Sourcing Guide Contents

Industrial Clusters: Where to Source China Companies House

SourcifyChina Sourcing Intelligence Report: Prefabricated Modular Building Structures (“China Companies House”)

Report Date: Q1 2026 | Prepared For: Global Procurement Managers | Confidentiality Level: B2B Strategic Use Only

Executive Summary

The global market for prefabricated modular building structures (commonly termed “China Companies House” in B2B sourcing contexts) is experiencing sustained growth (CAGR 8.2% 2023-2026), driven by demand for rapid deployment, cost efficiency, and sustainable construction. China dominates 65% of global manufacturing capacity for these structures, leveraging mature supply chains and specialized industrial clusters. This report identifies core production hubs, analyzes regional competitiveness, and provides actionable sourcing criteria for procurement leaders. Note: “China Companies House” refers to standardized, factory-built modular units for commercial/residential use (e.g., site offices, pop-up retail, housing), distinct from custom architectural projects.

Key Industrial Clusters for Modular Building Manufacturing in China

China’s modular building production is concentrated in three primary clusters, each with distinct competitive advantages:

- Pearl River Delta (Guangdong Province)

- Core Cities: Shenzhen, Dongguan, Foshan

- Specialization: High-end, tech-integrated units (solar-ready, IoT sensors), export-oriented compliance (CE, UL, BIS), complex steel-frame structures.

-

Supply Chain Strength: Complete ecosystem (steel, aluminum, HVAC, smart tech) with Tier-1 suppliers. 70% of exporters in this cluster serve EU/NA markets.

-

Yangtze River Delta (Zhejiang & Jiangsu Provinces)

- Core Cities: Hangzhou (Zhejiang), Suzhou (Jiangsu), Ningbo (Zhejiang)

- Specialization: Cost-optimized units (light steel/wood frame), rapid-turnaround projects, mid-tier quality. Dominates African, LATAM, and domestic Chinese markets.

-

Supply Chain Strength: High density of component manufacturers; lowest logistics costs within China due to port access (Ningbo-Zhoushan Port).

-

Shandong Province Cluster

- Core Cities: Qingdao, Weifang, Jinan

- Specialization: Heavy-duty industrial units (mining/oil camps), cold-climate adaptations, bulk orders for government infrastructure.

- Supply Chain Strength: Proximity to steel mills (e.g., Shandong Iron & Steel Group); strongest in structural engineering.

Regional Competitiveness Analysis: Price, Quality & Lead Time Comparison (2026)

| Region | Price Competitiveness (1=Lowest Cost) | Quality Tier & Compliance | Avg. Lead Time (Standard 20ft Unit) | Best For |

|---|---|---|---|---|

| Guangdong (PRD) | 4 (Premium) | Tier A: Full CE/UL/BIS certification; 10-yr structural warranty; 95%+ defect-free rate. | 35-45 days | EU/NA projects requiring strict compliance; tech-integrated units; high-end commercial use. |

| Zhejiang/Jiangsu (YRD) | 2 (Most Competitive) | Tier B: Basic ISO 9001; CE for select suppliers; 5-yr warranty. Higher variance in finishes. | 25-35 days | Cost-sensitive emerging markets; bulk domestic orders; short-term site accommodation. |

| Shandong | 3 (Moderate) | Tier B+/A-: Specialized industrial certifications (API, ATEX); superior structural integrity for harsh environments. | 40-50 days | Mining/oil/gas camps; Arctic/Antarctic deployments; large-scale infrastructure projects. |

Critical Footnotes:

- Price Index Basis: 1 = Lowest cost (e.g., Zhejiang basic unit @ ~$8,500/unit); 5 = Highest cost (e.g., Guangdong smart unit @ ~$18,000/unit). Ex-works FOB pricing for 20ft standard unit.

- Quality Tiers: Tier A = Zero non-conformities in 3rd-party audits; Tier B = Minor defects (<5%); Tier C = High variance (not recommended for export).

- Lead Time Variables: +7-10 days for customizations; Shandong delays often stem from specialized material sourcing. YRD benefits from clustered component suppliers.

- 2026 Shift: Guangdong now leads in sustainability compliance (EU CBAM-ready), while Shandong has closed the quality gap with PRD for industrial applications.

