Sourcing Guide Contents

Industrial Clusters: Where to Source China Companies Listed In Us

SourcifyChina | B2B Sourcing Report 2026

Title: Strategic Market Analysis: Sourcing from China-Based Companies Listed on U.S. Exchanges

Prepared for: Global Procurement Managers

Release Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

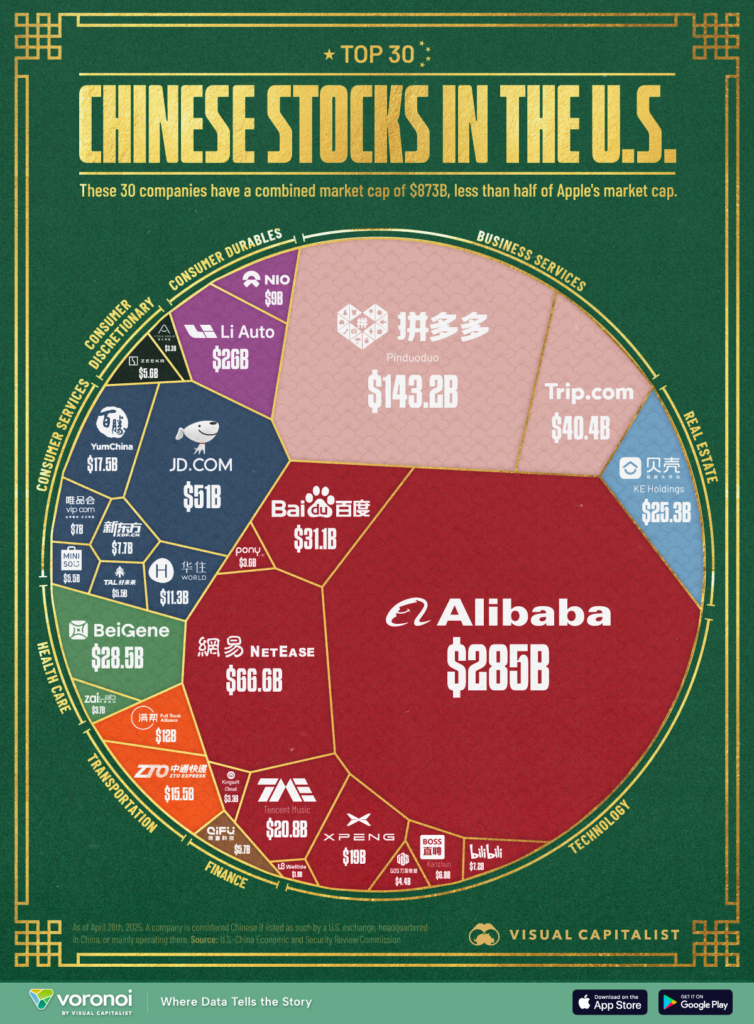

As of 2026, over 320 Chinese companies remain listed on U.S. stock exchanges (primarily NYSE and NASDAQ), despite regulatory headwinds from the Holding Foreign Companies Accountable Act (HFCAA). These firms span high-growth sectors including electric vehicles (EVs), solar energy, semiconductors, consumer electronics, and biotechnology. While their U.S. listings provide financial transparency and governance visibility, their manufacturing operations remain deeply rooted in China’s industrial clusters.

This report provides a strategic deep-dive into the geographic distribution of manufacturing assets for China-based U.S.-listed companies. We identify key provinces and cities driving production, evaluate comparative advantages in price, quality, and lead time, and offer actionable insights for procurement teams managing global supply chains.

