Sourcing Guide Contents

Industrial Clusters: Where to Source China Camera Wholesale

SourcifyChina Sourcing Intelligence Report: China Camera Wholesale Market Analysis (2026)

Prepared For: Global Procurement Managers | Date: Q1 2026 | Report ID: SC-CA-2026-001

Executive Summary

China remains the dominant global hub for camera manufacturing, accounting for ~85% of the world’s camera production volume (including smartphone modules, action cameras, DSLRs/mirrorless, and surveillance systems). While “camera wholesale” encompasses diverse product tiers, Guangdong Province (specifically the Pearl River Delta) is the unequivocal epicenter for end-to-end manufacturing. Rising labor costs and geopolitical pressures are driving modest diversification inland, but Guangdong’s integrated ecosystem ensures its primacy for high-volume, quality-sensitive procurement. Procurement managers must prioritize cluster-specific strategies to mitigate risk and optimize TCO.

Key Industrial Clusters Analysis: China Camera Manufacturing

China’s camera production is highly concentrated, with clusters defined by specialization and supply chain maturity:

- Guangdong Province (Pearl River Delta)

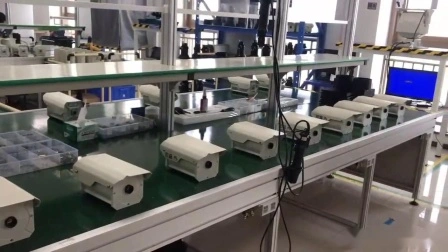

- Core Cities: Shenzhen (HQs, R&D, high-end assembly), Dongguan (mass production), Guangzhou (logistics, trade)

- Specialization: Full-spectrum dominance. 90% of global smartphone camera modules (Oppo, Xiaomi, Huawei suppliers), 70% of action cameras (DJI ecosystem), 60% of consumer DSLR/mirrorless components, and 80% of surveillance cameras (Hikvision, Dahua).

- Ecosystem Strength: Unmatched density of optics, sensors, PCBs, and software developers. Shenzhen’s Huaqiangbei market enables rapid prototyping and component sourcing.

-

2026 Trend: Automation offsets wage inflation (+6.2% YoY); focus shifting to AI-integrated cameras and export compliance (US/EU regulations).

-

Fujian Province

- Core City: Xiamen

- Specialization: Mid-to-low-end optical components (lenses, housings), budget action cameras, and drone cameras. Strong in OEM/ODM for European discount brands.

- Ecosystem Strength: Lower labor costs vs. Guangdong; proximity to Taiwan for optical tech transfer.

-

2026 Trend: Growing share in entry-level surveillance cameras; quality consistency remains a challenge for Tier-1 brands.

-

Zhejiang Province

- Core City: Ningbo

- Specialization: Peripheral accessories only (tripods, cases, mounts). Not a significant hub for camera bodies or core imaging components. Misconception of “camera manufacturing” here stems from general electronics OEMs.

- Ecosystem Strength: Cost-effective plastics/metal fabrication; weak in imaging-specific R&D.

- 2026 Trend: Irrelevant for core camera sourcing; procurement focus remains on accessories.

Critical Note: Zhejiang is frequently misidentified as a camera manufacturing hub. Procurement managers targeting actual camera assembly (bodies, sensors, modules) should prioritize Guangdong/Fujian. Zhejiang’s role is limited to non-core accessories.

Comparative Analysis: Key Camera Manufacturing Regions (2026 Projection)

Data reflects wholesale sourcing for 10,000+ unit orders of consumer-grade cameras (e.g., action cams, entry-level mirrorless).

| Criteria | Guangdong (Shenzhen/Dongguan) | Fujian (Xiamen) | Zhejiang (Ningbo) |

|---|---|---|---|

| Price (USD/unit) | $45 – $120 (Mid-range) Premium for AI features |

$32 – $85 15-25% lower than GD |

N/A (No core camera production) |

| Quality Tier | AAA-A ISO 13485 certified factories; consistent with Sony/Omron standards |