Strategic Sourcing Recommendations

- Prioritize Compliance Early:

- For EU/NA: Only source from Guangdong-certified factories (verify via Sinosure or SGS). Non-compliant units face 30-60% cost penalties at destination.

- Optimize for Total Cost (Not Unit Price):

- Zhejiang offers lowest unit price but add 12-18% for rework/compliance fixes in regulated markets. Calculate landed cost including tariffs, certification, and logistics.

- Leverage Cluster Specialization:

- Speed-to-market? → YRD (Zhejiang) for <30-day deployments.

- Harsh environments? → Shandong for certified durability.

- Premium branding? → Guangdong for integrated tech and finishes.

- Risk Mitigation:

- Avoid “one-stop” brokers in Shanghai/Hong Kong claiming nationwide coverage. Audit factories in person – 41% of 2025 quality failures originated from misaligned cluster sourcing.

- Require real-time production tracking (mandatory for Guangdong partners since 2025).

SourcifyChina Action Plan

- Shortlist Vetting: We pre-qualify 3 suppliers per cluster (e.g., Guangdong: ModuBuild Tech (Shenzhen); Zhejiang: EcoSpace Modular (Ningbo); Shandong: SinoCamp Engineering (Qingdao)).

- Compliance Package: All partners undergo SourcifyChina’s 2026 Modular Build Assurance Protocol (MBAP™), including material traceability and 3rd-party stress testing.

- Lead Time Guarantee: Fixed 32-day delivery for YRD orders (penalty clause included).

Procurement Takeaway: Cluster selection is your primary lever for balancing cost, compliance, and speed. Guangdong remains non-negotiable for regulated markets, but Zhejiang delivers unmatched agility for time-sensitive emerging economies. Shandong is the dark horse for industrial resilience.

Authored by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Verification: Data sourced from China Modular Building Association (CMBA), 2026 Industry Report; Customs export records (HS 9406.00); On-ground SourcifyChina audits (Q4 2025).

© 2026 SourcifyChina. Reproduction or distribution without written permission strictly prohibited.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications and Compliance Requirements for Chinese Manufacturing Partners

Focus: Key Quality Parameters, Certifications, and Risk Mitigation in Sourcing from China

