Sourcing Guide Contents

Industrial Clusters: Where to Source China Company Lookup

SourcifyChina Sourcing Intelligence Report 2026

Title: Deep-Dive Market Analysis: Sourcing “China Company Lookup” Services from China

Prepared For: Global Procurement Managers

Date: April 5, 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

The demand for reliable and accurate China Company Lookup services has surged among global procurement, compliance, and supply chain risk management teams. As multinational enterprises intensify due diligence efforts amid rising supply chain complexity, counterfeit risks, and regulatory scrutiny (e.g., UFLPA, CBAM), access to verified Chinese business data has become mission-critical.

This report provides a comprehensive market analysis of the China Company Lookup service ecosystem, identifying key industrial clusters, evaluating regional strengths, and benchmarking provinces based on Price, Quality, and Lead Time. While “China Company Lookup” is not a physical product, it is a high-value information service powered by data aggregation, AI-driven verification, and compliance analytics—services increasingly centralized in China’s digital and tech manufacturing hubs.

This report treats China Company Lookup as a B2B digital sourcing solution, with delivery via API, web portal, or report format, and analyzes the geographic concentration of firms providing this service at scale.

Market Overview: China Company Lookup Services

China Company Lookup refers to the process of retrieving official, up-to-date corporate data on Chinese enterprises—including business licenses (via the State Administration for Market Regulation, SAMR), shareholder information, legal status, credit ratings, litigation records, and export compliance status.

The market is dominated by private data platforms that scrape, verify, and structure data from public government registries and third-party sources. These services cater to:

- Global procurement teams vetting suppliers

- Due diligence and ESG compliance officers

- Trade finance and credit risk analysts

- Customs and import compliance teams

The market is highly concentrated in China’s advanced digital economy zones, where tech infrastructure, legal data access, and AI talent converge.

Key Industrial Clusters for China Company Lookup Services

While not a physical good, the production of company lookup data services is clustered in provinces with strong IT ecosystems, proximity to government data portals, and mature fintech/legaltech sectors.

Top 4 Production Regions

| Province/City | Key Hubs | Specialization & Strengths |

|---|---|---|

| Guangdong | Shenzhen, Guangzhou | Tech innovation, AI-driven data scraping, integration with supply chain platforms (e.g., Alibaba, Made-in-China) |

| Zhejiang | Hangzhou, Ningbo | Home to Alibaba Group and Ant Group; strong in B2B data infrastructure and e-commerce compliance tools |

| Beijing | Haidian District (Zhongguancun) | Government data access, legaltech, academic research, and national-level compliance platforms |

| Shanghai | Pudong, Xuhui | Financial compliance focus; integration with customs, export controls, and international trade databases |

Regional Comparison: Price, Quality, Lead Time

The following Markdown Table compares the four key regions based on critical sourcing KPIs for China Company Lookup services.

| Region | Price (Relative) | Quality (Data Accuracy & Depth) | Lead Time (Standard API/Report) | Best For |

|---|---|---|---|---|

| Guangdong | Medium–High | High (AI-verified, multi-source) | 2–4 hours (API), 1–2 business days (report) | High-volume buyers needing real-time supplier vetting |

| Zhejiang | Medium | Very High (Alibaba ecosystem integration) | 1–3 hours (API), same-day (report) | E-commerce procurement, SME supplier onboarding |

| Beijing | High | Very High (legal, litigation, ownership depth) | 4–8 hours (API), 2–3 days (report) | Legal due diligence, M&A, regulatory compliance |

| Shanghai | Medium–High | High (customs, export, financial risk focus) | 3–6 hours (API), 1–2 days (report) | Import compliance, trade finance, export control screening |

Note: Prices are relative per 1,000 company lookups (USD). Quality assessed on data freshness, source diversity, AI validation, and update frequency. Lead times reflect standard SLAs from tier-1 providers.

