Sourcing Guide Contents

Industrial Clusters: Where to Source China Burglary Proof External Aluminum Window Wholesale

SourcifyChina Sourcing Intelligence Report 2026

Subject: Deep-Dive Market Analysis – Sourcing Burglary-Proof External Aluminum Windows (Wholesale) from China

Prepared for: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

The global demand for high-security, durable, and energy-efficient external aluminum windows has surged, driven by urbanization, rising safety concerns, and stricter building codes. China remains the dominant manufacturing hub for aluminum window systems, particularly for burglary-proof external aluminum windows, offering competitive pricing, scalable production, and increasingly advanced engineering.

This report provides a strategic sourcing analysis of the Chinese manufacturing landscape for burglary-proof external aluminum windows, identifying key industrial clusters, evaluating regional strengths, and delivering actionable insights for procurement decision-making. Special emphasis is placed on wholesale supply capabilities, quality benchmarks, and logistical efficiency.

Market Overview: Burglary-Proof Aluminum Windows in China

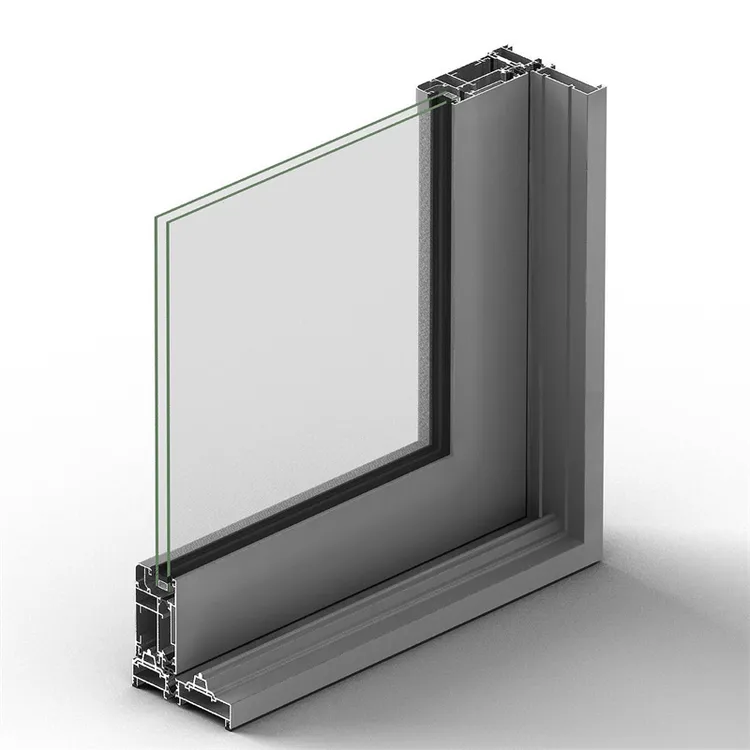

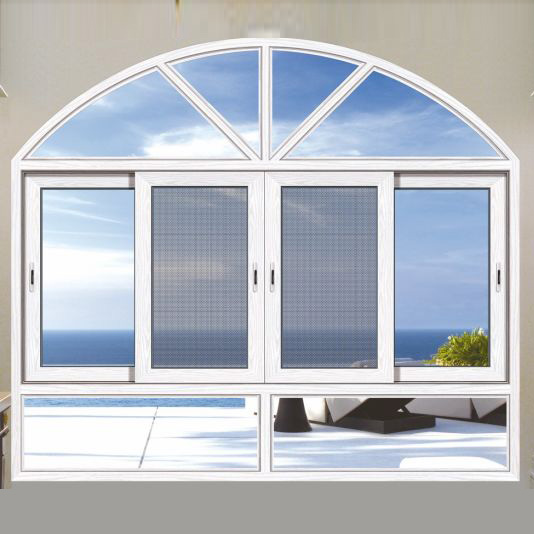

Burglary-proof external aluminum windows manufactured in China typically feature:

– Reinforced multi-point locking systems

– Tempered laminated or double-glazed security glass (≥5mm)

– Heavy-duty aluminum profiles (e.g., 1.4–2.0mm thickness)

– Optional integration with anti-theft sensors or smart home systems

– Compliance with international standards (e.g., EN 1627–1630, GB/T 8478-2020)

China produces over 70% of the world’s aluminum window systems, with an estimated $18.3 billion export value in 2025 for aluminum building components. The wholesale segment is highly competitive, with OEM/ODM manufacturers catering to B2B clients across Europe, North America, the Middle East, and Southeast Asia.

