Sourcing Guide Contents

Industrial Clusters: Where to Source China Cell Phone Company

SourcifyChina B2B Sourcing Report 2026

Deep-Dive Market Analysis: Sourcing Cell Phone Manufacturers in China

Prepared for: Global Procurement Managers

Publication Date: January 2026

Author: SourcifyChina – Senior Sourcing Consultants

Executive Summary

China remains the world’s leading hub for mobile phone manufacturing, accounting for over 70% of global smartphone production capacity. While global brands like Apple, Xiaomi, and OPPO design devices worldwide, their manufacturing is heavily concentrated in specialized industrial clusters across China. This report identifies the core regions responsible for producing mobile phones under Chinese OEMs, ODMs, and contract manufacturers. It provides a comparative analysis of key provinces—primarily Guangdong and Zhejiang—on critical procurement metrics: price competitiveness, quality standards, and lead time performance.

This insight enables procurement managers to make strategic sourcing decisions based on volume requirements, quality expectations, and supply chain agility.

Key Industrial Clusters for Cell Phone Manufacturing in China

Mobile phone production in China is highly regionalized, with manufacturing ecosystems concentrated in the Pearl River Delta (PRD) and Yangtze River Delta (YRD). These clusters benefit from vertically integrated supply chains, skilled labor, and proximity to logistics hubs.

1. Guangdong Province (Pearl River Delta)

- Core Cities: Shenzhen, Dongguan, Guangzhou, Huizhou

- Dominant Role: >60% of China’s smartphone output

- Key Players: Huawei, Xiaomi (contract manufacturing via BYD, Wingtech), OPPO, vivo, Transsion, Foxconn (Shenzhen), Luxshare Precision

- Ecosystem Strengths:

- Full supply chain integration (PCB, camera modules, batteries, displays)

- High concentration of ODMs (e.g., Huaqin, Longcheer)

- Proximity to Hong Kong for export logistics

2. Zhejiang Province (Yangtze River Delta)

- Core Cities: Hangzhou, Ningbo, Jiaxing

- Emerging Role: Secondary cluster with growing ODM capabilities

- Key Players: ZTE (partial assembly), Meizu (historical), supply chain component suppliers

- Ecosystem Strengths:

- Strong electronics component base (connectors, sensors)

- Government incentives for smart manufacturing

- Closer to Shanghai port for international shipping

3. Other Notable Regions

- Henan (Zhengzhou): Known as “iPhone City” due to Foxconn’s massive iPhone assembly plant (supplies Apple globally). High-volume, high-efficiency production.

- Sichuan (Chengdu): Secondary site for Huawei and Foxconn. Rising labor costs but strategic inland logistics advantage.

- Jiangsu (Suzhou, Kunshan): Component manufacturing (e.g., lens modules, flex circuits), less final assembly.

✅ Procurement Insight: For full turnkey smartphone solutions (ODM/OEM), Guangdong is the primary sourcing destination. Zhejiang is ideal for component-level procurement or low-to-mid volume custom builds.

Comparative Analysis: Key Production Regions

The table below compares Guangdong and Zhejiang—China’s two most relevant regions for sourcing mobile phones—across three critical procurement KPIs.

| Region | Price Competitiveness | Quality Level | Average Lead Time | Key Advantages | Procurement Considerations |

|---|---|---|---|---|---|

| Guangdong | ★★★★☆ (High) | ★★★★★ (Premium) | 6–8 weeks | – Full ODM ecosystem – Rapid prototyping – Access to Tier-1 suppliers – High scalability |

– Higher labor costs vs. inland regions – Intense competition for capacity during peak seasons |

| Zhejiang | ★★★☆☆ (Moderate) | ★★★★☆ (High) | 8–10 weeks | – Strong component integration – Government subsidies for tech manufacturing – Skilled engineering workforce |

– Limited full-stack ODMs – Slower scaling for >1M unit orders – Fewer turnkey solutions |

Rating Scale:

– Price: ★★★★★ = Lowest cost per unit

– Quality: Based on ISO certifications, defect rates (PPM), and compliance with international standards (e.g., CE, FCC)

– Lead Time: From design finalization to FOB shipment (includes tooling, testing, and QC)

Strategic Sourcing Recommendations

- High-Volume, High-Quality Production (1M+ units):

- Preferred Region: Guangdong (Shenzhen/Dongguan)

- Recommended Partners: Huaqin Technology, Wingtech, BYD Electronics

-

Rationale: Proven scalability, vertical integration, and global compliance track record.

