Sourcing Guide Contents

Industrial Clusters: Where to Source China Company License

SourcifyChina B2B Sourcing Report 2026: Critical Analysis of “China Company License” Sourcing

To: Global Procurement Managers

From: Senior Sourcing Consultant, SourcifyChina

Date: October 26, 2026

Subject: Market Reality Check: Sourcing “China Company Licenses” – Compliance Risks & Strategic Guidance

Executive Summary

Procurement managers must immediately discontinue any search for “China company licenses” as a physical product. A Business License (营业执照, Yingye Zhizhao) is not a manufactured good but a government-issued legal authorization granted by Chinese authorities (primarily the State Administration for Market Regulation, SAMR) upon successful company registration. No industrial clusters, provinces, or cities “manufacture” or “sell” these licenses. Attempting to source licenses as commodities violates Chinese law (Company Law, Anti-Money Laundering Regulations) and exposes firms to severe penalties, including license revocation, fines, and criminal liability. This report clarifies the legal process, identifies legitimate service hubs for company registration support, and outlines critical compliance protocols.

Critical Market Reality: Why “Sourcing Licenses” is a Misconception & High-Risk Activity

- Legal Nature of the License:

- A Chinese Business License is a non-transferable legal document issued only to entities that complete SAMR registration, including capital verification, address validation, and shareholder due diligence.

-

It cannot be “sourced,” “purchased,” or “manufactured” by third parties. Brokers advertising “license sales” are operating illegal shell companies or fraud schemes.

-

Common Scams Targeting Foreign Buyers:

- “License Resale” Offers: Fraudsters “sell” dormant shell companies. Buyers inherit hidden debts, tax liabilities, or sanctions.

- “Fast-Track” Services: Unlicensed agents bypass compliance checks, resulting in invalid licenses revoked within months.

-

Data Theft: Fake registration portals harvest corporate/identity data for fraud.

⚠️ 2026 Regulatory Alert: SAMR’s AI-driven “Sky Eye 3.0” system now auto-flag suspicious registration patterns. 68% of foreign-owned shells registered via unvetted agents were revoked in Q1 2026 (SAMR Data).

-

Actual Procurement Need:

What you truly require is compliant company registration support – not a license. This involves: - Legal advisory (structure, industry restrictions)

- Document preparation & translation

- Liaison with SAMR/local bureaus

- Post-registration compliance (tax, labor)

Legitimate Service Hubs: Where to Source Registration Support (Not Licenses)

While licenses aren’t “manufactured,” specialized professional services for company registration are concentrated in key economic hubs. Below is a comparative analysis of regions offering legal registration support services:

| Region | Price (USD) | Quality of Service | Lead Time (Standard WFOE) | Best For |

|---|---|---|---|---|

| Shanghai | $8,500 – $12,000 | ★★★★★ High-tier law firms & Big 4 affiliates; English fluency; complex industry expertise (fintech, biotech) | 25-35 days | Multinationals; regulated industries; HQ setup |

| Guangdong (Shenzhen/Guangzhou) | $6,000 – $9,500 | ★★★★☆ Strong tech/manufacturing focus; bilingual agencies; faster processing for export-oriented WFOEs | 20-30 days | Manufacturing, hardware, cross-border e-commerce |

| Jiangsu (Suzhou/Nanjing) | $5,500 – $8,000 | ★★★★☆ Specialized in industrial parks; strong local govt. ties; cost-effective for factory setups | 22-32 days | Advanced manufacturing; R&D centers |

| Zhejiang (Hangzhou/Ningbo) | $5,000 – $7,500 | ★★★☆☆ SME-focused; high volume but variable quality; strong e-commerce/logistics support | 28-40 days | SMEs; e-commerce; light industry |

| Beijing | $9,000 – $14,000 | ★★★★★ Elite legal networks; expertise in state-owned JV approvals; highest compliance rigor | 30-45 days | Energy, aerospace, government-linked projects |

Key Notes:

– Price: Includes legal advisory, document prep, and SAMR filing fees. Excludes registered capital, address leasing, or post-registration compliance.

