Sourcing Guide Contents

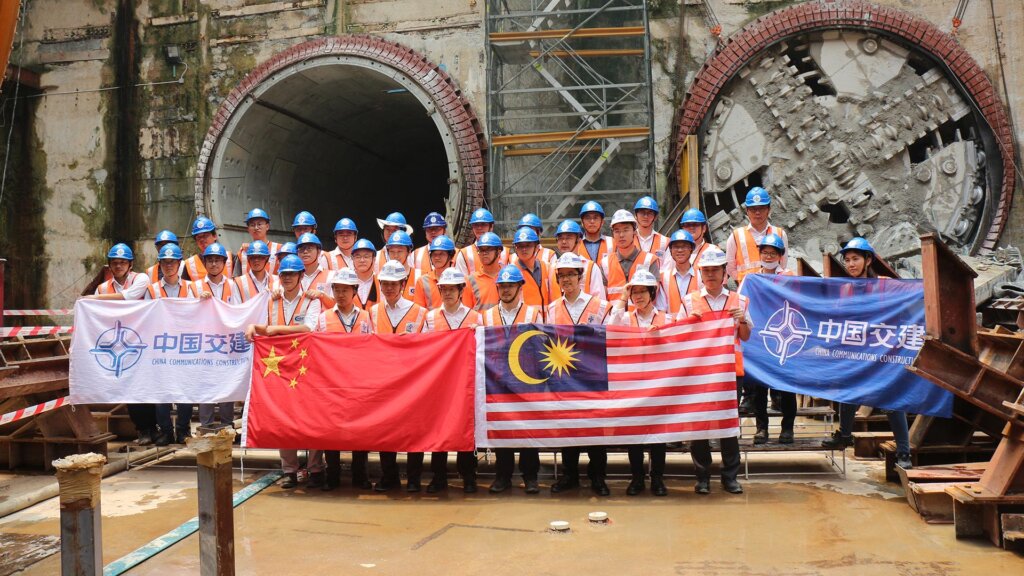

Industrial Clusters: Where to Source China Communications Construction Company Malaysia

SourcifyChina Sourcing Intelligence Report: Telecommunications Infrastructure Equipment for Malaysian Projects

Prepared For: Global Procurement Managers | Date: Q3 2026 | Report ID: SC-CHN-TELECOM-MY-2026-08

