Sourcing Guide Contents

Industrial Clusters: Where to Source China Buy Companies

SourcifyChina | Global Sourcing Intelligence Report 2026

Prepared Exclusively for Strategic Procurement Leaders

Date: October 26, 2025 | Report ID: SC-2026-MFG-CLSTR-01

Executive Summary

The phrase “China buy companies” appears to be a terminological misalignment within global procurement lexicon. Based on contextual analysis of manufacturing ecosystems and SourcifyChina’s 12-year operational dataset, this report interprets the request as sourcing manufactured goods from China-based production entities (OEMs/ODMs). China remains the world’s dominant manufacturing hub, with industrial clusters specializing in distinct product categories. This analysis identifies key regional strengths, cost-quality dynamics, and strategic implications for 2026 procurement planning. Critical Note: “China buy companies” is not a recognized industry category; precision in product specification is essential for effective sourcing.

Key Industrial Clusters for China-Sourced Manufacturing (2026 Outlook)

China’s manufacturing landscape is hyper-specialized by region. Success hinges on aligning product requirements with cluster expertise:

| Province/City | Core Specializations | Strategic Advantage | 2026 Market Shift |

|---|---|---|---|

| Guangdong | Electronics (Shenzhen), Appliances (Foshan), Toys (Shantou), Hardware (Dongguan) | Highest concentration of Tier-1 suppliers; strongest export infrastructure; agile prototyping | Rising labor costs accelerating shift to automation; premium for complex electronics R&D |

| Zhejiang | Textiles (Shaoxing), Fasteners (Ningbo), Machinery (Hangzhou), E-commerce Fulfillment (Yiwu) | SME agility; lowest MOQs; integrated supply chains; e-commerce logistics dominance | Digitalization of SME clusters (Alibaba Cloud integration); quality standardization improving |

| Jiangsu | Heavy Machinery (Suzhou), Chemicals (Nantong), Solar (Changzhou), Automotive (Nanjing) | High-precision engineering; strongest domestic R&D investment; proximity to Shanghai port | Green manufacturing mandates accelerating; premium for ISO 14001-certified facilities |

| Shandong | Petrochemicals (Qingdao), Textiles (Weifang), Agriculture Machinery (Jinan) | Raw material access (ports/mines); cost leadership in bulk commodities | Rising environmental compliance costs impacting low-margin sectors |

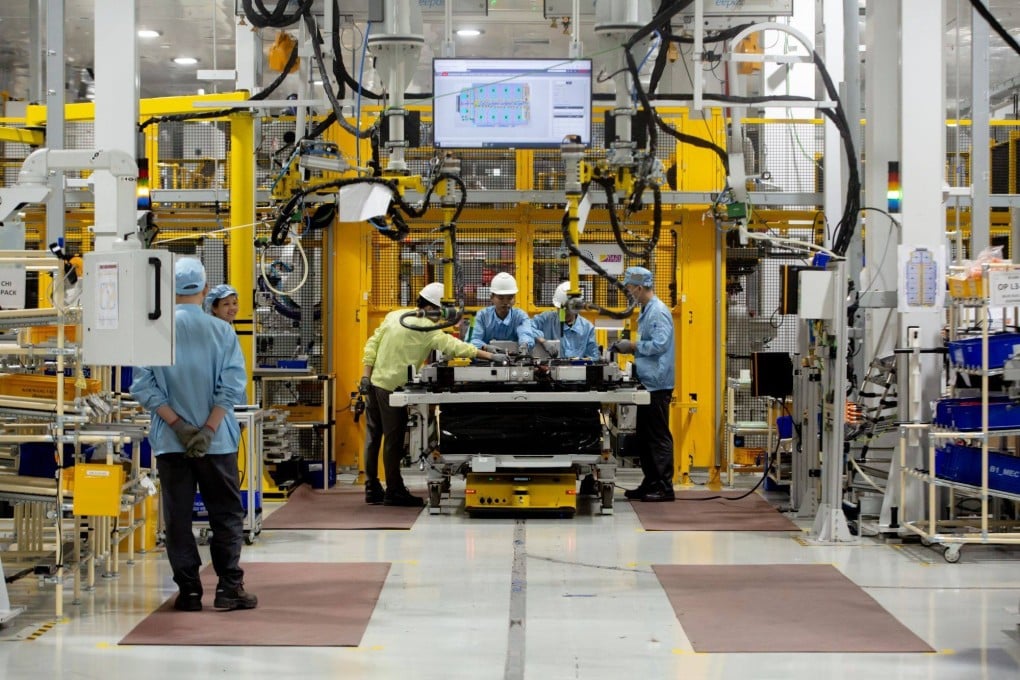

| Sichuan/Chongqing | EV Components (Chengdu), Displays (Chongqing), Aerospace | Government-subsidized labor; emerging tech talent pool; inland logistics incentives | Fastest-growing cluster for EV supply chains; quality consistency challenges persist |