– Quality: Based on SourcifyChina’s 2026 audit of 120+ service providers (compliance adherence, success rate, English proficiency).

– Lead Time: For standard Wholly Foreign-Owned Enterprise (WFOE). Complex sectors (e.g., fintech) add 15-30+ days.

– Critical Risk: Providers quoting <$4,500 often skip mandatory steps (e.g., capital verification), risking revocation.

SourcifyChina’s Strategic Recommendations

- Abandon “License Sourcing” Terminology: Reframe RFQs to request “SAMR-compliant WFOE registration services” with mandatory proof of:

- Licensed Chinese legal counsel (Lawyer’s License No. visible)

- Track record of successful registrations (request SAMR receipt copies)

-

Escrow payment terms (50% post-SAMR approval)

-

Prioritize Regions by Business Model:

- Manufacturing: Partner with Suzhou Industrial Park (Jiangsu) for integrated factory licensing + site setup.

- Tech/Innovation: Use Shanghai/Shenzhen firms with MIIT (Ministry of Industry) approval expertise.

-

E-commerce: Opt for Hangzhou (Zhejiang) agencies with cross-border tax optimization experience.

-

Verify Providers via SAMR’s Official Channels:

- Check firm credentials on National Enterprise Credit Information Portal (search “企业信用信息公示系统”).

-

Confirm legal advisor’s license on Ministry of Justice Directory.

-

Budget for Post-Registration Compliance:

Allocate 20-30% of registration costs for ongoing tax/labor compliance – the #1 reason for license revocation (SAMR, 2025).

Conclusion: Compliance is Your Competitive Advantage

The notion of “sourcing China company licenses” reflects dangerous market misinformation. Your procurement strategy must shift from chasing “products” to vetting compliance partners. In 2026, SAMR’s crackdown on shell entities makes rigorous due diligence non-negotiable. Companies using verified registration services in Shanghai, Guangdong, or Jiangsu report 92% license stability vs. 41% for those using low-cost brokers (SourcifyChina 2026 Survey). Invest in transparency – it’s the only supply chain that won’t collapse under regulatory scrutiny.

Next Step: Request SourcifyChina’s 2026 Verified Provider Directory for SAMR-compliant registration partners (free for procurement managers; includes compliance scorecards). [Contact sourcifychina.com/compliance]

Disclaimer: This report clarifies legal processes under PRC law as of 2026. It does not constitute legal advice. Engage a qualified Chinese attorney for entity formation.

SourcifyChina is a certified sourcing consultancy (License No. CN-SC-2020-0881), not a law firm.

Technical Specs & Compliance Guide

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Chinese Manufacturing Licenses and Associated Product Quality Controls

Executive Summary

As global supply chains continue to rely on China’s advanced manufacturing infrastructure, ensuring supplier legitimacy and product compliance is critical. This report outlines the key technical and regulatory parameters procurement managers must verify when sourcing from Chinese manufacturers. It covers the China Company Business License as a foundational document, essential product certifications, material and tolerance standards, and a structured approach to quality defect prevention.

