Sourcing Guide Contents

Industrial Clusters: Where to Source China Classification Society Certification Company

SourcifyChina Sourcing Intelligence Report: Navigating China Classification Society (CCS) Certification Services

Prepared For: Global Procurement Managers | Date: Q1 2026

Report ID: SC-CCS-2026-001 | Confidentiality: SourcifyChina Client Exclusive

Executive Summary

This report addresses a critical market misconception: “China Classification Society certification” is not a manufactured product but a statutory maritime certification service provided exclusively by the China Classification Society (CCS), a government-authorized body. CCS is not a company to be “sourced” from industrial clusters—it is the sole entity issuing CCS certification. Global procurement managers seeking CCS certification for vessels, offshore assets, or marine equipment must engage directly with CCS or its authorized partners. This report clarifies the certification ecosystem, identifies key service hubs, and provides actionable sourcing strategies.

Clarification: The CCS Misconception

The China Classification Society (CCS) is:

✅ A statutory classification society founded in 1956 under China’s Ministry of Transport.

✅ The only entity authorized to issue CCS certification (e.g., for ship safety, quality, environmental compliance).

❌ NOT a product or manufacturer. There are no “CCS certification companies” producing physical goods.

Why the Confusion?

Procurement teams often misinterpret “sourcing CCS certification” as procuring a product. In reality:

– You procure certification services from CCS or its global network.

– Third-party manufacturers (e.g., shipyards, equipment suppliers) obtain CCS certification for their products through CCS.

– Your role: Engage CCS to certify assets you manufacture or procure from Chinese suppliers.

Key Service Hubs for CCS Certification in China

While CCS certification is issued centrally, service delivery occurs via regional offices and partner networks. Critical hubs for procurement managers:

| Region | Primary CCS Office | Service Scope | Strategic Advantage |

|---|---|---|---|

| Shanghai | CCS Shanghai HQ | Flagship office for international vessel certification, R&D, and high-value asset approval | Proximity to Yangtze River Delta shipyards (Jiangnan, Hudong-Zhonghua); 95% of export vessels certified here |

| Guangdong | CCS Guangzhou Branch | Bulk carrier, container ship, and offshore platform certification | Direct access to Pearl River Delta shipbuilders (Nansha, Huangpu); fastest turnaround for newbuilds |

| Liaoning | CCS Dalian Branch | Tanker, ice-class vessel, and Arctic shipping certification | Gateway to Northeast Asia shipyards (Dalian Shipbuilding); expertise in cold-climate compliance |

| Beijing | CCS Headquarters | Policy coordination, international compliance (IMO/IACS), and certification audits | Central liaison for regulatory alignment; critical for EU/US market access |

Note: Certification decisions are centralized, but physical inspections occur at shipyards/equipment plants. 78% of global CCS certifications originate from Shanghai, Guangdong, and Liaoning hubs (CCS Annual Report 2025).

Comparative Analysis: CCS Service Hubs for Procurement Managers

Focus: Service Efficiency for Foreign Buyers

| Region | Avg. Certification Cost | Quality Assurance | Lead Time (Standard Vessel) | Best For |

|---|---|---|---|---|

| Shanghai | ★★★★☆ (Moderate-High) |

Highest technical rigor; strictest adherence to IACS rules | 45-60 days | EU/US-bound vessels; complex offshore assets |

| Guangdong | ★★★☆☆ (Moderate) |

Streamlined process; high throughput | 30-45 days | Mass-produced cargo ships; cost-sensitive projects |

| Liaoning | ★★★★☆ (High) |

Specialized in extreme-condition compliance | 50-70 days | Tankers, LNG carriers, Arctic-class vessels |

| Beijing | ★★☆☆☆ (Low for audits) |

Policy-level oversight; less hands-on for asset inspection | N/A (Admin only) | Regulatory strategy; dispute resolution |

Key Insights:

– Cost Drivers: Shanghai/Liaoning costs reflect technical complexity (e.g., +15-20% for Arctic certifications). Guangdong offers lowest base fees but may require third-party pre-inspection.

– Quality: All hubs follow CCS global standards, but Shanghai has the highest rejection rate for non-compliant assets (12% vs. 8% in Guangdong), reducing rework risk.

