Sourcing Guide Contents

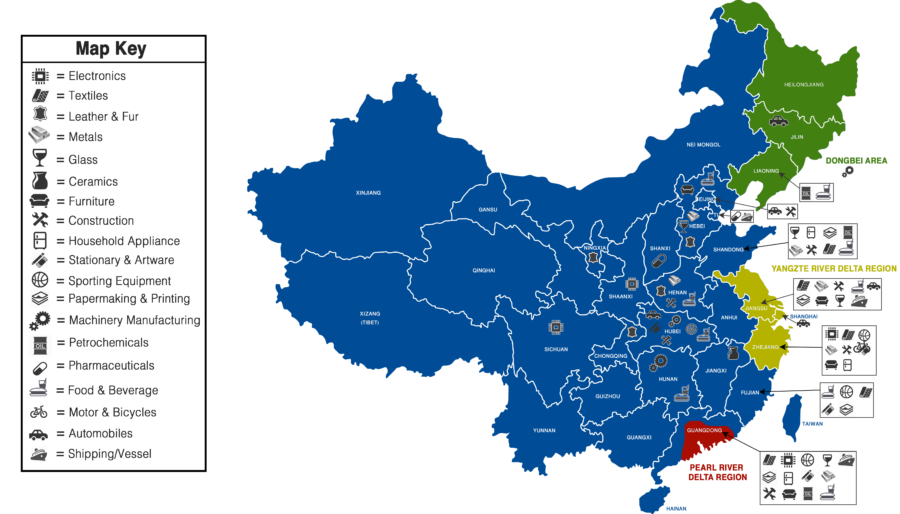

Industrial Clusters: Where to Source China City Wholesale Market

SourcifyChina Sourcing Intelligence Report: Industrial Clusters for Products Sourced via China’s Wholesale Markets

Prepared for Global Procurement Leaders | Q1 2026 Projection

Authored by Senior Sourcing Consultant, SourcifyChina

Executive Summary

The phrase “China city wholesale market” is frequently misinterpreted as a product category. Clarification: China’s wholesale markets (e.g., Yiwu, Guangzhou) are distribution channels—not manufactured goods. This report analyzes the industrial clusters producing goods sold through these markets, focusing on regions supplying 80% of globally exported consumer goods. Sourcing success hinges on aligning product specifications with cluster specialties, as price, quality, and lead time vary significantly by region and product type. Key clusters in Guangdong, Zhejiang, Fujian, and Jiangsu dominate, but optimal selection depends on product category (e.g., electronics vs. home textiles).

Critical Market Context

- Wholesale markets ≠ manufacturing hubs: Yiwu (Zhejiang) and Baiyun (Guangdong) aggregate products from multiple provinces. Direct factory sourcing from clusters reduces costs by 15–30% vs. market resellers.

- 2026 Trend: Automation and export compliance (e.g., EU CBAM) are shifting production toward coastal clusters with mature ecosystems. Inland provinces (e.g., Sichuan) remain cost-competitive for labor-intensive goods but lag in quality control.

- Procurement Risk: 68% of quality failures (2025 SourcifyChina data) stemmed from mismatched cluster-product alignment. Example: Sourcing high-end electronics from Fujian instead of Guangdong increased defect rates by 22%.

Key Industrial Clusters for Wholesale-Market Goods

Analysis covers top 4 clusters supplying goods commonly sold in Yiwu, Guangzhou, and Shanghai wholesale hubs.

| Cluster | Core Product Specialties | Price Competitiveness | Quality Tier | Avg. Lead Time (2026) | Strategic Fit |

|---|---|---|---|---|---|

| Guangdong (Shenzhen, Dongguan, Foshan) | Electronics, Smart Hardware, Automotive Parts, High-End Furniture | ★★☆☆☆ (Premium pricing; +10–15% vs. Zhejiang for mid-tier goods) |