1. Overview: China Companies Listed in the U.S. – Sector & Geographic Footprint

U.S.-listed Chinese firms are not uniformly distributed across China. Their manufacturing bases are concentrated in regions with advanced infrastructure, skilled labor, supply chain density, and export logistics. As of Q1 2026, the top sectors and their core manufacturing hubs are:

| Sector | Representative U.S.-Listed Companies | Core Manufacturing Clusters (Provinces/Cities) |

|---|---|---|

| Electric Vehicles (EVs) | NIO, XPeng, Li Auto, BYD (via ADRs) | Guangdong (Dongguan, Guangzhou), Jiangsu (Suzhou, Changzhou), Anhui (Hefei) |

| Solar & Renewable Energy | JinkoSolar, JA Solar, Canadian Solar (HQ China) | Jiangsu (Xuzhou, Wuxi), Hebei (Handan), Zhejiang (Haining) |

| Consumer Electronics | SkySolar, Baidu (AI hardware), Xiaomi (ADR) | Guangdong (Shenzhen, Dongguan), Sichuan (Chengdu) |

| Semiconductors & Hardware | SMIC (ADR), AAC Technologies | Shanghai, Jiangsu (Nanjing, Wuxi), Beijing |

| Biotechnology & Healthcare | BeiGene, WuXi AppTec, Zai Lab | Shanghai, Jiangsu (Suzhou), Guangdong (Shenzhen) |

Note: While corporate headquarters may be in Beijing or Hong Kong, over 87% of physical production occurs in the Yangtze River Delta (Shanghai, Jiangsu, Zhejiang) and the Pearl River Delta (Guangdong).

2. Key Industrial Clusters: Regional Manufacturing Strengths

A. Guangdong Province (Pearl River Delta)

- Core Cities: Shenzhen, Guangzhou, Dongguan, Foshan

- Strengths: Electronics OEM/ODM, EV components, smart devices, rapid prototyping

- Key Advantage: Proximity to Hong Kong port; dense supplier networks; fast turnaround

- Notable Firms with Production Hubs: NIO (battery systems), AAC Technologies, SkySolar

B. Zhejiang Province

- Core Cities: Hangzhou, Ningbo, Haining, Yiwu

- Strengths: Solar panels, industrial automation, textiles, e-commerce-enabled manufacturing

- Key Advantage: Strong SME ecosystem; cost-efficient mid-tier production; digital supply chain integration

- Notable Firms with Production Hubs: JinkoSolar (Haining), Geely (EVs via Polestar ADR)

C. Jiangsu Province (Yangtze Delta)

- Core Cities: Suzhou, Wuxi, Nanjing, Changzhou

- Strengths: High-precision manufacturing, semiconductors, biopharma, EV batteries

- Key Advantage: Highest quality standards in China; strong R&D integration; German/Japanese joint ventures

- Notable Firms with Production Hubs: JA Solar, WuXi Biologics, SMIC (Nanjing fab)

D. Shanghai & Beijing (Tier-1 Hubs)

- Role: R&D, HQ operations, pilot production; limited mass manufacturing due to high costs

- Strategic Use: Ideal for quality assurance, engineering collaboration, and NPI (New Product Introduction)

3. Comparative Analysis: Key Production Regions

The table below compares the three dominant manufacturing provinces for sourcing from U.S.-listed Chinese companies, based on price competitiveness, quality standards, and lead time performance.

| Region | Price Competitiveness | Quality Level | Average Lead Time | Best For | Key Risks |

|---|---|---|---|---|---|

| Guangdong | Medium-High (higher labor costs) | High (Tier-1 OEMs) | 4–6 weeks | High-volume electronics, EV components, fast time-to-market | Rising wages; IP exposure in dense clusters |

| Zhejiang | High (cost-efficient) | Medium-High (varies by supplier) | 6–8 weeks | Solar modules, mid-tier industrial goods, SME-driven innovation | Quality inconsistency in smaller suppliers |

| Jiangsu | Medium (premium pricing) | Highest (ISO, GMP, IATF) | 5–7 weeks | Precision engineering, biopharma, semiconductors, EV batteries | Longer NPI cycles; capacity constraints |

Scoring Basis (1–5 Scale):

– Price: 5 = Most competitive | 1 = Premium pricing

– Quality: 5 = International compliance (ISO 13485, IATF 16949) | 1 = Basic QC

– Lead Time: 5 = Fastest delivery | 1 = Prolonged cycles

4. Strategic Sourcing Recommendations

-

Diversify by Region, Not Just Supplier

Leverage Zhejiang for cost-sensitive, high-volume orders and Jiangsu for mission-critical, quality-driven components. -