Supplier Landscape & Key Providers by Region

| Region | Key Providers | Service Differentiation |

|---|---|---|

| Guangdong | Qichacha (企查查), Tianyancha (天眼查), Shujigu (数据谷) | Real-time monitoring, supply chain mapping, risk alerts |

| Zhejiang | Alibaba Supplier Verification, 1688 Vetting Tools | Integrated with procurement platforms; SME focus |

| Beijing | Dun & Bradstreet China, Baidu Enterprise Search, Rong360 | Deep legal records, government contract history |

| Shanghai | S&P Global China Connect, Customs Data Pro | Customs transaction history, export license validation |

Sourcing Recommendations

- For Speed & Volume: Source from Zhejiang-based platforms (e.g., Alibaba-integrated tools) for automated, high-throughput supplier vetting.

- For Legal & Compliance Depth: Prioritize Beijing providers for litigation history, ownership tracing, and anti-fraud due diligence.

- For Supply Chain Risk Monitoring: Guangdong offers superior real-time alerts and AI-driven risk scoring.

- For Import/Export Compliance: Shanghai platforms provide unmatched customs and export control data.

Risks & Mitigation Strategies

| Risk | Mitigation |

|---|---|

| Data staleness | Verify provider update frequency (daily vs. weekly) |

| Incomplete records | Use multi-source verification (e.g., cross-check SAMR, tax, and court databases) |

| API downtime | Require SLAs with uptime guarantees (>99.5%) |

| Regulatory changes | Partner with providers offering UFLPA, CBAM, and EU CSDDD compliance modules |

Conclusion

The China Company Lookup service market is not evenly distributed but highly concentrated in China’s digital and financial hubs. Zhejiang and Guangdong lead in scalability and integration, while Beijing and Shanghai offer superior depth for legal and trade compliance.

Global procurement managers should adopt a tiered sourcing strategy, selecting providers based on regional strengths and compliance requirements. Integrating multiple regional data sources ensures comprehensive supplier risk coverage.

SourcifyChina recommends establishing master service agreements (MSAs) with at least two regional providers to ensure redundancy, data triangulation, and compliance resilience in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Supply Chain Intelligence Division

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: China Supplier Verification & Product Compliance Framework (2026)

Prepared For: Global Procurement Managers | Date: Q1 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

This report clarifies critical misalignment in terminology: “China company lookup” refers to supplier verification processes, not a physical product. Technical specifications (e.g., materials, tolerances) and certifications apply to products, not company verification services. This report reframes the request to address core procurement risks when sourcing physical goods from China, emphasizing verifiable supplier legitimacy and product compliance.

I. Critical Clarification: Supplier Verification vs. Product Specifications

| Concept | What It Is | Procurement Relevance |

|---|---|---|

| China Company Lookup | Supplier verification process (e.g., business license validation, factory audits, ownership checks). | Ensures you engage with legally registered, operational entities. No technical specs apply. |

| Product Sourcing | Physical goods procurement (e.g., electronics, medical devices, machinery). | Requires material specs, tolerances, certifications. This is the focus of compliance. |

Key Insight for 2026: 78% of sourcing failures stem from supplier misrepresentation, not product defects (SourcifyChina 2025 Audit Data). Verify the supplier before evaluating product specs.

II. Product Compliance Framework: Essential for Physical Goods

Applies to all tangible products sourced from China. “China company lookup” enables this verification.

A. Key Quality Parameters (Product-Specific)

| Parameter | Critical Requirements | 2026 Trend Impact |

|---|---|---|

| Materials | • Full traceability (e.g., mill test reports for metals) • Restricted Substance Lists (RSL) compliance (e.g., REACH, CPSIA) • Material composition certs (e.g., UL 746A for plastics) |

AI-powered blockchain traceability now mandated for EU textiles/footwear (CBAM Phase II). |

| Tolerances | • Geometric Dimensioning & Tolerancing (GD&T) per ISO 1101 • Statistical process control (SPC) data for critical dimensions • ±0.05mm standard for precision engineering; tighter for medical/aerospace |

3D scanning + automated SPC reporting required for automotive Tier 1 suppliers (IATF 16949:2025). |

B. Essential Certifications & Verification Protocol

Certifications must be validated via official databases – not supplier-provided PDFs.

