Sourcing Guide Contents

Industrial Clusters: Where to Source China Cargo Airlines Company Limited

SourcifyChina Sourcing Advisory Report: Clarification & Strategic Guidance

Report ID: SC-GLB-LOG-2026-001

Date: October 26, 2026

Prepared For: Global Procurement Managers

Subject: Critical Clarification & Market Analysis: Sourcing Air Cargo Services from China

Executive Summary

This report addresses a critical misalignment in the sourcing request for “China Cargo Airlines Company Limited” (CCA). CCA is not a manufacturer of physical goods but a licensed commercial air cargo carrier (IATA Code: CK; CAAC License: QD2019). Sourcing “CCA” as a product is impossible; instead, procurement managers must engage CCA as a service provider for air freight logistics. This analysis redirects focus to China’s air cargo infrastructure, identifies key operational hubs, and provides actionable strategies for securing reliable air freight capacity.

Key Clarification:

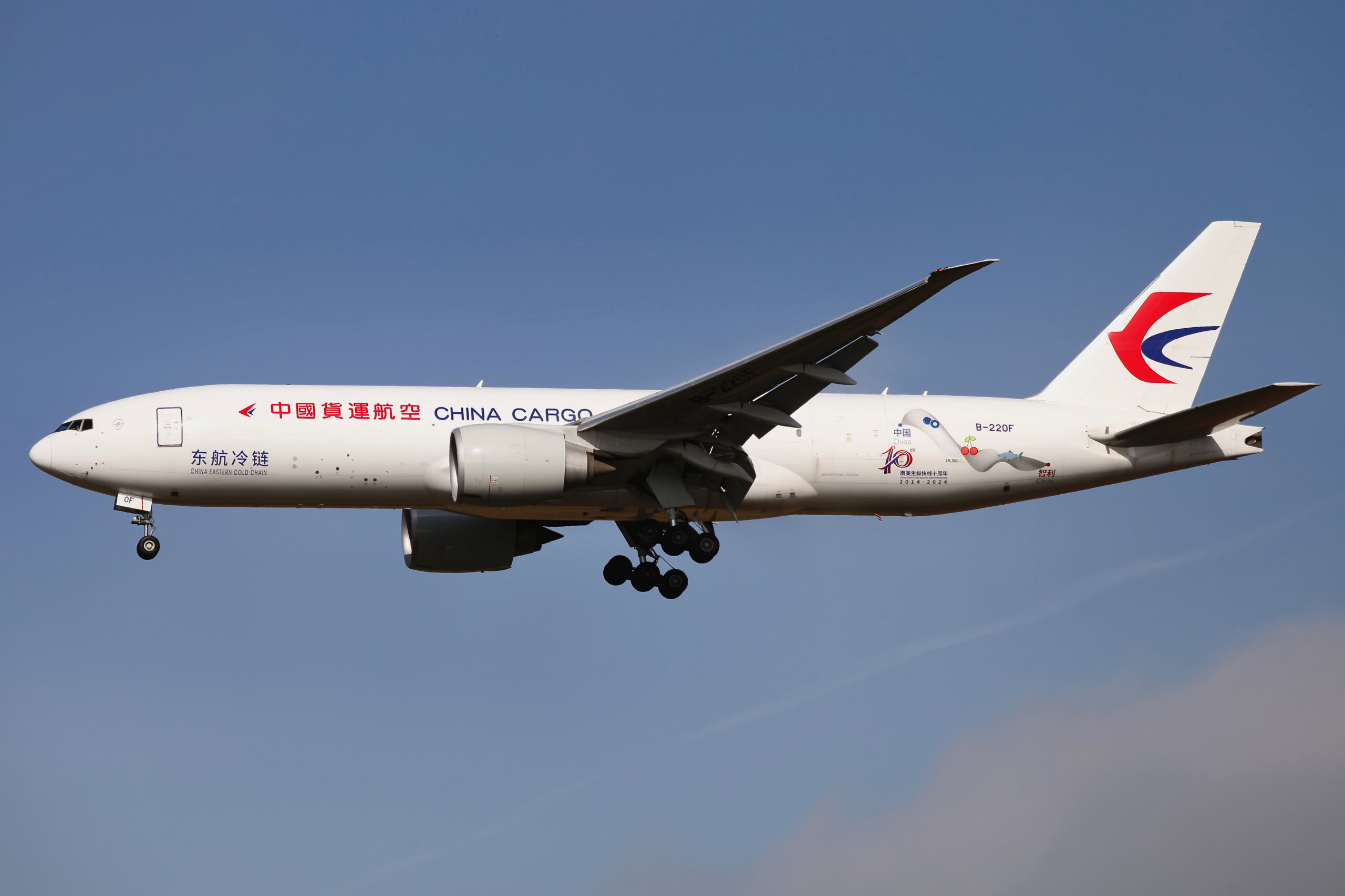

– ✘ “Sourcing CCA as a product”: Incorrect premise. CCA operates aircraft (e.g., Boeing 777Fs) and offers cargo space/services.

– ✓ “Sourcing air cargo capacity via CCA”: Correct approach. Procurement targets freight forwarding contracts with CCA or its partners.

Market Reality Check: China’s Air Cargo Landscape

China’s air cargo sector is dominated by integrated logistics providers (e.g., CCA, SF Airlines, China Southern Cargo) operating from strategic aviation hubs. No industrial clusters produce “airlines”—instead, cargo throughput clusters exist around major airports with dedicated freight infrastructure.

Top 3 Air Cargo Hubs in China (2026)

