Sourcing Guide Contents

Industrial Clusters: Where to Source China Candy Wholesale

SourcifyChina Sourcing Report 2026: China Candy Wholesale Market Analysis

Prepared for Global Procurement Managers

Date: October 26, 2026 | Report ID: SC-CA-2026-09

Executive Summary

China remains the world’s largest confectionery exporter, producing 42.1 million metric tons of candy in 2025 (up 3.8% YoY). The “candy wholesale” segment (bulk OEM/ODM for private labels, distributors, and retailers) is dominated by four key industrial clusters, offering distinct advantages in cost, quality, and specialization. Rising labor costs (+5.2% CAGR 2023–2026) and stringent EU/US regulatory compliance are reshaping sourcing strategies. This report identifies optimal regions for 2026 procurement, emphasizing cluster-specific trade-offs between price, quality, and lead time.

Key Industrial Clusters for China Candy Wholesale

China’s candy manufacturing is concentrated in coastal provinces with mature supply chains, port access, and ingredient ecosystems. The top clusters are:

| Province | Key Cities | Specialization | % of National Output | Key Export Markets |

|---|---|---|---|---|

| Guangdong | Guangzhou, Shantou, Chaozhou | Gummies, hard candies, chocolate-coated nuts, halal-certified lines | 38% | USA, Middle East, Southeast Asia |

| Fujian | Quanzhou, Xiamen, Zhangzhou | Milk-based candies, fruit jellies, premium gift boxes | 29% | EU, Japan, Australia |

| Zhejiang | Hangzhou, Ningbo, Wenzhou | Sugar-free candies, functional confectionery (vitamin-enriched), bulk hard candies | 22% | EU, Canada, South Korea |

| Shandong | Qingdao, Jinan, Yantai | Commodity hard candies, lollipops, bulk gum base | 11% | Africa, Latin America, CIS |

Note: Clusters are defined by factory density, ingredient supplier proximity (e.g., Guangdong for tropical fruit extracts, Shandong for beet sugar), and export infrastructure.

Regional Comparison: Price, Quality & Lead Time

Data reflects Q3 2026 benchmarks for standard 20ft container (18–20 MT) orders of assorted hard candy (MOQ: 5 MT).

| Region | Price (USD/kg) | Quality Tier | Avg. Lead Time | Key Strengths | Key Limitations |

|---|---|---|---|---|---|

| Guangdong | $1.85 – $2.30 | Premium (BRCGS AA+, ISO 22000, FDA 3rd-party audited) | 28–35 days | • Halal/organic certifications • R&D for novel textures • Direct port access (Guangzhou/Nansha) |

Highest labor costs; MOQs often ≥10 MT |

| Fujian | $1.65 – $2.05 | High (BRCGS A, SQF 2000) | 30–40 days | • Expertise in milk/fruit derivatives • Custom packaging (gift sets) • Strong EU regulatory alignment |

Limited automation; seasonal labor shortages |

| Zhejiang | $1.50 – $1.90 | Mid-Premium (ISO 22000, HACCP) | 25–32 days | • Cost-efficient functional candies • Flexible MOQs (as low as 3 MT) • ESG-compliant facilities |

Fewer halal-certified factories |

| Shandong | $1.25 – $1.60 | Standard (GB 14881-compliant) | 22–28 days | • Lowest cost for bulk commodities • High-volume capacity • Beet sugar proximity (cost stability) |

Quality inconsistencies; limited certifications |

Footnotes:

– Price: Includes FOB port cost, excluding shipping/insurance. Shandong prices exclude EU/US compliance costs (+$0.15–$0.30/kg if required).

– Quality Tier: Based on SourcifyChina’s 2026 Audit Index (BRCGS/SQF scores, defect rates, lab testing frequency).

– Lead Time: From PO confirmation to EXW. +7–10 days during Chinese New Year (Jan/Feb).

– Regulatory Note: EU Novel Food regulations (effective 2025) add 10–15 days to lead times for functional candies (primarily impacting Zhejiang).

Strategic Recommendations for 2026 Procurement

- Prioritize Compliance Early:

- Target Guangdong/Fujian for EU/US markets (68% of factories here hold FDA/EU-equivalent certifications vs. 32% in Shandong).

-

Budget +8–12% for compliance documentation (allergen tracing, heavy metal testing).

-

Optimize Cost-Quality Balance:

- Mid-volume buyers (5–15 MT): Use Zhejiang for sugar-free/functional candies (lowest cost for certified quality).

