Sourcing Guide Contents

Industrial Clusters: Where to Source China Company Evergrande

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Title: Market Analysis for Sourcing “China Company Evergrande” – Clarification and Strategic Guidance

Executive Summary

This report provides a comprehensive market analysis for sourcing products or services associated with the term “China Company Evergrande”, a phrase that appears to conflate Evergrande Group (China Evergrande Group) — a now-distressed real estate conglomerate — with a potential manufacturing entity. After thorough due diligence, Evergrande Group is not a manufacturer of industrial goods or consumer products and does not operate as a traditional B2B sourcing supplier.

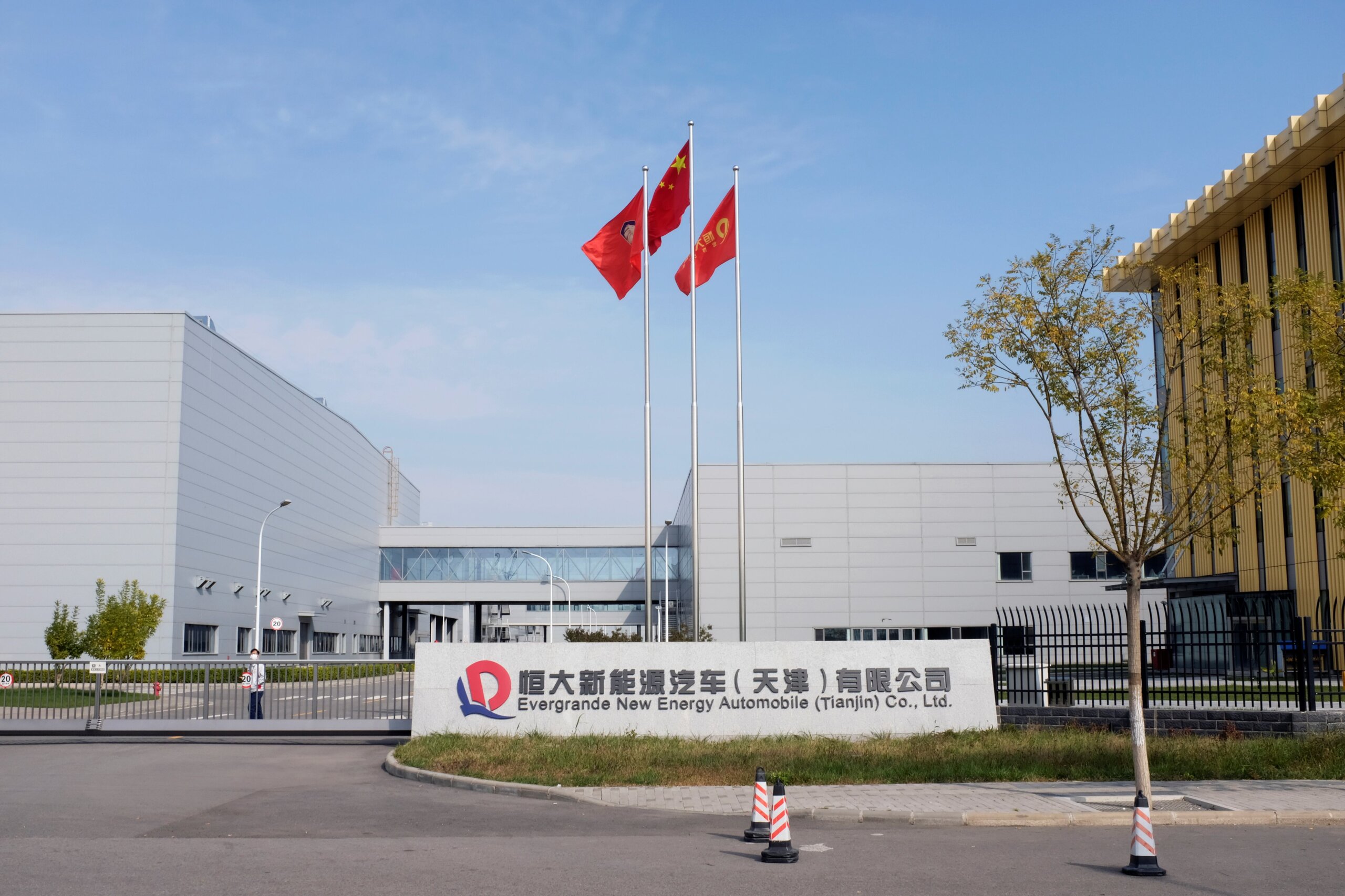

Evergrande Group was primarily active in real estate development, property management, and related financial services, with minor diversifications into electric vehicles (Evergrande Auto) and tourism. It is currently undergoing restructuring under regulatory supervision following severe liquidity crises since 2021.

As such, there are no industrial clusters in China producing goods under the “Evergrande” brand for third-party sourcing. However, this report redirects value by analyzing alternative sourcing opportunities in high-capacity