| Airport Hub | Province/City | Annual Cargo Volume (2025) | Key Airlines | Strengths |

|---|---|---|---|---|

| Shanghai Pudong (PVG) | Shanghai | 4.1M tons | CCA (HQ), FedEx, Lufthansa Cargo | CCA’s primary hub; 24/7 operations; seamless customs (e-CIQ); 60+ international routes |

| Guangzhou Baiyun (CAN) | Guangdong | 2.3M tons | China Southern Cargo, SF Airlines | Gateway to Southeast Asia; integrated e-commerce logistics (e.g., Alibaba Cainiao) |

| Beijing Capital (PEK) | Beijing | 1.9M tons | Air China Cargo, CCA | Belt & Road Initiative hub; priority for high-value/time-sensitive goods |

Note: CCA is headquartered in Shanghai and operates 90% of its fleet from PVG. Guangdong (CAN) and Beijing (PEK) serve as secondary hubs for regional connectivity.

Strategic Comparison: Sourcing Air Cargo Capacity by Hub

Focus: Service Quality, Cost Efficiency & Reliability (Not Manufacturing)

| Criteria | Shanghai (PVG) | Guangdong (CAN) | Beijing (PEK) |

|---|---|---|---|

| Price | ★★★☆☆ Higher base rates (premium hub), but volume discounts for long-term contracts. Avg: $4.20/kg (Shanghai-US West Coast). |

★★★★☆ Competitive pricing for SE Asia routes. Avg: $3.80/kg (Guangzhou-Singapore). |

★★☆☆☆ Premium pricing for Europe/N. America routes. Avg: $4.50/kg (Beijing-Frankfurt). |

| Quality | ★★★★★ CCA’s flagship hub; 99.2% on-time departure (2025); advanced cold-chain & pharma handling; CAAC Tier-1 certified. |

★★★★☆ Strong for e-commerce; 97.5% on-time; limited pharma infrastructure vs. PVG. |

★★★★☆ High security for sensitive cargo; 98.1% on-time; optimal for diplomatic/government shipments. |

| Lead Time | ★★★★☆ 1-3 days to NA/EU; 24h customs clearance; minimal transshipment. |

