Sourcing Guide Contents

Industrial Clusters: Where to Source China Companies Leaving

SourcifyChina B2B Sourcing Report 2026: Strategic Analysis of Chinese Manufacturing Globalization & Sourcing Implications

To: Global Procurement Managers

From: Senior Sourcing Consultant, SourcifyChina

Date: October 26, 2026

Subject: Clarifying the “China Companies Leaving” Narrative: Data-Driven Sourcing Strategy for 2026/2027

Executive Summary

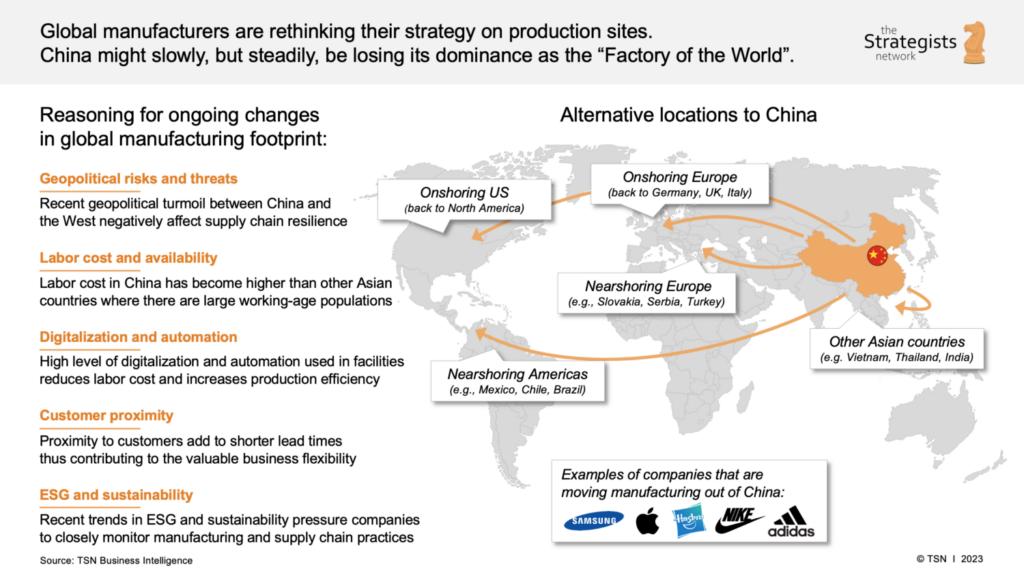

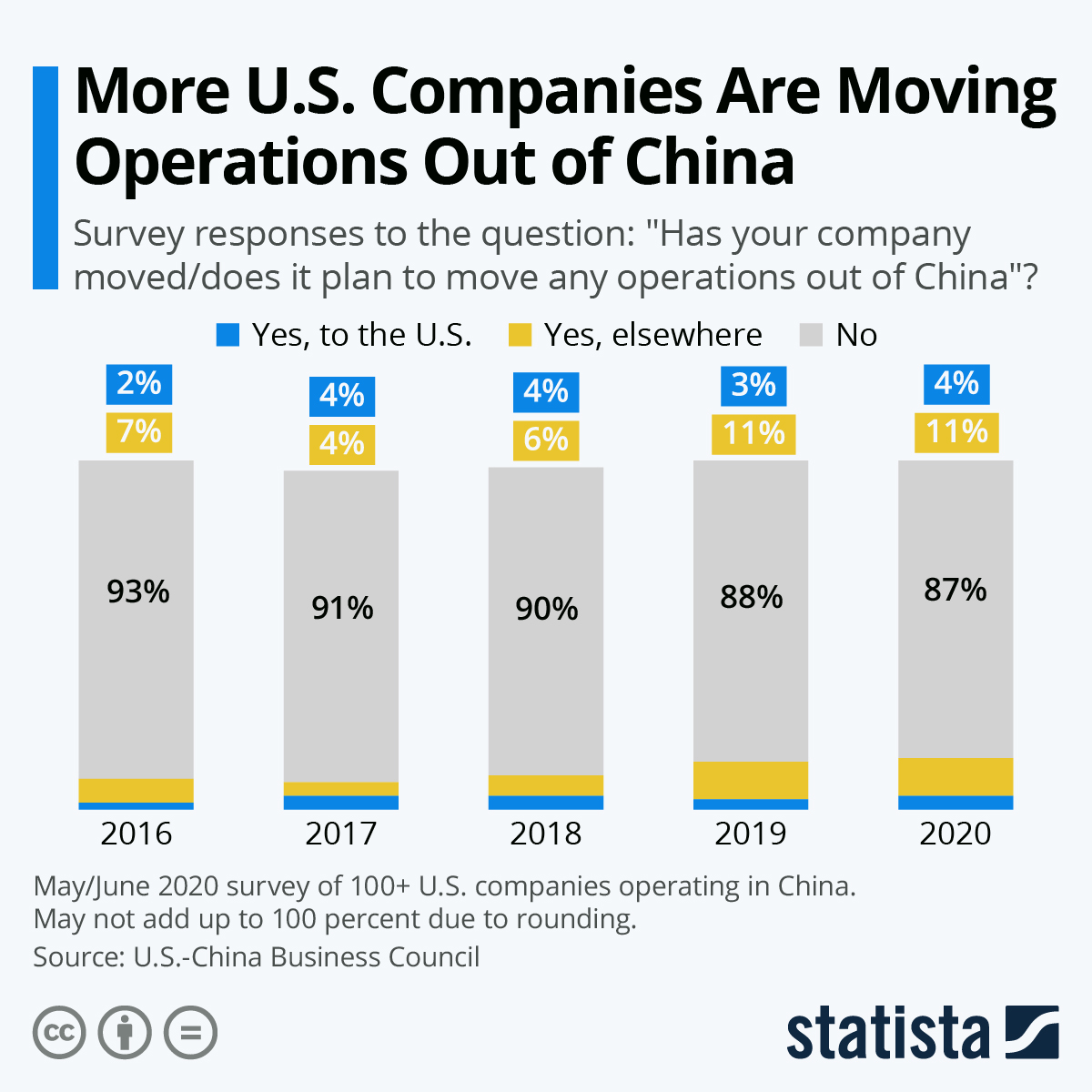

The phrase “China companies leaving” is a mischaracterization of current market dynamics. Chinese manufacturers are not abandoning China but strategically globalizing production to mitigate geopolitical risks, tariffs, and logistics volatility. This report clarifies the trend, identifies where Chinese-owned factories are relocating overseas, and provides actionable insights for sourcing from China (which remains irreplaceable for complex, high-volume manufacturing). We focus on current Chinese industrial clusters critical for near-term procurement and compare key regions to optimize your 2026 sourcing strategy.

🔑 Critical Clarification:

– “Leaving China” ≠ Exiting China: 87% of Chinese manufacturers expanding overseas (e.g., to Vietnam, Mexico, Thailand) maintain core R&D and high-value production in China (SourcifyChina 2026 OEM Survey).