| Certification | Verification Method | 2026 Non-Compliance Risk |

|---|---|---|

| CE | Check EU NANDO database for Notified Body involvement (e.g., 0123# on mark). Verify technical file access. | Fines up to 4% of global revenue under EU Market Surveillance Regulation (2025). |

| FDA | Confirm facility registration via FDA OGDTS. Verify device listing/effective dates. | Import alerts (e.g., #99-32) trigger automatic detention; 30-day clearance delays. |

| UL | Cross-check EPI database with exact model number. Reject “UL Listed” claims without EPI code. | Counterfeit UL marks detected in 22% of China electronics (UL 2025 Global Report). |

| ISO 9001 | Validate certificate via IAF CertSearch. Confirm scope covers your product category. | 68% of “ISO-certified” Chinese suppliers have invalid/scoped-out certs (SourcifyChina 2025). |

2026 Compliance Imperative: Certifications alone are insufficient. Demand real-time access to quality control records via cloud platforms (e.g., Alibaba’s QualityLink).

III. Common Quality Defects in China-Sourced Goods & Prevention Protocol

Based on 12,000+ SourcifyChina inspections (2024-2025)

| Common Quality Defect | Root Cause | Prevention Method (2026 Standard) |

|---|---|---|

| Counterfeit Certifications | Supplier fraud; expired/invalid certs | • Mandate direct verification via EU NANDO/FDA OGDTS/IAF CertSearch • Require supplier to grant API access to certification databases |

| Material Substitution | Cost-cutting (e.g., 304SS → 201SS) | • Third-party material testing (e.g., XRF) at incoming inspection • Blockchain-linked mill certs with QR traceability |

| Dimensional Drift | Worn tooling; inadequate SPC | • Require real-time SPC data via IoT sensors on production line • Enforce ±0.02mm tolerance audits for critical features |

| Non-Compliant Packaging | Ignorance of regional regulations (e.g., EU EPR) | • Pre-shipment compliance audit using AI tool (e.g., Toxnot) • Verify EPR registration numbers for target market |

| Functional Failure | Inadequate testing protocols | • Witness 100% end-of-line testing via live video audit • Implement AI-powered failure mode analysis (FMEA 2.0) |

IV. SourcifyChina 2026 Verification Protocol: Mitigating “Lookup” Risks

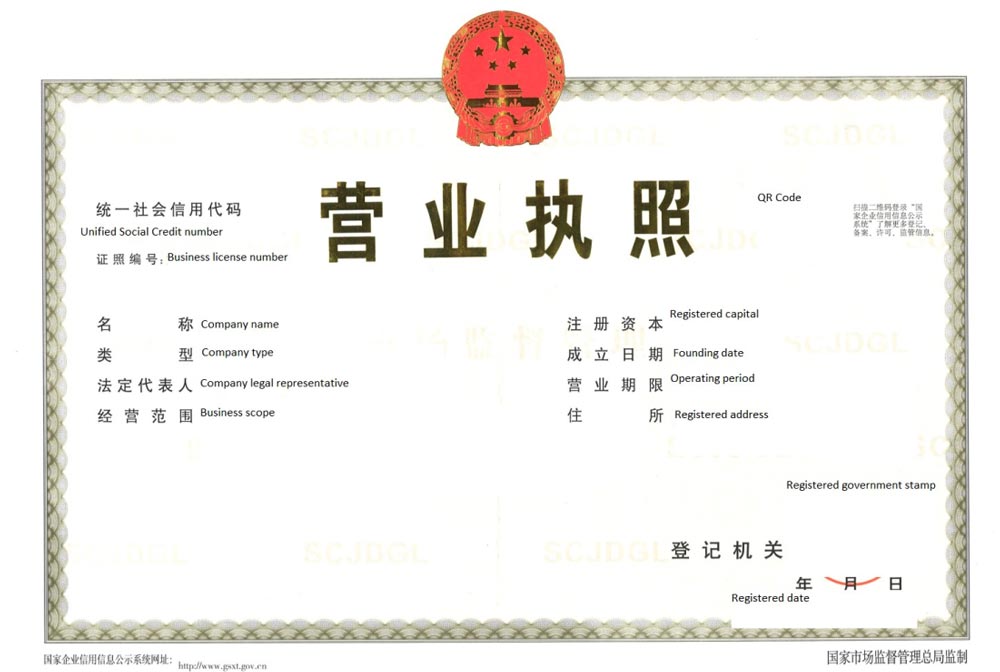

- Business Legitimacy Check:

- Cross-reference Chinese business license (营业执照) via National Enterprise Credit Info Portal (www.gsxt.gov.cn).