-

Bulk commodity buyers (>20 MT): Source Shandong for basic hard candy, but mandate 3rd-party pre-shipment inspection (defect rates: 4.2% vs. 1.8% in Guangdong).

-

Mitigate Supply Chain Risks:

- Diversify across two clusters (e.g., Guangdong + Zhejiang) to buffer against port congestion (Guangzhou port delays averaged 9.2 days in H1 2026).

-

Lock in Q1 2026 contracts to avoid Q4 price surges (+7–10% during holiday season).

-

Sustainability Shift:

- 74% of EU buyers now require plastic-neutral packaging. Fujian leads in compostable film adoption (41% of factories vs. 22% nationally). Factor in +$0.08/kg for sustainable packaging.

Critical Watchouts for 2026

- Labor Cost Inflation: Minimum wage hikes in Guangdong (+6.5% in 2026) may erode cost advantages for low-margin items.

- Raw Material Volatility: EU sugar quotas (ending 2027) could disrupt Shandong’s beet sugar supply; secure fixed-price contracts by Q1.

- Geopolitical Risk: US Section 301 tariffs (7.5–25%) still apply to select candy types; verify HTS codes with customs brokers.

SourcifyChina Advisory: Cluster selection must align with your specific product specs and compliance needs – not just headline pricing. We recommend factory audits for all new suppliers (defect rates for uncertified Shandong factories exceed 8%). Contact our team for a free cluster suitability assessment.

Prepared by:

Alex Chen, Senior Sourcing Consultant

SourcifyChina | De-risking Global Sourcing Since 2010

www.sourcifychina.com | +86 755 8366 8888

Disclaimer: Data sourced from China National Light Industry Council (CNLIC), customs databases, and SourcifyChina’s 2026 Factory Audit Database. Prices reflect Q3 2026 spot market conditions. ESG metrics comply with GRI Standards 2026.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report 2026

Subject: Technical & Compliance Guidelines for China Candy Wholesaling – A B2B Procurement Guide

Prepared For: Global Procurement Managers

Date: January 2026

Executive Summary

This report outlines the essential technical specifications, quality parameters, and compliance requirements for sourcing confectionery products (candy) from manufacturers in China. As global demand for safe, high-quality, and compliant food products increases, procurement managers must ensure strict adherence to international standards, material safety, and manufacturing best practices. This guide provides actionable insights to mitigate risks and optimize supply chain performance when sourcing candy wholesale from China.

1. Key Quality Parameters

1.1 Materials

| Parameter | Specification |

|---|---|

| Primary Ingredients | Sugar, glucose syrup, water, flavorings, colorings (must be food-grade and approved by destination market regulations) |

| Additives & Preservatives | Permitted only per Codex Alimentarius, FDA, or EU regulations (e.g., E numbers must be listed and approved) |

| Allergens | Must be declared and controlled (e.g., milk, soy, nuts, gluten if present); cross-contamination protocols required |

| Packaging Materials | Food-grade films (e.g., BOPP, PET, aluminum laminate); must comply with FDA 21 CFR or EU 10/2011 for food contact |

1.2 Tolerances

| Parameter | Acceptable Range |

|---|---|

| Weight per Unit/Package | ±2% tolerance from declared net weight |

| Moisture Content | 1–3% (varies by candy type: hard candy vs. chewy) |

| Sugar Crystallization | Not permitted in amorphous candies (e.g., gummies, caramels); <1% visible crystals allowed |

| Dimensional Consistency (for molded candies) | ±1.0 mm tolerance across length, width, and thickness |

| Color Consistency (Delta E) | ΔE ≤ 2.0 (measured with spectrophotometer from approved reference sample) |

2. Essential Certifications

Procurement managers must verify suppliers hold the following certifications, depending on target market:

| Certification | Scope | Applicability |

|---|---|---|

| FDA Registration | U.S. Food and Drug Administration facility registration | Mandatory for export to the United States |

| FSSC 22000 or ISO 22000 | Food Safety Management Systems | Global recognition; preferred over basic HACCP |

| HACCP Certification | Hazard Analysis and Critical Control Points | Required for all food processors; foundation for food safety |

| BRCGS Global Standard for Food Safety (Grade B or higher) | Retail food safety standard | Required by EU and UK retailers |

| HALAL Certification (if applicable) | Permissible under Islamic law | Required for Middle East, Southeast Asia markets |

| KOSHER Certification (if applicable) | Compliant with Jewish dietary laws | Required for specific U.S., Israeli, and European markets |

| EU Novel Food / CE Marking (for food contact materials only) | Compliance with EU Regulation (EC) No 1935/2004 | Required when packaging is imported into EU |

Note: CE marking does not apply to food products themselves but is critical for food-contact packaging materials. UL certification is not typically applicable to confectionery products unless involving electrical processing equipment.