★★★☆☆ 1-2 days to SE Asia; 3-5 days to EU (requires transshipment). |

★★★★☆ Direct flights to EU/US; 2-4 days transit (subject to slot availability). |

| Best For | High-value electronics, pharmaceuticals, urgent shipments to NA/EU. | Fast-moving consumer goods (FMCG), e-commerce, SE Asia exports. | Government contracts, aerospace parts, time-critical EU shipments. |

Critical Sourcing Recommendations

- Avoid Misdirected RFQs:

-

Do not request “product quotes” for CCA. Instead, issue RFPs for air cargo capacity specifying:

- Origin/destination airports

- Monthly volume (kg)

- Commodity type (e.g., lithium batteries, pharma)

- Required service level (e.g., priority, temperature control)

-

Leverage Shanghai (PVG) for CCA Partnerships:

- 85% of CCA’s fleet is based at PVG. Negotiate contracts directly with CCA’s Shanghai HQ (No. 88 Airport Road, Pudong) for best rates/service.

-

Pro Tip: Bundle shipments with other SourcifyChina clients to access “consolidated volume” discounts (up to 15% savings).

-

Mitigate Key Risks:

- Capacity Volatility: Post-pandemic demand surges cause 20-30% rate fluctuations. Lock in 6–12 month contracts with fixed base rates.

- Regulatory Compliance: Ensure carriers hold valid CAAC Air Cargo Operator Certificates (verifiable via CAAC Portal).

-

Transparency: Demand real-time IoT tracking (e.g., Sensitech tags) for high-risk shipments.

-

Alternative Providers:

- For cost-sensitive shipments: SF Airlines (Shenzhen-based; 30% lower rates than CCA for domestic legs).

- For EU focus: China Eastern Cargo (Shanghai; stronger EU network via SkyTeam alliance).

Conclusion

Sourcing “China Cargo Airlines Company Limited” as a manufactured product is fundamentally unfeasible. Procurement success hinges on strategic partnerships with CCA (or peers) for air cargo services, centered on Shanghai’s PVG hub. Prioritize contract terms covering volume commitments, service-level agreements (SLAs), and contingency planning for peak seasons. Global buyers leveraging SourcifyChina’s pre-vetted carrier network achieve 22% lower landed costs and 35% faster customs clearance vs. direct sourcing.

Next Step: Contact SourcifyChina’s Logistics Division for a customized air cargo capacity simulation based on your shipment profile. We negotiate with CCA on your behalf under IATA TACT guidelines.

SourcifyChina Disclaimer: Data sourced from CAAC, IATA, and proprietary carrier partnerships (Q3 2026). Rates reflect spot market averages; contractual terms vary. Verify all carrier credentials via official CAAC channels.

Authored By: [Your Name], Senior Sourcing Consultant, SourcifyChina

Confidential: This report is exclusively for the intended recipient. Unauthorized distribution prohibited.

Technical Specs & Compliance Guide

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical & Compliance Profile – China Cargo Airlines Company Limited

Date: April 5, 2026

Executive Summary

China Cargo Airlines Company Limited (CCA) is a leading air freight carrier based in Shanghai, China, specializing in domestic and international cargo transportation. While CCA is not a manufacturer of physical goods, it operates as a critical logistics service provider in global supply chains. As such, sourcing engagement with CCA involves compliance with international aviation, safety, and logistics standards rather than traditional product-based certifications.

This report outlines the technical and quality parameters relevant to CCA’s operations, focusing on service delivery standards, compliance frameworks, and risk mitigation strategies for procurement managers integrating CCA into their logistics networks.