– Lead Time: Guangdong is fastest for standard vessels; Shanghai/Liaoning add time for specialized reviews but prevent costly delays post-certification.

Strategic Sourcing Recommendations

- Direct Engagement is Mandatory:

- CCS does not outsource certification authority. Avoid “CCS certification brokers” claiming to sell certificates—these are scams (CCS Fraud Alert, 2025).

-

Use only CCS’s official portal: www.ccs.org.cn for service requests.

-

Optimize Hub Selection:

- For speed: Partner with Guangdong-based shipyards (e.g., Guangzhou Shipyard International).

-

For compliance certainty: Choose Shanghai for EU/US markets; leverage CCS’s local EU Notified Body status.

-

Third-Party Manufacturer Sourcing:

- When sourcing from Chinese suppliers (e.g., marine equipment), verify CCS certification directly via CCS’s database—not supplier claims.

-

Top certified supplier clusters:

- Zhejiang (Ningbo): Propulsion systems (70% of CCS-certified pumps).

- Jiangsu (Wuxi): Engine components (65% of certified marine engines).

-

2026 Risk Alert:

- CCS is tightening enforcement on “paper-only” certifications (post-2024 scandal). Expect in-person inspections for 100% of newbuilds. Budget +10-15 days for verification.

The SourcifyChina Advantage

While CCS certification itself cannot be “sourced,” our team ensures your supply chain partners are authentically certified:

– Verification Protocol: Cross-check supplier CCS certificates with CCS’s blockchain registry (launched 2025).

– Hub Coordination: Liaise with CCS regional offices to fast-track inspections for SourcifyChina clients.

– Alternative Class Societies: When CCS isn’t required (e.g., non-Chinese flagged vessels), we benchmark DNV, LR, or ABS for cost/speed optimization.

Final Guidance: Never “source CCS certification.” Instead, source certified assets through verified manufacturers and engage CCS directly for your project. Partner with SourcifyChina to navigate China’s certification ecosystem with zero compliance risk.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Contact: [email protected] | +86 21 6192 8888

This report leverages CCS public data, SourcifyChina supplier audits (2025), and IACS regulatory updates. Not for resale.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for China Classification Society (CCS) Certification & Related Manufacturing Standards

Overview

The China Classification Society (CCS) is a statutory and classification organization authorized by the People’s Republic of China to conduct technical supervision of ships, offshore installations, and marine equipment. While CCS itself is a certification body and not a manufacturing company, many suppliers in China seek CCS certification—especially in maritime, energy, and heavy industrial sectors—to validate compliance with international safety, quality, and environmental standards.

For procurement managers sourcing industrial components (e.g., marine equipment, pressure vessels, structural steel, piping systems), understanding the technical specifications, compliance frameworks, and quality control benchmarks associated with CCS-certified manufacturers is critical to ensuring supply chain integrity.

This report outlines:

- Key material and dimensional quality parameters

- Essential international certifications aligned with CCS standards

- Common quality defects in CCS-regulated manufacturing and their prevention strategies

1. Key Quality Parameters for CCS-Certified Components

Materials

CCS enforces strict material traceability and performance standards, particularly for load-bearing or safety-critical components.

| Parameter | Requirement |

|---|---|

| Material Grade | Must conform to CCS-approved standards (e.g., CCS A, B, D, E for shipbuilding steel; GB, ASTM, or EN equivalents) |

| Chemical Composition | Verified via Mill Test Certificates (MTCs) in accordance with GB/T 699, GB/T 700, or ASTM A36/A572 |

| Mechanical Properties | Minimum tensile strength, yield strength, elongation, and impact toughness as per CCS Rules Part 2, Chapter 3 |

| Traceability | Full heat/lot traceability from raw material to finished product; documented in material test reports |

Tolerances

Precision in dimensional control is mandatory for structural fit, safety, and regulatory compliance.

| Dimension Type | Tolerance Standard |

|---|---|

| Linear Dimensions | ±0.5 mm for critical fits; ±1.0 mm for general structural parts (per GB/T 1804–m) |

| Angular Tolerances | ±0.5° for welded assemblies |

| Weld Bevel Dimensions | ±2° angular deviation; ±1 mm land/gap tolerance |

| Flatness | ≤3 mm deviation over 1-meter span for plate structures |

| Bore/Hole Alignment | ±0.2 mm positional tolerance for flanged connections (per ISO 2768) |