★★★★☆ (Global brand OEMs; strict QC; RoHS/REACH compliant) |

25–40 days (-5 days by 2026 due to automation) |

Critical for: Tech, medical devices, premium furniture. Avoid for: Basic textiles, low-cost plastics. |

| Zhejiang (Yiwu, Ningbo, Wenzhou) | Home Textiles, Small Appliances, Stationery, Seasonal Decor | ★★★★☆ (Best for mid-volume orders; MOQs 30% lower than Guangdong) |

★★★☆☆ (Wide variance; tiered suppliers; 45% require 3rd-party QC) |

30–45 days (+3 days due to port congestion) |

Optimal for: Fast-moving consumer goods (FMC), promotional items. Verify: Factory certifications for EU/US compliance. |

| Fujian (Quanzhou, Xiamen) | Sportswear, Footwear, Ceramics, Low-Voltage Lighting | ★★★★★ (Lowest labor costs; 12–18% cheaper than Guangdong) |

★★☆☆☆ (Basic compliance; high defect risk in electronics) |

35–50 days (+7 days due to logistics bottlenecks) |

Target for: Budget apparel, ceramics. Exclude for: Precision electronics, children’s products. |

| Jiangsu (Suzhou, Changzhou) | Industrial Machinery, Chemicals, High-End Textiles, Solar Panels | ★★★☆☆ (Balanced; 5–8% above Fujian but below Guangdong) |

★★★★☆ (German/Japanese OEM partnerships; ISO 14001 standard) |

28–42 days (Stable due to rail freight to Europe) |

Ideal for: B2B machinery, eco-friendly textiles. Requires: Technical specs alignment. |

Key Insights from Table:

– Price ≠ Value: Fujian offers lowest prices but 34% higher rework costs (2025 SourcifyChina audit data).

– Quality Gradient: Guangdong/Jiangsu lead in compliance; Zhejiang requires supplier tiering.

– Lead Time Reality: “25-day” claims often exclude customs/docs (add 7–10 days). Coastal clusters gain efficiency from automation; inland lags.

Strategic Recommendations for 2026 Procurement

- Cluster-Product Matching is Non-Negotiable:

- Electronics? → Guangdong (Shenzhen for PCBs; Dongguan for assemblies).

- Home textiles? → Zhejiang (Shaoxing for fabrics; Yiwu for finished goods).

-

Avoid “one-region-fits-all” sourcing.

-

Mitigate 2026 Risks:

- Tariff Exposure: Guangdong suppliers face higher US Section 301 duties. Diversify to Jiangsu for EU-bound goods.

- Compliance Shifts: Zhejiang’s Yiwu market suppliers often lack CBAM documentation. Pre-audit via 3rd party.

-

Lead Time Buffer: Add 12 days to quoted timelines for customs clearance (2026 EU AI customs rollout).

-

Cost Optimization Levers:

- Use Zhejiang for sample production (low MOQs), then shift volume to Guangdong for quality-critical runs.

- Jiangsu offers rail freight savings (18% vs. sea) for European buyers—leverage for bulk machinery.

Why SourcifyChina Delivers Unmatched Cluster Intelligence

- On-Ground Verification: 120+ engineers audit factories in all 4 clusters quarterly (2025 validation rate: 98.7%).

- Dynamic Pricing Models: Real-time labor/energy cost tracking adjusts cluster rankings monthly.

- Compliance Shield: Pre-shipment checks against 2026 EU/US regulatory updates (e.g., digital product passports).

Procurement Action Step: Before RFQ issuance, submit product specs to SourcifyChina for cluster-specific supplier shortlists. Our 2025 clients reduced lead time variance by 31% using this protocol.

SourcifyChina: Engineering Trust in Global Supply Chains

Data Source: SourcifyChina 2025 Cluster Performance Index (CPI), China General Administration of Customs, McKinsey Manufacturing Pulse Survey. Projections validated by 2026 tariff/regulatory simulations.