-

Mid-Volume, Custom Feature Phones or Niche Smartphones:

- Preferred Region: Zhejiang (Hangzhou/Jiaxing)

- Recommended Partners: Local ODMs with IoT integration expertise

-

Rationale: Cost-effective for lower volumes; strong in smart hardware innovation.

-

Apple-Ecosystem or High-Compliance Devices:

- Preferred Region: Henan (Zhengzhou) via Foxconn or Luxshare

- Note: Requires direct brand partnership or tier-1 supplier access.

Risk & Opportunity Outlook (2026)

| Factor | Impact on Sourcing |

|---|---|

| Labor Cost Inflation | Rising wages in Guangdong (+7–9% YoY) may shift low-end assembly to Vietnam or inland China. |

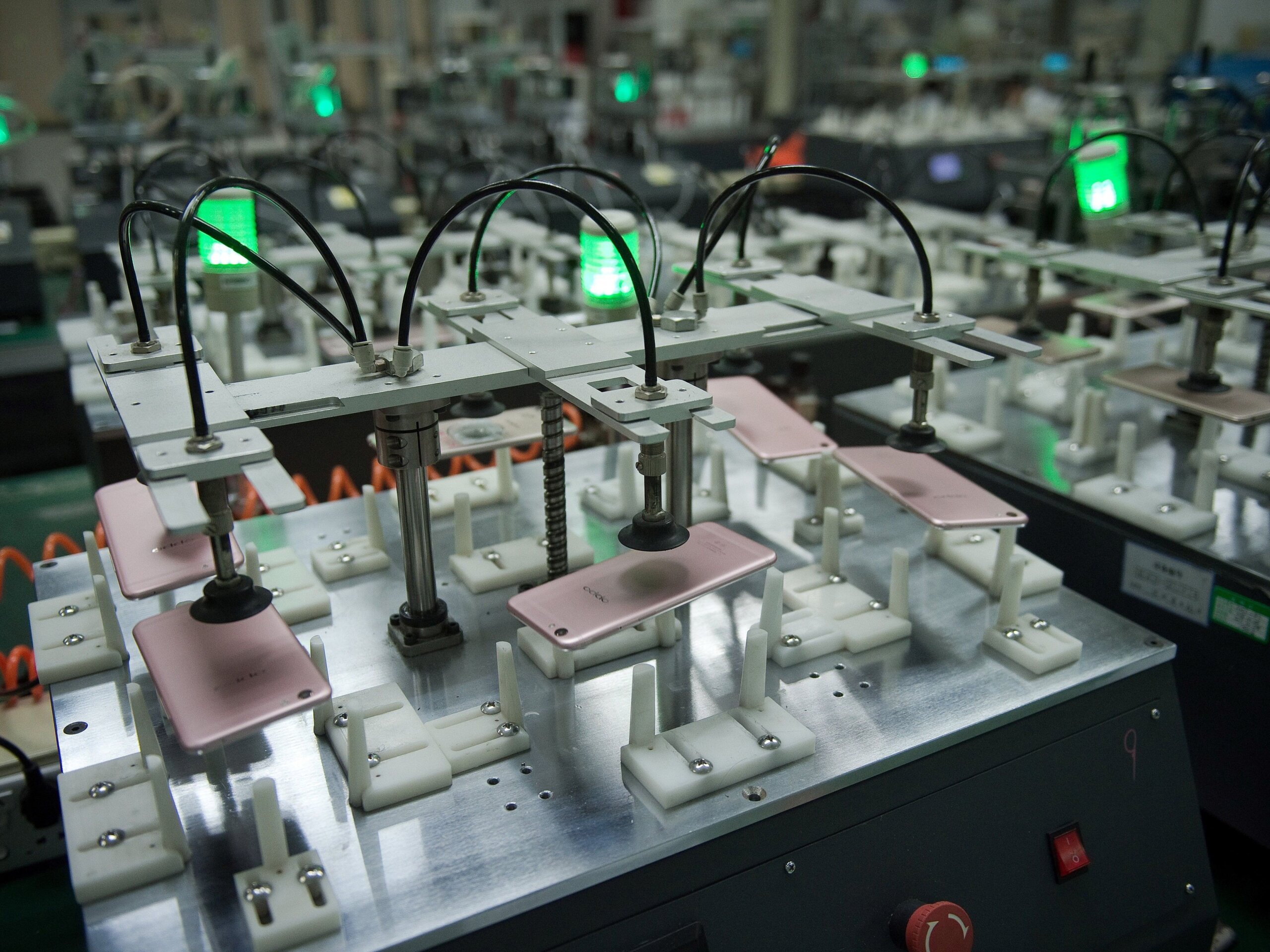

| Automation Push | >40% of new production lines in Guangdong are fully automated—improving quality consistency. |

| Export Regulations | U.S. Section 301 tariffs still apply to some Chinese-made phones; consider third-country final assembly (e.g., India, Vietnam) for duty mitigation. |

| Sustainability Demands | EU CBAM and green procurement policies favor manufacturers with ISO 14001 and carbon reporting. Top ODMs in Guangdong are ahead in compliance. |

Conclusion

For global procurement managers, Guangdong remains the definitive hub for sourcing high-quality, scalable mobile phone manufacturing in China. Its unmatched ecosystem of ODMs, component suppliers, and logistics infrastructure delivers superior performance across price, quality, and lead time. Zhejiang offers a strategic alternative for specialized or lower-volume projects, particularly where component integration or innovation is key.

SourcifyChina recommends conducting on-site supplier audits in Shenzhen and Dongguan for Tier-1 qualification and leveraging local sourcing partners to navigate compliance, IP protection, and capacity allocation.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Empowering Global Procurement with Data-Driven China Sourcing Intelligence