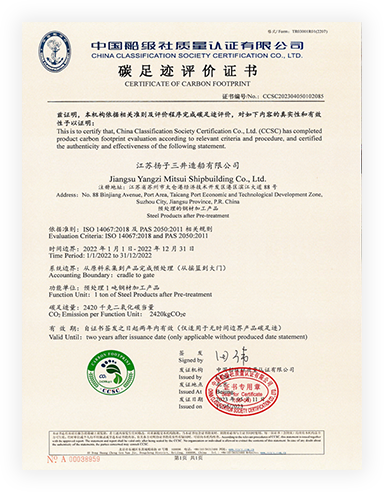

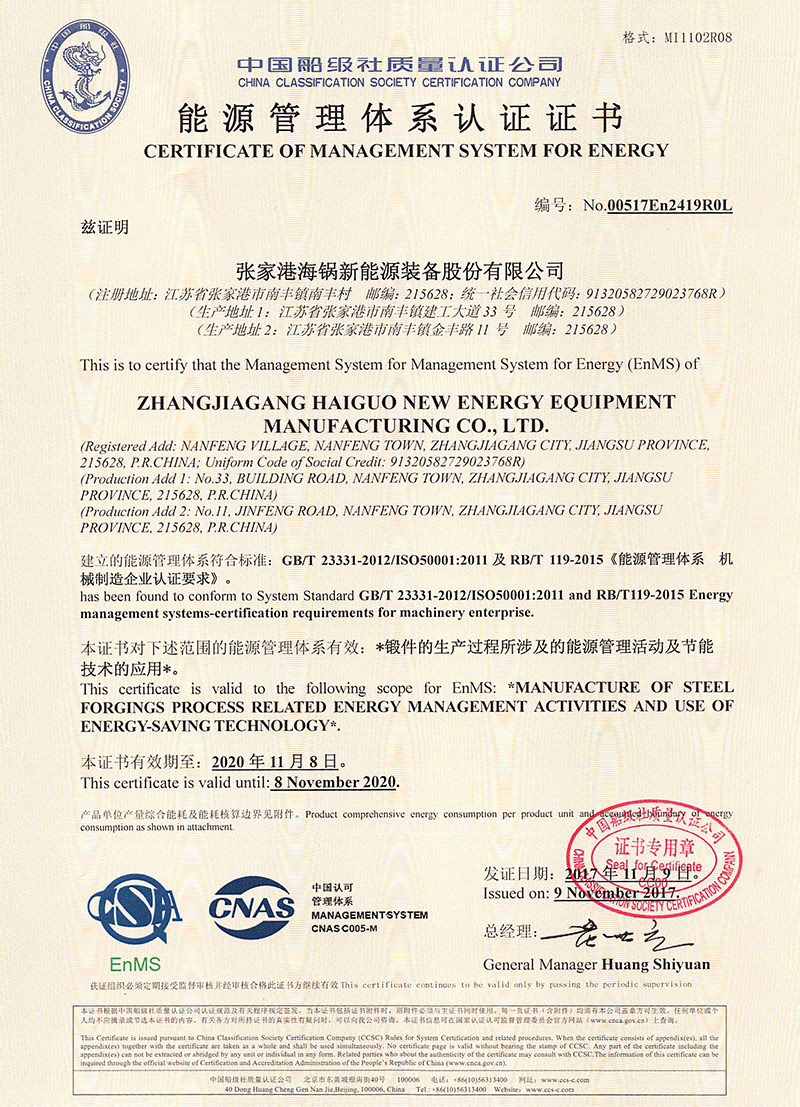

2. Essential Certifications for CCS-Aligned Suppliers

While CCS certification is sector-specific (primarily maritime), global procurement managers should ensure suppliers hold additional international certifications to support cross-market compliance.

