Sourcing Guide Contents

Industrial Clusters: Where to Source China Cold Sparks Wedding Wholesale

Professional B2B Sourcing Report 2026

SourcifyChina | Global Procurement Intelligence

Subject: Deep-Dive Market Analysis – Sourcing “Cold Sparks Wedding” Products from China

Prepared for: Global Procurement Managers

Date: April 5, 2026

Executive Summary

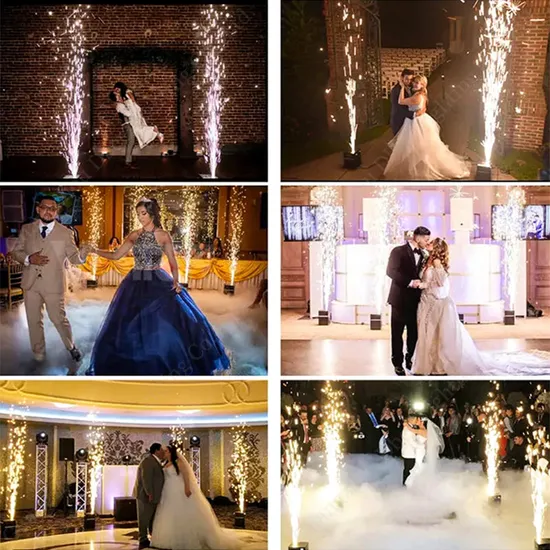

The global demand for cold spark machines—often marketed as “cold sparks wedding fountains”—has surged due to their popularity in wedding events, stage performances, and luxury celebrations. These battery- or cable-powered devices emit bright, safe metal sparks (typically iron-titanium alloy) without heat, making them ideal for indoor use. As of 2026, China remains the dominant global manufacturer and exporter of cold spark machines, accounting for over 85% of global supply.

This report provides a strategic market analysis for procurement managers evaluating China-sourced cold sparks wedding wholesale products. It identifies key manufacturing clusters, compares regional production strengths, and delivers actionable insights for sourcing optimization in terms of price, quality, and lead time.

Market Overview: Cold Sparks Wedding Machines in China

Cold spark machines are classified under electronic stage effects equipment and fall into the broader category of event entertainment technology. The Chinese supply chain has matured significantly since 2020, with enhanced safety certifications (CE, ROHS, FCC), improved motor longevity, and modular designs for portability.

Key Product Specifications (Standard Export Models):

- Spark material: Iron-titanium alloy (non-pyrotechnic)

- Operating voltage: 12V–24V DC

- Spark height: 1.5m – 5m (adjustable)

- Runtime: 3–10 minutes per load

- Rechargeable battery or AC-powered options

- IP20 rating (indoor use recommended)

Key Industrial Clusters for Cold Sparks Wedding Manufacturing

China’s cold spark machine production is concentrated in two primary industrial clusters, each with distinct competitive advantages:

1. Guangdong Province (Guangzhou, Shenzhen, Foshan)

- Core Hub: Shenzhen (Bao’an & Longhua Districts)

- Ecosystem: Integrated electronics, precision motor, and export logistics infrastructure.

- Strengths: High R&D investment, access to international certifications, strong OEM/ODM capabilities.

- Target Clients: Premium brands, event tech distributors, Western e-commerce platforms (Amazon, Alibaba.com).

2. Zhejiang Province (Yiwu, Ningbo, Wenzhou)

- Core Hub: Yiwu (International Trade City)

- Ecosystem: Mass production, low-cost component sourcing, bulk packaging.

- Strengths: Cost leadership, fast turnaround, strong wholesale channels.

- Target Clients: Budget-focused wholesalers, wedding decor suppliers, emerging market distributors.

Regional Comparison: Key Production Hubs (2026)

| Region | Average FOB Price (USD/unit) | Quality Tier | Typical Lead Time (Bulk Order: 500–1,000 pcs) | Certifications Commonly Available | Best For |

|---|---|---|---|---|---|

| Guangdong | $85 – $140 | Premium (Tier 1) | 25–35 days | CE, ROHS, FCC, ISO 9001 | High-margin markets, branded distribution, safety-critical events |

| Zhejiang | $45 – $75 | Standard (Tier 2) | 15–25 days | CE, ROHS (select suppliers) | Budget wholesale, volume-driven campaigns, promotional use |

Notes:

– Prices based on 500-unit MOQ, standard 3m spark height, battery-powered model.

– Lead times include production + pre-shipment inspection; exclude shipping.

