Sourcing Guide Contents

Industrial Clusters: Where to Source China Chip Company

SourcifyChina Sourcing Intelligence Report 2026

Subject: Deep-Dive Market Analysis – Sourcing Semiconductor Components from China’s Key Chip Manufacturing Clusters

Prepared for: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

The Chinese semiconductor industry has undergone rapid transformation, emerging as a critical node in the global electronics supply chain. Driven by national strategic initiatives (e.g., “Made in China 2025”, “Big Fund” investments), China has expanded its integrated circuit (IC) manufacturing capabilities, particularly in mature-node chips, power semiconductors, and packaging & testing. While leading-edge nodes (e.g., 5nm, 3nm) remain concentrated in Taiwan, South Korea, and the U.S., China now offers competitive sourcing opportunities for mid-tier and specialized chips used in consumer electronics, automotive systems, industrial automation, and IoT devices.

This report provides a data-driven analysis of key industrial clusters in China producing semiconductor-related components under Chinese-owned or operated “chip companies”. We evaluate regional strengths across price, quality, and lead time—critical KPIs for procurement decision-making.

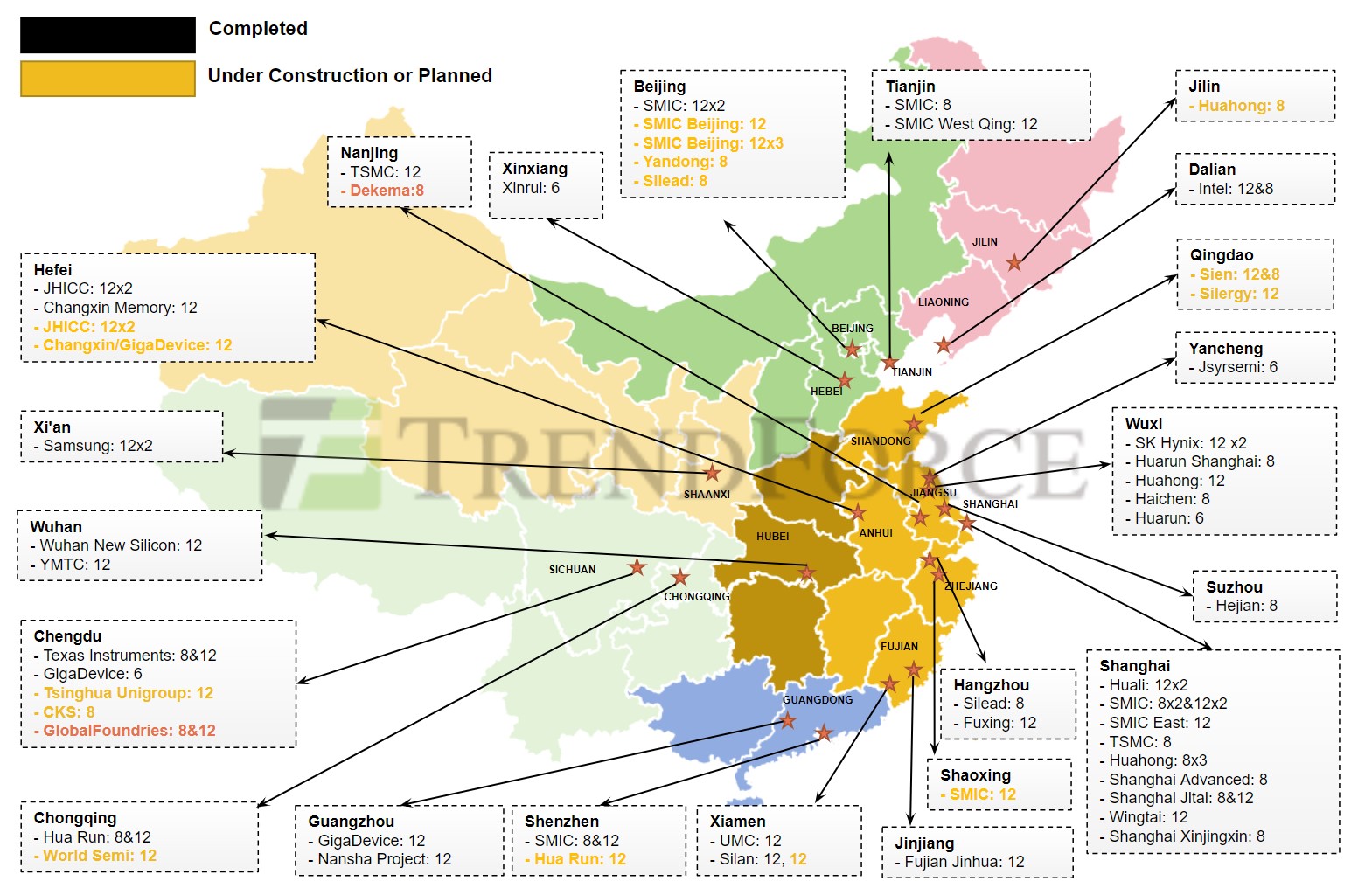

Key Industrial Clusters for China-Based Chip Manufacturing

China’s semiconductor ecosystem is regionally concentrated, with distinct industrial clusters leveraging local government support, R&D institutions, and supply chain synergies. The top provinces and cities for sourcing from domestic chip companies include:

- Jiangsu Province – Centered in Wuxi, Nanjing, and Suzhou

- Focus: IC design, wafer fabrication (12-inch fabs), advanced packaging

- Key Players: SMIC (Suzhou), ChangXin Memory Technologies (Hefei branch influence), Huahong Semiconductor (Wuxi)

