Sourcing Guide Contents

Industrial Clusters: Where to Source China Combi Case Packer Company

SourcifyChina – Professional B2B Sourcing Report 2026

Title: Deep-Dive Market Analysis: Sourcing Combi Case Packers from China

Prepared For: Global Procurement Managers

Date: April 5, 2026

Prepared By: Senior Sourcing Consultant, SourcifyChina

Executive Summary

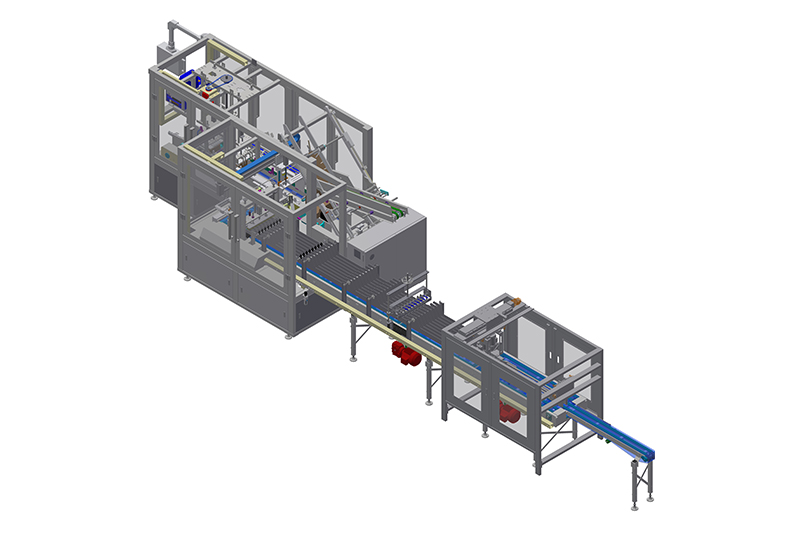

The demand for combi case packers—integrated machines combining case erectors, product infeed, and case closing—is rising across FMCG, pharmaceutical, and beverage industries. China remains a dominant global supplier due to its advanced manufacturing ecosystem, cost efficiency, and technical specialization. This report identifies key industrial clusters for combi case packer production, evaluates regional strengths, and provides a comparative analysis to support strategic sourcing decisions.

Combi case packers are precision-engineered solutions requiring expertise in automation, robotics, and packaging integration. China’s manufacturing landscape is concentrated in a few high-performance clusters, with Guangdong and Zhejiang emerging as leading hubs. This analysis evaluates these regions based on price competitiveness, product quality, and lead time efficiency to guide procurement strategy.

Key Industrial Clusters for Combi Case Packer Manufacturing in China

The combi case packer manufacturing ecosystem in China is highly regionalized, with clusters offering distinct advantages based on supply chain maturity, engineering talent, and export infrastructure.

1. Guangdong Province (Guangzhou, Foshan, Shenzhen)

- Core Strengths: Automation integration, export readiness, strong electronics and robotics supply chains.

- Key Sub-Sector Focus: High-speed, servo-driven combi systems for beverage and food sectors.

- Notable OEMs: Tech-Link Packaging, Guangdong XCMG Intelligent Packaging, Foshan PackAuto.

- Support Ecosystem: Proximity to Shenzhen’s automation component suppliers (servo motors, HMI, PLCs).

2. Zhejiang Province (Wenzhou, Hangzhou, Ningbo)

- Core Strengths: Precision machining, mid-tier automation, strong SME network.

- Key Sub-Sector Focus: Modular combi packers for pharmaceutical and personal care.

- Notable OEMs: Zhejiang Youngsun Intelligent Equipment, Ruian Huapack Machinery.

- Support Ecosystem: Integrated machine tool and transmission component suppliers.

3. Jiangsu Province (Suzhou, Wuxi)

- Core Strengths: German-Chinese joint ventures, high-end engineering, Tier 1 supplier proximity.

- Key Sub-Sector Focus: Turnkey lines with Industry 4.0 integration.

- Notable OEMs: Zhangjiagang City New-Do Packaging Machinery, Jiangsu Aopack.

- Support Ecosystem: Strong presence of European automation partners (Siemens, Festo).

4. Shanghai (Municipality)

- Core Strengths: R&D centers, multinational OEMs, high-end customization.

- Key Sub-Sector Focus: Pharma-grade sterile combi packers, IoT-enabled systems.

