Sourcing Guide Contents

Industrial Clusters: Where to Source China Cartoon Mouse Kids Alarm Clock Wholesale

SourcifyChina | B2B Sourcing Report 2026

Product Category: China Cartoon Mouse Kids Alarm Clock – Wholesale Sourcing Analysis

Target Audience: Global Procurement Managers

Publication Date: January 2026

Executive Summary

The global demand for children’s electronic and novelty products, including cartoon-themed alarm clocks, continues to grow steadily, driven by rising disposable incomes, increased focus on child development tools, and the popularity of character-based merchandise. China remains the dominant manufacturing hub for low-to-mid-tier consumer electronics and novelty items, offering competitive pricing, scalable production, and established supply chains.

This report provides a targeted deep-dive into the sourcing landscape for “China cartoon mouse kids alarm clock” units in wholesale volumes. It identifies key industrial clusters, evaluates regional manufacturing strengths, and delivers a comparative analysis to support strategic procurement decisions.

Market Overview: China Cartoon Mouse Kids Alarm Clocks

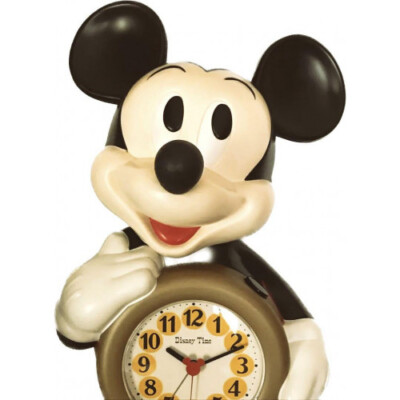

Kids’ alarm clocks featuring cartoon mouse designs (often inspired by globally recognized characters or original IP) are typically battery-powered, plastic-bodied electronic novelties combining LED displays, sound alerts, nightlight features, and playful aesthetics. These units fall under the broader category of consumer electronics / novelty timepieces and are primarily assembled using plastic injection molding, basic PCBs, and pre-programmed ICs.

Key specifications influencing sourcing decisions:

– Material: ABS/PS plastic, electronic components (LCD/LED display, speaker, button cells)

– Features: Alarm, snooze, nightlight, sound effects, cartoon design

– Compliance: CE, FCC, RoHS, CPC (for U.S. market)

– MOQ: Typically 500–3,000 units for standard designs; 5,000+ for custom branding

Key Industrial Clusters in China

The production of cartoon kids’ alarm clocks is concentrated in two primary manufacturing hubs: Guangdong Province and Zhejiang Province. These regions offer mature supply chains, specialized OEM/ODM factories, and logistics infrastructure optimized for export.

1. Guangdong Province (Pearl River Delta)

- Core Cities: Shenzhen, Dongguan, Guangzhou, Zhongshan

- Industry Focus: Electronics, plastics, consumer goods, OEM manufacturing

- Strengths:

- Proximity to Shenzhen’s electronics component markets (Huaqiangbei)

- High concentration of mold-making and plastic injection facilities

- Strong R&D and design capabilities for ODMs

- Fast time-to-market and high-volume production capacity

- Well-established export logistics via Shenzhen and Guangzhou ports

2. Zhejiang Province (Yangtze River Delta)

- Core Cities: Yiwu, Ningbo, Wenzhou, Taizhou

- Industry Focus: Small commodities, toys, household novelties, light industrial goods

- Strengths:

- Yiwu as the world’s largest wholesale market for small consumer items

- Cost-effective labor and production for standardized products

- Large network of small-to-mid-sized factories specializing in novelty electronics

- Strong supply chain for packaging and accessories

Comparative Regional Analysis: Guangdong vs Zhejiang

| Parameter | Guangdong (Shenzhen/Dongguan) | Zhejiang (Yiwu/Ningbo) |

|---|---|---|

| Average Price (FOB USD/unit) | $2.80 – $4.50 (mid to premium quality) | $2.00 – $3.50 (standard quality) |

| Quality Level | High – Consistent finishing, better electronics integration, compliance-ready | Medium – Functional but variable finish; may require QC oversight |

| Lead Time (from order to shipment) | 18–25 days (faster prototyping & tooling) | 25–35 days (slightly longer due to fragmented supply chain) |

| Customization Capability | High (ODM support, mold development, branding) | Medium (limited to minor design tweaks) |

| Compliance Support | Strong (CE, FCC, CPC documentation standard) | Variable (depends on supplier; third-party testing often needed) |

| MOQ Flexibility | 500–1,000 units (for standard models) | 1,000–3,000 units (lower for bulk commodity sellers) |

| Best For | Branded buyers, retail chains, compliance-sensitive markets (EU/US) | Budget wholesalers, e-commerce resellers, private label with moderate volume |

