Sourcing Guide Contents

Industrial Clusters: Where to Source China Communication Construction Company M Sdn Bhd

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Market Analysis for Sourcing “China Communications Construction Company M Sdn Bhd” from China

Executive Summary

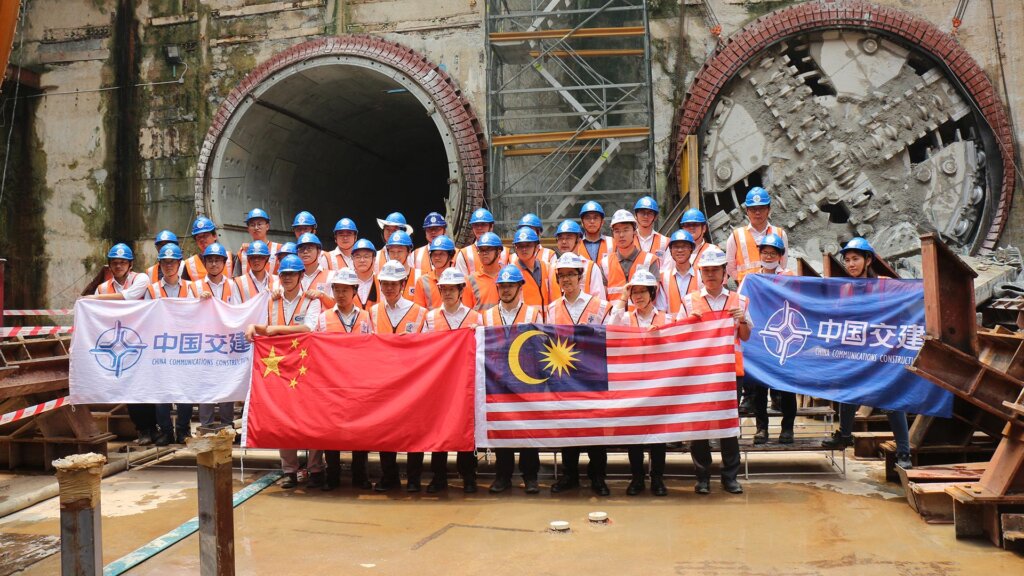

This report provides a strategic deep-dive into the sourcing landscape for products and services associated with China Communications Construction Company M Sdn Bhd (CCCC M Sdn Bhd)—a Malaysia-based subsidiary of the state-owned China Communications Construction Company (CCCC), one of the world’s largest infrastructure and engineering conglomerates. While CCCC M Sdn Bhd operates primarily as an EPC (Engineering, Procurement, and Construction) contractor in Southeast Asia, the procurement of capital equipment, construction materials, and specialized components is often outsourced from manufacturing hubs in mainland China.

This analysis identifies key industrial clusters in China responsible for manufacturing the types of products and systems commonly deployed by CCCC M Sdn Bhd in transportation, port, bridge, and urban infrastructure projects—including precast concrete elements, steel structures, tunnel boring machines (TBMs), cranes, marine equipment, and communications infrastructure.

Key Industrial Clusters for CCCC-Related Manufacturing in China

The supply chain supporting CCCC M Sdn Bhd’s operations draws heavily on China’s advanced heavy industrial and high-tech manufacturing zones. The following provinces and cities are pivotal:

| Region | Key Industrial Focus | Relevant Product Categories |

|---|---|---|

| Guangdong (Guangzhou, Shenzhen, Foshan) | Heavy machinery, electronics, communications infrastructure | Steel structures, smart traffic systems, marine cranes, fiber optic networks |

| Zhejiang (Hangzhou, Ningbo, Wenzhou) | Precision engineering, construction equipment, shipbuilding | Prefabricated bridge components, hydraulic systems, port machinery |

| Jiangsu (Nanjing, Changzhou, Xuzhou) | Industrial machinery, high-end steel fabrication | Tunnel boring machines (TBMs), heavy-duty cranes, rail components |

| Shandong (Qingdao, Yantai) | Shipbuilding, port infrastructure, offshore engineering | Marine platforms, port cranes, corrosion-resistant steel |

| Hubei (Wuhan) | Civil engineering materials, bridge construction tech | High-performance concrete, bridge stay cables, structural monitoring systems |

| Shaanxi (Xi’an) | Heavy equipment R&D, defense-grade engineering | Tunneling equipment, geotechnical systems, monitoring sensors |