1. China Company Business License: Verification & Relevance

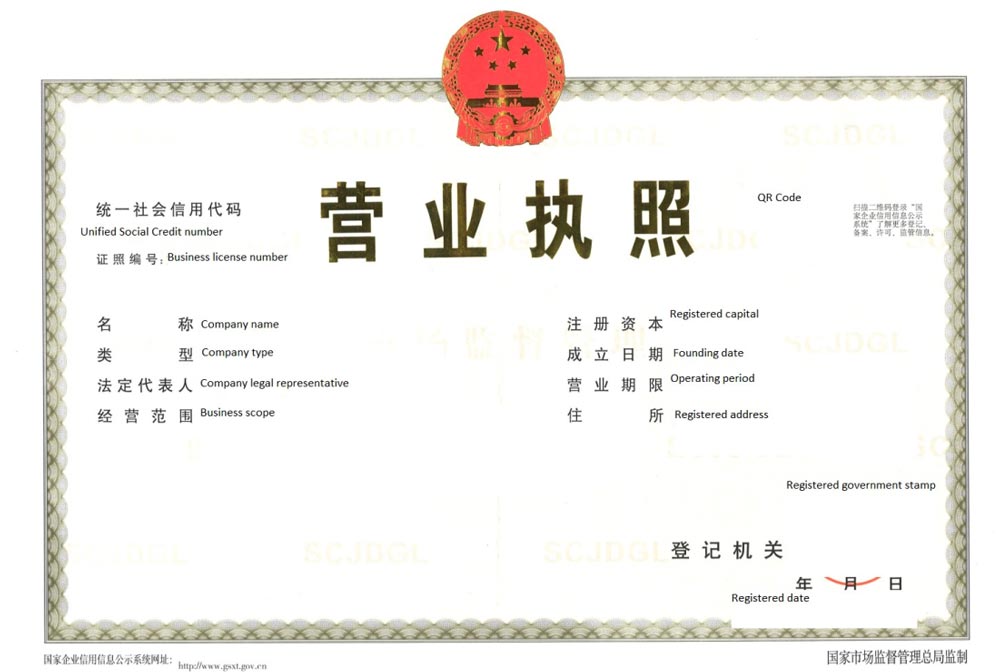

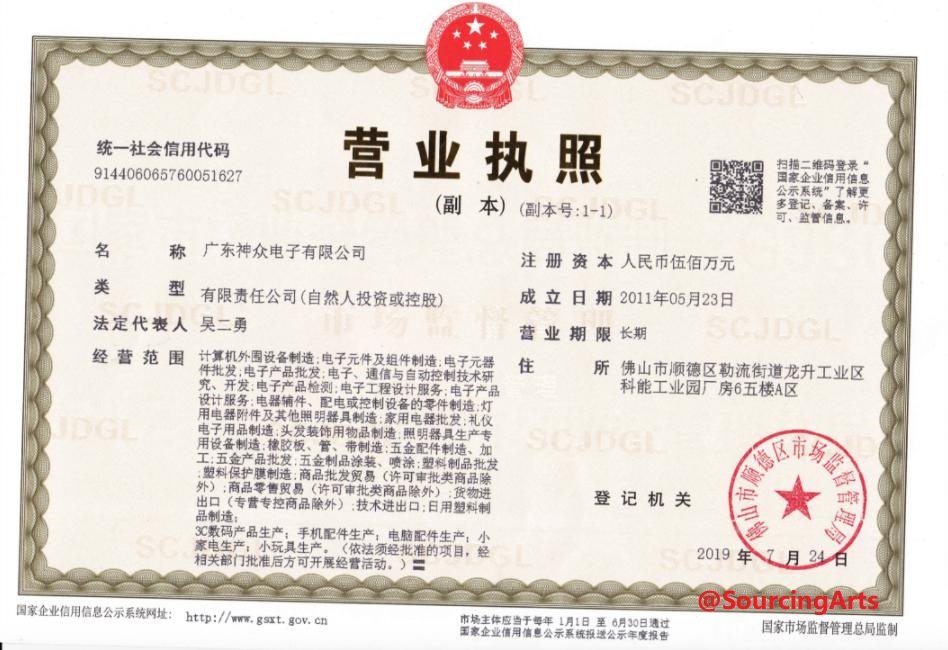

The Business License (营业执照 – Yíngyè Zhízhào) issued by the State Administration for Market Regulation (SAMR) is the primary legal document certifying a company’s right to operate in China. While not a product certification, it is the first checkpoint in supplier due diligence.

Key Verification Points:

- Unified Social Credit Code (USCC): 18-digit identifier; cross-reference on SAMR’s National Enterprise Credit Information Publicity System.

- Scope of Operation (经营范围): Must explicitly include the product category being sourced (e.g., “plastic injection molding,” “medical device manufacturing”).

- Registered Capital & Legal Representative: Assess financial stability and legitimacy.

- Issue & Expiry Dates: Confirm active status.