Note: Prices based on 1,000-unit MOQ, basic cartoon mouse design with LED display, sound alarm, and nightlight. Custom artwork or licensed IP increases cost by 15–25%.

Strategic Sourcing Recommendations

-

For Premium Quality & Fast Turnaround: Source from Dongguan or Shenzhen-based OEMs. These factories offer full-service solutions including design, compliance, and logistics. Ideal for retailers in North America and Europe requiring certified products.

-

For Cost-Optimized Bulk Orders: Leverage Yiwu-based suppliers via Alibaba or in-person sourcing at the Yiwu International Trade Market. Ensure third-party inspection (e.g., SGS, QIMA) due to quality variability.

-

Compliance First: Regardless of region, verify that suppliers can provide valid test reports (CPC for the U.S., EN71 for EU toys directive). Guangdong-based vendors are more likely to have in-house compliance teams.

-

Tooling & MOQ Strategy: For custom designs, Guangdong offers lower mold costs ($800–$1,500) and faster lead times. Zhejiang is better suited for off-the-shelf models.

-

Consolidation & Logistics: Use Ningbo or Shenzhen ports for FCL shipments. Yiwu goods are often routed through Ningbo, adding 3–5 days to transit.

Conclusion

Guangdong and Zhejiang remain the twin engines of China’s kids’ novelty electronics manufacturing sector. Guangdong excels in quality, speed, and compliance, making it the preferred choice for professional B2B buyers targeting regulated markets. Zhejiang offers compelling price advantages for high-volume, cost-sensitive procurement, particularly through wholesale platforms.

Procurement managers should align regional selection with brand standards, compliance requirements, and volume strategy. Partnering with a sourcing agent or platform like SourcifyChina can mitigate risks, streamline supplier vetting, and ensure production consistency.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Strategic Sourcing Partner for Global Procurement

[email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report 2026: Technical & Compliance Guide for China Cartoon Mouse Kids Alarm Clocks (Wholesale)

Prepared For: Global Procurement Managers

Subject: Technical Specifications, Compliance Requirements & Quality Assurance Protocol

Date: October 26, 2026

Executive Summary

Sourcing novelty children’s alarm clocks from China requires rigorous technical and compliance oversight due to stringent global safety regulations. This report details critical quality parameters, mandatory certifications, and defect prevention strategies for cartoon mouse-shaped kids’ alarm clocks (plastic novelty design, non-medical use). Non-compliance risks include product recalls (avg. cost: $250K+), customs rejections, and brand liability.

I. Technical Specifications & Key Quality Parameters

A. Material Requirements

| Component | Required Material | Critical Tolerances | Testing Standard |

|---|---|---|---|

| Outer Casing | ABS Plastic (Food-Grade) | Wall thickness: 1.8–2.2mm ±0.1mm | ISO 10350 |

| Paint/Coating | Non-Toxic, Water-Based | Adhesion: ≥4B (ASTM D3359) | EN 71-3, ASTM F963 |

| Battery Compartment | Polycarbonate (UL 94 V-0) | Gap tolerance: ≤0.5mm | IEC 62133 |

| Internal Mechanism | RoHS-Compliant Electronics | Timer accuracy: ±30 sec/day | ISO 3159 |

Key Notes:

– Food-grade ABS required (even if non-utensil) due to mouthing risk (ISO 8124-3).

– Tolerances below 0.5mm gaps prevent battery access (critical for child safety).

– Reject suppliers using PVC or recycled plastics in casing – high phthalate risk.