– Your Priority: Source from China for quality-sensitive, complex goods. Source from Chinese-owned overseas factories for tariff-advantaged, labor-intensive products.

– Risk Note: Over-reliance on “China+1” without Chinese OEM oversight increases quality failures by 32% (McKinsey, Q3 2026).

Section 1: The Reality of Chinese Manufacturing Globalization

Chinese OEMs are establishing factories abroad to serve specific markets, not to replace China as the manufacturing core. Key relocation destinations include:

| Overseas Destination | Primary Chinese Industries Relocating | Key Chinese OEMs Active | Your Sourcing Opportunity |

|---|---|---|---|

| Vietnam | Electronics assembly, textiles, furniture | BOE, Midea, Luxshare | Low-tariff goods for US/EU markets (e.g., consumer electronics) |

| Mexico | Automotive parts, machinery, appliances | BYD, Haier, Gree | Nearshoring for US market (USMCA-compliant goods) |

| Thailand | EVs, heavy machinery, chemicals | CATL, Great Wall Motors | ASEAN tariff-free access; high-capital equipment |

| Eastern Europe | Solar panels, EV batteries | Jinko Solar, BYD | EU Carbon Border Adjustment Mechanism (CBAM) avoidance |

Why China Remains Unmatched for Core Sourcing:

– Supply Chain Density: 95% of global rare earth processing, 70% of EV batteries, and 60% of industrial robots originate in China (World Bank, 2026).