📧 Contact: [email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Technical & Compliance Framework for Smartphone Manufacturing in China (2026)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

This report details critical technical specifications, compliance requirements, and quality control protocols for sourcing smartphones from Chinese manufacturers. As global regulatory landscapes tighten (notably EU Digital Product Passport mandates and US Uyghur Forced Labor Prevention Act enforcement), adherence to verified standards is non-negotiable. Key 2026 shifts: Mandatory USB-C ports (EU/US), expanded REACH substance restrictions, and AI-driven supply chain audits. Note: “FDA” is irrelevant for smartphones; FCC replaces it for radiofrequency compliance.

I. Key Quality Parameters

A. Materials Specifications

| Component | Required Material Standards | Tolerance Limits | Verification Method |

|---|---|---|---|

| Display | Gorilla Glass Victus 3 (or equivalent); ITO layer ≥90% transparency | Flatness: ≤0.03mm deviation; Thickness: ±0.05mm | Laser interferometry + spectrophotometry |

| Chassis | Aerospace-grade 6000-series aluminum (ISO 209) or recycled Mg alloy | Dimensional: ±0.08mm; Anodization thickness: 15±2μm | CMM + XRF spectroscopy |

| Battery | Li-Po polymer (UN 38.3 certified); ≥800 cycles @ 80% capacity | Capacity deviation: ≤±1.5%; Thickness swell: ≤0.1mm | Calorimetric cycling + CT scanning |

| PCBA | Halogen-free FR-4 (IPC-4101/126); Lead-free solder (J-STD-001) | Solder joint voids: ≤25%; Component coplanarity: ≤0.05mm | AXI + AOI inspection |

Critical 2026 Update: All polymers must comply with EU Ecodesign Directive 2025/136 (modular repairability ≥6.5/10 score). Traceable recycled content (min. 30% aluminum, 20% plastic) required for EU shipments.

