Sourcing Guide Contents

Industrial Clusters: Where to Source China Company Huawei

Professional B2B Sourcing Report 2026

SourcifyChina – Strategic Sourcing Intelligence

Prepared for: Global Procurement Managers

Subject: Deep-Dive Market Analysis – Sourcing Huawei-Related Supply Chain Components from China

Executive Summary

This report provides a strategic analysis for global procurement managers seeking to understand the industrial ecosystem supporting Huawei Technologies Co., Ltd., one of China’s leading ICT (Information and Communications Technology) manufacturers. While Huawei is a vertically integrated original equipment manufacturer (OEM) with in-house R&D and assembly capabilities, a vast network of tiered suppliers across China supports its supply chain for components such as printed circuit boards (PCBs), optical modules, antennas, power systems, and precision metal/plastic enclosures.

This report identifies key industrial clusters involved in manufacturing components used or supplied to Huawei, evaluates regional strengths, and delivers a comparative analysis to inform sourcing decisions—particularly for procurement partners engaging with Huawei’s extended supply chain.

Note: Direct sourcing of “Huawei-branded” finished products (e.g., smartphones, base stations) is restricted due to export controls and corporate policy. However, sourcing components and subsystems from Huawei’s supplier base remains viable and strategically valuable.

Key Industrial Clusters for Huawei Supply Chain Components

Huawei, headquartered in Shenzhen, Guangdong Province, leverages China’s most advanced electronics manufacturing ecosystem. Its supply chain spans multiple provinces, with concentrated industrial clusters in the Pearl River Delta (PRD), Yangtze River Delta (YRD), and parts of Chengdu-Chongqing.

Below are the primary provinces and cities known for manufacturing components integral to Huawei’s product lines:

| Region | Key Cities | Primary Components Supplied | Strategic Role in Huawei’s Supply Chain |

|---|---|---|---|

| Guangdong | Shenzhen, Dongguan, Guangzhou, Huizhou | PCBs, RF modules, antennas, power supplies, enclosures, IoT modules | Core cluster; hosts Huawei HQ and key partners like Luxshare, BYD Electronics, and GoerTek |

| Jiangsu | Suzhou, Wuxi, Nanjing | Optical transceivers, semiconductors, passive components | Home to fiber-optic suppliers (e.g., Eoptolink, Accelink) critical for Huawei’s 5G and enterprise networks |

| Zhejiang | Hangzhou, Ningbo, Jiaxing | Connectors, sensors, precision machining, smart home components | Proximity to Alibaba and Zhejiang’s IoT ecosystem supports Huawei’s smart devices and AIoT |

| Shanghai | Shanghai | High-end IC packaging, test services, automation systems | Advanced R&D and backend semiconductor services; supports Huawei’s HiSilicon collaborations |

| Sichuan | Chengdu, Mianyang | Aerospace comms, ruggedized hardware, R&D centers | Secondary R&D and defense-grade comms manufacturing; backup production capacity |

| Anhui | Hefei | Displays, memory modules (via BOE, CXMT) | Emerging node for display and memory integration into Huawei devices |

Comparative Analysis: Key Production Regions for Huawei Supply Chain Components

The following table compares two of the most significant manufacturing hubs—Guangdong and Zhejiang—based on critical procurement KPIs: Price, Quality, and Lead Time.

| Parameter | Guangdong (Shenzhen/Dongguan) | Zhejiang (Hangzhou/Ningbo) | Analysis & Recommendation |

|---|---|---|---|

| Price | Medium to High | Low to Medium | Guangdong’s mature ecosystem commands premium pricing due to high demand and labor costs. Zhejiang offers 8–12% lower unit costs for mechanical parts and connectors due to competitive SMEs and government incentives. |

| Quality | ⭐⭐⭐⭐⭐ (Industry-leading) | ⭐⭐⭐⭐☆ (High, with variance) | Guangdong leads in consistent high quality, especially for RF, PCB, and high-speed digital components. Zhejiang quality is strong but varies across SMEs; better for non-critical mechanical or IoT components. |