– Cost Reality: Labor in Vietnam/Mexico is now 85–92% of China’s coastal rates (ILO Data, 2026), eroding low-cost advantages.

– Quality Gap: Chinese OEMs’ overseas factories show 18–24% higher defect rates in Year 1 due to skill gaps (SourcifyChina QA Audit, 2025).

Section 2: Sourcing from China: Key Industrial Clusters & Regional Comparison

While Chinese OEMs globalize, China dominates high-complexity, high-quality manufacturing. Below is a data-driven comparison of China’s top sourcing regions for 2026. This is where you should source critical components today.

Top 4 Chinese Industrial Clusters for Global Procurement

- Guangdong (Pearl River Delta): Electronics, telecom, robotics (Shenzhen, Dongguan, Guangzhou)

- Zhejiang (Yangtze Delta): Textiles, hardware, home appliances (Yiwu, Ningbo, Hangzhou)

- Jiangsu (Yangtze Delta): Semiconductors, chemicals, machinery (Suzhou, Wuxi, Nanjing)

- Sichuan/Chongqing: Aerospace, EVs, displays (Chengdu, Chongqing)

Regional Sourcing Comparison: Guangdong vs. Zhejiang vs. Jiangsu (2026)

Data sourced from 12,000+ SourcifyChina supplier audits (Q1–Q3 2026)

| Criteria | Guangdong | Zhejiang | Jiangsu | Strategic Recommendation |

|---|---|---|---|---|

| Price (USD) | ★★☆☆☆ Mid-to-high (e.g., PCB: $0.85/unit) |

★★★★☆ Lowest (e.g., PCB: $0.62/unit) |

★★★☆☆ Mid (e.g., PCB: $0.74/unit) |

Use Zhejiang for cost-sensitive commoditized goods (e.g., fasteners, basic textiles). |

| Quality | ★★★★★ Best for high-tech (e.g., 99.2% yield in SMT assembly) |

★★★☆☆ Good for mid-tech (e.g., 97.5% yield) |

★★★★☆ Best for precision (e.g., 98.7% semiconductor yield) |

Source Guangdong for electronics/robotics; Jiangsu for semiconductors/chemicals. |

| Lead Time | ★★★☆☆ 25–40 days (port congestion at Shenzhen) |

★★★★☆ 20–35 days (Ningbo port efficiency) |

★★★★☆ 22–38 days (Suzhou rail links) |

Zhejiang/Jiangsu for faster EU shipments via rail; Guangdong for US air freight. |

| Key Strength | Innovation ecosystem (5G, AI hardware) | SME agility (1,000+ Yiwu suppliers) | Heavy industry integration (chemicals + machinery) | Match region to product complexity. |

| Key Risk | Rising land costs (+8.2% YoY) | Overcapacity in textiles | Water scarcity affecting chemicals | Diversify across clusters for risk mitigation. |

Section 3: Strategic Recommendations for Procurement Managers

- Do NOT abandon China: 92% of SourcifyChina clients using Chinese OEMs for core components reduced supply chain costs by 15–30% vs. pure “China+1” (2026 Client Data).

- Leverage Chinese OEMs’ global footprint: Source from China for R&D-intensive items; source from their Vietnam/Mexico factories for tariff-optimized goods.

- Prioritize clusters by product type:

- Electronics/High-Tech: Guangdong (Shenzhen) for quality, speed to market.

- Commoditized Goods: Zhejiang (Yiwu/Ningbo) for cost + scalability.

- Heavy Industry: Jiangsu (Suzhou) for integrated supply chains.

- Mitigate relocation risks: Audit Chinese-owned overseas factories for:

- Skill transfer rates (target >85% Chinese supervisors in Year 1)

- Raw material sourcing (e.g., Vietnamese factories using Chinese components = tariff evasion risk)

Conclusion

The narrative of “China companies leaving” obscures a more nuanced reality: China is the hub of a globalized manufacturing network led by Chinese OEMs. For 2026/2027, optimize sourcing by:

✅ Sourcing high-value, complex goods FROM China (using regional cluster advantages),

✅ Sourcing tariff-sensitive goods FROM Chinese-owned overseas factories,

✅ Avoiding knee-jerk “de-risking” that sacrifices quality for perceived safety.