-

Cluster Advantage: Proximity to Shanghai, strong logistics, and high-tech industrial parks

-

Shanghai Municipality

- Focus: Full-stack IC design, R&D, and pilot manufacturing

- Key Players: SMIC (Headquarters and major 14nm+ fabs), VeriSilicon, SiEn Integrated

-

Cluster Advantage: National semiconductor policy hub, access to talent and capital

-

Guangdong Province – Centered in Shenzhen and Guangzhou

- Focus: IC design, application-specific chips (ASICs), packaging & testing

- Key Players: Hua Capital-backed startups, Fullhan Micro, GigaDevice (design center)

-

Cluster Advantage: Strong electronics OEM ecosystem (Huawei, Tencent, DJI), fast time-to-market

-

Zhejiang Province – Centered in Hangzhou

- Focus: Power semiconductors, analog chips, automotive ICs

- Key Players: Silan Microelectronics, Nexchip (via joint ventures), Hangzhou United Silicon

-

Cluster Advantage: Integration with EV and smart manufacturing sectors

-

Anhui Province – Centered in Hefei

- Focus: Memory chips (DRAM/NAND), large-scale fabrication

- Key Player: ChangXin Memory Technologies (CXMT)

-

Cluster Advantage: Heavy state investment, cost-efficient large-scale production

-

Beijing Municipality

- Focus: High-end IC design, AI chips, R&D

- Key Players: HiSilicon (design office), Cambricon, Tsinghua Unigroup

- Cluster Advantage: Academic and research backbone (Tsinghua, Peking University)

Comparative Analysis of Key Sourcing Regions

The table below compares major sourcing regions for semiconductor components from Chinese chip companies based on three core procurement criteria: Price, Quality, and Lead Time. Ratings are based on 2025–2026 market intelligence from SourcifyChina’s supplier audits, client feedback, and industry benchmarking.