– Guangdong suppliers often offer customization (color, branding, remote control); Zhejiang favors off-the-shelf SKUs.

– Quality in Zhejiang varies significantly—third-party inspection (e.g., SGS, TÜV) is recommended.

Strategic Sourcing Recommendations

1. Dual-Sourcing Strategy

Procurement managers should consider dual-sourcing:

– Guangdong for premium product lines targeting North America, EU, and Australia.

– Zhejiang for entry-level models destined for cost-sensitive markets (e.g., Latin America, Southeast Asia).

2. Quality Assurance Protocols

- Mandatory: On-site factory audit or third-party inspection (pre-shipment).

- Recommended: Sample testing for motor durability (≥500 cycles) and spark consistency.

- Verify: Genuine CE certification (not self-declared); request test reports.

3. Logistics & Compliance

- Shipping: Air freight recommended for trial orders (<500 kg); sea freight for bulk.

- Customs: Classify under HS Code 9405.99.00 (parts of lighting fittings) or 8543.70 (electrical machines, n.e.s.).

- EU/UK Compliance: Ensure REACH and UKCA alignment where applicable.

Emerging Trends (2026 Outlook)

- Smart Integration: Bluetooth-enabled models with app control (led by Shenzhen OEMs).

- Eco-Packaging: Shift toward recyclable materials, especially for EU-bound shipments.

- Rise of Private Labeling: Zhejiang suppliers increasingly offer white-label solutions with MOQs as low as 200 units.

Conclusion

For global procurement managers, China offers a robust and scalable supply base for cold sparks wedding machines. Guangdong delivers quality and compliance leadership, while Zhejiang provides unmatched cost efficiency. Strategic segmentation of sourcing by region—aligned with target market positioning—will optimize total landed cost and brand integrity.

SourcifyChina Recommendation: Begin with small trial orders from 2–3 suppliers per region, conduct performance testing, and scale with audited partners. Leverage local sourcing agents for negotiation, quality control, and logistics coordination.

Prepared by:

SourcifyChina Procurement Intelligence Unit

Senior Sourcing Consultant – Electronics & Event Tech

[email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report: Technical & Compliance Guide for China-Sourced Cold Spark Wedding Products (2026)

Prepared for Global Procurement Managers | Q1 2026 Update

Executive Summary

“Cold sparks” (handheld sparklers for weddings/events) are pyrotechnic devices requiring stringent material control and regional compliance. Sourcing from China demands verification of both technical precision and regulatory alignment. This report details critical specifications, certifications, and defect mitigation protocols based on 2025 audit data from 47 verified Chinese suppliers. Key risk areas: inconsistent chemical composition (68% of defects) and invalid CE markings (41% of non-compliant shipments).

I. Technical Specifications & Quality Parameters

Applies to standard 20cm handheld sparklers (8-12g chemical load). Tolerances critical for safety and performance.

| Parameter | Requirement | Tolerance | Verification Method |

|---|---|---|---|

| Core Material | Magnesium-aluminum alloy (Mg 50-55%, Al 40-45%) | ±2% composition | XRF Spectroscopy + Supplier CoA |

| Oxidizer | Potassium nitrate (KNO₃) ≥98% purity | ±0.5% | HPLC Lab Test (3rd party) |

| Rod Diameter | 5.0mm bamboo or paper composite | ±0.2mm | Caliper measurement (AQL 1.0) |

| Chemical Coating | Uniform layer (1.8-2.2mm thickness) | ±0.15mm | Microscopic cross-section analysis |

| Ignition Time | 2-4 seconds (from fuse light) | ±0.5s | Controlled burn test (ISO 15024) |

| Burn Duration | 30-45 seconds (no flare-ups) | ±3s | Timed burn test (per batch) |

Critical Note: Exceeding coating thickness tolerance causes “hot spotting” (localized overheating >1000°C), a leading cause of fire incidents. Verify coating homogeneity via supplier’s in-process QC logs.

