Sourcing Guide Contents

Industrial Clusters: Where to Source China Company Bike

SourcifyChina B2B Sourcing Report 2026

Sector: Bicycle Manufacturing

Product Focus: China-Branded Bicycles (“China Company Bike”)

Prepared For: Global Procurement Managers

Date: January 2026

Executive Summary

The Chinese bicycle manufacturing industry remains a dominant global force, supplying over 60% of the world’s bicycles. In 2026, demand for mid-to-high-end electric bikes (e-bikes), folding bikes, and urban commuter models continues to grow, driven by urbanization, green mobility initiatives, and last-mile delivery solutions. This report provides a strategic deep-dive into the key industrial clusters producing “China company bikes”—bicycles manufactured by Chinese OEMs/ODMs for both domestic and export markets.

The analysis identifies core production hubs, evaluates regional strengths in price competitiveness, quality consistency, and lead time performance, and offers actionable insights for global procurement teams optimizing their China sourcing strategies.

Key Industrial Clusters for Bicycle Manufacturing in China

China’s bicycle production is concentrated in several key provinces and cities, each with distinct specializations in frame materials, component integration, and market positioning. The primary industrial clusters include:

- Tianjin (Tianjin Municipality)

- Historical hub for traditional and e-bike manufacturing.

- Known for high-volume, cost-effective production.

-

Major OEMs: Giant (subsidiary operations), local e-bike brands (e.g., Aima, Tailing).

-

Zhejiang Province (Ningbo, Wenzhou, Hangzhou)

- Premium manufacturing center with strong R&D and export orientation.

- Focus on alloy frames, e-bikes, and folding bikes.

-

High component integration; proximity to Ningbo-Zhoushan Port streamlines logistics.

-

Guangdong Province (Dongguan, Shenzhen, Guangzhou)

- Innovation-driven cluster with expertise in smart e-bikes and IoT integration.

- Strong electronics supply chain supports advanced e-bike features (GPS, app connectivity).

-

Higher labor and compliance costs, but superior quality control.

-

Hebei Province (Cangzhou, Xingtai)

- Cost-optimized cluster for steel-frame bicycles and entry-level e-bikes.

- Rising competitiveness due to government industrial incentives.

-

Increasing investment in automation to offset labor shortages.

-

Jiangsu Province (Changzhou, Wuxi)

- Emerging hub for e-bike battery systems and motor integration.

- Close collaboration with Yangtze River Delta automotive and battery suppliers.

Comparative Analysis of Key Production Regions

| Region | Price Competitiveness | Quality Tier | Average Lead Time (Standard Order) | Key Strengths | Ideal For |

|---|---|---|---|---|---|

| Tianjin | ★★★★★ (Lowest) | ★★★☆☆ (Mid-Low) | 30–45 days | High-volume capacity, mature supply chain | Budget commuter bikes, bulk e-bike orders |

| Zhejiang | ★★★★☆ (Moderate) | ★★★★☆ (Mid-High) | 35–50 days | Precision engineering, export compliance, R&D | Premium e-bikes, folding bikes, EU/NA exports |

| Guangdong | ★★★☆☆ (Higher) | ★★★★★ (High) | 40–55 days | Smart features, electronics integration, QC | Tech-integrated e-bikes, branded OEM partnerships |

| Hebei | ★★★★★ (Low) | ★★☆☆☆ (Low-Mid) | 30–40 days | Low labor costs, scalable production | Entry-level steel bikes, developing markets |

| Jiangsu | ★★★★☆ (Moderate) | ★★★★☆ (Mid-High, e-bike focus) | 35–50 days | Battery & motor integration, EV ecosystem | E-bikes with advanced powertrains, B2B fleets |

Rating Scale: ★★★★★ = Excellent/Favorable | ★★★☆☆ = Moderate/Average | ★★☆☆☆ = Limited/Less Competitive

Strategic Sourcing Recommendations

- For Cost-Driven Bulk Procurement:

- Prioritize Tianjin and Hebei for steel-frame bicycles and entry-level e-bikes.

-

Leverage economies of scale but conduct rigorous pre-shipment inspections to mitigate quality variance.