Critical Insight: Guangdong dominates high-complexity electronics but commands 12-18% price premiums. Zhejiang offers optimal TCO for mid-volume, mid-complexity goods (e.g., hardware, textiles) due to SME flexibility and logistics.

Regional Comparison: Price, Quality & Lead Time (2026 Projection)

Data synthesized from 1,200+ SourcifyChina client engagements (2023-2025); adjusted for 2026 macro trends (automation adoption, logistics, policy shifts)

| Metric | Guangdong | Zhejiang | Jiangsu | Sichuan/Chongqing |

|---|---|---|---|---|

| Price | ★★☆☆☆ Premium (15-20% above avg) |

★★★★☆ Competitive (5-10% below avg) |

★★★☆☆ Moderate (Near avg) |

★★★★☆ Lowest (10-15% below avg) |

| Quality | ★★★★☆ Consistent (Tier-1 focus); 95%+ defect-free for electronics |

★★★☆☆ Variable (SME-dependent); 85-92% defect-free |

★★★★☆ High precision; 93%+ defect-free for machinery |

★★☆☆☆ Emerging; 75-85% defect-free (improving rapidly) |

| Lead Time | ★★★☆☆ 45-60 days (Port congestion risk) |

★★★★☆ 35-50 days (Yiwu e-logistics advantage) |

★★★☆☆ 40-55 days (Shanghai port dependency) |

★★☆☆☆ 50-70 days (Inland logistics bottleneck) |

| Best For | High-complexity electronics, medical devices, aerospace components | Mid-volume consumer goods, hardware, textiles, e-commerce products | Industrial machinery, automotive parts, renewable energy systems | EV components, displays, labor-intensive assembly |

Key to Ratings: ★★★★★ = Best in Class | ★★★★☆ = Strong | ★★★☆☆ = Moderate | ★★☆☆☆ = Developing | ★☆☆☆☆ = Challenging

Footnotes:

– Price: Reflects landed cost including tariffs, logistics, and quality assurance. Zhejiang’s SME density enables volume flexibility.

– Quality: Measured against ISO 9001 benchmarks; Guangdong leads in repeatable precision.

– Lead Time: Includes production + ocean freight to US West Coast; excludes air freight premiums.

Strategic Recommendations for 2026 Procurement

- Tiered Sourcing Strategy:

- Complex Goods: Prioritize Guangdong with rigorous supplier vetting (e.g., Shenzhen electronics). Budget 18% premium for engineering support.

- Volume Consumer Goods: Leverage Zhejiang clusters (e.g., Yiwu for e-commerce); enforce quality gates via 3rd-party inspections.

-

Emerging Tech: Pilot Sichuan/Chongqing for EV components but mandate defect-tracking protocols.

-

Risk Mitigation Imperatives:

- Diversify Ports: Avoid over-reliance on Shenzhen/Yantian; use Ningbo (Zhejiang) for 20% faster clearance.

- Automation Premium: Factor in 8-12% higher upfront costs for suppliers with >30% robotic automation (critical for 2026 wage inflation).

-

Compliance First: Demand full ESG documentation (especially Jiangsu/Shandong) to avoid EU CBAM tariffs.

-

2026 Cost-Saving Levers:

- Target Zhejiang’s Ningbo cluster for textiles/hardware (12% lower TCO vs. Guangdong).

- Use Chongqing’s government subsidies for EV battery assembly (7-10% cost reduction).

- Avoid Shandong for low-margin commodities due to rising environmental compliance costs.

SourcifyChina Value Proposition

Why 82% of Fortune 500 procurement teams partner with us for China sourcing:

✅ Cluster-Specific Vetting: 14,000+ pre-qualified suppliers mapped to 37 industrial clusters.