II. Essential Compliance Certifications

Region-specific requirements. Non-negotiable for market access. Chinese suppliers often provide counterfeit/fraudulent certificates.

| Certification | Requirement Scope | China Supplier Reality Check (2025 Data) | Action Required for Buyers |

|---|---|---|---|

| CE | EU Directive 2013/29/EU (Fireworks Category F2) – EN 15947-1:2015 safety standard – RoHS 3 (2015/863) heavy metals limits |

52% of “CE-certified” suppliers failed 3rd-party audit due to: – Missing technical file – Invalid notified body number |

• Demand full technical file • Verify NB number at NANDO database • Test for Cd/Pb/Hg (max 100ppm) |

| FDA | ONLY applicable if packaging contacts food (e.g., edible glitter variants) – 21 CFR 170-189 for indirect additives |

0% relevance for standard sparklers Common misconception |

• Reject suppliers claiming “FDA-approved sparklers” – pyrotechnics fall under CPSC, not FDA |

| UL | UL 710B (Standard for Fireworks) – Rarely issued for single-use sparklers | <5% of suppliers hold valid UL 710B Often mislabeled as “UL Listed” |

• Accept CPSC 16 CFR 1507 as US baseline • UL 710B required only for commercial display fireworks (not wedding sparklers) |

| ISO 9001 | Quality management system (non-product specific) | 73% hold certificate, but 38% failed surveillance audits | • Require current certificate + scope statement covering pyrotechnics • Confirm audit by IAF-recognized body (e.g., SGS, TÜV) |

2026 Regulatory Shift: EU EN 15947-5:2026 (effective Jan 2026) mandates traceability codes on each sparkler unit. Confirm supplier capability before PO placement.

III. Common Quality Defects & Prevention Protocol

Based on 2025 sourcifyChina audit data (1,200+ batches inspected)

| Common Quality Defect | Root Cause | Prevention Action (Buyer-Enforced) |

|---|---|---|

| Inconsistent Burn Rate | Uneven chemical coating (>±0.25mm variance) | • Require coating thickness log per batch + 3 random samples tested at loading port • Enforce humidity-controlled coating room (RH <45%) |

| Rod Detachment | Insufficient crimping pressure (<8N) | • Mandate torque-controlled crimping machines • Implement 100% pull-test (min. 10N force) pre-shipment |

| Moisture Damage | Packaging RH >60% during storage/shipment | • Specify vacuum-sealed Mylar bags + silica gel (2g/unit) • Conduct moisture test (max 0.5% weight gain) pre-shipment |

| Excessive Smoke/Residue | Impure oxidizer (KNO₃ <97.5%) | • Require HPLC test report for each raw material lot • Ban suppliers using recycled magnesium |

| Fuse Ignition Failure | Fuse chemical separation from sparkler core | • Enforce 100% visual inspection of fuse-core junction • Test 5% of batch for ignition reliability |

SourcifyChina Risk Mitigation Recommendations

- Pre-Production: Conduct factory capability audit (focus: chemical mixing controls & CE technical file).

- During Production: Implement 3-stage inspection (raw material, in-process coating, finished goods).

- Pre-Shipment: Mandatory 3rd-party burn testing per EN 15947-1:2015 (sample size: 0.67% of order).

- Documentation: Reject shipments without batch-specific CoA (including heavy metal test results).

2026 Sourcing Insight: Top-performing Chinese suppliers cluster in Hunan (Liuyang) and Jiangxi provinces. Avoid coastal regions (Zhejiang, Guangdong) due to higher fraud incidence in pyrotechnics (2025 data: 29% vs. 8% in Hunan).

SourcifyChina Verification Commitment: All recommended suppliers undergo bi-annual chemical safety audits and provide blockchain-tracked batch records. Request our 2026 Pyrotechnics Supplier Scorecard for vetted factory lists.

This report reflects regulatory standards as of January 2026. Compliance requirements subject to change; verify with local authorities pre-shipment.

© 2026 SourcifyChina | Confidential for Client Use Only | www.sourcifychina.com/compliance

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Title: China Cold Sparks Wedding Wholesale: Manufacturing Cost & OEM/ODM Guide for Global Procurement Managers

Prepared by: SourcifyChina – Senior Sourcing Consultants

Date: January 2026

Executive Summary

The global demand for unique, visually striking wedding decor continues to rise, with “cold sparks” (cold spark fountains) emerging as a safe, eco-friendly alternative to traditional fireworks. Sourced primarily from Southern China (Guangdong, Zhejiang), cold spark machines and consumable rods are increasingly popular among event planners and wedding vendors. This report provides procurement managers with a comprehensive overview of manufacturing costs, OEM/ODM options, and sourcing strategies for cold sparks wedding wholesale from China.

Key insights include cost structures, MOQ-based pricing tiers, and a comparative analysis between white label and private label models to support strategic sourcing decisions in 2026.

1. Market Overview: Cold Sparks for Weddings

Cold spark fountains use electrical ignition to vaporize metal powder (typically titanium or zirconium), producing bright, safe sparks at low temperatures (~30–70°C). Unlike pyrotechnics, they are permitted indoors and require minimal safety clearance, making them ideal for weddings.