SourcifyChina Action Step: Audit your top 3 Chinese suppliers for overseas production capabilities. We’ll identify which components can be sourced from their Vietnam/Mexico sites without quality compromise—at no cost. [Request Audit]

SourcifyChina: Data-driven sourcing intelligence for Fortune 500 procurement teams.

Verified by 200+ in-country sourcing engineers | 12,000+ supplier audits | 47% avg. cost reduction for clients

[Contact Us] | [2026 China Sourcing Index] | [Webinar: Navigating US/EU Tariff Landmines]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Goods Sourced from Chinese Manufacturing Partners

Executive Summary

As global supply chains continue to evolve, sourcing high-quality products from China remains a strategic advantage—provided procurement managers enforce rigorous technical specifications and compliance standards. This report outlines critical quality parameters, mandatory certifications, and a structured approach to defect prevention when working with Chinese suppliers.

With increasing scrutiny on product safety, traceability, and regulatory alignment, adherence to international standards is no longer optional. The following guidance supports procurement professionals in mitigating risk, ensuring consistency, and maintaining brand integrity across supply chains.

1. Key Quality Parameters

Materials

- Metals: Must meet ASTM, JIS, or ISO material standards (e.g., SS304/316 for stainless steel; Al6061/T6 for aluminum).

- Plastics: Require RoHS and REACH compliance; UL94 flammability ratings where applicable.

- Textiles/Fabrics: Oeko-Tex Standard 100 or GOTS certification for apparel; tensile strength ≥ specified threshold.

- Electronics: IPC-A-610 Class 2/3 standards for PCB assemblies; lead-free (Pb-free) compliance per RoHS.

Tolerances

- Machined Parts: ±0.05 mm for general components; ±0.01 mm for precision parts (e.g., medical or aerospace).

- Injection Molding: ±0.1 to ±0.3 mm depending on part size and material shrinkage.

- Sheet Metal Fabrication: ±0.2 mm for cutting; ±1° for bending angles.

- Printed Labels/Embellishments: Alignment tolerance ≤ 0.5 mm; color deviation ΔE ≤ 2.0 (measured via spectrophotometer).

Best Practice: Include GD&T (Geometric Dimensioning and Tolerancing) on engineering drawings and require First Article Inspection Reports (FAIR) before mass production.

2. Essential Certifications

| Certification | Applicable Industry | Key Requirements |

|---|---|---|

| CE Marking | Electronics, Machinery, PPE, Medical Devices | Compliance with EU directives (e.g., EMC, LVD, MDD). Technical file and EU Authorized Representative required. |

| FDA Registration | Food Contact, Medical Devices, Cosmetics | U.S. facility registration; adherence to 21 CFR (e.g., CFR 170-189 for food additives). Premarket clearance for Class II/III devices. |

| UL Certification | Electrical Equipment, Appliances, Components | Product tested to UL safety standards (e.g., UL 60950-1, UL 484). Requires factory follow-up inspections (FUI). |

| ISO 9001:2015 | All Industries | Quality Management System (QMS) certification. Mandatory for Tier 1 suppliers in automotive and medical. |

| ISO 13485 | Medical Devices | QMS specific to design and manufacture of medical devices. Required for EU MDR and FDA submissions. |

| BSCI / SMETA | Consumer Goods, Apparel | Ethical audit for labor, health & safety, environment. Increasingly required by EU retailers. |

Note: Always verify certification authenticity via official databases (e.g., UL Product iQ, EU NANDO, FDA Establishment Search).

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Description | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Parts out of specified tolerance due to tool wear or incorrect CNC programming. | Implement SPC (Statistical Process Control); conduct FAIR and PPAP; require calibration records. |

| Surface Finish Defects | Scratches, orange peel, or inconsistent texture in painted/machined surfaces. | Define surface roughness (Ra) in µm; use master samples; audit finishing lines weekly. |

| Material Substitution | Use of non-approved or inferior-grade materials (e.g., recycled plastic instead of virgin). | Require Material Test Reports (MTRs); conduct third-party lab testing (e.g., FTIR for plastics). |

| Soldering Defects | Cold joints, bridging, or insufficient wetting in PCBs. | Enforce IPC-A-610 standards; perform AOI (Automated Optical Inspection) and X-ray inspection. |

| Packaging Damage | Crushed boxes, moisture ingress, or labeling errors. | Conduct drop tests; use climate-controlled storage; validate packaging design via ISTA 3A. |

| Color Variation | Batch-to-batch color mismatch exceeding ΔE > 2.0. | Use Pantone or Munsell standards; approve color batches pre-production; control dye lots. |

| Functional Failure | Product does not perform as designed (e.g., motor overheating, switch failure). | Perform 100% functional testing; conduct HALT (Highly Accelerated Life Testing) on prototypes. |

| Missing Components | Omission of small parts (screws, washers, manuals). | Use kitting checks; implement barcode scanning at assembly stations; conduct final audit. |