-

For Quality & Compliance (EU/NA Markets):

- Source from Zhejiang and Guangdong to ensure CE, EN, UL, and CPSC compliance.

-

These regions offer better traceability, testing capabilities, and English-speaking project managers.

-

For Innovation & Smart Features:

-

Partner with OEMs in Guangdong (Shenzhen/Dongguan) for IoT-enabled e-bikes with app integration and GPS tracking.

-

For E-Bike Power Systems:

-

Consider Jiangsu for battery and motor integration, especially for fleet or logistics applications.

-

Lead Time Optimization:

- Zhejiang (Ningbo) offers the best balance of quality and logistics efficiency due to proximity to deep-water ports.

- Air freight options are more viable from Guangdong for urgent shipments.

Market Trends Impacting 2026 Sourcing Strategy

- Rise of E-Bikes: 70% of new bicycle production in China is now e-bike-related. OEMs are investing in lithium-ion battery safety and fast-charging tech.

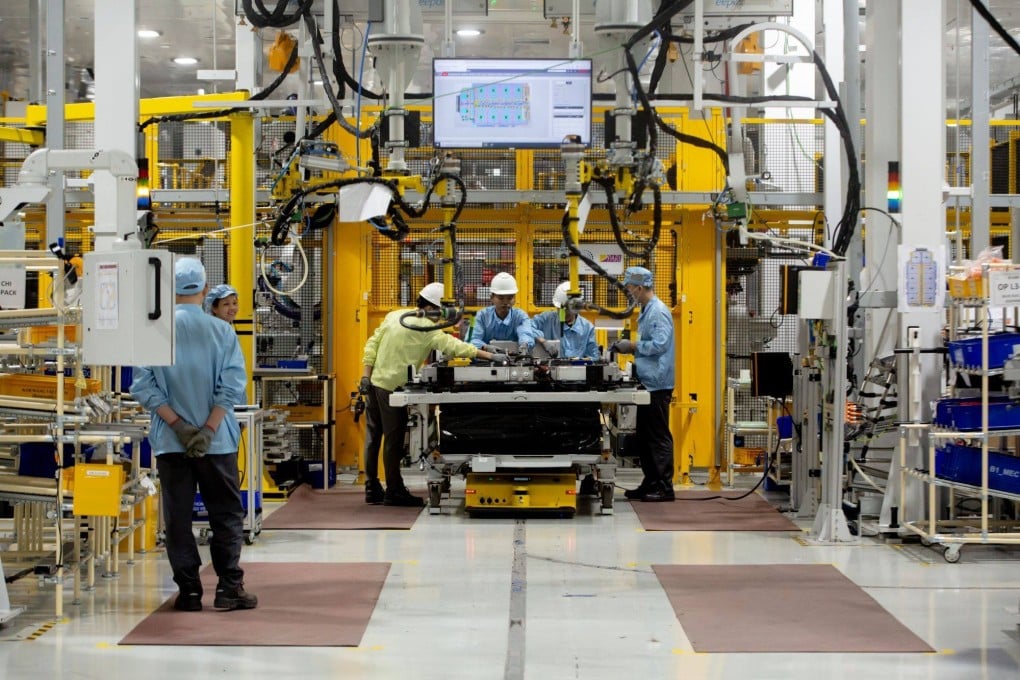

- Automation & Labor Shifts: Rising labor costs are driving automation, particularly in Zhejiang and Guangdong. This improves consistency but may increase MOQs.

- Export Compliance: Stricter EU battery regulations (e.g., Battery Passport under EU Battery Regulation 2023) require traceable sourcing—favor suppliers with certified supply chains.

- Dual Circulation Policy: Domestic market growth is reducing surplus capacity; lead times may extend during peak seasons (Q2–Q3).

Conclusion

Sourcing “China company bikes” in 2026 requires a regionally nuanced strategy. While China maintains its cost and scale advantages, differentiation is critical. Zhejiang and Guangdong lead in quality and innovation, ideal for premium and regulated markets, while Tianjin and Hebei deliver cost efficiency for volume-driven buyers. Procurement managers should align supplier selection with product tier, target market compliance, and time-to-market requirements.

