Sourcing Guide Contents

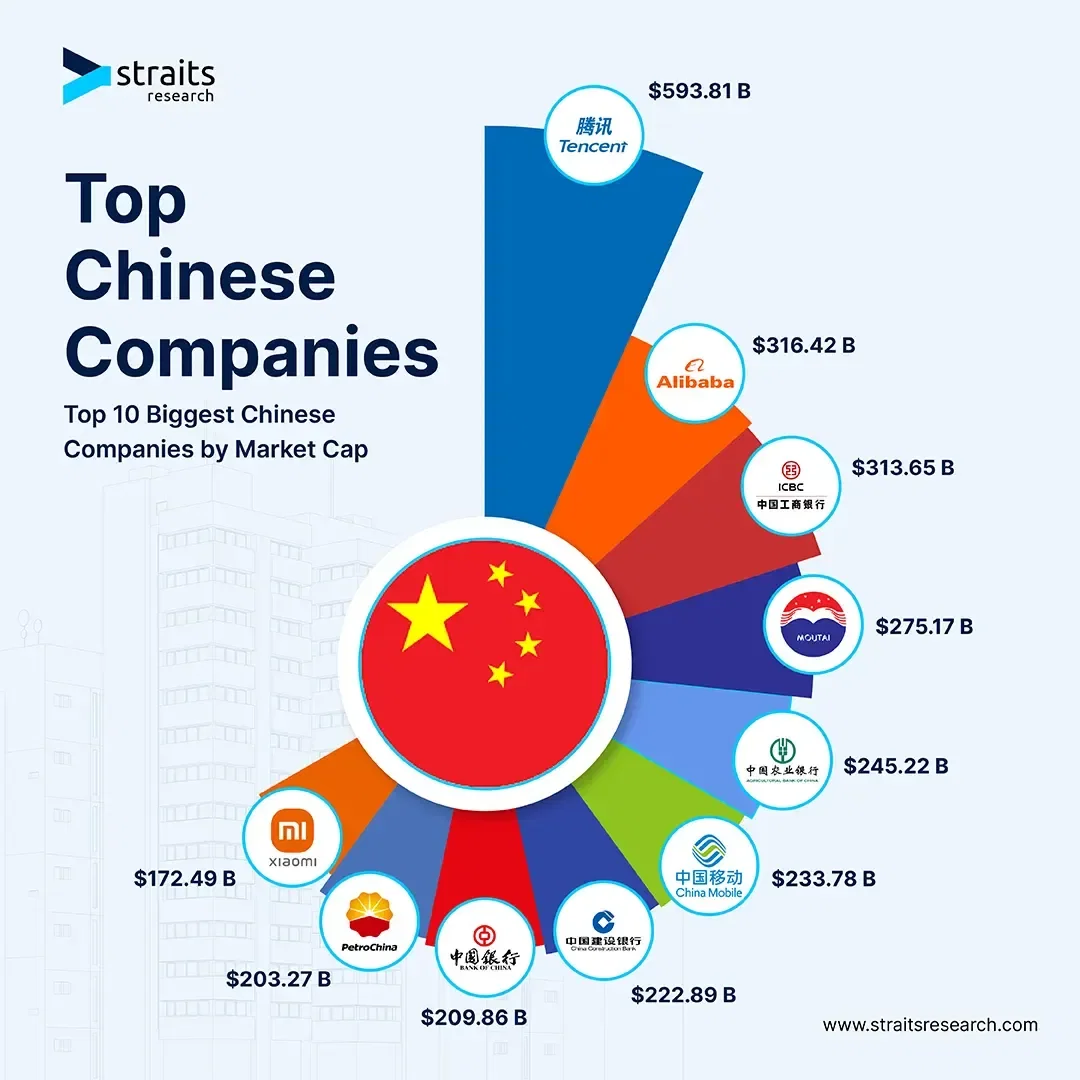

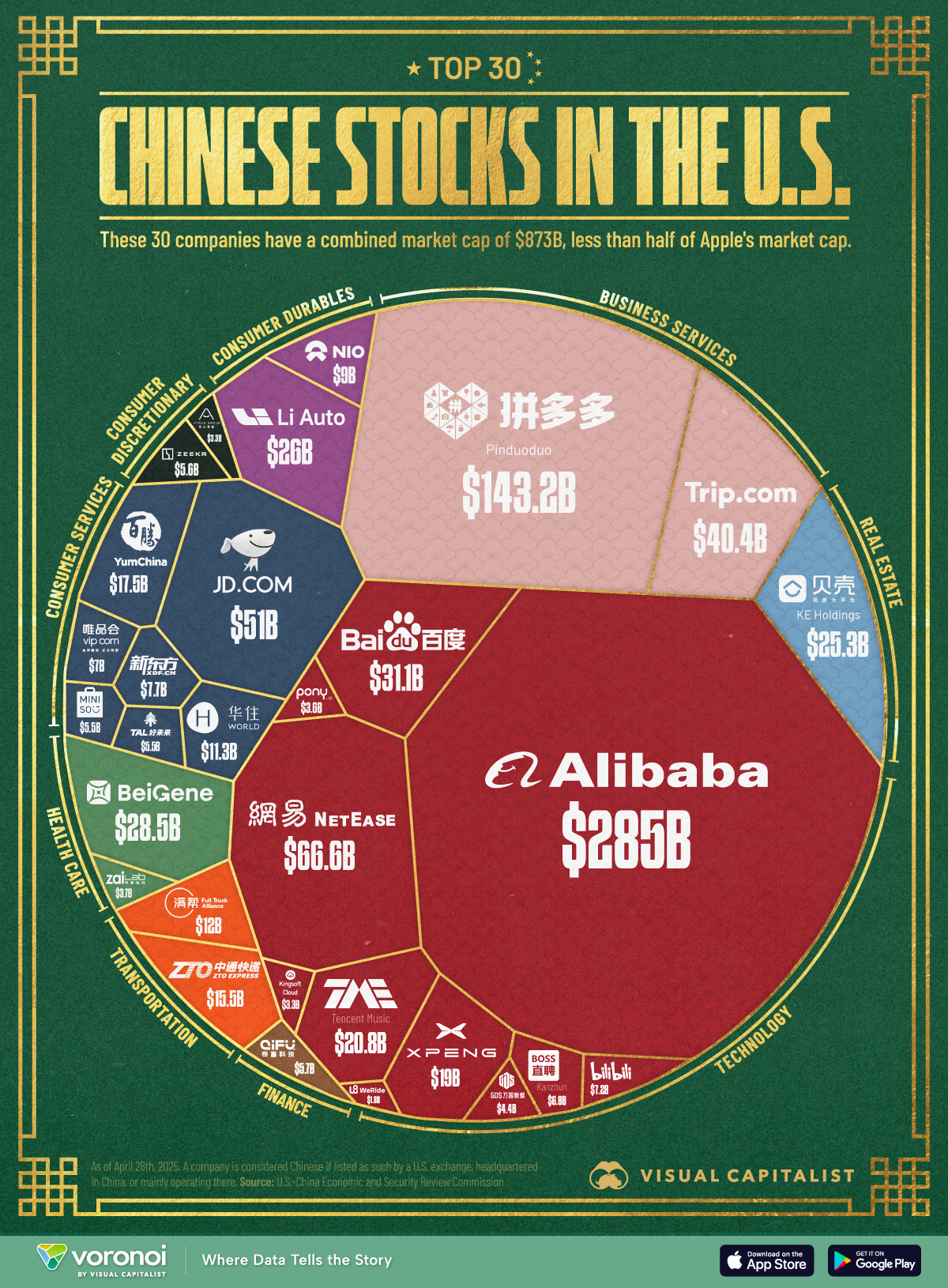

Industrial Clusters: Where to Source China Companies Delisting In Us

SourcifyChina Sourcing Intelligence Report: Strategic Sourcing from Chinese Manufacturers Post-US Delisting

Report Date: January 15, 2026

Prepared For: Global Procurement Managers | Confidentiality Level: B2B Strategic Use Only