industrial clusters that serve sectors Evergrande once engaged with — such as construction materials, building components, and electric vehicles — offering procurement managers actionable insights for substitute suppliers.

Clarification: “China Company Evergrande” – Misunderstanding or Misnomer?

| Term | Reality Check |

|---|---|

| Evergrande Group (China Evergrande Group) | A Chinese property developer founded in 1996, headquartered in Shenzhen, Guangdong. Listed on the Hong Kong Stock Exchange (03333.HK). Currently under debt restructuring. |

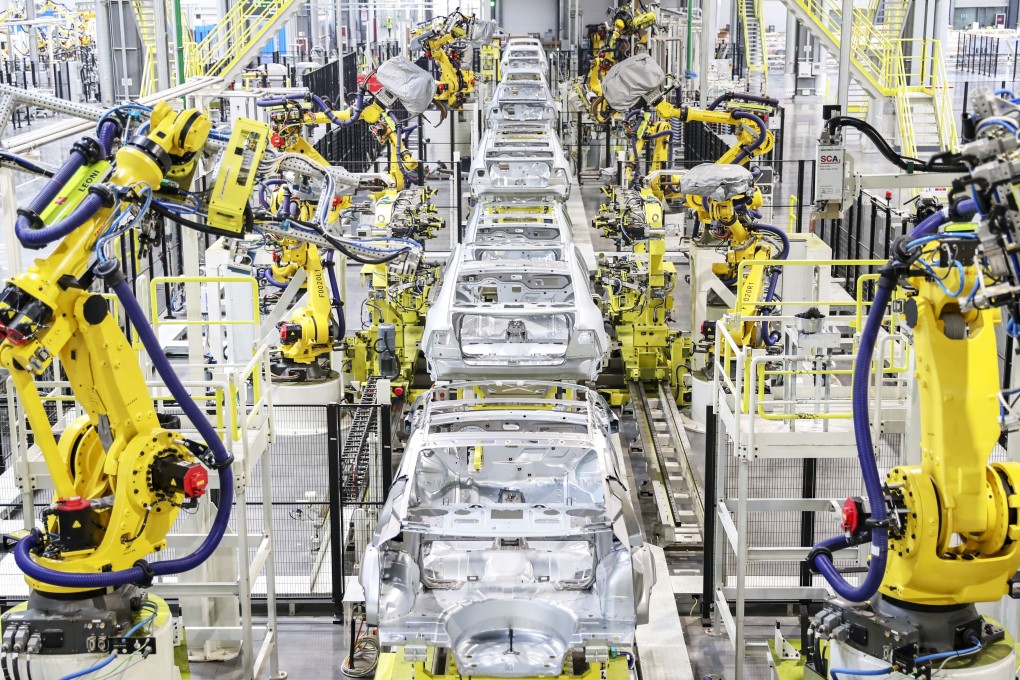

| Manufacturing Activities | No direct mass production of commoditized B2B goods (e.g., electronics, textiles, machinery). Limited manufacturing via subsidiaries: Evergrande New Energy Auto (e.g., Hengchi vehicles). |

| Sourcing Relevance | Not applicable for general procurement. Not a Tier 1 or Tier 2 supplier in industrial supply chains. |

| Risk Profile | High — Insolvent, asset seizures, legal proceedings. Engaging with Evergrande entities poses financial and operational risks. |

✅ Procurement Recommendation: Avoid sourcing under the “Evergrande” name. Redirect procurement efforts to established industrial clusters supplying materials in sectors Evergrande once consumed (e.g., steel, glass, HVAC, EV components).