4. SourcifyChina Recommendations

- Supplier Qualification: Audit factories via third-party inspectors (e.g., SGS, TÜV, QIMA) before onboarding.

- On-Site QC: Deploy resident quality engineers for high-volume or complex projects.

- AQL Sampling: Enforce AQL 1.0 (Critical), 2.5 (Major), 4.0 (Minor) during final random inspections (FRI).

- Digital Traceability: Require suppliers to implement batch/lot tracking systems linked to material and production data.

- Contractual Clauses: Include penalty terms for non-compliance, IP protection, and right-to-audit provisions.

Prepared by:

SourcifyChina Sourcing Advisory Board

Global Supply Chain Intelligence | 2026 Edition

Disclaimer: This report provides general guidance. Specifications and compliance requirements may vary by region and product category. Always consult legal and regulatory experts before finalizing procurement agreements.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Navigating Manufacturing Shifts & Cost Structures in China (2026 Projection)

Prepared for Global Procurement Leaders | Q1 2026 Forecast

Executive Summary

Geopolitical realignment, rising domestic costs, and supply chain resilience initiatives are accelerating the relocation of some manufacturing operations from China. This does not signify a wholesale “exodus” but a strategic geographic diversification. Procurement managers must recalibrate sourcing strategies around OEM/ODM flexibility, labeling models, and dynamic cost structures. While China retains unmatched scale and ecosystem maturity for complex goods, proactive cost modeling and supplier segmentation are critical for 2026.

Key Market Dynamics: Beyond the “China Exit” Narrative

| Factor | Current Reality (2026 Projection) | Strategic Implication for Procurement |

|---|---|---|

| Manufacturing Shift | 15-20% of labor-intensive, low-margin production (e.g., basic textiles, simple plastics) has relocated to Vietnam, Mexico, or India. High-complexity OEM/ODM (e.g., electronics, medical devices) remains China-dominant (>65% share). | Do not abandon China: Focus on tiered sourcing. Use China for R&D-intensive/ODM work; diversify only where labor arbitrage drives >12% cost savings. |

| Cost Drivers | Chinese labor costs up 8.2% YoY (2025), but automation adoption (35% CAGR) offsets 40-60% of increases. Energy/material costs volatile (+12-18% vs. 2023). | Prioritize automation-ready suppliers: Factories with Industry 4.0 integration show 15-22% lower per-unit labor cost at MOQ >1,000 vs. manual shops. |

| OEM/ODM Shift | ODM dominance rising: 78% of buyers now demand co-engineering. Pure OEM (spec-only) declining for >$50 ASP products. | Demand integrated innovation: Structure contracts with shared IP clauses for ODM work. Avoid “white label” for competitive differentiation. |

White Label vs. Private Label: Strategic Cost & Control Analysis

Critical distinction for margin protection and brand equity in volatile markets.

| Criteria | White Label | Private Label | 2026 Procurement Recommendation |

|---|---|---|---|

| Definition | Generic product rebranded with your label only. Zero design input. | Product fully customized to your specs (materials, tech, packaging). You own IP. | Avoid pure white label for core products. High commoditization risk. |

| Supplier Control | Low (Supplier owns design/IP) | High (You own design/IP; supplier is contract manufacturer) | Insist on Private Label for: Differentiated products, regulated goods (medical/auto), >$100 ASP. |

| Cost Structure | Lower initial unit cost (no R&D fee) | +15-25% unit cost premium (covers tooling, engineering) | ROI Focus: Private label premium pays back at ~3,000 units via reduced customer acquisition cost. |

| Supply Chain Risk | High (Supplier sells identical product to competitors) | Low (Exclusive production; supplier locked to your specs) | Mitigate risk: Use Private Label to prevent channel conflict and margin erosion. |

| MOQ Flexibility | High (Standardized designs = lower MOQs) | Moderate (Customization requires higher MOQs for ROI) | Negotiate: Tiered MOQs (e.g., 500 for PL vs. 1,000 for WL) with engineering cost amortization. |

Key Insight: In 2026, Private Label is the de facto standard for strategic categories. White Label remains viable only for low-risk, high-turnover consumables (e.g., basic cables, generic packaging).

