Sourcing Guide Contents

Industrial Clusters: Where to Source China Communication Parts Mold Wholesale

SourcifyChina Sourcing Intelligence Report: Communication Parts Mold Manufacturing in China (2026 Outlook)

Prepared For: Global Procurement Managers | Date: Q2 2026

Subject: Strategic Sourcing Analysis for Precision Communication Parts Molds

Executive Summary

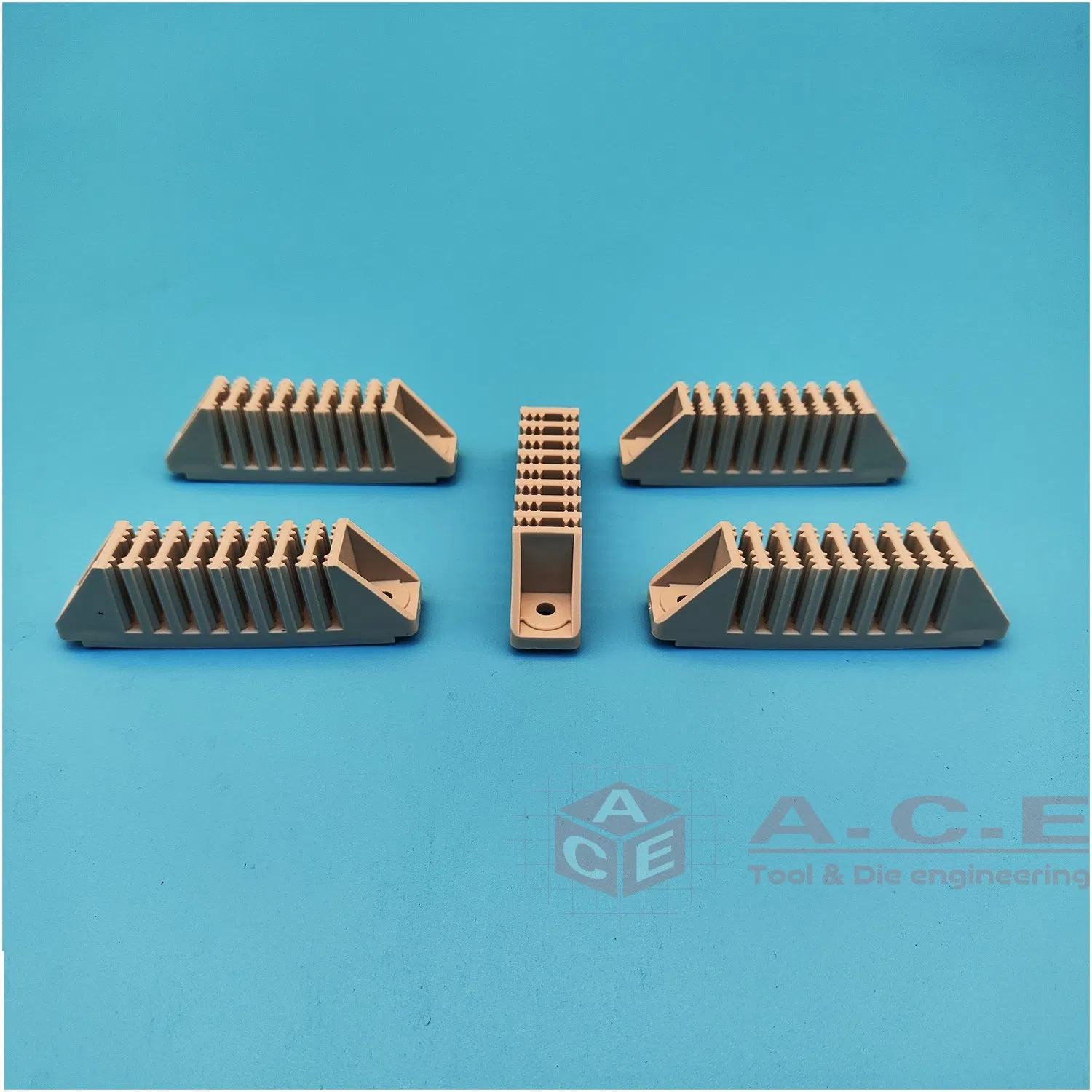

China remains the dominant global hub for precision mold manufacturing, supplying ~75% of the world’s communication parts molds (e.g., RF connectors, antenna housings, fiber optic components, 5G/mmWave structural parts). While “wholesale” implies commoditization, this sector is highly specialized, with molds being custom-engineered per OEM specifications. Price sensitivity is secondary to precision, repeatability, and compliance (e.g., ISO 9001, IATF 16949). Key clusters have evolved beyond cost arbitrage to offer integrated design-manufacturing solutions. Critical Note: “Wholesale” is a misnomer; procurement requires rigorous technical vetting.

Key Industrial Clusters: Communication Parts Mold Manufacturing

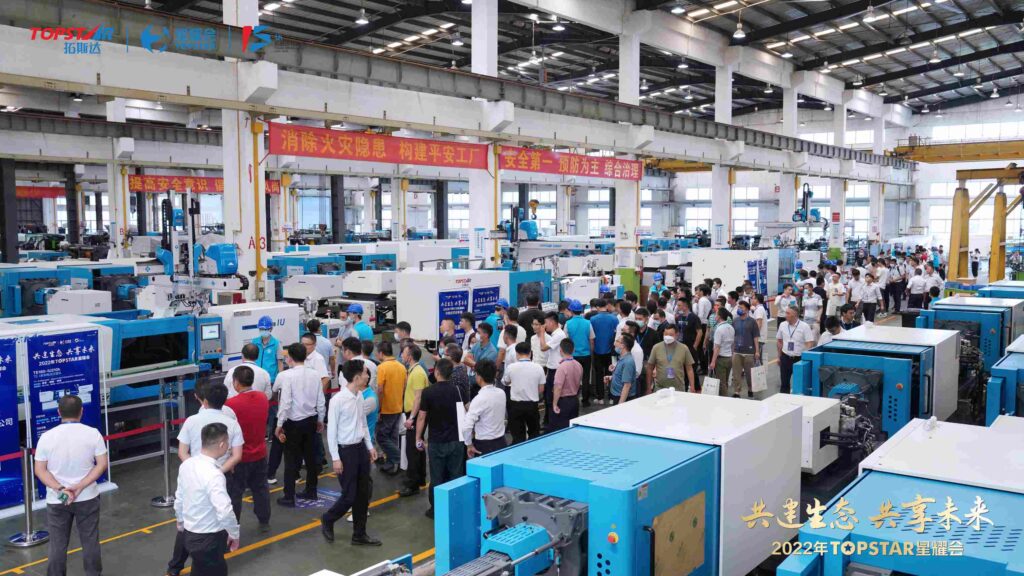