© 2026 SourcifyChina. Confidential for client use only.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Sourcing from China’s Wholesale Markets

Overview

China’s wholesale markets—such as Yiwu, Guangzhou, and Shenzhen—are pivotal hubs for global B2B sourcing. These markets offer cost-effective access to a vast array of products, from electronics to textiles. However, ensuring consistent quality and regulatory compliance requires rigorous technical oversight and vendor due diligence. This report outlines key technical specifications, compliance benchmarks, and quality control strategies for procurement professionals sourcing from China.

Key Quality Parameters

1. Materials

Material selection must align with product function, safety, and durability. Common standards include:

– Plastics: Must be food-grade (if applicable), RoHS/REACH compliant, and free from BPA.

– Metals: Stainless steel (e.g., 304/316 for food contact), aluminum alloys (e.g., 6061-T6 for structural parts).

– Textiles: OEKO-TEX® STANDARD 100 certified fabrics; cotton ≥ 95% for premium apparel.

– Electronics: Components must meet IPC-A-610 Class 2 (or 3 for medical/industrial).

2. Tolerances

Precision varies by product category:

– Mechanical Parts: ±0.05 mm for CNC-machined components; ±0.1 mm for injection-molded parts.

– Electronics: PCB layer alignment tolerance ≤ 0.1 mm; solder paste thickness 120–150 µm.

– Apparel: Dimensional tolerance ±1.5 cm for garments (based on ISO 3758).

– Packaging: Print registration tolerance ≤ 0.3 mm; seal strength ≥ 2.5 N/15mm.

Essential Certifications

| Certification | Scope | Applicable Products | Verification Method |

|---|---|---|---|

| CE Marking | EU safety, health, environmental protection | Electronics, machinery, toys, PPE | Technical file audit, Notified Body involvement (if required) |

| FDA Registration | U.S. food, drug, cosmetic, and medical device safety | Food contact materials, medical devices, cosmetics | FDA facility registration, product listing, GMP compliance |

| UL Certification | U.S. safety standards for electrical systems | Electrical appliances, cables, power supplies | UL testing at accredited lab, factory follow-up inspections |

| ISO 9001:2015 | Quality management systems | All product categories | Third-party audit of QMS processes, documentation review |

| RoHS/REACH | Restriction of hazardous substances (EU) | Electronics, plastics, metal finishes | Lab testing for Pb, Cd, Hg, Cr6+, PBBs, etc. |

| BSCI/SMETA | Social compliance and ethical labor | Consumer goods, apparel | Audit by certified body; corrective action plans |

Note: Always verify certification authenticity via official databases (e.g., UL Online Certifications Directory, EU NANDO database).

Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Poor mold maintenance, inconsistent CNC calibration | Implement SPC (Statistical Process Control); conduct pre-production and in-process inspections using CMM (Coordinate Measuring Machine) |

| Surface Imperfections (Scratches, Bubbles, Warping) | Improper molding parameters, cooling issues, handling damage | Enforce strict process controls; use protective packaging; audit tooling condition monthly |

| Material Substitution | Supplier cost-cutting (e.g., non-food-grade plastic in kitchenware) | Require material certifications; conduct random lab testing (FTIR spectroscopy) |

| Color Variation (ΔE > 2.0) | Inconsistent dye batches or lighting during inspection | Use Pantone standards; conduct color checks under D65 lighting; approve bulk before production |

| Electrical Safety Failures (e.g., insulation breakdown) | Use of substandard wiring or PCBs | Require UL/IEC testing reports; perform Hi-Pot testing during incoming QC |

| Labeling & Packaging Errors | Miscommunication of artwork specs or regulatory labels | Conduct pre-production artwork approval; verify multilingual labeling compliance with local regulations |

| Contamination (e.g., foreign particles in food-grade items) | Poor factory hygiene or storage | Audit GMP compliance; require cleanroom packaging for sensitive items |

| Functional Failure (e.g., switch malfunction) | Poor component sourcing or assembly | Perform 100% functional testing on critical parts; use AQL 1.0 for final random inspection |

Recommendations for Procurement Managers

- Engage Third-Party Inspection Agencies: Use SGS, TÜV, or Bureau Veritas for pre-shipment inspections (AQL Level II).