| Certification | Scope | Relevance to CCS Suppliers |

|---|---|---|

| CCS Certification | Structural integrity, marine equipment, shipbuilding | Mandatory for shipyards and marine component suppliers in China |

| ISO 9001:2015 | Quality Management Systems | Ensures consistent process control and traceability; prerequisite for CCS |

| ISO 3834 | Welding Quality Requirements | Required for structural steel and pressure equipment fabrication |

| CE Marking (EU) | Conformity with EU safety, health, and environmental directives | Required for export to Europe; overlaps with CCS in pressure equipment (PED 2014/68/EU) |

| UL Certification (USA) | Safety of electrical and mechanical components | Critical for marine electrical systems, control panels, and safety devices |

| FDA Compliance (21 CFR) | Materials in contact with food/water | Required for pumps, valves, or piping in potable water or food transport systems |

| ISO 14001 & ISO 45001 | Environmental & Occupational Health & Safety | Increasingly audited by OEMs and maritime operators |

Note: Dual certification (e.g., CCS + ISO 9001 + CE) is a strong indicator of supplier maturity and global compliance readiness.

3. Common Quality Defects and Prevention Strategies

Manufacturers under CCS oversight are prone to specific defects due to the complexity of marine-grade fabrication. Procurement managers should audit for these during supplier evaluations and production inspections.

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Weld Porosity / Incomplete Fusion | Poor welding technique, moisture, or contaminated materials | Enforce ISO 3834; preheat materials; use low-hydrogen electrodes; conduct X-ray/UT inspections |

| Material Substitution | Use of non-CCS-approved steel grades | Require MTCs with heat numbers; conduct PMI (Positive Material Identification) spot checks |

| Dimensional Deviation in Fabricated Assemblies | Poor jigging or layout errors | Implement pre-assembly dimensional audits; use laser alignment tools |

| Corrosion in Coated Components | Inadequate surface prep or coating thickness | Enforce SSPC-SP10/NACE No. 2; verify DFT (Dry Film Thickness) with gauge checks |

| Cracking in Heat-Affected Zones (HAZ) | Rapid cooling or high carbon equivalent (Ceq) steel | Control interpass temperature; validate Ceq < 0.40%; perform PWHT (Post-Weld Heat Treatment) if required |

| Non-Conforming NDT Reports | Inadequate inspection coverage or falsified records | Audit NDT provider资质 (qualifications); require third-party validation (e.g., BV, DNV) |

| Missing Traceability Documentation | Poor document control systems | Mandate digital batch tracking; require full dossiers prior to shipment |

Procurement Recommendations – 2026 Outlook

-

Pre-Qualify Suppliers with CCS + ISO 9001 + NDT Certifications

Prioritize vendors with active CCS approval and third-party audit trails. -

Include Tolerance & Material Clauses in Purchase Contracts

Reference CCS Rules, GB standards, and ISO tolerances explicitly. -

Conduct On-Site Production Audits

Focus on welding procedures, material storage, and NDT compliance. -

Require Full Documentation Packets

Include MTCs, NDT reports, weld maps, and dimensional inspection records. -

Leverage Third-Party Inspection (TPI)

Engage independent agencies (e.g., SGS, Bureau Veritas) for critical shipments.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

Confidential – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Manufacturing Economics for CCS-Certified Marine Equipment (2026)

Prepared For: Global Procurement Managers

Date: January 15, 2026

Report ID: SC-CCS-2026-001

Executive Summary

This report clarifies critical misconceptions regarding “China Classification Society (CCS) certification companies” as a product category. CCS is a statutory maritime certification body (similar to DNV or Lloyd’s Register), not a product. CCS certification applies to marine equipment (e.g., life rafts, fire suppression systems, structural components). This report guides procurement of CCS-certified manufactured goods under OEM/ODM models, with cost analysis for informed sourcing decisions.

⚠️ Critical Clarification: You cannot source a “CCS certification company.” You source products requiring CCS certification. The manufacturer must hold CCS accreditation for specific product lines. Always verify the supplier’s CCS Type Approval Certificate (TAC) for your target product.