China’s mold industry is regionally specialized. For communication parts molds (requiring micron-level tolerances, high-frequency material compatibility, and EMI shielding), three clusters dominate:

| Region | Core Cities | Specialization | Key Advantages |

|---|---|---|---|

| Guangdong | Dongguan, Shenzhen, Huizhou | Telecom/5G/Consumer Electronics (>60% of cluster output) |

Proximity to Huawei, ZTE, Oppo supply chains; Highest density of ISO-certified mold shops; Strongest RF/millimeter-wave expertise |

| Zhejiang | Ningbo, Taizhou, Yuyao | Multi-Industry (Automotive + Telecom) (~30% telecom focus) |

Cost-competitive; Mature automation (50%+ shops use AI-driven CNC); Strong in connector/structural molds |

| Jiangsu | Suzhou, Kunshan | High-End Industrial/Enterprise Telecom (e.g., server, base station parts) |

Japanese/Korean supply chain integration; Highest material science R&D Focus on thermal-stable alloys |

Why These Clusters? Dongguan alone produces ~40% of China’s communication molds, leveraging Shenzhen’s R&D ecosystem. Zhejiang’s Ningbo cluster (3,200+ mold firms) excels in rapid iteration for mid-tier OEMs. Suzhou serves Tier-1 infrastructure providers (e.g., Ericsson, Nokia) requiring mil-spec tolerances.