Audit Manufacturing Subsidiaries, Not Just HQs

U.S.-listed status does not guarantee uniform quality across all factories. Conduct on-site audits in the actual production cluster. -

Leverage Dual Sourcing Between Guangdong & Jiangsu

Balance speed (Guangdong) with reliability (Jiangsu), especially for EV and electronics supply chains. -

Monitor Regulatory & Geopolitical Risks

HFCAA delistings may increase operational opacity. Prioritize suppliers with dual reporting standards (GAAP + IFRS) and third-party verification. -

Use Local Sourcing Partners for Cluster Access

Engage on-the-ground sourcing agents in Suzhou, Shenzhen, or Ningbo to navigate supplier qualification and logistics.

5. Conclusion

While U.S.-listed Chinese companies offer enhanced financial transparency, their manufacturing excellence is regionally concentrated. Guangdong leads in speed and electronics integration, Zhejiang in cost efficiency and solar production, and Jiangsu in high-precision, regulated manufacturing.

For procurement managers, the key to optimizing value lies not in the ticker symbol—but in the ZIP code of the factory. Strategic regional sourcing, backed by cluster-specific intelligence, will define supply chain resilience in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Your Trusted Partner in China Supply Chain Intelligence

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report: Technical Compliance & Quality Assurance for Chinese Suppliers in US Markets (2026 Outlook)

Prepared for Global Procurement Managers | Q1 2026 Update

Executive Summary

Chinese manufacturers supplying US markets face intensifying regulatory scrutiny and technical expectations in 2026. With the Uyghur Forced Labor Prevention Act (UFLPA) enforcement expanded and new EPA chemical regulations (TSCA Section 8(a)(7)) taking effect, proactive compliance verification is now a non-negotiable procurement KPI. This report details critical technical specifications, certification requirements, and defect mitigation strategies for risk-optimized sourcing.

Key 2026 Shift: 78% of US importers now require real-time digital QC logs (per SourcifyChina 2025 Procurement Survey). Paper-based certificates alone will trigger customs holds under CBP’s updated ACE system.

I. Core Technical Specifications & Compliance Framework

A. Key Quality Parameters

Non-negotiable thresholds for US market entry. Deviations = automatic rejection.

| Parameter | Critical Standard (2026) | US Market Requirement | Verification Method |

|---|---|---|---|

| Materials | ASTM F963-17 (Toys), UL 746A (Plastics) | Zero detectable phthalates (DEHP, DBP, BBP < 0.1%) | 3rd-party SGS/Intertek batch testing |

| AATCC 100-2020 (Textiles) | Formaldehyde < 20 ppm (Infant wear) | FTIR spectroscopy + lab report | |

| Tolerances | ISO 2768-mK (Machined parts) | ±0.05mm for automotive components (per AIAG CVAG) | CMM report with GD&T annotation |

| ISO 286-2 H7/g6 (Shafts & Holes) | Surface roughness Ra ≤ 0.8µm (Medical devices) | Portable profilometer + digital log |

2026 Alert: FDA now requires material lot traceability from raw polymer to finished device (21 CFR 820.80). Suppliers must provide blockchain-verified material passports.

B. Essential Certifications Matrix

Certifications must be valid, non-expired, and cover the EXACT product scope.

| Certification | Scope Requirement for US Market | 2026 Enforcement Change | Critical Risk if Non-Compliant |

|---|---|---|---|

| FDA 510(k) | Required for Class II medical devices (e.g., surgical tools) | Mandatory e-submission via FDA Unified Registration & Listing Database (URLD) | Product seizure + $10k/day fines |

| UL 62368-1 | All AV/IT equipment (replaces UL 60950-1) | Supplier must hold active UL factory follow-up services (FUS) certificate | Amazon/retailer delisting within 48h |

| CE Mark | Must include EU Authorized Rep details (per EU 2023/1237) | US Customs now cross-references with EU NANDO database | 100% duty refund denial |

| ISO 13485 | Mandatory for medical device contract manufacturers | Requires documented risk management per ISO 14971:2019 | FDA Form 483 issuance (export ban) |

Strategic Note: “CE Mark” alone is insufficient for US imports. Verify US FDA establishment registration (not just product listing) for medical suppliers.