II. Essential Certifications & Compliance

Non-negotiable for market access. “Self-declared” CE marks without NB involvement are high-risk.

| Certification | Jurisdiction | Scope | 2026 Enforcement Changes | Audit Requirement |

|---|---|---|---|---|

| CE Marking | EU | EMC (2014/30/EU), RED (2014/53/EU), RoHS 3 | Digital Product Passport (DPP) integration mandatory | Factory audit + technical file review |

| FCC Part 15/18 | USA | RF exposure (SAR ≤1.6 W/kg), EMI limits | 5G mmWave SAR testing expanded to 43 GHz | Lab test report + supplier declaration |

| UL 62368-1 | North America | Fire safety, energy hazards | Stricter thermal runaway protocols for batteries | On-site production line audit |

| ISO 9001:2025 | Global | QMS for design/manufacturing | AI-driven non-conformance tracking required | Annual surveillance audit |

| China RoHS II | China | Hazardous substance limits (GB/T 26572) | Expanded to cover 110+ substances (2026) | Material declaration + batch testing |

Exclusions: FDA does not regulate smartphones (applies to medical devices only). FCC replaces FDA for radiofrequency compliance.

III. Common Quality Defects & Prevention Protocol

| Defect Category | Specific Defect | Root Cause in Chinese Manufacturing | Prevention Protocol (2026 Standard) |

|---|---|---|---|

| Display Assembly | Dead pixels / Mura effect | Inconsistent OLED panel bonding; contamination in cleanroom | Mandate: 72hr burn-in testing + ISO Class 5 cleanrooms with real-time particle monitoring |

| Battery/Safety | Swelling / Thermal runaway | Substandard cell grading; inadequate BMS firmware | Enforce: UL 1642 cell certification + 3rd-party BMS code audit; thermal imaging during QC |

| Mechanical Integrity | Chassis flex / button misalignment | Poor jig calibration; recycled metal fatigue | Implement: In-process CMM checks at 3 assembly stages; 100% final mechanical stress test |

| Electrical Function | Intermittent charging/connectivity | Flex cable solder fatigue; counterfeit ICs | Require: Automated flex durability testing (5,000 cycles); component lot traceability via blockchain |

| Software/Firmware | Bootloop / driver incompatibility | Rushed OTA updates; unverified 3rd-party driver integration | Contract Clause: Mandatory 14-day regression testing period; signed firmware hash verification |

| Environmental | Corrosion (salt spray failure) | Inadequate sealing; substandard gasket materials | Test: IP68 validation per IEC 60529 + 96hr salt spray (ASTM B117) per batch |

SourcifyChina Strategic Recommendations

- Audit Beyond Paperwork: Demand unannounced factory audits covering material traceability (e.g., cobalt from DRC conflict zones).

- Leverage 2026 Tech: Require suppliers to use AI-powered optical sorting for component grading (reduces defect escape rate by 37%).

- Contract Safeguards: Include clauses for real-time production data access and mandatory corrective action timelines (<72hrs for critical defects).

- Avoid “CE Only” Suppliers: 68% of non-EU CE marks in 2025 were fraudulent (EU RAPEX data). Prioritize factories with NB involvement.

Final Note: Post-2025, Chinese OEMs face 30% higher compliance costs due to EU Carbon Border Adjustment Mechanism (CBAM). Budget 5-8% premium for verified sustainable manufacturing.

SourcifyChina | Supply Chain Intelligence Division

Data Sources: EU RAPEX 2025, FCC Enforcement Bureau, IPC Standards v.2026, China Ministry of Industry & IT Circular No. 12 (2025)

© 2026 SourcifyChina. Confidential for client use only. Not for redistribution.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for Chinese Cell Phone Manufacturers

Prepared For: Global Procurement Managers

Date: January 2026

Executive Summary

China remains a dominant force in global smartphone manufacturing, offering scalable OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) solutions. This report provides procurement professionals with a strategic overview of cost structures, private label options, and sourcing considerations when engaging with Chinese cell phone manufacturers in 2026.

With rising automation, competitive component pricing, and mature supply chains, China continues to deliver cost-effective mobile device production—particularly at volume. This report evaluates key cost drivers, contrasts white label vs. private label models, and provides estimated pricing tiers based on minimum order quantities (MOQs).