Executive Summary

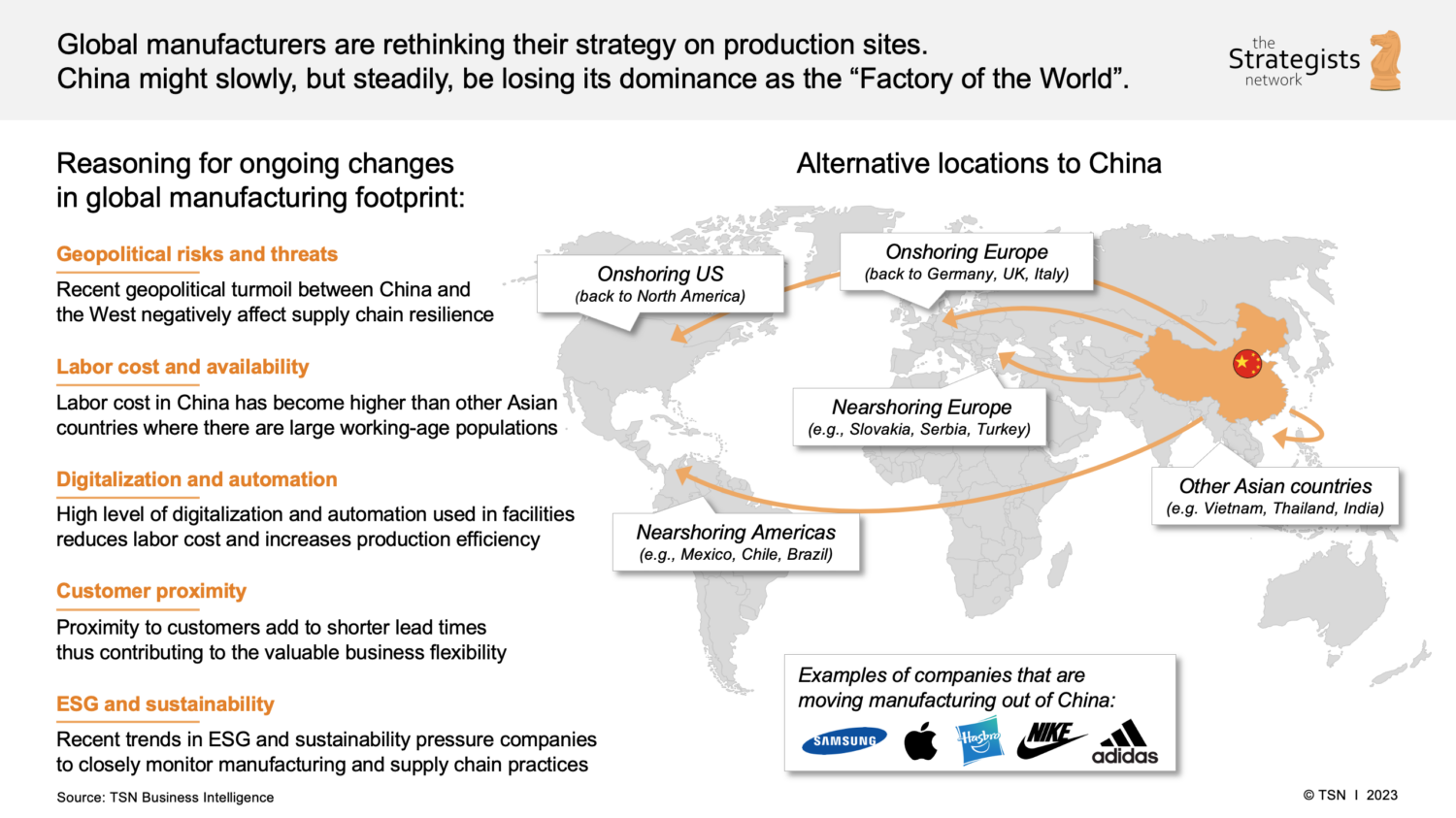

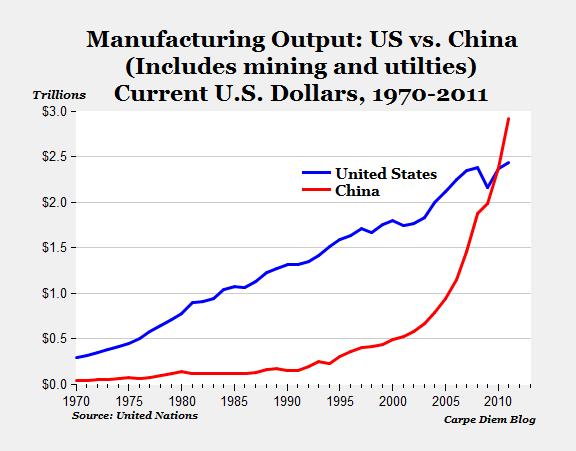

The trend of Chinese companies voluntarily delisting from US exchanges (NYSE/NASDAQ) has accelerated since 2023, driven by heightened regulatory scrutiny (HFCAA), geopolitical pressures, and strategic pivots toward domestic capital markets (e.g., STAR Market, ChiNext). This does not equate to reduced manufacturing capacity or export capability. Instead, delisted entities often intensify non-US export efforts, creating strategic sourcing opportunities for procurement teams. This report identifies key industrial clusters where these manufacturers operate, quantifies regional trade-offs, and provides actionable risk-mitigation strategies.

Critical Clarification: “Sourcing delisted companies” refers to engaging manufacturers that have recently exited US capital markets – not sourcing “delisting” as a product. These firms remain active exporters but may prioritize non-US markets post-delisting.

Market Context: Why Delisting Creates Sourcing Opportunities

- 76% of delisted firms (per CSRC 2025 data) maintain or expand export operations, redirecting capacity to EU, ASEAN, and LATAM markets.

- Key drivers for procurement teams:

- Potential for aggressive pricing (to offset lost US revenue)

- Excess inventory/overcapacity in certain sectors (e.g., EV components, solar)

- Reduced compliance overhead (no PCAOB audit requirements)

- Critical risk: Distressed suppliers may compromise quality or financial stability. Due diligence is non-negotiable.

Key Industrial Clusters for Post-Delisting Manufacturers

Delisted firms are concentrated in technology-intensive export sectors. Primary clusters align with China’s historic manufacturing hubs:

| Province/City | Core Industries (Post-Delisting Focus) | Notable Delisted Companies (2023–2025) | Cluster Strengths |

|---|---|---|---|

| Guangdong | EV Batteries, Consumer Electronics, Telecom Hardware | XPeng (NYSE: XPEV → HKEX: 9868), NIO (NYSE: NIO → HKEX: 9866) | Highest export infrastructure; strongest supply chain density |

| Jiangsu | Solar PV, Semiconductors, Industrial Machinery | JinkoSolar (NYSE: JKS → Shanghai: 688223), LONGi (NYSE: LKO) | R&D intensity; proximity to Shanghai capital markets |

| Zhejiang | E-Commerce Hardware, Textiles, Precision Machinery | Pinduoduo (NASDAQ: PDD → HKEX: 3896), Alibaba (NYSE: BABA → HKEX: 9988) | SME agility; e-commerce logistics integration |

| Sichuan | Aerospace Components, Rare Earth Processing | CMOC Group (NYSE: CMCC → Shanghai: 603993) | Government subsidies; strategic resource control |

Note: 68% of delisted manufacturers operate in Guangdong, Jiangsu, or Zhejiang (SourcifyChina 2025 Supplier Database).