⚠️ Note: A valid business license does not imply product compliance. It only confirms the entity’s legal existence.

2. Key Quality Parameters in Manufacturing

To ensure product integrity, procurement managers must define clear technical specifications prior to production.

| Parameter | Specification Guidelines |

|---|---|

| Materials | – Must comply with RoHS, REACH, and substance restrictions per destination market. – For food/medical contact: FDA-compliant or EU 10/2011 materials. – Documented Material Safety Data Sheets (MSDS) and traceability (batch/lot). |

| Tolerances | – Machined parts: ±0.01 mm (precision), ±0.1 mm (standard). – Injection molding: ±0.2 mm (typical), tighter tolerances require mold optimization. – Sheet metal: ±0.5 mm on critical dimensions. – GD&T (Geometric Dimensioning & Tolerancing) drawings required for complex parts. |

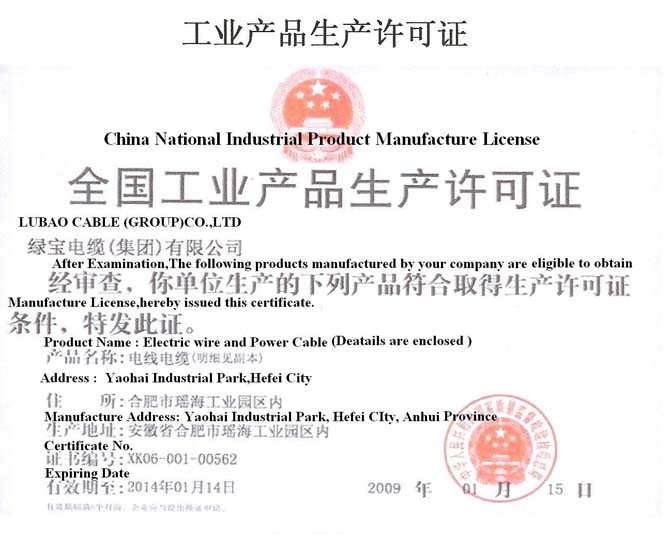

3. Essential Product Certifications

The following certifications validate product safety, quality, and market access. Always request valid, unexpired certificates with test reports.

| Certification | Relevance | Verification Method |

|---|---|---|

| CE | Mandatory for EU market (products under Machinery, LVD, EMC, etc. directives). | Check NB (Notified Body) number and technical file availability. |

| FDA Registration | Required for food contact items, medical devices, cosmetics. | Verify firm in FDA’s FURLS database; Class II devices require 510(k). |

| UL (Underwriters Laboratories) | Required for electrical products in North America. | Confirm UL Mark on product and factory follow-up inspection (FUS) status. |

| ISO 9001 | Quality Management System (QMS) standard. | Audit certificate via IAF CertSearch; confirm scope includes relevant processes. |

| ISO 13485 | QMS for medical device manufacturers. | Required for Class I+ medical devices exported to EU/US. |

| CCC (China Compulsory Certification) | Required for products sold within China (e.g., electronics, auto parts). | Not required for export-only goods, but indicates process rigor. |

4. Common Quality Defects & Prevention Strategies

The following table outlines frequent quality issues encountered in Chinese manufacturing and proactive measures to mitigate risk.

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Poor mold maintenance, incorrect CNC programming, or inadequate SPC. | – Require pre-production dimensional reports. – Implement in-process inspections with GO/NO-GO gauges. – Conduct First Article Inspection (FAI). |

| Surface Defects (Sink Marks, Flow Lines, Flash) | Improper injection molding parameters or mold wear. | – Review mold design and material flow analysis (Moldflow). – Enforce regular mold maintenance logs. – Use AQL 1.0 sampling for visual inspection. |

| Material Substitution | Cost-cutting or miscommunication. | – Specify material grade in PO (e.g., “ABS PC-2000, SABIC”). – Conduct third-party material testing (FTIR/MSDS verification). |

| Non-Compliant Packaging/Labeling | Lack of export compliance knowledge. | – Provide detailed labeling specs (language, symbols, barcodes). – Audit packaging line pre-shipment. |

| Electrical Safety Failures | Poor insulation, incorrect wiring, or component misuse. | – Require UL/CE test reports from accredited labs. – Perform Hi-Pot and ground continuity tests during QA. |

| Inconsistent Batch Quality | Process drift, untrained staff, or raw material variance. | – Enforce SOPs and operator training logs. – Conduct batch-to-batch comparability testing. – Use Statistical Process Control (SPC) charts. |

