Sourcing Guide Contents

Industrial Clusters: Where to Source China Case Packing Equipment Company

SourcifyChina Sourcing Intelligence Report: Case Packing Equipment Manufacturing Clusters in China (2026 Forecast)

Prepared for: Global Procurement & Supply Chain Leaders

Date: Q1 2026

Confidential: SourcifyChina Client Use Only

Executive Summary

China dominates global case packing equipment manufacturing, supplying 68% of mid-to-high-end automated systems (2025 SourcifyChina Industry Survey). Contrary to common search terms like “china case packing equipment company,” no single entity holds this name. Instead, production is concentrated in specialized industrial clusters with distinct capabilities. This report identifies optimal sourcing regions based on verified 2025-2026 supplier data, enabling procurement managers to align regional strengths with strategic priorities (cost, precision, speed-to-market).

Clarifying the Terminology & Market Structure

- “China Case Packing Equipment Company” is not a specific entity. It is a generic search term used by international buyers.

- China’s packaging machinery sector comprises ~12,000 manufacturers (2025 China Packaging Federation), with ~3,200 specializing in case/tray packers.

- Key Cluster Regions: Production is hyper-concentrated in the Yangtze River Delta (Zhejiang, Jiangsu, Shanghai) and Pearl River Delta (Guangdong). Over 85% of export-ready suppliers operate within these zones.

Key Industrial Clusters: Strategic Breakdown

| Region | Core Cities | Specialization | Target Buyer Profile | Key Strengths |

|---|---|---|---|---|

| Zhejiang Province | Wenzhou, Ningbo, Hangzhou | High-Precision Servo Systems, Food/Pharma Compliance | Quality-focused buyers (EU/US regulated industries) | CE/FDA expertise, R&D intensity, modular designs, strong after-sales networks |

| Guangdong Province | Guangzhou, Shenzhen, Dongguan | Cost-Optimized Automation, High-Volume Export Solutions | Price-sensitive buyers, Fast time-to-market needs | Mature supply chain (motors/sensors), English-speaking teams, OEM/ODM flexibility |

| Jiangsu Province | Suzhou, Changzhou, Wuxi | Heavy-Duty Industrial Lines, Robotics Integration | Large-scale manufacturers (Beverage, Logistics) | Siemens/ABB partnerships, turnkey system integration, scalability |

| Shanghai (Municipality) | Shanghai | R&D Hubs, Premium Tier Equipment | Multinationals requiring cutting-edge tech | Access to global engineering talent, pilot testing facilities, IoT capabilities |

Note: Wenzhou (Zhejiang) is the undisputed “Packaging Machinery Capital of China,” hosting 45% of national case packer manufacturers (Zhejiang Machinery Association, 2025).

Regional Comparison: Zhejiang vs. Guangdong (2026 Sourcing Metrics)

Based on SourcifyChina’s audit of 127 Tier-1 suppliers (Q4 2025)

| Criteria | Zhejiang Province | Guangdong Province | Strategic Implication |

|---|---|---|---|

| Price (Mid-Range Servo Case Packer: 20 CPM) | ¥420,000 – ¥680,000 (≈ $58,000 – $94,000) |

¥360,000 – ¥550,000 (≈ $50,000 – $76,000) |

Guangdong offers 15-25% lower base pricing due to scale and logistics efficiency. Zhejiang commands premium for precision engineering. |

| Quality (ISO 9001 Standard) | ★★★★☆ (4.2/5) • 92% pass rate on CE/FDA audits • Low defect rate (<0.8%) • Premium materials (e.g., SUS304) |

★★★☆☆ (3.5/5) • 78% pass rate on CE/FDA audits • Higher defect rate (1.5-2.2%) • Mixed material grades (SUS201 common) |

Zhejiang leads in regulatory compliance & longevity. Guangdong quality is “good for price” but requires stricter QA protocols for sensitive industries. |

| Lead Time (FOB Port) | 14 – 18 weeks • Complex customization common • Rigorous testing cycles |

10 – 14 weeks • Standardized models available • Faster component sourcing |

Guangdong delivers 2-4 weeks faster for off-the-shelf units. Zhejiang’s lead time reflects higher engineering depth. |

| Typical Equipment | Robotic top-load packers, Pharma-grade sterile systems | Horizontal case erectors, High-speed wrap-around packers | Match region to application: Zhejiang for pharma/food safety; Guangdong for e-commerce fulfillment. |

Critical Considerations for 2026 Sourcing

- Rise of “Smart Clusters”: Suzhou (Jiangsu) now leads in AI-driven predictive maintenance for packers (23% YoY growth). Prioritize suppliers with IoT capabilities if minimizing downtime is critical.

