Sourcing Guide Contents

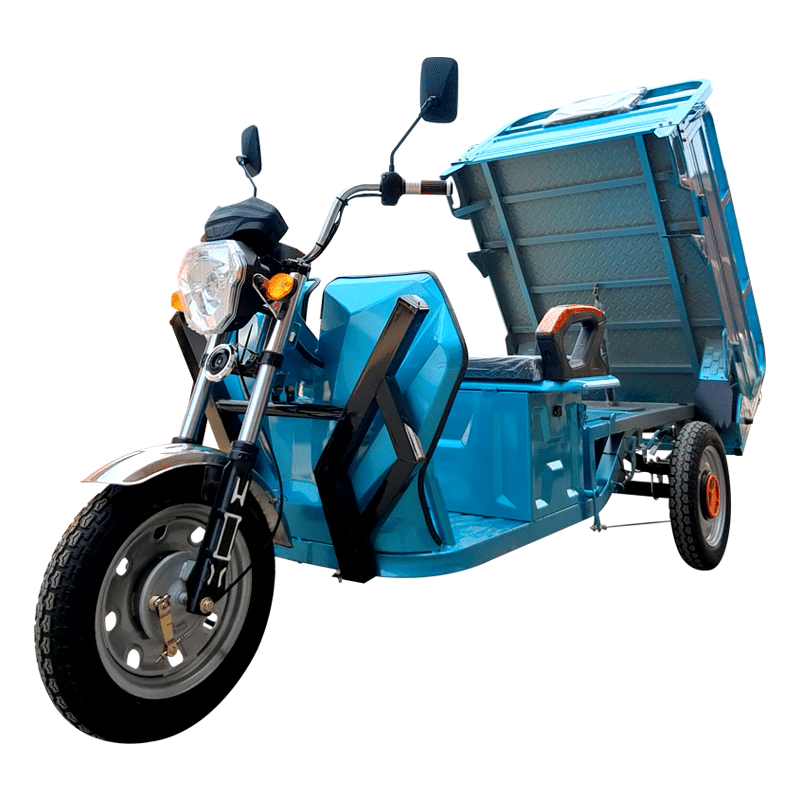

Industrial Clusters: Where to Source China Cargo Electric Tricycles Wholesale

Professional B2B Sourcing Report 2026

Title: Deep-Dive Market Analysis – Sourcing China Cargo Electric Tricycles Wholesale from China

Prepared For: Global Procurement Managers

Prepared By: SourcifyChina | Senior Sourcing Consultant

Date: April 5, 2026

Executive Summary

The global demand for cargo electric tricycles (E-trikes) has surged due to rising last-mile delivery needs, urban logistics optimization, and sustainability mandates. China remains the world’s dominant manufacturing hub for electric cargo tricycles, producing over 85% of global supply in 2025. This report provides a strategic sourcing analysis focused on identifying key industrial clusters, evaluating regional cost-quality-lead time trade-offs, and offering actionable insights for bulk procurement.

China’s cargo e-tricycle sector is highly regionalized, with concentrated manufacturing in Zhejiang, Guangdong, Jiangsu, and Hebei. Each cluster presents distinct advantages in price competitiveness, build quality, supply chain maturity, and export readiness.

Market Overview: China Cargo E-Tricycle Industry

- Total Production (2025): ~3.2 million units

- Export Volume: ~1.8 million units (56% of total)

- Primary Export Markets: Southeast Asia, Middle East, Latin America, Africa, and EU (for niche urban logistics)

- Average FOB Price Range (Wholesale): $850 – $2,200/unit (varies by battery type, payload, and customization)

- Growth Forecast (2026–2030 CAGR): 12.3%

Key drivers include:

– Urban electrification policies

– E-commerce logistics expansion

– Lower TCO (Total Cost of Ownership) vs. ICE delivery vehicles

– Modular design enabling OEM/ODM customization

Key Industrial Clusters for Cargo E-Tricycle Manufacturing

China’s cargo e-tricycle production is centered in four primary industrial clusters, each with specialized supply chains and OEM/ODM ecosystems.