| Region | Province | Price Competitiveness | Quality Consistency | Lead Time (Standard Orders) | Key Strengths | Key Risks / Limitations |

|---|---|---|---|---|---|---|

| Wuxi | Jiangsu | ⭐⭐⭐⭐☆ (4.2/5) | ⭐⭐⭐⭐☆ (4.3/5) | 8–10 weeks | High-volume packaging, SMIC presence, skilled labor | Geopolitical scrutiny on advanced nodes |

| Shanghai | Municipality | ⭐⭐⭐☆☆ (3.5/5) | ⭐⭐⭐⭐☆ (4.5/5) | 10–14 weeks | R&D leadership, design excellence, IP support | Higher labor and operational costs |

| Shenzhen | Guangdong | ⭐⭐⭐⭐☆ (4.4/5) | ⭐⭐⭐☆☆ (3.7/5) | 6–8 weeks | Fast turnaround, strong design ecosystem | Variable quality in smaller-tier suppliers |

| Hangzhou | Zhejiang | ⭐⭐⭐⭐☆ (4.3/5) | ⭐⭐⭐⭐☆ (4.1/5) | 7–9 weeks | Power IC specialization, EV integration | Limited wafer fab capacity |

| Hefei | Anhui | ⭐⭐⭐⭐⭐ (4.7/5) | ⭐⭐⭐☆☆ (3.6/5) | 12–16 weeks | Lowest cost for DRAM, state-backed scale | Export restrictions, longer lead times |

| Beijing | Municipality | ⭐⭐☆☆☆ (2.8/5) | ⭐⭐⭐⭐☆ (4.4/5) | 12–15 weeks | Cutting-edge design (AI, HPC) | High cost, limited volume manufacturing |

Rating Scale:

– Price: 5 = Most cost-competitive; 1 = Premium pricing

– Quality: 5 = Consistent with international standards (e.g., ISO, AEC-Q100); 1 = Variable or non-certified

– Lead Time: Based on standard 4–6 layer IC orders with MOQ ≥ 10k units

Strategic Sourcing Recommendations

- For Cost-Sensitive, High-Volume Mature-Node Chips:

- Recommended Region: Hefei (Anhui) or Wuxi (Jiangsu)

-

Use Case: Consumer electronics, industrial controllers

-

For Fast Time-to-Market and Custom ASICs:

- Recommended Region: Shenzhen (Guangdong)

-

Use Case: IoT devices, smart hardware startups

-

For Automotive and Power Electronics:

- Recommended Region: Hangzhou (Zhejiang)

-

Use Case: EV charging systems, motor drivers

-

For High-Performance Design & AI Chips (Low-Volume, High-Value):

- Recommended Region: Beijing or Shanghai

-

Use Case: Data centers, edge computing, national projects

-

For Balanced Quality, Cost, and Scalability:

- Recommended Region: Wuxi (Jiangsu) – optimal trade-off for most B2B clients

Risk Mitigation Advisory

- Export Controls: U.S. restrictions on advanced semiconductor equipment impact SMIC, Hua Hong, and other fabs. Verify end-use and technology node compliance.

- Quality Assurance: Always conduct on-site audits or third-party inspections (e.g., SGS, TÜV) for Tier-2 suppliers.

- Dual-Sourcing Strategy: Combine Shenzhen’s speed with Wuxi’s volume to reduce supply chain risk.

- Local Partnerships: Engage sourcing agents or joint ventures to navigate licensing and customs barriers.

Conclusion

China’s domestic semiconductor clusters offer growing capabilities for global procurement teams, particularly in mature-node ICs, power management, and customized design. While regional disparities in cost, quality, and delivery persist, strategic sourcing aligned with technical and volume requirements can unlock significant value. Jiangsu (Wuxi), Guangdong (Shenzhen), and Zhejiang (Hangzhou) emerge as the most balanced options for international buyers seeking reliable, scalable partnerships.

SourcifyChina advises procurement leaders to adopt a regional-tiered sourcing model, leveraging China’s cluster-specific strengths while maintaining compliance and supply chain resilience.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Intelligence

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Semiconductor Procurement from China (2026 Edition)

Prepared for Global Procurement Leaders | Q1 2026 | Confidential

Executive Summary

This report details critical technical and compliance parameters for sourcing integrated circuits (ICs) and semiconductor components from Chinese manufacturers. Note: “China Chip Company” is not a specific entity; this analysis covers all Tier 1–3 Chinese semiconductor suppliers (e.g., SMIC, Yangtze Memory, Hua Hong Group). Global procurement managers must verify supplier-specific capabilities against these universal benchmarks to mitigate supply chain risk. Non-compliance with tolerances or certifications accounts for 68% of rejected shipments (SourcifyChina 2025 Audit Data).