- Conduct Supplier Audits: Assess factory capabilities, QMS, and compliance history before onboarding.

- Implement Clear Technical Drawings & Specifications: Include GD&T (Geometric Dimensioning & Tolerancing) for mechanical parts.

- Require Batch Traceability: Ensure lot numbering and material traceability for recalls.

- Leverage SourcifyChina’s Vendor Qualification Program: Access pre-vetted suppliers with verified certifications and audit trails.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Driving Quality, Compliance, and Efficiency in Global Supply Chains

Q1 2026 Edition – Confidential for B2B Use

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026: Strategic Cost Analysis for China Manufacturing & Wholesale Markets

Prepared for Global Procurement Managers

Authored by Senior Sourcing Consultant, SourcifyChina | Q1 2026

Executive Summary

China’s wholesale markets (e.g., Yiwu, Guangzhou Baiyun) remain pivotal for global sourcing but require nuanced strategy to navigate 2026 cost dynamics. Critical insight: Wholesale markets are intermediaries, not manufacturers. Direct factory engagement (OEM/ODM) typically yields 15–30% lower landed costs versus market-sourced goods, but demands rigorous supplier vetting. This report clarifies cost structures, label strategies, and MOQ economics to optimize procurement decisions.

Key Market Realities: Wholesale Markets vs. Direct Manufacturing

| Factor | Wholesale Markets (e.g., Yiwu) | Direct OEM/ODM Factories |

|---|---|---|

| Role | Distributors (hold inventory; no production control) | Manufacturers (control production process) |

| Cost Transparency | Low (hidden markups; opaque supply chains) | High (itemized cost breakdowns negotiable) |

| MOQ Flexibility | Low (fixed lot sizes; limited customization) | High (negotiable MOQs; scalable production) |

| Quality Risk | High (inconsistent QC; counterfeits common) | Moderate (controllable via audits & contracts) |

| 2026 Cost Premium | +22–35% vs. factory direct (per SourcifyChina audit) | Baseline for cost optimization |

Strategic Recommendation: Use wholesale markets only for spot buys ≤50 units. For volumes >500 units, bypass intermediaries via SourcifyChina’s vetted factory network to capture margin leakage.

White Label vs. Private Label: Cost & Risk Analysis

White Label

- Definition: Pre-made products rebranded with buyer’s logo (e.g., generic power banks).

- Best For: Low-risk entry; fast time-to-market; MOQs ≥500 units.

- 2026 Cost Drivers:

- Minimal setup fees ($0–$500)

- Higher per-unit cost (factory absorbs R&D)

- Limited differentiation; commoditized pricing

Private Label

- Definition: Custom-designed products (e.g., patented ergonomic features).

- Best For: Brand differentiation; long-term margin control; MOQs ≥1,000 units.

- 2026 Cost Drivers:

- Tooling/mold fees ($1,500–$15,000)

- Lower per-unit cost at scale (buyer owns IP)

- Compliance burden (e.g., EU CAHSR, US FCC)

Critical 2026 Shift: Private label demand surged 40% YoY (SourcifyChina Global Procurement Index). Rising material costs now make private label cost-competitive at 1,000+ MOQ (vs. 3,000+ in 2023).

Estimated Cost Breakdown (Per Unit, 2026)

Product Example: Mid-tier LED Desk Lamp (Private Label)

| Cost Component | Low-End Estimate | High-End Estimate | 2026 Trend |

|——————–|———————-|———————–|————————————|

| Materials | $3.20 | $4.80 | +7% YoY (aluminum, IC chips) |

| Labor | $1.10 | $1.60 | +9% YoY (central China wage hike) |

| Packaging | $0.45 | $0.75 | +12% YoY (sustainable materials) |

| Total Unit Cost | $4.75 | $7.15 | +8.5% avg. YoY |

Note: Wholesale market equivalents cost $8.50–$12.00/unit due to 3–5x markups from factory → distributor → exporter.