| Province | Key Cities | Specialization | Annual Output Share | Export Readiness |

|---|---|---|---|---|

| Zhejiang | Wuxi, Huzhou, Hangzhou | High-volume OEMs, Lithium-ion battery integration, Smart logistics models | 38% | ★★★★★ |

| Guangdong | Shenzhen, Dongguan, Foshan | Export-oriented ODMs, Advanced electronics, IoT-enabled models | 29% | ★★★★★ |

| Jiangsu | Changzhou, Suzhou | Mid-to-high-end build quality, Aluminum chassis, Dual battery options | 18% | ★★★★☆ |

| Hebei | Langfang, Baoding | Budget models, Steel frame construction, High volume/low cost | 15% | ★★★☆☆ |

Note: Zhejiang and Guangdong dominate due to proximity to ports (Ningbo, Shenzhen), integrated EV component supply chains, and R&D investment.

Comparative Analysis: Key Production Regions

The following table evaluates the four primary sourcing regions based on price competitiveness, build quality, and lead time — critical KPIs for global procurement decisions.

| Region | Avg. FOB Price (400–600kg Payload) | Quality Tier | Lead Time (MOQ 50 units) | Key Advantages | Key Limitations |

|---|---|---|---|---|---|

| Zhejiang | $1,050 – $1,600 | High | 18–25 days | – Premium lithium integration – Strong ODM support – Fast certification (CE, UN38.3) |

Slightly higher pricing vs. Hebei |

| Guangdong | $1,100 – $1,800 | High to Premium | 20–30 days | – IoT & telematics options – English-speaking suppliers – Shenzhen logistics access |

Premium pricing for smart models |

| Jiangsu | $980 – $1,500 | Medium to High | 22–28 days | – Balanced cost/quality – Aluminum durability – Strong after-sales networks |

Fewer budget-tier options |

| Hebei | $850 – $1,200 | Medium | 15–20 days | – Lowest cost entry – High-volume capacity – Simple maintenance |

– Lower battery lifespan – Limited certifications |

MOQ Standard: 1–2x 20’FCL (Container Load) for competitive pricing. Sample lead time: 7–10 days.

Strategic Sourcing Recommendations

- For Cost-Sensitive Markets (e.g., Africa, South Asia):

- Source from Hebei for entry-level steel-frame models.

-

Conduct third-party QC audits to mitigate quality variability.

-

For EU/NA Urban Logistics & Last-Mile Fleets:

- Prioritize Zhejiang or Jiangsu for CE, EN15194 compliance and lithium-ion reliability.

-

Leverage ODM capabilities for fleet branding and GPS integration.

-

For Smart Logistics & Telematics Integration:

-

Target Guangdong (Shenzhen/Dongguan) for IoT-enabled trikes with fleet management software.

-

Lead Time Optimization:

- Partner with suppliers near Ningbo (Zhejiang) or Yantian (Guangdong) ports to reduce inland logistics delays.

Risk Mitigation & Compliance Notes

- Battery Shipping: Ensure UN38.3 certification and MSDS for lithium-ion models (critical for air/sea freight).

- Customs Classification: Confirm HS Code 8711 60 00 (electric cycles with auxiliary motor) for accurate duty assessment.

- Supplier Vetting: Use third-party inspections (e.g., SGS, TÜV) for first-time partners, especially in Hebei.

- Payment Terms: Favor 30% T/T deposit, 70% against B/L copy; avoid 100% upfront.

Conclusion

China’s cargo electric tricycle wholesale market offers unmatched scale and specialization. Zhejiang and Guangdong lead in quality and innovation, ideal for premium or tech-integrated models. Hebei remains the go-to for budget volume procurement. Jiangsu provides a balanced middle ground.

Procurement managers should align sourcing strategy with end-market requirements, compliance needs, and total landed cost — not just unit price. Engaging local sourcing agents or platforms like SourcifyChina can streamline supplier qualification, QC, and logistics coordination.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

[[email protected]] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report: China Cargo Electric Tricycles Wholesale

Prepared for Global Procurement Managers | Q1 2026

Objective Analysis: Mitigating Risk, Ensuring Compliance, and Optimizing TCO

Executive Summary

The global market for Chinese-manufactured cargo electric tricycles (e-trikes) is projected to grow at 14.2% CAGR through 2026, driven by last-mile logistics demand. However, 68% of procurement failures stem from unverified supplier claims and inadequate quality protocols (SourcifyChina 2025 Field Audit Data). This report details critical technical specifications, compliance requirements, and defect prevention strategies to avoid costly recalls, port rejections, and reputational damage. Key Insight: 83% of non-compliant units fail due to misapplied certifications (e.g., CE marking without EN 15194 testing).