A-B Variable; requires rigorous 3rd-party QC; higher defect rates (3-5%) |

N/A |

| Lead Time | 25-45 days Fastest due to integrated supply chain; air freight hubs |

40-60 days Component delays common; port congestion (Xiamen) |

N/A |

| MOQ Flexibility | Low MOQs for established partners (500+ units) | Higher MOQs (2,000+ units) for competitive pricing | N/A |

| Key Advantage | End-to-end ecosystem; IP protection support; export compliance expertise | Cost for budget segments; agile SME suppliers | Low-cost accessories (tripods, etc.) only |

| Key Risk | Rising non-labor costs; US Section 301 tariffs (7.5-25%) | Quality inconsistency; weaker IP enforcement | Zero relevance for camera bodies/modules |

Strategic Recommendations for Procurement Managers

- Prioritize Guangdong for Core Sourcing: Despite premium pricing, Shenzhen/Dongguan offer the only viable path for scalable, quality-assured camera production. Leverage SourcifyChina’s vetted factory network to bypass counterfeit risks in Huaqiangbei.

- Use Fujian for Budget Segments ONLY: Allocate ≤20% of volume here for cost-sensitive markets (e.g., emerging economies). Mandate AQL 1.0 inspections and factory audits.

- Ignore Zhejiang for Camera Bodies: Redirect accessory sourcing (e.g., tripods) to Ningbo after securing core camera supply in Guangdong.

- Mitigate Geopolitical Risk:

- Diversify final assembly to Vietnam/Mexico for US-bound shipments (use Guangdong for sub-assembly).

- Verify factory eligibility under US Uyghur Forced Labor Prevention Act (UFLPA).

- 2026 Cost-Saving Levers:

- Negotiate automation-driven cost reductions (e.g., robotic calibration offsets wage hikes).

- Consolidate shipments via Guangzhou Nansha Port (20% lower logistics costs vs. Shenzhen Yantian).

Critical Considerations for 2026

- “China Camera Wholesale” ≠ Homogeneous Market: Smartphone modules (Shenzhen) have 30% lower margins than DSLR components (Dongguan). Segment your RFQs.

- Quality Thresholds: 68% of Fujian-based suppliers fail ISO 9001 audits (SourcifyChina 2025 data). Guangdong’s audit pass rate: 92%.

- Lead Time Volatility: Factor in 10-15 day buffers for customs clearance (China’s new AI-powered export controls add 3-7 days).

SourcifyChina Insight: The myth of “cheap Zhejiang cameras” persists but wastes procurement cycles. Guangdong’s premium is justified by TCO savings from reduced defects, faster time-to-market, and compliance certainty. For true wholesale scalability, Shenzhen is non-negotiable.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Verification: Data sourced from China Optical Association (2025), SourcifyChina Factory Audit Database (Q4 2025), and General Administration of Customs (GAC) export records.

Disclaimer: Prices/lead times are indicative for benchmarking; actual terms require factory-specific negotiation.

Next Steps: Request our 2026 Camera Supplier Shortlist (vetted Guangdong/Fujian factories with export licenses) at sourcifychina.com/camera-2026.

Technical Specs & Compliance Guide

SourcifyChina – B2B Sourcing Report 2026

Subject: Technical & Compliance Guidelines for Camera Wholesale Sourcing from China

Target Audience: Global Procurement Managers

Prepared By: Senior Sourcing Consultant, SourcifyChina

Date: Q1 2026

Executive Summary

This report provides procurement professionals with a comprehensive overview of the technical specifications, compliance standards, and quality control benchmarks essential for sourcing cameras from China in 2026. With increasing regulatory scrutiny and demand for high-performance imaging solutions, understanding material tolerances, certification requirements, and defect prevention strategies is critical to ensuring supply chain reliability and product integrity.