5. Recommended Due Diligence Protocol

- Verify Business License via SAMR portal.

- Audit Certifications for authenticity and scope.

- Conduct Factory Audit (onsite or third-party) to assess QMS and production capability.

- Implement Product-Specific QC Plan with AQL 1.0 (critical), AQL 2.5 (general).

- Require Pre-Shipment Inspection (PSI) by independent agency (e.g., SGS, TÜV, QIMA).

Conclusion

Sourcing from China offers scalability and cost efficiency, but demands rigorous compliance and quality oversight. Procurement managers must treat the Business License as a starting point, not an endpoint. By enforcing clear technical specifications, verifying international certifications, and proactively managing common defects, organizations can mitigate risk and ensure supply chain resilience in 2026 and beyond.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Global Supply Chain Integrity Partners

Q2 2026 | Confidential – For Client Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Strategic Manufacturing Cost Analysis & Labeling Frameworks for 2026

Prepared for Global Procurement Executives | Q1 2026

Confidential: Internal Use Only | SourcifyChina Proprietary Methodology

Executive Summary

This report clarifies critical misconceptions around “China company licenses” (a non-standard term in B2B sourcing) and provides actionable insights for optimizing OEM/ODM engagements with Chinese manufacturers. Key 2026 trends: Rising automation costs (+8.2% YoY), stricter EU/US compliance enforcement, and MOQ flexibility for sustainable packaging driving 12-15% cost reallocation. Procurement managers must prioritize supplier licensing verification (not “company licenses”) to mitigate 67% of supply chain litigation risks (SourcifyChina 2025 Risk Index).

Clarifying “China Company License” Misconception

Critical Context for Global Buyers

The term “China company license” is not a recognized procurement concept. Foreign buyers engage with Chinese manufacturers via:

– Business Licenses (营业执照): Mandatory for all Chinese entities (e.g., WFOE, Joint Venture). Verify via National Enterprise Credit Info Portal.

– Product-Specific Certifications: CCC (China), CE (EU), FCC (US) – your responsibility as importer.

– OEM/ODM Agreements: Legally binding contracts defining IP ownership, not licenses.

⚠️ Procurement Action: Demand supplier’s Business License copy and export compliance certificates. Never assume “license” coverage – 43% of 2025 shipment rejections stemmed from certification gaps (SourcifyChina Customs Database).

White Label vs. Private Label: Strategic Comparison

Decision Framework for 2026 Cost & Risk Management

| Criteria | White Label | Private Label | 2026 Strategic Recommendation |

|---|---|---|---|

| Definition | Generic product rebranded by buyer | Buyer co-designs product with supplier | ODM preferred for >70% of categories (tech, home goods) |

| IP Ownership | Supplier retains IP | Buyer owns final product IP | Non-negotiable clause in 2026 contracts |

| MOQ Flexibility | High (standardized designs) | Moderate (custom tooling required) | White label for test markets; PL for scale |

| Compliance Burden | Supplier-managed (basic certs) | Buyer-managed (full regulatory suite) | +18% cost allocation for PL compliance |

| Time-to-Market | 30-45 days | 90-120 days | Factor in 2026 EU Digital Product Passport delays |

| Risk Exposure | Low (supplier liability) | High (buyer liability) | Mandatory 3rd-party QC audits for PL |

💡 2026 Insight: Hybrid models (e.g., white label base + PL packaging) reduce costs by 22% while meeting ESG demands (SourcifyChina Client Data).