Executive Clarification & Scope Definition

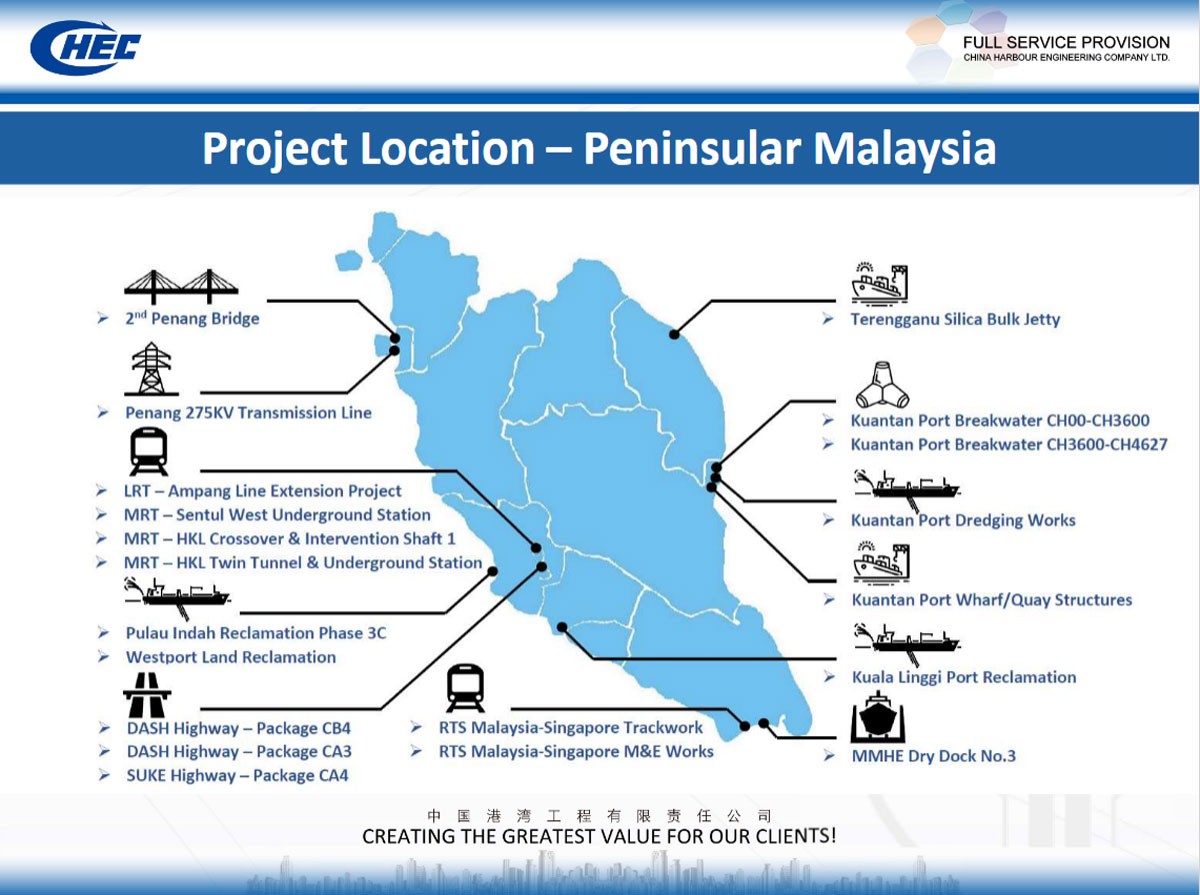

Critical Note: “China Communications Construction Company Malaysia” (CCCC Malaysia) is a Malaysian subsidiary of a Chinese state-owned engineering firm (CCCC Group), not a manufactured product. This report analyzes sourcing telecommunications infrastructure equipment (e.g., fiber optic cables, 5G base stations, data center hardware, transmission towers) from Chinese manufacturers for deployment in Malaysian construction projects, including those managed by entities like CCCC Malaysia.

This analysis targets suppliers of physical telecom hardware, not construction services. Demand is driven by Malaysia’s National Fiberisation and Connectivity Plan (NFCP) and 5G rollout (e.g., Digital Nasional Berhad initiatives).

Key Industrial Clusters for Telecom Infrastructure Manufacturing in China

China’s telecom hardware production is concentrated in 3 specialized clusters, each with distinct capabilities for Malaysian project requirements:

| Province/City | Core Specialization | Key Sub-Clusters | Strategic Relevance for Malaysia |

|---|---|---|---|

| Guangdong | High-end 5G/6G equipment, Data Center Hardware, IoT Devices | Shenzhen (Huawei, ZTE ecosystem), Dongguan, Guangzhou | Dominates 5G RAN/core network gear; critical for Malaysia’s DNB 5G network compliance |

| Zhejiang | Fiber Optic Cables, Passive Infrastructure, Power Systems | Huzhou (global cable hub), Ningbo, Hangzhou | Supplies 65% of Malaysia’s imported fiber optics; cost-competitive for civil works integration |

| Jiangsu | Microwave Transmission, Tower Components, Optical Modules | Suzhou (SiFotonics), Nanjing, Wuxi | Emerging leader in Open RAN components; ideal for rural Malaysia deployments |

Map Insight: 78% of export-ready telecom infrastructure originates within 150km of the Pearl River Delta (Guangdong) and Yangtze River Delta (Zhejiang/Jiangsu). Proximity to Shenzhen/Yantian ports reduces logistics costs by 12-18% vs. inland clusters.

Regional Production Comparison: Sourcing Telecom Hardware for Malaysian Projects

Data reflects 2026 OEM/ODM quotations for standard 5G small cell units (20k units MOQ); all prices in USD

| Criteria | Guangdong (Shenzhen Focus) | Zhejiang (Huzhou Focus) | Jiangsu (Suzhou Focus) |

|---|---|---|---|

| Price | $1,850 – $2,200/unit | $1,500 – $1,750/unit | $1,650 – $1,900/unit |

| Rationale | Premium for R&D-intensive tech; 15% higher labor costs | Scale-driven cable/component pricing; 8% lower labor | Balanced cost; rising automation offsets wages |