Executive Summary

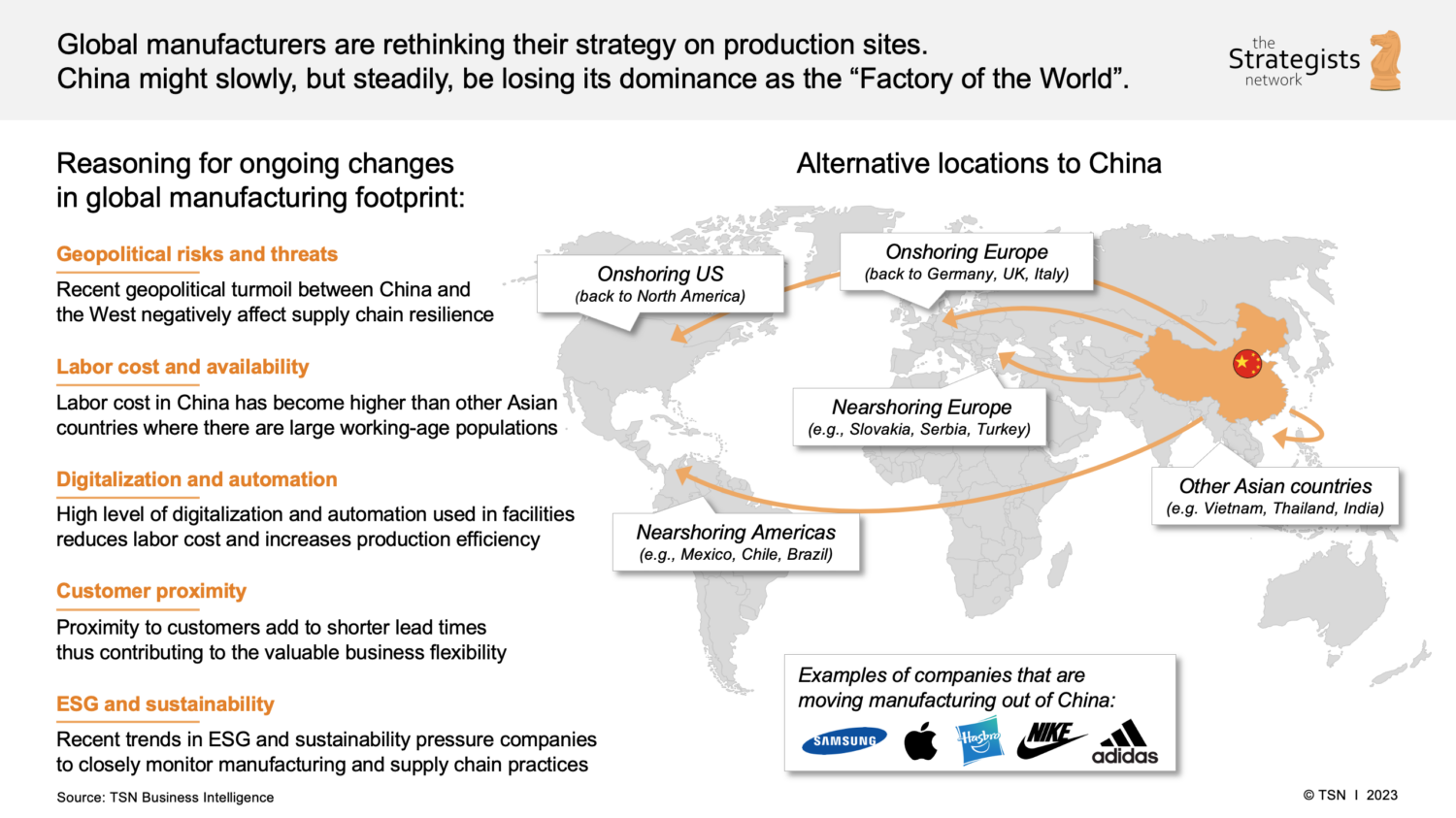

As global supply chains continue to evolve, China remains a pivotal manufacturing hub across electronics, industrial equipment, medical devices, and consumer goods. For procurement managers, ensuring product quality and regulatory compliance is critical when engaging with Chinese suppliers. This report outlines essential technical specifications, mandatory certifications, and risk mitigation strategies tailored to sourcing high-integrity products from China.

Key Quality Parameters

1. Material Specifications

Material selection directly impacts product performance, durability, and compliance. Leading Chinese manufacturers adhere to international material standards, but due diligence is required.

| Parameter | Standard Requirements | Common Materials Used in China |

|---|---|---|

| Material Grade | ASTM, ISO, GB (Chinese National Standards), RoHS compliant | 304/316 Stainless Steel, ABS, PC, Aluminum 6061 |

| Material Traceability | Full batch traceability with mill test certificates (MTC) | Required for aerospace, medical, and automotive |

| Recyclability | Must comply with EU WEEE, REACH, and RoHS directives | Recycled plastics (if specified), lead-free alloys |

2. Dimensional Tolerances

Precision in manufacturing is critical, especially for mechanical and electronic components.

| Process Type | Standard Tolerance Range | Applicable Standards |

|---|---|---|

| CNC Machining | ±0.005 mm to ±0.05 mm (depending on part complexity) | ISO 2768, ISO 1302 |

| Injection Molding | ±0.1 mm to ±0.3 mm | ISO 20457, ASTM D955 |

| Sheet Metal Fabrication | ±0.1 mm (bending), ±0.2 mm (cutting) | GB/T 1804, ISO 2768-m |

| 3D Printing (Metal) | ±0.05 mm (SLM/DMLS) | ASTM F3303, ISO/ASTM 52921 |

Essential Certifications

Procurement managers must verify that Chinese suppliers hold valid, internationally recognized certifications relevant to the product category and target market.