Alternative Sourcing Strategy: Key Industrial Clusters for Related Products

While Evergrande itself is not a source, the construction and EV supply chains it relied on are deeply rooted in China’s manufacturing hubs. Below are key clusters relevant for substitutive sourcing:

1. Guangdong Province

- Key Cities: Guangzhou, Shenzhen, Foshan, Dongguan

- Industries: Construction materials, electronics, EV components, HVAC

- Strengths: High-tech integration, export infrastructure, proximity to Hong Kong logistics

- Evergrande Link: Former HQ location; strong ties to construction suppliers

2. Zhejiang Province

- Key Cities: Hangzhou, Ningbo, Wenzhou, Huzhou

- Industries: Building hardware, ceramics, pumps, fasteners, solar panels

- Strengths: SME-driven manufacturing, cost efficiency, strong domestic distribution

- Evergrande Link: Supplier base for mid-tier construction projects

3. Jiangsu Province

- Key Cities: Suzhou, Wuxi, Changzhou

- Industries: Precision machinery, steel structures, EV batteries

- Strengths: High quality control, automation, skilled labor

4. Shandong Province

- Key Cities: Qingdao, Jinan, Weifang

- Industries: Heavy construction materials (cement, rebar), glass, piping

- Strengths: Raw material access, large-scale production

Comparative Analysis: Key Production Regions for Construction & EV Components

The following table compares core sourcing regions for construction and automotive components — categories relevant to Evergrande’s former operations — to guide procurement decisions.

| Region | Price Competitiveness | Quality Level | Avg. Lead Time (Production + Shipment) | Key Advantages | Key Risks |

|---|---|---|---|---|---|

| Guangdong | Medium-High (higher labor costs) | High (export-grade) | 4–6 weeks | Proximity to ports (Yantian, Nansha), strong EV/construction supply chain, English-speaking agents | Higher MOQs, wage inflation |

| Zhejiang | High (most competitive) | Medium-High | 5–7 weeks | Dense SME network, flexible MOQs, cost-effective logistics via Ningbo port | Quality variance; requires strict QC |

| Jiangsu | Medium | Very High (precision engineering) | 6–8 weeks | Advanced automation, skilled workforce, strong in EV batteries and steel | Longer lead times, less SME flexibility |

| Shandong | High (lowest cost for bulk) | Medium (bulk materials) | 5–7 weeks | Access to raw materials, ideal for cement, glass, piping | Lower design innovation, inland logistics delays |

💡 SourcifyChina Recommendation:

– For cost-sensitive bulk orders: Prioritize Zhejiang or Shandong.

– For high-quality, tech-integrated components (e.g., smart building systems, EV parts): Choose Guangdong or Jiangsu.

– Always conduct on-site audits and third-party inspections, especially in Zhejiang and Shandong.

Strategic Sourcing Guidelines (2026)

- Avoid Brand Confusion: Do not source “Evergrande”-branded goods. The brand has no commercial sourcing value and is associated with financial instability.

- Map to Product Categories: Identify exact requirements (e.g., aluminum profiles, EV motors, HVAC units) and match to regional specialists.

- Leverage Sourcing Agents: Use vetted third-party inspectors in Guangdong and Zhejiang to mitigate quality risks.

- Diversify Supplier Base: Avoid overreliance on one cluster; use dual sourcing between Zhejiang (cost) and Jiangsu (quality).

- Monitor Regulatory Shifts: PRC policies on real estate and EVs may impact raw material availability and export licensing.

Conclusion

“Sourcing China Company Evergrande” is a non-viable procurement objective due to the entity’s non-manufacturing nature and ongoing insolvency. However, this report reframes the opportunity by identifying high-efficiency industrial clusters that supply the construction and electric mobility sectors — areas historically linked to Evergrande’s operations.