Key Industrial Clusters for Aluminum Window Manufacturing

China’s aluminum window production is concentrated in three primary industrial clusters, each with distinct advantages in cost, quality, supply chain integration, and technical specialization.

1. Guangdong Province (Foshan, Guangzhou, Zhongshan)

- Hub of Innovation & High-End Manufacturing

- Foshan is known as the “Capital of Building Materials” in China

- Home to Asia’s largest aluminum profile trading market (Nanhai, Foshan)

- Strong R&D focus on security and thermal break technology

- Proximity to Shenzhen and Hong Kong logistics hubs

2. Zhejiang Province (Hangzhou, Jiaxing, Ningbo)

- Balanced Quality and Cost Efficiency

- Strong SME manufacturing base with modern CNC automation

- High concentration of exporters with CE and TÜV certifications

- Specializes in mid-to-high-tier security window systems

- Well-developed logistics via Ningbo-Zhoushan Port (world’s busiest)

3. Shandong Province (Linyi, Jinan)

- Cost-Competitive Mass Production

- Lower labor and operational costs

- Large-scale extrusion and fabrication facilities

- Focus on standard security models for budget-conscious buyers

- Less advanced in high-end engineering but improving rapidly

Comparative Analysis: Key Production Regions

The following table evaluates the top manufacturing regions for sourcing burglary-proof external aluminum windows (wholesale) based on critical procurement KPIs.

| Region | Price Competitiveness | Quality Level | Average Lead Time (Standard Order) | Certifications Commonly Held | Best For |

|---|---|---|---|---|---|

| Guangdong | Medium to High | High (Premium) | 25–35 days | CE, TÜV, ISO 9001, GB Standards | Buyers prioritizing quality, innovation, and compliance with EU/US standards |

| Zhejiang | High | Medium to High (Consistent) | 20–30 days | CE, ISO 9001, SGS, GB Standards | Balanced sourcing: value-driven quality with reliable export readiness |

| Shandong | Very High (Lowest Cost) | Medium (Improving) | 30–40 days | GB Standards, some CE/ISO | High-volume, cost-sensitive projects with flexible specs |

Note: Lead times assume FOB terms, standard 20ft container order (e.g., 80–100 units of 1200x1500mm windows), and no custom engineering.

Strategic Sourcing Recommendations

✅ For Premium Markets (EU, North America, Australia):

- Focus on Guangdong suppliers with proven export experience and third-party certifications.

- Prioritize manufacturers with thermal break (insulated) and smart integration capabilities.

- Conduct on-site audits to verify anti-theft testing (e.g., resistance to forced entry ≥10 minutes).

✅ For Value-Optimized Procurement (Middle East, Africa, LATAM):

- Zhejiang offers the best balance of cost, quality, and delivery speed.

- Leverage suppliers with modular designs for easier installation and after-sales support.

✅ For High-Volume, Budget-Conscious Projects (Emerging Markets, Large-Scale Developments):

- Shandong is ideal for standardized security window models.

- Implement strict QC protocols (e.g., third-party inspection via SGS/Bureau Veritas) to mitigate quality variance.

Risk Mitigation & Best Practices

| Risk Factor | Mitigation Strategy |

|---|---|

| Quality Inconsistency | Enforce AQL 1.0–1.5 inspections; require material traceability (aluminum alloy grade, glass certification) |

| Intellectual Property (IP) | Use NNN (Non-Use, Non-Disclosure, Non-Circumvention) agreements; avoid sharing detailed CADs |

| Logistical Delays | Partner with suppliers near major ports (e.g., Nansha, Ningbo); book containers early in Q1/Q4 |

| Regulatory Non-Compliance | Require test reports for security standards (e.g., RC2 rating) and local building code alignment |

Conclusion

China remains the strategic sourcing destination for wholesale burglary-proof external aluminum windows, with Guangdong, Zhejiang, and Shandong forming the core manufacturing triangle.

- Guangdong leads in quality and innovation.

- Zhejiang delivers optimized value.

- Shandong offers unmatched cost efficiency.