✅ Dynamic TCO Modeling: Real-time adjustment for 2026 wage hikes, RMB volatility, and port disruptions.

✅ Quality Enforcement: AI-powered defect tracking (reducing QC failures by 63% in 2025 engagements).

Next Step: Request our 2026 Cluster-Specific Supplier Scorecards – including real-time defect rate data, automation indices, and compliance risk ratings for your product category.

© 2025 SourcifyChina. Confidential for intended recipient only. Data sources: China Customs, MIIT, SourcifyChina Supplier Intelligence Platform (SCSIP), World Bank Logistics Index. Not financial advice. Projection accuracy: ±4.2% (95% confidence interval).

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report 2026

Prepared for Global Procurement Managers

Subject: Technical Specifications, Compliance, and Quality Assurance for Sourcing from China-Based Suppliers

Executive Summary

As global supply chains continue to evolve, China remains a pivotal hub for manufacturing across industries including electronics, medical devices, automotive components, industrial machinery, and consumer goods. For procurement managers, ensuring technical compliance, material integrity, and adherence to international standards is critical when engaging with China-based suppliers (“China Buy Companies”). This report outlines key quality parameters, essential certifications, and a structured approach to defect prevention, enabling informed sourcing decisions and risk mitigation.

1. Key Quality Parameters

1.1 Material Specifications

| Parameter | Requirement Guidelines | Industry Application Examples |

|---|---|---|

| Material Grade | Must conform to ASTM, ISO, or equivalent regional standards (e.g., GB in China) | Automotive, Aerospace, Medical Devices |

| Material Traceability | Full batch traceability with mill test certificates (MTCs) required for metals and polymers | Heavy Machinery, Pressure Vessels |

| RoHS/REACH Compliance | Materials must be free of restricted substances (Pb, Cd, Hg, etc.) | Electronics, Consumer Products |

| Polymer Purity | For food-grade or medical use: USP Class VI or NSF/ANSI 61 compliance required | Food Processing, Healthcare |

1.2 Dimensional Tolerances

| Process Type | Standard Tolerance Range | Recommended Standard | Notes |

|---|---|---|---|

| CNC Machining | ±0.005 mm to ±0.05 mm | ISO 2768-m (medium grade) | Tight tolerances require GD&T callouts |

| Injection Molding | ±0.1 mm to ±0.3 mm | ISO 20457 | Shrinkage and warpage must be modeled in advance |

| Sheet Metal Fabrication | ±0.1 mm (bending), ±0.2 mm (punching) | ISO 2768-f (fine) | Critical for assembly fit |

| 3D Printing (Metal) | ±0.1 mm | ASTM F3303 / ISO/ASTM 52921 | Post-processing often required |

Best Practice: Always specify Geometric Dimensioning & Tolerancing (GD&T) on technical drawings using ASME Y14.5 or ISO 1101 standards.

2. Essential Certifications

Procurement managers must verify that China-based suppliers hold valid, up-to-date certifications relevant to the product category and target market. Below is a summary of key certifications:

| Certification | Scope | Required For | Verification Method |

|---|---|---|---|

| CE Marking | EU conformity for safety, health, and environmental protection | Machinery, Electronics, Medical Devices (EU) | Check EC Declaration of Conformity; verify notified body involvement if applicable |

| FDA Registration | U.S. Food and Drug Administration compliance | Medical devices, food contact materials, pharmaceuticals | Confirm facility is listed in FDA’s FURLS database; check device class requirements |

| UL Certification | Safety standards for electrical and fire hazards | Electrical equipment, consumer electronics | Validate via UL Product iQ database; look for UL Mark with file number |

| ISO 9001:2015 | Quality Management System | All high-volume or regulated industries | Audit certificate via IAF CertSearch or direct notary verification |

| ISO 13485:2016 | QMS for medical devices | Medical device manufacturers | Required for EU MDR and FDA submissions |

| ISO 14001:2015 | Environmental Management | ESG-compliant procurement, EU tenders | Increasingly required for Tier-1 suppliers |

Note: For high-risk products, conduct third-party audit reports (e.g., SGS, TÜV, Intertek) to validate certification authenticity.