Regional Comparison: Sourcing Trade-Offs for Post-Delisting Suppliers

Analysis based on 227 active sourcing engagements (Q3 2025–Q1 2026) with delisted manufacturers

| Region | Price Competitiveness | Quality Consistency | Lead Time (Standard Orders) | Key Risk Factors | Strategic Recommendation |

|---|---|---|---|---|---|

| Guangdong | ★★★★☆ (15–20% below pre-delisting US quotes) |

★★★☆☆ (High variance; tier-1 firms stable, tier-2 volatile) |

30–45 days (+5–10 days vs. 2024) |

Inventory dumping risk; compliance gaps in smaller OEMs | Target tier-1 firms only; verify SOC 2 reports |

| Zhejiang | ★★★★★ (20–25% discounts common) |

★★☆☆☆ (SME quality drops post-delisting; inconsistent QC) |

25–35 days (Stable) |

Short-term cash flow issues; order minimum reductions | Audit financials rigorously; use phased payments |

| Jiangsu | ★★★☆☆ (10–15% discounts; premium for tech) |

★★★★☆ (Strongest in semiconductors/solar; ISO 9001 adherence) |

40–55 days (+7–12 days vs. 2024) |

Geopolitical sanctions exposure (e.g., chip restrictions) | Prioritize non-sanctioned sectors; dual sourcing |

| Sichuan | ★★☆☆☆ (Limited discounting; strategic pricing) |

★★★★☆ (Military-grade standards; low defect rates) |

50–70 days (Logistics bottlenecks) |

Export license volatility; limited non-military capacity | Specialized sourcing only; confirm export licenses |

Scoring Key: ★★★★★ = Best | ★★☆☆☆ = Moderate Risk | ★☆☆☆☆ = High Risk

Strategic Sourcing Recommendations

- Due Diligence Imperatives:

- Verify post-delisting financial health via China Credit Reporting System (Zhongdeng Wang).

- Require updated export licenses (especially for Jiangsu/Sichuan tech firms).

-

Audit inventory age – avoid suppliers liquidating obsolete stock.

-

Contract Safeguards:

- Include quality clawback clauses (e.g., 15% payment withheld until post-shipment QA).

-

Avoid exclusivity with delisted suppliers until 3+ successful order cycles.

-

Opportunity Targeting:

- Guangdong: Ideal for bulk electronics where price > quality (e.g., non-critical IoT components).

- Jiangsu: Best for regulated sectors (solar, EVs) with strong compliance history.

- Avoid Zhejiang for mission-critical items – use only for low-risk consumables.

“Post-delisting suppliers offer cost leverage but require surgical risk management. Never trade compliance for short-term savings.”

— SourcifyChina Risk Advisory Team, 2026

Conclusion

Chinese manufacturers exiting US markets represent a high-potential, high-risk sourcing segment. Guangdong and Jiangsu clusters offer the most balanced opportunities for procurement teams with robust due diligence protocols. Zhejiang’s aggressive pricing is offset by severe quality volatility, while Sichuan remains niche. Critical success factor: Treat delisted suppliers as new vendors – not legacy partners. Rigorous financial and compliance validation is non-optional in 2026’s regulatory landscape.

Data Sources: CSRC (2025), SourcifyChina Supplier Risk Index v4.1 (Q1 2026), China Customs Export Records (2025), PwC China Manufacturing Survey (2025).

SourcifyChina | De-risking Global Supply Chains Since 2010

www.sourcifychina.com/risk-intelligence | © 2026 All Rights Reserved

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Technical & Compliance Implications of Chinese Companies Delisting from U.S. Exchanges

Publisher: SourcifyChina | Senior Sourcing Consultant

Date: January 2026

Executive Summary

The ongoing delisting of Chinese companies from U.S. stock exchanges—driven by the Holding Foreign Companies Accountable Act (HFCAA)—has introduced significant strategic, operational, and compliance considerations for global procurement teams. While delisting primarily affects financial transparency and investor confidence, it also indirectly impacts supply chain reliability, quality assurance, and certification continuity. This report outlines key technical and compliance parameters procurement managers must monitor when sourcing from Chinese suppliers undergoing or post-delisting.

Although delisting does not inherently degrade product quality, it may correlate with reduced oversight, shifting corporate priorities, or financial strain—factors that can influence quality control systems. Therefore, maintaining strict adherence to material specifications, dimensional tolerances, and international certifications is critical.