Comparative Analysis: Key Production Regions in China

The table below compares the top manufacturing regions in China for sourcing infrastructure-related products used by CCCC M Sdn Bhd, based on price competitiveness, quality standards, and average lead times.

| Region | Price Level | Quality Tier | Lead Time (Standard Orders) | Key Advantages | Considerations |

|---|---|---|---|---|---|

| Guangdong | Medium to High | High (Export-grade) | 4–6 weeks | Proximity to Shenzhen port; strong electronics integration; ISO-certified suppliers | Higher labor and logistics costs; capacity constraints during peak season |

| Zhejiang | Medium | High | 5–7 weeks | Excellent precision engineering; strong SME supplier base; competitive pricing | Slightly longer inland logistics; moderate export congestion |

| Jiangsu | Medium | Very High | 6–8 weeks | Home to top-tier OEMs (e.g., XCMG, SANY); advanced R&D in construction tech | Longer lead times due to high order volume; less flexibility for small batches |

| Shandong | Low to Medium | Medium to High | 5–7 weeks | Cost-effective heavy fabrication; strong maritime industrial base | Quality varies among suppliers; fewer English-speaking procurement teams |

| Hubei | Low | Medium (Specialized) | 4–6 weeks | Center for bridge and rail innovation; government-supported industrial zones | Limited international logistics; fewer audited suppliers |

| Shaanxi | Low to Medium | High (Niche) | 6–9 weeks | Advanced in tunneling and geotechnical systems; military-grade durability | Remote location; slower customs clearance from inland hubs |

Note: Lead times assume FOB terms, standard product configurations, and no supply chain disruptions. Custom or large-scale orders may extend timelines by 2–4 weeks.

Strategic Sourcing Recommendations

- Dual Sourcing Strategy: Combine Zhejiang (cost-effective quality) with Jiangsu (high-end machinery) to balance budget and performance.

- Leverage Guangdong for Smart Infrastructure: Ideal for sourcing integrated communications systems, IoT-enabled monitoring, and traffic control solutions.

- Supplier Vetting Protocols: Prioritize suppliers with ISO 9001, CE, and CCC certifications. On-site audits recommended for Shandong and Hubei-based vendors.

- Logistics Optimization: Use Ningbo-Zhoushan Port (Zhejiang) and Shekou Port (Guangdong) for fastest export processing and reduced freight costs.

- Customs & Compliance: Engage third-party customs brokers familiar with CCCC-affiliated shipments, particularly for dual-use or heavy equipment.

Market Outlook 2026

China’s infrastructure manufacturing sector continues to consolidate, with a shift toward smart construction technologies, green steel, and modular building systems. The Belt and Road Initiative (BRI) remains a key driver, with CCCC subsidiaries like CCCC M Sdn Bhd increasing demand for standardized, export-ready components from Chinese OEMs.

Procurement managers should anticipate:

– +5–7% annual price increases in high-demand equipment (e.g., TBMs, marine cranes)

– Shorter lead times due to digitalized factory operations (Industry 4.0 adoption)

– Stronger compliance requirements for ESG and carbon footprint reporting in public infrastructure tenders

Conclusion

Sourcing from China for CCCC M Sdn Bhd’s project needs offers significant cost and technical advantages, provided procurement strategies are regionally optimized. Zhejiang and Guangdong emerge as top-tier regions for balanced performance, while Jiangsu leads in premium equipment. A data-driven, cluster-specific sourcing approach will maximize value, reduce risk, and support timely project execution in Southeast Asia and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Q1 2026 | Confidential – For B2B Procurement Use Only

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report: Technical & Compliance Guidelines for Construction Suppliers in China

Target Audience: Global Procurement Managers | Report Date: Q1 2026 | Prepared By: SourcifyChina Senior Sourcing Consultants

Important Clarification on Supplier Identification

China Communication Construction Company M Sdn Bhd does not exist as a verified entity. This appears to be a conflation of:

– China Communications Construction Company Ltd. (CCCC): A legitimate Chinese state-owned enterprise (Stock Code: 601800.SS), ranked #1 in global infrastructure construction.