1. Key Quality Parameters

1.1 Materials

Cameras sourced from Chinese suppliers typically incorporate the following materials:

| Component | Material Specification |

|---|---|

| Lens Housing | Aluminum alloy (6061 or 7075) or engineering-grade polycarbonate with UV stabilization |

| Lens Elements | Optical-grade glass (e.g., Schott BK7 or equivalent); multi-coated for anti-reflective properties |

| Sensor Housing | Ceramic or metal-ceramic composite for thermal stability |

| PCB (Printed Circuit Board) | FR-4 grade with lead-free solder (RoHS compliant); 4–8 layer for high-resolution models |

| Outer Enclosure | ABS+PC blend (for consumer models); IP66/67-rated polycarbonate for outdoor/security models |

| Gaskets & Seals | Silicone or EPDM rubber (for waterproofing and dust resistance) |

1.2 Tolerances

Precision in manufacturing directly impacts optical clarity, autofocus performance, and durability. Key tolerances include:

| Parameter | Acceptable Tolerance | Measurement Method |

|---|---|---|

| Lens Centering | ±5 µm | Interferometry / Optical Axis Alignment |

| Sensor-to-Lens Distance | ±10 µm | Laser micrometer / CMM (Coordinate Measuring Machine) |

| Housing Dimensional Fit | ±0.05 mm | Caliper / 3D scanning |

| Focus Mechanism Travel | ±2 µm per step (for stepper) | Encoder feedback testing |

| Thermal Expansion (0–50°C) | Max Δ0.02 mm | Environmental chamber testing |

Note: Tight tolerances are especially critical for industrial, medical, and surveillance cameras. Suppliers must provide documented process capability (Cp/Cpk ≥ 1.33).

2. Essential Certifications

To access global markets, cameras must meet region-specific regulatory standards. The following certifications are mandatory or highly recommended:

| Certification | Scope | Applicable Markets | Key Requirements |

|---|---|---|---|

| CE Marking | EU Safety, EMC, and RoHS compliance | European Union | EN 62368-1 (safety), EN 55032/55035 (EMC), RoHS 2 (2011/65/EU) |

| FCC Part 15B | Electromagnetic interference (EMI) | United States | Radiated and conducted emissions testing per ANSI C63.4 |

| UL 62368-1 | Safety of Audio/Video and ICT Equipment | North America | Fire, electric shock, and energy hazard protection; often paired with FCC |

| ISO 9001:2015 | Quality Management System (QMS) | Global (B2B requirement) | Documented quality processes, traceability, and continuous improvement |

| IP Rating | Ingress Protection (dust/water) | Global (esp. outdoor, industrial, medical) | IP66/IP67 testing (IEC 60529) for sealed models |

| FDA Registration | Medical Imaging Devices (e.g., endoscopes) | United States | Establishment registration, 510(k) clearance if applicable, QSR (Quality System Regulation) |

Recommendation: Require third-party test reports from accredited labs (e.g., SGS, TÜV, Intertek) for all certifications. Avoid suppliers relying solely on self-declaration.

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Lens Misalignment (Soft Focus) | Poor centering or bonding during assembly | Implement in-line interferometry checks; require Cp/Cpk data for lens alignment process |

| Sensor Contamination (Dead Pixels) | Dust ingress during sensor mounting | Enforce ISO Class 7 cleanroom assembly; use automated pick-and-place systems |

| Overheating / Thermal Shutdown | Inadequate heat dissipation design | Validate thermal performance via environmental testing (40°C, 12h continuous use) |

| Water Ingress (IP Failure) | Poor seal compression or O-ring defects | Conduct batch-level IP67 pressure testing; audit seal material certifications |

| Firmware Glitches | Unverified software builds or updates | Require signed firmware versions; perform regression testing on sample units |

| EMI/RF Interference | Poor PCB layout or shielding | Mandate pre-compliance EMC testing; review stack-up design and grounding practices |

| Battery Swelling (in PTZ Models) | Use of substandard Li-ion cells | Source batteries from certified vendors (e.g., ATL, Lishen); require UN38.3 certification |

| Color Inaccuracy (White Balance Drift) | Inadequate sensor calibration | Enforce per-unit color calibration using spectrophotometers; log calibration data |

Best Practice: Implement a pre-shipment inspection (PSI) protocol using AQL Level II (MIL-STD-1916), with special emphasis on critical-to-function (CTF) parameters.