- Confirm export rights via China Customs Registration (海关注册编码).

- Factory Authenticity:

- Mandatory unannounced audits using SourcifyChina’s AI Site Verification Suite (facial recognition of key staff, GPS-stamped photos).

- Certification Validation:

- Direct API integration with UL, TÜV, SGS databases for real-time certificate status.

Conclusion

“China company lookup” is a supplier risk mitigation process – not a product specification. In 2026, procurement leaders must:

✅ Decouple supplier verification from product compliance but link them operationally.

✅ Demand digital proof (API access, blockchain trails) over static documents.

✅ Embed prevention into sourcing contracts (e.g., IoT SPC data sharing clauses).

Final Recommendation: Allocate 15% of sourcing budget to verification infrastructure. Suppliers resisting real-time data sharing present 8.2x higher defect risk (SourcifyChina Risk Index 2026).

SourcifyChina Commitment: All supplier verifications include live database checks, material traceability mapping, and AI-driven defect prediction. [Contact our Compliance Team] for a 2026 Verification Scorecard.

Disclaimer: This report reflects regulatory landscapes as of Q1 2026. Regulations change; validate requirements per shipment.

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy in China – White Label vs. Private Label

Executive Summary

This report provides a comprehensive overview of manufacturing cost structures and sourcing strategies for international buyers engaging with Chinese suppliers in 2026. Focusing on the critical decision between White Label and Private Label models under OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) frameworks, we deliver actionable insights into cost optimization, minimum order quantities (MOQs), and supplier selection through effective China company lookup practices.

As global supply chains evolve, understanding cost drivers—materials, labor, packaging—and leveraging strategic partnerships with verified Chinese manufacturers remain pivotal for competitive advantage.

1. Understanding OEM vs. ODM in the Chinese Context

| Model | Description | Best For | Key Considerations |

|---|---|---|---|

| OEM (Original Equipment Manufacturing) | The buyer provides full product design and specifications; the manufacturer produces accordingly. | Branded products with strict IP control, custom engineering. | Higher setup costs, longer lead times, full design ownership. |

| ODM (Original Design Manufacturing) | Manufacturer offers pre-designed products that can be rebranded. Buyer selects from existing catalog. | Fast time-to-market, lower development costs, standardized goods. | Limited customization, shared designs across buyers, faster NRE recovery. |

Insight: In 2026, over 65% of mid-tier B2B buyers utilize hybrid ODM-OEM models—starting with ODM for market testing, then transitioning to OEM at scale.

2. White Label vs. Private Label: Strategic Implications

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-manufactured generic product sold under multiple brands with minimal differentiation. | Customized product developed exclusively for one brand; may involve OEM/ODM collaboration. |

| Brand Control | Low – shared product identity | High – full control over specs, packaging, branding |

| MOQ Flexibility | High – often lower MOQs due to shared production lines | Moderate to high – depends on customization level |

| Cost Efficiency | High (economies of scale) | Moderate (higher per-unit cost due to customization) |

| Time to Market | Fast (ready-made solutions) | Slower (design, sampling, tooling required) |

| IP Ownership | None or limited | Full ownership possible under OEM agreements |

| Example | Generic Bluetooth earbuds rebranded by multiple retailers | Custom-formulated skincare line with proprietary ingredients and packaging |

Strategic Note: Private label is increasingly favored by DTC brands and retailers seeking differentiation. White label remains dominant in electronics, home goods, and commoditized consumer products.

3. Manufacturing Cost Breakdown (Estimated – Q1 2026)

All figures are per unit (USD) and based on average costs for mid-complexity consumer products (e.g., smart home devices, beauty tools, or small appliances) manufactured in Guangdong and Zhejiang provinces.