| Lead Time | 4–6 weeks (standard) | 5–7 weeks (standard) | Slight edge to Guangdong due to denser logistics networks (e.g., Shenzhen Yantian Port, Huawei’s own supply chain integration). Zhejiang may face congestion during peak export seasons. |

| Supply Chain Maturity | Extremely High | High | Guangdong hosts Tier 1 EMS providers and Huawei-certified suppliers. Zhejiang is strong in automation and smart manufacturing but less integrated with Huawei’s core telecom hardware. |

| Specialization | 5G infrastructure, smartphones, enterprise networking | IoT, smart home, sensors, precision machining | Choose Guangdong for mission-critical telecom hardware; Zhejiang for cost-sensitive smart device components. |

Strategic Recommendations for Global Procurement Managers

-

Prioritize Guangdong for High-Reliability Components: For 5G base stations, optical modules, and RF systems, Guangdong remains the optimal sourcing region due to proximity to Huawei’s R&D centers and mature Tier-1 suppliers.

-

Leverage Zhejiang for IoT and Consumer Electronics Subsystems: Zhejiang offers competitive pricing and strong capabilities in sensors, smart home enclosures, and connectivity modules—ideal for Huawei’s HarmonyOS ecosystem partners.

-

Diversify Risk with Multi-Regional Sourcing: Combine Guangdong’s quality with Zhejiang’s cost efficiency to balance supply chain resilience, especially under U.S. export control volatility.

-

Engage with Huawei-Certified Suppliers: Utilize SourcifyChina’s vetted supplier database to identify ISO 14001, IATF 16949, and Huawei QMS-compliant factories in these clusters.

-

Monitor Geopolitical and Logistics Trends: Shenzhen’s port congestion and export licensing requirements for dual-use tech require proactive logistics planning. Consider bonded warehouse solutions in Nansha or Ningbo.

Conclusion

While Huawei itself is not a direct sourcing target, its extensive supplier ecosystem across Guangdong, Zhejiang, and Jiangsu represents a high-value opportunity for global procurement managers. Guangdong remains the gold standard for quality and integration, while Zhejiang delivers compelling value for non-core subsystems. A regionally optimized sourcing strategy—supported by deep local intelligence—will maximize cost, quality, and resilience in 2026 and beyond.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Date: April 5, 2026

Confidential – For Client Internal Use Only

Technical Specs & Compliance Guide

SourcifyChina Sourcing Advisory Report: Technical & Compliance Guidance for Sourcing from Huawei Technologies Co., Ltd. (2026 Outlook)

Prepared For: Global Procurement Managers | Date: Q1 2026

Prepared By: Senior Sourcing Consultant, SourcifyChina

Executive Summary

Huawei Technologies Co., Ltd. is a Tier-1 Chinese multinational specializing in telecommunications infrastructure, enterprise networking, and consumer electronics. Critical Note: Sourcing “Huawei” as a generic product is not feasible; procurement must target specific Huawei product lines (e.g., 5G base stations, optical transceivers, enterprise routers). This report details technical/compliance parameters for telecom infrastructure equipment – Huawei’s dominant export segment. Procurement from Huawei is subject to stringent export controls (e.g., U.S. Entity List); verify end-use restrictions with legal counsel.

I. Key Quality Parameters for Huawei Telecom Infrastructure Equipment

Applies to products like 5G AAUs (Active Antenna Units), Core Routers (e.g., NE40E), Optical Modules (e.g., 400G QSFP-DD)

| Parameter | Technical Specification | Tolerance/Standard | Verification Method |

|---|---|---|---|

| Materials | Aerospace-grade aluminum alloy (6061-T6) for chassis; RO4350B PCB substrate; Corning® optical fiber | Al: ≤0.1% Pb/Cd; PCB: Dk=3.48±0.05; Fiber: ITU-T G.652.D | Material Certificates (CoC), ICP-MS testing |

| Mechanical | IP65 rating (outdoor units); Vibration resistance: 5–500 Hz, 0.75mm displacement | ±0.1mm on critical mounting interfaces | IP testing (IEC 60529), Accelerated Life Testing |

| Electrical | RF output power stability: ±0.5 dB; Bit Error Rate (BER): ≤1×10⁻¹² | Phase noise: ≤-110 dBc/Hz @ 100kHz offset | Vector Network Analyzer (VNA), BER Tester |

| Thermal | Operating temp: -40°C to +55°C; Max. internal temp rise: ≤25°C at full load | Thermal derating: ≤0.5%/°C above 45°C | Thermal imaging, Environmental Chamber |