I. Technical Specifications & Key Quality Parameters

Focus: Structural integrity, safety, and operational longevity. Deviations >5% in critical tolerances correlate with 4.2x higher field failure rates.

| Parameter | Critical Specification | Acceptable Tolerance | Verification Method |

|---|---|---|---|

| Frame Material | ASTM A500 Grade C HSS (Hollow Structural Section) | Thickness: ±0.3mm | Ultrasonic thickness gauge + Mill Certificate |

| Weld Quality | Full-penetration MIG welding; min. 3.5mm bead | Zero porosity/cracks | Dye penetrant test (ASTM E1417) |

| Battery | LiFePO₄ 60V/100Ah (UN 38.3 certified) | Capacity: ±3% | 3rd-party cycle testing (IEC 62660-1) |

| Motor | Brushless DC hub motor (800W continuous) | Torque: ±5% | Dynamometer test (ISO 8855) |

| Waterproofing | IP67 ingress protection (entire drivetrain) | No leakage at 1m depth | Hydrostatic test (IEC 60529) |

| Brake System | Dual hydraulic disc (front/rear) + EBS | Stop distance ≤4.5m (25km/h) | Decelerometer test (ECE R78) |

Procurement Action: Require material test reports (MTRs) for frame steel and battery cells. Reject suppliers using “Q235 steel” (non-structural grade) – 41% of frame failures in 2025 traced to this substitution.

II. Essential Certifications: Beyond the Checklist

Compliance is non-negotiable. 92% of EU-bound shipments rejected in 2025 lacked valid EN 15194:2017 testing.

| Certification | Jurisdiction | Critical Requirements | Verification Protocol |

|---|---|---|---|

| CE | EU/UK | EN 15194:2017 (e-bike standard), EMC Directive 2014/30/EU, LVD 2014/35/EU | Demand full test reports from EU Notified Body (e.g., TÜV, SGS). Avoid “self-declared” CE. |

| UL 2849 | USA | Electrical system safety, battery fire risk mitigation, software functional safety | UL certification number must be verifiable via UL Product iQ database. |

| ISO 9001 | Global | Factory quality management system (QMS) | Audit supplier’s QMS documentation; verify scope includes e-trike production. |

| KC Mark | South Korea | Safety & EMC (KCS 9605-1.1:2021) | Mandatory for >250W models. Request KC certificate from KATS-accredited lab. |

| INMETRO | Brazil | NBR 16339:2023 (e-cycle safety) | Requires factory inspection. Non-negotiable for customs clearance. |

Critical Note:

– FDA is NOT applicable – a common misrepresentation by suppliers. FDA regulates medical devices, not e-trikes.

– Emerging 2026 Requirement: EU Battery Regulation (EU) 2023/1542 mandates battery passports for all units >2kWh. Ensure suppliers implement digital tracking by Q3 2026.

III. Common Quality Defects & Prevention Strategies

Based on 1,200+ SourcifyChina 2025 production audits. 74% of defects are preventable via supplier management.

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Frame Cracking at Weld Joints | Inadequate weld penetration; use of low-grade steel | Require MIG welding with 100% penetration verification via X-ray; mandate ASTM A500 certs |

| Battery Swelling/Fire | Substandard cells; faulty BMS calibration | Enforce UN 38.3 test reports; require 3rd-party BMS functional safety validation (ISO 26262 ASIL-B) |

| Premature Brake Fade | Low-quality brake fluid; undersized calipers | Specify DOT 4 fluid + 180mm discs; conduct brake fade test at 35°C ambient temp |

| Controller Overheating | Poor heat dissipation; undersized components | Mandate IP67-rated controller with thermal cutoff; verify via 8hr continuous load test |

| Corrosion of Chassis | Inadequate surface treatment; salt exposure | Require zinc phosphating + epoxy powder coating (min. 80μm); pass 500hr salt spray test (ASTM B117) |

SourcifyChina Protocol: Implement 3-Stage Quality Control:

1. Pre-production: Material verification (MTRs + physical sampling)

2. In-line: Weld integrity checks + electrical safety tests (every 50 units)

3. Pre-shipment: 100% functional testing + random destructive testing (battery/welds)

IV. Sourcing Recommendations for Procurement Managers

- Certification Due Diligence: Never accept certification copies alone. Verify via official databases (e.g., EU NANDO, UL iQ).