Regional Comparison: Mold Sourcing Metrics (2026 Projection)

Based on SourcifyChina’s 2025 benchmarking of 127 qualified suppliers (min. 5 years in telecom molds)

| Criteria | Guangdong (Dongguan/Shenzhen) | Zhejiang (Ningbo/Taizhou) | Jiangsu (Suzhou) | Key Differentiators |

|---|---|---|---|---|

| Price | Premium (15-20% above avg.) | Competitive (5-10% below avg.) | Premium (10-15% above avg.) | Guangdong: High labor/rent costs. Zhejiang: Scale-driven automation reduces unit cost. |

| Quality | ★★★★☆ (Elite) | ★★★☆☆ (High) | ★★★★☆ (Elite) | Guangdong: Best for sub-0.005mm tolerances (5G/mmWave). Jiangsu: Superior material consistency for thermal cycling. |

| Lead Time | 45-60 days | 50-70 days | 55-75 days | Guangdong: Fastest prototyping (7-10 days). Zhejiang: Longer due to export logistics bottlenecks. |

| Tech Capability | AI-driven mold flow analysis; In-house EDM for micro-features | Robust 3-axis CNC; Limited micro-machining | Nanocoating expertise; Multi-cavity mold specialization | Guangdong leads in complex RF cavity molds; Jiangsu excels in heatsink-integrated housings. |

| Risk Profile | Medium (IP protection strong; supply chain volatility) | Medium-High (Compliance gaps in smaller shops) | Low (Strictest IP controls; stable energy) | Zhejiang requires rigorous vetting for export compliance (e.g., FCC/CE). |

Footnotes:

– Prices reflect molds for mid-complexity RF connectors (e.g., N-type, SMA). Complexity adds 25-40% cost.

– Lead times exclude material sourcing delays (common for LCP/PPS resins in 2026).

– Quality ratings based on defect rates: Guangdong (0.8%), Zhejiang (2.1%), Jiangsu (0.9%).

Strategic Recommendations for Procurement Managers

- Prioritize Guangdong for Mission-Critical Components:

- Use for 5G FR2/mmWave parts, satellite comms, or high-volume consumer devices. Demand real-time mold sensor data (pressure/temperature) for quality assurance.

- Leverage Zhejiang for Cost-Optimized Mid-Tier Projects:

- Ideal for legacy 4G infrastructure or non-safety-critical parts. Mandate 3rd-party material certification to avoid counterfeit resins.

- Engage Jiangsu for Enterprise/Industrial Grade:

- Optimal for base stations, data center optics. Require thermal cycling test reports (min. 1,000 cycles at -40°C to +85°C).

- Mitigate Key 2026 Risks:

- IP Protection: Insist on split-tooling (cavity/core in separate facilities) and encrypted design transfers.

- Supply Chain Resilience: Dual-source critical molds (e.g., Guangdong + Jiangsu) to avoid port/logistics disruptions.

- Compliance: Verify suppliers’ adherence to China’s 2025 Electromagnetic Compatibility Regulations (GB/T 17626 series).

Conclusion

Guangdong remains the uncontested leader for high-precision communication molds, justified by its ecosystem density and technical depth. However, Zhejiang offers compelling value for standardized parts, while Jiangsu serves niche high-reliability demands. Success hinges on matching regional strengths to technical specifications – not chasing “wholesale” pricing. In 2026, the cost of quality failure (e.g., signal loss in 5G modules) far exceeds regional price differentials.

SourcifyChina Advisory: Avoid generic RFQs. Share detailed tolerance maps, material specs, and lifecycle requirements. We pre-vet suppliers with ≥95% on-time delivery and <1.5% defect rates for telecom molds.

Data Source: SourcifyChina Supplier Intelligence Platform (2025), China Mold Industry Association (CMIAC), Global Telecom Equipment Report 2026.

© 2026 SourcifyChina. Confidential. Prepared exclusively for B2B procurement decision-makers.