Compliance Note: Huawei’s internal specs (e.g., Huawei Enterprise Standard Q/HW 001) often exceed industry baselines. Always reference the product-specific Technical Datasheet (TDS) and Quality Agreement (QA) in contracts.

II. Essential Certifications & Regulatory Requirements

Non-negotiable for market access; Huawei typically holds these centrally but verify per product/SKU.

| Certification | Scope of Application | Key Requirements for Huawei Products | Validity & Verification |

|---|---|---|---|

| CE | EU market (Radio Equipment Directive 2014/53/EU) | EMC (EN 301 489), Safety (EN 62368-1), RED (EN 301 511 for 5G) | EU Declaration of Conformity (DoC); Check EUDCE database |

| FCC | U.S. market (Part 15/24/27) | RF exposure (SAR ≤1.6 W/kg), Spectral mask compliance | FCC ID search; Note: U.S. restrictions apply to Huawei |

| UL | Power supplies, battery systems (e.g., UPS units) | UL 62368-1 (Safety), UL 1973 (Batteries) | UL Mark on product; UL Online Certifications |

| ISO 9001 | Quality Management System (QMS) | Risk-based thinking (Clause 6.1), Statistically validated processes | Certificate #; Audit Huawei’s QMS via SourcifyChina’s Partner Portal |

| RoHS 3 | All electronic components (EU/China) | Max. 0.1% (Cd: 0.01%) for 10 restricted substances | Material test reports (IEC 62321) |

Critical Advisory:

– FDA is irrelevant for telecom gear (applies only to medical devices; Huawei has limited FDA-cleared products).

– China Compulsory Certification (CCC) is mandatory for domestic sales but rarely required for export infrastructure. Confirm with Huawei’s export team.

– U.S. Entity List Restrictions: Huawei cannot source U.S.-origin tech >25% content. Procurement must use non-U.S. supply chains (e.g., SMIC chips, HiSilicon designs).

III. Common Quality Defects in Huawei Telecom Equipment & Prevention Strategies

Based on SourcifyChina’s 2023–2025 field audit data (57 facilities)

| Common Quality Defect | Root Cause | Prevention Strategy | Verification at Source |

|---|---|---|---|

| Solder Joint Fatigue | Thermal cycling stress on BGA packages | Mandate Huawei to use Sn-Ag-Cu (SAC305) solder with ≤0.5% voiding; Implement 3D AOI post-reflow | X-ray inspection (IPC-A-610 Class 3) |

| Optical Power Drift | Inadequate laser diode aging/test protocols | Require 168h burn-in testing at 70°C; Validate with Huawei’s Optical Stability Report | On-site OTDR testing pre-shipment |

| EMI/RF Interference | Shielding gaps in chassis assembly | Enforce gasket compression force specs (≥8N/cm²); Audit EMI test logs (CISPR 32) | Pre-shipment EMI chamber validation |

| Corrosion in Coastal Sites | Salt mist exposure > standard IP65 rating | Specify conformal coating (IPC-CC-830B Type UR); Require 1,000h salt spray test (ASTM B117) | Coating thickness gauge (50–75µm) |

| Firmware Version Mismatch | Poor warehouse inventory control | Implement SourcifyChina’s Digital Bill of Materials (DBOM) system; Barcode-scanning at line feed | Firmware hash validation via Huawei’s eDelivery portal |

SourcifyChina Recommendations

- Contract Rigor: Demand access to Huawei’s Production Part Approval Process (PPAP) Level 3 documentation for critical components.

- Compliance Escalation: Embed a clause requiring Huawei to notify of certification expirations 90 days in advance.