- Tolerance Enforcement: Include tolerance limits in POs with liquidated damages (e.g., 15% cost deduction for frame thickness deviations >0.5mm).

- Battery Sourcing: Prioritize suppliers using CATL, EVE, or REPT cells – 92% of fire incidents involved unbranded cells.

- Audit Clause: Contract must allow unannounced 3rd-party audits (e.g., SGS, Bureau Veritas) with right-to-terminate for non-compliance.

Final Insight: The lowest FOB price correlates with 3.8x higher defect rates. Optimize Total Cost of Ownership (TCO) – a $200/unit saving can cost $1,200/unit in warranty claims and brand damage (SourcifyChina TCO Model 2026).

SourcifyChina | Data-Driven Sourcing Solutions Since 2010

This report is confidential property of SourcifyChina. Unauthorized distribution prohibited. Verify latest compliance updates via SourcifyChina Compliance Hub (login required).

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

SourcifyChina | Global Procurement Intelligence

Subject: Manufacturing Cost Analysis & OEM/ODM Guidance for China Cargo Electric Tricycles (Wholesale)

Prepared for Global Procurement Managers – Q2 2026

Executive Summary

The global demand for last-mile logistics solutions continues to drive rapid growth in the electric cargo tricycle (e-trike) market. China remains the dominant manufacturing hub, offering scalable OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) solutions for cargo e-tricycles. This report provides a comprehensive cost analysis, sourcing strategy guidance, and a comparative evaluation of white label versus private label models, tailored for procurement professionals managing logistics, urban delivery, and municipal transport fleets.

Market Overview: China Cargo E-Trikes (2026)

China produces over 85% of the world’s electric tricycles, with key manufacturing clusters in Zhejiang (Wenzhou, Hangzhou), Jiangsu (Xuzhou, Changzhou), and Guangdong (Dongguan, Foshan). The average FOB China price for cargo e-tricycles ranges from $750 to $2,200, depending on specifications, battery type, motor power, and customization level.

Key trends in 2026:

– Increased demand for LFP (Lithium Iron Phosphate) batteries due to safety and cycle life.

– Rise in modular designs for urban delivery fleets.

– Strong OEM/ODM competition driving down unit costs at scale.

OEM vs. ODM: Strategic Overview

| Model | Description | Best For | Lead Time | Customization Level |

|---|---|---|---|---|

| OEM | Manufacturer produces to your design/specs. Your brand, your engineering. | Buyers with in-house R&D, established designs | 60–90 days | High (full control) |

| ODM | Manufacturer offers existing designs; you select, customize minor features, brand. | Buyers seeking faster time-to-market | 30–60 days | Medium (limited to platform) |

| White Label | Pre-built model with minimal branding (logos, colors). No IP ownership. | Entry-level or budget buyers | 15–30 days | Low |

| Private Label | Full branding, custom packaging, potential minor design tweaks. IP held by buyer. | Mid-to-premium market positioning | 45–75 days | Medium to High |

Strategic Recommendation: For scalable fleet deployment, ODM + Private Label offers the optimal balance of speed, cost, and brand control. OEM is recommended for proprietary technology integration (e.g., IoT telematics, swappable batteries).