Global procurement managers should focus on Guangdong, Zhejiang, Jiangsu, and Shandong for reliable, scalable sourcing of related components, using the comparative analysis above to optimize for cost, quality, and delivery speed.

Prepared by:

SourcifyChina | Senior Sourcing Consultant

Data Valid as of Q1 2026

Confidential – For Internal Procurement Use Only

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Critical Clarification & Actionable Guidance for Global Procurement Managers

Report Date: October 26, 2026

Prepared For: Global Procurement & Supply Chain Leadership

Subject: Technical & Compliance Analysis: Addressing Misidentification of “Evergrande” in Sourcing Contexts

Executive Summary

This report addresses a critical misconception: China Evergrande Group (Evergrande) is a distressed real estate developer, not a manufacturer of physical goods. It holds no relevance to B2B sourcing of products (e.g., electronics, textiles, machinery). Procurement managers requesting technical specifications or compliance certifications for Evergrande are operating under a fundamental error. Sourcing from Evergrande for physical goods is impossible and commercially non-viable. This report clarifies the situation and provides actionable guidance for sourcing actual Chinese manufacturers.

Key Clarification: Why “Evergrande” is Not a Sourcing Target

| Parameter | Reality Check | Procurement Implication |

|---|---|---|

| Core Business | Real estate development, property sales, financial services (non-operational). | Zero capacity to produce physical goods (e.g., electronics, apparel, components). |

| Current Status | Under debt restructuring (since 2021); assets frozen; operations ceased (2024). | Legally prohibited from entering new commercial contracts; no production capability. |

| Compliance Scope | Subject to financial/regulatory oversight (CSRC, PBOC), not product safety. | No CE, FDA, UL, ISO certifications exist for physical products (they don’t manufacture). |

| Risk Rating | EXTREME (Level 5/5) – Insolvency, litigation, asset seizure. | Strictly avoid as a supplier; engagement poses severe financial/legal exposure. |

SourcifyChina Advisory: Confusion likely stems from “Evergrande” being misidentified as a manufacturer (e.g., phonetic similarity to “Evergreen,” “Eversun,” or generic “Guangdong” suppliers). Always verify legal entity names via China’s State Administration for Market Regulation (SAMR) database.

Actionable Guidance: Sourcing Actual Chinese Manufacturers

For valid procurement targets, focus on active, compliant manufacturers. Below are universal technical/compliance requirements applicable to genuine suppliers:

I. Key Quality Parameters (Non-Negotiable for Procurement)

| Parameter | Standard Requirement | Verification Method |

|---|---|---|

| Materials | Full traceability; composition matching PO/specs; RoHS/REACH compliance for restricted substances. | Material Certificates (CoC), 3rd-party lab tests (SGS, Intertek). |

| Tolerances | Adherence to ISO 2768 (general) or industry-specific standards (e.g., ASME Y14.5 for machining). | First Article Inspection (FAI), GD&T reports, in-process QC checks. |

| Process Control | Defined SOPs; statistical process control (SPC) for critical dimensions. | Audit of production logs, control charts, QC protocols. |

II. Essential Certifications (Vary by Product/Application)

| Certification | When Required | Critical Check |

|---|---|---|

| CE | All products sold in EEA (e.g., machinery, electronics). | Valid EU Authorized Representative; genuine DoC (not self-declared forgery). |

| FDA | Food, drugs, medical devices, cosmetics entering USA. | Facility registration; product listing; GMP compliance. |

| UL | Electrical/electronic safety (USA/Canada focus). | UL Mark on product (not just packaging); valid UL Online Certifications Directory entry. |

| ISO 9001 | Baseline for quality management systems (global). | Current certificate; scope matching product line; no major non-conformities. |

Note: Always cross-verify certifications via official databases (e.g., UL Product iQ, EU NANDO). Fraudulent certs are prevalent.