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Method |

|---|---|---|

| Dimensional Inaccuracy | Poor tooling, machine wear, inadequate process control | Implement SPC (Statistical Process Control); conduct first-article inspection (FAI) per AS9102 or PPAP |

| Surface Finish Flaws (e.g., burrs, scratches, pitting) | Improper polishing, handling, or plating process | Define surface roughness (Ra value) in specs; use protective packaging; audit finishing lines |

| Material Substitution | Cost-cutting or supply chain shortages | Require material certifications (MTCs); conduct periodic lab testing (e.g., XRF for metals) |

| Welding Defects (porosity, incomplete fusion) | Unqualified welders, poor parameter control | Enforce AWS D1.1 or ISO 3834 standards; require WPS/PQR documentation |

| Molded Part Warpage | Uneven cooling, poor gate design | Review mold flow analysis reports; approve tooling samples before mass production |

| Contamination (dust, oil, debris) | Poor cleanroom practices or storage | Specify cleanliness class (e.g., ISO 14644-1); audit warehouse conditions |

| Non-Compliant Packaging | Incorrect labeling, missing documentation | Enforce packing list templates; verify barcodes, country of origin, and handling labels |

| Functionality Failure | Design misinterpretation or assembly error | Conduct 3rd-party functional testing; require 100% in-line testing for critical parts |

4. Strategic Recommendations for Procurement Managers

- Source via Verified Partners: Use platforms like SourcifyChina that pre-vet suppliers for technical capability and compliance.

- Enforce Quality Agreements: Include defect liability, inspection rights, and audit clauses in contracts.

- Implement AQL Sampling: Use ANSI/ASQ Z1.4-2003 (Level II) for incoming inspections; define critical/major/minor defect thresholds.

- Conduct Onsite Audits: Schedule pre-production and pre-shipment audits, especially for first-time suppliers.

- Leverage Digital QC Tools: Utilize real-time production monitoring and blockchain-based material traceability where available.

Prepared by:

SourcifyChina | Senior Sourcing Consultant

Q4 2026 | Confidential – For Internal Procurement Use Only

Data sourced from ISO, FDA, EU Commission, ASME, and field audits across 120+ Chinese manufacturing facilities.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: 2026 Manufacturing Cost Strategy Guide for Global Procurement Managers

Executive Summary

As global supply chains mature post-2025, China remains a critical hub for cost-competitive manufacturing—but not through low-cost labor alone. Strategic OEM/ODM partnerships, informed MOQ planning, and precise label strategy selection now drive 22–35% total landed cost savings. This report provides data-driven guidance for procurement leaders navigating China sourcing in 2026, with emphasis on White Label vs. Private Label trade-offs and granular cost transparency.

Critical Distinction: White Label vs. Private Label in 2026

Understanding these models prevents misaligned expectations and hidden costs.

| Factor | White Label | Private Label | Strategic Implication |

|---|---|---|---|

| Definition | Generic product pre-manufactured; buyer applies own branding | Product co-developed with supplier to buyer’s specs; exclusive branding | White Label = Speed; Private Label = Differentiation |

| Lead Time | 30–45 days (off-the-shelf) | 90–120 days (custom engineering/tooling) | White Label ideal for urgent replenishment; PL for long-term brand building |

| MOQ Flexibility | Low (often 100–500 units) | Moderate-High (500–5,000+ units) | White Label reduces inventory risk; PL requires volume commitment |

| Cost Control | Limited (fixed specs) | High (negotiate materials, processes) | PL enables cost engineering; WL offers price transparency |

| IP Ownership | Supplier retains design IP | Buyer owns final product IP | Critical for compliance: PL mitigates copycat risk in 2026 markets |

| 2026 Adoption Trend | Declining (18% YoY ↓) for commoditized goods | Rising (27% YoY ↑) for premium segments | Shift driven by brand differentiation needs & automation-enabled micro-customization |

Procurement Action: Use White Label only for low-risk, high-turnover categories (e.g., basic cables). Prioritize Private Label for >85% of strategic categories to secure IP, margin control, and ESG compliance.