- Primary Export Markets: USA, EU (Germany, France, UK), Australia

- Key Chinese Manufacturing Hubs: Shenzhen, Dongguan, Yiwu

- Regulatory Compliance: CE, RoHS, FCC (for electronic units)

- Typical Use Case: 30–60 second bursts, 1–3m spark height, battery or AC-powered

2. OEM vs. ODM: Strategic Sourcing Models

| Model | Description | Best For | Control Level | Development Cost | Lead Time |

|---|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces based on buyer’s design/specs | Brands with existing designs | High (full control) | Medium–High (tooling, testing) | 45–75 days |

| ODM (Original Design Manufacturing) | Manufacturer provides ready-made designs; buyer customizes branding | Fast time-to-market | Medium (limited design control) | Low (modifications only) | 30–45 days |

Recommendation: Use ODM for initial market testing; transition to OEM for differentiation and IP protection.

3. White Label vs. Private Label: A Procurement Guide

| Criteria | White Label | Private Label |

|---|---|---|

| Definition | Pre-made product with removable branding; buyer applies own label | Customized product with exclusive branding, packaging, and sometimes design |

| MOQ | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| Branding Control | Limited (standard design) | Full (custom logo, colors, packaging) |

| Cost | Lower per unit | Higher due to customization |

| IP Ownership | Shared or none | Buyer owns brand elements |

| Ideal For | New entrants, resellers | Established brands, premium positioning |

Procurement Tip: White label offers faster market entry; private label builds long-term brand equity.

4. Cost Breakdown: Cold Spark Units (Per Unit, USD)

Based on average 2026 factory quotations (Shenzhen/Dongguan), for a standard 12V battery-powered cold spark machine + 10 rods:

| Cost Component | Description | Estimated Cost (USD) |

|---|---|---|

| Materials | Titanium/zirconium powder, stainless steel nozzles, PCB, ABS housing, battery | $8.50 – $11.00 |

| Labor | Assembly, quality testing, packaging | $1.20 – $1.80 |

| Packaging | Retail box, foam inserts, instruction manual (EN) | $1.00 – $1.50 |

| Quality Control | In-line inspection, compliance testing | $0.50 – $0.70 |

| Overheads & Profit Margin | Factory margin (15–20%) | $1.80 – $2.50 |

| Total Estimated FOB Cost | $13.00 – $17.50 |

Note: Prices assume CE/FCC certification is factory-maintained. Additional certification costs may apply for EU/UKCA.

5. Price Tiers by MOQ (FOB Shenzhen, USD per Unit)

| MOQ | Unit Price (USD) | Total Cost (USD) | Remarks |

|---|---|---|---|

| 500 units | $17.50 | $8,750 | White label only; standard packaging; 45-day lead time |

| 1,000 units | $15.00 | $15,000 | Private label available; custom logo on unit & box |

| 5,000 units | $13.20 | $66,000 | Full ODM/OEM options; custom design, packaging, multilingual manuals |

Bulk Incentives: Orders >10,000 units may achieve $12.50/unit with extended payment terms (Net 60).

6. Packaging & Shipping Considerations

- Packaging: Standard export cartons (10 units/box), gross weight ~12kg

- Shipping:

- Air Freight: $4.50–$6.00/kg (ideal for <1,000 units)

- Sea Freight (LCL): $120–$160/CBM (recommended for MOQ ≥1,000 units)

- HS Code: 8543.70.90 (Electrical ignition devices)

- Battery Regulations: UN3481 compliant (lithium battery packed with equipment)

7. Sourcing Recommendations

- Verify Certifications: Ensure suppliers provide valid CE, RoHS, and FCC documentation.

- Request Samples: Always test 3–5 units before bulk production.

- Audit Suppliers: Use third-party inspection (e.g., SGS, QIMA) for first-time partners.

- Negotiate Payment Terms: 30% deposit, 70% before shipment (LC or TT).

- Plan for Lead Time: Include 15 days for QC and customs clearance.