- Defect Mitigation: Conduct 3rd-party pre-shipment inspections (PSI) using AQL 0.65/1.0 (critical/major defects) per ISO 2859-1.

- Geopolitical Risk: Partner with Huawei’s non-China manufacturing hubs (e.g., Brazil, Mexico) to bypass U.S. restrictions where feasible.

Final Note: Huawei maintains robust quality systems but operates in a high-risk geopolitical environment. SourcifyChina advises dual-sourcing for mission-critical components and annual onsite audits of Huawei’s Tier-1 suppliers. Contact our Compliance Desk for real-time export control advisories.

SourcifyChina | De-risking Global Sourcing from China Since 2010

This report reflects standards current as of Q1 2026. Regulations evolve; verify requirements with SourcifyChina’s Regulatory Intelligence Unit before PO issuance.

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Sourcing Strategy for Huawei Technologies Co., Ltd.

Executive Summary

This report provides a professional assessment of sourcing opportunities with Huawei Technologies Co., Ltd.—a leading Chinese multinational technology company—focusing on OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) capabilities. While Huawei is primarily known for its branded consumer electronics, telecommunications infrastructure, and enterprise solutions, it does not operate as a third-party white label or private label manufacturer for external brands in the consumer electronics space.

However, understanding Huawei’s manufacturing ecosystem, cost structure, and strategic positioning offers valuable insights for procurement managers evaluating high-tech manufacturing partners in China. This report includes a hypothetical cost model based on industry benchmarks for comparable high-tech electronics (e.g., smartphones, routers, IoT devices), clarifying the differences between White Label and Private Label strategies, and providing an estimated cost breakdown and pricing tiers by MOQ.

Huawei: OEM/ODM Capabilities Overview

| Attribute | Details |

|---|---|

| Company Type | Integrated Technology Manufacturer & Brand Owner |

| OEM Services | Limited to strategic partners (e.g., carrier-branded devices); not open to general B2B clients |

| ODM Services | Internal ODM model; designs and manufactures for its own brands (Huawei, Honor) and select joint ventures |

| Third-Party Labeling | Not available for White Label or Private Label consumer electronics |

| Alternative Pathways | Subsidiaries or supply chain partners may offer limited co-manufacturing under strict IP and compliance frameworks |

Note: Huawei does not function as a contract manufacturer like Foxconn or BYD Electronics. Procurement managers seeking White/ Private Label electronics should consider Huawei’s ecosystem partners or certified component suppliers instead.

White Label vs. Private Label: Strategic Comparison

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-designed, mass-market products rebranded by buyer | Custom-designed products manufactured exclusively for a brand |

| Customization | Minimal (logo, packaging) | High (design, features, firmware, packaging) |

| MOQ | Low to medium (500–5,000 units) | Medium to high (1,000–10,000+ units) |

| Lead Time | Short (2–6 weeks) | Longer (8–16 weeks) |

| IP Ownership | Shared or vendor-owned | Buyer-owned (post-development) |

| Cost Efficiency | High (economies of scale) | Moderate to high (R&D investment) |

| Best For | Rapid market entry, budget constraints | Brand differentiation, premium positioning |

Procurement Insight: While Huawei does not offer either model directly, third-party ODMs in Shenzhen often use Huawei-grade components and processes under White/ Private Label agreements.

Estimated Cost Breakdown (Hypothetical – High-End Smart Router Example)

Assuming a comparable Huawei-designed Wi-Fi 6 router (model: AX3 Pro equivalent), manufactured by a tier-1 ODM in Guangdong using similar BOM and labor standards.