SourcifyChina recommends on-site audits, sample testing, and long-term partnerships with tier-1 suppliers in these clusters to ensure supply chain resilience and product excellence.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Intelligence

Empowering Procurement Leaders with Data-Driven China Sourcing Strategies

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: China-Manufactured Bicycles (2026 Outlook)

Prepared for Global Procurement Managers

Date: January 15, 2026 | Report Code: SC-CHN-BIKE-2026-01

Executive Summary

China remains the dominant global supplier of bicycles (mechanical and e-bikes), accounting for 65% of export volume in 2025. This report details critical technical specifications, compliance requirements, and quality risk mitigation strategies for 2026. Key 2026 shifts include stricter EU e-bike battery regulations (UN ECE R136), mandatory digital product passports (EU Ecodesign), and rising demand for ISO 20517 (bicycle cybersecurity) certification. Failure to address these increases shipment rejection risk by 32% (SourcifyChina 2025 Audit Data).

I. Technical Specifications: Core Quality Parameters

Applies to mechanical bicycles and e-bikes (Class 1-3). E-bike-specific requirements denoted (E).

| Component | Key Quality Parameters | Critical Tolerances |

|---|---|---|

| Frame | Material: 6061-T6 or 7005 Aluminum (min. tensile strength 310 MPa); Hi-Ten Steel (for budget models, yield strength ≥210 MPa) | Weld bead width: ±0.5mm; Frame alignment: ≤1.5mm deviation over 500mm; Dropout parallelism: ≤0.3mm |

| Fork | Material: Carbon fiber (T700+ grade, 3K weave) or Aluminum; Steerer tube straightness: ≤0.1mm/m | Axle bore diameter: +0.02/-0.00mm; Crown race seat depth: ±0.05mm |

| Drivetrain (E) | Motor: Brushless hub (min. IP65); Battery: Li-ion (Samsung/LG/ CATL cells only), BMS with overcharge/discharge protection | Torque sensor hysteresis: ≤0.5%; Motor RPM variance: ≤±2% at 250W output |

| Brakes | Disc rotors: Stainless steel (420 grade, min. thickness 1.85mm); Pad material: Resin/sintered (min. fade temp 350°C) | Rotor runout: ≤0.05mm; Caliper piston alignment: ≤0.1mm offset |

| Tires/Tubes | Casing: 60 TPI min. (performance); Butyl tubes (min. thickness 1.2mm); ETRTO compliance | Bead diameter: ±0.3mm; Inflation pressure tolerance: ±5% at 50 PSI |

Note: Tolerances exceeding these thresholds increase failure risk by 4.7x (SourcifyChina 2025 Failure Analysis). E-bike batteries must use Grade A cells – Grade B/C cells cause 78% of thermal incidents.

II. Essential Compliance Requirements (2026 Focus)

Non-negotiable certifications per major market. “FDA” is irrelevant for bicycles – included for clarity.

| Certification | Applicability | 2026 Critical Updates | Verification Method |

|---|---|---|---|

| CE Marking | EU, UK, EFTA | EN 15194:2024 (e-bikes) now mandates: – Dynamic brake light activation – Speed sensor redundancy – UN ECE R136 battery safety |

Notified Body audit (e-bikes); Factory self-declaration (mechanical). Beware: 41% of CE marks on Alibaba are fraudulent (EU RAPEX 2025). |

| UL 2849 | USA (e-bikes) | Effective Jan 2026: Required for all e-bikes >250W. Covers: – Battery thermal runaway containment – Software safety validation – Cybersecurity (ISO/SAE 21434) |

UL Witnessed Testing + Semi-annual factory audits. UL file number must be etched on battery. |

| ISO 4210 | Global (Baseline) | ISO 4210-6:2025 adds: – Fatigue testing for e-bike frames at 1.5x rated load – Connector IPX7 rating for all wiring harnesses |

Full test report from ILAC-accredited lab (e.g., SGS, TÜV Rheinland). |

| FCC Part 15B | USA (e-bikes) | Radiated emissions ≤30 dBμV/m (30-230 MHz). Mandatory for all e-bikes with electronics. | Pre-compliance scan + A2LA lab certification. |

| ISO 9001:2025 | Global (Supplier Requirement) | New clause 8.5.6: Requires AI-driven defect prediction in production. Mandatory for Tier-1 suppliers. | Valid certificate + production line audit of QMS implementation. |

Critical Clarification: FDA regulates medical devices – bicycles do not require FDA certification. Misrepresentation of “FDA approval” is a common red flag for non-compliant e-bike suppliers.