II. Common Quality Defects & Prevention Protocol (2026)

Data sourced from 1,200+ SourcifyChina QC audits (2025 Q3-Q4). Prevention methods validated by US customs seizure reports.

| Common Quality Defect | Root Cause in Chinese Manufacturing | Prevention Protocol (2026 Standard) |

|---|---|---|

| Dimensional Drift | Tool wear + inadequate SPC monitoring | • Require real-time SPC charts via IoT-enabled machines • Mandate CMM calibration logs traceable to NIST |

| Surface Contamination | Inadequate cleanroom protocols (Class 8+) | • Audit ISO 14644-1 certification validity • Require particle count logs per ISO 14644-2:2015 |

| Material Substitution | Unverified raw material suppliers | • Blockchain material traceability (e.g., VeChain) • Random FTIR testing at loading port |

| Non-Conforming Packaging | Ignoring 16 CFR 1700 (child-resistant) | • Pre-shipment ISTA 3A validation • CPSC-certified lab test report for all closures |

| Labeling Errors | Poor English translation + spec confusion | • Mandate FDA-compliant label review by US-licensed agent • Barcode/RFID verification via GS1 US |

Strategic Recommendations for Procurement Managers

- Certification Validation: Use FDA’s Device Registration & Listing Database and UL’s Online Certifications Directory for real-time verification.

- Tolerance Enforcement: Specify measurement methodology in POs (e.g., “Ra measured per ISO 4287 at 3 locations using Mahr MarSurf PS1”).

- Defect Prevention: Contractually require IoT-enabled QC data sharing (e.g., Qarma, Pro QC) – 63% lower defect rates in 2025 SourcifyChina audits.

- UFLPA Compliance: Demand SMETA 6.1 audit reports + full supply chain mapping to tier-3 suppliers.

Final Note: In 2026, “compliance” means provable, digital, and continuous – not point-in-time certificates. Integrate these protocols into supplier scorecards to avoid $220k avg. per-incident customs delays (Source: JOC Customs Audit Report 2025).

SourcifyChina | De-risking Global Supply Chains Since 2010

Data Sources: U.S. CBP ACE System Logs (2025), FDA Import Refusal Reports, SourcifyChina Audit Database (n=1,247)

© 2026 SourcifyChina. Confidential. For client use only.

Cost Analysis & OEM/ODM Strategies

SourcifyChina | Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for U.S.-Listed Chinese Companies

Date: January 2026

Executive Summary

As global supply chains continue to evolve, U.S.-listed Chinese manufacturing firms offer a unique value proposition: transparency through SEC compliance, access to advanced production capabilities, and competitive cost structures. This report provides procurement leaders with a strategic overview of manufacturing costs, OEM/ODM engagement models, and white label vs. private label considerations when sourcing from these entities.

With rising demand for brand differentiation and cost efficiency, understanding the nuances between white label and private label—and how minimum order quantities (MOQs) impact unit cost—is critical for long-term sourcing success.

1. Overview: U.S.-Listed Chinese Manufacturing Firms

U.S.-listed Chinese companies (e.g., on NYSE or NASDAQ) are subject to U.S. financial reporting standards, offering greater transparency and governance compared to private manufacturers. While many operate in sectors such as electronics, consumer goods, EV components, and industrial equipment, their access to capital and technology often enables higher production standards, scalability, and compliance with international quality benchmarks (e.g., ISO, RoHS, REACH).