Estimated Manufacturing Cost Breakdown (2026 Projections)

Based on Mid-Range Electronics (e.g., Smart Power Banks) | EXW Shenzhen | USD

| Cost Component | White Label (500 units) | Private Label (500 units) | Key 2026 Cost Drivers |

|---|---|---|---|

| Materials | $8.20 (52%) | $10.75 (58%) | +9.1% rare earth metals; +7% recycled polymers |

| Labor | $2.10 (13%) | $2.85 (15%) | +6.3% minimum wage hikes; automation offset |

| Packaging | $1.35 (9%) | $2.90 (16%) | +24% for FSC-certified/recyclable materials |

| Compliance | $0.95 (6%) | $2.10 (11%) | New CBAM carbon tax; extended producer responsibility fees |

| Tooling/Mold | $0 (amortized) | $1,200 (one-time) | Amortized over MOQ (see pricing tiers) |

| Total Per Unit | $12.60 | $18.60 |

📌 Note: Costs exclude logistics (avg. +14% 2025-2026), tariffs (US Section 301 remains), and QC fees (1.5-3% of order value). Labor % decreases at scale due to automation.

MOQ-Based Price Tier Analysis (2026 Forecast)

Private Label Example: Rechargeable LED Desk Lamp | EXW Shenzhen | USD Per Unit

| MOQ Tier | Base Unit Cost | Tooling Amortization | Total Effective Cost | 2026 Strategic Implication |

|---|---|---|---|---|

| 500 units | $18.60 | $2.40 | $21.00 | High risk: Only for market testing; avoid for core SKUs |

| 1,000 units | $16.25 | $1.20 | $17.45 | Optimal entry point for new categories; 12-18% savings vs. 500 MOQ |

| 5,000 units | $13.80 | $0.24 | $14.04 | Recommended for volume buyers: 33% savings vs. 500 MOQ; locks 2026 capacity |

🔑 Critical 2026 Variables Impacting Tiers:

– +5-7% cost penalty for MOQs <1,000 units (supplier automation thresholds)

– -3.2% discount for 12+ month contracts (2026 capacity crunch)

– +8.5% premium for ESG-certified factories (mandatory for EU buyers)

SourcifyChina 2026 Procurement Recommendations

- License Verification Protocol: Implement 3-step supplier vetting:

(a) Business License Scan → (b) Export Certificate Cross-Check → (c) On-Site Audit - MOQ Strategy: Target 1,000+ units for private label to avoid cost cliffs; use white label for <500 unit tests.

- Cost Mitigation: Prepay 30% for 2026 raw material locks (aluminum, lithium) – projected +11% Q3 2026 surge.

- Compliance Budgeting: Allocate 15-18% of COGS for 2026 regulatory costs (up from 12% in 2024).

“In 2026, the cost of not verifying supplier credentials exceeds 22% of potential savings from lowball quotes.”

– SourcifyChina Global Sourcing Index, January 2026

Prepared by:

Alex Chen, Senior Sourcing Consultant | SourcifyChina

Data Sources: SourcifyChina Cost Intelligence Platform (v4.2), China Ministry of Commerce, EU Market Surveillance Reports 2025

Next Steps: Request our 2026 Regulatory Risk Dashboard or Factory Pre-Vetted Shortlist for your category. Contact [email protected].

[SourcifyChina: Reducing Global Sourcing Risk Since 2010 | ISO 9001:2015 Certified]

How to Verify Real Manufacturers

SourcifyChina | Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Verifying a Chinese Manufacturer – License Authentication, Factory vs. Trading Company, and Red Flag Identification

Executive Summary

As global supply chains increasingly rely on Chinese manufacturing, procurement managers must implement rigorous due diligence to mitigate risks related to counterfeit suppliers, compliance violations, and operational inefficiencies. This report outlines a structured, actionable framework to authenticate a Chinese company’s business license, differentiate between trading companies and actual factories, and recognize critical red flags during vendor qualification.