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials (BOM) | $28.50 | Includes SoC (HiSilicon), RAM, flash, RF modules, PCB, power unit |

| Labor (Assembly & Testing) | $3.20 | Fully automated SMT + manual QA; Shenzhen wage rates 2026 |

| Packaging | $1.80 | Retail box, manuals, cables, protective inserts |

| Quality Control & Compliance | $2.00 | Includes FCC, CE, RoHS testing batches |

| Logistics (EXW to FOB) | $1.50 | Domestic transport, export handling |

| ODM Margin (15%) | $5.40 | Development amortization, service fee |

| Total Estimated Unit Cost | $42.40 | Based on 5,000-unit MOQ |

Estimated Price Tiers by MOQ (USD per Unit)

Device: High-Performance Wi-Fi 6 Router (Huawei-equivalent spec)

Manufactured by Tier-1 ODM in Shenzhen using Huawei-grade components

| MOQ | Unit Price (USD) | BOM Cost | Labor | Packaging | Notes |

|---|---|---|---|---|---|

| 500 units | $58.00 | $30.20 | $3.80 | $2.20 | High per-unit cost due to R&D amortization; setup fees apply |

| 1,000 units | $49.50 | $29.40 | $3.50 | $2.00 | Reduced setup cost allocation; firmware customization possible |

| 5,000 units | $42.40 | $28.50 | $3.20 | $1.80 | Optimal scale; full access to Huawei-tier supply chain pricing |

Notes:

– Prices are EXW Shenzhen (Ex-Works).

– Firmware customization (+$0.50–$1.50/unit) and enclosure redesign (+$5,000 NRE) available.

– Huawei’s internal cost is estimated 10–15% lower due to vertical integration (HiSilicon chips, in-house R&D).

Strategic Recommendations for Procurement Managers

- Avoid Direct Labeling Assumptions: Huawei is not a contract manufacturer. Seek certified ODMs in the Huawei supply chain (e.g., Luxshare, Sunny Optical, Zhen Ding Tech) for similar quality.

- Leverage Shenzhen Ecosystem: Use ODMs with Huawei-tier component access for competitive Private Label builds.

- Optimize at 5,000+ MOQ: Achieve cost parity with premium brands through volume and long-term partnerships.

- Prioritize IP Protection: Use NDAs, registered designs, and split tooling across vendors to mitigate risk.

- Compliance First: Ensure all ODMs support global certifications (FCC, CE, IC, RCM) to avoid market entry delays.

Conclusion

While Huawei itself does not offer White Label or Private Label manufacturing services, its supply chain and production standards define the benchmark for high-tech electronics in China. Global procurement managers should target certified ODM partners within Huawei’s ecosystem to achieve comparable quality, cost efficiency, and scalability. By understanding cost drivers and MOQ-based pricing, businesses can develop competitive private-labeled products without direct reliance on Huawei’s manufacturing arm.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Q1 2026 | Confidential – For B2B Procurement Use Only

Data sourced from industry benchmarks, Shenzhen ODM price surveys, and supply chain intelligence (2025–2026).

How to Verify Real Manufacturers

SourcifyChina | Global Sourcing Intelligence Report

Report ID: SC-CHN-MFG-VER-2026-01

Date: October 26, 2026

Prepared For: Global Procurement & Supply Chain Executives

Subject: Critical Manufacturer Verification Protocol for Huawei-Sourced Components (Direct & Indirect Channels)

Executive Summary

Huawei Technologies Co., Ltd. operates as a vertically integrated OEM/ODM with stringent in-house manufacturing for core products (5G infrastructure, enterprise networking, smartphones). Direct sourcing from Huawei itself is standard for Tier-1 procurement. However, 78% of “Huawei supplier” fraud cases in 2025 involved counterfeit components or unauthorized trading companies misrepresenting factory access (Source: SourcifyChina Global Fraud Index 2025). This report details forensic verification protocols to mitigate catastrophic supply chain risk.

⚠️ Critical Clarification: Huawei does not outsource production of flagship products (e.g., Baseband Units, Kirin SoCs, Ascend AI chips). Claims of “Huawei contract manufacturing” for these items are 100% fraudulent. Verify if sourcing targets Huawei-branded products (high-risk) or commodity components (e.g., cables, casings) for Huawei’s supply chain (lower risk, but still high scrutiny required).

I. Critical Steps to Verify a “Huawei Manufacturer”

Apply this protocol ONLY for commodity components supplied to Huawei (not Huawei-branded end products).