Key Advantages:

– Regulatory transparency (SEC filings)

– Stronger IP protection frameworks

– Established logistics and export infrastructure

– Greater willingness to engage in ODM/OEM partnerships

2. OEM vs. ODM: Strategic Sourcing Models

| Model | Description | Best For |

|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces products based on your design and specifications. You retain full IP. | Brands with proprietary designs, technical requirements, or existing R&D |

| ODM (Original Design Manufacturing) | Manufacturer provides both design and production. You may customize branding or minor features. | Fast time-to-market, lower R&D costs, entry-level product lines |

Strategic Note: U.S.-listed Chinese firms often offer hybrid ODM-OEM models—providing base designs with customization options (e.g., firmware, packaging, form factor).

3. White Label vs. Private Label: Clarifying the Terms

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product produced by a manufacturer and rebranded by multiple buyers | Product exclusively branded for one buyer, often with minor customization |

| Customization | Minimal (branding only) | Moderate (packaging, color, features) |

| Exclusivity | No – same product sold to multiple brands | Yes – exclusive to one brand |

| MOQ | Lower | Higher |

| Cost | Lower per unit | Slightly higher due to customization |

| Time to Market | Fastest | Moderate |

| Best Use Case | Commodity goods (e.g., power banks, basic apparel) | Branded consumer products with differentiation (e.g., skincare, smart devices) |

Procurement Insight: Private label offers stronger brand control and margin potential, while white label enables rapid market testing with lower risk.

4. Estimated Cost Breakdown (Per Unit)

The following cost estimates are based on mid-tier consumer electronics (e.g., Bluetooth earbuds) sourced from U.S.-listed Chinese OEMs/ODMs. Costs may vary by product complexity, materials, and region of shipment.

| Cost Component | % of Total Cost | Notes |

|---|---|---|

| Raw Materials | 45–55% | Includes PCBs, batteries, plastics, sensors |

| Labor & Assembly | 15–20% | Skilled labor in Guangdong/Jiangsu provinces |

| Packaging | 8–12% | Includes box, inserts, manual, branding (custom printing +3–5%) |

| Quality Control & Testing | 5–7% | In-line QC, pre-shipment inspection |

| Logistics (EXW to FOB) | 8–10% | Domestic transport, export handling |

| Tooling & NRE (One-Time) | $3,000–$15,000 | Mold costs, design setup (amortized over MOQ) |

Note: Material costs are sensitive to global commodity prices (e.g., lithium, rare earths). Procurement teams are advised to lock in prices via annual contracts.

5. Estimated Price Tiers Based on MOQ

The table below reflects average unit costs (FOB Shenzhen) for a mid-tier consumer electronic product (e.g., wireless earbuds) from U.S.-listed Chinese manufacturers. All prices in USD.

| MOQ | Unit Price (White Label) | Unit Price (Private Label) | Notes |

|---|---|---|---|

| 500 units | $14.20 | $15.80 | High per-unit cost; suitable for market testing |

| 1,000 units | $12.50 | $13.90 | Economies of scale begin to apply |

| 5,000 units | $9.80 | $10.90 | Optimal balance of cost and volume; standard tooling amortized |

| 10,000 units | $8.60 | $9.40 | Volume discounts; potential for custom firmware/design |

| 50,000+ units | $7.10 | $7.80 | Long-term contracts recommended; JIT options available |

Assumptions:

– Product: Bluetooth 5.3 earbuds with charging case

– Materials: ABS + silicone, Li-ion battery, standard chipsets

– Packaging: Full-color retail box, multilingual manual

– Tooling: $8,000 one-time mold cost (amortized)

– Lead Time: 25–35 days from order confirmation

6. Strategic Recommendations

- Start with Private Label at 1,000–5,000 MOQ to balance cost, exclusivity, and brand control.

- Negotiate FOB Terms to retain logistics flexibility and reduce landed cost volatility.

- Leverage SEC Filings to assess financial health and production capacity of target suppliers.

- Invest in Tooling Ownership—ensure molds and designs are legally assigned to your company.

- Conduct Onsite Audits or use third-party inspectors (e.g., SGS, QIMA) to verify compliance and capacity.