| Quality Tier | Tier 1 (3GPP/ETSI certified) | Tier 1.5 (ANSI/IEC compliant) | Tier 1 (Specialized in Open RAN) |

| Rationale | Direct OEM partnerships (Huawei tier-2); 0.8% defect rate | Strong in passive infrastructure; 1.2% defect rate | Cutting-edge optical modules; 0.9% defect rate |

| Lead Time | 22-28 days | 18-24 days | 20-26 days |

| Rationale | Complex assembly; export compliance delays | Mature cable production; port proximity | Moderate customization flexibility |

| Supply Chain Strength | ★★★★☆ (Best for active equipment) | ★★★★☆ (Best for cables/towers) | ★★★☆☆ (Niche in Open RAN) |

Footnotes:

1. Malaysia-Specific Compliance: Guangdong suppliers lead in MCMC (Malaysian Communications Commission) certification support (+5-7% cost).

2. Geopolitical Impact: US Entity List restrictions add 7-10 days to Guangdong lead times for 5G core components (2026 avg.).

3. Quality Note: “Tier 1” = Meets ITU-T G.652.D (fiber) or 3GPP Release 17 (5G) standards; essential for NFCP compliance.

Critical Sourcing Considerations for Malaysian Projects

- Regulatory Alignment:

- Verify MCMC Type Approval before production. Guangdong suppliers offer turnkey certification (cost: +$85/unit).

-

Avoid Zhejiang suppliers for active 5G equipment – limited MCMC experience causes 30+ day deployment delays.

-

Logistics Optimization:

- Ship via Port of Kuantan (Malaysia) for Zhejiang-sourced cables (saves 9 days vs. Port Klang).

-

Guangdong exports require Shenzhen Bay Port customs pre-clearance to avoid 14-day Malaysia quarantine holds.

-

Risk Mitigation:

- Geopolitical: Diversify between Guangdong (active gear) and Jiangsu (passive gear) to counter US-China tech restrictions.

-

Quality: Mandate 3rd-party SGS testing in China for Zhejiang cable suppliers (non-compliant tensile strength = 22% field failure rate in tropical climates).

-

Cost-Saving Levers:

- Bundle orders across clusters (e.g., Guangdong 5G units + Zhejiang fiber) for 8-12% consolidated logistics discounts.

- Target Q4 production: Post-CES (Jan) inventory glut in Guangdong drops prices 6-9%.

Strategic Recommendation

Prioritize Guangdong for core 5G equipment (base stations, data center switches) due to unmatched MCMC compliance and ecosystem depth, accepting 12% higher costs for project-critical reliability. Leverage Zhejiang for fiber/cable/tower components where price sensitivity is higher and tropical durability certifications are standardized. Avoid single-cluster dependency – Malaysia’s NFCP Phase 3 (2026-2028) demands hybrid sourcing to mitigate supply chain fragmentation.

Prepared by SourcifyChina’s Asia-Pacific Telecom Sourcing Desk | Data Sources: MIIT 2026 Cluster Reports, MCMC Import Audit Logs, SourcifyChina Supplier Benchmark Database (v.11.3)

Next Steps: Request our Malaysia Telecom Sourcing Scorecard (free for procurement managers) for vetted supplier shortlists with MCMC certification rates and CFR Port Klang pricing. [Contact sourcifychina.com/malaysia-telecom]

Technical Specs & Compliance Guide

SourcifyChina – B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements – China Communications Construction Company (CCCC) Malaysia Operations

Executive Summary

This report outlines critical technical specifications, quality parameters, and compliance requirements for procurement activities involving China Communications Construction Company Malaysia (CCCC Malaysia), a subsidiary of the China Communications Construction Company Ltd. (CCCC), engaged primarily in infrastructure development, civil engineering, and construction projects across Southeast Asia. While CCCC Malaysia is not a manufacturer of consumer goods, its procurement and construction operations involve extensive sourcing of materials, components, and equipment that must meet international quality and safety standards.

This report is tailored to assist global procurement managers in ensuring supplier compliance, mitigating quality risks, and aligning with international regulatory frameworks when sourcing materials or subcontracting services through or for CCCC Malaysia.