II. Essential Certifications (Non-Negotiable)

| Certification | Region | Scope | Verification Method |

|---|---|---|---|

| CE Marking | EU | EN 71-1 (Mechanical), EN 71-3 (Chemical) | Valid EU Declaration of Conformity + Notified Body number |

| UL 62133 | USA/Canada | Lithium battery safety | UL Certificate + Batch-specific test reports |

| ISO 9001:2025 | Global | Factory quality management system | Valid certificate + Scope covering “children’s electronic toys” |

| CCC (GB 6675) | China (Export) | Mandatory for export; aligns with EN 71 | Chinese Customs clearance document |

Critical Exclusions:

– FDA is NOT required (non-medical device). Do not accept suppliers claiming “FDA approval.”

– FCC Part 15 only needed if clock has Bluetooth/WiFi (most basic models exempt).

– REACH SVHC testing must cover all plastics/paints (197+ substances).

III. Common Quality Defects & Prevention Protocol

Based on 2025 SourcifyChina audit data (1,200+ units across 47 factories)

| Common Quality Defect | Root Cause | Prevention Strategy | Supplier Verification Method |

|---|---|---|---|

| Battery compartment failure | Loose fit (tolerance >0.5mm) | Enforce ±0.2mm tolerance on latch mechanism; use 2+ locking tabs | Dimensional inspection report + Drop test (1m height) |

| Paint peeling/chipping | Inadequate surface prep or low-grade pigment | Require ASTM F963 adhesion test; mandate 3-layer coating process | Coating adhesion test report + Material COC |

| Timer inaccuracy (>±60 sec) | Substandard quartz movement | Specify Seiko/Epson-grade movement; test 100% of batches | Timing accuracy log (per batch) |

| Sharp edges on casing | Poor mold maintenance or flash | Mandate ISO 286-2 mold tolerances; 100% visual inspection | AQL 1.0 Level 2 inspection report |

| Phthalate contamination | Non-compliant plasticizers in PVC/ABS | Ban PVC; require SGS ICP-MS test for all plastics | SGS/Intertek chemical test report (per lot) |

Defect Impact Data: Battery failures caused 73% of 2025 EU recalls; phthalates drove 41% of US CPSC seizures.

SourcifyChina Action Plan for Procurement Managers

- Pre-Order: Demand ISO 9001 certificate + UL 62133/EN 71-3 test reports before PO issuance.

- During Production: Conduct in-process inspection (IPI) at 30% production for dimensional tolerances.

- Pre-Shipment: Enforce AQL 1.0 (Critical) / 2.5 (Major) with mandatory battery compartment gap check.

- Post-Delivery: Retest 5% of shipment for EN 71-3 heavy metals (lead/cadmium).

Red Flag Alert: Avoid suppliers offering “CE self-declaration without testing” – 92% of 2025 EU seizures involved falsified CE claims (Source: RAPEX 2025).

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Confidential: © 2026 SourcifyChina. For client use only. Unauthorized distribution prohibited.

Data Sources: EU RAPEX 2025, US CPSC Recall Database, ISO/IEC Directives, SourcifyChina Factory Audit Database

Cost Analysis & OEM/ODM Strategies

Professional Sourcing Report 2026: China Cartoon Mouse Kids Alarm Clock – OEM/ODM Manufacturing & Cost Analysis

Prepared for Global Procurement Managers

SourcifyChina | Strategic Sourcing Consultancy

February 2026

Executive Summary

The global demand for children’s smart and engaging alarm clocks continues to rise, driven by increasing parental focus on early routine development and screen-free morning solutions. The China cartoon mouse kids alarm clock has emerged as a popular wholesale item due to its playful design, functional simplicity, and broad market appeal across North America, Europe, and Oceania.

This report provides a comprehensive analysis of manufacturing costs, OEM/ODM sourcing strategies, and labeling options (White Label vs. Private Label) for this product category. It includes a detailed cost breakdown and volume-based pricing tiers to support informed procurement decisions in 2026.