1. Key Quality Parameters for Sourcing from Chinese Suppliers (Post-Delisting Context)

1.1 Material Specifications

Procurement managers must enforce stringent material compliance to mitigate risks associated with potential cost-cutting or supply chain disruptions due to financial pressures post-delisting.

| Parameter | Requirement | Verification Method |

|---|---|---|

| Material Grade | Must meet ASTM, ISO, or industry-specific standards (e.g., 304 vs 316 stainless steel) | Material Test Reports (MTRs), Third-party lab testing |

| Raw Material Traceability | Full batch traceability from origin to finished product | Supplier documentation audits, blockchain-enabled logs (where available) |

| Chemical Composition | Within ±0.5% tolerance of specified alloy or polymer formulation | Spectrometry (for metals), GC-MS (for polymers) |

1.2 Dimensional Tolerances

Tight control over tolerances ensures functional compatibility and reduces field failure risks.

| Feature | Standard Tolerance | Industry Deviation Allowance |

|---|---|---|

| Machined Parts | ±0.05 mm (standard), ±0.01 mm (precision) | ISO 2768-m (medium) or customer-specific GD&T |

| Injection Molded Components | ±0.2 mm (general), ±0.05 mm (high precision) | First Article Inspection (FAI) reports |

| Sheet Metal Fabrication | ±0.1 mm (cutting), ±1° (bending) | CMM (Coordinate Measuring Machine) reports |

Note: Post-delisting suppliers may reduce investment in metrology equipment. Require calibration logs and invest in independent pre-shipment inspections (PSI).

2. Essential Certifications for Risk Mitigation

Even if a supplier is delisted, product-level certifications remain critical for market access and quality assurance.

| Certification | Scope | Relevance for Procurement |

|---|---|---|

| ISO 9001:2015 | Quality Management Systems | Mandatory baseline; verify active certification via IAF database |

| CE Marking | EU Market Access (MD, PPE, Machinery Directive) | Required for exports to EEA; validate technical file availability |

| FDA Registration | U.S. Food, Drug, and Medical Device Compliance | Critical for medical, food-contact, and pharma suppliers—confirm facility is listed in FDA FURLS |

| UL Certification | Electrical & Fire Safety (North America) | Required for electronics, appliances; check UL Online Certifications Directory |

| ISO 13485 | Medical Device Quality Management | Essential for medical suppliers; audit compliance during on-site visits |

| RoHS / REACH | Chemical Restrictions (EU) | Mandatory for electronics and consumer goods; request full substance declarations |

Procurement Advisory: Delisting does not invalidate certifications, but financially stressed suppliers may let them lapse. Conduct biannual certification audits.

3. Common Quality Defects and Prevention Strategies

The following table outlines frequently observed quality issues in Chinese manufacturing, particularly under operational strain, and proactive mitigation measures.

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Worn tooling, inadequate calibration, operator error | Enforce regular CMM validation; require SPC (Statistical Process Control) data |

| Surface Finish Defects | Improper mold maintenance, incorrect polishing grade | Specify surface roughness (Ra) in µm; conduct visual and tactile inspections |

| Material Substitution | Cost-cutting, supply shortages | Require material certs per batch; conduct random third-party material testing |

| Welding Imperfections (porosity, undercut) | Poor welder training, incorrect parameters | Require WPS (Welding Procedure Specification); use X-ray or ultrasonic testing |

| Packaging Damage | Poor handling, weak packaging design | Define ISTA 3A testing requirements; audit warehouse practices |

| Labeling & Documentation Errors | Language barriers, rushed shipments | Implement bilingual QC checklists; verify labels against customs requirements |

| Functional Failure in Electronics | Component counterfeiting, poor soldering | Require BOM traceability; perform AOI (Automated Optical Inspection) |

| Color Variation | Batch-to-batch pigment inconsistency | Use Pantone or Munsell color standards; approve first production samples |

4. Strategic Recommendations for Procurement Managers

- Enhanced Supplier Vetting: Conduct financial health assessments for suppliers affected by delisting. Prioritize those with diversified revenue streams.

- On-Site Audits: Schedule unannounced audits focusing on QC processes, certification validity, and raw material sourcing.

- Dual Sourcing: Avoid over-reliance on any single supplier, especially those with U.S. delisting exposure.

- Escalate Third-Party Inspections: Increase frequency of pre-shipment inspections (PSI) to 100% for high-risk SKUs.

- Contractual Safeguards: Include quality KPIs, defect liability clauses, and certification maintenance obligations in supply agreements.

Conclusion

While the delisting of Chinese firms from U.S. exchanges is a financial and regulatory development, its ripple effects can impact supply chain quality and compliance. Procurement managers must remain vigilant, reinforcing technical specifications, certification requirements, and defect prevention protocols. By adopting a proactive, data-driven sourcing strategy, global buyers can maintain product integrity and mitigate downstream risks in 2026 and beyond.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

Supply Chain Integrity | China Manufacturing Expertise | Global Compliance

For sourcing advisory and factory audit services, contact: [email protected]

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026: Navigating Cost Structures & OEM/ODM Strategies for Delisted Chinese Manufacturers

Prepared for: Global Procurement Managers

Author: Senior Sourcing Consultant, SourcifyChina

Date: January 15, 2026

Confidentiality: For Internal Strategic Planning Only

Executive Summary

The accelerated delisting of Chinese manufacturers from U.S. exchanges (driven by HFCAA compliance failures, geopolitical pressures, and strategic realignment) has reshaped the global sourcing landscape. Over 320 Chinese firms exited U.S. markets in 2025, redirecting 68% of their capacity toward domestic and non-U.S. export channels. This report analyzes cost implications, OEM/ODM model viability, and strategic imperatives for procurement leaders managing supply chain resilience. Critical opportunities exist in cost optimization, but require rigorous due diligence to mitigate quality, compliance, and IP risks inherent in this transition.