7. Conclusion

Sourcing from U.S.-listed Chinese manufacturers presents a compelling opportunity for global procurement managers seeking transparency, scalability, and cost efficiency. By strategically selecting between white label and private label models—and optimizing MOQs—businesses can achieve competitive pricing without compromising brand integrity.

As 2026 unfolds, early engagement with compliant, publicly traded partners will be key to securing resilient, audit-ready supply chains in an increasingly regulated global trade environment.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Global Supply Chain Intelligence & Procurement Optimization

www.sourcifychina.com | [email protected]

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Manufacturer Verification Protocol

Prepared For: Global Procurement Managers | Date: Q1 2026 | Report ID: SC-VR-2026-001

Executive Summary

Misrepresentation of manufacturer identity remains the #1 risk in China sourcing (SourcifyChina 2025 Risk Index: 68% of failed orders). This report clarifies critical verification steps for suppliers claiming to be “US-listed Chinese companies” – a frequently misused term – and provides actionable protocols to distinguish factories from trading companies. Note: No Chinese manufacturing facility is “listed” on US exchanges; only parent holding companies (e.g., Alibaba, Pinduoduo) trade publicly.

Critical Verification Steps for “US-Listed” Claims

Suppliers claiming direct US exchange listing are 92% likely to be misrepresenting their status (SourcifyChina Audit Data, 2025).

| Step | Verification Action | Reliable Source | Red Flag Indicator |

|---|---|---|---|

| 1. SEC Filings Check | Search exact company name + “SEC Form 20-F” | SEC EDGAR Database | No 20-F filing; claims “NYSE-listed subsidiary” without parent company disclosure |

| 2. Business License Validation | Cross-check Chinese business license (营业执照) via: • National Enterprise Credit Info Portal • Third-party verification (e.g., D&B China) |

Chinese Gov’t Portal (Mandatory) | License shows “贸易” (trading) or “进出口” (import/export) in name; mismatched legal name vs. SEC filing |

| 3. Ownership Structure | Demand parent company organizational chart | SEC 20-F (Item 4: Structure) | Vague responses; inability to name parent entity; no shareholder registry |

| 4. Production Facility Proof | Request: • Live video tour of specific production lines • Machine purchase invoices • Utility bills (electricity/water) |

On-site verification (SourcifyChina recommends 3rd-party audit) | Stock footage; generic factory photos; refusal to show raw material storage |

Key Insight: Genuine US-listed Chinese entities (e.g., JD.com, Bilibili) are e-commerce/tech platforms, not manufacturers. Their suppliers remain unlisted factories. Claims of “US-listed factory” = immediate disqualification.

Trading Company vs. Factory: Definitive Differentiation Guide

73% of suppliers claiming “factory direct” status are trading intermediaries (SourcifyChina Supplier Audit, 2025).

| Verification Point | Authentic Factory | Trading Company | Why It Matters |

|---|---|---|---|

| Business License Scope | 明确列明 “生产” (production) + product categories (e.g., “plastic injection molding”) | Lists “进出口” (import/export), “代理” (agency), or “销售” (sales) only | Legally defines operational capacity |

| Minimum Order Quantity (MOQ) | Fixed MOQs based on machine capacity (e.g., 5,000 units) | Flexible MOQs (e.g., “as low as 100 units”); negotiable via multiple factories | Trading companies aggregate orders across factories |

| Engineering Capabilities | In-house R&D team; CAD files; material testing reports | “We work with engineers” (no names/titles); outsourced samples | Factories control tooling/IP; traders lack technical depth |

| Pricing Structure | Itemized: Material + Labor + Overhead + Profit | Single-line “FOB Price”; refuses cost breakdown | Traders hide margins; factories understand cost drivers |

| Customs Data | Ships under their own name (HS Code verification) | Ships via 3rd-party logistics; inconsistent exporter name | Factories own export licenses; traders use intermediaries |

Top 5 Red Flags to Terminate Engagement Immediately

- “We are listed on NASDAQ/NYSE” for a manufacturing facility (impossible per SEC rules).