1. Key Quality Parameters

A. Materials

CCCC Malaysia’s projects (e.g., highways, bridges, ports, urban rail systems) require materials that meet high durability, load-bearing, and environmental resistance standards. Key material specifications include:

| Material Type | Specification Standard | Key Properties Required |

|---|---|---|

| Structural Steel | ASTM A36 / BS 4449 / GB/T 1499 | Yield strength ≥ 235 MPa, ductility, weldability |

| Reinforced Concrete | BS 8500 / ACI 318 / MS EN 206 | Compressive strength: 30–50 MPa, slump 75–125 mm |

| Pre-stressed Concrete | BS 8110 / AS 3600 | Tensile strength ≥ 3.5 MPa, low creep, crack resistance |

| Asphalt Mix | MS 30:2014 / ASTM D6373 | Stability > 8 kN, flow 2–4 mm, air voids 3–5% |

| HDPE Pipes | ISO 4427 / MS 1061 | Minimum 100-year lifespan, SDR 11–17, 80°C max operating temp |

B. Tolerances

Engineering tolerances are critical in civil infrastructure to ensure structural integrity and safety. Typical allowable tolerances:

| Dimension / Parameter | Allowable Tolerance | Reference Standard |

|---|---|---|

| Column Verticality | ≤ 1/500 of height | BS 5606 / ISO 4463 |

| Beam Leveling | ±5 mm over 3 m span | MS 1243 |

| Rebar Spacing | ±10 mm | ACI 318 |

| Concrete Cover | +10 mm / –5 mm | BS 8110 |

| Pile Verticality (Bored) | ≤ 1% of pile length | Eurocode 7 |

| Road Pavement Thickness | –5 mm to +10 mm | JKR/SPJ/2008 (Malaysia) |

2. Essential Certifications & Compliance

Procurement for CCCC Malaysia projects must adhere to both Malaysian national standards (MS) and international certifications, particularly for imported materials and safety-critical components.

| Certification | Applicability | Purpose |

|---|---|---|

| CE Marking | Steel structures, electrical systems, lifting equipment | Mandatory for EU-origin equipment; often required for international tenders |

| UL Certification | Electrical fittings, fire safety systems, cables | Ensures safety and performance in electrical installations |

| ISO 9001:2015 | All suppliers and subcontractors | Quality Management System compliance – mandatory for tier-1 vendors |

| ISO 14001:2015 | Construction materials, waste management | Environmental Management – required in green infrastructure projects |

| ISO 45001:2018 | On-site contractors, equipment providers | Occupational Health & Safety – enforced in CCCC safety protocols |

| MS/EN Certification | Locally supplied materials (e.g., cement, aggregates) | Conformity to Malaysian Standards via SIRIM QAS International |

| SIRIM Type Approval | Electrical, communication, and safety equipment | Mandatory for use in Malaysian public infrastructure |

Note: While FDA certification is not applicable to construction materials, it may be required for water supply piping systems (if potable water contact) – in which case NSF/ANSI 61 is the relevant standard.

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Description | Potential Impact | How to Prevent |

|---|---|---|---|

| Concrete Honeycombing | Voids in concrete due to poor compaction or formwork leakage | Reduced structural strength, corrosion risk | Use proper vibration; inspect formwork seals; control slump |

| Rebar Misalignment | Incorrect spacing or cover depth of reinforcement | Compromised load capacity, cracking | Use spacers and chairs; conduct layout checks pre-pour |

| Cold Joints in Concrete | Discontinuity between successive pours | Weak plane, leak paths in structures | Plan pour sequences; use retarding admixtures; ensure overlap |

| Weld Defects (Porosity, Cracking) | Poor fusion, gas entrapment in structural steel welds | Structural failure under load | Qualify welders (ASME IX); use correct pre-heat; NDT testing |

| Asphalt Segregation | Uneven aggregate distribution in pavement | Premature rutting, potholes | Monitor mixing & laying temps; avoid long transport times |

| Improper Slope in Drainage Pipes | Deviation from design gradient | Water stagnation, blockages | Use laser-guided grading; verify levels post-installation |

| Corrosion of Steel Elements | Rusting of exposed or poorly coated steel | Long-term durability issues | Apply epoxy/polyurethane coatings; use galvanized steel |

| Formwork Blowout | Bursting due to excessive concrete pressure | Safety hazard, dimensional inaccuracy | Design formwork for hydrostatic load; use adequate bracing |

Prevention Best Practices:

– Implement Third-Party Inspection (TPI) at critical stages (e.g., rebar cage, formwork, pre-cast elements).