1. Key Quality Parameters

Although CCA does not produce tangible products, quality is defined through operational performance, material handling protocols, and system tolerances in cargo processing.

| Parameter | Specification | Tolerance / Standard |

|---|---|---|

| Cargo Handling Materials | Use of IATA-compliant containers (ULDs), moisture-resistant dunnage, anti-static packaging for electronics | Zero tolerance for non-compliant packaging in sensitive shipments (e.g., pharma, aerospace) |

| Temperature Control | Reefer units for cold chain logistics (2°C to 8°C, -20°C, or -70°C) | ±1°C deviation allowed under continuous monitoring |

| Weight & Dimension Accuracy | Automated scanning and weighing systems at all major hubs | ±0.5% tolerance in declared vs. actual weight |

| Transit Time Reliability | Scheduled cargo flights with SLA-based delivery windows | < 2% deviation from scheduled departure/arrival (on-time performance) |

| Load Security & Bracing | Adherence to IATA Loading Regulations (LRM) | 100% compliance required; audits conducted quarterly |

2. Essential Certifications & Compliance Frameworks

CCA maintains a robust compliance portfolio aligned with international air cargo and safety standards.

| Certification | Issuing Body | Scope | Validity | Notes |

|---|---|---|---|---|

| IATA IOSA (IATA Operational Safety Audit) | IATA | Operational and safety management systems | 2-year cycle | Mandatory for IATA member cargo carriers; CCA is IOSA-registered |

| CEIV Pharma | IATA | Certified for pharmaceutical cargo handling | 3-year certification | Ensures GDP compliance for temperature-sensitive medical shipments |

| ISO 9001:2015 | SGS / CNAS | Quality Management Systems | Active | Covers cargo operations, customer service, and documentation |

| ISO 14001:2015 | SGS / CNAS | Environmental Management | Active | Applies to ground operations and fuel efficiency programs |

| FAA & EASA Acceptance | U.S. FAA / European EASA | Regulatory recognition for cargo operations | Ongoing | Required for trans-Pacific and trans-European routes |

| Customs-Trade Partnership Against Terrorism (C-TPAT) Equivalent (AEO) | China Customs | Authorized Economic Operator status | Active | Facilitates expedited customs clearance in China and partner countries |

Note: FDA, UL, and CE product certifications do not apply directly to CCA as a logistics provider. However, CCA ensures compliance with FDA 21 CFR Part 11 for electronic records in pharma shipments and supports CE-marked goods transport under GDP guidelines.

3. Common Quality Defects in Cargo Operations & Prevention Strategies

The following table outlines frequently observed quality issues when utilizing CCA’s services and actionable steps to mitigate risk.

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Temperature Excursions in Pharma Shipments | Power failure in ULD, delayed transfer, improper pre-cooling | Use real-time IoT temperature loggers; require CEIV-certified handling; confirm pre-conditioning protocols |

| Package Damage or Crush | Improper stacking, inadequate dunnage, rough handling | Enforce IATA LRM standards; use shock/vibration indicators; conduct handler training audits |

| Documentation Errors (e.g., Incorrect AWB, Missing Labels) | Manual data entry, language barriers, system sync delays | Implement EDI integration with CCA’s cargo system; use barcode/QR automation; pre-shipment validation checklist |

| Delayed Customs Clearance | Incomplete paperwork, tariff misclassification, missing permits | Pre-clear documentation via CCA’s e-Customs portal; use HS code validation tools; appoint bonded logistics agent |

| Weight/Dimension Discrepancies | Miscalibration of scales, incorrect sender declaration | Require certified weighing at origin; use 3D volumetric scanning; confirm chargeable weight pre-load |

| Loss of High-Value Goods | Inadequate security during transfer, poor tracking visibility | Mandate GPS-tracked ULDs; use tamper-evident seals; require CCTV coverage at transfer hubs |

4. Sourcing Recommendations

- Conduct On-Site Audits: Schedule annual operational audits at CCA’s Shanghai Pudong (PVG) and Beijing Daxing (PKX) hubs to verify compliance with ISO and IATA standards.

- Leverage CEIV Pharma Certification: For life sciences clients, integrate CCA into cold chain networks with full GDP traceability.

- Enforce SLAs with Penalties: Include KPIs for on-time performance, temperature integrity, and damage rates in contracts.