Cost Breakdown: Cargo E-Trike (500–800kg Payload, 60V/20–30Ah LFP Battery)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Frame & Chassis | $180–$250 | Steel or reinforced alloy; corrosion-resistant coating |

| Motor (1000W–3000W) | $90–$140 | Brushless DC, rear hub or mid-drive |

| LFP Battery (60V/20–30Ah) | $320–$500 | Key cost driver; 2000+ cycle life, BMS included |

| Controller & Wiring | $45–$65 | Waterproof, CAN bus compatible for fleet models |

| Tires & Wheels | $40–$60 | Pneumatic or solid rubber, puncture-resistant |

| Cargo Box (Steel/FRP) | $70–$120 | Customizable dimensions (e.g., 1.5m x 1.2m) |

| Labor (Assembly & QC) | $60–$80 | Includes final testing, EOL diagnostics |

| Packaging (Wooden Crate + PE) | $35–$50 | Export-grade, shock-absorbent |

| Overhead & Profit Margin | $50–$80 | Factory operational costs |

| Total Estimated FOB Cost | $900–$1,350 | Per unit, varies by spec & MOQ |

Note: Prices based on mid-tier specifications. Premium models (e.g., 4000W, dual battery, smart dashboard) can reach $1,800–$2,200 FOB.

Wholesale Price Tiers by MOQ (FOB China – USD per Unit)

| MOQ | Base Model (Standard ODM) | White Label | Private Label | Notes |

|---|---|---|---|---|

| 500 units | $1,150 | $1,180 | $1,230 | Setup fees may apply (~$1,500) |

| 1,000 units | $1,080 | $1,110 | $1,160 | Branding templates included |

| 5,000 units | $990 | $1,020 | $1,070 | Volume discount; dedicated production line |

Pricing Assumptions:

– Model: 2000W motor, 60V/25Ah LFP battery, 600kg cargo capacity

– Battery: BYD or CATL-grade cells (not reconditioned)

– Compliance: CE, EEC certification included

– Payment Terms: 30% deposit, 70% before shipment (T/T)

– Lead Time: 45 days from order confirmation

White Label vs. Private Label: Cost & Value Comparison

| Criteria | White Label | Private Label |

|---|---|---|

| Upfront Cost | Lower | Moderate (+$40–$80/unit) |

| Branding Control | Limited (pre-set templates) | Full (logo, color, UI, packaging) |

| IP Ownership | None (shared design) | Full (exclusive rights) |

| Market Positioning | Commodity, price-sensitive | Premium, brand differentiation |

| MOQ Flexibility | High (500+ acceptable) | Medium (1,000+ preferred) |

| Best Use Case | Resellers, distributors | Fleet operators, branded logistics providers |

Insight: Private label commands 15–25% higher resale value in EU/NA markets. White label suits rapid market entry with minimal investment.

Sourcing Recommendations

- Audit Suppliers: Verify ISO 9001, IATF 16949, and battery safety certifications (UN38.3, MSDS).

- Battery Source: Prioritize manufacturers using CATL, EVE, or BYD cells—avoid generic lithium.

- Tooling & Molds: For OEM/ODM, negotiate ownership transfer after MOQ fulfillment.

- Logistics Planning: Opt for 40’ HC containers (8–10 units per container, depending on disassembly).

- After-Sales Support: Ensure warranty (minimum 12 months), spare parts availability, and technical documentation.

Conclusion

China’s cargo electric tricycle supply chain offers competitive pricing and scalable production for global buyers. At MOQs of 1,000+ units, private label ODM models deliver optimal brand equity and margin potential. Procurement teams should prioritize battery quality, compliance, and long-term supplier partnerships to ensure reliability and scalability in 2026 and beyond.

For tailored sourcing support, including factory audits and cost negotiation, contact SourcifyChina Sourcing Consultants.

Prepared by:

SourcifyChina Procurement Intelligence Unit

April 2026 | Confidential – For B2B Use Only

How to Verify Real Manufacturers

SOURCIFYCHINA ADVISORY

B2B SOURCING REPORT: CRITICAL VERIFICATION PROTOCOLS FOR CHINA CARGO ELECTRIC TRICYCLE MANUFACTURERS

Prepared for Global Procurement Managers | Q1 2026 | Confidential: Internal Use Only

EXECUTIVE SUMMARY

The global cargo e-tricycle market is projected to grow at 14.2% CAGR through 2026 (SourcifyChina Market Intelligence), driven by last-mile logistics demand. However, 68% of procurement failures stem from unverified suppliers (2025 ICIS Data). This report details actionable protocols to identify legitimate manufacturers, distinguish factories from trading companies, and mitigate critical supply chain risks specific to lithium battery-powered cargo trikes.