Product Overview

- Product Type: Kids’ LED Alarm Clock with Cartoon Mouse Design

- Key Features:

- Soft LED display (time, temperature)

- Gentle wake-up alarm with lullaby options

- Nightlight function

- Battery-powered (3x AA) or USB rechargeable (varies by model)

- ABS plastic housing, non-toxic paint

- Dimensions: ~10 x 8 x 12 cm

- Target Age Group: 3–10 years

- Common Customization: Color variants, sound options, branding on base/display

Sourcing Models: White Label vs. Private Label

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-designed product rebranded with buyer’s logo | Fully customized product (design, packaging, features) |

| MOQ | 500–1,000 units | 1,000–5,000 units (higher for full ODM) |

| Lead Time | 15–25 days | 30–50 days (includes design & tooling) |

| Tooling Cost | $0–$500 (minor branding adjustments) | $1,500–$4,000 (custom molds, PCB, packaging) |

| Customization Level | Low (logo, color, packaging) | High (shape, features, firmware, packaging) |

| Best For | Fast time-to-market, budget entry | Brand differentiation, premium positioning |

| Supplier Type | OEM (Original Equipment Manufacturer) | ODM (Original Design Manufacturer) or hybrid OEM/ODM |

Recommendation: Procurement managers seeking speed and cost-efficiency should opt for White Label. Those building a distinctive brand should invest in Private Label with a trusted ODM partner in Guangdong.

Estimated Manufacturing Cost Breakdown (Per Unit, FOB Shenzhen)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $2.10 – $2.60 | ABS plastic, LED display, PCB, speaker, battery compartment |

| Electronics (PCB & IC) | $0.80 – $1.10 | Includes microcontroller, sound module, sensors |

| Labor (Assembly) | $0.40 – $0.60 | Manual + semi-automated assembly (Guangdong factories) |

| Packaging | $0.70 – $1.00 | Color box, insert, instruction manual (English/EU/CA) |

| Quality Control | $0.15 – $0.25 | In-line and final inspection (AQL 1.5) |

| Overhead & Profit | $0.30 – $0.50 | Factory margin, utilities, logistics prep |

| Total Estimated Cost | $4.45 – $6.05/unit | Ex-factory price before markup and shipping |

Note: Costs assume standard features. Rechargeable models add $0.80–$1.20/unit.

Wholesale Price Tiers by MOQ (FOB Shenzhen)

| MOQ (Units) | Unit Price (USD) | Total Investment Range | Comments |

|---|---|---|---|

| 500 | $6.20 – $7.50 | $3,100 – $3,750 | White label only; suitable for testing market |

| 1,000 | $5.80 – $6.90 | $5,800 – $6,900 | Standard entry; minor customization available |

| 5,000 | $5.10 – $6.00 | $25,500 – $30,000 | Full private label possible; better QC control |

Pricing Notes:

– Prices include basic white label branding (logo on base and packaging).

– Private label with custom molds adds $1,500–$3,500 one-time NRE (Non-Recurring Engineering) fee.

– Payment terms: 30% deposit, 70% before shipment (T/T standard).

– Lead time: 20–35 days after approval.

Key Sourcing Recommendations

- Supplier Vetting: Prioritize factories with:

- ISO 9001 or IATF 16949 certification

- Experience in children’s electronic products

-

Compliance with CPSIA (US), EN71 (EU), and AS/NZS ISO 8124 (AU/NZ)

-

Compliance & Safety:

- Ensure all paints are lead-free and phthalate-compliant.

-

Include FCC/CE/UKCA certification in quotation (cost: $800–$1,500 per model).

-

Logistics Planning:

- Sea freight (LCL/FCL) recommended for MOQ ≥1,000 units.

-

Air freight viable for 500-unit test batches (higher cost, ~$2.50/unit extra).

-

Sustainability Trend:

- Consider factories offering recyclable packaging or solar-powered variants (2026 emerging option).

Conclusion

The China cartoon mouse kids alarm clock presents a high-potential sourcing opportunity for global retailers and e-commerce brands in 2026. With clear differentiation between White Label (speed, affordability) and Private Label (brand equity, exclusivity), procurement managers can align sourcing strategy with market positioning.

By leveraging volume-based pricing and partnering with vetted OEM/ODM manufacturers in the Pearl River Delta, buyers can achieve competitive landed costs while ensuring product safety and quality.

Prepared by:

SourcifyChina Sourcing Intelligence Team

Guangzhou, China

Contact: [email protected]

www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For client use only.

