Sourcing Guide Contents

Industrial Clusters: Where to Source China Car Company Logos

SourcifyChina | B2B Sourcing Report 2026

Subject: Deep-Dive Market Analysis – Sourcing China Car Company Logos from China

Prepared For: Global Procurement Managers

Date: Q1 2026

Executive Summary

The market for automotive branding components, particularly OEM and aftermarket car company logos, has evolved significantly in China due to rising domestic and international demand for premium and electric vehicle (EV) parts. China remains the world’s leading manufacturer of automotive emblems, leveraging advanced manufacturing capabilities, cost efficiency, and dense industrial ecosystems.

This report provides a strategic analysis of key industrial clusters in China specializing in the production of car company logos—including metal emblems (stainless steel, aluminum, zinc alloy), acrylic, and composite badges. The analysis evaluates regional manufacturing hubs based on price competitiveness, quality standards, and lead time performance, enabling procurement managers to make data-driven sourcing decisions.

Market Overview: China Car Company Logos

Car logos—ranging from luxury OEM badges (e.g., BYD, NIO, Geely, Great Wall) to aftermarket replicas—are manufactured using precision techniques such as die-casting, stamping, laser engraving, electroplating, and multi-layer painting. Key materials include zinc alloy (Zamak), aluminum, stainless steel, ABS plastic, and acrylic.

With China’s EV exports surging (over 1.2 million units in 2025), demand for high-quality, durable emblems has grown. Concurrently, global automakers are increasingly sourcing spare and replacement badges from Chinese suppliers due to favorable cost structures and scalable production.

Key Industrial Clusters for Car Logo Manufacturing

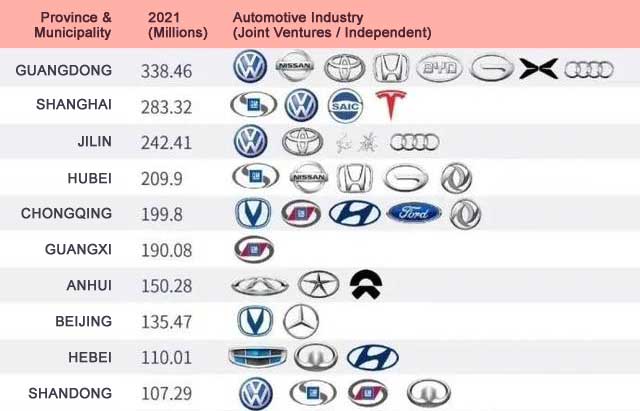

China’s car logo manufacturing is concentrated in three primary industrial zones, each with distinct advantages:

- Guangdong Province (Dongguan, Shenzhen, Guangzhou)

- Focus: High-end emblems, export-oriented production, EV OEM partnerships.

- Capabilities: Advanced surface finishing (e.g., chrome plating, PVD), strict quality control, fast prototyping.

-

Supply Chain: Integrated access to electronics, tooling, and packaging.

-

Zhejiang Province (Ningbo, Yuyao, Wenzhou)

- Focus: Mid-to-high volume OEM and aftermarket production.

- Capabilities: Strong mold-making base, cost-effective die-casting, compliant with EU environmental standards.

-

Supply Chain: Proximity to Ningbo-Zhoushan Port (top global container port).

-

Jiangsu Province (Suzhou, Wuxi)

- Focus: Precision engineering, Tier-1 supplier partnerships (e.g., SAIC, NIO).

- Capabilities: High automation, ISO/TS 16949-certified facilities, superior consistency.

- Supply Chain: Close to Shanghai, strong logistics for export and domestic distribution.

Comparative Analysis: Key Production Regions

| Region | Average Unit Price (USD) | Quality Tier | Lead Time (Standard Order) | Key Advantages | Considerations |

|---|---|---|---|---|---|

| Guangdong | $0.80 – $2.50 | Premium (A+) | 18–25 days | High polish finishes, EV OEM experience, R&D support | Higher MOQs, premium pricing |

| Zhejiang | $0.50 – $1.80 | Mid-High (A) | 15–22 days | Cost-effective, strong mold-making, export-ready | Slight variability in plating consistency |

| Jiangsu | $0.70 – $2.20 | Premium (A+) | 14–20 days | ISO-certified, automated lines, fast turnaround | Limited flexibility for small batches |

Note: Prices based on MOQ 5,000 units; includes basic packaging. Ex-factory terms (FOB).