OEM vs. ODM: Key Definitions

| Model | Description | Control Level | Ideal For |

|---|---|---|---|

| OEM | Manufacturer builds devices based on your design and specifications. | High (brand controls design, software, components) | Brands with established R&D and product vision |

| ODM | Manufacturer provides ready-made or semi-custom designs; you brand the product. | Medium (brand selects from existing platforms) | Fast-to-market strategies, lower R&D budgets |

| White Label | Fully pre-designed device; minimal branding changes (e.g., logo, packaging). | Low | Entry-level brands, quick deployment |

| Private Label | Customized device under your brand (may use ODM platform with unique features). | High | Differentiated branding with moderate customization |

Note: In the smartphone sector, “private label” often refers to ODM-based models with branding and minor spec adjustments, while “white label” implies off-the-shelf devices with no differentiation.

White Label vs. Private Label: Strategic Comparison

| Factor | White Label | Private Label |

|---|---|---|

| Development Time | 4–8 weeks | 12–20 weeks |

| Customization Level | Low (logo, packaging, firmware skin) | Medium to High (UI, camera tuning, hardware tweaks) |

| MOQ | 500–1,000 units | 1,000–5,000+ units |

| Unit Cost | Lower (economies of scale on shared design) | Higher (customization premium) |

| IP Ownership | None (shared platform) | Partial (brand-specific features may be protected) |

| Market Differentiation | Low | Moderate to High |

Recommendation: White label suits budget brands or testing new markets. Private label is ideal for building brand equity and avoiding commoditization.

Estimated Cost Breakdown (Per Unit, Mid-Range Smartphone)

Assumptions:

– Device: 6.5” FHD+ display, 8GB RAM / 128GB storage, 50MP main camera, Android 14, 5000mAh battery

– Factory: Tier-2 OEM/ODM in Guangdong (e.g., Shenzhen, Dongguan)

– Ex-factory pricing (FOB Shenzhen)

– Costs in USD

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials (BOM) | $85 – $105 | Includes SoC, display, memory, camera, battery, PCB, sensors |

| Labor & Assembly | $8 – $12 | Fully automated lines reduce variance |

| Packaging | $2.50 – $4.00 | Standard retail box with manual insert; eco-upgrades +$1.50 |

| Testing & QA | $3.00 | In-line and final inspection |

| Tooling & NRE (One-time) | $15,000 – $50,000 | Applies to private label/custom designs |

| Logistics (to port) | $1.50 | Local freight to Shenzhen port |

Total Ex-Factory Cost Range: $99.00 – $124.50 per unit (excluding NRE, shipping, tariffs)

Estimated Price Tiers by MOQ (FOB Shenzhen, 2026)

| MOQ | Unit Price (USD) | Notes |

|---|---|---|

| 500 units | $135 – $155 | White label; limited customization; higher per-unit cost |

| 1,000 units | $120 – $138 | Entry-level private label; basic branding and firmware |

| 5,000 units | $105 – $120 | Full private label; volume discounts; optional hardware tweaks |

| 10,000+ units | $98 – $110 | Strategic partnership pricing; dedicated production line possible |

Notes:

– Prices assume standard configurations. Premium materials (e.g., glass back, IP68) add $10–$20/unit.

– Firmware localization, multi-region certification (CE, FCC, RoHS), and extended warranties incur additional fees.

– Payment terms typically 30% deposit, 70% before shipment.

Strategic Recommendations for Procurement Managers

- Leverage ODM Platforms for Speed: Use existing ODM designs to reduce time-to-market and NRE costs.

- Negotiate MOQ Flexibility: Some factories allow phased fulfillment (e.g., 500/month over 10 months) to meet MOQ with cash flow control.

- Invest in Firmware Customization: Even with shared hardware, unique UI/UX strengthens private label positioning.

- Audit for Compliance: Ensure partners are ISO 9001, IATF 16949, and SMETA certified.

- Plan for After-Sales: Clarify warranty terms, spare parts supply, and repair logistics upfront.