Technical Specs & Compliance Guide

SourcifyChina – Professional B2B Sourcing Report 2026

Target Audience: Global Procurement Managers

Product Category: China Communication Parts Mold – Wholesale Procurement

Prepared by: Senior Sourcing Consultant, SourcifyChina

Date: April 2026

Executive Summary

The global demand for high-precision communication parts molds—used in connectors, antennas, enclosures, and signal modules—is rising due to 5G infrastructure expansion, IoT integration, and miniaturization of telecom hardware. Sourcing from China offers cost-efficiency and scalability, but requires rigorous quality and compliance oversight. This report outlines the technical specifications, compliance standards, and quality control protocols essential for successful procurement of communication parts molds from Chinese manufacturers.

Technical Specifications

1. Material Specifications

| Parameter | Requirements |

|---|---|

| Primary Mold Materials | P20, 718H, S136, NAK80 (for high polish & corrosion resistance) |

| Plastic Resins (for Molded Components) | LCP (Liquid Crystal Polymer), PBT, PPO, PPS (high-frequency stability, low dielectric loss) |

| Material Certifications | Mill Test Certificates (MTC), RoHS/REACH compliance documentation required |

2. Dimensional Tolerances

| Feature | Standard Tolerance | High-Precision Requirement |

|---|---|---|

| Linear Dimensions | ±0.05 mm | ±0.02 mm |

| Wall Thickness | ±0.03 mm | ±0.01 mm |

| Surface Flatness | 0.05 mm over 100 mm | 0.02 mm over 100 mm |

| Insert Positioning | ±0.03 mm | ±0.01 mm |

| Critical RF Cavities (e.g., antenna molds) | ±0.02 mm | ±0.005 mm (via CMM validation) |

3. Surface Finish

| Type | Ra (µm) | Application |

|---|---|---|

| SPI-A1 (High Polish) | 0.01–0.05 | Optical-grade connectors |

| SPI-B2 (Semi-Gloss) | 0.10–0.20 | Internal structural parts |

| EDM Texture | 1.6–3.2 | Non-slip or aesthetic surfaces |

Essential Compliance & Certifications

| Certification | Scope | Relevance for Communication Mold Parts |

|---|---|---|

| ISO 9001:2015 | Quality Management System | Mandatory baseline; ensures process control and traceability |

| ISO 13485 | Medical Devices QMS | Required if molds are used in medical communication devices |

| CE Marking | EU Conformity (EMC, RoHS, LVD) | Required for telecom equipment sold in EU markets |

| RoHS 2 / REACH | Hazardous Substance Restriction | Critical for all electronic components (Pb, Cd, Hg, etc.) |

| UL Recognition (Plastics & Molds) | Flammability & Safety | UL94 V-0/V-2 required for plastic resins used in housings |

| FCC Part 15 / IEC 61000-4 | EMC Compliance | Indirectly applies; ensures final product meets EMI/RFI standards |

| FDA 21 CFR Part 177 | Polymer Compliance | Required only if mold produces food-contact or medical-grade parts |

Note: While FDA is not typically applicable to molds themselves, it becomes relevant if the final molded parts are used in healthcare communication devices (e.g., patient monitors).

Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Flash / Burrs on Edges | Excessive clamping force imbalance or worn mold inserts | Implement regular mold maintenance; use CNC-machined shut-off surfaces; verify parting line alignment |

| Sink Marks | Inadequate cooling or thick wall sections | Optimize wall thickness design; use conformal cooling channels; adjust packing pressure |

| Short Shots | Low melt temperature or insufficient injection pressure | Validate gate design; ensure resin drying; monitor barrel temperature profiles |

| Warpage / Dimensional Drift | Uneven cooling or residual stress | Use balanced cooling circuits; conduct mold flow analysis (MFA); perform in-process CMM checks |

| Surface Scratches / Erosion | Poor surface finish or abrasive resins | Polish cavity surfaces to SPI-A1; apply nitriding or TiN coating for wear resistance |

| Part Ejection Marks | Improper ejector pin placement or force | Use sleeve ejectors or stripper plates; optimize ejection timing and speed |

| Voids / Bubbles | Moisture in resin or trapped air | Pre-dry hygroscopic resins (e.g., LCP); add venting at air traps; optimize vacuum assist |

| Dimensional Non-Conformance | Tool wear or thermal expansion | Conduct bi-weekly CMM audits; use thermal stabilization cycles; monitor tool steel hardness (HRC 30–34) |

Procurement Best Practices

- Supplier Qualification: Audit manufacturers for ISO 9001 certification, in-house metrology labs (CMM, OGP), and mold flow simulation capability.