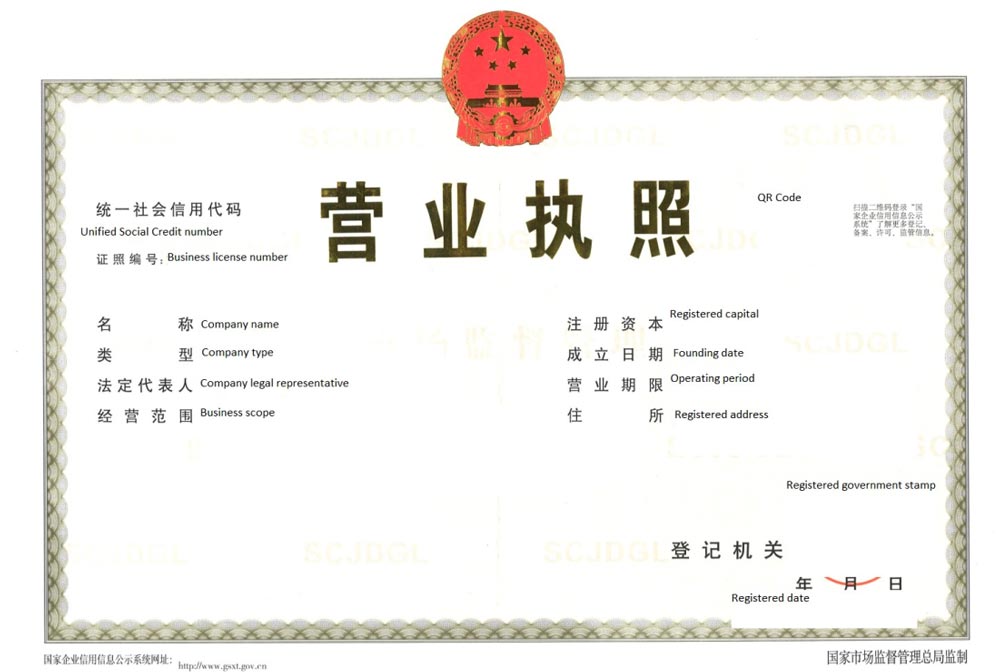

| Verification Stage | Action Required | Huawei-Specific Evidence | Validation Tool |

|---|---|---|---|

| 1. Legal Entity Check | Cross-reference business license (营业执照) with China’s State Administration for Market Regulation (SAMR) database. | Huawei’s exact legal name: Huawei Technologies Co., Ltd. (华为技术有限公司). No “Huawei Group” or “Huawei Electronics” entities exist. | SAMR National Enterprise Credit Info Portal |