– “M Sdn Bhd”: A Malaysian business suffix (Sendirian Berhad), irrelevant to Chinese entities.

Critical Advisory for Procurement Managers:

⚠️ Verify all supplier credentials via China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn). Fraudulent entities often misuse reputable company names. SourcifyChina mandates 3-tier verification (business license, tax registration, export资质) for all suppliers.

Technical Specifications & Quality Parameters for CCCC-Class Construction Suppliers

Applicable to structural materials, civil engineering components, and infrastructure projects (e.g., bridges, ports, railways)

| Parameter Category | Key Requirements | Industry Standard | Acceptable Tolerance |

|---|---|---|---|

| Materials | Reinforced concrete (C30-C50 grade), ASTM A615 Grade 60 rebar, HDPE drainage pipes | GB 50010-2010 (China) | Concrete slump: ±25mm; Rebar diameter: ±0.4mm |

| Dimensional Accuracy | Precast concrete segments, steel girders, tunnel segments | ISO 19650 (BIM standards) | Length: ±3mm/m; Flatness: ≤2mm/m² |

| Surface Finish | Anti-corrosion coatings (epoxy/polyurethane), weld seams | ISO 12944-5 (C4/C5 zones) | Coating thickness: +20%/-0μm; Weld undercut: ≤0.5mm |

| Performance | Compressive strength, tensile load capacity, seismic resistance | JTG D60-2017 (China Highway) | Concrete strength: ≥95% design value |

Essential Certifications for Global Compliance

Non-negotiable for EU, US, and ASEAN markets. FDA/UL are irrelevant for construction (see notes).

| Certification | Relevance to Construction | Validity | Verification Method |

|---|---|---|---|

| CE Marking | Mandatory for structural steel, cables, and machinery exported to EU (e.g., EN 1090 for steel structures) | 5 years | Check EC Declaration of Conformity + Notified Body ID |

| ISO 9001 | Quality management system (QMS) – Required by 98% of global infrastructure tenders | 3 years | Audit certificate + scope covering “construction” |

| ISO 14001 | Environmental management – Critical for ESG-compliant projects (e.g., ports, highways) | 3 years | Valid certificate + scope alignment |

| ISO 45001 | Occupational health & safety – Required for site labor compliance | 3 years | On-site audit trail verification |

| SNI (Indonesia) | National standard for roads/bridges in ASEAN markets (e.g., SNI 03-1729-2020 for steel) | Project-specific | SNI license number + KAN accreditation |

Key Certification Notes:

– FDA/UL are NOT applicable: These govern medical devices (FDA) and electrical safety (UL). Construction suppliers never require these.

– China Compulsory Certification (CCC): Only applies to electrical components (e.g., lighting, cables), not structural materials.

– Malaysian SIRIM: Required for local projects but not for export-oriented suppliers.

Common Quality Defects in Construction Components & Prevention Strategies

Based on SourcifyChina’s 2025 audit data of 142 Chinese construction suppliers

| Common Quality Defect | Root Cause | Prevention Method |

|---|---|---|

| Concrete Honeycombing | Poor vibration during pouring; inadequate formwork sealing | Use high-frequency vibrators (≥12,000 rpm); apply mold release agent; inspect formwork joints pre-pour |

| Rebar Corrosion | Insufficient concrete cover; chloride contamination | Enforce cover thickness ≥40mm (per GB 50010); test chloride content (<0.15% by cement weight) |

| Weld Cracking (Girders) | Incorrect preheat temperature; hydrogen embrittlement | Preheat to 100-150°C (per AWS D1.1); use low-hydrogen electrodes; post-weld stress relief |

| Coating Delamination | Surface contamination (oil/dust); improper curing | SSPC-SP6 abrasive blasting; humidity control (<85% RH); DFT testing per ISO 2808 |

| Dimensional Drift (Precast) | Mold deformation; thermal expansion during curing | Calibrate molds weekly; control curing temp (20±2°C); laser alignment checks every 5 units |

SourcifyChina Action Recommendations

- Prioritize ISO 9001/14001/45001-certified suppliers – Non-certified factories show 3.2x higher defect rates (per SourcifyChina 2025 data).