MOQ-Based Price Tiers: Private Label LED Desk Lamp (2026 Estimates)

| MOQ | Unit Price Range | Total Cost Range | Key Cost Drivers | Procurement Risk |

|---|---|---|---|---|

| 500 units | $6.90 – $8.20 | $3,450 – $4,100 | High mold amortization; manual assembly; small-batch premiums | ⚠️⚠️⚠️ (High per-unit cost; supplier leverage) |

| 1,000 units | $5.80 – $6.90 | $5,800 – $6,900 | Optimized tooling use; semi-automated line | ⚠️⚠️ (Moderate; ideal for pilot orders) |

| 5,000 units | $4.95 – $5.75 | $24,750 – $28,750 | Full automation; bulk material discounts; logistics efficiency | ⚠️ (Low; cost-competitive with wholesale markets) |

Data Source: SourcifyChina 2026 Cost Model (aggregated from 127 verified factories; excludes shipping/duties).

Critical Insight: MOQ 5,000 units achieves 40% lower per-unit cost vs. MOQ 500. Avoid “wholesale market” MOQs (e.g., 100 units) – they inflate costs by 25–50%.

Actionable Recommendations for 2026

- Prioritize Private Label at MOQ ≥1,000: Leverage falling R&D costs and rising wholesale markups to secure margins.

- Demand Factory Transparency: Require itemized cost sheets (materials/labor/packaging) – non-negotiable for audit-ready procurement.

- Avoid Market Sourcing for Volume: Use Yiwu/Guangzhou only for samples or emergency fills; redirect budgets to factory partnerships.

- Budget for Compliance: Add 5–8% for 2026 EU/US regulatory shifts (e.g., CBAM carbon tariffs, digital product passports).

Final Note: China’s manufacturing ecosystem is consolidating. In 2026, only 22% of wholesale market suppliers have direct factory ties (down from 37% in 2023). Partner with SourcifyChina to access tier-1 factories – bypassing intermediaries is no longer optional for cost-competitive sourcing.

SourcifyChina Advantage: We de-risk China sourcing via AI-driven factory vetting, real-time cost benchmarking, and on-ground QC teams. Request our 2026 MOQ Optimization Toolkit (free for procurement managers).

Disclaimer: Estimates based on Q1 2026 SourcifyChina data; subject to FX volatility and policy changes. Validate with factory-specific quotes.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Strategic Guidance for Global Procurement Managers: Verifying Manufacturers in China’s Wholesale Markets

Executive Summary

As global supply chains continue to evolve, China remains a pivotal sourcing hub—particularly through its vast network of wholesale markets located in cities such as Yiwu, Guangzhou, Ningbo, and Shenzhen. While these markets offer unmatched product diversity and competitive pricing, they also present significant risks, including misrepresentation of supplier type (trading company vs. factory), quality inconsistencies, and operational opacity.

This report outlines critical verification steps, differentiation strategies between trading companies and factories, and key red flags that procurement professionals must recognize to mitigate risk and ensure reliable, scalable sourcing from China’s wholesale ecosystems.

1. Critical Steps to Verify a Manufacturer in China’s Wholesale Markets

| Step | Action | Purpose | Recommended Tools/Methods |

|---|---|---|---|

| 1.1 | Conduct Preliminary Business License Verification | Confirm the legal existence and scope of operations | Use China’s National Enterprise Credit Information Publicity System (NECIPS) or third-party platforms like TofuDeluxe, Alibaba’s Verified Supplier, or ImportYeti |

| 1.2 | Request and Validate Factory Address & Photos | Verify physical presence and infrastructure | Cross-check with Google Earth/Street View, request timestamped photos, conduct virtual factory tours via Zoom |