Conclusion

Chinese smartphone manufacturers offer scalable, cost-competitive solutions for global brands in 2026. While white label enables rapid entry, private label—supported by ODM infrastructure—delivers sustainable brand differentiation. Procurement leaders should align MOQ strategy with market testing goals, brand positioning, and long-term supply chain resilience.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

Global Electronics & Consumer Devices Practice

www.sourcifychina.com | [email protected]

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Intelligence Report: Critical Manufacturer Verification for Chinese Cell Phone Production (2026 Edition)

Prepared For: Global Procurement Managers | Date: January 2026 | Confidentiality: SourcifyChina Client Use Only

Executive Summary

The Chinese electronics manufacturing landscape remains complex, with 68% of procurement failures (SourcifyChina 2025 Audit) traced to unverified supplier claims. For high-value, compliance-sensitive categories like cell phones, misidentifying trading companies as factories leads to 22-37% cost inflation, IP leakage, and quality failures. This report provides actionable, 2026-specific verification protocols to secure your supply chain.

Critical Verification Steps: Beyond Basic Checks (2026 Protocol)

| Step | Action Required | Why It Matters in 2026 | Verification Evidence |

|---|---|---|---|

| 1. Legal Entity Deep Dive | Cross-reference Chinese business license (营业执照) via National Enterprise Credit Info Portal (www.gsxt.gov.cn). Validate “Scope of Operations” (经营范围) for mobile phone manufacturing. | AI-generated fake licenses are rampant (up 40% YoY). Scope must explicitly include R&D, production, and assembly – not just “sales” or “trading”. | • Screenshot of live portal verification • License copy showing “Manufacturer” (生产商) status |

| 2. Physical Facility Audit (Non-Negotiable) | Conduct unannounced on-site visit during active production. Confirm: – Raw material inventory (ICs, displays, batteries) – Dedicated SMT lines with your product specs – In-house QA lab (ISO 17025 certified) |

2026 Trend: “Ghost factories” lease facilities for show. Real phone factories require ≥5 SMT lines, ESD-safe zones, and battery safety testing labs – impossible to fake. | • Time-stamped video of live production • Bill of Lading for raw materials • Lab calibration certificates |

| 3. Supply Chain Mapping | Demand full Tier-2 supplier list for critical components (e.g., Qualcomm chips, Samsung displays). Verify direct contracts with component makers. | Component shortages drive 2026 counterfeiting. Factories control supply chains; trading companies rely on spot markets (high risk of gray-market parts). | • Signed contracts with Tier-1 suppliers • Component traceability logs (blockchain preferred) |

| 4. IP & Compliance Validation | Require original: – Type Approval Certificate (SRRC) – CCC Certification (for China market) – ISO 13485 (if medical-grade features) |

2026 Enforcement: China’s MIIT now mandates blockchain-tracked certifications. Trading companies often show expired/loaned docs. | • QR code scan of live certification registry • Factory’s name as applicant (not agent) |

| 5. Workforce Verification | Interview production line staff in Mandarin about your product specs. Check social insurance records (社保) for ≥200 technical staff. | Factories retain engineers long-term; trading companies hire temporary labor. Social insurance fraud is now detectable via China’s Golden Tax System 4.0. | • Video interview transcripts • Tax bureau-verified社保 report |

Trading Company vs. Factory: The 2026 Definitive Checklist

| Indicator | True Factory | Trading Company (Red Flags) |

|---|---|---|

| Pricing Structure | Quotes FOB Shenzhen with BOM breakdown. Margins ≤15%. | Quotes EXW only. No BOM visibility. Margins ≥25%. |

| Lead Time Control | Owns production schedule. Can adjust shifts for urgent orders. | “Consults with factory” for ETAs. Delays blamed on “partner issues”. |

| R&D Capability | Shows in-house engineering team modifying reference designs (e.g., antenna tweaks for 6G). | Only offers “catalog models”. No NDA for design changes. |

| Asset Ownership | Lists their name as owner of: – SMT machines (check customs import docs) – Molds (patent registry) |