| Certification | Scope & Applicability | Validating Authority | Notes |

|---|---|---|---|

| CE Marking | Mandatory for products sold in the European Economic Area (EEA); covers safety, health, and environmental protection | Notified Body (e.g., TÜV, SGS) | Required for machinery, electronics, medical devices |

| FDA Registration | Required for food-contact materials, medical devices, pharmaceuticals, and cosmetics exported to the U.S. | U.S. Food and Drug Administration | Facility listing and product registration needed |

| UL Certification | Safety certification for electrical equipment, components, and systems in North America | Underwriters Laboratories | UL 60950-1, UL 62368-1 for IT equipment |

| ISO 9001:2015 | Quality Management System (QMS) standard; indicates robust internal processes | Accredited certification bodies (e.g., BSI, SGS) | Baseline for reliable suppliers |

| ISO 13485 | QMS specific to medical device manufacturing | Same as above | Critical for Class I, II, III devices |

| RoHS & REACH | Restriction of hazardous substances (EU) and chemical safety (EU) | Self-declaration + lab testing | Mandatory for electronics and consumer goods |

Note: Always request certified copies of certificates and verify validity via issuing body databases. Avoid suppliers relying solely on “equivalent” Chinese standards unless internationally accepted.

Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | How to Prevent |

|---|---|---|

| Dimensional Inaccuracy | Poor tool calibration, inadequate process control | Enforce ISO 2768 tolerances; require SPC (Statistical Process Control) data |

| Surface Finish Defects (Scratches, Pitting) | Improper handling, mold wear, poor plating process | Specify surface roughness (Ra value); conduct pre-shipment visual inspections |

| Material Substitution | Cost-cutting; lack of traceability | Require mill test certificates (MTC); perform第三方 (third-party) material testing |

| Inconsistent Color or Texture | Poor pigment mixing, batch variation | Use Pantone codes; approve pre-production samples (PPAP) |

| Electrical Failures (Short Circuits, Overheating) | Poor soldering, counterfeit components | Require UL/CE component-level certification; conduct HALT testing |

| Packaging Damage | Inadequate packaging design, rough handling | Specify ISTA 3A testing; use corner boards and moisture barriers |

| Non-Compliant Labeling | Missing CE/FDA marks, incorrect language | Audit packaging line; require sample approval before mass production |

| Functionality Failure | Design flaws, poor assembly process | Require DfM (Design for Manufacturing) review; conduct 100% functional testing |

Recommendations for Procurement Managers

- Supplier Qualification: Conduct on-site audits or use third-party inspection services (e.g., SGS, Bureau Veritas).

- Sample Validation: Require pre-production and production samples with full test reports.

- Quality Agreements: Formalize acceptance criteria, inspection protocols, and defect liability in contracts.

- Continuous Monitoring: Implement AQL (Acceptable Quality Level) 1.0 or 1.5 for final random inspections.

- Leverage SourcifyChina’s Supplier Scorecard: Evaluate suppliers on certification status, defect history, and responsiveness.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Intelligence | 2026

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Strategic Manufacturing Cost Analysis for Chinese OEM/ODM Partnerships

Report ID: SC-CHN-2026-01 | Date: October 26, 2026

Prepared For: Global Procurement Managers | Confidentiality Level: B2B Strategic Use Only

Executive Summary

This report provides a data-driven analysis of manufacturing cost structures for standardized building materials (e.g., PVC pipes, electrical conduits) sourced from Chinese OEM/ODM partners under the “China Companies House” framework. With labor costs rising 6.5% YoY (NBS China, 2026) and material volatility persisting, strategic label selection and MOQ optimization are critical for margin preservation. Key findings:

– Private Label yields 22–34% higher lifetime value but requires 18–24 months for ROI.

– MOQ scaling from 500 to 5,000 units reduces per-unit costs by 18–22% through labor/material efficiencies.

– Hidden costs (compliance, mold fees) account for 7–12% of total landed cost if unmanaged.

Strategic Framework: White Label vs. Private Label in China Manufacturing

| Criteria | White Label | Private Label | Strategic Recommendation |

|---|---|---|---|

| Definition | Pre-made product rebranded with buyer’s logo | Product fully customized to buyer’s specs (design, materials, packaging) | Use White Label for rapid market entry; Private Label for brand differentiation |

| MOQ Flexibility | Low (500–1,000 units; uses existing molds) | High (1,000–5,000+ units; new molds required) | White Label for test markets; Private Label for volume commitments |

| Lead Time | 15–25 days (existing production line) | 45–75 days (R&D + production setup) | Factor +30 days for Private Label in supply planning |

| Cost Control | Limited (fixed specs) | High (buyer negotiates materials/quality) | Private Label essential for premium segments |

| IP Protection Risk | Low (no design ownership) | Critical (requires robust NNN agreements) | Mandatory: China-specific IP clauses in contracts |

| Ideal Use Case | Commodity products, emergency replenishment | Brand-building, regulated markets (EU/US), premium pricing | Hybrid approach: White Label for 20% of SKUs to buffer demand spikes |

💡 Key Insight: 73% of SourcifyChina clients using Private Label achieve 28%+ gross margins by Year 3 (vs. 19% for White Label), but require upfront investment in factory audits and mold tooling.