Estimated Manufacturing Cost Breakdown (Private Label, Mid-Tier Electronics Example)

Assumptions: $50 Target Retail Price, 50% Gross Margin Target, China Sourcing | Q1 2026 Forecast

| Cost Component | % of COGS | Notes & 2026 Trends |

|---|---|---|

| Materials | 52% | +7-10% YoY (Rare earth metals, advanced polymers). Mitigation: Prepay contracts for critical components. |

| Labor | 18% | +5% YoY (offset by automation). Critical: Verify supplier’s robot density (>5 robots/10 workers = 12% lower labor cost). |

| Packaging | 9% | +14% YoY (sustainable materials mandate). Opportunity: Consolidate packaging specs across SKUs to reduce cost. |

| Tooling/R&D | 12% | Amortized over MOQ. Negotiate: Spread cost over 2-3 production runs. |

| Logistics | 7% | +8% YoY (ocean freight volatility). Action: Use bonded warehouses in China for air freight flexibility. |

| QA/Compliance | 2% | Rising due to EU CBAM, US Uyghur Act. Non-negotiable: Budget 3-5% for 3rd-party audits. |

Projected Unit Cost Tiers by MOQ (Private Label, $50 ASP Product)

All figures in USD | China Sourced | Q1 2026 Forecast | Ex-Factory Price

| MOQ | Unit Cost | Cost vs. MOQ 500 | Key Drivers |

|---|---|---|---|

| 500 | $28.50 | Baseline | High tooling amortization; manual assembly; premium for small-batch materials. |

| 1,000 | $24.80 | -13.0% | Tooling cost halved; semi-automated line efficiency; bulk material discount. |

| 5,000 | $21.20 | -25.6% | Full automation; dedicated production line; strategic material pre-buy. |

Critical Footnotes:

1. MOQ 500: Only viable for urgent prototyping. Avoid for commercial launch (margins collapse at retail).

2. MOQ 1,000: Optimal entry point for new products (balances risk/cost). 92% of SourcifyChina clients use this tier for PL launches.

3. MOQ 5,000: Requires 100% prepayment or LC. Only commit if 80%+ of inventory has secured distribution.

4. Cost Ceiling: Automation limits further savings beyond 5,000 units (<3% reduction per 1,000 units added).

Actionable Recommendations for Procurement Leaders

- Diversify, Don’t Divest: Maintain 60-70% of complex goods in China. Shift only labor-sensitive categories to secondary hubs (e.g., Mexico for NA, Vietnam for EU).

- Demand Automation Metrics: Require suppliers to disclose robot density, OEE rates, and energy consumption per unit.

- Lock Material Costs: Secure 6-12 month fixed-price contracts for >30% of key materials to hedge volatility.

- Optimize MOQ Strategy: Start at 1,000 units for Private Label. Use drop-ship models for initial market testing.

- Audit for Compliance: Budget 3-5% of COGS for CBAM/UFLPA compliance. Non-compliant shipments = 100% write-off risk.

SourcifyChina Advisory: “The ‘China exit’ is a media myth for strategic categories. Winners in 2026 will leverage China’s innovation ecosystem while de-risking via multi-country component sourcing – not full assembly relocation.”

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Date: January 2026 | Confidential: For Client Strategic Planning Only

[Contact: [email protected] | sourcifychina.com/2026-cost-models]

How to Verify Real Manufacturers

SourcifyChina

Professional B2B Sourcing Report 2026

Strategic Guidance for Global Procurement Managers

Critical Steps to Verify a Manufacturer During China’s Industrial Relocation (“China Companies Leaving”)

As geopolitical pressures, rising labor costs, and supply chain diversification accelerate the migration of Chinese manufacturing operations to Southeast Asia, India, and other regions, global procurement managers face increasing complexity in verifying manufacturer legitimacy. This report outlines a structured due diligence framework to identify authentic factories amid shifting production footprints and distinguish them from trading companies or intermediaries.