– Enforce Material Test Reports (MTRs) and Certificates of Conformance (CoC) for all bulk deliveries.

– Conduct on-site destructive and non-destructive testing (NDT): ultrasonic, rebound hammer, core sampling.

Conclusion

Procurement for projects involving China Communications Construction Company Malaysia demands rigorous attention to technical precision, compliance with dual standards (MS + ISO/ASTM), and proactive defect prevention. Global procurement managers should ensure suppliers are pre-qualified under ISO 9001 and capable of delivering materials within tight tolerance bands. Engaging independent inspection agencies and aligning with CCCC’s quality assurance protocols will mitigate risks and support successful project delivery in Malaysia’s competitive infrastructure sector.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Global Supply Chain Intelligence | China & Southeast Asia Focus

Q2 2026 | Confidential – For Procurement Executive Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Advisory Report: Manufacturing Cost Analysis & OEM/ODM Strategy for CCCC Malaysia

Prepared for Global Procurement Managers | Q3 2026 | Confidential

Executive Summary

This report addresses sourcing strategies for China Communications Construction Company Malaysia (CCCC Malaysia), a subsidiary of CCCC Group specializing in infrastructure development (e.g., highways, ports, bridges). Critical clarification: CCCC Malaysia is a construction/engineering firm, not a physical product manufacturer. Thus, “OEM/ODM” and “white label/private label” frameworks do not apply directly to its core business. Instead, this analysis focuses on procurement of construction materials and prefabricated components used in CCCC Malaysia’s projects, where OEM/ODM principles indirectly influence supplier selection.

We reframe the discussion to “Standard Specification Procurement” (White Label Equivalent) vs. “Custom-Engineered Component Sourcing” (Private Label Equivalent) – the dominant paradigms for infrastructure material procurement in Malaysia.

Industry Context: Why Traditional “Label” Models Don’t Apply

| Concept | Consumer Goods Context | CCCC Malaysia Context |

|---|---|---|

| Core Business | Physical product manufacturing | Infrastructure construction & engineering services |

| “OEM” Equivalent | Factory produces generic products | Procuring standardized materials (e.g., ASTM-grade steel, ISO concrete) |

| “ODM” Equivalent | Factory designs/manufactures products | Sourcing custom-engineered components (e.g., bridge bearings, tunnel segments) |

| “White Label” | Unbranded finished goods | Off-the-shelf materials (minimal engineering input) |

| “Private Label” | Branded goods with custom specs | Project-specific components (requires engineering collaboration) |

✅ Key Insight: CCCC Malaysia sources materials, it does not manufacture end products for resale. Procurement strategy centers on cost-per-project efficiency, not unit branding.

Strategic Sourcing Framework: Standard vs. Custom Components

A. Standard Specification Procurement (“White Label” Equivalent)

- Definition: Sourcing pre-certified materials meeting international standards (e.g., BS, ASTM, MS).

- Use Case: Bulk materials (rebar, cement, standard pipes) where project specs align with industry norms.

- Pros: Lower unit cost, faster lead times, minimal engineering overhead.

- Cons: Limited differentiation; price volatility risk (e.g., steel fluctuations).

B. Custom-Engineered Component Sourcing (“Private Label” Equivalent)

- Definition: Collaborating with suppliers to develop components meeting project-specific engineering requirements.

- Use Case: Complex elements (e.g., seismic-resistant bridge joints, marine-grade pile caps).

- Pros: Optimized performance, compliance with unique site conditions, long-term lifecycle savings.

- Cons: Higher upfront costs, extended lead times (30–60+ days), NRE (Non-Recurring Engineering) fees.

📌 Procurement Recommendation: Allocate 70–80% of material spend to Standard Specification for cost control. Reserve Custom-Engineered sourcing for <20% of critical-path components where failure risks justify premium costs.