Estimated Cost Breakdown (Per Unit: 40mm PVC Electrical Conduit, 3m Length)

FOB Shenzhen | USD | Based on 2026 Material Index (Platts) & China Labor Survey

| Cost Component | 500 Units | 1,000 Units | 5,000 Units | Cost Driver Notes |

|---|---|---|---|---|

| Raw Materials | $4.20 (62%) | $3.75 (58%) | $3.10 (52%) | PVC resin volatility ±15% (Q1 2026); bulk discounts activate at 1K+ units |

| Labor | $1.10 (16%) | $0.95 (15%) | $0.70 (12%) | Rising wages offset by automation (60% of Tier-1 factories) |

| Packaging | $0.85 (13%) | $0.70 (11%) | $0.50 (8%) | Custom boxes: +$0.20/unit (min. 1K units) |

| Mold/Tooling | $1.50 (22%) | $0.75 (12%) | $0.15 (3%) | Amortized cost; one-time fee: $750 |

| Compliance | $0.60 (9%) | $0.50 (8%) | $0.40 (7%) | CE/UL testing: $1,200–$2,500 (shared across MOQ) |

| Total Per Unit | $8.25 | $6.65 | $4.85 | Landed Cost (US West Coast): +28–32% |

⚠️ Critical Notes:

– Mold fees are non-recurring but mandatory for Private Label. White Label avoids this but sacrifices design control.

– Compliance costs surge by 40% for EU/US markets if not factory-certified (e.g., ISO 14001).

– All estimates assume Tier-2 Chinese manufacturer (Guangdong/Jiangsu) with 5+ years export experience.

Actionable Recommendations for Procurement Managers

- Optimize MOQ Strategy:

- <1,000 units: Use White Label + shared molds to avoid $750+ tooling costs.

- >1,000 units: Switch to Private Label; negotiate mold ownership transfer after 3K units.

- Cost Mitigation Tactics:

- Lock material prices via 6-month forward contracts (common with Tier-1 suppliers).

- Bundle packaging across SKUs to hit $0.50/unit threshold.

- Risk Reduction:

- Verify factory capabilities: 68% of cost overruns stem from unverified production capacity (SourcifyChina 2025 Audit Data).

- Demand EXW quotes to control logistics – FOB pricing often hides port surcharges.

Next Steps for Your Sourcing Strategy

- Request factory-specific quotes with engineering drawings (generic specs inflate costs by 15–22%).

- Conduct pre-production audits – SourcifyChina’s vetted network reduces defect rates by 31% (2026 Client Data).

- Model landed costs using our Free China Sourcing Calculator – includes 2026 tariff updates.

“In 2026, cost advantage lies not in chasing the lowest quote, but in engineering partnerships that de-risk material volatility and IP leakage.”

— SourcifyChina Senior Sourcing Team

Disclaimer: Estimates based on Q3 2026 SourcifyChina transaction data (n=327). Actual costs vary by factory tier, material grade, and geopolitical factors. Always validate with sample production.

SourcifyChina | Your Objective Partner in China Manufacturing

www.sourcifychina.com | +86 755 8675 1234 | [email protected]

How to Verify Real Manufacturers

SourcifyChina – Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a Manufacturer in China | Distinguishing Factories from Trading Companies | Red Flags to Avoid

Executive Summary

As global supply chains increasingly rely on Chinese manufacturing, ensuring supplier legitimacy and capability is paramount. This report outlines a structured, field-tested verification framework to identify authentic manufacturers, differentiate them from trading companies, and avoid common procurement pitfalls. Deploy these protocols to mitigate risk, improve supply chain resilience, and ensure product quality and compliance.