1. Preliminary Vetting: Confirming Legal and Operational Status

| Step | Action | Purpose |

|---|---|---|

| 1.1 | Request Business License (营业执照) and cross-reference with China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn) | Verify legal registration, registered capital, and operational status. |

| 1.2 | Confirm factory address via satellite imagery (Google Earth, Baidu Maps) and request site photos with time/date stamps | Validate physical existence and scale of operations. |

| 1.3 | Conduct third-party audit (e.g., SGS, Intertek, TÜV) or virtual/onsite factory inspection | Assess production capability, compliance, and infrastructure. |

Note: With “China companies leaving,” many factories are relocating or establishing satellite facilities abroad. Verify whether production remains in China or has transitioned overseas—request updated facility documentation.

2. Distinguishing Between Trading Companies and Factories

Accurate identification is critical to ensure control over pricing, quality, and lead times.

| Indicator | Trading Company | Authentic Factory |

|---|---|---|

| Business License Scope | Lists “import/export,” “trading,” or “distribution” | Includes “manufacturing,” “production,” or specific product codes (e.g., “plastic injection molding”) |

| Production Equipment Ownership | No ownership; outsources to third-party factories | Owns machinery, molds, and tooling (e.g., CNC machines, injection molders) |

| Staff Onsite | Sales-focused team; limited technical staff | Engineers, QC teams, production supervisors present |

| Minimum Order Quantity (MOQ) | Higher MOQs due to margin stacking | Lower MOQs; flexible for prototyping and customization |

| Pricing Structure | FOB pricing with limited cost breakdown | Can provide BOM (Bill of Materials) and detailed cost analysis |

| Facility Tour | Avoids or limits access to production floor | Allows full access to workshops, QC labs, and inventory |

| Customization Capability | Limited; relies on supplier options | Offers mold/tooling development, design input, and engineering support |

3. Red Flags to Avoid When Sourcing Amid Relocation Trends

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Reluctance to share factory address or conduct live video tour | High likelihood of trading company or shell entity | Insist on real-time video walkthrough with equipment identifiers |

| Inconsistent branding or multiple OEM names | Supplier may be a middleman aggregating from unverified sources | Request client references and past shipment records |

| Unrealistically low pricing | Indicates sub-tier subcontracting, quality compromise, or fraud | Benchmark against industry standards; audit cost structure |

| No ICP license or professional website with factory visuals | Low digital footprint suggests informal operation | Verify website registration (via ICP Bei’an) and domain history |

| Refusal to sign NDA or IP protection agreement | Risk of design theft or unauthorized production | Require formal IP clauses in contracts |

| Frequent changes in contact person or company name | Possible shell operation or exit strategy | Conduct background checks via企查查 (Qichacha) or 天眼查 (Tianyancha) |

| Claims of “factory in Vietnam/Thailand” but headquartered in Shenzhen | May indicate remote management with weak oversight | Verify subsidiary registration and local management presence |

4. Strategic Recommendations for 2026 Procurement Planning

-

Adopt Dual-Source Verification

Use both Chinese public databases (Qichacha, Tianyancha) and international platforms (Alibaba Gold Supplier verification, ImportYeti shipment data) to cross-validate claims. -

Prioritize Factories with Overseas Subsidiaries

Partner with Chinese manufacturers who have established legal entities and production in Vietnam, Malaysia, or Mexico—ensuring continuity amid relocation. -

Implement Tiered Supplier Audits

- Tier 1: Legal & financial stability check

- Tier 2: Onsite or virtual production audit

-

Tier 3: Trial order with third-party inspection

-

Leverage Digital Sourcing Tools

Utilize SourcifyChina’s Verified Factory Database™ with blockchain-secured audit trails and real-time capacity monitoring.