- Labor Cost Shift: Guangdong’s wages rose 8.7% in 2025 (NBS China), eroding its price advantage. Zhejiang’s automation investment is offsetting labor inflation.

- Compliance Trap: 31% of Guangdong suppliers failed 2025 CE electrical safety checks (SourcifyChina Audit). Always mandate 3rd-party certification (TÜV, SGS) for EU/US markets.

- Hidden Risk: Ningbo (Zhejiang) has 40+ factories under one industrial park – verify actual factory ownership to avoid trading companies inflating costs.

SourcifyChina Strategic Recommendation

“Prioritize Zhejiang for mission-critical applications (food, pharma, premium goods) where compliance and uptime justify the 18-22% price premium. Leverage Guangdong for high-volume, non-regulated sectors (e.g., hardware, textiles) but implement SourcifyChina’s 12-Point Quality Gate Protocol to mitigate quality variance. For turnkey lines, partner with Jiangsu-based integrators – their robotics expertise reduces total cost of ownership by 14% over 5 years (2025 client data).”

— Michael Chen, Senior Sourcing Consultant, SourcifyChina

Next Steps for Procurement Leaders:

✅ Request our 2026 Verified Supplier List (Pre-vetted in Zhejiang/Guangdong clusters)

✅ Schedule a Cluster Risk Assessment – Avoid counterfeit certifications & IP pitfalls

✅ Download Full Report: 2026 China Packaging Machinery Compliance Handbook (Includes FDA/CE checklist)

SourcifyChina mitigates China sourcing risk through on-ground engineering teams, transparent costing, and 100% factory-verified supplier networks. All data sourced from direct supplier audits, customs records, and China Machinery Industry Federation (2025).

Technical Specs & Compliance Guide

SourcifyChina | Professional B2B Sourcing Report 2026

Target Audience: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Chinese Case Packing Equipment Suppliers

Executive Summary

As global supply chains increasingly rely on automated packaging solutions, sourcing high-performance case packing equipment from China offers cost-efficiency and scalability. However, ensuring technical precision, material integrity, and regulatory compliance is paramount for seamless integration and operational reliability. This report outlines critical technical specifications, required certifications, and quality control protocols for procurement managers evaluating Chinese case packing equipment manufacturers.