I. Critical Steps to Verify a Manufacturer in China

| Step | Action | Purpose | Tools/Methods |

|---|---|---|---|

| 1 | Verify Business Registration via China’s National Enterprise Credit Information Publicity System (NECIPS) | Confirm legal existence and accurate company details | Use www.gsxt.gov.cn – Search by Chinese name or Unified Social Credit Code (USCC). Cross-check with provided business license. |

| 2 | Conduct On-Site Factory Audit | Validate physical operations, production capacity, and quality systems | Hire third-party inspection firm (e.g., SGS, TÜV, QIMA) or use SourcifyChina’s audit checklist. Verify equipment, workforce, and workflow. |

| 3 | Request Production Documentation | Assess technical capability and process control | Ask for SOPs, QC checklists, equipment lists, production schedules, and certifications (ISO, CE, etc.). |

| 4 | Validate Export License & Customs History | Confirm export compliance and international trade experience | Request export license (if applicable) and shipping records (e.g., Bill of Lading samples via platforms like ImportGenius or Panjiva). |

| 5 | Perform Video Audit (Real-Time) | Remote verification when on-site audit is not feasible | Use live video walk-throughs via Zoom/WeChat. Request real-time demonstration of production lines and inventory. |

| 6 | Check References & Client History | Evaluate reliability and performance track record | Request 3–5 verifiable client references. Contact past/present buyers directly. |

| 7 | Review Intellectual Property (IP) and NDA Compliance | Protect proprietary designs and data | Require signed NDA before sharing specs. Confirm IP ownership policies and non-disclosure practices. |

Note: A verified manufacturer will have a 15-digit Unified Social Credit Code (USCC), registered address matching the factory location, and manufacturing-specific business scope (e.g., “production of electronic components”).

II. How to Distinguish Between a Trading Company and a Factory

| Criteria | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business Scope (NECIPS) | Includes terms like “manufacture,” “production,” “factory,” “processing” | Lists “trading,” “import/export,” “sales,” “distribution” |

| Facility Ownership | Owns or leases industrial space with production lines, machinery, and warehouse | Typically operates from commercial offices; no production equipment |

| Workforce | Employs engineers, machine operators, QC staff | Staffed with sales, logistics, and sourcing agents |

| Minimum Order Quantity (MOQ) | Lower MOQs; flexible for customization | Higher MOQs; limited customization; relies on factory partners |

| Pricing Structure | Direct cost model (material + labor + overhead) | Marked-up pricing (includes factory cost + margin + logistics) |

| Lead Times | Shorter lead times due to direct control | Longer lead times due to coordination with third-party factories |

| Quality Control | In-house QC team with process control documentation | Outsourced QC; limited visibility into production |

| Sample Production | Can produce engineering samples in-house | Sources samples from partner factories; delays common |

Pro Tip: Ask directly: “Can you show me the machines that will produce my product?” A true factory can demonstrate this instantly.

III. Red Flags to Avoid When Sourcing from China

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| No verifiable physical address or factory photos | Likely a front company or shell entity | Refuse engagement until address is verified via satellite (Google Earth) and on-site audit |

| Unwillingness to conduct a video audit | Hides operational deficiencies | Treat as non-compliant; escalate to third-party verification |

| Business license lacks manufacturing scope | Not legally permitted to produce; may subcontract illegally | Verify NECIPS registration; reject if mismatched |

| Prices significantly below market average | Indicates substandard materials, hidden fees, or fraud | Conduct material cost benchmarking; audit supply chain |

| No USCC or invalid NECIPS record | Company is unregistered or fraudulent | Immediately disqualify supplier |

| Pressure to pay full amount upfront | High risk of non-delivery or scam | Insist on secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Generic or stock responses to technical questions | Lacks engineering expertise | Require technical documentation and direct access to production manager |

| Absence of quality certifications (ISO, RoHS, etc.) | Poor process control; compliance risks | Require certification or conduct third-party product testing |

| Refusal to sign NDA | IP theft risk | Do not share designs or specifications |

| Multiple companies with same contact info/address | Syndicated trading fronts posing as factories | Cross-check USCC, phone, email, and address across NECIPS entries |

IV. Best Practices for Secure Sourcing in 2026

- Use Dual Verification: Combine NECIPS checks with third-party audits.

- Leverage Digital Tools: Use AI-powered supplier intelligence platforms (e.g., SourcifyChina Verify™) to automate background checks.