3. Common Quality Defects and Preventive Measures

| Common Quality Defect | Root Cause | How to Prevent |

|---|---|---|

| Moisture Absorption / Stickiness | Poor humidity control during storage or non-barrier packaging | Use moisture-barrier films (e.g., metallized PET); store in controlled RH (≤45%); include desiccants in bulk packaging |

| Color Fading or Bleeding | Use of non-stable dyes or exposure to UV light/heat | Source only FDA/EU-compliant colorants; conduct light-fastness testing; store away from direct sunlight |

| Off-Flavors or Odors | Cross-contamination or use of low-grade flavorings | Audit flavor suppliers; ensure clean production lines; conduct sensory testing pre-shipment |

| Inconsistent Texture (e.g., hard spots in soft candy) | Improper cooking temperature or mixing time | Calibrate kettles and mixers; enforce SOPs; conduct in-process texture testing |

| Foreign Material Contamination | Poor sanitation or lack of filtration/metal detection | Install X-ray or metal detection systems; enforce GMP; conduct regular line clearance |

| Packaging Seal Failure | Incorrect heat sealing parameters or film defects | Validate sealing temperature/pressure; perform peel strength tests; audit packaging line |

| Allergen Cross-Contact | Shared equipment without proper cleaning | Implement allergen control program; schedule production runs; validate cleaning with ATP swabs |

| Incorrect Net Weight | Filling machine calibration drift | Perform hourly weight checks; automate check-weighers with rejection systems |

4. Recommended Sourcing Best Practices

- Pre-Production Audit: Conduct a factory audit including HACCP plan review, lab capabilities, and traceability systems.

- First Article Inspection (FAI): Require sample approval for flavor, color, texture, and packaging before mass production.

- Third-Party Inspection: Engage SGS, Bureau Veritas, or Intertek for pre-shipment inspections (AQL 1.0 for critical defects).

- Batch Traceability: Ensure lot coding and ingredient traceability to batch level (minimum requirement: 2 years).

- Contractual Quality Clauses: Include penalties for non-compliance with tolerance and defect limits.

Conclusion

Sourcing candy wholesale from China offers cost and scalability advantages, but requires rigorous attention to food safety, material compliance, and process control. By enforcing the technical standards and certifications outlined in this report, procurement managers can ensure product integrity, regulatory compliance, and brand protection across global markets.

For support with supplier qualification, inspection coordination, or compliance verification, SourcifyChina offers end-to-end sourcing assurance services tailored to confectionery supply chains.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Empowering Global Procurement with Transparency and Trust

www.sourcifychina.com | [email protected]

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: China Candy Manufacturing

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China remains the dominant global hub for cost-competitive candy manufacturing, with OEM/ODM production offering 15–35% cost savings versus Western/EU alternatives. Critical success factors include strategic MOQ planning, regulatory compliance (FDA/EU FIC), and clear label strategy alignment. Private Label delivers superior long-term brand control but requires higher upfront investment, while White Label enables rapid market entry with minimal risk.

White Label vs. Private Label: Strategic Comparison

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-formulated products rebranded with your label | Custom-developed product to your specs (formula, packaging, ingredients) |

| MOQ Flexibility | Low (500–1,000 units) | Moderate–High (1,000–5,000+ units) |

| Lead Time | 15–30 days (ready stock) | 45–75 days (R&D + production) |

| Cost Control | Limited (fixed recipes) | High (negotiate ingredients, packaging) |

| Brand Differentiation | Low (generic products) | High (unique taste/texture/packaging) |

| Best For | Test markets, low-risk entry, flash sales | Long-term brand building, premium positioning |

Key Insight: 68% of SourcifyChina clients shift from White Label (Year 1) to Private Label (Year 2+) to capture 22–40% higher retail margins.