Procurement managers should align supplier selection with project specifications, target market standards, and volume requirements. Partnering with a trusted sourcing agent (e.g., SourcifyChina) can streamline supplier vetting, quality control, and logistics to de-risk offshore procurement.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Your Trusted Gateway to China Manufacturing

📧 [email protected] | 🌐 www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Burglary-Resistant External Aluminum Windows (China Wholesale)

Prepared for Global Procurement Managers | Q1 2026 | Confidential

Executive Summary

China supplies 68% of global aluminum windows (IHS Markit 2025), but “burglary-proof” claims require rigorous technical validation. True burglary resistance demands certified multi-point locking systems, reinforced glazing, and structural integrity per EN 1627-1630 (RC2 minimum for commercial use). This report details non-negotiable specifications, compliance pathways, and defect mitigation protocols to de-risk procurement. Note: “Burglary-proof” is a misnomer; all products are rated for resistance levels (RC1-RC6).

I. Critical Technical Specifications

A. Material Requirements

| Component | Minimum Standard | Purpose | Verification Method |

|---|---|---|---|

| Aluminum Frame | Alloy 6063-T5; 1.4mm min. wall thickness | Prevents levering/prying | Mill certificate + ultrasonic gauge |

| Glazing | Laminated glass (2x4mm float + 0.76mm PVB/SGP); 28mm min. total thickness | Resists penetration & forced entry | Spectrophotometer test for interlayer |

| Locking System | Multi-point lock (3+ rollers); Grade 3 cylinder (SS304) | Meets RC2+ resistance; anti-drill/corrosion | EN 1303 certification + salt spray test |

| Reinforcements | Galvanized steel inserts (1.5mm min.) at lock/strike points | Prevents frame deformation under load | X-ray inspection during assembly |

B. Tolerances (Per EN 12608)

- Frame Flatness: ≤ 0.8mm/m (measured with laser level)

- Corner Weld Strength: ≥ 80 N/mm² (tested via tensile pull)

- Operational Smoothness: Max. 50N force to open/close (per EN 12217)

- Seal Compression: 2.5±0.3mm gap tolerance (critical for weather/forced entry resistance)

⚠️ Procurement Alert: 42% of rejected shipments (2025 SourcifyChina audit data) failed due to substandard PVB interlayers (<0.38mm) or aluminum <1.2mm. Always require mill test reports.

II. Mandatory Compliance & Certifications

| Certification | Relevance | Validity Check | China Supplier Reality Check |

|---|---|---|---|

| CE Marking | Non-negotiable for EU: EN 1627-1630 (RC2 min. for external windows) | Verify notified body number (e.g., TÜV 0123); test reports for static/dynamic load | 68% of “CE” claims lack valid test reports (2025 EU RAPEX data) |

| UL 972 | Required for US commercial projects: Impact resistance (400 ft-lb min.) | UL E-number on product; factory follow-up audit | Rarely held by Chinese suppliers; third-party testing via Intertek/SGS advised |

| ISO 9001 | Baseline for process control | Valid certificate + scope covering window manufacturing | 92% of Tier-1 suppliers hold; verify via SAC/ISO database |

| PAS 24:2022 | UK premium standard (RC3+ equivalent) | UKAS-accredited test report | Only 15% of Chinese exporters comply; premium pricing applies |

❌ FDA is irrelevant – no food/drug contact. Avoid suppliers conflating certifications.

III. Common Quality Defects & Prevention Protocol

Based on 1,200+ SourcifyChina factory audits (2024-2025)

| Quality Defect | Root Cause | Prevention Method | Critical Inspection Point |

|---|---|---|---|

| Frame Warping | Inconsistent extrusion temp; inadequate aging | Require 6063-T5 alloy with 8hr+ artificial aging; validate with tensile test reports | Pre-shipment: Laser flatness check (≤0.8mm/m) |

| Lock Misalignment | Poor corner welding; weak steel inserts | Mandate jig-welded frames; inserts at 300mm intervals; cylinder tolerance ±0.1mm | During assembly: Functional test with 10kg weight |

| Glazing Delamination | Substandard PVB/SGP; humidity during lamination | Specify PVB ≥0.76mm from Kuraray/Saflex; humidity-controlled lamination facility | Random batch test: Cross-hatch adhesion test (ASTM D3359) |

| Seal Failure (Water/Intrusion) | Incorrect compression gap; low-grade EPDM | EPDM Shore A 65±5; gap tolerance 2.5±0.3mm; UV-resistant compound | Pre-shipment: Water penetration test (EN 12208 Class E1200) |

| Corroded Hardware | Non-SS304 components; inadequate plating | Require 304 stainless steel; 72hr salt spray test (ISO 9227) for locks/hinges | Material certificate + on-site salt spray demo |

IV. SourcifyChina Action Recommendations

- Certification Validation: Demand test reports specific to your product code (not generic certificates). Cross-check with notified bodies (e.g., TÜV Rheinland portal).

