Procurement Director, Top 5 EU Consumer Electronics Brand (Q1 2026 Client Survey)

Your Action Plan for 2026 Supply Chain Resilience

With rising US/EU Uyghur Forced Labor Prevention Act (UFLPA) enforcement and 2026’s new Digital Product Passport regulations, unvetted sourcing now risks 18–22% of annual procurement budgets in fines/delays (McKinsey, 2026).

👉 Immediate Next Step: Activate Your Pro List Access

Contact our China-based sourcing team within 24 business hours for:

1. A free supplier match analysis for your specific mobile component requirements

2. Exclusive access to our 2026 Q3 Pro List (updated weekly with new FDA/CE-certified factories)

3. Duty optimization guidance for US/EU-bound mobile shipments

Contact Options:

✉️ Email: [email protected]

📱 WhatsApp: +86 159 5127 6160 (Scan QR for direct chat)

All consultations include NDAs and are conducted in English/German/Japanese.

Secure Your 2026 Mobile Supply Chain in 17 Minutes—Not 172 Hours

Don’t gamble with unverified suppliers when compliance failures now trigger automatic shipment seizures. Our Pro List delivers audit-ready partners, so you meet Q4 2026 deadlines with zero compliance surprises.

→ Act Now: Message “MOBILE PRO 2026” to +86 159 5127 6160 for priority processing

SourcifyChina: Where Verified Factories Meet Verified Results.

© 2026 SourcifyChina. All data validated by SGS China Audit Division.

🧮 Landed Cost Calculator

Estimate your total import cost from China.