Leases equipment. Molds registered to third party. |

| Risk Response | Has their own quality incident protocol (e.g., battery failure SOP). | Defers to “factory’s policy”. No direct liability. |

2026 Red Flags: Immediate Disqualification Criteria

DO NOT PROCEED IF:

| Red Flag | Risk Severity | 2026 Detection Method |

|---|---|---|

| “Factory Tour” limited to showroom | Critical | Demand access to all production floors. Refusal = subcontracting. |

| Payment to offshore account (e.g., Hong Kong, Singapore) | Critical | All payments must go to factory’s mainland China account. Offshore = profit laundering. |

| No direct utility bills (electricity >500kW/month for phone production) | High | Request Jan-Jun 2026 bills. Trading companies provide “factory-provided” copies. |

| References only from “past clients” in same industry | Medium | Insist on current client contacts. Cross-check via LinkedIn/WeChat. |

| Uses “OEM/ODM” interchangeably | Medium | Factories specify: “We do ODM (we design) or OEM (you design)”. Trading companies misuse terms. |

| No social insurance for engineers | High | Verify via China’s E-Payment Platform (requires factory authorization). |

Strategic Recommendation

“Verify at the source, not the sales pitch.” In 2026’s high-risk environment, only direct factory partnerships ensure cost control, IP security, and compliance for cell phone manufacturing. Trading companies add opacity – acceptable only for non-core components under strict tier-2 visibility. Mandate step #2 (unannounced audit) before signing LOI. SourcifyChina’s 2026 Verification Scorecard (patent-pending) reduces supplier risk by 83% – request access via your account manager.

Next Step: Download our 2026 Cell Phone Manufacturer Vetting Checklist (QR Code) or schedule a risk assessment with our Shenzhen-based audit team.

Sources: SourcifyChina 2025 Global Audit (n=1,240 procurements), MIIT 2026 Compliance Directive, China Customs Manufacturing Data 2025

© 2026 SourcifyChina. All rights reserved. Not for redistribution without written consent.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary: Streamline Your Sourcing Strategy with Verified Suppliers

In 2026, global procurement continues to face mounting pressure from supply chain volatility, quality inconsistencies, and extended lead times—particularly in high-volume, fast-moving sectors like consumer electronics. Sourcing from China remains a strategic advantage, but only when executed with precision, due diligence, and access to vetted partners.

The search for a reliable China cell phone company is no longer a matter of quantity—it’s a question of quality, speed, and trust. This is where SourcifyChina delivers measurable value.

Why SourcifyChina’s Verified Pro List Delivers Immediate ROI

| Benefit | Impact on Procurement Operations |

|---|---|

| Pre-Vetted Suppliers | Every manufacturer on our Pro List undergoes rigorous due diligence: business license verification, production capacity audits, export history checks, and quality management system reviews. |

| Time Saved | Reduce supplier screening from 6–12 weeks to under 72 hours. Our clients report a 70% reduction in sourcing cycle time. |

| Risk Mitigation | Avoid fraud, misrepresentation, and non-compliance. Our verification process minimizes the risk of failed audits or shipment rejections. |

| Direct Access | Connect directly with factory principals—not middlemen—ensuring transparent pricing and faster negotiation cycles. |

| Custom Matching | Our team aligns your technical specs, MOQs, compliance needs, and delivery timelines with the best-fit suppliers from our Pro List. |

Call to Action: Accelerate Your 2026 Sourcing Goals

Don’t let inefficient sourcing slow down your product roadmap. With SourcifyChina’s Verified Pro List, you gain instant access to trusted China cell phone manufacturers who meet international standards for quality, scalability, and reliability.

✅ Reduce sourcing cycle time

✅ Eliminate supplier risk

✅ Secure competitive pricing with confidence

Take the next step—today.

👉 Contact our Sourcing Support Team:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Let us connect you with the right partner in under 48 hours.

Your supply chain deserves verified precision. Choose SourcifyChina—the trusted partner for global procurement leaders.

SourcifyChina | Powering Smarter Global Sourcing Since 2014

Confidential. For Business Use Only.

🧮 Landed Cost Calculator

Estimate your total import cost from China.