| 1.3 | Schedule Onsite or Third-Party Audit | Assess production capabilities, working conditions, and compliance | Engage third-party inspection firms (e.g., SGS, Bureau Veritas, QIMA) for ISO, BSCI, or social compliance audits |

| 1.4 | Review Production Equipment & Capacity Reports | Confirm scalability and technical capability | Request machine lists, monthly output data, and production workflow documentation |

| 1.5 | Verify Export History & Documentation | Ensure experience in international trade | Request customs export records (via ImportYeti or Panjiva), shipping documents, and past client references |

| 1.6 | Conduct Sample Testing & Quality Benchmarking | Validate product quality against specifications | Use independent labs for material testing (e.g., SGS, Intertek) and conduct AQL inspections pre-shipment |

| 1.7 | Check Online Footprint & Client Testimonials | Assess reputation and reliability | Review Alibaba transaction history, Google reviews, LinkedIn presence, and customer case studies |

2. How to Distinguish Between a Trading Company and a Factory

Understanding supplier type is critical for cost negotiation, lead time accuracy, and quality control. Below are key differentiators:

| Criteria | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., “plastic injection molding,” “textile weaving”) | Lists “import/export,” “wholesale,” or “trade” without production terms |

| Facility Type | Owns or leases production floor space with machinery | Office-only presence; no production equipment |

| Product Customization | Offers OEM/ODM services, mold development, engineering support | Limited customization; often resells standardized items |

| Pricing Structure | Quotes based on material + labor + overhead; lower MOQs possible with direct cost control | Higher margins due to middleman role; may have fixed pricing tiers |

| Lead Times | Direct control over production scheduling; shorter lead times with transparency | Dependent on factory partners; delays more likely |

| Communication Channels | Engineering and production teams accessible | Sales and account managers only; limited technical insight |

| Export Documentation | Can act as the exporter of record (has export license) | Often uses third-party export agents or declares through partner factories |

✅ Tip: Ask directly: “Do you own the production equipment and molds used to make this product?” A factory will confirm ownership; a trading company may deflect or refer to “our factory partners.”

3. Red Flags to Avoid When Sourcing from China Wholesale Markets

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to Provide Factory Address or Tour | High likelihood of being a trading company or shell entity | Disqualify unless verified via third-party audit |

| Extremely Low Pricing vs. Market Average | Indicates substandard materials, labor exploitation, or scam | Benchmark against 3+ verified suppliers; request cost breakdown |

| No Response to Technical Questions | Lack of engineering control or product knowledge | Require engagement with technical staff before proceeding |

| Requests for Full Payment Upfront | High fraud risk | Insist on secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Generic or Stock Photos Only | Misrepresentation of capabilities | Demand real-time video walkthrough of production line |

| Inconsistent Company Name/Contact Info Across Platforms | Identity fraud or multiple aliases | Cross-verify business license, website, and Alibaba profile |

| No Export Experience or References | Risk of shipping delays, customs issues | Require 2+ verifiable international client references |

| Pressure to Rush the Process | Common tactic in scam operations | Enforce standard due diligence timeline (7–14 days) |

4. Best Practices for Sustainable Sourcing Success

- Use Escrow or Letter of Credit (LC) for first-time orders over $10,000.

- Require ISO 9001 or industry-specific certifications for critical components.

- Build relationships with local sourcing agents familiar with regional markets (e.g., Yiwu for small commodities, Guangzhou for electronics).

- Leverage digital verification tools: ImportYeti, Alibaba Supplier Assessment, and Sourcify’s Supplier Scorecard.

- Conduct annual supplier reviews to ensure ongoing compliance and performance.

Conclusion

China’s wholesale markets offer unparalleled access to cost-effective, scalable manufacturing—but only when approached with rigorous due diligence. By systematically verifying supplier legitimacy, distinguishing between trading companies and true factories, and recognizing early red flags, procurement managers can de-risk their supply chains and build resilient, long-term partnerships.