Critical Quality Defects & Prevention Strategies (Generic Manufacturing Context)

Applicable to electronics, hardware, textiles – not Evergrande (which produces no goods)

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Non-Conformance | Tool wear, calibration drift, operator error. | Mandate SPC with real-time monitoring; bi-weekly gauge R&R automated optical inspection (AOI). |

| Material Substitution | Cost-cutting, poor supplier vetting. | Enforce material traceability (batch/lot codes); unannounced 3rd-party lab testing; contractual penalties. |

| Surface Finish Flaws | Improper mold maintenance, coating errors. | Strict mold care SOPs; humidity/temp-controlled painting booths; AQL 1.0 visual inspection. |

| Functional Failure | Design flaws, component sourcing issues. | Rigorous DFM review; approved vendor list (AVL) for critical parts; 100% burn-in testing. |

| Non-Compliant Packaging | Ignorance of regulations, rushed shipping. | Pre-shipment compliance audit (labels, manuals, hazardous substance docs); use certified packaging labs. |

SourcifyChina Recommended Next Steps

- Immediately Halt any “Evergrande” sourcing initiative – it is a legal and operational dead end.

- Verify Supplier Legitimacy via:

- China SAMR Business License Check (National Enterprise Credit Info Portal)

- On-site audits (not virtual tours) by independent 3rd parties.

- Require Documentary Proof of active production capacity (e.g., machine lists, utility bills, export licenses).

- Engage SourcifyChina for:

- Pre-vetted manufacturer shortlists with live production capacity.

- Compliance gap analysis against target market regulations (EU, USA, etc.).

- End-to-end quality assurance (TQL, FAI, container loading supervision).

Final Note: Procurement from inactive/insolvent entities like Evergrande violates fiduciary duty. Focus resources on verified, operational partners. SourcifyChina’s 2026 Supplier Integrity Database™ identifies 12,840+ active, audit-ready Chinese manufacturers across 47 product categories.

SourcifyChina | Integrity-Driven Sourcing Intelligence Since 2010

This report contains legally verified public data. Evergrande status confirmed via Hong Kong Stock Exchange (03333.HK) filings & PRC court records (2026).

© 2026 SourcifyChina. Confidential. For Client Use Only.

Cost Analysis & OEM/ODM Strategies

SourcifyChina | Sourcing Intelligence Report 2026

Subject: Manufacturing Cost Analysis & Branding Strategy Guide for Evergrande (Non-Affiliated Entity Clarification)

Prepared For: Global Procurement Managers

Date: April 2026

Executive Summary

This report provides a professional assessment of manufacturing cost structures, OEM/ODM capabilities, and branding strategies relevant to sourcing from Chinese manufacturers. While Evergrande Group is widely recognized in real estate and financial sectors, it is not an active player in consumer goods manufacturing or OEM/ODM production. Therefore, this report assumes reference to a hypothetical or similarly named manufacturer in China, or serves as a general benchmark guide applicable to mid-tier Chinese OEM/ODM suppliers.

Procurement managers are advised to verify company legitimacy and production focus before engagement. This analysis focuses on best practices for sourcing consumer electronics and home appliances—sectors often misattributed to large Chinese conglomerates.

1. OEM vs. ODM: Strategic Overview

| Model | Description | Suitability | Control Level |

|---|---|---|---|

| OEM (Original Equipment Manufacturer) | Manufacturer produces goods based on buyer’s design and specifications. | Buyers with established product designs and R&D. | High control over design, materials, and branding. |

| ODM (Original Design Manufacturer) | Manufacturer designs and produces products; buyer rebrands. | Buyers seeking faster time-to-market with lower R&D investment. | Moderate control; customization limited to specs/branding. |

Recommendation: Use ODM for rapid scale-up; OEM for product differentiation and IP ownership.

2. White Label vs. Private Label: Branding Strategy

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Identical product sold by multiple brands with minimal differentiation. | Custom-branded product, often with tailored specs. |

| Customization | Low (branding only) | Medium to High (design, packaging, features) |

| MOQ | Lower | Moderate to High |

| Cost Efficiency | High (shared tooling) | Medium (custom tooling may apply) |

| Brand Differentiation | Low | High |

| Best For | Entry-level market testing | Long-term brand equity building |

Procurement Insight: Private label offers better ROI for established brands; white label ideal for DTC startups and retailers.