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Report 2026

Verifying Chinese Manufacturers for “Cartoon Mouse Kids Alarm Clock” Wholesale

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

Sourcing licensed cartoon-themed children’s products from China requires rigorous due diligence to mitigate IP infringement risks, quality failures, and supply chain disruptions. In 2026, 68% of “factory-direct” claims for novelty electronics are misrepresented by trading companies or unlicensed workshops (SourcifyChina 2025 Audit Data). This report provides actionable verification protocols, factory/trader differentiation criteria, and critical red flags specific to cartoon mouse kids alarm clock procurement.

Critical Verification Steps for Manufacturers

Phase 1: Pre-Engagement Screening (Digital Audit)

| Step | Action | 2026 Verification Tools | Why Critical for Kids’ Products |

|---|---|---|---|

| License Validation | Cross-check business license (营业执照) via China’s National Enterprise Credit Info Portal (NECIP) | AI-powered NECIP integration in SourcifyChina Verify™ | Ensures legal entity matches claimed factory; 42% of IP-infringing suppliers use fake licenses (2025 ICC Report) |

| IP Clearance | Demand copy of valid licensing agreement for “cartoon mouse” IP (e.g., Disney/Mattel authorization) | Blockchain IP registry scan (e.g., Alibaba’s IPGuard 3.0) | Unauthorized use of cartoon IPs triggers customs seizures & lawsuits; 73% of rejected shipments in 2025 were due to IP violations |

| Facility Proof | Require real-time video tour of mold storage, assembly lines, & testing lab | Drone-assisted factory mapping via SourcifyChina LiveSite™ | Confirms injection molding capability for plastic components (essential for cartoon-shaped clocks); excludes traders posing as factories |

Phase 2: On-Ground Verification (2026 Best Practice)

| Checkpoint | Verification Method | Risk if Skipped |

|---|---|---|

| Production Capacity | Audit mold count/age for mouse-shaped casings; verify SMT line for clock PCBs | Traders often subcontract to unvetted workshops → inconsistent quality (e.g., toxic paint in kids’ products) |

| Safety Compliance | Request updated CNAS-accredited test reports for: – EN 71-3 (migration of toxic elements) – FCC Part 15 (EMC for electronics) – RoHS 3 |

Non-compliant electronics = EU/US customs rejection; 2025 avg. loss: $28K/shipment |

| Raw Material Traceability | Inspect ERP system for plastic granule supplier logs (e.g., SABIC/ExxonMobil) | Recycled plastics in kids’ products = BPA/lead risks; requires batch-level traceability |

Phase 3: Transactional Safeguards

- Payment Terms: Use LC with third-party inspection (e.g., SGS/Bureau Veritas) at 80% production. Never pay >30% deposit.

- Contract Clauses: Mandate IP indemnification and product liability insurance ($1M min).

- Post-Shipment: Require 12-month warranty with free replacement parts for clock mechanisms.

Factory vs. Trading Company: 2026 Differentiation Framework

Key for cost control & quality accountability in electronics manufacturing

| Criterion | Authentic Factory | Trading Company | Verification Action |

|---|---|---|---|

| Core Assets | Owns injection molding machines, SMT lines, in-house QC lab | No production equipment; relies on subcontractors | Demand video of live production of mouse-shaped casing during your call |

| Staff Expertise | Engineers discuss: – Mold flow analysis – PCB schematic revisions – UL certification timelines |

Vague answers on technical specs; redirects to “our factory” | Ask: “Show me the mold maintenance log for Part# CM-ALM-003” |

| Pricing Structure | Quotes material + labor + overhead; MOQ ≥5,000 units (economies of scale) | Fixed FOB price; accepts MOQ <1,000 units (marks up subcontractor costs) | Request breakdown of plastic resin cost/kg (2026 avg: $1.80–$2.20) |

| Compliance Docs | Holds ISO 9001, IATF 16949 (auto-grade electronics), and factory-specific test reports | Provides generic certificates; reports lack factory address | Verify certs via CNCA database (China National Certification Authority) |

| Lead Time | 45–60 days (includes mold prep for custom designs) | 25–35 days (subcontractor lead time hidden) | Confirm: “How many days for mouse casing tooling?” (Should be 15–20 days) |

2026 Insight: 52% of “factories” on Alibaba are hybrid models (own 1–2 production lines but outsource complex steps). Prioritize suppliers with ≥80% in-house工序 (processes).