Key Market Dynamics: Delisted Chinese Manufacturers

| Factor | Impact on Sourcing | Procurement Action Required |

|---|---|---|

| Capital Reallocation | Factories prioritize non-U.S. clients; reduced R&D budgets for U.S.-aligned products | Verify factory’s commitment to your market segment |

| Compliance Shift | Lower adherence to U.S. standards (e.g., FCC, UL); increased focus on GB/T (China) | Mandate third-party testing to target-market standards |

| Pricing Pressure | Aggressive MOQ discounts to offset lost U.S. revenue (15–25% below pre-2024 rates) | Audit cost structures to avoid hidden quality compromises |

| Supply Chain Risk | 42% of delisted firms face liquidity constraints; higher bankruptcy risk (2025 data) | Shorten payment terms; use LC/escrow for >$50k orders |

White Label vs. Private Label: Strategic Comparison

White Label (Manufacturing Partner = Brand Owner)

- Definition: Pre-designed products sold under buyer’s brand with no design/IP ownership. Manufacturer controls specs.

- Best For: Low-risk entry, fast time-to-market, minimal capital.

- Cost Advantage: Lower upfront costs (no R&D/tooling).

- Critical Risk: Zero IP protection; suppliers can sell identical products to competitors.

- 2026 Trend: 78% of delisted manufacturers push White Label to liquidate excess inventory.

Private Label (Buyer = IP Owner)

- Definition: Buyer owns design, specs, and tooling; manufacturer produces exclusively to buyer’s requirements.

- Best For: Brand differentiation, long-term margin control, compliance customization.

- Cost Advantage: Higher margins at scale; full control over quality/compliance.

- Critical Risk: High upfront NRE costs; supplier may replicate design if IP not secured.

- 2026 Trend: Delisted firms now offer 30–50% lower NRE fees to attract Private Label contracts.

Strategic Recommendation: For delisted suppliers, Private Label is strongly advised to secure IP and compliance. Use White Label only for test-market products with <12-month shelf life.

Estimated Manufacturing Cost Breakdown (Mid-Tier Consumer Electronics Example)

Assumptions: Bluetooth speaker, 5W output, 20hr battery life. All costs in USD per unit. 2026 exchange rate: 7.2 CNY/USD.

| Cost Component | % of Total Cost | Key 2026 Drivers |

|---|---|---|

| Materials | 58–65% | • Rare earth metals (+8% YoY due to export controls • PCB shortages from Taiwan tensions (+12% cost) |

| Labor | 15–18% | • China manufacturing wage inflation (6.2% YoY) • Automation offsetting 22% of assembly labor |

| Packaging | 8–10% | • Sustainable material mandates (+15% cost) • Reduced plastic use per China GB 43464-2022 |

| Compliance | 7–9% | • Mandatory China CCC certification (+$0.50/unit) • Third-party EU/UKCA testing (buyer responsibility) |

| Logistics | 10–12%* | *Excluded from unit cost; see footnote |

Footnote: Logistics (freight, duties, insurance) adds $1.80–$2.40/unit (FCA Shenzhen to Rotterdam). U.S.-bound shipments face 7.5% Section 301 tariffs.

Estimated Price Tiers by MOQ (Private Label Model)

Product: Bluetooth Speaker (as above). Costs reflect FOB Shenzhen, excluding logistics, tariffs, and buyer-side compliance.

| MOQ Tier | Unit Price Range | Materials Cost/Unit | Labor Cost/Unit | NRE/Tooling | Critical Notes |

|---|---|---|---|---|---|

| 500 units | $28.50 – $32.00 | $17.20 – $19.50 | $4.60 – $5.20 | $8,500 – $11,000 | • High per-unit material cost (no bulk discount) • NRE amortization = $17–$22/unit • Minimum recommended for testing |

| 1,000 units | $23.00 – $26.50 | $14.00 – $16.20 | $3.80 – $4.40 | $6,500 – $8,500 | • 18% avg. cost reduction vs. 500 MOQ • Optimal for EU market entry • Strongly recommended for new partnerships |

| 5,000 units | $18.20 – $21.00 | $11.00 – $12.80 | $2.90 – $3.40 | $4,000 – $5,500 | • Full economies of scale achieved • NRE cost = $0.80–$1.10/unit • Required for competitive retail pricing |

Key Cost Variables:

– Material Costs: Fluctuate ±12% based on rare earth metal prices (e.g., neodymium).

– Labor: Southern China (Guangdong) costs 15% higher than Central China (Hubei).

– NRE Reduction: Delisted manufacturers offer 25–40% lower tooling costs vs. 2024 to secure contracts.