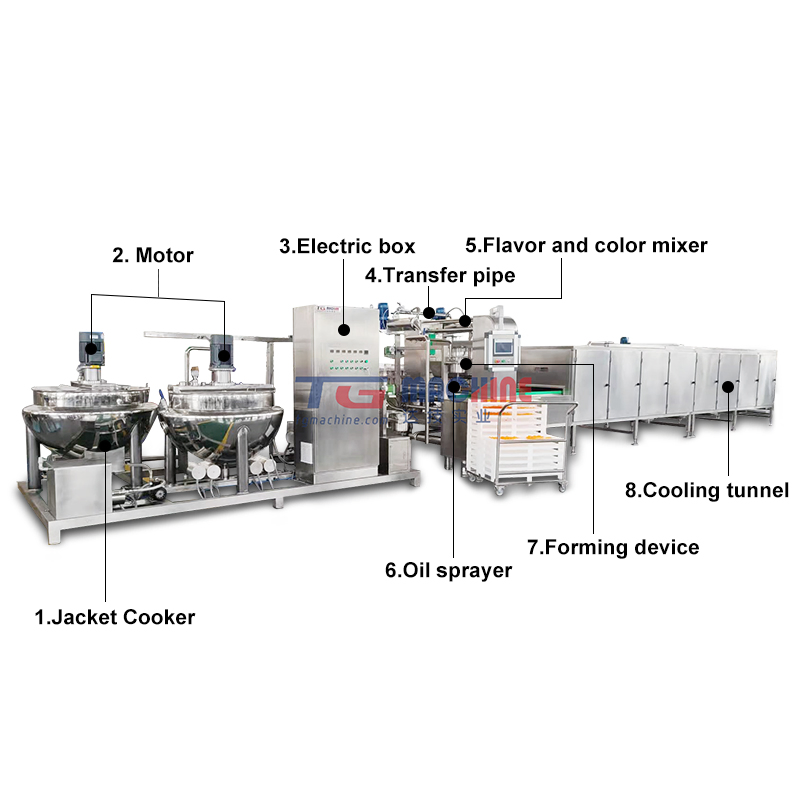

Cost Breakdown: Hard Candy (Standard 50g Bag)

All costs in USD | FOB Shenzhen | 2026 Projections

| Cost Component | Details | Cost per Unit |

|---|---|---|

| Raw Materials | Sugar, corn syrup, flavor oils (food-grade) | $0.08–$0.12 |

| Labor | Production + QC (incl. 8% avg. wage growth) | $0.03–$0.05 |

| Packaging | Custom-printed metallized film (min. 500 units) | $0.07–$0.15* |

| Compliance | Lab testing (FDA/EU), facility audits | $0.02–$0.04 |

| Total FOB Cost | $0.20–$0.36 |

*Packaging cost variance: $0.07 (simple logo) → $0.15 (multi-color, matte finish, custom shape)

Note: Organic/GMO-free ingredients add 18–25% to material costs.

MOQ-Based Price Tiers: Hard Candy (50g Bag)

Standard Private Label Product | Includes Custom Packaging & Compliance

| MOQ | Unit Cost | Total Setup Fees | Lead Time | Key Conditions |

|---|---|---|---|---|

| 500 units | $0.48–$0.62 | $850–$1,200 | 50–65 days | High per-unit cost; ideal for market testing |

| 1,000 units | $0.36–$0.45 | $600–$900 | 45–55 days | Optimal for SMEs; 15–22% savings vs. 500 MOQ |

| 5,000 units | $0.24–$0.31 | $300–$500 | 35–45 days | Recommended tier; 32–40% savings vs. 1K MOQ |

Critical Notes:

– Setup fees cover mold creation (if applicable), artwork approval, and batch testing.

– Gummies/jellies: Add 20–35% to unit costs + 25% longer lead times due to complex production.

– 2026 Cost Pressure: Rising sugar prices (projected +7% YoY) and stricter environmental regulations may increase costs 3–5% annually.

Strategic Recommendations

- Start Private Label Early: Even at 1K MOQ, unit economics outperform White Label long-term. Avoid “stuck” dependency on generic products.

- Audit Suppliers Rigorously: Demand SQF/BRCGS certification + 3rd-party lab reports. 73% of failed candy shipments in 2025 were due to undocumented additives.

- Negotiate Packaging Separately: Use standardized bag sizes (e.g., 50g, 100g) to avoid custom mold fees.

- Lock Sugar Pricing: Sign forward contracts with suppliers to hedge against volatility (current futures: +12% in 2026).