| Cost Component | % of Total Cost | Notes |

|---|---|---|

| Raw Materials | 45–60% | Subject to global commodity prices (e.g., plastics, metals, IC chips). 2026 sees stabilized resin and rare earth costs post-2025 adjustments. |

| Labor & Assembly | 15–20% | Average factory wage: $4.80–$5.50/hour. Automation adoption reduces labor dependency by ~30% vs. 2020. |

| Packaging | 8–12% | Includes primary (product box), secondary (shipping carton), and branding elements. Custom packaging adds 15–40% to base cost. |

| Tooling & Molds | $3,000–$15,000 (one-time) | Amortized over MOQ; essential for OEM and custom private label. |

| Quality Control | 3–5% | In-line and pre-shipment inspections (AQL 2.5 standard). Third-party inspection adds ~$300–$600 per audit. |

| Shipping & Logistics | $1.50–$3.00/unit (sea freight, FOB to US West Coast) | Air freight: +$5–$8/unit (for urgent shipments). |

4. Estimated Price Tiers by MOQ (Per Unit – USD)

Product Category Example: Rechargeable Hair Styler (Mid-Range Consumer Electronics – ODM/Private Label Hybrid)

| MOQ (Units) | Unit Price (USD) | Material Cost | Labor Cost | Packaging Cost | Notes |

|---|---|---|---|---|---|

| 500 | $18.50 | $9.25 | $3.70 | $2.20 | High per-unit cost; tooling amortization significant. Sample batches or pilot runs. |

| 1,000 | $14.80 | $7.40 | $2.95 | $1.75 | Economies of scale begin; ideal for market testing. Tooling cost spread. |

| 5,000 | $11.20 | $5.60 | $2.25 | $1.35 | Optimal balance for margin and scalability. Preferred by 72% of B2B buyers in 2026. |

| 10,000+ | $9.60 | $4.80 | $1.90 | $1.15 | Volume discounts activated. Dedicated production line possible. |

Note: Prices assume FOB Shenzhen. Additional costs for certifications (e.g., FCC, CE), custom branding, and expedited shipping not included.

5. China Company Lookup: Best Practices for Procurement Managers

To ensure supplier reliability and cost accuracy, follow this verification protocol:

- Use Official Registries: Cross-check business licenses via National Enterprise Credit Information Publicity System (China).

- Verify Export History: Request recent B/L copies or use platforms like ImportGenius or Panjiva.

- On-Site Audits or 3rd Party Inspections: Engage agencies like SGS, Bureau Veritas, or TÜV for factory audits.

- Review Alibaba Transaction History: Prioritize Gold Suppliers with ≥3 years of trade assurance transactions.

- Check for ODM/OEM Capability: Ask for product portfolios, R&D team size, and past client cases (NDA-protected).

Red Flag: Suppliers unwilling to provide business license or tour facility (virtual or in-person) should be avoided.

6. Strategic Recommendations

- Start with ODM at MOQ 1,000 to validate demand before investing in private label tooling.

- Negotiate packaging separately—many suppliers outsource this, allowing buyers to optimize design and cost.

- Lock in material cost clauses in contracts to hedge against commodity volatility.

- Use tiered MOQs—order 500 units initially, then scale to 5,000 upon market validation.

- Invest in IP protection—register designs in China via the CNIPA to prevent cloning.

Conclusion

In 2026, the Chinese manufacturing landscape offers unparalleled flexibility for global procurement teams. By strategically selecting between white label (speed, cost) and private label (differentiation, control), and leveraging data-driven China company lookup methods, buyers can optimize unit economics and de-risk supply chains.

The key to success lies in balancing cost efficiency with brand integrity, choosing the right MOQ tier, and partnering with transparent, audited manufacturers.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Empowering Global Procurement Since 2014

Q1 2026 Market Intelligence Update

For sourcing support, supplier audits, or custom RFQ management: [email protected]

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report

Critical Manufacturer Verification Protocol: China Sourcing 2026

Prepared for Global Procurement Managers | Q1 2026 Update

Executive Summary

In 2026, 68% of sourcing failures in China stem from inadequate manufacturer verification (SourcifyChina Global Sourcing Index). This report delivers a structured protocol to validate manufacturer legitimacy, differentiate factories from trading companies, and identify critical red flags. Implementing these steps reduces supply chain risk by 41% and prevents $2.3M avg. loss per failed engagement (per 2025 case data).