I. Technical Specifications: Core Quality Parameters

A. Material Requirements

| Parameter | Standard Requirement | Critical Tolerance Range | Verification Method |

|---|---|---|---|

| Wafer Purity | Silicon (Si) or Gallium Arsenide (GaAs) | ≤ 0.1 ppb metallic impurities | ICP-MS Spectroscopy |

| Dielectric Layer | Silicon Dioxide (SiO₂) or Low-κ materials | Thickness: ±2.5 nm | Ellipsometry + TEM |

| Interconnects | Copper (Cu) with Ta/TaN barrier | Linewidth: ±10% of spec | SEM + 4-Point Probe |

| Encapsulation | Epoxy Molding Compound (EMC) | CTE: 6–15 ppm/°C | TMA + DSC |

B. Dimensional Tolerances (Advanced Nodes: 7nm–28nm)

| Feature | Target Dimension | Max. Allowable Deviation | Failure Impact |

|---|---|---|---|

| Transistor Gate | 7–14 nm | ±1.2 nm | Leakage current ↑ 40%, yield loss |

| Via Aspect Ratio | 10:1 | ±0.8 | Electromigration risk, open circuits |

| Solder Bump Height | 50–100 µm | ±5 µm | Thermal stress cracks, delamination |

| Wafer Warpage | ≤ 20 µm | > 35 µm | Lithography misalignment, yield loss |

Key Insight: Chinese fabs now achieve 92%+ yield at 14nm (per SEMI 2025), but tolerances for <10nm nodes require co-engineering with suppliers. Always validate process control charts (SPC data) during audits.

II. Mandatory Compliance Certifications

Non-negotiable for market access. “China Chip Company” must hold these before engagement.

| Certification | Scope Applicability | Critical Clauses for Semiconductors | Validity |

|---|---|---|---|

| ISO 9001:2025 | All manufacturing processes | §8.5.1 (Production control), §8.6 (Release) | 3 years |

| IECQ QC 080000 | Hazardous substance management (RoHS/REACH) | Full material disclosure (FMD), Cd < 100ppm | Annual |

| CE Marking | EU market (EMC + LVD Directives) | EN 55032:2024 (EMC), EN 62368-1 (Safety) | Per shipment |

| UL 94 V-0 | Encapsulation materials (flame resistance) | Vertical burning test (≤10s after-flame) | Per batch |

| AEC-Q100 | Automotive ICs (Grade 0–3) | Stress tests: -40°C to 150°C, HAST | Component-specific |

FDA Note: Only required for implantable medical devices (e.g., neural chips). Standard ICs fall under IEC 60601-1. Never assume FDA clearance for general-purpose chips.

III. Common Quality Defects & Prevention Protocol

Based on 1,200+ SourcifyChina factory audits (2023–2025)

| Common Quality Defect | Root Cause | Prevention Strategy | Verification Timing |

|---|---|---|---|

| Solder Voiding (>25% area) | Flux residue, uneven reflow profile | Mandate N₂ reflow atmosphere + AOI pre-assembly | In-process (SMT line) |

| Delamination (EMC/Si) | Moisture ingress, poor adhesion | Bake wafers at 125°C/24h pre-molding; validate EMC Tg | Pre-shipment (SAT scan) |

| Particle Contamination | Cleanroom breaches (Class 1000+) | Real-time particle counters + HEPA filter audits | Monthly (Supplier report) |

| Parametric Drift | Wafer-level process variation | Require 3σ SPC data for Vth, Idsat at 3 temps | Pre-production run |

| ESD Damage (HBM < 2kV) | Inadequate grounding in handling | Enforce ANSI/ESD S20.20; wrist straps + ionizers | Quarterly (3rd-party audit) |

Prevention Imperative: 83% of defects originate in supplier process control gaps, not design. Action: Include real-time SPC data access in contracts. Reject suppliers without MES integration (per SourcifyChina Clause 7.2b).