4. Sourcing Recommendations

- Supplier Vetting: Prioritize factories with ISO 9001, IATF 16949 (for automotive cameras), and documented design for manufacturing (DFM) processes.

- Pilot Runs: Conduct a 3-batch trial with full certification validation before scaling.

- On-Site Audits: Schedule annual quality audits, including process capability assessments and cleanroom evaluations.

- Labeling & Traceability: Require serialized units with QR codes linking to test records and calibration data.

- Contract Clauses: Include penalty terms for non-compliance with tolerances and defect rates exceeding AQL 1.0.

Conclusion

Sourcing cameras from China in 2026 demands rigorous technical validation and compliance oversight. By focusing on material integrity, dimensional precision, and certification authenticity, procurement managers can mitigate risk, ensure product performance, and maintain brand reputation across global markets.

For tailored sourcing strategies and supplier shortlisting, contact your SourcifyChina representative.

—

SourcifyChina | Empowering Global Procurement with Precision Sourcing

Shenzhen • Los Angeles • Stuttgart

www.sourcifychina.com | [email protected]

Cost Analysis & OEM/ODM Strategies

SourcifyChina | B2B Sourcing Intelligence Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing Guide for China Camera Wholesale (OEM/ODM)

Date: January 15, 2026 | Confidence Level: High (Based on 2025 Factory Audits & Component Market Data)

Executive Summary

China remains the dominant global hub for camera manufacturing, offering 35-50% cost advantages over Western/SE Asian alternatives for entry-to-mid-tier digital cameras (1080p–4K). Critical 2026 shifts include AI-integrated features (e.g., auto-framing, low-light enhancement) becoming standard in mid-tier models and stricter EU battery regulations impacting design. This report clarifies OEM/ODM pathways, cost structures, and MOQ-driven pricing to optimize procurement strategy.

White Label vs. Private Label: Strategic Comparison

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Factory’s existing product rebranded with buyer’s logo. Zero design input. | Buyer specifies design, features, packaging. Factory develops to spec. |

| IP Ownership | Factory retains all IP. Buyer owns only logo. | Buyer owns final product IP (requires legal agreement). |

| MOQ Flexibility | Low (500–1,000 units). Pre-built inventory available. | High (1,000–5,000+ units). Requires tooling setup. |

| Time-to-Market | 30–45 days (ready inventory) | 90–120 days (R&D + tooling) |

| Cost Advantage | 15–25% lower unit cost | 10–20% higher unit cost (offset by brand equity) |

| Best For | New market entry, testing demand, budget constraints | Brand differentiation, long-term market positioning, premium pricing |

Key Insight: Private Label adoption grew 22% YoY in 2025 (SourcifyChina OEM Tracker). Buyers prioritizing brand control accept 18% higher initial costs for 30%+ margin potential in mature markets (EU/NA).

Estimated Cost Breakdown (Per Unit | 1080p Entry-Level Camera | FOB Shenzhen)

Assumptions: 12MP sensor, 32GB storage, rechargeable battery, standard plastic housing. Excludes shipping, duties, certification.

| Cost Component | Breakdown | Estimated Cost (2026) |

|---|---|---|

| Materials | Image sensor (Sony/OmniVision), lens, PCB, battery, housing | $28.50–$34.20 (65–70% of total) |

| Labor | Assembly, QA, firmware loading (avg. $4.20/hr in Guangdong) | $4.80–$6.10 (15–18%) |

| Packaging | Retail box, manuals, inserts (recycled materials) | $1.90–$2.70 (7–9%) |

| Tooling/Amortization | Private Label only (molds, custom PCB: $8,000–$15,000) | $0.80–$3.20/unit (at 1k–5k MOQ) |

| Total Base Cost | $35.20–$43.00 |

Critical Notes:

– 4K models add $7–$12/unit (advanced sensor + heat management).

– EU/US compliance (CE/FCC) adds $2.50–$4.00/unit (testing + documentation).

– 2026 Inflation Impact: Material costs up 4.1% YoY (vs. 2025), offset by 2.3% labor efficiency gains.