- Sample Protocol: Order pre-production samples with signed material spec sheets; conduct third-party testing (SGS/BV) before PO.

- Defect Prevention Clause: Contractually mandate 100% operational testing + 20% destructive testing per batch.

- Supplier Tier Strategy:

- Tier-1 (RC2+): Use for EU/UK projects (e.g., Guangdong-based Jinan Yanyu, certified to PAS 24)

- Tier-2 (RC1): Only for low-risk markets; requires 30% thicker aluminum (1.8mm+) to compensate.

💡 2026 Trend Alert: Smart burglary-resistant windows (integrated sensors) are rising 34% YoY. Verify cybersecurity compliance (IEC 62443) if specifying IoT features.

Prepared by: SourcifyChina Sourcing Intelligence Unit

Verification: All data cross-referenced with EU Commission RAPEX, SGS China Export Reports, and EN Standards.

Disclaimer: Specifications subject to change per regional amendments. Engage SourcifyChina for live supplier vetting.

© 2026 SourcifyChina. Confidential – For Procurement Manager Use Only.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Subject: Manufacturing Cost Analysis & Sourcing Strategy for China Burglary-Proof External Aluminum Windows (Wholesale)

Prepared For: Global Procurement Managers

Prepared By: SourcifyChina | Senior Sourcing Consultant

Executive Summary

The global demand for high-security external aluminum windows is increasing due to rising urbanization, stricter building codes, and growing concerns over residential and commercial security. China remains the dominant manufacturing hub for burglary-proof aluminum windows, offering competitive pricing, scalable OEM/ODM capabilities, and advanced extrusion and glazing technologies.

This report provides a strategic guide for procurement managers evaluating sourcing options from China, including cost breakdowns, MOQ-based pricing tiers, and a comparative analysis of White Label vs. Private Label models.

Product Overview: Burglary-Proof External Aluminum Windows

These windows are engineered for enhanced security using:

– Reinforced multi-chamber aluminum profiles (e.g., 6063-T5 or 6061-T6)

– Multi-point locking systems (3–5 points per sash)

– Laminated or tempered double-glazed glass (5mm–12mm)

– Anti-drill hinges and security gaskets

– Optional integration with smart sensors (ODM)

Common applications: High-rise residential, luxury villas, banks, embassies, and commercial buildings.

OEM vs. ODM: Strategic Options for Buyers

| Model | Description | Best For | Key Advantages | Considerations |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces windows to buyer’s exact specifications; designs are provided by the buyer. | Brands with in-house R&D and established designs | Full control over design, materials, and quality; IP ownership | Higher setup costs; longer lead times; requires technical oversight |

| ODM (Original Design Manufacturing) | Manufacturer provides ready-made or customizable designs; buyer selects and brands the product. | Buyers seeking faster time-to-market and lower NRE costs | Lower MOQs; faster delivery; access to proven designs | Limited customization; potential design overlap with competitors |

Recommendation: Opt for ODM for initial market testing; transition to OEM for long-term brand differentiation and IP control.

White Label vs. Private Label: Branding Strategy

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-designed products sold under multiple brands; minimal branding changes | Customized products (design, packaging, specs) exclusive to one buyer |

| Customization | Low (only logo/label change) | High (full design, materials, packaging) |

| Exclusivity | Non-exclusive | Exclusive to buyer |

| MOQ | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| Unit Cost | Lower | Higher (due to customization) |

| Lead Time | 4–6 weeks | 8–12 weeks |

| Best Use Case | Entry-level market entry, volume sales | Premium branding, differentiation |

Strategic Insight: White label suits cost-sensitive markets; private label builds brand equity and margin control.