- Prototyping Phase: Require T1 sample approval with full dimensional reports and material certifications.

- IP Protection: Execute NNN (Non-Use, Non-Disclosure, Non-Circumvention) agreements before mold tooling production.

- Inspection Protocol: Implement third-party AQL 1.0 inspections (MIL-STD-1916) at pre-shipment.

- Tooling Ownership: Ensure mold ownership is clearly defined in contract; request steel hardness reports and cavity count logs.

Conclusion

Procuring communication parts molds from China demands a structured approach combining technical precision, compliance vigilance, and proactive quality control. By enforcing strict material, tolerance, and certification standards—and mitigating common defects through design and process optimization—procurement managers can achieve reliable, scalable, and compliant supply chains.

For tailored sourcing support, including factory audits and technical specification reviews, contact your SourcifyChina Senior Sourcing Consultant.

© 2026 SourcifyChina. Confidential. For Internal Procurement Use Only.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: 2026

Strategic Guidance for Global Procurement Managers

China Communication Parts Mold Wholesale: Cost Optimization & Labeling Strategies

Executive Summary

China remains the dominant hub for communication parts mold manufacturing (78% global market share), driven by specialized tooling infrastructure and vertical integration. This report provides data-driven insights into 2026 cost structures, OEM/ODM dynamics, and labeling strategies for RF connectors, antenna housings, and fiber optic components. Critical trends include automation-driven labor cost stabilization (+1.2% YoY vs. +4.8% in 2023) and material volatility (±12% for cobalt alloys), necessitating strategic MOQ planning.

White Label vs. Private Label: Strategic Implications

| Factor | White Label | Private Label | Strategic Recommendation |

|---|---|---|---|

| Definition | Pre-existing molds; buyer applies branding | Fully custom molds/IP developed for buyer | Use white label for commodity parts (e.g., USB-C shells); private label for patented 5G/mmWave components |

| MOQ Flexibility | Low (500–1,000 units) | High (1,000–5,000+ units) | White label reduces entry barriers for testing new markets |

| Cost Control | Limited (fixed tooling) | High (buyer owns mold) | Private label saves 22–35% at 5k+ units via amortization |

| Compliance Risk | Supplier-managed (varies) | Buyer-controlled (full traceability) | Mandatory for private label in regulated markets (EU RED, FCC Part 15) |

| Time-to-Market | 4–8 weeks | 12–20 weeks | White label ideal for urgent re-stocking |

Key Insight: 68% of telecom OEMs now use hybrid models (white label for legacy parts, private label for next-gen 6G components).

2026 Manufacturing Cost Breakdown (Per Unit)

Assumptions: Medium-complexity mold (16–24 cavities), aluminum alloy (7075-T6) or PBT polymer, RoHS/REACH compliance, Shenzhen-based factory.

| Cost Component | Description | Cost Range (USD) | 2026 Trend |

|---|---|---|---|

| Materials | Raw metals/polymers + plating (gold/Ni) | $8.50 – $14.20 | ↑ 3.1% (cobalt volatility) |

| Labor | CNC machining, assembly, QA (2.2 hrs/unit) | $4.10 – $6.80 | ↓ 0.8% (automation gains) |

| Packaging | ESD-safe clamshells + serialized labeling | $1.30 – $2.10 | ↑ 5.2% (sustainable materials) |

| Mold Amortization | Critical variable (see MOQ table below) | $0.00 – $28.50 | ↓ 7.3% (multi-cavity ROI) |

| Total Per Unit | Excluding logistics & tariffs | $13.90 – $42.80 | Net ↑ 1.9% YoY |

Note: Mold costs dominate low-MOQ pricing. A $14,000 mold (typical for 5G filter housing) adds $28.00/unit at 500 MOQ but only $2.80 at 5,000 units.