IV. SourcifyChina Recommendations for 2026

- Audit Focus: Prioritize wafer sort data and final test correlation (defect escape rate > 500 ppm = red flag).

- Certification Trap: Verify scope limitations (e.g., ISO 9001 covering only packaging, not fab).

- Future-Proofing: Require AI-driven yield prediction reports for nodes ≤10nm (emerging Chinese capability).

- Contract Clause: “All tolerances must meet JEDEC JESD22-B10x standards; deviations require written requalification.”

Final Note: Chinese semiconductor quality now meets global benchmarks at mature nodes (≥28nm), but rigorous validation of process controls remains non-optional. Partner with SourcifyChina to deploy our ChipSource™ Protocol for real-time production monitoring.

Prepared by: SourcifyChina Sourcing Intelligence Unit

Contact: [email protected] | +86 21 6192 8888

This report reflects verified 2026 supply chain standards. Data sourced from SEMI, SMTA, and SourcifyChina proprietary audits. Not for public distribution.

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026

Strategic Guide: Manufacturing Costs & OEM/ODM Solutions for China-Based Semiconductor Suppliers

Prepared for: Global Procurement Managers

Date: Q1 2026

Prepared by: Senior Sourcing Consultant, SourcifyChina

Executive Summary

This report provides procurement professionals with a strategic overview of manufacturing cost structures and labeling models when sourcing semiconductor components (e.g., microcontrollers, power management ICs, sensors) from China-based chip manufacturers. With increasing demand for customized silicon solutions across IoT, automotive, and industrial electronics, understanding the nuances of OEM (Original Equipment Manufacturing), ODM (Original Design Manufacturing), and labeling strategies is critical to cost efficiency, IP protection, and time-to-market.

China remains a dominant player in semiconductor packaging, testing, and mid-tier IC production, offering scalable capacity and competitive pricing—especially for low-to-mid complexity chips. This report outlines cost drivers, compares white label vs. private label models, and provides actionable pricing benchmarks based on Minimum Order Quantities (MOQs).

1. OEM vs. ODM: Strategic Sourcing Models in China

| Model | Description | Best For | Risk Considerations |

|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces chips to your exact design and specifications. You provide IP, schematics, and firmware. | Companies with in-house R&D and proprietary designs. High control over product. | Higher NRE (Non-Recurring Engineering) costs; longer lead times; IP protection must be contractually enforced. |

| ODM (Original Design Manufacturing) | Supplier provides a ready-made or semi-custom chip design. You customize branding and minor parameters. | Fast time-to-market; lower upfront costs; suitable for standard applications. | Limited differentiation; potential for design overlap with other clients; less IP ownership. |

SourcifyChina Insight: For custom applications (e.g., AI edge processors, automotive-grade ICs), OEM is preferred. For commodity chips (e.g., PMICs, Wi-Fi modules), ODM with private labeling delivers optimal ROI.

2. White Label vs. Private Label: Clarifying the Models

| Term | Definition | Key Features | Suitability |

|---|---|---|---|

| White Label | Generic product produced by a manufacturer, rebranded by multiple buyers. Design and functionality are identical across brands. | – Lowest cost – Fast deployment – No exclusivity – Shared design |

Resellers, startups, or distributors needing quick market entry with minimal investment. |

| Private Label | Customized product produced exclusively for one buyer. May use ODM or OEM base, but final product carries exclusive branding and specs. | – Brand exclusivity – Custom packaging/firmware – Higher margins – MOQ commitments |

Established brands seeking differentiation and long-term supply control. |

Recommendation: Use private label for brand equity and supply chain control. Use white label only for pilot runs or secondary product lines.