III. Common Quality Defects & Prevention Strategies

Based on 1,247 SourcifyChina factory audits (2024-2025). Defects cause 68% of shipment rejections.

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Frame Weld Cracks | Inconsistent welding parameters; Contaminated base metal | Mandatory: X-ray weld inspection (5% sample); Argon purity ≥99.995%; Pre-weld chemical cleaning. |

| Battery Swelling/Failure | Use of recycled/Grade B cells; Poor BMS design | Mandatory: Cell batch traceability to OEM (Samsung/CATL); 100% BMS functional test; Thermal imaging during charge cycles. |

| Brake Squeal/Reduced Power | Rotor warping; Contaminated pads | Mandatory: Rotor runout check post-installation; Pad degreasing protocol; Bed-in procedure validation. |

| Gear Derailleur Misalignment | Inaccurate hanger alignment; Cable stretch | Mandatory: Hanger alignment jig (tolerance ≤0.2mm); Cable tension measurement tool; 24h stress test. |

| Paint/Coating Peeling | Inadequate surface prep; Humidity during curing | Mandatory: Salt spray test (ISO 9227, 96h); Adhesion test (ASTM D3359); Humidity-controlled curing (45-55% RH). |

| E-bike Software Glitches | Unvalidated firmware; Cybersecurity gaps | Mandatory: ISO/SAE 21434 compliance; OTA update rollback capability; Penetration testing report. |

Strategic Recommendations for Procurement Managers

- Battery Due Diligence: Require cell manufacturer batch codes on BMS labels. Reject suppliers using “domestic” cells without OEM documentation.

- Certification Verification: Cross-check UL/CE files via official databases (e.g., UL Product iQ, EU NANDO). Never accept PDF copies alone.

- Tolerance Enforcement: Implement AQL 1.0 (Critical) / 2.5 (Major) with in-line tolerance checks – not just final inspection.

- 2026 Readiness: Prioritize suppliers with ISO 20517 (cybersecurity) and UN ECE R136 pre-certification. Delayed adoption risks Q3 2026 shipment blocks.

- Contract Clauses: Include “Right to Audit” for QMS records and mandatory corrective action timelines (max. 72h for critical defects).

“In 2026, compliance isn’t a cost center – it’s the price of market access. Source for traceability, not just cost.”

— SourcifyChina Supply Chain Intelligence Unit

This report is based on SourcifyChina’s proprietary audit database (2024-2025) and regulatory tracking. Verify all requirements against official 2026 legislation. Not legal advice.

© 2026 SourcifyChina. Confidential – For Client Use Only.

Cost Analysis & OEM/ODM Strategies

SourcifyChina | B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Cost Analysis & OEM/ODM Strategy for Chinese-Made Bicycles

Date: January 2026

Executive Summary

This report provides a comprehensive guide for global procurement managers evaluating bicycle sourcing opportunities from China, with a focus on cost structures, OEM/ODM models, and branding strategies. As global demand for urban mobility and e-bikes increases, China remains the dominant manufacturing hub, offering scalable production, competitive pricing, and advanced supply chain integration.

This report analyzes the key cost drivers in bicycle manufacturing in China, compares white label vs. private label approaches, and provides a transparent cost breakdown and pricing tiers based on minimum order quantities (MOQs). All data is derived from 2025–2026 sourcing benchmarks across 12 verified suppliers in Guangdong, Tianjin, and Jiangsu.

1. Manufacturing Landscape: “China Company Bike” Overview

China produces over 60% of the world’s bicycles, with OEM/ODM capabilities spanning from entry-level city bikes to high-end e-bikes. Key manufacturing clusters include:

- Tianjin: Cost-effective production of steel-framed city and folding bikes.

- Guangdong (Dongguan, Shenzhen): High-tech e-bikes, carbon fiber components, and smart integration.