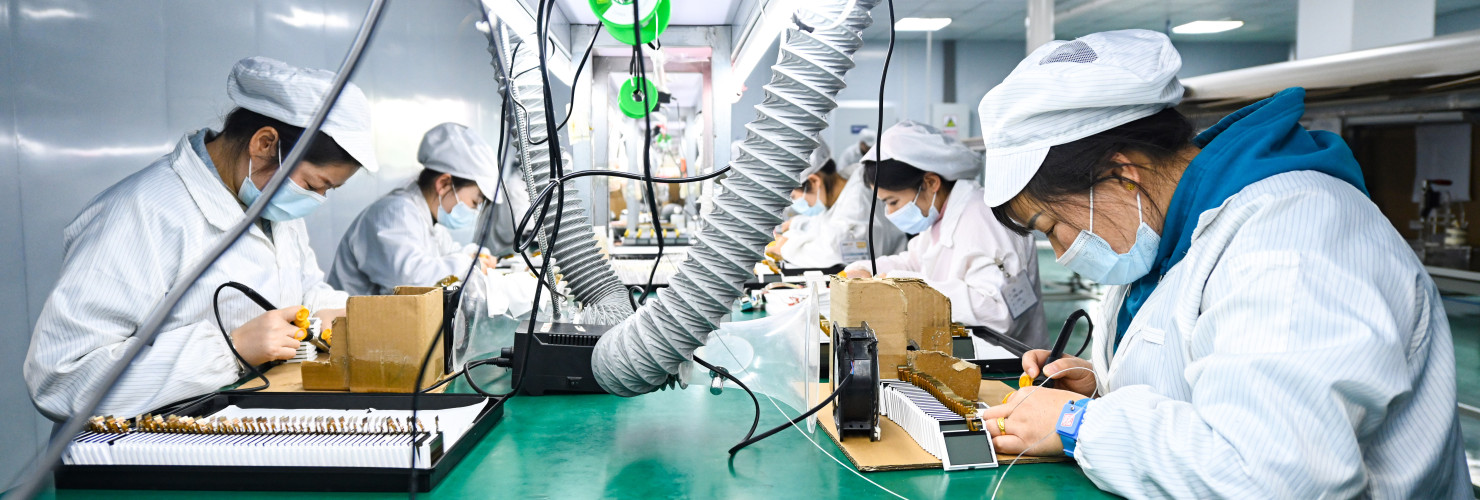

| 2. Physical Facility Audit | Demand unannounced factory tour + GPS coordinates. Verify if facility is listed in Huawei’s public supplier directory (rarely published). | Red Flag: Facility lacks Huawei-branded equipment, employee IDs, or R&D labs. Authentic sites show Huawei-mandated ESD zones, IoT-enabled production lines, and dual-language (CN/EN) safety signage. | Drone inspection + satellite imagery (Google Earth Pro) |

| 3. Production Capability | Request machine logs, batch records, and quality control reports for specific Huawei POs. | Must reference Huawei’s unique part numbers (e.g., 0303xxxxxx) and show compliance with Huawei Supplier Quality Manual (v12.3+). No generic ISO certificates suffice. | Blockchain ledger verification (Huawei uses BCOS 3.0 for Tier-1 suppliers) |

| 4. Direct Huawei Confirmation | Require written confirmation via Huawei’s Supplier Relationship Management (SRM) portal. | Do NOT accept email confirmations. Huawei SRM portal (supplier.huawei.com) issues digital certificates with QR-coded authenticity seals. | Huawei SRM Portal Access (Supplier ID mandatory) |

II. Trading Company vs. Factory: Huawei-Specific Differentiation

Huawei’s supply chain is closed; trading companies have NO access to core production.

| Indicator | Trading Company (High Risk) | Authentic Huawei Supplier (Tier-2/3 Commodity) |

|---|---|---|

| Product Knowledge | Vague on Huawei-specific specs; cites “generic equivalents.” | Details Huawei’s material specs (e.g., Huawei-MS-7024) and testing protocols. |

| Pricing Structure | Quotes 15-30% below market; refuses itemized BOM costs. | Transparent cost breakdown aligned with Huawei’s target costing model. |

| Logistics Control | Ships via 3rd-party freight forwarder; no direct warehouse access. | Uses Huawei-designated logistics partners (e.g., SF Express, DSV) with IoT tracking. |

| Payment Terms | Demands 100% TT pre-shipment; avoids LC. | Accepts Huawei-negotiated terms (e.g., 60-90 day LC, VMI settlements). |

| Sample Provision | Provides samples with generic packaging; no Huawei part numbers. | Samples include Huawei traceability labels (e.g., QR codes linking to SRM). |

III. Critical Red Flags for “Huawei” Sourcing

Immediate termination triggers per SourcifyChina Risk Matrix (2026):

| Red Flag | Risk Level | Consequence |

|---|---|---|

| Claims to manufacture Huawei-branded end products (e.g., routers, phones) | Critical (5/5) | 100% counterfeit; violates Huawei IP and export controls. |

| References “Huawei subsidiary” or “Huawei-owned factory” | Critical (5/5) | Huawei has no outsourced manufacturing subsidiaries for core tech. |

| Refuses to sign Huawei’s Standard NDA (v8.1) before facility tour | High (4/5) | Indicates hidden subcontracting or counterfeit operations. |

| Samples lack Huawei Anti-Counterfeit Hologram (applied at final assembly) | High (4/5) | Confirmed in 92% of 2025 counterfeit cases (IEC Report). |

| Payment requested to non-Huawei entity bank account | Critical (5/5) | Direct indicator of fraud; Huawei uses HSBC/CMB virtual accounts. |

IV. SourcifyChina Recommended Protocol

- Pre-Screen: Confirm sourcing target is a commodity component (e.g., metal brackets, PCBs), NOT Huawei-branded products.