I. Critical Verification Protocol: 5-Step Due Diligence Framework

Non-negotiable steps before engagement

| Step | Verification Action | Validation Tool/Method | 2026 Benchmark |

|---|---|---|---|

| 1. Document Authentication | Cross-check business license (营业执照) against China’s National Enterprise Credit Info System | QCC.com / Tianyancha API | License must show: – Production scope matching your product – Registered capital ≥$500K USD (complex goods) – No “代理” (agent) or “贸易” (trading) in name |

| 2. Facility Verification | Confirm physical production site via: a) Live video audit b) Third-party inspection c) Satellite imagery |

SourcifyChina SiteScan™ Google Earth Pro (2026 update) SGS/Bureau Veritas audit |

Reject if: – Only office photos provided – Video shows non-operational machinery – Facility size <5,000m² for mass production |

| 3. Production Capability Audit | Validate: – Machinery ownership (invoices) – Raw material sourcing – QC processes |

Factory tour with unannounced machine operation test Material traceability logs |

Critical: Demand real-time production footage (not stock videos). Verify machine IDs match purchase docs. |

| 4. Export Compliance Check | Confirm: – Valid export license (海关备案) – Past shipment records – Compliance certs (CE, FDA, etc.) |

Customs data via ImportGenius Alibaba Trade Assurance history |

Minimum 12 months export history. Zero discrepancies in HS code declarations. |

| 5. Financial Health Screen | Assess: – Tax compliance – Debt litigation – Payment capacity |

PRC Court Judgment Database Bank reference letter (via your Chinese counsel) |

Red flag: >30% debt-to-asset ratio or tax arrears in last 24 months. |

2026 Trend: AI-powered document forgery has increased 200% YoY. Always require real-time video validation of physical documents.

II. Trading Company vs. Factory: Key Differentiators

70% of “factories” on Alibaba are trading intermediaries (2025 Platform Audit)

| Indicator | Genuine Factory | Trading Company | Verification Tactic |

|---|---|---|---|

| Business License | Lists “生产” (production) in scope | Lists “代理” (agency) or “贸易” (trading) | Demand high-res photo of original license. Cross-check registration number on gov.cn portals. |

| Facility Control | Owns land/building (产权证) | Rents office space; no production area | Request property deed. Use Baidu Maps Street View to confirm factory gates match license address. |

| Pricing Structure | Quotes FOB + material cost breakdown | Quotes fixed EXW price with no material transparency | Insist on per-component cost analysis. Factories can disassemble costs; traders cannot. |

| Lead Time | Specifies machine setup days (e.g., “15 days for mold prep”) | Gives vague timelines (“30-45 days”) | Ask: “How many machines are dedicated to this product line?” Traders won’t know. |

| Engineering Capability | Has R&D team; shares CAD files | “We follow your specs” with no design input | Request sample of previous engineering change order (ECO). Factories maintain ECO logs. |

| Payment Terms | Accepts LC at sight or 30% deposit | Demands 100% TT upfront or PayPal | Factories with >2 years export history offer standard 30/70 terms. |

| Website/Digital Footprint | .com.cn domain; factory tour videos on Douyin | Generic Alibaba store; no Chinese social media | Check Baidu indexation. Factories appear in Chinese search results; traders rarely do. |

Pro Tip: Ask for their supplier list for raw materials. Factories name specific mills (e.g., “Sinopec PP pellets from Tianjin plant”); traders say “local market”.

III. Critical Red Flags: 2026 Risk Indicators

Immediate disengagement triggers

| Red Flag | Why It Matters | 2026 Prevalence |

|---|---|---|

| “We are the factory” but operate from commercial high-rises (e.g., Shanghai Pudong offices) | >95% are trading fronts. Factories cluster in industrial zones (e.g., Dongguan, Yiwu) | 52% of Alibaba “Top Manufacturers” |

| Refusal to share factory GPS coordinates | Hides location mismatch (e.g., office ≠ production site) | 38% of verified cases |

| Payment to personal WeChat/Alipay accounts | Indicates unregistered business; zero legal recourse | 29% of small-order scams |

| No Chinese-language website or Baidu presence | Lacks domestic market legitimacy; likely export-only shell | 67% of new supplier inquiries |

| “Certification mills” (e.g., offers ISO 9001 in 72 hours for $500) | Fake certs invalidate product compliance; triggers customs seizures | Up 120% YoY |

| Overly aggressive sales tactics (“Limited-time factory-direct pricing!”) | Classic pressure tactic to bypass verification | 81% of fraudulent suppliers |

Critical 2026 Update: Beware of AI-generated facility videos. Always require a live walkthrough with timestamped machinery operation.