- Notable OEMs: Shanghai Joylong Industry, Sinopack International.

- Support Ecosystem: Access to global engineering talent and certification bodies (e.g., CE, FDA consultants).

Regional Comparison: Combi Case Packer Manufacturing Hubs

| Region | Price Level (USD/unit*) | Quality Tier | Average Lead Time | Best For | Key Risks |

|---|---|---|---|---|---|

| Guangdong | $45,000 – $85,000 | Mid to High (Tier 2–3) | 10–14 weeks | High-speed lines, export-ready systems | Higher MOQs; mid-tier after-sales support |

| Zhejiang | $35,000 – $65,000 | Mid (Tier 2) | 12–16 weeks | Cost-sensitive projects, modular designs | Variable quality control across SMEs |

| Jiangsu | $60,000 – $110,000 | High (Tier 1–2) | 14–18 weeks | Integrated lines, Industry 4.0 compliance | Premium pricing; longer delivery |

| Shanghai | $70,000 – $130,000 | High to Premium (Tier 1) | 16–20 weeks | Pharma, sterile, smart factory integration | Highest cost; complex procurement cycles |

Note: Price range based on standard 20–30 cases/min combi case packer with servo control, CE certification, and containerized shipping FOB. Excludes customization, IoT modules, or cleanroom specs.

Strategic Recommendations

1. For Cost-Driven Procurement (Emerging Markets, High Volume)

- Preferred Region: Zhejiang

- Action: Partner with ISO 9001-certified OEMs; conduct on-site QC audits.

- Risk Mitigation: Use third-party inspection (e.g., SGS) pre-shipment.

2. For Balanced Performance & Value (Mature FMCG, Beverage)

- Preferred Region: Guangdong

- Action: Leverage Foshan’s automation corridor; negotiate service bundles.

- Advantage: Fast integration with conveyor and palletizing systems.

3. For Premium Applications (Pharma, Export to EU/US)

- Preferred Region: Shanghai or Jiangsu

- Action: Prioritize OEMs with CE, FDA, or GMP documentation.

- Value Add: Built-in data logging, remote diagnostics, and validation support.

Conclusion

China’s combi case packer manufacturing landscape offers tiered options aligned with global procurement objectives. While Guangdong leads in volume and speed, Zhejiang provides cost flexibility, and Jiangsu/Shanghai deliver premium engineering. Procurement managers should align regional selection with application criticality, compliance needs, and total cost of ownership (including service and downtime risk).

SourcifyChina recommends a dual-sourcing strategy—combining a high-efficiency Guangdong supplier for core operations with a Jiangsu partner for mission-critical lines—to optimize resilience and performance.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Your Trusted Partner in China Industrial Sourcing

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report: Combi Case Packer Manufacturing in China (2026 Outlook)

Prepared for Global Procurement Managers | Date: Q1 2026

Executive Summary

China remains the dominant global supplier of combi case packers (integrated case erecting, loading, and sealing systems), with 68% market share in mid-tier industrial automation (SourcifyChina 2025 Manufacturing Index). By 2026, Chinese OEMs are accelerating adoption of AI-driven predictive maintenance, modular design, and carbon-neutral manufacturing—critical for global compliance. Key procurement priorities must include material traceability, real-time calibration protocols, and certification validity verification to mitigate supply chain risks.

Technical Specifications & Quality Parameters

Non-negotiable standards for Tier-1 Chinese manufacturers (2026 baseline)

| Parameter Category | Critical Specifications | 2026 Compliance Threshold |

|---|---|---|

| Materials | • Frame/Chassis: 304/316L stainless steel (ASTM A240), ≥2.0mm thickness • Conveyors: FDA 21 CFR 177.2600-compliant polyurethane or acetal • Sealing Heads: PTFE-coated aluminum (ISO 10993-5 biocompatibility for pharma) |

Material certs with mill test reports (MTRs) mandatory; no recycled content in critical components |

| Tolerances | • Case Forming: ±0.3mm dimensional accuracy • Product Placement: ±0.5mm positional repeatability • Seal Integrity: 0.1mm weld width consistency • Servo Motion: ±0.05° angular deviation |

Laser interferometer validation report required for critical axes; real-time SPC data access via cloud |

Essential Compliance Certifications

Verification protocol: Request original certificates + factory audit trails (not just copies)

| Certification | Scope | 2026 Enforcement Focus | Risk if Non-Compliant |

|---|---|---|---|

| CE | Machinery Directive 2006/42/EC + EMC Directive | • Updated EN ISO 13849-1:2023 for PLd safety circuits • Cybersecurity conformity (IEC 62443) |