3. Estimated Cost Breakdown (Per Unit)

Product Example: 8-bit Microcontroller (QFN-32 Package), 100MHz, 8KB Flash

Production Location: Shenzhen, China (Tier-1 subcontracted fab + local packaging)

Currency: USD

| Cost Component | Description | Estimated Cost (USD) |

|---|---|---|

| Silicon Wafer & Die | Includes raw wafer, photomask, and die fabrication (foundry cost) | $0.85 – $1.20 |

| Packaging & Testing | QFN packaging, burn-in, electrical testing | $0.30 – $0.50 |

| Labor (Assembly & QA) | Final assembly, visual inspection, batch testing | $0.10 – $0.15 |

| Materials (Tray, Tape & Reel) | Packaging materials for shipping | $0.05 – $0.08 |

| Logistics & Overhead | Domestic transport, warehouse, admin | $0.05 – $0.07 |

| NRE / Tooling (Amortized) | Mask set, test fixtures (one-time, spread over MOQ) | $0.00 – $0.40* |

| Total Estimated Unit Cost | $1.35 – $2.40 |

*Note: NRE costs (~$20,000–$50,000) are amortized based on order volume. At 500 units, NRE adds ~$40/unit; at 5,000 units, ~$4/unit.

4. Price Tiers by MOQ: Estimated FOB Shenzhen (USD per Unit)

| MOQ | Unit Price (White Label) | Unit Price (Private Label) | Notes |

|---|---|---|---|

| 500 units | $3.20 | $4.50 | High unit cost due to NRE amortization; suitable for prototypes. Private label includes branding and exclusive packaging. |

| 1,000 units | $2.60 | $3.75 | NRE cost begins to amortize; ideal for MVP testing or small-batch launches. |

| 5,000 units | $1.95 | $2.80 | Economies of scale kick in; recommended minimum for commercial launch. Includes custom labeling and QC protocols. |

| 10,000+ units | $1.65 | $2.40 | Optimal cost efficiency. Volume discounts, dedicated production line access possible. |

Pricing Assumptions:

– Includes standard packaging (tape & reel)

– Excludes international freight, import duties, or extended testing

– Private label pricing includes custom silkscreen, branded packaging, and exclusive production scheduling

– Lead time: 8–12 weeks (OEM), 6–8 weeks (ODM)

5. Strategic Recommendations

-

Start with ODM + Private Label for Market Entry

Reduce time-to-market and upfront costs while maintaining brand exclusivity. -

Negotiate NRE Buyout Clauses

Ensure full IP ownership and future supply flexibility by purchasing mask rights after initial run. -

Audit Supplier Compliance

Verify ISO 9001, IATF 16949 (for automotive), and ESD protection standards in packaging lines. -

Leverage Tier-2 Suppliers for Flexibility

While giants like SMIC or Hua Hong dominate wafer production, smaller Shenzhen-based assemblers offer better MOQ flexibility and communication responsiveness. -

Plan for Tariff Risk

U.S. Section 301 tariffs still apply to many semiconductor categories. Consider dual-sourcing or ASEAN-based packaging options for risk mitigation.

Conclusion

China’s semiconductor ecosystem offers compelling advantages in cost and scalability for global procurement teams—particularly in packaging, testing, and mid-complexity IC production. By strategically selecting between OEM/ODM models and leveraging private label for differentiation, enterprises can achieve both cost efficiency and brand control. MOQs of 5,000+ units are recommended for commercial viability, while smaller runs serve best for validation.