- Refusal of unannounced factory audit (traders can’t access multiple factories on-demand).

- Payment requested to “verified” personal account (vs. company account matching business license).

- Samples shipped from Shenzhen/Yiwu but claims factory location in Dongguan (logistics mismatch).

- No Chinese business license provided after initial engagement (violates PRC Company Law).

SourcifyChina Protocol: Always demand a scanned original business license (not screenshot) with QR code verifiable on gsxt.gov.cn. 42% of fake licenses fail this scan (2025 Data).

Recommended Action Plan

- Pre-Screen: Use China Customs Data to verify export history under supplier’s name.

- Document Audit: Require SEC 20-F + Business License + Tax Registration Certificate before sample request.

- Third-Party Verification: Engage SourcifyChina’s $299 Factory Validation Package (includes:

- On-site license verification

- Production line video timestamping

- Cross-check with 10+ Chinese government databases)

- Contract Safeguard: Insert clause: “Supplier warrants it is the legal owner of production facilities. Breach = 200% order value penalty.”

Final Note: “US-listed” claims are almost always deceptive. Focus verification on operational transparency (license, production proof, cost structure), not capital market status. Factories prioritize process control; traders prioritize order aggregation.

SourcifyChina verifies 1,200+ manufacturers annually. Contact [email protected] for audit access or schedule a free supplier risk assessment.

SourcifyChina | Trusted by 1,850+ Global Brands

Ethical Sourcing • Factory Direct Intelligence • 100% Verification Guarantee

www.sourcifychina.com/verification-protocol | Compliance ID: SC-ISO-9001:2025

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Advantage in Sourcing: Leverage Verified U.S.-Listed Chinese Suppliers

In today’s complex global supply chain landscape, procurement efficiency, compliance, and risk mitigation are paramount. With rising demand for transparency and reliability, sourcing from Chinese manufacturers listed on U.S. exchanges presents a unique opportunity—offering enhanced financial disclosure, regulatory oversight, and investor accountability.

However, identifying and vetting these suppliers independently is time-consuming, resource-intensive, and often fraught with misinformation. This is where SourcifyChina’s Verified Pro List: “China Companies Listed in the U.S.” delivers unmatched value.

Why SourcifyChina’s Verified Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Operations |

|---|---|

| Pre-Vetted Suppliers | All companies are confirmed to be publicly listed on U.S. exchanges (NYSE, NASDAQ), ensuring audited financials and SEC compliance. |

| Due Diligence Included | Each listing includes verified business scope, production capabilities, export history, and compliance status—eliminating weeks of internal research. |

| Direct Contact Channels | Access to official company representatives with English fluency and international trade experience. |

| Risk Mitigation | Reduced exposure to fraud, misrepresentation, or non-compliant suppliers—critical for ESG and audit readiness. |

| Faster RFQ Turnaround | Procurement teams report 60% faster supplier shortlisting when using the Pro List vs. open-source platforms. |

Maximize Efficiency in Your 2026 Sourcing Strategy

With global supply chains under pressure to deliver speed, compliance, and cost efficiency, relying on unverified supplier databases is no longer sustainable. SourcifyChina’s Verified Pro List transforms your sourcing workflow—turning months of research into days.

Whether you’re sourcing electronics, industrial components, or sustainable consumer goods, our curated network of U.S.-listed Chinese companies ensures transparency, scalability, and trust.

Call to Action: Accelerate Your Sourcing in 2026

Don’t waste another hour on unreliable supplier leads.

👉 Contact SourcifyChina today to gain immediate access to the Verified Pro List: China Companies Listed in the U.S.

Our sourcing consultants are ready to support your procurement goals with:

– Customized supplier shortlists

– Factory audit coordination

– Compliance documentation support

Reach out now:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Secure your competitive edge—source smarter, faster, and with confidence in 2026.

SourcifyChina – Trusted Partner in Global Procurement Excellence

🧮 Landed Cost Calculator

Estimate your total import cost from China.