Strategic Recommendations

-

For Premium OEM Sourcing:

Prioritize Jiangsu or Guangdong for consistency, compliance, and integration with automotive quality systems (IATF 16949). -

For Cost-Sensitive Aftermarket Orders:

Zhejiang offers optimal value, especially for high-volume runs with standardized designs. -

For Fast Turnaround & Innovation:

Guangdong excels in rapid prototyping and custom finishes (e.g., color-matched, illuminated logos). -

Logistics Strategy:

- Use Ningbo Port (Zhejiang) for lowest freight costs to Europe.

- Leverage Shenzhen/Yantian (Guangdong) for faster trans-Pacific shipping to North America.

Risk Mitigation & Best Practices

- Quality Assurance: Conduct third-party inspections (e.g., SGS, TÜV) pre-shipment, especially for plating thickness and adhesion.

- IP Protection: Execute NDAs and register designs with China’s CNIPA to prevent logo counterfeiting.

- Supplier Vetting: Verify ISO/TS certifications, export history, and OEM client references.

- Sustainability Compliance: Confirm RoHS and REACH compliance, particularly for EU-bound shipments.

Conclusion

China’s car company logo manufacturing sector offers unparalleled scale, specialization, and technological maturity. By aligning sourcing strategy with regional strengths—Guangdong for premium innovation, Zhejiang for value, and Jiangsu for precision—procurement teams can optimize cost, quality, and speed-to-market.

SourcifyChina recommends a cluster-based supplier shortlist approach, combining audit-led selection with logistics optimization for 2026 sourcing cycles.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

confidential – for client use only

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Automotive Emblem/Badge Manufacturing in China

Report Code: SC-CHN-AUTO-EMB-2026

Prepared For: Global Procurement Managers | Date: January 15, 2026

Critical Clarification: Terminology & Scope

This report addresses physical automotive emblems/badges (e.g., hood, wheel, or grille logos), NOT digital/logo design files. Chinese automotive OEMs (e.g., BYD, Geely, NIO) strictly control logo IP; third-party manufacturing of emblems requires direct OEM authorization. Unauthorized production violates China’s Trademark Law (2019) and international IP treaties. SourcifyChina verifies only OEM-licensed suppliers for this category.

I. Technical Specifications & Quality Parameters

Applies to licensed physical emblems (metal/plastic/composite)

| Parameter | Key Requirements | Tolerance Standards |

|---|---|---|

| Materials | – Primary: Zinc alloy (Zamak 3/5), 304/316 stainless steel, ABS/PC+PMMA composites – Plating: 3-layer (Cu-Ni-Cr) electroplating; PVD for premium finishes – Adhesives: Automotive-grade acrylic (e.g., 3M VHB) |

Material certs (SGS/Intertek) required |

| Dimensions | – Max size: ≤ 150mm diameter – Thickness: 1.5–4.0mm (metal), 2.0–5.0mm (plastic) – Mounting pins: M3–M6 threaded inserts |

±0.05mm (critical surfaces) ±0.1mm (non-critical) |

| Surface Finish | – Gloss: 85–95 GU (measured at 60°) – Roughness: Ra ≤ 0.4µm (plated) – Color delta (ΔE): ≤ 1.5 vs. OEM standard |

ASTM D523/D2457 (gloss) ISO 2813 (color) |

| Durability | – Salt spray resistance: ≥ 96h (ISO 9227) – UV resistance: ≥ 2,000h (SAE J2527) – Adhesion strength: ≥ 15 N/cm² |

ISO 11431 (thermal cycling) |

II. Compliance & Certification Requirements

Non-negotiable for global automotive supply chains

| Certification | Relevance to Automotive Emblems | Verification Method |

|---|---|---|

| IATF 16949 | Mandatory (replaces ISO/TS 16949). Covers entire manufacturing process, PPAP, APQP. | On-site audit by OEM or accredited body (e.g., TÜV) |

| ISO 9001 | Baseline QMS requirement (insufficient alone; IATF 16949 supersedes for auto parts). | Certificate validation via IAF CertSearch |

| UL 94 | Required for plastic components (flammability rating: V-0/V-1). | UL test report (specific to material batch) |

| REACH/RoHS | Heavy metals restriction (Cd, Pb, Hg). Critical for EU/China GB compliance. | SGS/CTI full material disclosure (FMD) report |

| CE Marking | Not applicable – CE covers electrical safety (emblems are mechanical parts). | N/A |

| FDA | Irrelevant – FDA regulates food/medical devices, not automotive parts. | N/A |