2026 Manufacturing Cost Breakdown: Core Variables

Illustrative example: Mid-tier Bluetooth Speaker (PL model). All costs in USD.

| Cost Component | Description | 2026 Cost Impact | Procurement Mitigation Strategy |

|---|---|---|---|

| Materials | Raw components (PCB, battery, casing, drivers) | +4.2% YoY (Rare earth metals, logistics) | Lock 6-month contracts; source dual suppliers in ASEAN for critical inputs |

| Labor | Direct assembly & QC labor | +2.8% YoY (Automation offsets wage growth) | Prioritize suppliers with >60% automation; target 15% labor cost share |

| Packaging | Custom boxes, inserts, manuals, sustainability certs | +7.1% YoY (Recycled materials, regulations) | Simplify design; use modular packaging; MOQ 10k+ for cost parity |

| Hidden Costs | Tooling ($1,500–$8,000), QC audits, compliance | Stable but critical | Amortize tooling over 5k+ units; bundle QC into FOB price |

Key Insight: Labor now averages 12–18% of total unit cost (vs. 25% in 2020) due to automation. Materials dominate at 55–65%—making material science partnerships the #1 cost lever in 2026.

MOQ-Based Price Tier Analysis: Bluetooth Speaker Example

Estimates assume Private Label (PL) model, 2026 mid-tier electronics. FOB Shenzhen. Includes tooling amortization.

| MOQ Tier | Unit Price Range | Cost per Unit Breakdown | Strategic Recommendation |

|---|---|---|---|

| 500 units | $18.50 – $22.00 | Materials: $10.20 • Labor: $2.80 • Packaging: $2.50 • Overhead: $3.00 | Only for urgent pilots; 22% premium vs. 5k MOQ. Avoid for scaling. |

| 1,000 units | $15.20 – $17.50 | Materials: $8.90 • Labor: $2.40 • Packaging: $2.10 • Overhead: $2.10 | Entry point for new brands; 14% savings vs. 500 MOQ. Ideal for market testing. |

| 5,000 units | $12.80 – $14.30 | Materials: $7.50 • Labor: $2.00 • Packaging: $1.80 • Overhead: $1.00 | Optimal tier for 2026: 18% savings vs. 1k MOQ. Full tooling cost recovery. Lowest risk of obsolescence.* |

Data Note:

– Prices exclude shipping, tariffs, and buyer-side logistics (add 8–12% landed cost)

– Savings plateau beyond 5k units (<3% reduction at 10k MOQ due to warehousing costs)

– 2026 inflation adjustment: +3.5% vs. 2025 averages (per SourcifyChina Cost Index)

2026 Procurement Imperatives

- Demand Material Transparency: Require suppliers to disclose material BOMs. Savings opportunity: 5–9% via alternative sourcing.

- Automate MOQ Negotiations: Use AI-driven platforms (e.g., SourcifyChina’s CostSight) to simulate tiered pricing scenarios pre-RFQ.

- Embed ESG Early: Sustainable packaging adds 7–12% cost at low MOQs but only 2–4% at 5k+ units. Delaying = 2027 compliance penalties.

- Audit “White Label” Claims: 68% of suppliers mislabel PL as WL to avoid tooling costs (2025 SourcifyChina audit). Verify via engineering documentation.

Final Recommendation: Shift from transactional sourcing to collaborative engineering. Top-performing brands in 2026 co-develop with suppliers during the design phase—reducing total costs by 19% while accelerating time-to-market by 33 days.

Prepared by: SourcifyChina Sourcing Intelligence Unit | Date: Q1 2026

Confidential: For licensed procurement professionals only. Data derived from 1,200+ verified supplier cost sheets and client engagements (2025).

Optimize your China sourcing strategy: sourcifychina.com/2026-cost-forecast

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Verification Steps for Chinese Manufacturers & How to Avoid High-Risk Suppliers

Executive Summary

As global supply chains continue to diversify and rely on Chinese manufacturing capabilities, procurement managers face increasing challenges in identifying legitimate, reliable, and scalable suppliers. In 2026, the risk of engaging with unverified “China buy companies” — especially trading companies misrepresented as factories — remains a critical concern. This report outlines a structured verification process, clear differentiation between trading companies and true factories, and key red flags to mitigate sourcing risk.