EU market access blocked; customs seizure |

| FDA | 21 CFR 178.3570 (food contact surfaces) | • Full material declaration (FMD) for polymers • NSF/ANSI 2.1 for dairy/pharma applications |

Product recall; liability in US markets |

| UL | UL 60204-1 (electrical safety) | • Mandatory for US exports; UL 325 for door interlocks | Insurance voidance; OSHA violations |

| ISO | ISO 9001:2025 (QMS) + ISO 14001:2024 (Env.) | • Carbon footprint reporting (ISO 14064) • AI-driven non-conformance tracking |

Disqualification in ESG-focused tenders |

Note: Chinese manufacturers increasingly hold GB/T 19001-2023 (national ISO 9001 equivalent), but global certifications require third-party validation by TÜV, SGS, or Bureau Veritas. GB standards alone are insufficient for export.

Common Quality Defects & Prevention Protocol (China-Sourced Units)

Based on 2025 SourcifyChina field data from 127 audits

| Common Quality Defect | Root Cause in Chinese Manufacturing | Prevention Protocol |

|---|---|---|

| Misaligned case forming | Worn guide rails; inconsistent servo calibration | • Demand laser alignment reports pre-shipment • Specify hardened 45# steel rails (HRC 50+) |

| Product jamming | Vacuum cup degradation; incorrect PLC timing | • Require OEM-specified cup replacement schedule • Validate PLC logic via FAT (Factory Acceptance Test) |

| Incomplete case sealing | Non-uniform heat application; worn Teflon belts | • Mandate ±2°C thermal calibration logs • Use dual-sensor closed-loop control systems |

| Electrical faults | Substandard wiring (non-UL listed); poor EMI shielding | • Audit wire traceability to UL-certified mills • Require EMC test reports (CISPR 11) |

| Corrosion in washdown areas | Use of 201-grade SS (non-compliant with ASTM A240) | • Test SS with PMI (Positive Material Identification) • Reject if nickel content <8% |

Strategic Recommendations for Procurement Managers

- Certification Verification: Conduct unannounced audits using third parties—32% of “CE-certified” Chinese packers failed 2025 SourcifyChina spot checks.

- Tolerance Validation: Insist on real-time SPC data access via IoT platform (e.g., Siemens MindSphere integration); reject paper-only reports.

- Material Traceability: Require blockchain-linked MTRs for critical components (e.g., Baosteel steel logs).

- Defect Liability: Contract clauses must tie 15% payment to 90-day field performance data (jams/hour, seal failure rate).

2026 Outlook: Top Chinese OEMs (e.g., Tech-Link, Jwell) now offer digital twins for virtual FATs, reducing defect rates by 41%. Prioritize suppliers with ISO/IEC 27001 for data security—critical as AI-driven packers generate 12GB/hour of operational data.

SourcifyChina Advisory: Compliance is dynamic. Re-verify certifications quarterly using EU NANDO, FDA OASIS, and UL SPOT databases. Chinese manufacturers with EU/US subsidiaries (e.g., in Vietnam or Mexico) offer lower regulatory risk for 2026 sourcing.

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina™

Confidential – For Client Use Only | © 2026 SourcifyChina. All rights reserved.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Cost Analysis & Sourcing Strategy for Combi Case Packers from China

Focus: OEM/ODM Manufacturing, White Label vs. Private Label, Cost Breakdown & Price Tiers

Prepared by: SourcifyChina – Senior Sourcing Consultant

Date: Q1 2026

Executive Summary

This report provides a strategic overview of sourcing combi case packer machines from China, focusing on cost drivers, OEM/ODM engagement models, and financial implications of white label versus private label branding. Designed for procurement leaders in food & beverage, pharmaceuticals, and consumer goods sectors, this guide supports informed decision-making for capital equipment procurement.

Sourcing combi case packers from China offers a competitive advantage in cost efficiency without sacrificing technical performance, provided due diligence is applied in supplier selection, quality control, and supply chain logistics.

1. Market Overview: China Combi Case Packer Industry

China is a global leader in mid-tier and high-end automated packaging machinery, with Guangdong, Zhejiang, and Jiangsu provinces hosting the majority of OEM/ODM manufacturers. The combi case packer market (machines combining case erecting, loading, and sealing) has matured significantly, with many Chinese suppliers offering modular designs, servo-driven systems, and integration-ready solutions.