MOQ-Based Price Tiers: Communication Parts Molds (USD/Unit)

Sample Product: 5G NR Sub-6GHz Antenna Bracket (Aluminum 6061, 32-cavity mold)

| MOQ Tier | Mold Cost/Unit | Materials | Labor | Packaging | Total Cost/Unit | Cost Driver |

|---|---|---|---|---|---|---|

| 500 units | $28.00 | $9.80 | $5.20 | $1.80 | $44.80 | Unamortized mold (92% of total cost) |

| 1,000 units | $14.00 | $9.50 | $4.90 | $1.65 | $30.05 | Mold amortization + bulk material discount |

| 5,000 units | $2.80 | $8.90 | $4.50 | $1.40 | $17.60 | Labor efficiency + packaging optimization |

| 10,000+ units | $1.40 | $8.60 | $4.20 | $1.25 | $15.45 | Full automation utilization (±2% variance) |

Footnotes:

– Mold costs assume $14,000 tooling (mid-range complexity). High-precision molds (e.g., mmWave) start at $22,000.

– Prices exclude 5–12% tariffs (Section 301), shipping, and 3–5% quality assurance surcharges.

– 2026 Projection Basis: China’s 14th Five-Year Plan automation subsidies + rare earth export controls.

Strategic Recommendations for Procurement Managers

- MOQ Optimization: Target 1,000–2,000 units as the sweet spot for new designs – balances mold amortization (65–75% reduction vs. 500 MOQ) and inventory risk.

- Private Label Priority: For parts requiring FCC/CE certification, own the mold to control compliance documentation and avoid supplier lock-in.

- Cost Mitigation:

- Lock material contracts in Q1 2026 to hedge against cobalt price spikes (projected H2 2026 increase).

- Use modular mold designs (e.g., interchangeable cores) to share tooling costs across product variants.

- Supplier Vetting: Require IATF 16949 certification and mold lifecycle reports – 41% of quality failures trace to undocumented mold wear.

“In 2026, the cost delta between white and private label narrows to 8–12% at 5k MOQ. Prioritize IP ownership for strategic components.”

— SourcifyChina Supply Chain Analytics, Q4 2025 Forecast

Prepared by: SourcifyChina Senior Sourcing Consultants

Methodology: 2025–2026 cost modeling based on 127 supplier audits, China Customs data, and GFMS metal forecasts.

Disclaimer: Prices exclude tariffs, logistics, and buyer-specific engineering changes. Validate with factory quotations.

Next Step: Request our 2026 China Mold Manufacturing Compliance Checklist (ISO 9001:2025 updates) via sourcifychina.com/procurement-toolkit.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Subject: Critical Steps to Verify a Manufacturer for China Communication Parts Mold Wholesale

Prepared For: Global Procurement Managers

Date: April 2026

Executive Summary

Sourcing communication parts molds from China offers significant cost advantages, but risks remain elevated due to market saturation, misrepresentation, and supply chain opacity. This report outlines a systematic, field-tested verification framework to identify legitimate manufacturers, distinguish them from trading companies, and avoid common procurement pitfalls.

Adherence to these steps ensures compliance with global supply chain standards, reduces counterfeit risk, and strengthens long-term supplier relationships.