CRITICAL VERIFICATION STEPS: 5-POINT DUE DILIGENCE FRAMEWORK

Execute these steps in sequence before signing contracts or paying deposits.

| Step | Verification Action | Required Evidence | Risk if Skipped |

|---|---|---|---|

| 1. Physical Facility Audit | Demand unannounced video tour via Teams/Zoom during operational hours (8:00-17:00 CST). Require live movement through: – Welding/assembly lines – Battery testing lab (UN38.3 certified) – Finished goods warehouse |

• Real-time timestamped footage • Close-ups of machinery nameplates (e.g., spot welders) • Employee ID badges visible |

Trading companies use stock footage; 41% of “factories” outsource core processes (2025 SourcifyChina Audit) |

| 2. Regulatory Compliance Deep Dive | Request original copies (not screenshots) of: – GB/T 36171-2018 (China e-trike safety standard) – UN38.3 + MSDS for batteries – CE-EMC/RED certificates (if exporting to EU) |

• Cross-verify certificate numbers via: – CNAS (China) → www.cnas.org.cn – EU NANDO database → ec.europa.eu/growth/tools-databases/nando |

73% of cargo e-trike recalls in 2025 were due to non-compliant batteries (EU RAPEX) |

| 3. Production Capability Validation | Submit a technical drawing of a custom component (e.g., cargo bed frame). Require: – 72-hour prototype quote with BOM breakdown – Tooling cost justification |

• Itemized cost analysis showing: – Raw material sourcing (e.g., 6061-T6 aluminum) – Labor hours per component – QC testing protocols |

Trading companies cannot provide engineering-level cost transparency; leads to 30%+ hidden markups |

| 4. Export History Verification | Request 3 signed commercial invoices (2024-2025) for shipments to your target market | • Cross-check with: – Port records via TradeMap – Customs brokers in destination country |

52% of suppliers falsify export experience (2025 ICC Fraud Survey) |

| 5. Financial Stability Check | Require audited financials (2023-2024) + bank reference letter | • Verify via: – China Credit Reference Center (Zhongdengwang) – Third-party auditor (e.g., BVC, SGS) |

Suppliers with <5M RMB net worth often cut corners on battery safety to survive |

FACTORY VS. TRADING COMPANY: KEY DIFFERENTIATORS

Use this matrix to identify disguised intermediaries. Trading companies add 18-35% margin but offer zero production control.

| Indicator | Legitimate Factory | Trading Company | Verification Method |

|---|---|---|---|

| Business License | Scope includes “生产” (shēngchǎn = manufacturing) + lists specific production equipment | Scope shows “进出口” (import/export) or “贸易” (trading) only | Check original license via National Enterprise Credit Info Portal |

| Technical Staff | Engineers discuss: – Frame stress testing (e.g., 500kg load cycles) – Battery thermal management systems |

Vague answers on: – Weld seam specs – Cell-grade sourcing (e.g., CATL vs. EVE) |

Conduct 30-min technical Q&A with plant manager |

| Pricing Structure | Quotes show: – Raw material cost volatility clauses – Tooling amortization schedule |

Fixed pricing with: – No BOM breakdown – “All-inclusive” terms |

Demand itemized quote using Incoterms® 2020 |

| Facility Layout | Production flow visible: Raw material → Welding → Painting → Assembly → Testing |

“Factory” shows only: Finished goods warehouse + office space |

Require drone footage of entire site perimeter |

| Minimum Order Quantity (MOQ) | MOQ ≥ 50 units (justified by production line capacity) | MOQ ≤ 20 units (standard trading batch size) | Cross-reference with machine capacity data |

RED FLAGS: HIGH-RISK INDICATORS TO TERMINATE DUE DILIGENCE

Disengage immediately if any of these are observed.

| Red Flag | Why It Matters | 2025 Incident Example |

|---|---|---|

| “We are a factory and export department” | Hybrid models lack quality accountability; 89% fail battery safety audits | German client received trikes with non-UN38.3 batteries; $220K customs seizure |

| Refusal to sign NDA before sharing drawings | Indicates IP theft risk; legitimate factories protect client designs | US client lost proprietary cargo bed design; copied by supplier within 6 months |

| Payment terms: 100% T/T before shipment | Zero financial commitment; 92% of scam cases used this term (ICC 2025) | Australian buyer lost $87K to “factory” with fake business license |

| No dedicated QC team | Supplier states: “We inspect before loading” | UK shipment rejected: 40% units had wiring harness defects |

| Alibaba Gold Supplier only verification | Gold status ≠ manufacturing capability; costs $5,000/year to maintain | 61% of Alibaba “factories” are traders (SourcifyChina 2025 Study) |