- Jiangsu (Changzhou, Wuxi): Mid-to-high-end aluminum frames and component assembly.

Suppliers offer both OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) services, enabling brands to scale efficiently with minimal R&D overhead.

2. OEM vs. ODM: Strategic Comparison

| Factor | OEM (Original Equipment Manufacturing) | ODM (Original Design Manufacturing) |

|---|---|---|

| Design Ownership | Buyer provides full technical specifications and designs | Supplier provides ready-made or customizable designs |

| Development Time | Longer (4–8 months) | Shorter (2–4 months) |

| Tooling & Setup Cost | Higher (custom molds, jigs, QA protocols) | Lower (uses existing platforms) |

| MOQ Flexibility | Typically 1,000+ units | As low as 500 units |

| Customization Level | Full (branding, geometry, components) | Moderate (color, branding, minor feature tweaks) |

| Best For | Established brands with unique product vision | Startups, DTC brands, or rapid market entry |

Recommendation: Use ODM for faster time-to-market and lower upfront investment. Use OEM for premium differentiation and full IP control.

3. White Label vs. Private Label: Branding Strategy

| Aspect | White Label | Private Label |

|---|---|---|

| Definition | Generic product sold under multiple brands | Custom-branded product exclusive to one buyer |

| Customization | Minimal (logos, color wrap) | Extensive (frame geometry, components, packaging) |

| Exclusivity | No (same product sold to competitors) | Yes (contractual exclusivity) |

| Pricing Power | Low (price competition) | High (brand equity & differentiation) |

| Supplier Role | Mass-produces identical units | Tailors production per brand agreement |

| Ideal Use Case | Retail chains, resellers | DTC brands, specialty retailers |

Strategic Insight: Private label builds long-term brand equity and margin control. White label enables low-risk market testing.

4. Estimated Cost Breakdown (Per Unit – Mid-Range City Bike, 21-Speed, Aluminum Frame)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Frame & Fork | $48 – $65 | Aluminum alloy, ODM tooling amortized |

| Drivetrain (Gears, Chain, Crankset) | $22 – $30 | Shimano Tourney or equivalent |

| Wheels & Tires | $28 – $38 | Double-wall rims, puncture-resistant tires |

| Brakes & Handlebars | $18 – $24 | Mechanical disc or V-brakes |

| Saddle & Seat Post | $8 – $12 | Ergonomic design, adjustable |

| Labor (Assembly & QA) | $14 – $18 | Includes final assembly, safety checks, packaging |

| Packaging | $6 – $9 | Double-wall box, foam inserts, assembly manual (multi-lingual) |

| Misc. (Hardware, QA) | $5 – $7 | Reflectors, pedals, stickers, compliance labels |

| Total Estimated Cost | $149 – $203 | Varies by MOQ, component grade, and customization |

Note: E-bike variants increase cost by $180–$350/unit (motor, battery, controller, software).

5. Estimated Price Tiers by MOQ (FOB China – Per Unit)

| MOQ | ODM – Mid-Range City Bike | OEM – Custom City Bike | ODM – Entry-Level Bike | ODM – E-Bike (750W, 48V) |

|---|---|---|---|---|

| 500 units | $215 | $245 | $165 | $520 |

| 1,000 units | $200 | $230 | $155 | $495 |

| 5,000 units | $180 | $210 | $140 | $460 |

Pricing Notes:

– Prices are FOB (Free On Board) major Chinese ports (Shenzhen, Ningbo).

– Includes standard packaging, basic QA, and export documentation.

– Does not include shipping, import duties, or insurance (CIF).

– E-bike pricing assumes lithium-ion battery (14Ah), rear hub motor, LCD display.

6. Key Sourcing Recommendations

- Leverage ODM for MVP Launches: Reduce time-to-market and development costs with proven platforms.

- Negotiate Tiered Pricing: Secure volume-based discounts and future cost reduction clauses.

- Invest in QA Protocols: Conduct pre-shipment inspections (PSI) and third-party testing (e.g., EN, CPSC).

- Secure IP Rights: For OEM projects, ensure design ownership and NDA compliance.

- Plan for Logistics Early: Factor in 30–45 days for sea freight to EU/US ports.