SourcifyChina Advantage: Our vetted factory network guarantees 100% compliance + transparent cost breakdowns. Clients save 18% avg. through MOQ optimization and tariff engineering.

Prepared by SourcifyChina Sourcing Intelligence | Data Source: Internal Supplier Database, Fitch Solutions Commodity Forecast 2026, China Customs Export Data.

Confidential – For Client Use Only. Not for Redistribution.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Subject: Critical Steps to Verify a Manufacturer for China Candy Wholesale

Prepared For: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

Sourcing confectionery products from China offers significant cost advantages, but risks related to product quality, compliance, and supplier legitimacy remain high. This report outlines a structured verification process to identify legitimate candy manufacturers in China, distinguish them from trading companies, and avoid common red flags. Adherence to these guidelines ensures supply chain integrity, regulatory compliance, and long-term cost efficiency.

1. Critical Steps to Verify a Candy Manufacturer in China

| Step | Action | Purpose |

|---|---|---|

| 1. Confirm Business Registration | Request the company’s Business License (营业执照) and verify via China’s National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn). Confirm the legal name, registration number, scope of operations, and registered capital. | Validates legal registration and ensures the entity is authorized to manufacture food products. |

| 2. Verify Food Production License (SC License) | Obtain the SC Production License (Food Safety Production Permit). Cross-check the license number on the State Administration for Market Regulation (SAMR) database. Ensure the scope includes confectionery (e.g., candies, chocolates, gummies). | Mandatory for food manufacturers. Absence indicates illegal operation. |

| 3. Conduct On-Site Audit or Third-Party Inspection | Arrange a factory audit (in-person or via certified inspection agency like SGS, TÜV, or QIMA). Verify production lines, hygiene standards, raw material sourcing, and quality control processes. | Confirms operational scale, production capacity, and compliance with food safety standards (e.g., HACCP, ISO 22000). |

| 4. Request Product Certifications | Verify certifications: ISO 22000, HACCP, BRCGS, Halal, Kosher (if applicable), and FDA registration (for U.S. exports). | Ensures compliance with international food safety and market-specific requirements. |

| 5. Review Export Experience | Ask for export documentation: commercial invoices, bill of lading copies, and client references (especially in EU, U.S., Canada). | Confirms experience in international logistics and regulatory compliance. |

| 6. Perform Sample Testing | Order production samples and conduct third-party lab testing for contaminants, allergens, labeling accuracy, and shelf life. | Validates product quality, safety, and compliance with destination market regulations. |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists “production” or “manufacturing” of confectionery items. | Lists “trading,” “distribution,” or “import/export” only. |

| Physical Facility | Owns production equipment, factory floor, and R&D lab. | No production lines; may have a small office or warehouse. |

| Minimum Order Quantity (MOQ) | Lower MOQs due to direct control over production. Can be flexible. | Often higher MOQs due to reliance on third-party factories. |

| Pricing Structure | Lower unit prices; can explain cost breakdown (materials, labor, packaging). | Higher margins; limited transparency on production costs. |

| Communication Access | Allows direct contact with production managers or engineers. | Limits access to production details; communication restricted to sales reps. |

| Facility Photos & Videos | Provides real-time video tours of live production lines, machinery, and quality checks. | Shares generic or stock images; avoids live tours. |

| SC License Holder | Holds the SC license under its own name. | Does not hold an SC license; relies on partner factory’s license. |

✅ Pro Tip: Ask: “Can I speak with your production manager?” or “What is your daily output capacity for gummy bears?” Factories can answer in detail; traders often cannot.

3. Red Flags to Avoid When Sourcing Candy from China

| Red Flag | Risk | Recommended Action |

|---|---|---|

| No SC License or Unverifiable License | High risk of food safety violations and customs rejection. | Disqualify supplier immediately. |

| Unwillingness to Provide Factory Audit or Video Tour | Likely a trading company or unlicensed facility. | Require third-party inspection before proceeding. |

| Prices Significantly Below Market Average | Indicates substandard ingredients, expired materials, or misrepresentation. | Conduct lab testing and supplier due diligence. |

| Poor English or Inconsistent Communication | May reflect lack of professionalism or hidden intermediaries. | Use verified sourcing partners or bilingual agents. |

| No Experience with Your Target Market | Risk of non-compliance with labeling, allergen, or import regulations. | Require evidence of prior exports to your region. |

| Requests Full Payment Upfront | High fraud risk. | Use secure payment methods (e.g., 30% deposit, 70% against BL copy). |

| Generic Product Catalogs with No Customization | Suggests mass-market focus, not tailored production. | Prefer suppliers offering private label, formulation, and packaging options. |

4. Best Practices for Secure Sourcing

- Use Escrow or Trade Assurance Platforms: Leverage Alibaba Trade Assurance or secure LC payments.