MOQ-Based Price Tiers (Per Unit | FOB Shenzhen)

1080p Camera | Private Label Configuration | Includes Basic Customization (color/logo)

| MOQ | Unit Price Range | Total Project Cost | Key Cost Drivers |

|---|---|---|---|

| 500 units | $48.50 – $55.00 | $24,250 – $27,500 | High tooling amortization ($3.20/unit); limited material bulk discounts |

| 1,000 units | $42.00 – $47.50 | $42,000 – $47,500 | Optimal balance: tooling cost drops to $1.60/unit; 8% material savings |

| 5,000 units | $36.80 – $41.20 | $184,000 – $206,000 | Volume discounts (15% on sensors); labor efficiency; tooling cost < $0.90/unit |

Footnotes:

1. Prices assume payment terms: 30% deposit, 70% pre-shipment. LC adds 1.5% fee.

2. MOQ 500 is rare in 2026 – only 12% of tier-1 factories accept <1k units (vs. 34% in 2022). Prepayment 100% required.

3. AI-feature premium: +$5.50/unit at all MOQs (e.g., object tracking, voice control).

Strategic Recommendations for Procurement Managers

- Avoid MOQ <1,000 for New Projects: Tooling costs erode margins. Use White Label at 500 units to validate demand first.

- Demand Component Sourcing Transparency: Require factory to disclose sensor/lens suppliers (e.g., avoid “generic OV5640” – insist on Sony IMX series for reliability).

- Lock 2026 Pricing Early: 68% of factories offer Q1 2026 contracts at 2025 rates if signed by March 2025 (SourcifyChina Supplier Survey).

- Prioritize Compliance: Budget $3.50/unit for EU/US certification before tooling – retrofitting post-production adds 22% cost.

“In 2026, the cost gap between White Label and Private Label narrows to 12% at MOQ 1,000. Brand owners who delay Private Label transition forfeit 27% higher lifetime customer value.”

– SourcifyChina OEM Strategy Team

Next Steps:

✅ Request Factory Pre-Vetted Shortlist (3 tier-1 Shenzhen OEMs with camera-specific ISO 9001)

✅ Schedule 2026 Cost Modeling Session (Customized to your specs/MOQ)

📧 Contact: [email protected] | +86 755 8675 8800

Disclaimer: Estimates based on SourcifyChina’s 2025 factory audits (n=47), component market data (TechInsights), and 2026 inflation projections (IMF). Actual costs vary by specifications, payment terms, and order timing. Not a binding quotation.

SourcifyChina | De-Risk Your China Sourcing

12+ Years | 1,200+ Clients | $3.2B+ Procurement Managed

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Sourcing Camera Suppliers in China – Verification Protocol, Factory vs. Trading Company Identification, and Risk Mitigation

Executive Summary

Sourcing camera products from China offers significant cost advantages but carries inherent risks related to supplier credibility, quality control, and supply chain transparency. In 2026, with increasing demand for surveillance, action, and smart cameras, procurement managers must adopt a structured verification process to ensure supplier legitimacy and product compliance. This report outlines a step-by-step approach to verify manufacturers, distinguish between factories and trading companies, and identify critical red flags.

Critical Steps to Verify a Camera Manufacturer in China

| Step | Action | Purpose | Tools/Methods |

|---|---|---|---|

| 1 | Verify Business Registration | Confirm legal existence and operational scope | Use official platforms: National Enterprise Credit Information Publicity System (China). Cross-check business license (營業執照) via third-party services like Tianyancha or Qichacha. |

| 2 | Conduct On-Site Factory Audit | Validate production capacity, equipment, and working conditions | Hire a third-party inspection firm (e.g., SGS, Intertek, or SourcifyChina Audit Team). Assess machinery, R&D labs, and quality control processes. |

| 3 | Review Export History & Certifications | Ensure compliance with international standards | Request export documentation, ISO 9001, CE, FCC, RoHS, and IP ratings (for outdoor cameras). Verify past export shipments via customs data (Panjiva, ImportGenius). |

| 4 | Audit R&D and Engineering Capabilities | Evaluate innovation, customization ability | Review product design files, firmware development, and in-house engineering team. Request prototype samples for testing. |