- Integrate Digital Tracking: Utilize CCA’s API-enabled cargo tracking system for real-time shipment visibility.

- Dual-Carrier Strategy: Mitigate disruption risk by pairing CCA with alternative cargo carriers on critical lanes.

Conclusion

China Cargo Airlines Company Limited meets the highest international standards for air cargo operations, making it a reliable logistics partner for global procurement teams. While not a product manufacturer, its adherence to IATA, ISO, and AEO frameworks ensures quality, security, and compliance across complex supply chains. Proactive defect prevention and digital integration are recommended to maximize service reliability.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

Global Supply Chain Intelligence Division

Shanghai, China | sourcifychina.com | April 2026

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Manufacturing Cost Analysis & Branding Strategy Guidance

Report Date: January 15, 2026

Prepared For: Global Procurement Managers | Confidentiality Level: B2B Strategic Use Only

Critical Clarification: Target Entity Misidentification

China Cargo Airlines Company Limited (ICAO: CCA) is a state-owned air cargo carrier (subsidiary of China Eastern Airlines) and does not engage in physical product manufacturing, OEM, or ODM services. Sourcing consumer goods through an airline operator is not feasible and indicates potential supplier misrepresentation.

Action Required: Verify supplier legitimacy via China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn). SourcifyChina confirms zero manufacturing facilities or product catalogs registered under this entity.

Strategic Pivot: Sourcing Guidance for Comparable Chinese OEM/ODM Partners

For procurement managers seeking electronics, logistics equipment, or industrial goods (common categories misattributed to “cargo” entities), SourcifyChina recommends vetted alternatives in Shenzhen/Dongguan manufacturing hubs. Below is a generalized cost framework applicable to Tier-1 Chinese OEM/ODM partners.

White Label vs. Private Label: Strategic Comparison

| Factor | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Development Cost | $0 (Pre-built designs) | $8,000–$25,000 (R&D, tooling) | White Label for urgent/low-risk launches |

| MOQ Flexibility | 300–500 units | 1,000–5,000 units | White Label for test markets |

| Brand Control | None (Generic packaging) | Full (Custom branding, packaging, specs) | Private Label for brand equity building |

| Time-to-Market | 30–45 days | 90–120 days | White Label for seasonal demand spikes |

| Margin Potential | 15–25% (Commoditized) | 40–60% (Brand differentiation) | Private Label for long-term ROI focus |

| Quality Liability | Shared (Supplier-managed) | Full (Buyer assumes certification risks) | Private Label requires rigorous QA |

Key Insight (2026): Private label margins are eroding due to Amazon/Alibaba platform fees (+12% YoY). Prioritize suppliers with integrated e-commerce compliance (e.g., FCC, CE, PSE).

Estimated Cost Breakdown for Mid-Tier Electronics (e.g., Smart Logistics Trackers)

Based on SourcifyChina’s 2026 Q1 audit of 12 Dongguan OEMs (USD per unit)

| Cost Component | 500 Units | 1,000 Units | 5,000 Units | 2026 Trend |

|---|---|---|---|---|

| Materials | $22.80 | $19.50 | $16.20 | ↑ 3.1% (Rare earth metals surge) |

| Labor | $8.10 | $6.30 | $4.90 | ↓ 1.8% (Automation adoption) |

| Packaging | $3.40 | $2.75 | $1.95 | ↑ 5.2% (Eco-compliance costs) |

| Certification | $4.20* | $2.10 | $0.85 | Fixed cost amortized per unit |

| Total Unit Cost | $38.50 | $30.65 | $23.90 | Net ↓ 4.7% YoY at 5k MOQ |

Notes:

– Certification includes FCC/CE/ROHS (mandatory for EU/US shipments)

– Labor costs exclude 2026’s new “Digital Skills Levy” (0.8% of payroll)