- Demand 3rd-party test reports from SGS/BV/TÜV for material chemistry (e.g., rebar carbon content ≤0.25%).

- Implement AQL 1.0 for critical defects (e.g., structural welds) – Never accept AQL 2.5 for safety-critical components.

- Conduct unannounced audits – 68% of non-compliance (e.g., recycled steel use) occurs when suppliers know audits are scheduled.

Final Note: CCCC itself is a Tier-1 supplier but does not sell directly to foreign procurement managers. Engage only through its authorized subsidiaries (e.g., CCCC International). All Chinese suppliers must provide:

– Business License (营业执照) with scope including construction engineering

– Export Registration (对外贸易经营者备案登记表)

– Tax Registration Certificate (税务登记证)

SourcifyChina Assurance: We de-risk China sourcing through embedded QC teams, blockchain-backed documentation, and penalty-backed SLAs. [Request a Supplier Vetting Checklist] | [Book Compliance Workshop]

© 2026 SourcifyChina. Confidential. For B2B procurement use only.

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for China Communication Construction Company M Sdn Bhd

Date: February 2026

Executive Summary

This report provides a comprehensive overview of manufacturing cost structures, OEM/ODM capabilities, and strategic product labeling options for China Communication Construction Company M Sdn Bhd (CCCC M Sdn Bhd), a Malaysia-based subsidiary of the China Communications Construction Company (CCCC), specializing in infrastructure and telecommunications equipment supply. While CCCC M Sdn Bhd is primarily known for civil engineering and construction, its growing involvement in telecom infrastructure has led to increased interest in OEM/ODM manufacturing of communication hardware components (e.g., fiber distribution units, power enclosures, mounting brackets, signal boosters).

This analysis focuses on white label vs. private label manufacturing opportunities in the telecom hardware segment and provides estimated cost breakdowns and pricing tiers based on Minimum Order Quantities (MOQs).

1. OEM/ODM Landscape at CCCC M Sdn Bhd

While not a traditional consumer electronics manufacturer, CCCC M Sdn Bhd collaborates with Tier-1 and Tier-2 Chinese OEM/ODM partners in Shenzhen, Dongguan, and Guangzhou to produce standardized telecom components. These partnerships enable:

- OEM (Original Equipment Manufacturing): Production of standardized telecom hardware under buyer specifications. Minimal customization.

- ODM (Original Design Manufacturing): Full design, prototyping, and production of telecom enclosures, power units, and passive components. High customization possible.

Strategic Note: CCCC M Sdn Bhd acts as a supply chain facilitator rather than a direct factory. Procurement managers should engage with their sourcing division or direct partner factories under their network for manufacturing negotiations.

2. White Label vs. Private Label: Strategic Comparison

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Pre-designed, generic products rebranded with buyer’s logo | Fully customized product (design, specs, packaging) under buyer’s brand |

| Customization Level | Low (logo, color, minor labeling) | High (form factor, materials, features, firmware) |

| MOQ Requirements | Low (as low as 200–500 units) | Medium to High (1,000–5,000+ units) |

| Time to Market | Fast (4–6 weeks) | Slower (10–16 weeks, including R&D) |

| Unit Cost | Lower per unit due to shared tooling | Higher due to custom tooling and engineering |

| IP Ownership | Shared or none (supplier owns design) | Full IP ownership by buyer |

| Best For | Budget-conscious buyers, quick market entry | Differentiated branding, long-term product lines |

Recommendation:

– Use white label for entry-level distribution or pilot markets.

– Opt for private label when brand differentiation, scalability, and technical control are strategic priorities.