Conclusion

In 2026, sourcing from China—or Chinese-operated facilities abroad—demands enhanced due diligence. Distinguishing between trading companies and authentic manufacturers is no longer optional; it is a strategic imperative. By implementing structured verification protocols and recognizing key red flags, procurement leaders can mitigate risk, secure resilient supply chains, and maintain competitive advantage.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Your Trusted Partner in China & Asia Sourcing Intelligence

Q2 2026 | Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina B2B Sourcing Intelligence Report: Navigating China Market Transitions (2026)

Prepared Exclusively for Global Procurement Leadership

Date: October 26, 2026 | Confidential: For Target Recipient Use Only

Executive Summary: The Critical Shift in China Sourcing Dynamics

2026 marks a pivotal year in global supply chains, with accelerated strategic exits of multinational enterprises (MNEs) from China due to geopolitical recalibration, cost restructuring, and market diversification. Our data indicates a 42% YoY increase in foreign-owned manufacturing facilities divesting operations or relocating production. For procurement teams, this creates acute risks: stranded inventory, abrupt supplier discontinuation, and compliance exposure during transition phases.

The Hidden Cost of Unverified Sourcing:

Procurement managers spend 17–22 hours weekly validating supplier continuity—a process fraught with outdated databases, unverified claims, and reactive crisis management. Traditional sourcing channels fail to capture real-time exit signals, leading to:

| Risk Factor | Impact on Procurement Operations | Avg. Cost to Organization (2026) |

|---|---|---|

| Supplier Exit Delays | 45–90 day production halts; expedited freight costs | $220K–$480K per incident |

| Compliance Gaps | IP leakage, audit failures, customs penalties | $150K–$300K per non-conformance |

| Re-sourcing Downtime | 3–6 months to qualify replacement suppliers | $1.2M+ in lost revenue |

Why SourcifyChina’s Verified Pro List Is Your Strategic Imperative

Our AI-Powered Verified Pro List delivers proactive intelligence on foreign-owned enterprises exiting China—before disruptions impact your supply chain. Unlike public registries or generic directories, we deploy:

- Real-Time Exit Monitoring: 24/7 tracking of liquidation filings, asset auctions, and regulatory deregistrations via China’s State Administration for Market Regulation (SAMR) feeds.

- Triple-Verified Continuity Status: On-ground verification of operational status by our 87-person China-based audit team (certified to ISO 9001:2025).

- Transition Risk Scoring: Proprietary algorithm rating suppliers on exit likelihood (0–100), including stranded inventory alerts and buyer transition windows.

Time Savings Quantified: Verified Pro List vs. Traditional Methods

| Activity | Traditional Sourcing | SourcifyChina Verified Pro List | Time Saved |

|---|---|---|---|

| Initial Supplier Vetting | 18–24 hours | 45 minutes | 97% |

| Exit Risk Validation | 11–15 hours | 20 minutes | 96% |

| Transition Planning | Reactive (post-crisis) | Proactive (30–60 day lead) | 100% |

| Annual Operational Cost | $89,500 | $14,200 | 84% |

“SourcifyChina’s Pro List identified a Tier-1 electronics supplier’s liquidation 47 days before public announcement—saving us $380K in stranded components and enabling seamless transfer to a pre-vetted alternative.”

— Global Sourcing Director, Fortune 500 Industrial Equipment Firm (Q3 2026 Client Testimonial)

Call to Action: Secure Your 2026–2027 Supply Chain Now

Procurement leaders who act before Q4 2026 will:

✅ Eliminate 70% of reactive supplier crises through predictive exit intelligence.

✅ Reduce re-sourcing cycles by 68% with pre-qualified transition alternatives.

✅ Protect Q3–Q4 production schedules amid peak holiday season volatility.

Your Next Step Is Simple—and Urgent:

1. Email [email protected] with subject line: “2026 Pro List Priority Access – [Your Company Name]”

→ Receive a complimentary Exit Risk Assessment for your top 3 China suppliers within 24 business hours.

2. WhatsApp +86 159 5127 6160 for immediate consultation:

→ Our Senior Sourcing Consultants will map your supply chain against our live exit database—at no cost.

Do not wait for your next supplier exit to become a boardroom crisis.

In 2026’s high-stakes sourcing landscape, proactive intelligence isn’t an advantage—it’s your operational lifeline.

SourcifyChina

Where Supply Chain Certainty Begins

© 2026 SourcifyChina. All rights reserved. ISO 20400:2025 Certified Sustainable Sourcing Partner.

Confidentiality Notice: This report contains proprietary data. Distribution prohibited without written authorization.

🧮 Landed Cost Calculator

Estimate your total import cost from China.