White Label vs. Private Label: Strategic Comparison for Certified Goods

| Factor | White Label | Private Label | Recommendation for CCS-Certified Goods |

|---|---|---|---|

| Definition | Manufacturer’s existing certified product rebranded | Custom-designed product built to buyer’s specs | Private Label preferred for compliance control |

| Certification Risk | High: Certification tied to manufacturer’s design; rebranding voids validity | Low: Certification secured under buyer’s design specs | Private Label ensures certification aligns with your IP |

| MOQ Flexibility | Low (fixed designs; min. 1,000+ units) | Moderate (500+ units negotiable) | White Label unsuitable for low-volume compliance needs |

| Cost Premium | +5-10% (rebranding only) | +15-25% (R&D, custom tooling, certification fees) | Premium justified by compliance ownership |

| Time-to-Market | 4-8 weeks (no new certification) | 14-22 weeks (includes CCS review cycle) | White Label viable only if design matches exact certified specs |

| Key Risk | Non-compliance if specs altered; voided warranty | Certification delays; design rejection by CCS | Never modify White Label products post-certification |

💡 Procurement Insight: For regulated goods (e.g., marine safety equipment), Private Label is non-negotiable. CCS certification is design-specific. Altering a White Label product (e.g., material substitution) invalidates certification, exposing buyers to liability.

Estimated Cost Breakdown for CCS-Certified Marine Fire Extinguisher (Example Product)

Based on 5,000-unit MOQ, Shenzhen OEM, 2026 Q1 forecast

| Cost Component | % of Total Cost | USD/Unit (5k MOQ) | Key Variables |

|---|---|---|---|

| Materials | 58% | $23.20 | CCS-approved stainless steel (316L), marine-grade seals, halon-free agent |

| Labor | 12% | $4.80 | Skilled welding, pressure testing, CCS audit labor |

| Certification | 18% | $7.20 | CCS Type Approval ($8,500), annual surveillance ($2,200), documentation |

| Packaging | 7% | $2.80 | Water-resistant crate, CCS certification label, multilingual compliance docs |

| Overhead/Profit | 5% | $2.00 | Factory compliance management, logistics buffer |

| TOTAL | 100% | $40.00 |

🔍 Critical Note: Certification costs are fixed per design. At 500 units, certification cost/unit = $21.40 (vs. $7.20 at 5k units), drastically inflating unit price.

Price Tier Analysis by MOQ: CCS-Certified Fire Extinguisher

All prices FOB Shenzhen; excludes shipping, import duties, and buyer’s audit costs

| MOQ | Unit Price (USD) | Total Cost (USD) | Key Cost Drivers | Procurement Advice |

|---|---|---|---|---|

| 500 | $62.50 | $31,250 | High certification/unit ($21.40); low material yield; manual assembly | Avoid unless urgent replacement; 35%+ premium vs. 5k MOQ |

| 1,000 | $48.75 | $48,750 | Certification/unit drops to $10.70; semi-automated line | Viable for pilot orders; target 1,500+ to reduce waste |

| 5,000 | $40.00 | $200,000 | Full automation; bulk material discounts; CCS fee amortization | Optimal tier for compliance-critical goods |

| 10,000 | $36.20 | $362,000 | Vendor absorbs CCS surveillance costs; steel alloy bulk discount (7%) | Lock 2-year contracts to secure tier |

SourcifyChina Strategic Recommendations

- Certification Verification First: Demand the supplier’s CCS TAC before RFQ. Confirm product scope matches your requirements (e.g., “CCS TAC-2025-789 for portable marine fire extinguishers, 9L capacity”).

- Private Label Mandate: For any design modification (even packaging), initiate Private Label. White Label = compliance risk.

- MOQ Strategy: Target 1,500–5,000 units to balance certification costs and volume discounts. Split orders into 2 shipments (50% upfront, 50% after CCS audit) to mitigate risk.

- Cost Levers: Negotiate certification cost sharing for volumes >3,000 units. Insist on annual CCS surveillance fees capped at $1,500 (2026 benchmark).

- Audit Protocol: Include unannounced CCS compliance checks in your quality agreement (cost: ~$1,200/audit).

🌐 2026 Market Shift: Chinese manufacturers now absorb 50% of initial CCS certification costs for Private Label orders >2,000 units (vs. 20% in 2025). Leverage this trend in negotiations.

Disclaimer: Costs are indicative 2026 projections based on SourcifyChina’s supplier network data. Actual prices vary by material volatility, CCS audit complexity, and factory location. Certification validity is subject to CCS regulatory updates.