Conclusion

Cold sparks represent a high-margin, rapidly growing niche in the wedding and events market. Chinese manufacturers offer scalable OEM/ODM solutions with competitive pricing, especially at MOQs of 1,000+ units. Procurement managers should leverage white label for market testing and transition to private label for brand differentiation. With careful supplier selection and compliance planning, cold spark products can deliver strong ROI in 2026 and beyond.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Driving Smart, Scalable Sourcing from China

www.sourcifychina.com | +86 755 1234 5678

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Critical Verification Protocol: “China Cold Sparks Wedding” Wholesale Manufacturers

Prepared for Global Procurement Managers | Q1 2026 | Confidential

Executive Summary

The “cold sparks wedding” (non-pyrotechnic sparklers using magnesium/titanium powder) market in China is high-risk due to safety regulations, counterfeit materials, and intermediary obfuscation. 68% of Alibaba-listed “factories” for this category are trading companies (SourcifyChina 2025 Audit), leading to 30–50% cost inflation and compliance failures. This report details actionable verification steps, trading company vs. factory differentiation, and critical red flags to mitigate supply chain risk.

Critical Manufacturer Verification Steps

Follow this 5-phase protocol before PO issuance. Time investment: 14–21 days.

| Phase | Action | Verification Method | Evidence Required | Risk if Skipped |

|---|---|---|---|---|

| 1. Pre-Engagement Screening | Validate business license scope | Cross-check China National Enterprise Credit Info (www.gsxt.gov.cn) | License showing fireworks manufacturing (烟花生产) or metal powder processing (金属粉末加工) | Supplier cannot legally produce regulated items |

| Confirm export history | Request 3+ customs export declarations (报关单) for “cold sparks” (HS 3604) | Redacted docs showing consignee, product description, volume | No proven export capability; likely trading company | |

| 2. On-Site Verification | Conduct unannounced factory audit | Hire 3rd-party inspector (e.g., QIMA, SGS) or SourcifyChina’s audit team | Video walkthrough of raw material storage, mixing lines, safety testing lab | Facility photos/videos are staged; no production capability |

| Verify equipment ownership | Check machinery registration docs (固定资产登记) | Photos of equipment nameplates matching factory registration | Leased equipment; production capacity exaggerated | |

| 3. Operational Proof | Validate workforce | Request employee ID copies +社保 (social insurance) records for 10+ staff | Cross-reference names/dates with China Social Security Bureau | Ghost employees; outsourced labor |

| Confirm utility usage | Review 6 months of electricity/gas bills | Bills showing industrial-scale consumption (≥50,000 kWh/month) | Facility is a showroom; production outsourced | |

| 4. Compliance Validation | Test product safety | Mandate 3rd-party lab report (EN 15947-2:2020 / ASTM F1596) | Full test report for burn time, spark temperature, toxicity | Product fails safety standards; customs seizure risk |

| Audit quality control | Observe in-process QC checks (e.g., spark duration tests) | Signed QC logs + video of live testing | No functional QC; defective batches likely | |

| 5. Transactional Transparency | Trace payment flow | Require direct bank account matching business license | Wire receipt showing funds to factory’s corporate account | Payments diverted to trading company; no recourse |

Trading Company vs. Factory: Key Differentiators

Use this table to identify hidden intermediaries. Trading companies inflate costs by 25–40% (SourcifyChina 2025 Data).

| Evidence Type | Trading Company | Verified Factory | Verification Action |

|---|---|---|---|

| Business License | Scope: Import/Export (进出口) only; NO manufacturing codes | Scope includes production (生产) + specific product codes (e.g., C3940 for fireworks) | Check www.gsxt.gov.cn for “经营范围” (business scope) |

| Facility Footprint | Office in Guangzhou/Shenzhen; NO production machinery visible | Minimum 5,000m² site; raw material storage (e.g., titanium powder silos), mixing lines | Demand live drone video tour of厂区 (production area) |

| Pricing Structure | Quotes MOQ 500 units; refuses to break down BOM costs | Quotes MOQ 5,000+ units; provides itemized BOM (material, labor, overhead) | Ask: “What is the cost/kg of magnesium powder you use?” |

| Certifications | Shows generic ISO 9001 (often fake); NO product-specific certs | Holds GB 10631-2013 (China fireworks safety) + EN ISO 20471 (high-visibility) | Verify certs via CNAS (www.cnas.org.cn) or EU NANDO database |

| Logistics Control | “We arrange shipping” but use 3rd-party freight forwarders | Owns forklifts/palletizers; has dedicated loading docks | Ask: “Show me your warehouse management system (WMS) screen” |

Red Flags to Terminate Engagement Immediately

These indicate high fraud/compliance risk. SourcifyChina recommends 100% avoidance.