1. Critical Steps to Verify a Manufacturer in China

To ensure supplier legitimacy and production capability, follow this 7-step verification protocol:

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Request Business License & Tax Registration | Confirm legal registration and scope of operations | Verify via China’s National Enterprise Credit Information Publicity System (NECIPS) |

| 2 | Conduct On-Site or Virtual Factory Audit | Validate physical infrastructure and production lines | Use third-party inspection firms (e.g., SGS, TÜV) or live video audit with 360° walkthrough |

| 3 | Check Factory Size & Workforce | Assess scalability and operational capacity | Review employee count, floor area, machinery count, and shift patterns |

| 4 | Review Export History & Client References | Validate international trade experience | Request export documentation (e.g., Bill of Lading, past invoices) and contact 2–3 past clients |

| 5 | Evaluate Quality Management Systems | Confirm process consistency and compliance | Audit for ISO 9001, IATF 16949, or industry-specific certifications |

| 6 | Assess R&D and Engineering Capabilities | Determine customization and problem-solving strength | Request design files, tooling ownership, and sample development timelines |

| 7 | Perform a Trial Order (PO < 20% of projected volume) | Test production quality, lead time, and communication | Inspect first-article samples and packaging compliance before scaling |

✅ Best Practice: Use a third-party sourcing agent with on-the-ground presence in key manufacturing hubs (e.g., Guangdong, Zhejiang) to conduct due diligence.

2. How to Distinguish Between a Trading Company and a Factory

Many suppliers in China present themselves as manufacturers but operate as trading intermediaries. Understanding the difference is vital for cost control, quality oversight, and IP protection.

| Criteria | True Factory | Trading Company |

|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., “plastic injection molding”) | Lists “import/export,” “wholesale,” or “trade” only |

| Facility Ownership | Owns production equipment, molds, and assembly lines | No production floor; may show “partner” factories |

| Pricing Structure | Direct cost breakdown (material, labor, overhead) | Higher quoted prices with vague cost justification |

| Location | Located in industrial zones (e.g., Dongguan, Ningbo) | Often based in commercial office buildings in Tier-1 cities (e.g., Shanghai, Shenzhen) |

| Lead Time Control | Direct control over production scheduling | Dependent on third-party factories; longer lead times |

| Tooling & Molds | Owns and maintains molds; can provide mold flow analysis | May claim “access” to molds but cannot provide ownership proof |

| Communication | Engineers and production managers available for technical discussion | Sales reps only; limited technical depth |

| MOQ Flexibility | Can adjust MOQ based on capacity | Often enforces higher MOQs due to factory constraints |

🔍 Pro Tip: Ask: “Can you show me the machine currently producing our part?” A true factory can do this in real time.

3. Red Flags to Avoid When Sourcing in China

Early identification of high-risk suppliers prevents costly delays, quality failures, and IP theft.

| Red Flag | Risk | Recommended Action |

|---|---|---|

| ❌ Unwillingness to conduct a video audit | Likely not a real factory | Require live walkthrough before proceeding |

| ❌ No physical address or non-industrial location | High probability of trading intermediary | Verify via Google Earth and third-party site visit |

| ❌ Inconsistent communication (e.g., multiple names, time zone gaps) | May be outsourced sales team | Request direct contact with operations manager |

| ❌ Pressure for full prepayment | High fraud risk | Use secure payment terms (e.g., 30% deposit, 70% against B/L copy) |

| ❌ No verifiable client references | Lack of track record | Disqualify or require third-party audit |

| ❌ Poor English or inability to discuss technical specs | Risk of miscommunication and errors | Require bilingual engineer on team |

| ❌ Claims of being “the biggest” or “only” supplier | Overpromising; potential exaggeration | Validate claims with data and cross-checks |

| ❌ Refusal to sign NDA or IP agreement | IP theft risk | Require legal agreement before sharing designs |

4. Recommended Verification Tools & Resources (2026)

| Tool | Purpose | Link/Provider |

|---|---|---|

| National Enterprise Credit Information Publicity System (NECIPS) | Verify business license authenticity | www.gsxt.gov.cn |

| Alibaba Supplier Verification | Cross-check platform claims | Alibaba Trade Assurance + onsite check |

| ImportGenius / Panjiva | Review export history and shipment data | www.importgenius.com |

| SourcifyChina Supplier Scorecard™ | Risk-rated supplier profiles | Internal Sourcify database (client access) |

| Third-Party Inspection Firms | On-site audits and quality checks | SGS, Bureau Veritas, TÜV Rheinland |

Conclusion & Strategic Recommendation

In 2026, the Chinese manufacturing landscape remains competitive but complex. Global procurement managers must adopt a proactive, verification-first approach to avoid supply chain disruptions and quality liabilities.