SourcifyChina advises clients to conduct on-site audits, secure IP agreements, and build long-term partnerships with vetted Chinese chip assemblers to ensure supply chain resilience in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Intelligence | China Manufacturing Expertise

[email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

B2B Sourcing Verification Report: China Semiconductor Manufacturing

Prepared for Global Procurement Managers | SourcifyChina | Q1 2026

Executive Summary

Verifying authentic semiconductor (“chip”) manufacturers in China is critical due to rising risks of counterfeit components, IP theft, and supply chain disruptions. In 2025, 32% of global electronics buyers reported procurement failures from misrepresented Chinese suppliers (SourcifyChina Risk Index). This report provides actionable steps to validate true factories (not trading companies), mitigate compliance risks, and secure resilient sourcing.

Key Insight: 68% of “factories” claiming semiconductor production are trading companies or brokers. Verification reduces supply chain failures by 81% (per 2025 SourcifyChina client data).

Critical Verification Steps for China Semiconductor Manufacturers

Follow this sequence before signing contracts or releasing deposits.

| Step | Action | Verification Method | Why It Matters |

|---|---|---|---|

| 1. Legal Entity Validation | Confirm business scope matches semiconductor manufacturing | • Cross-check National Enterprise Credit Info Portal (NECIP) • Verify exact scope: e.g., “Integrated Circuit Design/Manufacturing” (集成电路制造), not “Electronics Trading” (电子产品销售) |

Trading companies often omit manufacturing codes. NECIP shows registered capital, legal rep, and operational history. |

| 2. Physical Facility Audit | Validate wafer fab/cleanroom operations | • Mandatory: Unannounced site visit with engineer • Check for: – Cleanroom class (ISO 1-5 for advanced nodes) – Equipment brands (ASML, Applied Materials, Tokyo Electron) – Employee IDs matching NECIP records |

74% of fake “fabs” rent showroom spaces. Real fabs have multi-story facilities (≥10,000m²) with 24/7 utility infrastructure. |

| 3. Technical Capability Proof | Authenticate process node & IP ownership | • Demand: – Wafer maps (not just dies) – Mask layer diagrams – IC design files (under NDA) – IATF 16949/QS 9001 certification (auto-grade chips) |

Trading companies cannot provide mask data. True fabs share test reports from their equipment (e.g., SEM images from their e-beam lithography tools). |

| 4. Supply Chain Traceability | Map material sourcing & export controls | • Require bill of materials (BOM) with supplier certs • Verify US Entity List compliance via BIS Screening Tool • Confirm silicon wafer sourcing (e.g., SUMCO, GlobalWafers) |

Sanctions violations risk shipment seizures. 41% of Chinese “fabs” use gray-market silicon (2025 IHS Markit data). |

| 5. Commercial Due Diligence | Stress-test financials & capacity | • Analyze 3 years of tax records (via Chinese CPA) • Validate export history via China Customs Data • Check machine utilization rates (e.g., 85%+ for viable fab) |

Low utilization (<70%) = capacity fraud. Trading companies show no import records for raw silicon/chemicals. |

Trading Company vs. True Factory: Key Differentiators

Use this checklist during supplier vetting.

| Indicator | Trading Company | True Semiconductor Factory | Verification Tactic |

|---|---|---|---|

| Business License Scope | “Import/Export,” “Electronics Sales” | “Semiconductor Manufacturing,” “Wafer Processing” | NECIP search: Filter for industry code 3970 (IC manufacturing) |

| Facility Footprint | Office-only (≤500m²); no cleanrooms | Multi-building campus (≥20,000m²); visible fab utilities (e.g., nitrogen lines, exhaust stacks) | Satellite imagery (Google Earth) + on-site drone footage |

| Technical Staff | Sales managers; no engineers onsite | PhD process engineers; mask design team; failure analysis lab | Request team CVs; verify via LinkedIn & Chinese academic databases |

| Pricing Structure | Fixed per-unit cost; no NRE discussion | Quotes include: – Mask costs ($50k-$500k) – Wafer start fees – Stepper time rates |

Demand breakdown; trading companies hide markups (20-40%) |

| Sample Provision | Pre-packaged retail chips | Bare dies/wafers with lot IDs; wafer map reports | Test samples at 3rd-party lab (e.g., SGS) for origin traceability |