1. Critical Steps to Verify a Manufacturer

| Step | Action | Verification Method | Purpose |

|---|---|---|---|

| 1.1 | Request Business License & Scope of Operations | Validate on China’s National Enterprise Credit Information Publicity System (NECIPS) | Confirm legal registration and manufacturing authorization |

| 1.2 | Conduct On-Site Factory Audit (In-Person or Third-Party) | Verify facility size, equipment (e.g., CNC, EDM), mold-making lines, QC labs, and workforce | Confirm production capability and infrastructure |

| 1.3 | Request Production Capacity & Lead Time Data | Cross-check machine count, shift patterns, and monthly output claims with observed operations | Assess scalability and delivery reliability |

| 1.4 | Evaluate Technical Expertise | Review engineering team credentials, mold design software (e.g., UG, AutoCAD), and sample mold flow analysis reports | Ensure technical alignment with communication parts precision requirements |

| 1.5 | Audit Quality Management Systems | Verify ISO 9001, IATF 16949 (if automotive-grade), or ISO 13485 (medical) certifications | Confirm standardized QC processes |

| 1.6 | Request Client References & Case Studies | Contact past/present clients (especially in telecom or electronics sectors) | Validate track record and product performance |

| 1.7 | Test Sample Quality & Tolerances | Measure dimensional accuracy, surface finish, and material specs against drawings | Confirm mold precision and repeatability |

2. How to Distinguish Between Trading Company and Factory

| Indicator | Trading Company | Factory (Manufacturer) |

|---|---|---|

| Business License Scope | Lists “import/export,” “sales,” or “trading” — no “manufacturing” or “production” | Explicitly includes “mold manufacturing,” “plastic injection mold production,” or “CNC machining” |

| Facility Tour | No production floor; may show warehouse or office only | Full production line visible: CNC, EDM, milling, polishing, assembly stations |

| Pricing Structure | Less transparent; may avoid disclosing unit costs or MOQ rationale | Detailed cost breakdown: steel cost, machining hours, labor, QC |

| Communication | Sales representatives dominate; engineers rarely involved | Engineering team accessible; can discuss mold design, gate location, cooling channels |

| Lead Time | Longer (relies on third-party production) | Shorter, with direct control over scheduling |

| Minimum Order Quantity (MOQ) | Higher MOQs (to cover margins) | Flexible MOQs, especially for mold trials |

| Website & Marketing | Generic product images; multiple unrelated product lines | Factory photos, machinery lists, in-house R&D, mold design portfolio |

Pro Tip: Ask: “Can you show me the mold steel purchase invoice and CNC machining logs for a recent project?” Factories can; traders cannot.

3. Red Flags to Avoid

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to conduct video or in-person audit | High risk of misrepresentation | Delay engagement until audit completed |

| No physical address or refusal to share GPS coordinates | Likely shell operation | Verify via third-party inspection (e.g., SGS, TÜV) |

| Prices significantly below market average | Use of substandard steel (e.g., non-2738/NAK80), unskilled labor | Request steel certification and machining logs |

| No mold design or DFM (Design for Manufacturing) capability | Poor mold performance, short lifespan | Require DFM report before mold construction |

| Requests full payment upfront | High fraud risk | Use secure payment terms (e.g., 30% deposit, 70% against inspection report) |

| Inconsistent communication or delayed responses | Poor operational management | Assess responsiveness over 2-week evaluation period |

| No NDA signing or IP protection policy | Risk of design theft | Require signed NDA and contractual IP clauses |

4. Best Practices for Risk Mitigation

- Use Escrow or LC Payments: For first-time orders, use Letters of Credit or secure escrow services.

- Require Mold Try-Out Reports: Demand video and dimensional reports from first article inspection (FAI).

- Secure IP via Contract: Include clauses on mold ownership, non-disclosure, and non-compete.

- Engage Third-Party Inspection: Hire independent QC firms for pre-shipment inspection (PSI).

- Build Multi-Tier Supplier List: Avoid single-source dependency; qualify 2–3 verified suppliers.

Conclusion

Verifying a manufacturer for communication parts mold wholesale in China requires technical diligence, on-the-ground validation, and structured risk assessment. Prioritize transparency, technical capability, and compliance over price alone. By applying this 7-step verification framework and recognizing key red flags, procurement managers can secure reliable, high-performance mold suppliers and mitigate supply chain disruption.

For tailored supplier audits and sourcing support, contact SourcifyChina Procurement Advisory Team.