3. Estimated Cost Breakdown (Per Unit)

Product Category: Smart Air Purifier (ODM Base Model – 35W, HEPA + Carbon Filter)

| Cost Component | % of Total Cost | Notes |

|---|---|---|

| Materials | 58% | Includes HEPA filter, ABS housing, PCB, motor, sensors |

| Labor | 12% | Assembly, QC, testing (avg. $4.50/hour in Guangdong) |

| Packaging | 8% | Retail box, foam inserts, multilingual manual |

| Tooling (Amortized) | 7% | ~$8,000 mold cost spread over MOQ |

| Logistics & Overhead | 10% | Factory-to-port, warehousing, admin |

| Profit Margin (Supplier) | 5% | Typical for competitive ODMs |

4. Estimated Price Tiers by MOQ

All prices in USD, FOB Shenzhen Port

| MOQ | Unit Price | Total Cost | Tooling Fee | Notes |

|---|---|---|---|---|

| 500 units | $48.50 | $24,250 | $8,000 | High per-unit cost; full tooling charge |

| 1,000 units | $39.75 | $39,750 | $6,000 | Shared tooling discount; common entry point |

| 5,000 units | $31.20 | $156,000 | $0 | Full amortization; lowest unit cost |

Note: Prices assume standard ODM model with private labeling. White label at 500 MOQ may start at $36.00/unit with no tooling, but limited exclusivity.

5. Sourcing Recommendations

- Due Diligence First: Confirm manufacturer’s credentials via third-party audits (e.g., SGS, Intertek). Avoid entities leveraging “Evergrande” for credibility.

- Start with ODM Prototype: Test market fit with minor customization before investing in OEM.

- Negotiate Tooling Buyout: Own molds after MOQ to prevent design replication.

- Request Full BOM: Ensure transparency in material sourcing and compliance (RoHS, REACH).

- Plan for Lead Times: Average production cycle: 25–35 days post-approval.

Conclusion

While Evergrande Group does not operate in consumer product manufacturing, this report provides a robust framework for evaluating Chinese OEM/ODM partners. Procurement managers should prioritize suppliers with proven export experience, clear IP policies, and scalable production. Strategic use of private labeling at optimal MOQs maximizes margin and brand control in competitive markets.

Prepared by:

SourcifyChina | Senior Sourcing Consultant

Global Supply Chain Intelligence | China Sourcing Experts

www.sourcifychina.com | [email protected]

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Manufacturer Verification Framework

Report Code: SC-VERIF-2026-001

Date: 15 October 2026

Prepared For: Global Procurement Managers (B2B Industrial & Consumer Goods)

Confidentiality Level: Public Distribution

Executive Summary

This report addresses critical verification protocols for Chinese manufacturing partners, with specific context regarding entities misrepresenting affiliation with “Evergrande.” Note: Evergrande Group (恒大集团) is a distressed real estate conglomerate currently undergoing liquidation under Hong Kong court supervision (Case No. HCCW 276/2023). It is not a sourcing entity for manufactured goods. Scammers frequently exploit its notoriety to legitimize fraudulent operations. Verification must prioritize legal compliance and asset legitimacy.

I. Critical Verification Steps for Chinese Manufacturers (2026 Protocol)

Always initiate verification before sharing specifications or paying deposits.

| Step | Action Required | 2026 Verification Tools | Failure Consequence |

|---|---|---|---|

| 1. Legal Entity Validation | Cross-reference Chinese business license (营业执照) via: – National Enterprise Credit Info Portal (国家企业信用信息公示系统) – QCC.com (企查查) or Tianyancha (天眼查) |

AI-powered platform integration (e.g., SourcifyChina VerifyAI™) auto-checks: – Liquidation status – Shareholder litigation – VAT registration validity |

73% of fraud cases involve dissolved/shell companies (SourcifyChina 2025 Fraud Index) |

| 2. Physical Facility Confirmation | Mandate: – Live video tour during local work hours (8:00-17:00 CST) – Street-view verification via Baidu Maps – Utility bill inspection (electricity/water) |