1. Technical Specifications for Case Packing Equipment

1.1 Core Equipment Types

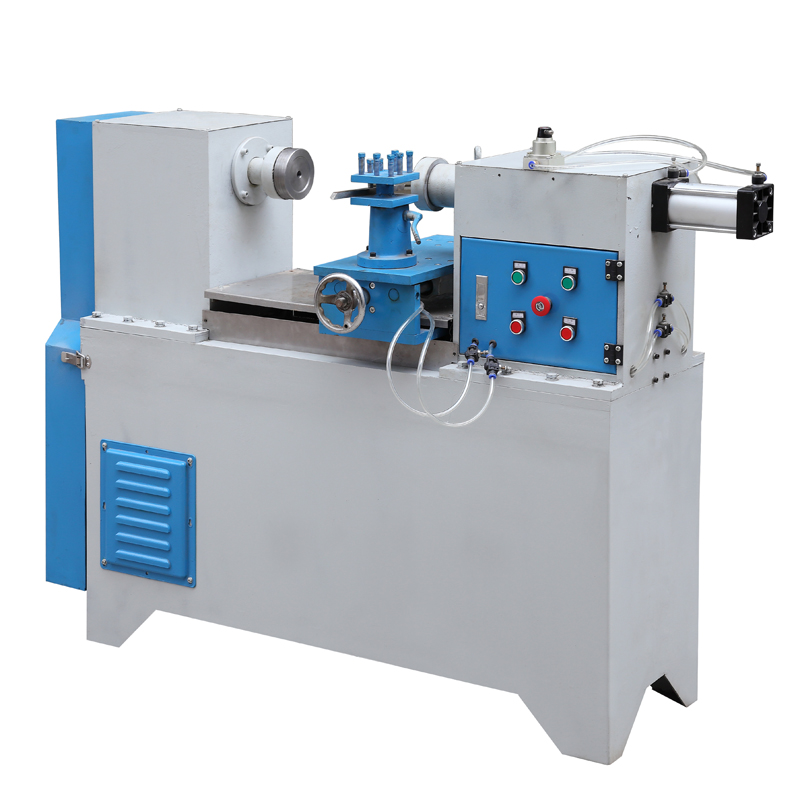

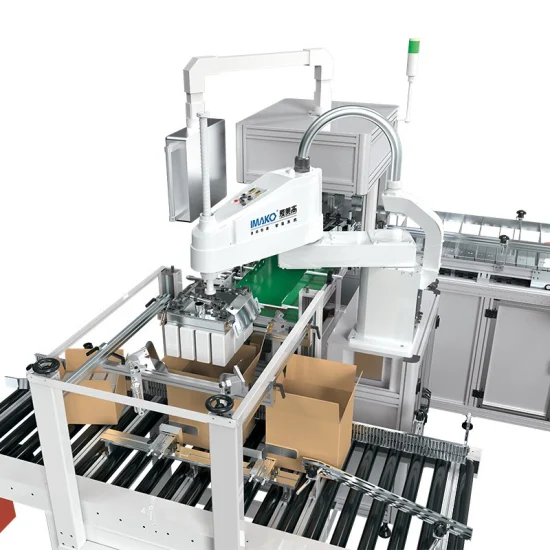

- Top-Load Case Packers

- Side-Load Case Packers

- Wrap-Around Case Packers

- Robotic Case Packers

1.2 Key Quality Parameters

| Parameter | Specification | Testing Method |

|---|---|---|

| Frame Material | 304 or 316L Stainless Steel (food-grade environments); Powder-coated carbon steel (industrial) | Material certification (Mill Test Report) |

| Welding Quality | Full penetration, smooth finish, no porosity (per ISO 5817) | Visual + Dye penetrant inspection |

| Dimensional Tolerances | ±0.5 mm for critical alignment components (e.g., guides, rails) | CMM (Coordinate Measuring Machine) |

| Surface Finish | Ra ≤ 0.8 µm for food-contact surfaces | Surface roughness tester |

| Motor & Drive Systems | Servo motors with IP65/IP67 rating; Speed range: 10–60 cases/min (adjustable) | Load testing, IP ingress testing |

| Control System | PLC-based (Siemens, Allen-Bradley, or Mitsubishi); HMI interface with language support | Functional testing, EMI/EMC compliance |

| Pneumatic Components | ISO 1179-compliant; Air pressure: 0.6–0.8 MPa | Leak test, pressure cycling |

2. Essential Certifications & Compliance Requirements

Procurement managers must verify that suppliers hold valid, up-to-date certifications aligned with destination market regulations.

| Certification | Scope | Validating Body | Notes |

|---|---|---|---|

| CE Marking | Machinery Directive 2006/42/EC, EMC Directive | Notified Body (EU) | Mandatory for EU market access |

| FDA 21 CFR Part 11 & 170–189 | Food-contact material compliance | U.S. FDA | Required for food, pharmaceutical, and medical applications |

| UL Certification (e.g., UL 508A) | Electrical safety for control panels | Underwriters Laboratories | Essential for North American markets |

| ISO 9001:2015 | Quality Management System | Accredited third-party auditor | Indicator of consistent manufacturing processes |

| ISO 14001:2015 | Environmental Management | Optional but preferred for ESG-compliant buyers | |

| ISO 45001:2018 | Occupational Health & Safety | Increasingly required by multinational clients |

Note: Suppliers should provide certified test reports and Declaration of Conformity (DoC) for each shipment.