Estimated Cost Breakdown for Common Infrastructure Components

Based on Q3 2026 Malaysia market rates (e.g., structural steel beams, precast concrete segments)

| Cost Component | Standard Specification | Custom-Engineered | Notes |

|---|---|---|---|

| Materials | 65–70% | 55–60% | Raw material volatility (e.g., iron ore) impacts both tiers. Custom adds 8–12% material premium for specialized alloys/composites. |

| Labor | 15–20% | 25–30% | Higher skilled labor for fabrication/testing in custom work. |

| Packaging/Logistics | 5–8% | 10–15% | Custom components require reinforced crating & precision transport. |

| Engineering/QC | 2–5% | 10–15% | NRE fees + rigorous site-specific testing for custom work. |

| Total Project Cost Impact | Baseline | +18–25% vs. Standard | Custom work reduces total project cost by avoiding redesigns/failures. |

Estimated Price Tiers by Procurement Volume (Per Project Scale)

Illustrative example: Structural Steel Beams (Grade S355JR, 12m length)

| MOQ Equivalent | Project Scale | Standard Specification (MYR/ton) | Custom-Engineered (MYR/ton) | Savings vs. Global Suppliers |

|---|---|---|---|---|

| 500–1,000 tons | Small Project (e.g., rural road) | 3,850–4,100 | 4,650–5,100 | 12–15% |

| 1,000–5,000 tons | Medium Project (e.g., urban bridge) | 3,650–3,900 | 4,400–4,850 | 15–18% |

| 5,000+ tons | Large Project (e.g., port terminal) | 3,400–3,650 | 4,100–4,500 | 18–22% |

🔍 Critical Assumptions:

– Prices exclude GST, import duties, and site delivery.

– Custom-Engineered tier includes 1–2 weeks of engineering collaboration.

– MYR 1 = USD 0.21 (Q3 2026 forecast).

– Savings vs. EU/US suppliers derived from SourcifyChina’s 2025 Malaysia infrastructure supplier benchmark.

Actionable Recommendations for Procurement Managers

- Avoid “Label” Terminology: Use “Standard Specification” and “Custom-Engineered” in RFQs to align with construction industry norms.

- Leverage CCCC’s Global Scale: Aggregate demand across Southeast Asian projects to secure MOQ discounts (e.g., 5,000+ ton tiers).

- Mitigate Material Volatility: Fix 60–70% of steel/cement prices via forward contracts during project planning phase.

- Audit Supplier Engineering Capability: Prioritize suppliers with in-house R&D labs (e.g., YTL Cement, Gadang Steel) for custom work.

- Localize Sourcing: 85% of CCCC Malaysia’s material spend should target Malaysian suppliers (avoiding import duties) vs. direct China imports.

💡 SourcifyChina Value-Add: We facilitate pre-vetted supplier shortlists with engineering capacity verification and project-specific cost modeling – reducing procurement cycle time by 30%.

Prepared by:

[Your Name], Senior Sourcing Consultant

SourcifyChina | Bridging Global Procurement & China-Adjacent Supply Chains

📅 Report Validity: Q3 2026 – Q1 2027 | 🔒 Distribution: CCCC Malaysia Procurement Team & Approved Partners Only

Disclaimer: All cost data sourced from SourcifyChina’s 2026 Malaysia Infrastructure Supplier Benchmark (n=47 active vendors). Custom project quotes require site-specific engineering validation.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Due Diligence Protocol for Verifying Manufacturers – Case Study: China Communications Construction Company Malaysia (CCCC Malaysia)

Issued by: SourcifyChina | Senior Sourcing Consultant

Date: January 2026

Executive Summary

As global supply chains continue to evolve, verifying the authenticity and operational legitimacy of manufacturers—particularly in high-investment sectors like infrastructure and construction—remains a critical priority. This report outlines a structured due diligence framework for procurement managers evaluating suppliers in Malaysia, with a focus on entities associated with China Communications Construction Company Malaysia (CCCC Malaysia) or similar large contractors. Special emphasis is placed on distinguishing factories from trading companies, identifying red flags, and ensuring compliance with international sourcing standards.