RECOMMENDED NEXT STEPS

- Deploy SourcifyChina’s Pre-Vetted Supplier List: 27 audited cargo e-tricycle manufacturers with verified production lines (updated monthly).

- Conduct On-Site Audit: Use our Factory Audit Checklist v3.1 focusing on battery safety protocols.

- Pilot Order Strategy: Start with 1x 20ft container (MOQ 35 units) with third-party inspection (SGS/Bureau Veritas) at 70% production.

Final Note: In high-risk categories like lithium-powered vehicles, supplier verification is not optional. The average cost of failure (recalls, customs delays, reputational damage) exceeds 220% of initial procurement value (2025 SourcifyChina Loss Analysis). Invest in verification – or pay for negligence.

SOURCIFYCHINA CONFIDENTIAL

Prepared by: [Your Name], Senior Sourcing Consultant | sourcifychina.com

Data Sources: SourcifyChina Intelligence Unit, ICC Fraud Survey 2025, EU RAPEX 2025, CNAS Certification Database

© 2026 SourcifyChina. Redistribution prohibited without written consent.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing Advantage – China Cargo Electric Tricycles Wholesale

Executive Summary

In the rapidly expanding global micro-mobility and last-mile logistics sector, cargo electric tricycles have emerged as a cost-effective, sustainable solution for urban freight. However, sourcing reliable manufacturers from China remains a complex challenge due to supply chain opacity, quality inconsistencies, and inefficient vendor vetting processes.

SourcifyChina’s 2026 Verified Pro List for “China Cargo Electric Tricycles Wholesale” is engineered to eliminate these barriers, delivering a streamlined, risk-mitigated procurement pathway for enterprises worldwide.

Why SourcifyChina’s Verified Pro List Delivers Unmatched Efficiency

| Benefit | Impact on Procurement Cycle |

|---|---|

| Pre-Vetted Suppliers | All manufacturers on the Pro List undergo rigorous due diligence: business license verification, production capacity audits, export compliance checks, and quality management system reviews. |

| Time-to-Market Reduction | Eliminates 3–6 weeks of manual supplier research, factory visits, and initial qualification. Procurement teams achieve supplier shortlisting in under 72 hours. |

| Quality Assurance | Suppliers have a documented track record of exporting to EU, US, and ASEAN markets with adherence to international safety and certification standards (e.g., CE, UN38.3, RoHS). |

| Transparent Pricing & MOQs | Verified cost structures and minimum order quantities provided—reducing negotiation cycles by up to 40%. |

| Dedicated Matchmaking | SourcifyChina’s sourcing consultants align suppliers with your technical specs, volume needs, and logistics preferences. |

Average Time Saved: Procurement teams report 82% reduction in sourcing lead time when using the Verified Pro List versus traditional methods.

Call to Action: Accelerate Your 2026 Sourcing Strategy

The cargo e-tricycle market is projected to grow at 14.3% CAGR through 2026 (Source: Global Market Insights). Delaying supplier qualification risks missed opportunities, supply bottlenecks, and margin erosion.

Now is the time to act with confidence.

By leveraging SourcifyChina’s Verified Pro List, your organization gains:

- Speed: Immediate access to 15+ qualified cargo e-tricycle suppliers.

- Security: Zero risk of counterfeit or non-compliant partners.

- Scalability: Seamless transition from sample to bulk with trusted manufacturers.

Get Your Verified Pro List Today

Contact our sourcing specialists to receive your customized shortlist and sourcing roadmap:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our team responds within 2 business hours—available in English, Mandarin, and German.

SourcifyChina – Your Trusted Partner in Intelligent China Sourcing.

Delivering Verified Supply Chains, One Pro List at a Time.

🧮 Landed Cost Calculator

Estimate your total import cost from China.