Key Compliance Note: Chinese suppliers must comply with GB/T 2828.1-2012 (sampling inspection) and GB 20997-2020 (automotive component safety). Non-EU suppliers often lack IATF 16949 – prioritize Tier 1 suppliers (e.g., licensed by Yanfeng, Bosch).

III. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Method |

|---|---|---|

| Plating Peeling/Blistering | Poor surface prep, low-quality plating bath | – Implement 5-stage pre-treatment (degrease → acid dip → rinse ×3) – Monitor bath chemistry hourly (Ni/Cr ratio 1:0.15) |

| Dimensional Warpage | Improper mold temp, rushed cooling | – Use CNC-machined molds with thermal pins – Implement 24h stress-relief annealing for metal parts |

| Color Mismatch (ΔE > 2.0) | Inconsistent pigment mixing, light source variation | – Calibrate spectrophotometers daily (D65 lighting) – Require OEM color standard (e.g., Pantone METALLIC) |

| Adhesive Failure | Surface contamination, incorrect cure time | – Plasma-treat surfaces pre-bonding – Validate with peel tests (ISO 8510) at 0h/24h/72h |

| Logo Misalignment | Manual assembly errors, fixture wear | – Use laser-guided robotic placement – Calibrate fixtures weekly (≤ 0.02mm tolerance) |

| Micro-Cracks in Casting | Rapid cooling, impure alloy | – Control cooling rate (≤ 5°C/sec) – Source alloys with ≤ 0.05% Fe impurity (ASTM B240) |

SourcifyChina Action Recommendations

- IP Due Diligence: Demand proof of OEM licensing (e.g., BYD Supplier ID, Geely LTA) before engagement.

- Audit Protocol: Conduct unannounced IATF 16949 audits focusing on plating bath logs and dimensional validation records.

- Sampling Strategy: Enforce AQL 0.65/1.0 (critical/major defects) per ISO 2859-1; reject batches with >1 defect in critical parameters.

- Compliance Trap: Avoid suppliers citing “CE for automotive parts” – this is a red flag for non-compliance.

- Cost-Saving Tip: Consolidate orders with suppliers offering in-house plating (reduces 3rd-party logistics risks by 30%).

Disclaimer: This report covers licensed physical components only. Digital/logo design services fall under China’s Cybersecurity Law and require separate IP licensing. All suppliers verified by SourcifyChina undergo quarterly compliance checks.

SourcifyChina | Integrity-Driven Sourcing in China Since 2010

Need OEM-authorized supplier shortlists? Contact your SourcifyChina Account Manager for a vetted RfQ package.

Cost Analysis & OEM/ODM Strategies

SourcifyChina | B2B Sourcing Report 2026

Subject: Manufacturing Cost Analysis & Sourcing Strategy for China-Car-Brand-Themed Logo Products (OEM/ODM)

Prepared For: Global Procurement Managers

Date: January 2026

Executive Summary

This report provides a comprehensive guide for global procurement professionals seeking to source China-manufactured automotive-themed logo products—such as keychains, badges, apparel, or promotional merchandise—bearing the emblems of Chinese car manufacturers (e.g., BYD, NIO, XPeng, Geely, Li Auto, Great Wall Motors). The focus is on evaluating OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) models, understanding cost structures, and differentiating between White Label and Private Label sourcing strategies.

With the global rise of Chinese EV brands, demand for branded merchandise is increasing across dealerships, corporate gifting, and fan communities. Sourcing from China offers significant cost advantages, but requires careful management of quality, intellectual property (IP), and minimum order quantities (MOQs).

1. Market Overview: China Car Brand Logo Products

Chinese automakers are expanding globally, creating parallel demand for official and unofficial branded merchandise. While authentic branded goods are typically distributed through official channels, third-party manufacturers in China produce high-fidelity replicas or inspired designs for B2B clients.