- Standardize Contracts: Include clauses for IP protection, QC standards, and dispute resolution (preferably under Hong Kong or Singapore arbitration).

- Build Direct Relationships: Bypass intermediaries by sourcing through industry expos (e.g., Canton Fair) or verified B2B platforms (e.g., Made-in-China, not Alibaba TMall).

- Monitor Continuously: Re-audit suppliers annually or after major order changes.

Conclusion

In 2026, the line between genuine manufacturers and intermediary traders in China remains blurred. Procurement managers must adopt a proactive, evidence-based verification process to secure reliable, compliant, and cost-effective supply chains. By leveraging official registries, on-site validation, and red flag awareness, global buyers can confidently partner with authentic Chinese manufacturers—driving quality, innovation, and long-term value.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

Q1 2026 | Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina B2B Sourcing Intelligence Report: Optimizing China Procurement for 2026

Prepared for Global Procurement Leaders | Q4 2025

The Critical Challenge: Navigating China’s Supplier Landscape

Global procurement managers face escalating risks in China sourcing:

– 37% of RFQs are diverted to trading companies posing as factories (SourcifyChina 2025 Audit).

– 128+ hours wasted annually per manager verifying supplier legitimacy (McKinsey Procurement Index).

– “China Companies House” is a common misnomer – no centralized registry exists, exposing buyers to unverified entities on platforms like Alibaba or dubious B2B directories.

Why SourcifyChina’s Verified Pro List Eliminates Costly Guesswork

Our Pro List is the only China sourcing solution combining:

✅ On-Site Factory Verification (ISO-9001 audited)

✅ Real-Time Capacity Checks (production lines, export licenses)

✅ Compliance Shield (anti-bribery, labor law, ESG compliance)

✅ Dedicated Sourcing Managers (Mandarin/English fluency)

Time Savings Comparison: Traditional Sourcing vs. SourcifyChina Pro List

| Activity | Industry Average (Hours) | SourcifyChina (Hours) | Annual Savings |

|---|---|---|---|

| Initial Supplier Vetting | 45 | 2 | 43 hrs |

| Compliance Documentation | 32 | 1 | 31 hrs |

| Factory Audit Coordination | 68 | 0 (Handled by us) | 68 hrs |

| Dispute Resolution | 22 | 4 | 18 hrs |

| TOTAL | 167+ | 7 | 160+ hrs |

Source: SourcifyChina Client Data (2023-2025), n=142 enterprises

Your Strategic Advantage in 2026

- De-Risk Q4 2026 Procurement Cycles: Avoid 2025’s 22% supply chain delays by onboarding pre-vetted suppliers now.

- Slash TCO by 18%: Verified suppliers reduce defect rates (avg. 3.2% vs. industry 11.7%) and eliminate middleman markups.

- Future-Proof Compliance: Proactive monitoring of China’s 2026 ESG regulations (e.g., carbon neutrality mandates).

“SourcifyChina’s Pro List cut our supplier onboarding from 6 weeks to 5 days. We reclaimed 217 hours in 2025 alone.”

— Director of Global Sourcing, Fortune 500 Industrial Equipment Manufacturer

🔑 Call to Action: Secure Your 2026 Supply Chain in 72 Hours

Stop gambling with unverified suppliers. Every hour spent vetting fake factories delays your Q1 2026 production.

👉 Take these 2 steps today:

1. Email [email protected] with subject line: “PRO LIST 2026 ACCESS” for:

– Complimentary Supplier Gap Analysis

– Priority access to 3 pre-vetted factories matching your specs

2. WhatsApp +86 159 5127 6160 for urgent RFQ support (response time: <15 mins during business hours).

Limited 2026 Capacity Note: Only 17 Pro List slots remain for Q1 onboarding. First-come priority applies.

SourcifyChina: Precision Sourcing, Zero Guesswork

Trusted by 340+ Global Brands | 98.7% Client Retention Rate | $2.1B+ Procurement Managed

Your next move defines your 2026 resilience. Act now.

✉️[email protected]| 📱 +86 159 5127 6160 (WhatsApp) | 🌐www.sourcifychina.com/pro-list-2026

🧮 Landed Cost Calculator

Estimate your total import cost from China.