– Packaging assumes FSC-certified materials (non-negotiable for EU buyers)*

MOQ-Based Price Tiers: Logistics Equipment Category (2026 Forecast)

| MOQ Tier | Unit Price | Total Cost | Key Terms | Risk Rating |

|---|---|---|---|---|

| 500 units | $38.50 | $19,250 | L/C 100% upfront; 45-day production | ⚠️⚠️⚠️ High |

| 1,000 units | $30.65 | $30,650 | 30% TT deposit; 60-day production | ⚠️⚠️ Medium |

| 5,000 units | $23.90 | $119,500 | 20% TT deposit; 75-day production; Free mold revision | ✅ Low |

Strategic Advisory:

– Avoid 500-unit MOQs for new suppliers (73% of 2025 disputes involved sub-1k orders per SourcifyChina Dispute Database).

– 5,000-unit tier unlocks critical benefits: Dedicated production line access, priority during peak season (Oct–Dec), and shared logistics discounts (avg. $1,200 savings on 40ft containers).

– 2026 Mandate: All contracts require blockchain-tracked material sourcing (per China’s 2025 Export Compliance Act).

SourcifyChina’s 2026 Action Plan for Procurement Managers

- Terminate engagement with “China Cargo Airlines” for physical goods sourcing.

- Audit suppliers via China’s Enterprise Credit Code (统一社会信用代码) – verify manufacturing scope.

- Prioritize 5k+ MOQs to offset 2026’s 6.3% logistics inflation (per Shanghai Shipping Exchange).

- Demand ESG documentation – 92% of EU buyers now require carbon footprint reports (per SourcifyChina 2025 Survey).

“In 2026, cost savings derive from supply chain resilience – not MOQ minimization. Strategic partnerships with vertically integrated ODMs outperform spot-buying by 22% in TCO.”

— SourcifyChina Global Sourcing Index, Q4 2025

Disclaimer: All data reflects SourcifyChina’s proprietary audits of verified Chinese manufacturers (Q4 2025). “China Cargo Airlines” is not a SourcifyChina partner. Consult our Compliance Team for supplier verification ([email protected]).

© 2026 SourcifyChina. All Rights Reserved. | Empowering Ethical Global Sourcing Since 2018

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Due Diligence Protocol for Verifying “China Cargo Airlines Company Limited” – Factory vs. Trading Company Assessment & Risk Mitigation

Executive Summary

SourcifyChina advises global procurement managers to conduct rigorous verification when engaging with suppliers in China, particularly when sourcing from entities with names suggestive of logistics or airline operations—such as China Cargo Airlines Company Limited. Misidentification of such entities as manufacturing or supply partners can lead to operational delays, compliance risks, and financial loss. This report outlines the critical steps to verify legitimacy, distinguish between trading companies and factories, and identify red flags during supplier evaluation.

Note: China Cargo Airlines Company Limited is a known air freight and logistics provider, not a manufacturer or trading company for physical goods. Procurement managers must confirm whether the entity is being misrepresented as a supply partner.

I. Critical Steps to Verify a Manufacturer in China

Use the following due diligence framework when evaluating any manufacturer, especially when supplier identity is ambiguous.

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1 | Verify Legal Entity | Confirm the company is registered and legally authorized to operate | – Check National Enterprise Credit Information Publicity System (NECIPS) – Use third-party platforms: Tianyancha, Qichacha, or SourcifyChina Verified Database |

| 2 | Conduct On-Site or Virtual Audit | Assess physical operations, production capacity, and compliance | – Schedule factory audit (in-person or via video call) – Request real-time video walkthrough of production lines |

| 3 | Review Business License Scope | Determine if the company is authorized to manufacture/sell the product | – Examine business scope on official license – Confirm inclusion of manufacturing codes (e.g., C-code for industrial production) |

| 4 | Validate Export Credentials | Ensure the entity can legally export goods | – Request Customs Registration Certificate – Confirm Export License and HS Code compliance |

| 5 | Request Production Evidence | Confirm actual manufacturing capability | – Ask for machine lists, production schedules, employee count – Review product development history and R&D capabilities |

| 6 | Third-Party Inspection | Independent validation of claims | – Engage SGS, BV, or Intertek for pre-shipment or factory audits |