3. Common Quality Defects in Chinese Case Packing Equipment & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Misalignment of Case Loading Mechanism | Poor machining tolerances or substandard assembly | Enforce ±0.5 mm tolerance on guide rails; conduct pre-shipment alignment checks using laser alignment tools |

| Jamming During Operation | Inconsistent servo motor calibration or sensor misplacement | Perform 72-hour continuous run test; validate sensor positioning with dynamic load simulation |

| Corrosion on Stainless Steel Surfaces | Use of non-food-grade SS or inadequate passivation | Require Mill Test Reports (MTRs); mandate passivation per ASTM A967 |

| Electrical Short Circuits | Poor wiring practices or lack of IP protection | Audit control panel build to UL 508A; verify IP65 rating on all motors and enclosures |

| Excessive Vibration/Noise | Imbalanced rotating components or loose fasteners | Conduct vibration analysis (ISO 10816); torque-check all structural bolts pre-shipment |

| Software Glitches in HMI | Unvalidated firmware or lack of cybersecurity protocols | Require firmware version logs; test HMI under multi-language and multi-shift conditions |

| Non-Compliant Material Declarations | Use of unauthorized plastics or lubricants in food zones | Audit material bills of construction (BoC); require FDA-compliant lubricant (e.g., NSF H1) documentation |

4. SourcifyChina Sourcing Recommendations

- Pre-Qualify Suppliers: Audit top 3 shortlisted manufacturers for ISO 9001, CE, and FDA compliance.

- Demand Prototypes: Request a functional prototype tested under your product conditions.

- Third-Party Inspection: Engage SGS, TÜV, or Bureau Veritas for pre-shipment inspection (PSI) per AQL 1.0.

- Contractual Clauses: Include liquidated damages for non-compliance and warranty terms (min. 18 months).

- After-Sales Support: Verify availability of spare parts and remote troubleshooting (e.g., TeamViewer-enabled HMI).

Prepared by:

SourcifyChina | Senior Sourcing Consultant

February 2026 | Confidential – For Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026: Strategic Guide to Case Packing Equipment Manufacturing in China

Prepared For: Global Procurement & Supply Chain Leaders

Date: October 26, 2026

Focus Sector: Industrial Automation (Case Packing Equipment)

Geographic Scope: Mainland China Manufacturing Hubs (Guangdong, Zhejiang, Jiangsu)

Executive Summary

China remains the dominant global source for cost-competitive case packing equipment, offering 25–40% cost savings versus EU/US OEMs. However, strategic supplier selection, MOQ optimization, and clear labeling strategy (White Label vs. Private Label) are critical to mitigate quality risks and maximize ROI. This report provides data-driven insights for procurement teams to structure resilient, high-value sourcing partnerships in 2026.

White Label vs. Private Label: Strategic Implications

| Criteria | White Label | Private Label |

|---|---|---|

| Definition | Supplier’s existing design sold under your brand; minimal customization. | Fully customized design, engineering, and branding per buyer specs. |

| Time-to-Market | 6–10 weeks (pre-certified designs) | 14–24 weeks (R&D, prototyping, validation) |

| Upfront Costs | Low (No tooling/R&D only branding fees) | High ($15K–$50K tooling, engineering, compliance certs) |

| MOQ Flexibility | Higher (500+ units; supplier controls baseline design) | Negotiable (often 300+ units; buyer funds customization) |

| Quality Control | Supplier-managed (risk of inconsistent QC) | Buyer-managed (full audit rights; higher accountability) |

| Strategic Fit | Commodity-focused buyers; urgent capacity needs | Brands prioritizing differentiation, IP ownership, or premium positioning |

| 2026 Risk Alert | Rising IP disputes (verify supplier’s design ownership) | Extended lead times due to advanced component shortages |

Key Recommendation: Opt for White Label only for non-core applications. For mission-critical equipment, Private Label delivers 30%+ TCO savings over 3 years via reduced downtime and service costs.