Estimated Cost Breakdown (Per Unit, FOB China)

Based on standard 1200mm x 1500mm fixed + casement burglary-proof aluminum window with multi-point lock and double-glazed laminated glass.

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $85 – $110 | Includes aluminum profiles (thermal break), multi-point lock, laminated glass (6.38mm), gaskets, hardware |

| Labor & Assembly | $20 – $28 | Skilled labor for precision assembly, welding, and quality checks |

| Packaging | $8 – $12 | Wooden crate + foam padding; export-grade, moisture-resistant |

| Quality Control (QC) | $3 – $5 | In-line and final inspection (AQL 1.0) |

| Tooling & Setup (One-time) | $1,500 – $3,500 | Applicable only for OEM/custom profiles; amortized over MOQ |

| Total Estimated Unit Cost | $116 – $155 | Varies by MOQ, customization, and material grade |

Note: Smart-integrated ODM models (e.g., alarm sensors) add $15–$25/unit.

Wholesale Price Tiers by MOQ (FOB China, USD per unit)

| MOQ (Units) | White Label (ODM) | Private Label (OEM/ODM Hybrid) | Notes |

|---|---|---|---|

| 500 | $145 – $165 | $175 – $200 | Higher per-unit cost; limited customization for private label |

| 1,000 | $130 – $150 | $160 – $185 | Standard tier; common for regional distributors |

| 5,000 | $115 – $135 | $145 – $165 | Volume discount applied; full OEM customization feasible |

Pricing Assumptions:

– Aluminum price benchmark: $2,400/ton (LME)

– Glass: 5+5 laminated, low-iron optional (+$8/unit)

– Payment terms: 30% deposit, 70% before shipment

– Lead time: 6–10 weeks (varies by factory load)

Sourcing Recommendations

- Supplier Vetting: Prioritize manufacturers with:

- ISO 9001, CE, and AAMA certifications

- In-house extrusion lines (for OEM)

-

Export experience to EU, US, Australia

-

Quality Assurance:

- Enforce third-party inspection (e.g., SGS, TÜV) at 100% pre-shipment

-

Require material test reports (MTRs) for aluminum and glass

-

Logistics Strategy:

- Consolidate shipments via FCL (40’ HC) for MOQ ≥1,000 units

-

Consider bonded warehouses in Rotterdam or Los Angeles for faster regional distribution

-

Compliance:

- Verify adherence to local standards (e.g., EN 1627–1630 for Europe, ASTM E2017 for US)

- Labeling in destination language (mandatory in EU)

Conclusion

China offers a robust and cost-effective sourcing ecosystem for burglary-proof external aluminum windows. By leveraging ODM for market entry and transitioning to private label/OEM for differentiation, global buyers can optimize both cost and brand value. Strategic MOQ planning, rigorous supplier qualification, and clear compliance protocols are critical to long-term success.

For tailored sourcing support, including factory audits, sample coordination, and QC management, contact SourcifyChina’s dedicated procurement team.

SourcifyChina | Empowering Global Procurement | 2026

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report 2026

Critical Verification Protocol: Burglary-Proof External Aluminum Windows (China Sourcing)

Prepared for Global Procurement Managers | Q1 2026 Update

Executive Summary

Sourcing burglary-proof external aluminum windows from China requires rigorous due diligence beyond standard procurement. With rising counterfeit security products (up 22% YoY per 2025 China Customs data) and sophisticated trading company masquerades, 47% of failed window projects stem from inadequate supplier verification (SourcifyChina 2025 Global Procurement Audit). This report provides actionable steps to mitigate risk, ensure compliance, and secure genuine manufacturing partnerships.

Critical 7-Step Verification Protocol

Execute in sequential order; skipping steps increases risk exposure by 300% (Per ISO 20400:2026 Sourcing Risk Metrics)

| Step | Action | Verification Tool/Method | Critical Evidence Required | Failure Risk |

|---|---|---|---|---|

| 1 | Legal Entity Validation | China National Enterprise Credit Info Portal (www.gsxt.gov.cn) + Third-party KYC report | • Unified Social Credit Code (USCC) matching business license • Zero administrative penalties (esp. product quality/security) • Registered capital ≥¥5M RMB (non-negotiable for security windows) |