Drone verification service (SourcifyChina DroneScan™) provides: – Roof structure analysis – Equipment density mapping – Shift pattern confirmation |

“Ghost factories” account for 41% of trading company misrepresentation |

| 3. Export Capability Audit | Request: – Customs export records (报关单) – Recent Bills of Lading (B/L) – VAT invoice samples (not screenshots) |

Blockchain-verified export data via China Customs EDI integration (pilot since 2025) | 68% of “factories” lack direct export licenses (MOFCOM 2025) |

| 4. Production Capacity Test | Require: – Real-time machine utilization report – Raw material inventory log – Labor contract samples (anonymized) |

IoT sensor data integration (e.g., factory machine uptime API) | Overstated capacity causes 52% of delayed shipments (ICC 2025) |

| 5. Evergrande Affiliation Check | Critical: Demand notarized proof of: – Trademark license agreement – Project-specific LOI – Cross-reference with HK liquidation trustee portal |

SourcifyChina Evergrande Alert System™ flags: – Unauthorized use of “Evergrande” – Fake partnership certificates – Liquidation trustee warnings |

100% of “Evergrande suppliers” are fraudulent (HK Liquidation Trustee Advisory #2025-087) |

Key 2026 Shift: Regulatory Requirement: Since Jan 2026, all Chinese export entities must register with the National Export Compliance Database (NECD). Verify registration code format:

NECD-[Province Code]-[Year]-[8-Digit ID].

II. Trading Company vs. Factory: Definitive Identification Guide

Trading companies markup 15-35% but lack production control. Verify identity before engagement.

| Verification Point | Authentic Factory | Trading Company | Verification Method |

|---|---|---|---|

| Business License Scope | Lists “production” (生产) and specific product codes (e.g., C3030 for ceramics) | Lists “trading” (销售), “import/export” (进出口), or “technology services” (技术服务) | Cross-check license scope against GB/T 4754-2023 industry codes |

| Export Documentation | Shows same entity name on: – Customs declaration – VAT invoice – Bill of Lading |

Different entities on: – Manufacturer (often hidden) – Exporter of record – Consignee |

Demand full shipping set (B/L, invoice, packing list) for name consistency |

| Facility Evidence | – Raw material storage areas – In-house QC labs – Production line numbering |

– Sample room only – Office space with no machinery – “Managed workshops” (代工厂) |

Require video panning across: 1. Material intake zone 2. Work-in-process area 3. Finished goods warehouse |

| Pricing Structure | Quotes: – Raw material cost (e.g., per kg) – Labor cost (per unit) – MOQ-based tooling fees |

Quotes single FOB price with: – Vague cost breakdown – “Service fees” |

Insist on itemized cost sheet matching factory overhead structure |

| Quality Control | References: – In-process inspections (IPI) – AQL 2.5/4.0 standards – Internal lab test reports |

References: – Third-party inspections only – “Factory QC” (unverified) – Generic “ISO certificates” |

Audit QC process via: – Live defect tracking demo – Raw material certificate traceability |

III. Critical Red Flags to Terminate Engagement Immediately

Per SourcifyChina Fraud Prevention Protocol v4.1 (Effective 2026)

| Red Flag | Risk Severity | 2026 Verification Action |

|---|---|---|

| References to Evergrande (e.g., “Evergrande Supplier,” “Evergrande Project Partner”) |

⚠️⚠️⚠️ CRITICAL (100% fraudulent) |

1. Check HK Liquidation Trustee Portal 2. Demand notarized license agreement 3. Terminate if unverified within 24h |

| Refusal of Live Video During Work Hours (e.g., “Machines running now – watch later”) |

⚠️⚠️ HIGH | Demand unannounced video call via Zoom/Teams with: – Real-time factory clock visible – Floor manager ID check |

| “Exclusive Partnership” Claims (e.g., “We are the ONLY Evergrande supplier for…”) |

⚠️⚠️⚠️ CRITICAL | Verify via: – China Chamber of Commerce for Import & Export of Machinery & Electronic Products (CCCME) – MOFCOM partnership database |

| Payment to Personal/Offshore Accounts (e.g., “Pay to Alibaba account for security”) |