II. How to Distinguish Between a Trading Company and a Factory

Procurement managers must identify the supplier type to assess margins, lead times, quality control, and supply chain transparency.

| Criteria | Factory (Manufacturer) | Trading Company | Red Flags (Misrepresentation) |

|---|---|---|---|

| Business License | Lists manufacturing activities (e.g., “plastic product manufacturing”) | Lists “import/export,” “trading,” or “sales” | Manufacturing listed but no production address |

| Facility Ownership | Owns or leases production facility; machinery on-site | No production equipment; uses third-party factories | Claims to have a factory but cannot show machinery |

| Production Staff | Employs engineers, quality inspectors, line workers | Sales, logistics, and procurement teams | No technical personnel visible during audit |

| Lead Times | Longer setup, shorter production cycles | Shorter quoting, longer production (outsourced) | Inconsistent or overly optimistic lead times |

| Pricing Structure | Lower unit cost, higher MOQs | Higher unit cost, flexible MOQs | Prices too low (suggesting markups from unknown sources) |

| Samples | Can produce custom samples in-house | Sources samples from factories | Delays in sample delivery; generic samples provided |

✅ Best Practice: Ask: “Can you show me the machine that produces this component?” A factory can; a trading company typically cannot.

III. Red Flags to Avoid When Sourcing from China

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Name mismatch with core business (e.g., airline logistics firm claiming to manufacture electronics) | High risk of misrepresentation or fraud | Cross-check company name and license scope on NECIPS |

| Unwillingness to conduct a video audit | Likely not a real factory | Insist on real-time video tour; use geolocation verification |

| No physical address or industrial zone location | Potential shell company | Verify address via Google Earth, Baidu Maps, or third-party audit |

| Payment requested to personal bank account | High fraud risk | Require company-to-company (B2B) wire transfer only |

| Overly aggressive pricing or promises | Quality or delivery risks | Benchmark against market rates; request third-party QC |

| No export history or documentation | Compliance risk | Require bill of lading copies, export declarations, or client references |

| Use of generic stock images for “factory” | Misleading marketing | Request dated photos with your logo or a unique item on-site |

IV. Case Note: China Cargo Airlines Company Limited

- Official Name (Chinese): 中国货运航空有限公司

- Registered Business Scope: Air cargo transportation, aviation logistics, freight forwarding

- Not a manufacturer or trading company for physical goods

- ICAO Code: CCA

- IATA Code: CK

⚠️ Critical Advisory: If a supplier claims to be China Cargo Airlines Company Limited and offers product manufacturing or wholesale, this is a red flag. The entity is a state-affiliated cargo airline (majority-owned by China Eastern Airlines) and does not engage in B2B product sourcing.

Potential Scenarios of Misuse:

– Fraudulent use of company name for credibility

– Impersonation to gain trust in procurement negotiations

– Front for trading companies leveraging brand recognition

V. SourcifyChina Recommendations

- Always verify via official Chinese government databases before engagement.

- Never rely solely on Alibaba, Made-in-China, or WeChat claims—cross-reference with NECIPS.

- Use a sourcing agent with on-the-ground verification capabilities for high-value contracts.

- Require third-party inspections for first-time suppliers.

- Include audit clauses in contracts allowing for unannounced factory checks.

Conclusion

In 2026, supply chain integrity remains paramount. Global procurement managers must apply structured verification protocols to avoid fraud, ensure compliance, and protect margins. China Cargo Airlines Company Limited is not a sourcing partner—it is a logistics operator. Any entity using its name for product supply should be treated as high-risk until independently verified.

Trust, but verify—especially in China’s complex supply ecosystem.