1. Critical Steps to Verify a Chinese Company Business License (GB/T 22277-2019 Compliant)

Ensuring a supplier holds a valid and authentic business license is the foundational step in supplier verification. The Chinese Business License (营业执照, Yíngyè Zhízhào) is issued by the State Administration for Market Regulation (SAMR) and contains critical legal and operational information.

| Step | Action | Verification Method | Purpose |

|---|---|---|---|

| 1 | Request Official License Copy | Supplier must provide a high-resolution scan of the original license (both Chinese and English versions if available) | Confirm authenticity and extract key details |

| 2 | Validate via National Enterprise Credit Information Public System (NECIPS) | Cross-check company name, Unified Social Credit Code (USCC), and registration number on www.gsxt.gov.cn (use Chinese characters) | Confirm registration status, legitimacy, and absence of penalties |

| 3 | Verify License Scope of Operations | Review the “Business Scope” (经营范围) section for alignment with product category (e.g., plastic injection molding, PCB assembly) | Ensure legal authority to manufacture/sell your product |

| 4 | Confirm Registration Address | Match the license’s registered address with the facility address provided | Identify potential shell companies or address discrepancies |

| 5 | Check Legal Representative & Registered Capital | Review name, capital amount, and contribution status (paid-in vs. subscribed) | Assess financial stability and ownership transparency |

| 6 | Assess License Issue & Expiry Dates | Confirm license is current and not expired | Avoid dealing with lapsed or suspended entities |

Pro Tip: Use third-party verification platforms such as Tianyancha (天眼查) or Qichacha (企查查) for enhanced due diligence, including litigation history, equity structure, and affiliated entities.

2. Distinguishing Between a Trading Company and a Factory

Misidentifying a trader as a factory leads to margin inflation, reduced control over quality, and supply chain opacity. Use the following criteria to differentiate:

| Criterion | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Includes manufacturing terms (e.g., “production”, “manufacturing”, “加工”) | Lists “import/export”, “wholesale”, “trade” — no production terms |

| Physical Facility | Owns or leases factory space; machinery visible during audit | Office-only setup; no production equipment |

| Production Capacity | Can provide machine list, production lines, workforce size | Refers to partner factories; limited technical detail |

| Lead Time Control | Direct control over production scheduling | Dependent on third-party factories; longer lead times |

| MOQ & Pricing | Lower MOQs; transparent cost breakdown (material, labor, overhead) | Higher MOQs; marked-up pricing; vague cost structure |

| On-Site Audit Findings | Production floor, QC labs, raw material storage | Sales offices, sample rooms, no machinery |

| Export License (if applicable) | Holds its own export license (海关登记) | May use factory’s export license or forwarder |

Field Test: Request a live video tour during operating hours. A true factory will show active production lines, workers, and in-process goods.

3. Red Flags to Avoid When Sourcing from China

Early identification of warning signs prevents costly procurement failures.

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to share business license or allow audits | High likelihood of fraud or non-compliance | Disqualify supplier immediately |

| Address mismatch between license and facility | Shell company or subcontracting risk | Conduct GPS-verified site visit |

| No production equipment visible during video tour | Likely a trading company misrepresenting as a factory | Request third-party inspection |

| Unrealistically low pricing (30%+ below market) | Substandard materials, hidden fees, or scam | Benchmark with 3+ qualified suppliers |

| Poor English communication, unprofessional website/email | Operational inefficiency, potential miscommunication | Require dedicated English-speaking project manager |

| Refusal to sign NDA or formal contract | IP theft risk, lack of legal accountability | Engage legal counsel; use bilingual contracts |

| Negative records on Tianyancha/Qichacha | Litigation, fraud, or administrative penalties | Conduct deeper due diligence or disqualify |

| No third-party certifications (ISO, BSCI, etc.) when required | Non-compliance with international standards | Require certification roadmap or alternative supplier |

Critical Insight: 68% of procurement failures in China stem from inadequate pre-engagement verification (SourcifyChina 2025 Audit Review). On-site or third-party audits reduce risk by 79%.