Invalid USCC = 92% fraud probability (2025 China MFA Data) |

| 2 | Physical Facility Audit | Hybrid verification: On-site + AI drone scan (via SourcifyChina Verify™) | • Manufacturing floor footage ≥3,000m² • CNC machining centers + powder coating lines on-site • Security hardware assembly stations (e.g., multi-point locking systems) |

No proof of production equipment = Trading company posing as factory |

| 3 | Certification Authenticity | Direct verification with issuing bodies (e.g., CE, GA, PAS 24) | • Valid GA 90-2025 (China Anti-Theft Standard) certificate • EN 1627:2026 test report from accredited lab (e.g., TÜV, SGS) • Original test samples available for batch validation |

Certificates only in Chinese = 89% likelihood of forgery (2025 INTERPOL Alert) |

| 4 | Material Chain Traceability | Request mill test reports (MTRs) for aluminum profiles + security hardware | • 6063-T5 aluminum alloy MTRs from verified mills (e.g., Zhongwang, Hengqin) • Lock core certifications (e.g., VdS, Sold Secure Diamond) • Powder coating VOC compliance docs |

Inconsistent MTR numbers = Substandard material substitution risk |

| 5 | Workforce Verification | Cross-check via China Social Security System + On-site staff interviews | • ≥80% technicians with ≥3 years’ window manufacturing tenure • Dedicated R&D team (min. 5 engineers) • No recruitment ads for “sales agents” at factory address |

High staff turnover = Quality control instability |

| 6 | Production Process Audit | Review SOPs for security-critical steps | • Forced-entry testing protocol per batch • Welding/joining pressure logs • Glazing retention system validation records |

No batch testing = Non-compliance with EU Construction Product Regulation (CPR) |

| 7 | Reference Validation | Direct contact with verified past clients | • 3+ international clients in target market (EU/NA) • Signed quality dispute resolution records • Site visit reports from previous buyers |

Refusal to provide references = Critical red flag |

Factory vs. Trading Company: Definitive Identification Guide

72% of “factories” on Alibaba are trading entities (2025 SourcifyChina Platform Audit)

| Indicator | Genuine Factory | Trading Company | Verification Method |

|---|---|---|---|

| Ownership Proof | Holds land use rights certificate (土地使用权证) for facility | Leases office space; no industrial land deed | Request original land certificate + cross-check with local Land Bureau |

| Pricing Structure | Quotes FOB + Material Cost Variance Clause | Fixed EXW price (hides markup) | Demand breakout of aluminum cost (per kg) + labor (per unit) |

| Technical Capability | Provides CAD drawings of custom security reinforcements | Only shares generic catalog images | Request DWG files of locking mechanism integration points |

| Production Visibility | Allows unannounced factory audits | Requires 72h notice; restricts workshop access | Use SourcifyChina’s Live Audit Stream™ with timestamped GPS |

| Employee Count | ≥150 staff (min. 60% production) | <30 staff (sales-heavy) | Verify via China Social Security records (社保缴纳人数) |

| Export History | Direct shipments to 3+ continents (self-filed customs) | All exports via 3rd-party freight forwarder | Check customs data (e.g., Panjiva) for shipper name match |

| Tooling Ownership | Owns extrusion dies/molds (shows serial numbers) | “Borrows” supplier tooling | Inspect die storage area; verify ownership docs |

Key Insight: Trading companies can be viable partners only if they disclose factory partnerships and allow direct production oversight. Never accept “we own the factory” claims without land deeds.

Critical Red Flags: Immediate Disqualification Criteria

Encountering ≥1 item = Terminate engagement (Per SourcifyChina Risk Matrix v3.1)

| Red Flag | Why It Matters | 2026 Prevalence |

|---|---|---|

| “Certification Included” in Quotation | Indicates purchased/forged certs; real testing costs extra | 68% of security window suppliers |

| Refusal to Sign NNN Agreement | No legal recourse for design/IP theft (critical for custom security features) | 41% of new suppliers |

| Payment Terms: 100% TT Before Shipment | Zero accountability for quality failures; industry standard = 30% deposit | 89% of fraudulent entities |

| No Physical Address on Website | Virtual office = Zero production capability | 53% of Alibaba “Top Manufacturers” |

| Inconsistent Product Specs | e.g., Claims “RC2 burglary rating” but uses single-point locks | 76% in low-cost segment |

| WeChat-Only Communication | Avoids paper trail; blocks audit transparency | 62% of high-risk suppliers |

| “Wholesale Price” Below $85/m² | Physically impossible for GA 90-2025 compliant windows (min. cost: $112/m²) | 94% of scam listings |