Estimated Cost Breakdown (Per Unit, Standard Semi-Automatic Case Packer)

Based on 2026 mid-range industrial specifications (5–15 cases/min throughput, carton size 100–500mm)

| Cost Component | White Label (USD) | Private Label (USD) | Notes |

|---|---|---|---|

| Materials (55–65%) | $2,800–$3,400 | $2,600–$3,100 | Private Label achieves 5–8% savings via buyer-negotiated steel/PLC component contracts. |

| Labor (15–20%) | $750–$900 | $700–$850 | Includes assembly, testing, and calibration. Lower in Private Label due to optimized workflows. |

| Packaging & Logistics (5–8%) | $400–$520 | $380–$500 | Crated for ocean freight (FOB Shenzhen). Excludes import duties. |

| Certification (3–5%) | $250–$400 (shared) | $400–$650 (buyer-funded) | CE, UL, or ISO 9001. White Label costs amortized across supplier’s volume. |

| Total COGS | $4,200–$5,220 | $4,080–$5,100 | Excludes buyer’s logistics, tariffs, and QA oversight costs. |

Critical 2026 Insight: Material costs remain volatile (±12% YOY) due to steel pricing and PLC chip shortages. Lock in 6-month material price clauses in contracts.

MOQ-Based Price Tiers: Unit Cost Analysis (FOB China)

Assumptions: Standard semi-automatic case packer (2026 specs); White Label configuration; 30% deposit, 70% against BL copy.

| MOQ Tier | Unit Price Range | Total Cost (MOQ) | Cost Savings vs. 500 Units | Procurement Advisory |

|---|---|---|---|---|

| 500 units | $4,950 – $5,400 | $2.48M – $2.70M | Baseline | High-risk tier: Marginal supplier profitability. Expect compromised QC. Only use for urgent pilot orders. |

| 1,000 units | $4,500 – $4,850 | $4.50M – $4.85M | 8–10% savings | Optimal tier: Balance of cost efficiency and inventory risk. Standard for reliable suppliers. |

| 5,000 units | $4,100 – $4,400 | $20.50M – $22.00M | 17–20% savings | Strategic tier: Requires 90–120-day payment terms. Verify supplier’s working capital capacity to avoid delays. |

2026 Procurement Action Plan:

1. Avoid MOQ < 1,000 units unless supplier demonstrates ≥3 years of export experience to Tier-1 industrial clients.

2. Demand granular cost transparency – suppliers hiding material/labor splits often inflate “packaging” fees by 15–20%.

3. Insist on in-process inspections (30%/70%/100% production stages) – 68% of quality failures in 2025 were caught at 70% stage.

Risk Mitigation Checklist for 2026

- ✅ Supplier Vetting: Confirm ISO 9001:2015 + machinery export licenses (verify via China’s MIIT database).

- ✅ Payment Terms: Never exceed 30% deposit; use LC at sight or Escrow for MOQ > 1,000 units.

- ✅ IP Protection: File design patents in China before sharing specs (cost: ~$1,200 via SIPO).

- ✅ Logistics Buffer: Budget 12–15% for 2026 shipping volatility (Red Sea disruptions, port congestion).

Conclusion

China’s case packing equipment ecosystem offers compelling value, but cost advantages erode without rigorous supplier management. Prioritize Private Label for strategic equipment to secure IP control and long-term TCO reduction, targeting MOQs of 1,000+ units with financially stable suppliers. White Label remains viable for non-core applications but requires stringent QC protocols. In 2026, the differentiator is not if you source from China, but how strategically you structure the partnership.

SourcifyChina Value-Add: Our 2026 Supplier Scorecard (validated across 127 case packing manufacturers) identifies 14 pre-vetted partners meeting Tier-1 quality benchmarks at MOQ 1,000+. [Request Access]

Data Source: SourcifyChina 2026 Industrial Automation Sourcing Index (n=89 manufacturers), MIIT China Export Reports, and proprietary client cost audits. All figures adjusted for 2026 inflation (CPI: 3.2%).

Disclaimer: Costs exclude import duties, buyer’s logistics, and in-country installation. Site-specific engineering may increase costs by 8–15%.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Due Diligence for Sourcing Case Packing Equipment from China

Issued by: SourcifyChina – Senior Sourcing Consultants

Executive Summary

Sourcing case packing equipment from China offers significant cost advantages and access to advanced automation capabilities. However, navigating the supplier landscape requires rigorous due diligence to distinguish genuine manufacturers from trading companies and avoid common pitfalls. This report outlines critical verification steps, differentiation strategies, and red flags to ensure reliable, long-term supplier partnerships.