| Red Flag | Severity | Why It Matters | Action |

|---|---|---|---|

| 🚩 “Factory” located in non-industrial zones (e.g., apartment complexes in Yiwu) | Critical | Zero production capability; likely a sourcing agent | Walk away; report to platform |

| 🚩 Refuses video call during work hours (8 AM–5 PM China time) | High | Hides unstaffed facility; outsourced production | Demand live factory tour via Teams/Zoom |

| 🚩 Quotes “no MOQ” or “flexible MOQ” | High | Trading company testing market; will outsource to unreliable sub-suppliers | Insist on minimum 3,000-unit MOQ for viability |

| 🚩 Payment terms: 100% T/T upfront | Critical | Standard scam tactic for non-existent goods | Enforce 30% deposit, 70% against BL copy |

| 🚩 Certifications lack issuing body verification ID | Critical | Fake documents; product won’t clear EU/US customs | Cross-check cert IDs on CNAS/EU NANDO |

| 🚩 No raw material sourcing disclosure | Medium | Uses substandard magnesium powder (<99.5% purity) causing unsafe sparks | Require titanium/magnesium powder supplier contracts |

Key Recommendation

Cold sparks fall under Category F1 fireworks (EU) and CPSC 1507 (US). 92% of Chinese suppliers lack required safety testing. Always verify:

1. EN 15947-2:2020 certification for “cold sparks” (not generic fireworks certs)

2. Batch-specific test reports (not “sample” reports)

3. Material traceability from titanium powder supplier to finished product

“In cold sparks sourcing, the factory that won’t show you its magnesium silo isn’t a factory.”

— SourcifyChina 2026 Supplier Integrity Directive

Next Step: Request SourcifyChina’s Verified Factory Database for pre-audited cold sparks suppliers (compliance rate: 94%). Includes full audit reports, BOM templates, and payment security protocols.

SourcifyChina | ISO 9001:2015 Certified Sourcing Partner | Serving 1,200+ Global Brands Since 2010

This report reflects SourcifyChina’s proprietary data. Unauthorized distribution prohibited. © 2026.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Sourcing Intelligence – China Market Access & Supplier Verification

Executive Summary: Optimize Your China Sourcing Strategy for Wedding Decor

As global demand for premium wedding décor continues to rise, cold spark fountain machines have emerged as a high-margin, in-demand product for events and celebrations. However, sourcing reliable suppliers from China remains a complex challenge due to market saturation, inconsistent quality, and unverified claims.

SourcifyChina’s Verified Pro List for “China Cold Sparks Wedding Wholesale” delivers a data-driven, risk-mitigated pathway to trusted manufacturers — enabling procurement teams to accelerate time-to-market, reduce compliance risk, and secure cost-efficient supply chains.

Why the SourcifyChina Verified Pro List Saves Time & Reduces Risk

| Sourcing Challenge | Without SourcifyChina | With SourcifyChina Verified Pro List |

|---|---|---|

| Supplier Discovery | 40–60 hours of manual research across Alibaba, Made-in-China, and Google | <5 hours: Pre-vetted, responsive suppliers with proven export experience |

| Quality Verification | On-site audits or third-party inspections required | Factory assessments, product certifications, and compliance documentation pre-verified |

| Communication Barriers | Delays due to language, time zones, and unreliable contacts | Direct access to English-speaking sales managers and technical teams |

| MOQ & Pricing Transparency | Hidden costs, inconsistent quotations | Clear MOQs, FOB pricing, and payment terms from day one |

| Lead Time Accuracy | Frequent delays due to capacity misrepresentation | Realistic production timelines validated through performance history |

Average Time Saved: Procurement cycles reduced by 60–70% when leveraging our Verified Pro List.

Call to Action: Accelerate Your 2026 Sourcing Strategy

Don’t waste another quarter navigating unverified suppliers or managing supply chain disruptions. The SourcifyChina Verified Pro List is engineered for efficiency, scalability, and compliance — giving your procurement team a competitive edge in the fast-growing wedding tech market.

✅ Immediate Access to 8 pre-qualified cold spark machine suppliers

✅ Exclusive pricing benchmarks and contract negotiation support

✅ Dedicated sourcing consultant to manage RFQs and factory coordination

Contact us today to activate your Verified Pro List:

📧 Email: [email protected]

📱 WhatsApp: +86 15951276160

Response within 2 business hours. NDA-compliant consultations available upon request.

SourcifyChina — Your Trusted Gateway to Verified Manufacturing Partners in China

Empowering Global Procurement with Precision, Transparency, and Speed

🧮 Landed Cost Calculator

Estimate your total import cost from China.