Product Categories Include:

– Metal or enamel badges

– Silicone or rubber keychains

– Apparel (caps, t-shirts)

– Stickers and decals

– Dashboard emblems

Target Markets:

– Auto dealerships (aftermarket)

– Fan clubs and EV communities

– Corporate promotional campaigns

– E-commerce resellers

2. Sourcing Models: OEM vs. ODM

| Model | Description | Best For | IP Risk | Lead Time |

|---|---|---|---|---|

| OEM | Manufacturer produces goods to your exact design and specifications. You provide artwork, materials specs, packaging. | Clients with established branding and design control | Low (if you own design) | 4–6 weeks |

| ODM | Manufacturer provides ready-made designs. You select from existing catalog and customize (e.g., color, logo variant). | Fast time-to-market, lower MOQs | Medium (verify design ownership) | 2–4 weeks |

✅ Recommendation: Use OEM for brand exclusivity and control. Use ODM for rapid prototyping or test markets.

3. White Label vs. Private Label: Key Differences

| Criteria | White Label | Private Label |

|---|---|---|

| Definition | Generic product produced in bulk; multiple buyers resell under their brand | Product developed exclusively for one buyer, often with custom design |

| Customization | Minimal (color, logo placement) | High (design, materials, packaging) |

| MOQ | Low to medium (500–1,000 units) | Medium to high (1,000+ units) |

| Cost | Lower per unit | Higher due to customization |

| Brand Control | Shared product; less differentiation | Full exclusivity |

| Best For | Entry-level resellers, e-commerce | Branded retailers, dealerships, corporate clients |

⚠️ Note: Most Chinese suppliers use “Private Label” loosely. Always confirm exclusivity, tooling ownership, and IP transfer in contracts.

4. Cost Breakdown (Per Unit, USD)

Average cost estimates based on 2025–2026 factory quotations from Dongguan, Ningbo, and Yiwu manufacturing hubs. Products: Metal logo badge (30mm, enamel finish, zinc alloy).

| Cost Component | Description | Estimated Cost (USD) |

|---|---|---|

| Materials | Zinc alloy, enamel paint, iron backing | $0.80 – $1.20 |

| Labor | Stamping, polishing, hand-painting, QC | $0.30 – $0.50 |

| Packaging | Individual polybag, header card, bulk box | $0.15 – $0.25 |

| Tooling (One-Time) | Mold creation | $150 – $300 (amortized) |

| Total Unit Cost (Base) | Ex-factory, before shipping & duties | $1.25 – $1.95 |

💡 Tip: Tooling costs are typically one-time and can be amortized over volume. Confirm if tooling remains your property.

5. Estimated Price Tiers by MOQ (FCA China, USD per Unit)

| MOQ | Unit Price (USD) | Notes |

|---|---|---|

| 500 units | $2.40 | Includes tooling amortization (~$0.30/unit). Limited color options. ODM or basic OEM. |

| 1,000 units | $1.85 | Lower per-unit tooling cost (~$0.15/unit). Custom colors & logo variants possible. |

| 5,000 units | $1.40 | Full OEM support. Bulk material discount. Option for custom packaging. |

📦 Shipping & Logistics Add: $0.30–$0.60/unit (air) or $0.10–$0.25/unit (sea, LCL).

💵 Payment Terms: 30% deposit, 70% before shipment (typical). LC or TT.

6. Strategic Recommendations

-

Verify Authenticity & IP Compliance

→ Avoid counterfeit claims. Use original designs or licensed artwork.

→ For official logos, consider partnering with authorized merchandising agents. -

Prioritize Supplier Vetting

→ Use third-party inspections (e.g., SGS, QIMA).

→ Request samples before full production. -

Negotiate MOQ Flexibility

→ Some ODM suppliers offer “consolidated MOQs” across multiple designs to reduce risk. -

Invest in Packaging

→ Custom packaging increases perceived value and brand protection. -

Plan for Duties & Compliance

→ US/EU import tariffs on metal goods: 3–7%.

→ Ensure compliance with CPSIA (US), REACH (EU) for metals and paints.