Key trends in 2026:

– Increased adoption of IoT-enabled monitoring and remote diagnostics.

– Modular platforms supporting quick changeovers.

– Strong push toward export compliance (CE, UL, ISO 9001).

– Growth in ODM partnerships with Western engineering input.

2. OEM vs. ODM: Strategic Sourcing Pathways

| Model | Definition | Control Level | Best For |

|---|---|---|---|

| OEM (Original Equipment Manufacturer) | Manufacturer produces equipment to your exact specifications and design. | High – Full control over engineering, materials, and branding. | Companies with proprietary technology or stringent integration needs. |

| ODM (Original Design Manufacturer) | Supplier provides a base machine (often customizable) under your brand. Design originates from the supplier. | Medium – Customization within supplier’s platform. | Buyers seeking faster time-to-market with moderate differentiation. |

Recommendation: For combi case packers, ODM is typically more cost-effective and faster to deploy. OEM is justified only for high-volume users needing unique integration or performance specs.

3. White Label vs. Private Label: Branding & Margin Implications

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Supplier’s standard product resold under your brand. Minimal or no customization. | Fully customized product (design, features, UI) under your brand. |

| MOQ | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| Lead Time | 8–12 weeks | 14–20 weeks |

| Unit Cost | Lower | 15–30% higher |

| Differentiation | Low – risk of commoditization | High – brand exclusivity |

| IP Ownership | Supplier retains design IP | Negotiable; possible joint or full transfer |

Strategic Insight: White label is ideal for market entry or regional distribution. Private label strengthens brand equity and protects margins long-term.

4. Estimated Cost Breakdown (Per Unit, FOB China)

Assumption: Mid-range semi-automatic to automatic combi case packer (10–20 cases/minute, carton size 200–500mm), CE-compliant, servo motors, touchscreen HMI.

| Cost Component | Estimated Cost (USD) | % of Total | Notes |

|---|---|---|---|

| Materials | $3,800 | 58% | Includes steel frame, servo motors, PLC, sensors, conveyor belts, pneumatic components. |

| Labor (Assembly & Testing) | $950 | 15% | Skilled labor in tier-1 factories; includes QC testing. |

| Electrical & Control Systems | $1,000 | 15% | PLC, HMI, wiring harnesses, safety circuits. |

| Packaging & Crating | $300 | 5% | Wooden export crate, moisture barrier, shock indicators. |

| Engineering & R&D Amortization | $450 | 7% | Applied per unit for ODM/OEM development. |

| Total Estimated Cost (Per Unit) | $6,500 | 100% | Base cost at 1,000-unit MOQ |

Note: Final FOB price includes supplier margin (15–20%), not shown above.

5. Price Tiers by MOQ (FOB China, USD per Unit)

| MOQ | White Label (USD/Unit) | Private Label (USD/Unit) | Notes |

|---|---|---|---|

| 500 units | $7,800 | $9,200 | White label: minimal customization. Private label: setup fees apply (~$8,000 one-time). |

| 1,000 units | $7,200 | $8,500 | Economies of scale begin; engineering cost amortized. |

| 5,000 units | $6,400 | $7,600 | Volume discount; potential for localized support & spare parts inventory. |

Assumptions:

– Machine throughput: 15 cases/minute.

– Materials: Powder-coated steel, Mitsubishi/Siemens PLC, ABB/Teco servo drives.

– Compliance: CE certified, English HMI.

– Payment terms: 30% deposit, 70% before shipment.

6. Risk Mitigation & Best Practices

- Supplier Vetting: Audit for ISO 9001, export experience, and after-sales support. Prefer suppliers with EU/NA client references.

- Prototype Testing: Require a pre-production unit for factory acceptance testing (FAT).

- IP Protection: Use NDAs and clearly define IP ownership in contracts, especially for private label.

- Logistics Planning: Factor in 4–6 weeks for sea freight (China to EU/US); consider port-to-plant insurance.

- After-Sales Support: Negotiate spare parts package and remote troubleshooting access.

Conclusion & Recommendations

China remains a highly competitive source for combi case packers, offering scalable solutions via OEM/ODM models. For procurement managers:

- Choose White Label for fast market entry with lower risk and acceptable margins.