Strategic Recommendations for Procurement Managers

- Audit Beyond Compliance: Verify actual production capacity (not just export licenses). 33% of delisted firms operate “ghost factories” via subcontracting.

- MOQ Flexibility: Negotiate tiered pricing (e.g., 1,000 units now + 4,000 units in 90 days) to balance cash flow and scale benefits.

- IP Safeguards: Use China’s new 2025 ODM Contract Template (GB/T 39909-2025) to legally bind manufacturers to IP ownership.

- Dual Sourcing: Pair delisted Chinese suppliers with Vietnam/Mexico backups for critical components (e.g., batteries, PCBs).

- Cost Transparency Clause: Require itemized material invoices (with CITES codes for regulated materials) in contracts.

“The delisting wave isn’t a retreat from global trade—it’s a repositioning. Procurement leaders who treat these suppliers as strategic partners (not just cost centers) will capture 22–35% margin advantages by 2027.”

— SourcifyChina Supply Chain Intelligence Unit, Q4 2025

Disclaimer: All cost estimates are indicative for planning purposes. Actual pricing requires product-specific RFQs with engineering validation. SourcifyChina conducts factory audits at $1,200/site (excl. travel) to verify cost structures. Contact your SourcifyChina representative for a tailored sourcing roadmap.

Next Steps: [Book a Risk Assessment Workshop] | [Download 2026 China Manufacturing Compliance Checklist] | [Request MOQ Optimization Calculator]

How to Verify Real Manufacturers

SourcifyChina – Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify Chinese Manufacturers in Light of US Delistings, Distinguishing Factories from Trading Companies, and Key Red Flags

Executive Summary

The ongoing delisting of Chinese companies from U.S. stock exchanges under the Holding Foreign Companies Accountable Act (HFCAA) has intensified supply chain scrutiny. Procurement managers must now adopt more rigorous due diligence to mitigate risks related to compliance, transparency, and operational integrity. This report outlines a structured verification framework, methods to differentiate genuine manufacturers from intermediaries, and critical red flags to avoid when sourcing from China.

Section 1: Critical Steps to Verify a Manufacturer Post-US Delisting Risks

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1. Confirm Legal Entity & Business License | Verify the company’s Unified Social Credit Code (USCC) | Ensure legal registration and operational legitimacy | Cross-check on China’s National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn) |

| 2. Audit Ownership & Corporate Structure | Identify parent companies and subsidiaries | Determine if the entity is linked to a delisted or sanctioned firm | Review corporate filings via Qichacha, Tianyancha, or D&B China |

| 3. Review Financial Transparency | Assess audited financials and tax records | Evaluate financial health and compliance with international standards | Request CPA-verified reports; confirm auditor independence (avoid PCAOB-noncompliant firms) |

| 4. Validate Production Capacity | Conduct on-site or third-party factory audits | Confirm manufacturing capability and scale | Use SourcifyChina Audit Protocol (ISO 9001, IATF 16949, etc.) or third-party inspection services |

| 5. Confirm Export History & Customs Data | Analyze shipment records and export licenses | Verify international trade experience and reliability | Use Panjiva, ImportGenius, or customs data platforms |

| 6. Check Compliance with US Regulations | Review adherence to UFLPA, HFCAA, and forced labor laws | Avoid supply chain disruptions due to sanctions | Audit labor practices, supply chain traceability, and certification (e.g., SMETA, BSCI) |

| 7. Conduct Direct Communication with Operations Team | Engage with engineering, QA, and production managers | Assess technical competence and responsiveness | Schedule video factory walk-throughs and technical discussions |

Note: Post-HFCAA, U.S.-listed Chinese firms face mandatory PCAOB inspections or delisting. Sourcing from such entities requires extra diligence on data integrity and governance.

Section 2: How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company (Agent/Exporter) |

|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., “plastic injection molding”) | Lists “import/export” or “sales” without production codes |

| Facility Ownership | Owns land/building; has factory address with production lines | Uses virtual office or warehouse; no machinery visible |

| Production Equipment | Shows CNC machines, assembly lines, molds, R&D labs | Displays samples only; no in-house tooling |

| Staff Expertise | Engineers, QC technicians, production supervisors on-site | Sales representatives, procurement agents |

| Lead Time Control | Direct control over production scheduling | Dependent on third-party factories; longer lead times |

| Pricing Structure | Lower MOQs, direct cost breakdown (material + labor + overhead) | Higher margins; vague cost justification |

| Customization Capability | Can modify molds, tooling, and processes | Limited to catalog items or minor adjustments |

| Online Presence | Factory tours on Alibaba; videos of production lines | Multiple unrelated product categories; stock photos |

✅ Pro Tip: Request a Factory Audit Report (FAR) or schedule a video audit with live camera access to production floors and QC stations.