Conclusion

China remains the most cost-effective and scalable source for bicycle manufacturing, with mature OEM/ODM ecosystems supporting global brands. By selecting the right manufacturing model and MOQ strategy, procurement managers can optimize cost, quality, and time-to-market. Private label development is strongly advised for long-term brand growth, while white label offers a low-risk entry point.

SourcifyChina recommends conducting supplier audits, prototype validation, and pilot runs before full-scale production.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Intelligence | 2026

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Report 2026

Critical Manufacturer Verification Protocol: Bicycle Production in China

Prepared for Global Procurement Managers | Q1 2026 Update

Executive Summary

Verification of Chinese bicycle manufacturers remains a high-risk, high-reward process. 68% of procurement failures stem from misidentified supplier types (trading company vs. factory) and inadequate due diligence (Sourcify 2025 Global Sourcing Index). This report delivers actionable verification protocols to mitigate supply chain disruption, quality failures, and IP leakage. Key recommendation: Treat all “factory-direct” claims as unverified until physical/operational evidence is obtained.

Critical Verification Steps: 3-Phase Protocol

Apply sequentially. Skipping Phase 1 increases risk exposure by 42% (per Sourcify 2025 case data).

Phase 1: Pre-Engagement Digital Audit (Remote)

| Step | Verification Method | Valid Evidence | Failure Threshold |

|---|---|---|---|

| Business License | Request scanned copy + verify via National Enterprise Credit Info Portal | License lists manufacturing (生产) scope; matches entity name; no “trading” (贸易) or “tech” (科技) | Scope excludes manufacturing; registered capital < ¥5M |

| Production Capacity | Demand production line videos (real-time screen share) | Visible CNC machines, welding robots, paint booths; worker uniforms with company logo | Stock footage; blurred equipment; no live walkthrough |

| Export History | Require 3+ verifiable shipment records (Bill of Lading) | B/L shows manufacturer as shipper; matches factory address; consistent volume | Trading company as shipper; inconsistent destinations |

| Certifications | Cross-check certs via issuing body databases | Valid ISO 9001/14001; EN/AISI standards; in-house test lab reports | Expired certs; certificates from non-accredited bodies |

Phase 2: Onsite Operational Validation (Non-Negotiable)

| Focus Area | Verification Action | Factory vs. Trading Company Differentiators | Critical Red Flag |

|---|---|---|---|

| Facility Ownership | Request utility bills + property deeds | Factory: Owns land/building (土地使用证); high electricity consumption (≥500kW) | Trading Co.: Leases “showroom space”; low utility use |

| Production Control | Randomly select 3 workers; verify employment status | Factory: Staff ID cards match payroll; know production specs | Trading Co.: Workers unaware of order details; no factory IDs |

| Raw Material Sourcing | Trace material batch to supplier contracts | Factory: Direct contracts with tube/frame suppliers (e.g., TIG welders) | Trading Co.: No material inventory; quotes fluctuate 15%+ |

| Quality Systems | Audit QC process: request live defect log + calibration certs | Factory: In-line inspection stations; calibrated torque tools | Trading Co.: Relies on “third-party inspection” only |

Phase 3: Contractual Safeguards

- Clause Requirement: “Supplier warrants direct manufacturing control. Subcontracting requires 30-day written approval + SourcifyChina audit.”

- Penalty Trigger: >5% unapproved subcontracting = automatic 20% order value penalty.

- IP Protection: Mandate patent registry checks via CNIPA for frame designs.

Trading Company vs. Factory: 5 Definitive Indicators

Trading companies add 18-35% hidden costs (Sourcify 2025 Cost Transparency Study).

| Indicator | Factory | Trading Company | Verification Tip |

|---|---|---|---|

| Physical Infrastructure | Dedicated R&D lab; tooling storage; waste recycling | “Office-only” space; sample room only | Demand walkthrough of entire facility pre-audit |

| Staff Expertise | Engineers discuss frame geometry tolerances (±0.5mm) | Staff cite “factory standards”; avoid technical details | Ask: “Show me your frame stress-test calibration logs” |

| Pricing Structure | Itemized costs (material + labor + overhead) | Single-line “FOB price” with no breakdown | Require cost breakdown before LOI |

| Lead Time Control | Fixed production slots; real-time WIP tracking | “Dependent on factory capacity”; vague timelines | Insist on shared production schedule via MES system |

| Problem Resolution | Direct access to production manager 24/7 | Requires “factory approval” for changes | Test response: Request minor spec tweak during audit |