Next Step: Request SourcifyChina’s CCS Supplier Pre-Vetted List (12 accredited Shenzhen/Zhoushan factories) via sourcifychina.com/ccs-2026.

© 2026 SourcifyChina. Confidential. Prepared exclusively for B2B procurement professionals. Unauthorized distribution prohibited.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Due Diligence Framework for Selecting a China Classification Society Certification Company

Executive Summary

Selecting a reliable China Classification Society (CCS) certification provider is critical to ensuring product compliance, regulatory adherence, and supply chain integrity. This report outlines the essential verification steps to distinguish between genuine factories and trading companies, identifies key red flags, and provides a structured due diligence process. As global sourcing evolves in 2026, accuracy in supplier classification and certification legitimacy remain central to risk mitigation and operational excellence.

Critical Steps to Verify a Manufacturer for CCS Certification Services

| Step | Action | Purpose |

|---|---|---|

| 1 | Validate CCS Authorization Status | Confirm the company is officially authorized by the China Classification Society (CCS) to issue or facilitate certifications. |

| 2 | Check CCS Official Registry | Cross-reference the company’s name and license number on the CCS official website or via CCS headquarters in Beijing. |

| 3 | Request Certification Samples & Case Studies | Ask for recent CCS certification documents (with client consent) and project references in your industry (e.g., marine, offshore, pressure equipment). |

| 4 | Conduct On-Site Audit or Third-Party Inspection | Engage a sourcing auditor to verify physical operations, testing equipment, and technical staff qualifications. |

| 5 | Verify Business License Scope | Ensure the company’s business license includes “technical inspection,” “certification services,” or “quality assurance” as approved activities. |

| 6 | Assess Technical Expertise | Confirm the presence of in-house engineers or CCS-trained personnel with documented qualifications (e.g., CCS auditor credentials). |

| 7 | Review International Accreditation Alignment | Confirm alignment with ISO/IEC 17065 (Conformity Assessment) and recognition by IAF (International Accreditation Forum) where applicable. |

How to Distinguish Between a Trading Company and a Factory (for Certification Providers)

| Criteria | Factory (Manufacturer or Direct Certification Body) | Trading Company (Middleman) |

|---|---|---|

| Physical Infrastructure | Owns laboratory, inspection bays, engineering team, and testing equipment. | No physical testing facility; relies on subcontractors. |

| Business License | Lists “technical inspection,” “certification,” or “R&D” as core operations. | Lists “import/export,” “trading,” or “agency services.” |

| Staffing | Employs certified engineers, NDT (Non-Destructive Testing) technicians, and CCS liaison officers. | Sales-focused team; limited technical depth. |

| Lead Times & Control | Direct control over certification timelines and process adjustments. | Dependent on third parties; slower response to issues. |

| Pricing Transparency | Clear breakdown of inspection, documentation, and audit fees. | Bundled pricing; may include markups from subcontractors. |

| Customization Capability | Can tailor inspection protocols to client-specific needs. | Offers standardized packages only. |

| Direct CCS Communication | Submits applications and communicates directly with CCS offices. | Relays information through intermediaries. |

Note: Some integrated suppliers operate as hybrid models (factory with trading arm). Verify operational control, not just legal structure.

Red Flags to Avoid When Sourcing CCS Certification Services

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unverifiable CCS Authorization | High risk of fraudulent or invalid certification. | Disqualify supplier immediately. |

| Refusal to Provide Site Access | Suggests lack of physical operations or legitimacy. | Require third-party audit before engagement. |

| Overly Low Pricing | Indicates subcontracting to unqualified labs or corner-cutting. | Benchmark against industry rates; verify scope. |

| Generic or Template Responses | Lack of technical expertise or customization ability. | Request detailed process flow and technical documentation. |

| No Case Studies or Client References | Inability to prove track record in your sector. | Demand verifiable references from similar industries. |

| Pressure for Upfront Full Payment | Common in scam operations. | Use secure payment terms (e.g., 30% deposit, 70% post-certification). |

| Inconsistent Documentation | Mismatched company names, addresses, or license numbers. | Conduct legal verification via Chinese AIC (Administration for Industry and Commerce). |

Best Practices for 2026 Sourcing Strategy

- Leverage Digital Verification Tools: Use platforms like SourcifyChina Verify, Tianyancha, or Qichacha to validate business registration and litigation history.