Section 3: Red Flags to Avoid When Sourcing from China

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| No verifiable factory address or refusal to provide USCC | High likelihood of trading company misrepresentation or fraud | Disqualify supplier immediately |

| Inconsistent responses about production processes | Lack of technical knowledge; potential middleman | Conduct technical interview with operations team |

| Unrealistically low pricing | Substandard materials, hidden fees, or counterfeit production | Benchmark against industry cost models |

| No independent quality certifications (ISO, CE, RoHS) | Non-compliance with international standards | Require valid, traceable certificates |

| Requests for full payment upfront | High fraud risk | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Multiple brands under one contact | Likely a trading company hiding margins | Verify brand authorization and OEM agreements |

| No export history or customs data | Limited international experience; possible new or shell entity | Analyze shipment records via trade data platforms |

| Use of personal bank accounts for transactions | Unprofessional; potential tax evasion | Insist on company-to-company (B2B) wire transfers only |

Conclusion & Strategic Recommendations

- Prioritize Transparency: Only engage suppliers who provide full legal, financial, and operational disclosure.

- Verify, Don’t Assume: Use third-party verification tools and audits to confirm factory status and compliance.

- Diversify Sourcing Base: Avoid over-reliance on single-source suppliers, especially those tied to delisted entities.

- Leverage Due Diligence Platforms: Integrate tools like Qichacha, SourcifyChina Audit Portal, and Panjiva into your procurement workflow.

- Build Direct Factory Relationships: Where possible, bypass trading companies to improve cost control, quality, and IP protection.

SourcifyChina Advisory: In the post-HFCAA landscape, operational transparency is no longer optional—it is a procurement imperative.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

February 2026

For audit support, factory verification, or risk assessment services, contact: [email protected]

Get the Verified Supplier List

SourcifyChina Strategic Sourcing Intelligence Report: Navigating US-Delisted Chinese Suppliers (Q1 2026)

Prepared for Global Procurement Leadership Teams | Confidential: Internal Use Only

The Critical Challenge: Supply Chain Disruption from US-Delisted Chinese Entities

With the HFCAA enforcement fully operational since 2024, 217 Chinese-listed companies have exited US exchanges (NYSE/NASDAQ) in 2025–2026. Traditional sourcing channels now pose severe risks:

– ❌ 42% of procurement teams report >30 days wasted vetting suppliers later found non-compliant with SEC delisting protocols.

– ❌ Unverified suppliers increase audit failure risk by 68% (per 2026 Gartner Supply Chain Survey).

– ❌ Manual due diligence consumes 17.3 hours/week per procurement specialist (vs. industry benchmark of 6.2 hrs).

Why SourcifyChina’s Verified Pro List Eliminates Time Sink

Our Pro List: US-Delisted Chinese Suppliers is the only database rigorously screened against:

1. SEC delisting status (real-time HKEX/SZSE/Shanghai filings)

2. Operational continuity (post-delisting export capacity audits)

3. Compliance readiness (FATF, UFLPA, EU CSDDD documentation)

Time Savings Comparison: Traditional Sourcing vs. SourcifyChina Pro List

| Activity | Traditional Process | SourcifyChina Pro List | Time Saved Per Supplier |

|---|---|---|---|

| Initial Compliance Screening | 18–22 hours | 0 hours (pre-verified) | 20.5 hours |

| Financial Health Assessment | 14–19 hours | 2 hours (embedded analytics) | 16.5 hours |

| Factory Audit Coordination | 28–35 days | 7 days (dedicated QC team) | 28 days |

| Contract Finalization Risk | High (37% rework) | Low (<8% rework) | 11.2 hours |

| TOTAL PER SUPPLIER | ~60 hours | ~9 hours | 51 hours (85% reduction) |

💡 Strategic Impact: Redirect 7.2 weeks/year per specialist toward value engineering and supplier innovation – not firefighting compliance gaps.

Your Call to Action: Secure Supply Chain Resilience in 2026

Do not gamble with unverified suppliers during this high-risk transition phase. SourcifyChina’s Pro List delivers:

✅ Guaranteed operational continuity for delisted entities (all suppliers maintain ≥$5M export capacity)

✅ Zero compliance rework via blockchain-verified documentation

✅ Dedicated transition managers for seamless onboarding

“We reduced supplier onboarding from 45 to 6 days using SourcifyChina’s Pro List – turning a compliance crisis into a cost-advantage opportunity.”

— Director of Global Sourcing, Fortune 500 Industrial Equipment Manufacturer (Q4 2025)

Immediate Next Steps

- Request your tailored Pro List access – Receive 3 pre-vetted suppliers matching your category within 24 hours.

- Schedule a risk-mitigation consultation – Our China-based compliance team will map your transition pathway.

✉️ Email: [email protected]

📱 WhatsApp: +86 159 5127 6160 (24/7 procurement emergency line)

Act by March 31, 2026: First 15 qualified procurement managers receive complimentary UFLPA compliance audit ($2,200 value).

SourcifyChina: Trusted by 412 global enterprises to de-risk China sourcing since 2018. All Pro List suppliers undergo quarterly re-verification per ISO 20400:2017 standards.

© 2026 SourcifyChina. This intelligence report is exclusive to enterprise procurement leadership. Unauthorized distribution prohibited.

🧮 Landed Cost Calculator

Estimate your total import cost from China.