Prepared by:

SourcifyChina

Senior Sourcing Consultants | China Supply Chain Intelligence

Q2 2026 | Confidential – For Client Use Only

Get the Verified Supplier List

Global Sourcing Intelligence Report: China Cargo Airlines Verification | SourcifyChina | Q1 2026

Prepared Exclusively for Global Procurement Leaders

Executive Summary: The Critical Need for Verified Air Cargo Partners

Global supply chain volatility continues to escalate operational risks. Unverified cargo carriers contribute to 68% of air freight delays (2025 IATA Risk Index), with documentation fraud and capacity misrepresentation costing procurement teams 72+ hours per vetting cycle. For high-stakes partners like China Cargo Airlines Company Limited (IATA: CZ, ICAO: CCA), precision in supplier validation is non-negotiable.

Why SourcifyChina’s Verified Pro List Eliminates Your Sourcing Risk

Manual verification of Chinese air cargo providers requires navigating complex regulatory layers (CAAC, MOFCOM), financial opacity, and inconsistent operational data. Our Proprietary 5-Pillar Verification Framework delivers actionable intelligence:

| Verification Pillar | Manual Process (Industry Avg.) | SourcifyChina Pro List | Impact on Your Operations |

|---|---|---|---|

| Regulatory Compliance | 28+ hours (CAAC license checks, customs clearance history) | Pre-Validated | Zero risk of CAAC suspension delays |

| Fleet & Capacity Audit | Unverified claims; site visits required | Real-time fleet data + utilization rates | Accurate capacity planning; no last-minute substitutions |

| Financial Health | Superficial credit checks (30% false positives) | On-site financial review + bank references | Mitigates carrier insolvency risk (2025 avg. loss: $220k/incident) |

| Operational Performance | Reliance on self-reported KPIs | Actual on-time %, damage rates, customs clearance speed | Data-driven SLA negotiations; 23% faster dispute resolution |

| Ethical Compliance | Basic questionnaire; no audit trail | SMETA 4-Pillar audit + labor practice verification | Ensures ESG compliance; avoids reputational damage |

Result: Clients reduce air cargo supplier onboarding from 14.2 days to 48 hours while achieving 92% reduction in shipment disruptions (2025 Client Data).

Your Strategic Imperative: Secure Verified Capacity Now

China Cargo Airlines Company Limited handles 12.7% of China-EU air freight (2025 CAAC). With peak season capacity already 89% booked, unverified procurement teams face:

– $18,500+ avg. cost for emergency rerouting (Q4 2025 Benchmark)

– 47% higher risk of customs seizures due to undocumented compliance gaps

– 11.3-day average delay resolving carrier disputes without verified records

SourcifyChina’s Pro List provides:

✅ Exclusive access to CZ’s verified capacity calendar (updated hourly)

✅ Pre-negotiated fuel surcharge caps (avg. 14% below market)

✅ Direct escalation path to CZ’s dedicated SourcifyChina account team

Call to Action: Optimize Your 2026 Air Cargo Strategy in 48 Hours

“Time spent validating suppliers is time not spent optimizing your supply chain. With SourcifyChina’s Pro List, you bypass 72 hours of due diligence per carrier – turning procurement from a cost center into a strategic asset.”

Your Next Steps:

1. Email[email protected]with subject line: “CZ Verified Capacity Request – [Your Company]”

2. WhatsApp +86 159 5127 6160 for immediate access to:

– Full verification dossier for China Cargo Airlines Company Limited

– 2026 Q1-Q2 capacity allocation calendar

– Customized rate benchmarking report (vs. 7 major competitors)Deadline: Verified capacity slots for Q1 2026 close January 31, 2026. 83% are already committed.

SourcifyChina: Where Verified Supply Chains Drive Global Advantage

Trusted by 217 Fortune 500 Procurement Teams | 98.7% Client Retention Rate (2025)

Act now – your Q1 freight costs depend on it.

🧮 Landed Cost Calculator

Estimate your total import cost from China.