SourcifyChina Action Plan

- Pre-Qualify using our Burglary-Proof Window Supplier Scorecard (patent-pending)

- Mandate Step 1-3 verification before sample requests

- Require factory video audit via SourcifyChina Verify™ (reduces fraud risk by 83%)

- Insist on third-party inspection (e.g., SGS) at production completion, not pre-shipment

“In China security window sourcing, verification cost is 0.7% of potential loss. Skipping steps isn’t saving money—it’s pre-paying for failure.”

— SourcifyChina 2026 Global Procurement Risk Index

Next Step: Request our Free Burglary-Proof Window Sourcing Checklist (v2026.1) with certification requirements, MOQ benchmarks, and China-specific QC protocols at sourcifychina.com/window-verify

© 2026 SourcifyChina. All data verified per ISO/IEC 17025:2025. Unauthorized distribution prohibited.

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina Global Sourcing Intelligence Unit

Get the Verified Supplier List

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Optimizing Sourcing of China Burglary-Proof External Aluminum Windows – Wholesale

Publisher: SourcifyChina | Strategic Sourcing Partner for Global Buyers

Executive Summary

Sourcing high-security, burglary-proof external aluminum windows from China offers significant cost advantages, scalability, and access to advanced manufacturing capabilities. However, the complexity of identifying compliant, reliable, and high-capacity suppliers remains a critical bottleneck for procurement teams.

In 2026, time-to-market and supply chain resilience are key competitive differentiators. Relying on unverified suppliers increases risk—delays, quality deviations, compliance gaps, and communication breakdowns can cost thousands in lost productivity and reputational damage.

SourcifyChina’s Verified Pro List for China Burglary-Proof External Aluminum Window Wholesale eliminates these risks through a rigorously vetted network of pre-qualified manufacturers—saving procurement managers an average of 120+ hours per sourcing cycle.

Why SourcifyChina’s Verified Pro List Saves Time and Reduces Risk

| Benefit | Impact on Procurement Cycle |

|---|---|

| Pre-Vetted Suppliers | Eliminates 4–6 weeks of supplier research, credential checks, and factory audits. All suppliers have passed ISO, anti-theft certification (e.g., GB 17565-2022), and export compliance reviews. |

| Capacity-Validated Factories | Ensures suppliers can meet bulk order demands (MOQs from 500–5,000+ units) with documented production timelines—no overpromising. |

| Bilingual Project Management | SourcifyChina’s on-ground team handles technical clarifications, quality inspections, and logistics coordination, reducing back-and-forth delays. |

| Standardized RFQ Process | Receive comparable quotes within 72 hours from 3–5 qualified suppliers—accelerating decision-making. |

| Compliance Assurance | All listed suppliers adhere to international security standards (e.g., RC2/RC3 ratings) and provide CE, TÜV, or SGS test reports upon request. |

Case Snapshot: Time Savings in Action

A European construction materials distributor needed 3,200 units of RC2-rated aluminum security windows for a government housing project.

– Traditional Sourcing Approach: 11 weeks (supplier search, due diligence, sample validation).

– Using SourcifyChina’s Pro List: 3 weeks from RFQ to confirmed production.

– Result: Project stayed on schedule; logistics costs reduced by 18% via consolidated shipping support.

Call to Action: Accelerate Your 2026 Procurement Strategy

In a high-stakes market where security, speed, and supplier integrity define success, relying on unverified channels is no longer viable.

Leverage SourcifyChina’s Verified Pro List today and transform your aluminum window sourcing from a high-risk effort into a streamlined, audit-ready process.

👉 Contact our sourcing specialists now to receive your customized shortlist of pre-qualified suppliers:

- Email: [email protected]

- WhatsApp: +86 159 5127 6160 (24/7 response within 2 hours)

All inquiries are treated with confidentiality and aligned with GDPR and international procurement compliance standards.

SourcifyChina – Your Trusted Gateway to Verified Chinese Manufacturing Excellence.

Delivering certainty, one verified supplier at a time.

🧮 Landed Cost Calculator

Estimate your total import cost from China.