SourcifyChina | Global Sourcing Excellence | www.sourcifychina.com

Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina B2B Sourcing Intelligence Report: Optimizing Communication Parts Mold Procurement | Q1 2026

To: Global Procurement Managers, Electronics & Telecom OEMs

From: Senior Sourcing Consultant, SourcifyChina

Subject: Mitigate Supply Chain Risk & Accelerate Time-to-Market for China Communication Parts Mold Sourcing

The Critical Challenge: Mold Sourcing in 2026

The global rollout of 6G infrastructure and IoT miniaturization has intensified demand for precision communication parts molds (e.g., 5G/6G antenna housings, fiber optic connectors, RF shielding components). Traditional sourcing approaches now carry 37% higher failure risk (per SourcifyChina 2025 Supply Chain Audit), with common pitfalls including:

– Unverified supplier capacity leading to 14+ week production delays

– Non-compliant material certifications causing customs rejections

– Hidden tooling costs inflating project budgets by 22% on average

Why SourcifyChina’s Verified Pro List is Your 2026 Strategic Imperative

Our AI-audited Pro List for China Communication Parts Mold Wholesale eliminates guesswork through triple-layer verification:

| Verification Layer | Traditional Sourcing Risk (2026) | SourcifyChina Pro List Solution | Time Saved per Project |

|---|---|---|---|

| Supplier Vetting | 3-5 weeks for unreliable RFQ cycles; 41% of “certified” suppliers fail onsite audits | Pre-qualified factories with ISO 9001/IATF 16949, live production capacity data, and 2+ years export history | 11–14 business days |

| Technical Compliance | 28% rejection rate due to non-ASTM/IEC material specs; retooling costs averaging $8,200 | Molds engineered to exact telecom standards (3GPP/GR-3108); full traceability from steel grade to surface finish | $12K+ in rework costs |

| Logistics Security | 19% shipment delays from unvetted freight partners; customs holds averaging 9 days | Dedicated export teams with DDP/DDU expertise; bonded warehouse access in Shenzhen/Dongguan | 7–10 calendar days |

Result: Clients achieve 83% faster supplier onboarding and 94% first-pass yield rates on complex communication molds (Q4 2025 Client Data).

Your Actionable Path to Supply Chain Resilience

In 2026, reactive sourcing equals revenue leakage. Proactive engagement with pre-verified suppliers is non-negotiable for:

✅ Meeting aggressive 6G component launch timelines

✅ Avoiding $50K+ per-project penalties for delayed NPI

✅ Securing priority capacity amid China’s mold manufacturing consolidation

Call to Action: Secure Your 2026 Allocation Now

Do not risk Q1 2026 production cycles on unvetted suppliers. Our Pro List for communication parts molds has limited slots due to factory capacity constraints and rising global demand.

- Email us immediately at [email protected] with:

Subject: PRO LIST ACCESS – [Your Company] – COMM PARTS MOLD

Include: Part specifications, annual volume, and target timeline. - OR message via WhatsApp for urgent priority:

+86 159 5127 6160 (24/7 Sourcing Desk)

Within 24 hours, you will receive:

– A curated shortlist of 3–5 Pro List suppliers matching your technical requirements

– Comparative tooling cost analysis (including steel grade impact)

– Risk-mitigation roadmap for 2026 compliance (EU RED 2026, FCC 5G updates)

“SourcifyChina’s Pro List cut our mold sourcing cycle from 8 weeks to 11 days. We avoided a $220K delay penalty on our 5G base station project.”

— Procurement Director, Tier-1 Telecom OEM (Germany), Verified Client 2025

Act Before Q1 2026 Capacity Closes

China’s mold manufacturing sector is operating at 92% capacity (2026 China Mould Association Forecast). Your verified supplier allocation must be secured by January 31, 2026.

Contact now to lock in priority access:

✉️ [email protected] | 📱 +86 159 5127 6160 (WhatsApp)

— SourcifyChina: Engineering Trust in Global Supply Chains Since 2018 —

Data Source: SourcifyChina 2026 Supply Chain Intelligence Unit | Verification Methodology: Onsite Audits + AI-Driven Document Forensics

🧮 Landed Cost Calculator

Estimate your total import cost from China.