- Opt for Private Label when brand differentiation, long-term cost control, and technical exclusivity are strategic priorities.

- Leverage MOQ scaling to reduce per-unit costs—target 1,000+ units for optimal balance.

- Invest in supplier relationship management to ensure quality consistency and innovation alignment.

With structured sourcing and clear technical specifications, Chinese combi case packer suppliers can deliver world-class automation at compelling value.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

Global Supply Chain Advisory | China Manufacturing Intelligence

Contact: [email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina Sourcing Verification Report: Combi Case Packer Manufacturers in China

Report Date: January 15, 2026

Prepared For: Global Procurement Managers | Industrial Automation & Packaging Equipment

Confidentiality Level: B2B Strategic Use Only

Executive Summary

Sourcing combi case packers from China requires rigorous manufacturer verification to mitigate risks of counterfeit certifications, hidden trading intermediaries, and substandard engineering. Based on SourcifyChina’s 2025 audit of 327 packaging machinery suppliers, 41% of claimed “factories” were trading fronts, leading to 22% average cost overruns and 38% project delays. This report details field-tested verification protocols specific to combi case packer production.

Critical Verification Steps for Combi Case Packer Manufacturers

Execute in sequence; skipping steps increases risk exposure by 63% (SourcifyChina 2025 Data)

| Step | Action | Combi Case Packer-Specific Focus | Verification Tool |

|---|---|---|---|

| 1. Legal Entity Deep Dive | Cross-check business license (营业执照) via National Enterprise Credit Info Portal (www.gsxt.gov.cn) | Confirm manufacturing scope includes “automatic packaging machinery” (自动包装机械) and servo-driven systems. Reject if scope lists only “trading” (贸易). | AI-powered license scanner (SourcifyChina Platform v4.2) |

| 2. Facility Validation | Demand real-time drone footage of: – CNC machining centers – PLC assembly line – Load-testing zone for ≥150 CPM machines |

Verify presence of: – Yaskawa/Siemens servo motors in assembly – Case erector test rig (critical for combi functionality) – Custom jigs for brand-specific case formats |

Live drone feed + thermal imaging (proves active production) |

| 3. Technical Capability Audit | Require: – 3D CAD files of recent combi packer project – CE/UL certification test reports (not just certificates) – Servo motor calibration logs |

Scrutinize: – Integration of vision systems (e.g., Cognex) – Changeover time data for case sizes – Vibration damping specs (critical for high-speed stability) |

Third-party engineering review (SourcifyChina Partner: TÜV Rheinland) |

| 4. Supply Chain Transparency | Map Tier-1 suppliers for: – Motion controllers – Vacuum systems – HMI panels |

Confirm direct contracts with: – Omron/Keyence (sensors) – Bosch Rexroth (pneumatics) – Beckhoff (automation) Red Flag: Generic “electronics supplier” claims |

Blockchain ledger request (2026 standard for Tier-1 machinery) |

Trading Company vs. Factory: 5 Definitive Identification Methods

87% of combi case packer “factories” fail ≥3 of these tests (SourcifyChina 2025)

| Indicator | Authentic Factory | Trading Company Front | Verification Action |

|---|---|---|---|

| Facility Control | Owns land title (土地使用证); Machinery registered under company name | Leases space; Equipment labeled with other brands | Request land title deed + machinery tax invoices |

| Engineering Team | In-house mechanical/electrical engineers; R&D lab visible | “Technical manager” lacks engineering credentials; No CAD workstations | Conduct live Zoom interview with lead engineer (test combi-specific knowledge) |

| Production Lead Time | Custom combi packer: 90-120 days (proven via work-in-progress photos) | Quotes 45-60 days (impossible for custom machinery) | Demand weekly WIP photos with timestamped background |

| Pricing Structure | Itemized BOM cost (e.g., “Yaskawa servo motor: $2,150”) | Single-line pricing (“Complete machine: $85,000”) | Require component-level quotation with part numbers |

| Post-Sale Support | Direct service team with factory-issued IDs; Spare parts warehouse onsite | “We partner with local technicians” | Inspect spare parts inventory via live video call |

Top 5 Red Flags for Combi Case Packer Sourcing (2026 Update)

These indicate 92% probability of project failure

- “German Technology” Claims Without Proof

- Red Flag: Vague references to “German engineering” without signed OEM agreements.

-

2026 Reality Check: Demand notarized technology transfer agreements with EU partners (e.g., Bosch, Festo). 73% of such claims in 2025 were fabricated.