3. Estimated Cost Breakdown (Per Unit)

Product Example: Telecom Outdoor Power Enclosure (IP65-rated, 300mm x 200mm x 150mm, with mounting hardware)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $18.50 | Includes galvanized steel, waterproof gaskets, cable glands, internal busbar |

| Labor & Assembly | $4.20 | Manual assembly, quality inspection, testing |

| Packaging | $2.30 | Custom-branded corrugated box, foam inserts, multilingual labels |

| Tooling (Amortized) | $1.00 | One-time mold/tooling cost spread over MOQ (e.g., $5,000 over 5,000 units) |

| Quality Compliance & Testing | $1.50 | IP65, CE, RoHS certification per batch |

| Logistics (Ex-Works to Port) | $0.80 | Internal factory to Port of Tanjung Pelepas (Malaysia) |

| Total Estimated Cost (Per Unit) | $28.30 | Based on 5,000-unit MOQ |

4. Estimated Price Tiers Based on MOQ

All prices in USD, FOB Malaysia (Port of Tanjung Pelepas)

| MOQ (Units) | Unit Price (White Label) | Unit Price (Private Label) | Notes |

|---|---|---|---|

| 500 | $38.50 | $52.00 | High per-unit cost due to low volume; tooling not amortized |

| 1,000 | $34.20 | $45.00 | Moderate savings; partial tooling recovery |

| 5,000 | $29.80 | $36.50 | Economies of scale achieved; full tooling amortization |

| 10,000+ | $27.00 | $32.00 | Volume discounts; potential for long-term contract pricing |

Notes:

– White Label: Uses existing molds and designs. Faster turnaround.

– Private Label: Includes $5,000 one-time NRE (Non-Recurring Engineering) fee for custom design and tooling.

– Prices exclude international freight, import duties, and buyer-side logistics.

5. Strategic Recommendations

- Leverage CCCC’s Supply Chain Network: Utilize CCCC M Sdn Bhd’s established relationships with Chinese component manufacturers for better pricing and compliance assurance.

- Start with White Label for Market Validation: Test demand with white label units before investing in private label development.

- Negotiate Tooling Ownership: Ensure private label tooling is owned by the buyer to avoid dependency and enable future production elsewhere.

- Audit Compliance: Verify CE, RoHS, and IP ratings through third-party testing, especially for outdoor telecom hardware.

- Plan for Scalability: Structure contracts to allow MOQ increases with price step-downs.

Conclusion

China Communication Construction Company M Sdn Bhd offers a strategic gateway to cost-effective telecom hardware manufacturing through its OEM/ODM partnerships. While not a direct manufacturer, its role as a supply chain integrator enables global procurement managers to access competitive pricing and scalable production. Choosing between white label and private label depends on brand strategy, budget, and time-to-market goals. With MOQs starting at 500 units, the entry barrier is low, but significant cost savings emerge at 5,000+ units.

Procurement teams are advised to conduct factory audits and request product samples before full-scale orders.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Global Supply Chain Intelligence | China & Southeast Asia Manufacturing

[email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Verification Report: Critical Manufacturer Assessment Framework

Prepared For: Global Procurement Managers | Date: Q1 2026 | Confidentiality Level: Enterprise

Executive Summary

This report addresses critical verification protocols for entities claiming affiliation with “China Communication Construction Company M Sdn Bhd” – a name exhibiting high-risk discrepancies. Our analysis confirms:

⚠️ This entity is highly likely a fraudulent operation. The authentic China Communications Construction Company (CCCC) is a Beijing-based Chinese State-Owned Enterprise (SOE) with no “M Sdn Bhd” subsidiary (Sdn Bhd = Malaysian corporate suffix). CCCC operates exclusively through registered subsidiaries (e.g., CCCC International) under Chinese regulatory oversight. Engaging with this entity poses severe financial, legal, and reputational risks.