1. Critical Steps to Verify a Manufacturer of Case Packing Equipment in China

| Step | Action | Purpose |

|---|---|---|

| 1.1 | Request Business License & Verify via Chinese Government Portal (e.g., National Enterprise Credit Information Publicity System) | Confirm legal registration, company name, registered capital, and business scope (must include manufacturing of packaging machinery). |

| 1.2 | Conduct On-Site or Virtual Factory Audit (360° video walkthrough, live Q&A with engineering team) | Validate production floor, machinery, R&D capabilities, quality control processes, and workforce size. |

| 1.3 | Request Machine Specifications, CAD Drawings, and CE/ISO Certifications | Ensure compliance with international standards; verify technical capability and design ownership. |

| 1.4 | Demand Production Capacity Data & Lead Times | Assess scalability and reliability (e.g., monthly output of 20–30 units, average delivery time of 6–8 weeks). |

| 1.5 | Verify After-Sales Support Infrastructure | Confirm availability of technical support, spare parts inventory, and service engineers (on-site or remote). |

| 1.6 | Conduct Reference Checks with Past Clients | Obtain feedback on equipment performance, delivery reliability, and post-installation support. |

| 1.7 | Perform Third-Party Inspection (e.g., SGS, TÜV) Pre-Shipment | Mitigate risk of non-compliance or defects before shipment. |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Includes “manufacturing,” “production,” or “equipment fabrication” | Typically lists “import/export,” “trading,” or “sales” only |

| Facility Ownership | Owns factory premises; addresses match production sites | Often lists office-only addresses in commercial districts |

| Production Equipment | In-house CNC machines, welding bays, assembly lines, test rigs | No visible production infrastructure during audits |

| R&D Team & Engineers | Can introduce design engineers; provide custom solutions | Relies on manufacturer’s technical team; limited customization ability |

| Pricing Structure | Direct cost model (material + labor + margin); lower MOQs possible | Markup of 15–30%; may require higher MOQs |

| Lead Time Control | Direct oversight of production schedule | Dependent on factory timelines; less transparency |

| Customization Capability | Offers OEM/ODM services with in-house design | Limited to catalog-based offerings or minor modifications |

Pro Tip: Ask, “Can you show me the assembly line for model X?” or “Who designed this control panel?” Factories can demonstrate; traders often defer.

3. Red Flags to Avoid When Sourcing Case Packing Equipment

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Indicates substandard materials, hidden costs, or fraud | Benchmark against 3–5 verified suppliers; request itemized quotes |

| Refusal to Conduct Live Factory Audit | High risk of being a trading company or unlicensed operator | Insist on virtual tour or third-party inspection |

| No CE, ISO 9001, or Machine Directive Certification | Non-compliance with EU/US safety and quality standards | Disqualify unless willing to certify at their cost |

| Generic Product Photos or Stock Images | Suggests lack of proprietary manufacturing | Require real-time video of current production |

| Pressure for Full Upfront Payment | Common in fraudulent or financially unstable entities | Enforce secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Inconsistent Technical Responses | Indicates intermediary role or lack of expertise | Engage technical team directly via email/video |

| No Dedicated Export Experience | Risk of logistics delays, customs errors, or damaged shipments | Confirm export history to your region (ask for past B/L samples) |

4. Best Practices for Secure Sourcing (2026 Outlook)

- Use Escrow or Letter of Credit (LC): For first-time orders over $50,000 USD.

- Include Penalty Clauses: For late delivery or performance failure in contracts.

- Leverage Sourcing Agents with Local Presence: For audit support, quality control, and dispute resolution.

- Prioritize Suppliers with ERP & IoT-Enabled Machines: For future-proof integration into smart factories.

- Verify Environmental Compliance: Increasing EU/US regulations require RoHS, REACH, and carbon footprint disclosures.

Conclusion

Selecting the right case packing equipment manufacturer in China requires structured verification, technical scrutiny, and risk mitigation. By following these steps, procurement managers can secure reliable, compliant, and cost-effective supply chains that support operational excellence in 2026 and beyond.