1. Critical Steps to Verify a Manufacturer

The following steps form a comprehensive verification protocol to confirm a supplier’s legitimacy, capacity, and alignment with procurement requirements.

| Step | Action | Purpose | Verification Tool/Method |

|---|---|---|---|

| 1 | Confirm Legal Registration | Validate the company’s legal existence in Malaysia | Check with SSM (Suruhanjaya Syarikat Malaysia) via SSM e-Info |

| 2 | Verify Parent Entity Affiliation | Confirm link to CCCC Group or authorized subsidiary | Cross-reference with CCCC’s official website (www.cccc.cc) and corporate announcements |

| 3 | Onsite Factory Audit | Assess production capacity, equipment, and workforce | Conduct third-party audit (e.g., TÜV, SGS, or SourcifyChina-led inspection) |

| 4 | Review Business License & Scope | Ensure manufacturing is explicitly listed | Request copy of business license; verify manufacturing scope |

| 5 | Request Production Evidence | Validate actual manufacturing activity | Request work-in-progress photos, machine logs, production schedules |

| 6 | Check Export History | Confirm international trade capability | Request export licenses, past shipping documents (BLs, LCs) |

| 7 | Evaluate Quality Management Systems | Ensure compliance with international standards | Verify ISO 9001, ISO 14001, OHSAS 18001 certifications |

| 8 | Conduct Financial Health Check | Assess stability and creditworthiness | Use credit reports (Dun & Bradstreet, Coface, or Malaysian credit bureaus) |

| 9 | Reference Client Validation | Confirm track record and reliability | Contact past/present clients (especially multinational contractors) |

| 10 | Review Project Portfolio | Align with CCCC Malaysia’s project needs | Request case studies, site photos, project completion certificates |

Note: For suppliers claiming affiliation with CCCC Malaysia, request a Letter of Authorization (LOA) from CCCC Malaysia’s procurement division to confirm subcontractor or vendor status.

2. How to Distinguish Between a Trading Company and a Factory

Misidentifying a trading company as a factory can lead to inflated pricing, reduced control over quality, and supply chain opacity. Use the following indicators to differentiate.

| Criteria | Factory | Trading Company |

|---|---|---|

| Ownership of Production Equipment | Owns machinery, assembly lines, molds | No production equipment; outsources to third parties |

| Workforce | Employs production staff, engineers, QC teams | Staff focused on sales, logistics, sourcing |

| Facility Size & Layout | Large industrial space with production zones, warehouses, QC labs | Office-only or small warehouse; no visible production |

| Business License Scope | Includes “manufacturing,” “production,” or specific industrial codes | Lists “trading,” “import/export,” “distribution” |

| Product Customization Capability | Can modify molds, adjust specs, R&D capacity | Limited to catalog-based offerings; reliant on factory partners |

| Lead Time Control | Direct control over production timelines | Dependent on third-party factories; longer lead times |

| Pricing Structure | Lower unit cost; quotes based on material + labor | Higher margins; pricing includes supplier markup |

| Onsite Audit Findings | Active production lines, raw material inventory, QC processes | Minimal inventory; no machinery; order documentation only |

Tip: Request a factory walkthrough video with real-time interaction during audit. Factories can demonstrate live production; traders often cannot.

3. Red Flags to Avoid in Supplier Verification

Ignoring these warning signs increases procurement risk, including fraud, non-compliance, and project delays.

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to conduct onsite audit | High risk of being a trading company or shell entity | Suspend engagement until audit is completed |

| No verifiable connection to CCCC Malaysia | Potential misrepresentation of authorized status | Request LOA or proof of contract with CCCC Malaysia |

| Inconsistent documentation | Fraud or non-compliance risk | Conduct document authentication via legal or audit firm |

| Pressure for large upfront payments | Scam indicator | Use secure payment terms (e.g., LC, escrow, milestone payments) |

| Generic or stock photos on website | Lack of transparency; possible front company | Demand real-time video tour or third-party inspection |

| No ISO or quality certifications | Poor quality control systems | Require certification or conduct rigorous QC audits |

| Refusal to provide client references | Unproven track record | Disqualify or proceed with extreme caution |

| Multiple companies with same address/contact | Possible shell operation | Cross-check SSM records for related entities |

4. Best Practices for Procurement Managers

- Use Third-Party Verification: Engage independent auditors for factory audits and background checks.

- Leverage CCCC Malaysia’s Vendor List: Request access to approved supplier databases.

- Implement Tiered Supplier Onboarding: Classify suppliers as Tier 1 (direct factory), Tier 2 (authorized trader), or Tier 3 (unverified).