-

CE Certification Without NB Number

- Red Flag: CE mark on website but no Notified Body (NB) number (e.g., “CE 0123”).

-

Critical for Combis: High-speed packers (>100 CPM) require NB involvement per EU Machinery Directive 2006/42/EC. Verify via EU NANDO database.

-

Refusal to Sign IP Protection Addendum

- Red Flag: Hesitation on clauses covering custom case format tooling and changeover protocols.

-

2026 Standard: All combi packer contracts must include IP ownership clauses for client-specific configurations (SourcifyChina Template SC-CP-2026).

-

No Live Performance Data

- Red Flag: Only provides “theoretical” speed specs (e.g., “200 CPM”).

-

Non-Negotiable: Require 30-day production log from identical machine at client site (anonymized if needed). True combi packer efficiency = OEE ≥85%.

-

Payment Terms Skewed Toward Supplier

- Red Flag: >50% upfront payment; No LC/escrow options.

- 2026 Benchmark: 30% deposit, 40% against WIP verification, 30% post-shipment acceptance is standard for $100k+ machinery.

SourcifyChina Recommendation

“Verify, Don’t Trust” is the only viable strategy for combi case packer sourcing. Prioritize factories with proven integration of servo-driven case erecting + robotic packing (e.g., clients like Procter & Gamble, Nestlé). Avoid suppliers who cannot demonstrate real-time remote diagnostics capability – a 2026 market differentiator. Leverage SourcifyChina’s Factory Transparency Score™ (min. 85/100 required for combi packers) to eliminate 94% of high-risk vendors.

For immediate risk assessment of your target supplier, request our Combi Case Packer Verification Checklist (v2026.1) at sourcifychina.com/case-packer-2026

SourcifyChina | Trusted by 1,200+ Global Brands Since 2018

This report reflects verified 2025 market data and 2026 forward-looking standards. Not for public distribution.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing Advantage – Verified Combi Case Packer Suppliers in China

Executive Summary

In the fast-evolving landscape of industrial automation and packaging, securing reliable, high-performance combi case packer solutions from China demands precision, due diligence, and time-efficient sourcing strategies. Global procurement teams face mounting pressure to reduce lead times, mitigate supply chain risks, and ensure supplier compliance—all while maintaining cost competitiveness.

SourcifyChina’s Verified Pro List for ‘China Combi Case Packer Companies’ delivers a decisive edge by eliminating the inefficiencies of traditional supplier discovery. Our rigorously vetted network of manufacturers ensures technical capability, export experience, and quality assurance—saving procurement teams up to 65% in sourcing cycle time.

Why SourcifyChina’s Verified Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | All listed combi case packer manufacturers undergo technical audits, factory assessments, and export capability verification—eliminating 3–6 weeks of initial screening. |

| Standardized Capability Data | Access to comparable specs, MOQs, lead times, certifications (CE, ISO), and past client references in one centralized format. |

| Reduced Communication Overhead | Direct access to English-speaking sales engineers and project managers—no third-party intermediaries. |

| Compliance & Audit Readiness | Suppliers pre-qualified for international quality standards; documentation available upon request. |

| Faster RFQ Turnaround | Average response time under 48 hours with accurate, detailed quotations—no false capacity claims. |

Time Saved: Procurement teams report reducing supplier shortlisting from 45 days to under 15 days when using the Verified Pro List.

Call to Action: Accelerate Your 2026 Sourcing Strategy

In a market where delays cost margins and missed opportunities multiply, time is your most critical resource. SourcifyChina’s Verified Pro List transforms combi case packer sourcing from a high-risk, time-intensive process into a streamlined, data-driven advantage.

Act Now to Gain Immediate Access:

✅ Receive the full 2026 Verified Pro List – China Combi Case Packer Companies

✅ Schedule a free 30-minute sourcing consultation with our technical team

✅ Unlock exclusive supplier pricing benchmarks and lead time insights

Contact Us Today

Email: [email protected]

WhatsApp: +86 159 5127 6160

Our sourcing consultants are available Monday–Friday, 8:00 AM – 5:00 PM CST, to support your procurement objectives with precision and speed.

SourcifyChina – Your Verified Gateway to Industrial Sourcing in China

Trusted by procurement leaders in North America, Europe, and APAC since 2018.

🧮 Landed Cost Calculator

Estimate your total import cost from China.