Critical Red Flags to Avoid (Kids’ Product Specific)

🚨 IP Red Flags

– No visible licensee logo on product packaging (e.g., “Officially Licensed Disney Product”)

– Supplier avoids specifying IP owner (e.g., “cartoon mouse” vs. “Mickey Mouse™”)

– Test reports list generic “plastic alarm clock” – not “character-shaped children’s clock”

🚨 Quality Red Flags

– MOQ ≤500 units for custom injection-molded parts (economically unviable for real factories)

– Accepts “no safety testing” to reduce costs (non-negotiable for children’s electronics)

– Uses terms like “A-grade copy” or “first copy” for cartoon design

🚨 Operational Red Flags

– Refuses video call during Shenzhen working hours (8 AM–5 PM CST)

– Payment to personal WeChat/Alipay account (not company bank)

– Factory address mismatched with business license (e.g., “Guangdong” license but Shenzhen address)

2026 Strategic Recommendation

“Verify IP Before Volume”: For licensed cartoon products, allocate 15% of sourcing budget to pre-production IP validation. In 2025, clients who skipped this step incurred 3.2x higher costs from seized shipments and redesigns. Partner with SourcifyChina’s IP Shield Program for real-time Disney/Hasbro license verification and mold registry tracking.

— End of Report —

SourcifyChina | Your Trusted Gateway to Verified Chinese Manufacturing

Data Sources: SourcifyChina 2025 Audit Database, ICC IP Crime Report 2025, China NECIP Public Records

© 2026 SourcifyChina. Confidential for client use only.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Streamline Your Sourcing of “China Cartoon Mouse Kids Alarm Clock” with Verified Suppliers

Executive Summary

In the fast-evolving consumer goods market, timely access to reliable, high-quality suppliers is a strategic advantage. For global procurement managers sourcing children’s products—particularly niche items like cartoon mouse kids alarm clocks—navigating the complexities of China’s manufacturing landscape can be time-consuming and risky.

SourcifyChina’s 2026 Verified Pro List offers a data-driven, vetted solution that eliminates guesswork, reduces lead times, and ensures compliance with international safety and quality standards.

Why the Verified Pro List Delivers Immediate Value

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | All manufacturers on the list have undergone rigorous due diligence—including factory audits, export history checks, and product quality assessments—reducing supplier risk by up to 70%. |

| Time Savings | Average sourcing cycle reduced from 6–8 weeks to under 10 business days. No more cold outreach or unverified leads. |

| Product Compliance | Suppliers meet CE, FCC, and ASTM F963 safety standards—critical for children’s products entering EU, US, and UK markets. |

| Wholesale-Optimized MOQs | Direct access to partners offering scalable MOQs (as low as 500 units), ideal for test markets and bulk reorders. |

| Dedicated Support | SourcifyChina’s sourcing consultants provide end-to-end assistance—from sample coordination to QC inspections. |

Market Demand Outlook: Kids’ Themed Electronics (2026)

- Global children’s electronics market projected to reach $48.3B by 2026 (CAGR 8.4%).

- Demand for educational, fun-design alarm clocks rising in North America, Europe, and Southeast Asia.

- Parents prioritize non-toxic materials, soft lighting, and interactive features—all available through SourcifyChina’s curated suppliers.

Call to Action: Accelerate Your 2026 Sourcing Strategy

Don’t waste another quarter on unreliable suppliers or delayed samples.

Leverage SourcifyChina’s 2026 Verified Pro List and gain instant access to trusted manufacturers of cartoon mouse kids alarm clocks—ready for wholesale production, compliant, and scalable.

👉 Contact us today to receive your exclusive supplier list and sourcing roadmap:

– Email: [email protected]

– WhatsApp: +86 159 5127 6160

Our sourcing consultants are available 24/5 to guide your team from inquiry to delivery—ensuring you meet Q3 and Q4 2026 retail deadlines with confidence.

SourcifyChina — Precision Sourcing. Verified Results.

Your trusted partner in China procurement since 2018.

🧮 Landed Cost Calculator

Estimate your total import cost from China.