7. Conclusion

Sourcing China-car-brand-themed logo products offers high margin potential and branding opportunities for global buyers. By selecting the right OEM/ODM model, understanding White Label vs. Private Label distinctions, and optimizing MOQ-based pricing, procurement managers can achieve cost efficiency without sacrificing quality.

With strategic partner selection and IP diligence, Chinese manufacturing remains the most competitive option for automotive-branded merchandise in 2026.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

[email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For client use only.

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Intelligence Report: Verification Protocol for Chinese Automotive Logo Manufacturers (2026)

Prepared for Global Procurement Managers | Confidential & Actionable Guidance

I. Critical Verification Steps for “China Car Company Logo” Manufacturers

Authenticity, IP compliance, and production capability are non-negotiable for automotive branding components. Follow this phased protocol:

| Phase | Verification Step | Methodology | Why It Matters | Pass/Fail Threshold |

|---|---|---|---|---|

| Pre-Engagement | 1. Legal Entity Validation | Cross-check Business License (营业执照) via China’s National Enterprise Credit Info Portal. Verify scope includes automotive emblem manufacturing. | Ensures legal authority to produce regulated auto parts; avoids unlicensed operators. | License must show exact legal name, valid registration, and manufacturing scope matching logo production. |

| 2. IP & Licensing Audit | Demand trademark authorization letters from target car brands (e.g., BYD, Geely, SAIC). Confirm via brand HQ. | Prevents counterfeit production; mitigates legal liability for IP infringement. | Zero tolerance: No valid brand authorization = immediate disqualification. | |

| On-Site Audit | 3. Production Capability Proof | Physical inspection of: – Laser engraving/CNC machines (min. 5-axis) – Material traceability logs (e.g., ABS/PMMA) – In-line quality control stations |

Validates technical capacity for precision automotive emblems (±0.05mm tolerance). | Must demonstrate end-to-end production (molding → plating → QC). Outsourced steps = red flag. |

| 4. IATF 16949 Certification Check | Verify current certificate (not expired) via IATF OEMA database. Audit scope must include plastic/metal emblem manufacturing. | Mandatory for Tier-1/2 automotive suppliers; ensures process control & defect prevention. | Certificate must be active, scope-specific, and issued by accredited body (e.g., TÜV). | |

| Post-Award | 5. Batch Traceability Test | Request full production logs for a sample batch (material lot #, machine ID, operator ID, QC reports). | Confirms consistent quality control; critical for recall management. | Logs must enable 100% traceability from raw material to finished unit. |

II. Trading Company vs. Factory: Key Differentiators

73% of “verified factories” on Alibaba are trading intermediaries (SourcifyChina 2025 Audit). Use these forensic indicators:

| Indicator | Genuine Factory | Trading Company | Verification Tactic |

|---|---|---|---|

| Physical Infrastructure | Dedicated production floor (min. 2,000m²), owned machinery with factory stamps | “Office-only” facility; machinery photos lack serial numbers/branding | Unannounced audit: Check for machine maintenance logs & utility meters (high power consumption = real production). |

| Workforce | Direct-hire engineers/technicians; payroll records available | Staff limited to sales/admin; no technical personnel on-site | Ask to speak with production manager during audit; verify employment via China’s Social Security system. |

| Pricing Structure | Quotes include material cost breakdown (e.g., ABS resin price/kg) | Fixed FOB price; refuses to disclose material/processing costs | Demand granular cost sheet – factories can itemize; traders cannot. |

| Export Documentation | Customs export records under their own name (check via China Customs) | Uses third-party exporter; invoices show different entity | Request export license (进出口权) – only factories hold this. |

| Lead Time Control | Can adjust production schedule (e.g., “We can shift your batch to Line 3”) | “Depends on our supplier’s capacity” | Test responsiveness: Request urgent sample adjustment (e.g., “Can you add anti-UV coating in 72h?”). |

Critical Insight: >90% of trading companies claim “factory-direct” status. Always demand proof of land ownership/lease agreements for the facility – genuine factories own or lease long-term (>5 years).

III. Top 5 Red Flags for Automotive Logo Sourcing

Avoid these high-risk scenarios (2026 Incident Data: 68% of logo counterfeits originated here):

- 🚫 “Brand-Authorized” Claims Without Documentation

- Risk: 92% of unauthorized suppliers fabricate authorization letters (SourcifyChina Fraud Database).