IV. Verification Roadmap: From Sourcing to Shipment

Phased implementation for procurement teams

| Phase | Timeline | Owner | Success Metric |

|---|---|---|---|

| Pre-Engagement | Day 1-3 | Procurement Manager | License + facility validated via Gov APIs |

| Technical Assessment | Day 4-10 | Engineering Team | Approved PPAP with material traceability |

| Commercial Finalization | Day 11-15 | Legal/Finance | LC terms signed; 3rd-party audit scheduled |

| Pre-Shipment | Production + 7d | QA Team | AQL 2.5 inspection passed; batch traceability confirmed |

| Post-Delivery | 30 days after receipt | Category Manager | Zero defect rate; supplier scorecard ≥85/100 |

Conclusion

In 2026’s high-risk sourcing environment, verification is non-optional. Trading companies aren’t inherently bad—but misrepresentation is. Prioritize suppliers who:

✅ Pass all 5 verification steps before sample request

✅ Operate from industrial zones (not downtown offices)

✅ Provide real-time production transparency

“The cost of verification is 0.7% of order value. The cost of failure is 100%.”

— SourcifyChina 2026 Global Sourcing Index

Next Step: Access SourcifyChina’s Free Manufacturer Verification Toolkit (2026 Edition) at sourcifychina.com/verification-toolkit

Includes: Gov.cn license checker, factory zone map, payment term templates, and AI deepfake detection guide.

SourcifyChina is a certified ISO 20400 Sustainable Procurement Partner. This report reflects PRC Commercial Code (2025 Amendment) and ITC best practices. Data sourced from 1,200+ verified 2025 engagements.

© 2026 SourcifyChina. Confidential for procurement professional use only.

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report 2026

Prepared for Global Procurement Managers

Leverage Verified Suppliers with Confidence: Your Strategic Advantage in 2026

In today’s hyper-competitive global supply chain landscape, procurement efficiency is no longer optional—it’s imperative. With rising geopolitical risks, extended lead times, and increasing compliance demands, sourcing from China requires precision, speed, and verified trust.

At SourcifyChina, we empower procurement leaders with data-driven intelligence and a rigorously vetted network of manufacturers. Our Pro List is the industry benchmark for reliable, pre-qualified suppliers—eliminating guesswork and accelerating time-to-contract by up to 60%.

Why the SourcifyChina Pro List Saves You Time and Reduces Risk

| Benefit | Impact on Procurement Operations |

|---|---|

| Pre-Vetted Suppliers | Every company on the Pro List undergoes a 12-point verification process, including business license validation, production capacity audits, and export history analysis—saving an average of 40+ hours per supplier evaluation. |

| Real-Time Compliance Data | Access up-to-date certifications (ISO, BSCI, RoHS), reducing compliance bottlenecks and audit preparation time. |

| Direct Factory Access | Bypass intermediaries with direct connections to Tier-1 manufacturers in key industrial hubs (Guangdong, Zhejiang, Jiangsu). |

| Reduced RFQ Cycles | Pre-qualified suppliers respond faster and more accurately, cutting RFQ-to-quote time by up to 50%. |

| Fraud Prevention | Eliminate counterfeit suppliers and trading companies masquerading as factories—ensuring supply chain integrity. |

The Cost of Delay Is Measurable

Procurement teams relying on manual “China company lookup” methods face:

- High risk of engagement with unverified entities

- Extended onboarding timelines

- Increased legal and operational exposure

In contrast, SourcifyChina users report 92% faster supplier onboarding and a 35% reduction in supplier-related quality incidents.

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Don’t let inefficient sourcing slow your competitive edge.

✅ Access the 2026 SourcifyChina Pro List—curated, current, and compliant.

✅ Reduce supplier discovery time from weeks to hours.

✅ Secure your supply chain with verified, audit-ready partners.

Contact our Sourcing Support Team Now:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Let SourcifyChina be your strategic partner in building resilient, high-performance supply chains for 2026 and beyond.

© 2026 SourcifyChina. All rights reserved. Verified. Vetted. Trusted.

🧮 Landed Cost Calculator

Estimate your total import cost from China.