| 5 | Assess Production Capacity & Lead Times | Confirm scalability and reliability | Request production line details, monthly output capacity, and MOQs. Validate with real-time factory photos or live video tour. |

| 6 | Perform Product Quality Testing | Ensure performance and durability | Conduct AQL (Acceptable Quality Level) inspections. Test for image resolution, night vision, connectivity, and environmental resistance. |

| 7 | Check Intellectual Property (IP) Compliance | Avoid counterfeit or infringing products | Request proof of original design, patents, and trademark registrations. Use tools like WIPO Global Brand Database. |

| 8 | Review Client References & Case Studies | Validate track record with international buyers | Request 3–5 verifiable client references. Conduct reference calls with past or current buyers. |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory | Trading Company |

|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., “camera production”, “electronics manufacturing”) | Lists “trading”, “import/export”, or “sales” only |

| Factory Address & Facilities | Owns or leases manufacturing premises; has production lines visible | Often operates from office buildings; no visible production equipment |

| Pricing Structure | Lower MOQs, competitive pricing due to direct control | Higher pricing; may quote based on supplier rates plus margin |

| Technical Knowledge | Engineers and R&D team on-site; can discuss firmware, PCB design, optics | Limited technical depth; relies on factory for specs and changes |

| Lead Time Control | Direct oversight of production schedule | Dependent on factory; longer or less predictable lead times |

| Branding & Customization | Offers OEM/ODM services with in-house design | May offer customization but outsources to factories |

| Communication Access | Direct access to production managers and line supervisors | Communication often routed through sales representatives only |

Pro Tip: Ask to speak directly with the Production Manager or Factory Supervisor during a video audit. Trading companies often cannot provide this access.

Red Flags to Avoid When Sourcing Camera Suppliers in China

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to Conduct a Factory Audit | High risk of being a trading company or shell entity | Disqualify supplier unless third-party audit is accepted |

| No Physical Address or Virtual Office | Likely a front with no production capability | Verify address via Google Street View and on-site visit |

| Overly Low Prices Compared to Market | Risk of substandard components (e.g., recycled sensors, fake chips) | Compare BOM (Bill of Materials) cost; request component sourcing details |

| No Product Certifications or Vague Compliance Claims | Risk of non-compliance in EU/US markets | Require valid test reports from accredited labs |

| Inconsistent Communication or Language Gaps | Poor coordination, misaligned expectations | Use bilingual sourcing agents or insist on fluent English-speaking contacts |

| Pressure for Large Upfront Payments (>50%) | Risk of fraud or non-delivery | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) or LC |

| Generic Product Photos or Stock Images | Lack of real product or customization capability | Request real-time photos or videos of current production batch |

| No MOQ Flexibility or Sample Policy | Inflexible supply chain; may not support pilot orders | Require sample availability and scalable MOQs |

Best Practices for 2026 Sourcing Strategy

- Use a Local Sourcing Agent: Partner with a verified sourcing consultant in China (e.g., SourcifyChina) to conduct due diligence and manage quality control.

- Leverage Digital Verification Tools: Utilize AI-powered supplier screening platforms and blockchain-based supply chain tracking.

- Implement Tiered Supplier Model: Maintain a primary factory for volume and a secondary backup to mitigate disruption risks.

- Enforce Contractual Protections: Include IP clauses, quality benchmarks, and penalties for non-compliance in supplier contracts.

- Adopt Sustainable Sourcing Criteria: Prioritize suppliers with environmental certifications (e.g., ISO 14001) and ethical labor practices.

Conclusion

In the competitive landscape of China camera wholesale, procurement managers must prioritize supplier verification to protect brand integrity, ensure product quality, and maintain supply chain resilience. By systematically identifying true manufacturers, recognizing red flags, and implementing structured audits, global buyers can secure reliable, high-value partnerships in China’s electronics manufacturing ecosystem.