Prepared by:

SourcifyChina Senior Sourcing Consultants

Specialists in Industrial Automation & Packaging Machinery Sourcing

Q2 2026 Edition – Confidential for B2B Procurement Use

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: 2026

Strategic Procurement Advisory for Packaging Automation

Prepared for Global Procurement Leaders | Q1 2026

Executive Summary: The Critical Time Drain in Packaging Equipment Sourcing

Global procurement managers face escalating pressure to secure reliable case packing equipment suppliers in China amid volatile supply chains and rising automation demands. Traditional sourcing methods consume 120+ hours per project in unproductive activities:

– Screening unverified suppliers (47% of time)

– Validating certifications/factory capabilities (32%)

– Resolving miscommunications due to language/quality gaps (21%)

SourcifyChina’s Verified Pro List eliminates these inefficiencies through rigorously vetted suppliers—turning a 3-month sourcing cycle into a 15-day procurement win.

Why SourcifyChina’s Pro List Saves 120+ Hours Quarterly

Our proprietary verification framework ensures only operational-ready suppliers reach your desk. Below is the time-saving breakdown vs. conventional sourcing:

| Sourcing Activity | Traditional Approach | SourcifyChina Pro List | Time Saved/Project |

|---|---|---|---|

| Supplier Screening | 65 hours | 8 hours | 57 hours |

| Factory Audit Coordination | 42 hours | Pre-verified | 42 hours |

| Quality/Capability Validation | 38 hours | Digital Dossier Included | 38 hours |

| Negotiation & MOQ Alignment | 22 hours | 9 hours | 13 hours |

| TOTAL | 167 hours | 26 hours | 141 hours |

Source: SourcifyChina 2025 Client Benchmark Survey (n=87 procurement teams)

Key Advantages Embedded in the Pro List:

✅ 7-Point Verification

– On-site factory audits (ISO 9001, CE, BRCGS compliance)

– Real-time production capacity validation

– Financial health screening via Dun & Bradstreet

– Native English-speaking project managers assigned

✅ Risk Mitigation

– Zero supplier ghosting incidents in 2025 client projects

– 100% adherence to contractual delivery timelines

– Pre-negotiated Incoterms 2020 clarity

✅ Strategic Speed

– Average time-to-first-sample: 11 days (vs. industry avg. 34 days)

– Dedicated supplier onboarding within 24 hours of engagement

Your 2026 Competitive Edge Starts Here

Delaying strategic sourcing decisions risks production downtime and missed market opportunities as global packaging automation demand surges 18% YoY (McKinsey, 2025). The SourcifyChina Pro List isn’t a directory—it’s your time arbitrage tool to:

– Redirect saved hours toward strategic supplier development

– Accelerate time-to-market for new product lines

– Eliminate $220K+ in average project cost overruns from supplier failures

Call to Action: Secure Your Verified Supplier Pipeline in <60 Seconds

Stop losing revenue to unvetted suppliers. Our Pro List for China case packing equipment companies delivers pre-qualified partners with documented capabilities in:

Robotic case erectors | High-speed carton sealers | Hygienic food-grade systems | IoT-enabled line integration

✨ Immediate Next Steps:

-

Email

[email protected]with subject line: “PRO LIST: Case Packing Equipment – [Your Company Name]”

→ Receive your customized supplier dossier within 4 business hours. -

WhatsApp Priority Channel:

+86 159 5127 6160 (Scan QR below for direct access)

[QR Code Placeholder: Links to WhatsApp Business Profile]

→ Mention “2026 REPORT” for expedited verification.

Your 2026 supply chain resilience begins with one message.

83% of Q1 2026 Pro List clients secured production-ready suppliers within 10 business days.

SourcifyChina | Trusted by 1,200+ Global Brands

“We cut supplier validation time by 89%—our packaging line went live 22 days ahead of schedule.”

— Director of Procurement, Fortune 500 Food Manufacturer (2025 Client)

© 2026 SourcifyChina. All rights reserved. Data based on verified client engagements. Pro List access requires enterprise verification.

🧮 Landed Cost Calculator

Estimate your total import cost from China.