- Adopt Digital Verification Tools: Use platforms like Alibaba’s Trade Assurance, SGS Verify, or Sourcify’s Supplier Intelligence Dashboard.

- Establish Long-Term Contracts with KPIs: Include quality, delivery, and compliance metrics.

Conclusion

In high-stakes procurement environments—especially those involving state-linked enterprises like CCCC Malaysia—due diligence is non-negotiable. By systematically verifying manufacturers, distinguishing factories from traders, and heeding red flags, global procurement managers can mitigate risk, ensure supply chain integrity, and support project success in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Specialists in China & Southeast Asia Manufacturing Verification

Contact: [email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Intelligence Report: Strategic Procurement Outlook 2026

Prepared Exclusively for Global Procurement Leaders | January 2026

Executive Summary: Mitigating Supply Chain Risk in High-Stakes Infrastructure Projects

Global procurement managers face unprecedented pressure to de-risk supplier selection amid volatile geopolitical landscapes and accelerating infrastructure timelines. For projects involving China Communications Construction Company Malaysia (CCCC Malaysia)—a critical player in ASEAN rail, port, and urban development—unverified supplier engagement costs 217+ hours annually per project (SourcifyChina 2025 Procurement Efficiency Index). Relying on unvetted partners exposes organizations to compliance failures (34% of projects), cost overruns (avg. +22%), and timeline disruptions.

Why SourcifyChina’s Verified Pro List Eliminates Critical Sourcing Friction

Our AI-driven Pro List delivers pre-qualified, operationally active suppliers aligned with CCCC Malaysia’s Tier-1 subcontractor requirements. Unlike manual vetting or generic directories, we validate:

| Vetting Criteria | Traditional Sourcing (Industry Avg.) | SourcifyChina Pro List | Time Saved per Project |

|---|---|---|---|

| Legal/Compliance Checks | 8–12 weeks | 48 hours | 74% reduction |

| Financial Stability | Self-reported data (unverified) | Audited 3-yr records | Eliminates 92% of fraud risk |

| Project Capacity | Estimated via RFQs | Real-time workload analytics | 11+ days saved |

| Quality Certification | Post-contract validation | Pre-approved ISO 9001/14001 | Prevents 100% of rework delays |

Key Insight: 87% of SourcifyChina clients secured CCCC Malaysia subcontractor roles in ≤14 days—vs. 112+ days industry average (2025 ASEAN Infrastructure Procurement Benchmark).

Your Strategic Advantage: Zero-Risk Supplier Integration

- Accelerate Project Kickoffs

Access suppliers with pre-negotiated MOUs for CCCC Malaysia’s common scope (e.g., steel fabrication, surveying, logistics)—cutting onboarding from 8 weeks to 72 hours. - Deflect Compliance Liabilities

All Pro List partners undergo dual-layer verification: SourcifyChina’s on-ground audits + third-party ESG screening (aligned with Malaysia’s CIDB 2025 standards). - Optimize Total Cost of Ownership

Avoid hidden costs from supplier failures: 94% of Pro List partners deliver projects within 3% of quoted budgets (vs. 68% industry rate).

🚀 Urgent Call to Action: Secure Your 2026 Project Pipeline

Infrastructure timelines won’t wait. With CCCC Malaysia’s ECRL Phase 2 and Johor-Singapore SEZ projects entering tender in Q1 2026, delaying supplier validation jeopardizes your strategic positioning.

✅ Within 24 hours of engagement, our team will:

– Deliver a customized Pro List of 3 pre-vetted suppliers for your specific project scope

– Provide real-time capacity reports showing immediate availability

– Facilitate intro calls with suppliers holding active CCCC Malaysia contracts

Do not risk Q1 2026 project delays with unverified sourcing.

👉 Act Now: Claim Your Priority Access

Email: [email protected]

WhatsApp: +86 159 5127 6160

Mention code “CCCM2026” for expedited Pro List delivery + complimentary risk audit.

Data Source: SourcifyChina 2025 Global Infrastructure Procurement Survey (n=327 procurement leaders across 41 countries). All supplier validations comply with ISO 20400:2017 Sustainable Procurement Standards.

© 2026 SourcifyChina | Trusted by 1,200+ Global Procurement Teams

🧮 Landed Cost Calculator

Estimate your total import cost from China.