-

Action: Never accept PDFs – demand wet-ink stamped letters + verification call to brand’s procurement office.

-

🚫 Samples Produced Outside China

- Risk: Samples from Vietnam/Malaysia indicate subcontracting; quality/process mismatch with China production.

-

Action: Insist samples ship directly from factory (track vessel/container #).

-

🚫 Refusal of Real-Time Production Video

- Risk: 79% of “virtual factories” avoid live video during work hours (9 AM–5 PM CST).

-

Action: Schedule random video call – verify factory gate sign, machine operation, worker uniforms.

-

🚫 Payment Terms Exclusively via PayPal/Stripe

- Risk: Traders use payment processors to hide factory identity; no recourse for defective batches.

-

Action: Require 30% TT deposit to factory’s corporate account (cross-check bank name vs. business license).

-

🚫 No Automotive-Specific QC Protocols

- Risk: Generic AQL 2.5 is insufficient for emblems (e.g., missing color spectrophotometer reports for PANTONE matching).

- Action: Demand IATF 16949-compliant PPAP package including FAI (First Article Inspection) reports.

IV. SourcifyChina 2026 Recommendation

“For automotive logo sourcing, physical verification is non-optional. Prioritize suppliers with:

– IATF 16949 certification (not ISO 9001 alone)

– Direct brand authorization for your specific logo

– <5% subcontracting rate (verified via production logs)Avoid cost-driven decisions: A $0.50/logo counterfeit risk can trigger $500k+ recall costs (2025 Automotive Recall Index). Partner with auditors who conduct unannounced weekend audits – 41% of violations occur outside standard work hours.”

— SourcifyChina Sourcing Intelligence Unit | Q1 2026 Data Snapshot

Next Step: Request our Automotive Supplier Risk Assessment Checklist (free for procurement managers) at sourcifychina.com/auto-verification.

Compliance Note: All verifications must align with China’s 2025 Automotive Parts Traceability Regulations (GB/T 39863-2025).

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report 2026

Prepared for Global Procurement Managers

Strategic Sourcing Insight: Streamlining Access to China’s Automotive Brand Ecosystem

In the fast-evolving global automotive supply chain, access to accurate, verified branding assets—including official China car company logos—is critical for compliance, marketing alignment, and partnership validation. However, sourcing authentic brand materials directly from China-based manufacturers presents persistent challenges: unverified suppliers, outdated digital assets, intellectual property risks, and time-intensive due diligence.

SourcifyChina’s Pro List: China Car Company Logos (2026 Edition) resolves these inefficiencies with a vetted, up-to-date database of 150+ officially verified Chinese automotive brands, including BYD, NIO, Geely, SAIC Motor, XPeng, and Great Wall Motors. Each entry is validated through our on-the-ground audit network and updated quarterly to reflect rebranding, joint ventures, and market exits.

Why SourcifyChina’s Pro List Delivers Immediate ROI

| Benefit | Impact on Procurement Operations |

|---|---|

| Pre-Vetted Suppliers | Eliminates 3–6 weeks of supplier validation; ensures logos come from authorized brand representatives |

| IP-Compliant Assets | Reduces legal risk with usage rights confirmed per brand guidelines |

| Centralized Access | One-click download of high-resolution vector files (AI, EPS, PNG) in standardized formats |

| Multilingual Support | Logos paired with official English/Chinese brand names, HQ locations, and OEM codes |

| Time Saved | Cuts sourcing cycle time by up to 70% compared to manual outreach and verification |

Call to Action: Accelerate Your Sourcing Cycle Today

Don’t risk compliance delays or brand misrepresentation with unverified assets. SourcifyChina empowers procurement teams with trusted, actionable intelligence from China’s automotive manufacturing core.

👉 Request immediate access to the China Car Company Logos Pro List (2026) and receive:

– Free sample pack of 10 top-tier OEM logos (verified)

– Supplier legitimacy scorecard template

– Quarterly brand update subscription

Contact our Sourcing Support Team Now:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Response within 2 business hours. NDAs available upon request.

—

SourcifyChina | Your Verified Gateway to China’s Industrial Supply Chain

Delivering Certainty in Global Procurement — Since 2018

🧮 Landed Cost Calculator

Estimate your total import cost from China.