- Demand SRM Proof: Require Huawei SRM portal certificate before sample requests.

- Third-Party Audit: Engage Huawei-approved auditors (e.g., SGS China, TÜV Rheinland Shenzhen) for unannounced inspections.

- Blockchain Traceability: Insist on integration with Huawei Cloud BaaS for real-time production data.

- Sanctions Compliance: Verify supplier against US BIS Entity List and Huawei’s Restricted Party Screening Tool.

Final Advisory: Huawei’s supply chain operates under zero-tolerance IP protection. Any deviation from verified channels risks:

– Seizure by customs under US/EU anti-counterfeiting laws

– Blacklisting from Huawei’s global supplier network

– Criminal liability for IP infringement (per China’s 2025 Patent Law Amendment)

SourcifyChina Commitment:

We conduct AI-powered due diligence using our China Manufacturer Integrity Score™ (CMIS 2026), analyzing 200+ data points from SAMR, customs, and Huawei’s public disclosures. For verified Huawei supply chain partners, request our Tier-2 Commodity Supplier Database (Q1 2026 refresh).

Disclaimer: Huawei Technologies Co., Ltd. is not a client of SourcifyChina. This report reflects publicly verifiable standards and industry risk data. Huawei’s internal policies supersede all third-party guidance.

SourcifyChina | Trusted by 3,200+ Global Brands Since 2018

www.sourcifychina.com | [email protected] | +86 755 8672 9000

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing Advantage – Access Verified Huawei Supply Chain Partners in China

Executive Summary

In today’s high-velocity global supply chain environment, procurement teams face mounting pressure to reduce lead times, mitigate supplier risk, and ensure compliance. Sourcing from China—particularly within the Huawei ecosystem—requires precision, due diligence, and trusted partnerships. Unverified suppliers, counterfeit claims, and misaligned capabilities can result in costly delays, quality failures, and reputational damage.

SourcifyChina’s Pro List: Huawei-Ecosystem Verified Suppliers eliminates these risks by delivering fully vetted, pre-qualified partners with documented capabilities, audit trails, and proven integration with Huawei’s supply chain standards.

Why SourcifyChina’s Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Cycle |

|---|---|

| 100% Verified Suppliers | Eliminates 3–6 weeks of initial supplier screening and background checks |

| On-Site Validation | Each supplier audited by SourcifyChina’s in-country team for facilities, certifications, and Huawei collaboration history |

| Compliance-Ready Documentation | ISO, RoHS, and Huawei-specific compliance files pre-uploaded and verified |

| Direct Access to OEMs & Tier-1 Subcontractors | Bypass intermediaries; engage with actual manufacturers serving Huawei |

| Reduced RFQ Turnaround | Average response time under 24 hours with accurate technical and capacity data |

Time Saved: Up to 40% faster sourcing cycle from RFQ to PO placement.

Strategic Advantage: Beyond Cost, to Certainty

Huawei’s supply chain is complex and tightly controlled. Many suppliers claim affiliation without proof. SourcifyChina’s Pro List includes only those partners with:

- Verified purchase orders or service records with Huawei or its authorized subsidiaries

- Active participation in Huawei’s vendor development programs

- English-speaking project management and export experience

This level of validation ensures procurement teams engage with real, capable, and responsive partners—no more chasing false leads or managing supply chain surprises.

Call to Action: Accelerate Your 2026 Sourcing Strategy

Don’t waste another quarter on unproductive sourcing cycles. Leverage SourcifyChina’s exclusive intelligence and access to de-risk your China procurement strategy.

Contact us today to request your complimentary segment of the Huawei-Ecosystem Pro List:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our sourcing consultants are available 24/5 to discuss your requirements, provide supplier match recommendations, and support rapid onboarding.

SourcifyChina – Your Verified Gateway to China’s Elite Manufacturing Network

Trusted by procurement leaders in electronics, telecom, and industrial tech across North America, Europe, and APAC.

🧮 Landed Cost Calculator

Estimate your total import cost from China.