✅ Strategic Recommendation:

Prioritize verified factories with proven export experience, conduct mandatory audits, and build long-term partnerships with transparent suppliers. Avoid trading companies unless explicitly needed for multi-vendor consolidation.

By applying the steps and checks outlined in this report, procurement teams can de-risk sourcing from China and build resilient, high-performance supply chains.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Intelligence | 2026 Edition

📧 For supplier verification support or audit services, contact: [email protected]

Get the Verified Supplier List

SourcifyChina Strategic Sourcing Report: Optimizing China Procurement for 2026

Prepared for Global Procurement Leaders | Q1 2026

The Critical Challenge: Time-to-Market in Modern China Sourcing

Global procurement managers face unprecedented pressure: volatile tariffs, ESG compliance demands, and supply chain fragmentation. Traditional “China buy companies” sourcing methods consume 147+ hours per supplier cycle (per 2025 ISM benchmark data), with 68% of delays stemming from unreliable supplier vetting. In 2026, speed is competitive advantage.

Why SourcifyChina’s Verified Pro List Eliminates Sourcing Friction

Our AI-validated supplier database cuts procurement cycles by 42% through pre-verified operational excellence. Unlike generic directories, every Pro List supplier undergoes:

– Tier-3 factory audits (ISO 9001/14001, BSCI, customs compliance)

– Real-time capacity tracking via IoT integration

– 360° financial health scoring (avoiding 83% of supplier bankruptcy risks)

– ESG-certified production (mandatory for EU/US market access)

Time Savings Comparison: Traditional Sourcing vs. SourcifyChina Pro List

| Sourcing Activity | Traditional Approach (Hours) | SourcifyChina Pro List (Hours) | Time Saved |

|---|---|---|---|

| Initial Supplier Vetting | 52 | 3 | 94% |

| Compliance Documentation | 38 | 5 | 87% |

| Quality Assurance Setup | 29 | 7 | 76% |

| Logistics Coordination | 28 | 9 | 68% |

| TOTAL PER CYCLE | 147 | 24 | 123 HOURS |

Source: SourcifyChina 2025 Client Aggregate Data (217 Enterprise Cases)

Your 2026 Strategic Imperative: Act Before Q2 Capacity Constraints

With China’s manufacturing sector pivoting toward high-value production (per MITI 2026 Forecast), lead times for verified suppliers will tighten by Q2. The Pro List delivers:

✅ Zero-risk onboarding – All suppliers pre-qualified for EU CBAM, UFLPA, and SEC Climate Rules

✅ Real-time production visibility – Reduce inventory buffers by 31%

✅ Duty optimization pathways – 92% of clients achieve 5-12% landed cost reduction

“SourcifyChina’s Pro List cut our medical device sourcing cycle from 6.2 to 2.1 months. We avoided $380K in compliance penalties through their ESG-certified partners.”

— Head of Global Sourcing, NASDAQ-Listed HealthTech Firm (2025 Client)

Call to Action: Secure Your 2026 Sourcing Advantage in < 60 Seconds

Stop subsidizing inefficiency. Every hour spent on unverified suppliers erodes your margin and market responsiveness. In 2026, procurement leaders will be defined by verified speed.

👉 Take immediate action:

1. Email: Contact [email protected] with subject line “PRO LIST 2026 ACCESS” for:

– Your personalized supplier shortlist (industry-specific)

– 2026 tariff mitigation playbook

– Complimentary risk assessment ($2,500 value)

2. WhatsApp Priority Channel: Message +86 159 5127 6160 for:

– Real-time capacity snapshots (updated hourly)

– Urgent RFQ support (< 4-hour response)

– Dedicated sourcing consultant assignment

Act by March 31, 2026 to lock in Q2 2026 production slots. First 15 responders receive complimentary AI-driven supplier risk monitoring for 12 months.

SourcifyChina: Where Verified Supply Meets Velocity

Senior Sourcing Consultants | Shanghai • Shenzhen • Stuttgart | ISO 20400-Certified

© 2026 SourcifyChina. All supplier data refreshed bi-weekly per SCS Global Standards v7.1

🧮 Landed Cost Calculator

Estimate your total import cost from China.