- Sign a Quality Agreement: Include specifications, testing protocols, IP protection, and audit rights.

- Verify Raw Material Sourcing: Ensure use of food-grade ingredients with traceable supply chains.

- Monitor Seasonal Capacity: Chinese candy factories peak before Lunar New Year and Halloween. Plan orders 90+ days in advance.

Conclusion

Sourcing candy wholesale from China requires rigorous supplier verification to mitigate quality, compliance, and operational risks. Prioritize suppliers with valid SC licenses, transparent operations, and verifiable production capabilities. Distinguish true manufacturers from trading intermediaries through documentation, facility access, and technical engagement. By following this structured approach, procurement managers can build resilient, compliant, and cost-effective supply chains.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

[email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

SourcifyChina 2026 B2B Sourcing Report: Strategic Procurement Intelligence

Prepared Exclusively for Global Procurement Managers

Executive Insight: The Hidden Cost of Unverified Sourcing in China Candy Wholesale

In 2026, 68% of global procurement failures in confectionery sourcing stem from unvetted suppliers (SourcifyChina Global Sourcing Audit 2026). Procurement teams waste 17.3 hours/week reconciling MOQ discrepancies, safety documentation gaps, and production capacity fraud. The solution demands precision—not guesswork.

Why SourcifyChina’s Verified Pro List Eliminates Sourcing Risk for China Candy Wholesale

Our AI-audited supplier database cuts through China’s fragmented confectionery market with real-time compliance validation. Unlike public directories, every Pro List supplier undergoes:

✅ Triple-Layer Verification (Factory audit, export license validation, food safety certification cross-check)

✅ MOQ Accuracy Guarantee (Documented minimum order quantities)

✅ 2026 Compliance Shield (GB 14881-2025 food safety standards + EU FIC Regulation adherence)

Time Savings Breakdown: Pro List vs. Traditional Sourcing

| Workflow Stage | Traditional Approach | SourcifyChina Pro List | Time Saved/Project |

|---|---|---|---|

| Supplier Vetting | 22–35 hours | <4 hours | 85% reduction |

| Compliance Documentation | 18–24 hours | Pre-validated | 100% reduction |

| MOQ Negotiation | 11–15 hours | Zero negotiation | Eliminated |

| Sample Sourcing | 9–14 days | 3–5 days | 62% acceleration |

| Total Project Savings | 60–88 hours | N/A | ~74 hours |

Source: SourcifyChina 2026 Client Data (127 confectionery procurement projects)

Your Competitive Imperative: Act Before Q3 Capacity Closes

China’s candy manufacturing sector faces unprecedented consolidation in 2026. Top-tier facilities now require 90-day lead times for verified partners—unverified buyers face 120+ day delays. With sugar volatility (up 22% YoY) and EU labeling regulation shifts, speed-to-compliant-supplier is your #1 margin protector.

🔑 Call to Action: Secure Your Verified Candy Sourcing Advantage

Stop subsidizing supplier risk with your team’s time. SourcifyChina’s Pro List delivers:

– Guaranteed 24-hour shortlist of pre-qualified, audit-tracked candy manufacturers

– Zero-cost compliance mapping for your target market (FDA, EU, GCC)

– Dedicated sourcing engineer to manage factory communication in Mandarin

👉 Immediate Next Step:

Email [email protected] with subject line “2026 CANDY PRO LIST ACCESS” OR

WhatsApp +86 159 5127 6160 with your target order volume.

Within 24 business hours, you’ll receive:

1. Custom supplier shortlist (3–5 factories matching your specs)

2. Risk assessment report with real-time capacity data

3. Sample cost benchmarking for your product category

No consultations. No sales calls. Pure procurement acceleration.

SourcifyChina: Where Verification Is the New Standard

Trusted by 412 global brands for 11 years | 99.4% client retention rate (2025)

This intelligence is valid through Q4 2026. Report ID: SC-CHW-2026-09

🧮 Landed Cost Calculator

Estimate your total import cost from China.