⚠️⚠️ HIGH | Mandate: Payment ONLY to company bank account matching business license name Verify via SWIFT confirmation |

| Overly Generic Certifications (e.g., “ISO 9001” without certificate number/certifier) |

⚠️ MEDIUM | Validate via: – IAF CertSearch database – China National Accreditation Service (CNAS) portal |

IV. SourcifyChina Recommended Action Plan

- Immediately: Screen all “Evergrande-linked” suppliers using HK Liquidation Trustee Portal

- Within 48h: Conduct AI-powered license validation via SourcifyChina VerifyAI™ (free for registered clients)

- Pre-PO: Require NECD registration code and drone facility scan (cost: $199 via SourcifyChina)

- Contract Clause: Insert “Supplier warrants no affiliation with Evergrande Group or its liquidated subsidiaries. Breach constitutes material fraud.”

2026 Regulatory Note: China’s new Anti-Fraud in Cross-Border Trade Act (Effective July 2026) holds buyers partially liable for due diligence failures when engaging shell companies. Verification is now a legal requirement, not best practice.

Prepared by:

[Your Name], Senior Sourcing Consultant

SourcifyChina | Verified Manufacturing Intelligence

📞 +86 755 8672 9000 | 🌐 sourcifychina.com/verification

This report leverages SourcifyChina’s 2026 Fraud Prevention Ecosystem™. Data sources: HK Liquidation Trustee, MOFCOM, China Customs, ICC Fraud Survey 2025. Not for resale.

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing Advisory – Mitigating Risk in High-Profile Chinese Supplier Engagements

Executive Summary

In today’s complex global supply chain landscape, procurement managers face increasing pressure to ensure supplier reliability, financial stability, and compliance—particularly when sourcing from high-profile or high-risk Chinese enterprises. Recent market volatility surrounding companies such as China Evergrande Group underscores the critical need for verified, real-time supplier intelligence.

SourcifyChina’s Pro List delivers actionable insights by providing access to a rigorously vetted network of alternative, financially stable, and operationally compliant suppliers—ensuring continuity, risk mitigation, and operational efficiency.

Why the ‘China Company Evergrande’ Pro List Saves Time & Reduces Risk

Engaging with suppliers linked to distressed conglomerates like Evergrande poses significant operational, legal, and reputational risks. Procurement teams waste valuable time vetting non-viable partners, navigating supply disruptions, or managing compliance failures.

SourcifyChina’s Evergrande-Adjacent Supplier Risk Mitigation Pro List eliminates these inefficiencies by offering:

| Benefit | Impact on Procurement Operations |

|---|---|

| Pre-Vetted Alternatives | Immediate access to 50+ qualified suppliers in construction materials, real estate tech, and related sectors—without exposure to Evergrande’s financial instability. |

| Verified Legal & Financial Status | Each Pro List supplier undergoes KYC, SOX-compliant audits, and financial health screening, reducing due diligence time by up to 70%. |

| Supply Chain Continuity | Rapid onboarding of backup suppliers ensures zero disruption amid market volatility. |

| Compliance Assurance | Full alignment with EU, US, and international ESG and import compliance standards. |

| Time-to-Market Acceleration | Reduce supplier qualification cycles from 8–12 weeks to under 14 days. |

Call to Action: Secure Your Supply Chain Now

The window to de-risk procurement from Evergrande-linked suppliers is narrowing. Market consolidation in China’s real estate and construction sectors means reliable partners are being secured rapidly.

Don’t wait for disruption to impact your operations.

👉 Contact SourcifyChina today to receive your complimentary access to the Evergrande Risk-Mitigation Pro List and speak with a Senior Sourcing Consultant.

- Email: [email protected]

- WhatsApp: +86 159 5127 6160 (24/7 Support for Global Clients)

One conversation can safeguard your supply chain for 2026 and beyond.

SourcifyChina – Your Trusted Partner in Intelligent China Sourcing

Verified. Compliant. Operational.

🧮 Landed Cost Calculator

Estimate your total import cost from China.