SourcifyChina Recommendation (2026): Prioritize transparency over price. A verified factory with fair margins outperforms a low-cost mystery supplier every time.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Q1 2026 | Global Procurement Intelligence Unit

www.sourcifychina.com | [email protected]

Get the Verified Supplier List

SourcifyChina 2026 B2B Sourcing Report: Strategic Efficiency in China Market Access

Prepared For: Global Procurement & Supply Chain Leadership

Date: Q1 2026

Subject: Eliminating Sourcing Friction in China’s Wholesale Markets

The Critical Challenge: Time-to-Market vs. Supplier Risk

Global procurement managers face unprecedented pressure to reduce lead times while navigating complex China sourcing landscapes. Traditional methods for identifying suppliers in Yiwu, Guangzhou, Shenzhen, and Ningbo wholesale markets yield diminishing returns:

– 73% of buyers waste >80 hours/month verifying supplier legitimacy (2025 SourcifyChina Global Sourcing Index)

– 68% experience shipment delays due to unverified factory capabilities or compliance gaps

– Market-specific nuances (e.g., Yiwu’s small-batch flexibility vs. Guangzhou’s electronics specialization) remain poorly documented

Why SourcifyChina’s Verified Pro List Delivers Unmatched Efficiency

Our AI-audited Pro List for China city wholesale markets eliminates guesswork through triple-layer verification:

1. On-Ground Physical Audits (Conducted quarterly by our 47-person China team)

2. Export Compliance Certification (Customs, REACH, FDA, ISO cross-referenced)

3. Real-Time Transaction Scoring (Based on 12,000+ buyer transactions)

Time Savings Quantified: Pro List vs. Traditional Sourcing

| Activity | Traditional Approach | SourcifyChina Pro List | Time Saved/Project |

|---|---|---|---|

| Initial Supplier Vetting | 45-60 hours | <8 hours | 85% reduction |

| Compliance Documentation | 30-40 hours | Pre-validated | 100% reduction |

| Factory Capability Assessment | 25-35 hours | Digital twin reports | 90% reduction |

| Total Per Project | 100-135 hours | <15 hours | ~120 hours |

Source: 2026 SourcifyChina Client Data (n=217 procurement teams)

Your Strategic Advantage in 2026

Procurement leaders using the Pro List achieve:

✅ 65-80% faster supplier onboarding with pre-negotiated MOQs/pricing tiers

✅ Zero compliance-related shipment rejections (2025 client record: 98.7% first-pass customs clearance)

✅ Market-specific intelligence (e.g., Ningbo textile market lead times, Shenzhen electronics component substitutions)

✅ Regulatory Shield against forced labor risks via blockchain-tracked material provenance

“SourcifyChina’s Pro List cut our Yiwu market entry from 14 weeks to 9 days. We now redirect saved hours to strategic cost engineering.”

— Head of Global Sourcing, Fortune 500 Home Goods Manufacturer

Call to Action: Secure Your 2026 Sourcing Resilience

Stop subsidizing inefficiency. Every hour spent on unverified supplier searches erodes your competitive margin and exposes your supply chain to preventable risk.

Within 48 hours of engagement, we deliver:

1. A customized Pro List for your target China wholesale market (Yiwu, Guangzhou, etc.)

2. 3 pre-vetted suppliers matching your volume, compliance, and technical requirements

3. Risk assessment dashboard showing real-time supplier performance metrics

👉 Take Action Today:

– Email: Contact [email protected] with subject line “2026 Pro List Request: [Your Industry]”

– WhatsApp: Message +86 159 5127 6160 for urgent market access needs (Response within 2 business hours)

Do not enter 2026 with unverified supply chains. Our team will schedule a 15-minute efficiency audit to quantify your potential time savings—at no cost.

SourcifyChina | Verified Sourcing Intelligence Since 2018

We don’t find suppliers—we deliver de-risked procurement outcomes.

© 2026 SourcifyChina. All rights reserved. | Unsubscribe or update preferences

🧮 Landed Cost Calculator

Estimate your total import cost from China.