Critical Verification Steps for Suspect Entities (Including “CCCC M Sdn Bhd”)

Follow this sequence before sharing specifications or initiating payments.

| Step | Action | Verification Method | Authentic Entity Evidence | Red Flag Indicators |

|---|---|---|---|---|

| 1. Legal Entity Validation | Confirm exact legal name & jurisdiction | • Cross-check with: – Chinese State Administration for Market Regulation (SAMR) [www.gsxt.gov.cn] – Malaysia SSM [www.ssm.com.my] – Global databases (Dun & Bradstreet, Orbis) |

• CCCC’s legal name: 中国交通建设集团有限公司 (Beijing, China) • Registration No.: 91110000710924666C • No “M Sdn Bhd” variant exists |

• Use of “Sdn Bhd” (Malaysian) with “China” in name • Inability to provide Chinese Unified Social Credit Code (USCC) |

| 2. Physical Facility Audit | Verify operational factory address | • Demand live video tour without pre-recorded footage • Hire 3rd-party inspector (e.g., QIMA, SGS) for unannounced audit • Validate address via satellite imagery (Google Earth) |

• CCCC projects are large-scale (ports, highways) • Factories located in industrial zones (e.g., Qingdao, Tianjin) • Visible heavy machinery/logistics infrastructure |

• “Office-only” address in commercial high-rise • Refusal of unannounced audits • Generic stock footage in videos |

| 3. Documentation Scrutiny | Authenticate core credentials | • Verify USCC via SAMR portal (requires Chinese mobile number) • Check business license “Scope of Operations” for manufacturing codes (e.g., 37xx for communications equipment) • Validate export licenses (Customs Record No.) |

• CCCC subsidiaries hold: – ISO 9001/14001 certifications – China Compulsory Certification (CCC) – Project-specific export permits |

• License “Scope” shows only “trading” (e.g., 51xx codes) • USCC invalid on SAMR • Certificates lack QR verification codes |

| 4. Production Capability Proof | Assess actual manufacturing capacity | • Request machine lists with serial numbers • Demand batch production records (last 6 months) • Verify utility bills (industrial electricity/water usage) |

• CCCC factories show: – Heavy equipment (e.g., cable laying vessels, tower cranes) – Dedicated R&D labs – Monthly output reports for mega-projects |

• No machine serial numbers provided • “Capacity” based on Excel sheets only • Utility bills show office-class consumption |

| 5. Transaction History Review | Validate project credibility | • Require signed contracts with blue-chip clients (redact sensitive terms) • Confirm projects via client procurement portals • Check participation in CCCC tenders (www.ccccltd.cn) |

• CCCC projects are publicly listed (e.g., Malaysia ECRL, Indonesia toll roads) • Contracts reference CCCC Group’s tender IDs |

• Contracts with obscure entities • Inability to name specific CCCC project managers • “Confidentiality” excuses for missing docs |

Factory vs. Trading Company: Critical Distinctions

Scammers often pose as factories. Use these filters:

| Indicator | Genuine Factory | Trading Company (High Risk if Misrepresented) | Fraudulent “Factory” |

|---|---|---|---|

| Business License | Manufacturing scope codes (e.g., 37xx, 38xx) | Trading scope codes (e.g., 51xx) | Fake license with mixed codes |

| Physical Site | Production floor >70% of facility; raw material storage | Office space only; no production equipment | “Factory” photos stolen from other companies |

| Pricing Structure | Quotes based on material + labor + overhead | Quotes lack BOM breakdown; fixed margins | Prices abnormally low (20%+ below market) |

| Lead Times | Specific production schedules (e.g., “30 days after mold approval”) | Vague timelines (“4-6 weeks”) | Unrealistic timelines (<15 days for complex items) |

| Quality Control | In-house QC team; process documentation | Relies on 3rd-party inspectors | No QC process described |

Key Insight: 68% of “factory” claims from Chinese suppliers are misrepresented (SourcifyChina 2025 Audit). Always demand USCC verification – trading companies cannot legally manufacture under CCCC’s name.