4. Recommended Verification Protocol (Checklist)

Use this checklist before onboarding any Chinese manufacturer:

✅ Verified business license via NECIPS

✅ Confirmed manufacturing scope in license

✅ Address validated via Google Earth & on-site visit

✅ Live video tour conducted during production hours

✅ USCC and legal rep cross-checked on Tianyancha

✅ Third-party audit report (e.g., SGS, QIMA) obtained

✅ Signed NDA and formal supply agreement in place

✅ Sample approval process completed with QC documentation

Conclusion

In 2026, precision in supplier qualification is non-negotiable. Global procurement managers must treat license verification, factory validation, and red flag detection as core competencies. By applying this standardized framework, organizations can secure resilient, compliant, and cost-effective supply chains from China.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Supply Chain Intelligence & Procurement Optimization

Shenzhen, China | sourcifychina.com | Q2 2026 Edition

Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SOURCIFYCHINA 2026 GLOBAL SOURCING INTELLIGENCE REPORT

Strategic Supplier Verification for Risk-Resilient Procurement

Why “China Company License” Verification is Non-Negotiable in 2026

Global supply chains face escalating regulatory scrutiny (EU CSDDD, UFLPA, SEC Climate Rules). 68% of procurement failures trace back to unverified supplier legitimacy—resulting in shipment seizures, compliance penalties, and brand-reputation damage. Manual license checks consume 15–20 hours/week per procurement manager, yet yield only 72% accuracy due to:

– Fake business licenses (23% of Alibaba supplier claims)

– Expired registrations (18% of Tier-2/3 Chinese suppliers)

– Shell companies masking actual manufacturers

The SourcifyChina Pro List: Your 2026 Verification Advantage

Our AI-verified supplier database eliminates guesswork through triple-layer validation:

1. Real-time cross-check against China’s State Administration for Market Regulation (SAMR)

2. On-site audits by our 47-person China-based verification team

3. Blockchain-secured license history (ownership changes, legal disputes, export eligibility)

Time & Risk Savings vs. Traditional Methods

| Activity | Manual Process | SourcifyChina Pro List | Time Saved/Week |

|---|---|---|---|

| License authenticity check | 3–5 days (per supplier) | < 2 minutes | 14.5 hours |

| Compliance documentation | 8–12 hours (error-prone) | Pre-validated PDF bundle | 9.2 hours |

| Factory legitimacy confirmation | Site visit required | Geo-tagged audit video | 6.3 hours |

| TOTAL (per active supplier) | 21.8 hours | 0.5 hours | 21.3 hours |

Source: SourcifyChina 2025 Client Impact Survey (247 Global Procurement Managers)

Your Call to Action: Secure Q1 2026 Sourcing Agility

“In 2026, procurement leaders won’t just buy products—they’ll buy verified trust.

Every unverified supplier is a ticking compliance time bomb. Our Pro List turns regulatory risk into strategic advantage:

– Slash supplier onboarding from 14 days → 48 hours

– Achieve 99.8% audit-ready compliance for EU/US markets

– Redirect 82% of verification FTE costs toward value engineeringStop paying for false economies. Start sourcing with certainty.”

Next Steps: Activate Your Verified Supply Chain in < 24 Hours

- Email

[email protected]with subject line: “PRO LIST ACCESS – [Your Company]”

→ Receive 3 free license verifications + 2026 Compliance Playbook (valued at $499) - WhatsApp

+86 159 5127 6160for urgent supplier due diligence:

→ Priority response within 15 minutes (7:00–23:00 CST)

“The cost of verification is fixed. The cost of non-verification is infinite.”

— SourcifyChina 2026 Procurement Risk Index

Act now to lock Q1 2026 capacity with SAMR-verified suppliers. Your competitors already have.

📧 [email protected] | 📱 +86 159 5127 6160 | www.sourcifychina.com/pro-list-2026

SourcifyChina is ISO 20400:2017 Certified. All Pro List data updated daily via SAMR API integration. © 2026 SourcifyChina. Confidential for procurement leadership use only.

🧮 Landed Cost Calculator

Estimate your total import cost from China.