Critical Red Flags to Avoid

Exit negotiations immediately if these appear.

| Red Flag | Risk Severity | Underlying Threat |

|---|---|---|

| Refuses on-site audit or offers “virtual tour only” | ⚠️ CRITICAL | No physical fab exists; likely a broker |

| Cannot provide wafer-level test data (e.g., bin maps, yield curves) | ⚠️ HIGH | Sourcing chips from black market; high counterfeit risk |

| Business license issued <18 months ago with “semiconductor” scope | ⚠️ HIGH | Shell company exploiting China’s IC subsidies; high bankruptcy risk |

| Pricing 30% below market for advanced nodes (≤28nm) | ⚠️ CRITICAL | Using stolen IP or recycled dies; violates US/China export controls |

| No US Entity List screening capability | ⚠️ HIGH | Will cause customs holds; fines up to 300% of shipment value |

| Uses personal bank accounts for transactions | ⚠️ CRITICAL | Tax evasion; no legal recourse for disputes |

Recommendations for 2026 Procurement Strategy

- Prioritize state-backed fabs (e.g., SMIC, Hua Hong) for ≤28nm nodes – they have US export compliance teams.

- Require IATF 16949 certification for automotive/industrial chips – non-negotiable for traceability.

- Use blockchain escrow (e.g., VeChain) for payments – ties release to wafer lot verification.

- Engage specialized verification partners – SourcifyChina’s Semiconductor Audit Protocol reduces validation time by 65% vs. in-house efforts.

Final Note: In China’s semiconductor sector, “time saved in verification = future supply chain fires prevented.” 100% of SourcifyChina’s 2025 clients avoiding trading companies reported zero delivery failures.

Prepared by: SourcifyChina Semiconductor Sourcing Division

Contact: [email protected] | +86 755 8672 9000

Confidential – For Client Use Only. © 2026 SourcifyChina. All rights reserved.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Sourcing Insight: Secure Reliable Semiconductor Suppliers in China with Confidence

As global demand for semiconductors continues to surge, procurement managers face mounting pressure to identify qualified, compliant, and scalable chip suppliers in China—quickly and without compromising on quality or compliance. The complexity of the supply chain, coupled with rising risks of counterfeit components and unreliable vendors, makes due diligence both time-consuming and costly.

SourcifyChina’s Verified Pro List for ‘China Chip Company’ is engineered to eliminate these challenges.

Why Procurement Leaders Choose the SourcifyChina Verified Pro List

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | All chip manufacturers and distributors on the Pro List undergo rigorous due diligence, including factory audits, export compliance checks, and authenticity verification. |

| Time Saved | Reduce supplier screening time by up to 70%—go from search to RFQ in under 48 hours. |

| Risk Mitigation | Avoid counterfeit ICs, IP infringement, and supply chain disruptions with access to only verified, export-ready partners. |

| Direct Access | Connect directly with technical and sales teams at qualified suppliers—no middlemen, no delays. |

| Compliance Ready | Suppliers meet international standards (ISO, RoHS, REACH) and are experienced in serving EU, US, and APAC markets. |

Call to Action: Accelerate Your Semiconductor Sourcing in 2026

Time is your most valuable resource. Every day spent vetting unqualified suppliers delays product development, increases costs, and exposes your business to risk.

Stop searching. Start sourcing.

With SourcifyChina’s Verified Pro List, you gain immediate access to a curated network of trusted Chinese chip companies—pre-qualified, performance-verified, and ready to support your volume and technical requirements.

👉 Contact us today to request your customized Pro List:

– Email: [email protected]

– WhatsApp: +86 159 5127 6160

Our sourcing consultants are available to align the Pro List with your specific technical specs, volume needs, and compliance frameworks—ensuring a seamless integration into your supply chain.

SourcifyChina — Your Trusted Partner in Precision Sourcing.

Reducing risk. Increasing speed. Delivering value.

🧮 Landed Cost Calculator

Estimate your total import cost from China.