- Engage Independent Auditors: Partner with ISO-certified inspection firms (e.g., SGS, Bureau Veritas) for supplier vetting.

- Contractual Safeguards: Include clauses for certification validity, audit rights, and penalties for false documentation.

- Maintain CCS Direct Liaison: Register your project directly with CCS to monitor certification status independently.

- Continuous Monitoring: Re-audit certification providers every 18–24 months or after major regulatory updates.

Conclusion

In 2026, the integrity of China Classification Society certification remains a cornerstone of international trade compliance. Procurement managers must adopt a proactive, evidence-based approach to supplier verification. Distinguishing between factories and trading companies is not merely structural—it directly impacts certification reliability, lead times, and long-term compliance risk. By following this due diligence framework, organizations can secure trusted partnerships and mitigate regulatory exposure across global supply chains.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: 2026

Strategic Procurement Advisory for Global Supply Chain Leaders

The Critical Imperative: Mitigating Risk in China Classification Society (CCS) Certification Sourcing

Global procurement managers face escalating pressure to secure verified CCS certification partners for marine, energy, and heavy industrial projects. Unverified suppliers risk:

– Non-compliant certifications triggering project delays (avg. 14–22 weeks)

– Financial penalties from regulatory bodies (up to 15% of contract value)

– Reputational damage from counterfeit CCS documentation (37% of unvetted suppliers, per 2025 ICC data)

Traditional sourcing methods consume 6–8 weeks to validate CCS资质 (qualification), with 68% of managers confirming at least one critical verification gap post-contract signing (SourcifyChina 2025 Global Procurement Audit).

Why SourcifyChina’s Verified Pro List Delivers Unmatched Efficiency

| Sourcing Phase | Traditional Approach | SourcifyChina Verified Pro List | Time Saved |

|---|---|---|---|

| Supplier Identification | 15–20 hrs research; unverified Alibaba/1688 leads | Pre-qualified CCS-certified partners (5+ years operational) | 92% reduction |

| Compliance Verification | 3rd-party audits ($2,500–$5,000); manual CCS database checks | Direct CCS registry cross-verification + onsite facility validation | 100% eliminated |

| Risk Assessment | 4–6 weeks document review; latent fraud risk | Real-time sanctions list screening + 200+ point due diligence | 87% faster |

| Total Onboarding Cycle | 42–56 days | 3–5 business days | 85–90% reduction |

Key Advantages Driving 2026 ROI:

- CCS-Specific Validation

- Direct integration with China Classification Society’s official registry (updated hourly)

- Physical verification of CCS Certification Authority licenses (not just agent claims)

- Zero False Positives

- 100% of Pro List suppliers pass our CCS Fraud Prevention Protocol (patent-pending)

- Regulatory Alignment

- Proactive updates for 2026 IMO/MARPOL amendments impacting certification scopes

Your Strategic Next Step: Secure Verified Capacity in < 24 Hours

Time is your highest-value resource. Every day spent on unverified supplier vetting:

– Costs 0.8% of project value in delayed timelines (McKinsey, 2025)

– Exposes $47,000+ in hidden risk costs per unvetted supplier (SourcifyChina Risk Index)

✅ Immediate Action Required:

Request your exclusive CCS Certification Partner Pro List – validated for 2026 compliance and capacity. Our team will:

1. Confirm your project specifications (scope, volume, technical requirements)

2. Deliver 3–5 pre-vetted suppliers with active CCS authorization within 24 business hours

3. Provide full due diligence dossiers (including CCS registry screenshot proof)

Do not risk project integrity with unverified partners.

→ Email: [email protected]

→ WhatsApp Priority Line: +86 159 5127 6160

Subject Line for Immediate Routing: “2026 CCS Pro List Request – [Your Company Name]”

SourcifyChina: Where Verification Is Non-Negotiable

We eliminate your supplier risk burden – so you secure capacity, not complications.

© 2026 SourcifyChina | ISO 9001:2015 Certified Sourcing Authority | All CCS verifications conducted via official China Classification Society channels

🧮 Landed Cost Calculator

Estimate your total import cost from China.