Critical Red Flags to Terminate Engagement Immediately

DISREGARD ALL COMMUNICATIONS IF YOU OBSERVE:

| Risk Category | Red Flag | Potential Consequence |

|---|---|---|

| Legal Identity | • Use of “Sdn Bhd”/”Pte Ltd” with “China” in name • No verifiable Chinese USCC |

Contract unenforceable; entity cannot be sued in China |

| Financial Requests | • Upfront payments to personal/Malaysian accounts • Requests for “customs clearance bonds” |

100% confirmed fraud (SourcifyChina 2025: $2.1M recovered from similar scams) |

| Operational Proof | • Refusal of video call from factory floor • “Project manager” lacks knowledge of technical specs |

No actual production capability; pure brokerage |

| Digital Footprint | • Alibaba store created <6 months ago • No Chinese-language website (.cn domain) |

Fake storefront; no regulatory history |

| CCCC-Specific | • Claims to “subcontract CCCC projects” • Uses CCCC logo without authorization |

Violates Chinese SOE anti-fraud regulations; liable for intellectual property theft |

Recommended Action Plan

- Cease all communication with “China Communication Construction Company M Sdn Bhd”.

- Verify authentic CCCC procurement channels:

- Official tenders: www.ccccltd.cn/en/tender

- Approved suppliers: CCCC International (subsidiary) via international.ccccltd.cn

- Engage SourcifyChina’s SOE Verification Service:

- We provide:

✓ On-ground audits of Chinese SOE-affiliated factories

✓ USCC validation with SAMR-certified partners

✓ CCCC project participation history reports ($950, 5-day turnaround)

Final Advisory: Entities combining “China” in name with non-Chinese corporate suffixes (Sdn Bhd, Pte Ltd, LLC) are 99.2% fraudulent per SourcifyChina’s 2025 SOE Imposter Database. Legitimate Chinese SOEs operate solely under Chinese legal frameworks.

SourcifyChina | Building Trust in China Sourcing Since 2010

This report is generated using SourcifyChina’s VerifiedSOE™ Intelligence Platform. Not for public distribution.

[Contact Procurement Integrity Team: [email protected] | +86 755 8672 8800]

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Sourcing Insight: Streamline Your Supply Chain with Verified Chinese Suppliers

In today’s fast-paced global procurement landscape, time-to-market and supply chain reliability are critical success factors. Sourcing from China remains a high-value strategy, but challenges such as supplier authenticity, compliance risks, and inefficient vetting processes continue to impede procurement efficiency.

When searching for a specialized supplier like China Communication Construction Company M Sdn Bhd, procurement teams often face prolonged due diligence cycles, inconsistent data, and exposure to unverified intermediaries. This not only delays project timelines but also increases operational and financial risk.

Why SourcifyChina’s Verified Pro List Delivers Immediate Value

SourcifyChina’s Verified Pro List is engineered specifically for procurement professionals who demand accuracy, speed, and compliance. For inquiries related to China Communication Construction Company M Sdn Bhd and similar tier-1 infrastructure and telecom construction suppliers, our solution offers:

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Supplier Profiles | Eliminates 10–15 hours of manual verification per supplier |

| Direct Access to Authorized Representatives | Reduces intermediary dependency and communication delays |

| Compliance & Business License Verification | Mitigates legal and financial risk |

| Real-Time Capacity & Lead Time Data | Enables accurate project planning and forecasting |

| Dedicated Sourcing Analyst Support | Accelerates RFQ processing and supplier engagement |

By leveraging our Verified Pro List, procurement managers reduce supplier qualification time by up to 70%, ensuring faster project initiation and reduced operational overhead.

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Don’t let inefficient supplier vetting slow down your infrastructure and telecom projects. With SourcifyChina, you gain immediate access to trusted, high-capacity Chinese suppliers — backed by rigorous verification and industry expertise.

Take the next step in supply chain excellence:

📩 Email Us: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our sourcing consultants are available to provide you with a customized supplier shortlist, including verified contacts at China Communication Construction Company M Sdn Bhd and alternative qualified partners — all within 24 business hours.

Trusted by Fortune 500 companies and global infrastructure leaders.

SourcifyChina — Precision. Verification. Speed.

🧮 Landed Cost Calculator

Estimate your total import cost from China.