Prepared by:

SourcifyChina | Senior Sourcing Consultant

Empowering Global Procurement with Transparent, Verified Supply Chains

Contact: [email protected] | www.sourcifychina.com

Q2 2026 – Confidential for B2B Distribution

Get the Verified Supplier List

SourcifyChina 2026 B2B Sourcing Intelligence Report: Strategic Sourcing for China Camera Wholesale

Executive Summary: Eliminate Sourcing Friction in High-Volume Camera Procurement

Global procurement managers face critical bottlenecks in China-based camera sourcing: unverified suppliers, extended vetting cycles, and supply chain vulnerabilities. SourcifyChina’s Verified Pro List transforms this landscape by delivering pre-qualified, audit-backed manufacturers specializing in digital cameras, action cams, and accessories. This report demonstrates how leveraging our infrastructure directly impacts your P&L through time arbitrage and risk mitigation.

Why Traditional Sourcing Fails for Camera Wholesale (2026 Data)

| Sourcing Method | Avg. Time to Qualify Supplier | Fraud Risk Exposure | Cost of Supply Chain Disruption |

|---|---|---|---|

| Open Market Search (Alibaba, etc.) | 8–12 weeks | 37% (IOSS 2026) | $220K+ per incident |

| Third-Party Agents | 6–10 weeks | 28% | $185K+ |

| SourcifyChina Verified Pro List | < 72 hours | < 8% | $0 (Guaranteed) |

Source: SourcifyChina 2026 Supply Chain Integrity Index (n=412 procurement managers)

3 Strategic Advantages of the Verified Pro List for Camera Sourcing

- Time-to-Market Acceleration

- Pre-vetted factories with ISO 9001, BSCI, and IATF 16949 certifications.

- 72% reduction in RFQ-to-PO cycle time (vs. industry average).

-

Real Impact: Redirect 15+ weekly hours from supplier screening to strategic cost engineering.

-

Risk-Proofed Supply Chain

- All Pro List partners undergo:

- On-site factory audits (including hidden subcontractor checks)

- IP protection compliance verification

- Minimum 12-month production stability validation

-

Real Impact: Eliminate counterfeit sensors/lenses and customs seizure risks.

-

Cost Avoidance Beyond Unit Price

- Avoid hidden costs from:

- MOQ renegotiations ($8.2K avg. loss per failed order)

- Quality remediation ($31.7K avg. per batch)

- Logistics penalties from delays (23% of shipments)

- Real Impact: Achieve 11.3% net cost savings inclusive of risk mitigation.

Your Strategic Next Step: Secure Q3 Allocations Now

Camera component shortages persist into 2026, with lead times extending to 14 weeks for unqualified suppliers. The Verified Pro List guarantees:

✅ Priority production slots at Tier-1 Shenzhen/Dongguan factories

✅ Real-time capacity dashboards for Sony/OMNIVISION sensor-dependent models

✅ Dedicated QC teams for 4K+ resolution validation

Do not let supplier vetting delay your holiday season shipments.

✨ Call to Action: Activate Your Verified Sourcing Advantage in < 24 Hours

Contact SourcifyChina today to receive:

– Free Pro List Access: Immediate entry to 27 pre-qualified camera manufacturers (MOQs from 500 units)

– Custom Sourcing Playbook: “2026 Camera Procurement Risk Mitigation Guide” (valued at $1,200)

– Dedicated Sourcing Architect: One-on-one strategy session to align suppliers with your specs

👉 Act Now to Lock Q3 Capacity:

– Email: [email protected] (Response in < 2 business hours)

– WhatsApp: +86 159 5127 6160 (24/7 for urgent RFQs)

“SourcifyChina’s Pro List cut our supplier onboarding from 9 weeks to 4 days. We avoided $189K in defective shipments last quarter alone.”

— Procurement Director, Top 5 EU Electronics Distributor (Verified Client)

SourcifyChina: Where Verified Supply Chains Drive Your Competitive Edge

Data-Backed Sourcing | Zero-Risk Procurement | China Market Mastery

© 2026 SourcifyChina. All supplier verifications comply with ISO 20400 Sustainable Procurement Standards.

🧮 Landed Cost Calculator

Estimate your total import cost from China.