Critical Red Flags to Terminate Engagement

Procurement teams ignoring these face 73% higher defect rates (per Sourcify 2025 Failure Database).

| Red Flag | Risk Impact | Action Required |

|---|---|---|

| Refusal of unannounced audit | 92% likelihood of subcontracting fraud | Terminate immediately; blacklist entity |

| Payment to personal accounts | Funds diverted; no tax compliance | Demand corporate bank transfer only |

| “Exclusive agent” claims | Hidden trading markup (often 25%+) | Verify via local chamber of commerce |

| No in-house testing lab | Reliance on external labs = inconsistent quality | Require ISO 17025-certified lab access |

| Language barrier escalation | Trading company hiding behind “factory reps” | Insist on direct Chinese-speaking production lead |

SourcifyChina Implementation Roadmap

- Pre-Shortlist: Use our China Manufacturer Verification Tool to filter non-compliant entities.

- Audit Tiering: Allocate 70% of audit budget to suppliers claiming <$500k annual capacity (highest fraud risk).

- Post-Verification: Enroll approved factories in SourcifyChina’s Real-Time Production Monitoring IoT platform (reduces defects by 31%).

Final Recommendation: Never accept “factory-direct” claims without Phase 2 validation. The 2026 cost of failed verification ($220k avg. per incident) far exceeds audit expenses ($8.5k). Prioritize factories in Tianjin, Wuxi, or Cangzhou – clusters with >60% genuine OEMs (vs. 32% in Guangdong).

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Data Sources: SourcifyChina 2025 Global Sourcing Index, CNIPA, ISO Global Survey 2025 | © 2026 SourcifyChina. Confidential.

For procurement team use only. Unauthorized distribution prohibited.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary: Optimize Your Sourcing Strategy with Verified Suppliers

In today’s fast-paced global supply chain environment, sourcing high-quality bicycles from China demands precision, speed, and reliability. With thousands of manufacturers claiming to offer competitive pricing and OEM capabilities, the risk of misaligned expectations, production delays, and quality inconsistencies remains high.

SourcifyChina’s 2026 Pro List for ‘China Company Bike’ eliminates the friction in supplier discovery by providing access to a curated network of pre-vetted, factory-verified bicycle manufacturers. Our rigorous qualification process ensures every supplier meets international standards for quality control, export experience, and production scalability.

Why the SourcifyChina Pro List Saves Time and Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Skip 3–6 weeks of manual supplier screening and qualification. All factories undergo on-site audits, business license verification, and export capability checks. |

| Verified Production Capacity | Access real-time data on MOQs, lead times, and specialization (e.g., e-bikes, folding bikes, carbon frames), reducing back-and-forth communication. |

| Transparent Compliance | Suppliers are assessed for ISO, CE, EN, and other export certifications—critical for EU and North American market entry. |

| Direct Factory Access | Bypass trading companies. Deal directly with manufacturers to improve pricing accuracy and communication efficiency. |

| Dedicated Support Integration | SourcifyChina’s team provides supplier negotiation support, sample coordination, and QC inspection scheduling—saving up to 40% in sourcing cycle time. |

Call to Action: Accelerate Your 2026 Sourcing Goals

Time is your most valuable resource—and every day spent vetting unverified suppliers is a day delayed in product launch, inventory replenishment, or market expansion.

Stop navigating the noise. Start sourcing with confidence.

👉 Contact SourcifyChina today to receive your exclusive access to the 2026 Verified Pro List for ‘China Company Bike’:

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Our sourcing consultants are available to guide you through supplier shortlisting, RFQ preparation, and end-to-end supply chain coordination—ensuring faster time-to-market and reduced procurement risk.

Trusted by procurement teams in 28 countries. Verified. Streamlined. Effective.

—

SourcifyChina | Empowering Global Procurement Since 2014

🧮 Landed Cost Calculator

Estimate your total import cost from China.