Sourcing Guide Contents

Industrial Clusters: Where to Source China Bulk Monk Fruit Extract

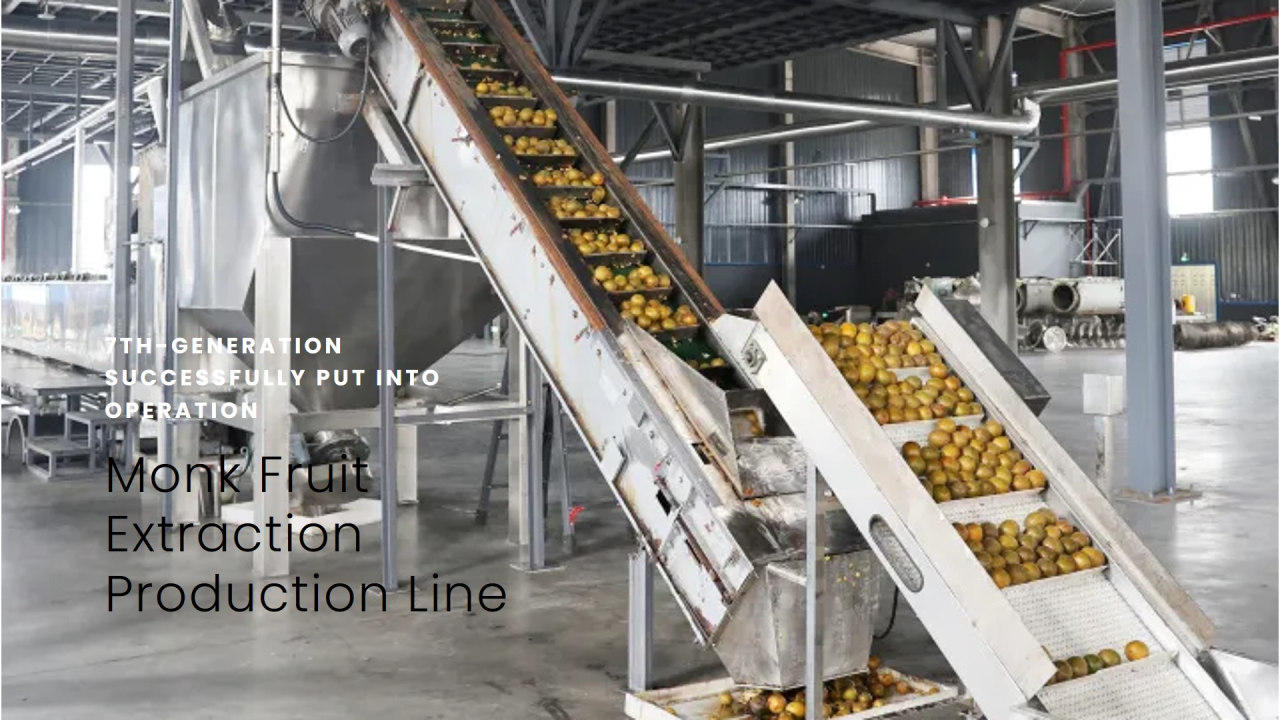

SourcifyChina Sourcing Intelligence Report: Bulk Monk Fruit Extract (MFE) Market Analysis – China Focus

Report Date: October 26, 2026

Prepared For: Global Procurement & Supply Chain Leadership

Prepared By: SourcifyChina Senior Sourcing Consulting Team

Executive Summary

China dominates global monk fruit (Siraitia grosvenorii) cultivation and extract production, supplying >90% of the world’s bulk MFE. Driven by rising global demand for natural, zero-calorie sweeteners (CAGR 12.3% 2024-2026), sourcing from China remains cost-advantaged but requires strategic regional selection and rigorous quality oversight. Key challenges include volatile raw material supply (monk fruit is highly climate-sensitive), inconsistent mogroside V purity standards, and evolving export regulations. Guangdong and Zhejiang provinces emerge as the primary industrial clusters for processed bulk extract, while Guangxi remains the critical cultivation heartland. Procurement success hinges on aligning regional strengths with specific quality, cost, and timeline requirements.

Market Context & Sourcing Imperatives

- Global Demand Surge: Driven by clean-label trends in NA/EU beverages, dairy, and supplements. Demand for high-purity (≥80% Mogroside V) extracts is growing fastest (+18% YoY).

- China’s Dominance: Controls 95%+ of global monk fruit cultivation (primarily in Guangxi). Processing capacity is concentrated in advanced manufacturing hubs.

- Key Sourcing Risks:

- Raw Material Volatility: Crop yields fluctuate significantly with weather (drought/flooding in Guangxi).

- Quality Fragmentation: Wide variance in Mogroside V content, solvent residues, and microbial limits among suppliers.

- Regulatory Shifts: China’s NMPA tightening export documentation; US FDA/EFSA scrutiny on heavy metals & allergens increasing.

- Strategic Imperative: Move beyond price-centric sourcing. Prioritize supplier capability validation, traceability, and regulatory compliance alignment.

Key Industrial Clusters for Bulk Monk Fruit Extract Production

While Guangxi Zhuang Autonomous Region (specifically Nanning, Guilin, Yongfu County) is the undisputed cultivation epicenter (producing ~85% of China’s monk fruit), bulk extract manufacturing is concentrated in advanced industrial provinces with superior infrastructure, R&D, and export logistics:

-

Guangdong Province (Foshan, Guangzhou, Shenzhen)

- Why it Leads: Proximity to Hong Kong port logistics, highest concentration of GMP-certified facilities (USP/EP), strong export compliance expertise, access to international technical talent. Dominates high-purity (≥80% Mogroside V) and specialty-grade (water-soluble, organic) extract production.

- Supplier Profile: Mix of large, export-focused manufacturers (e.g., Nature’s Sweeteners, Biomex) and mid-sized, tech-driven innovators. Strongest QA/QC protocols.

-

Zhejiang Province (Hangzhou, Ningbo, Jiaxing)

- Why it Leads: Hub for pharmaceutical/nutraceutical ingredient manufacturing. High density of ISO 22000/FSSC 22000 certified plants. Strong focus on cost-optimized standard grades (50-70% Mogroside V). Excellent chemical engineering talent pool.

- Supplier Profile: Primarily large-scale chemical/nutraceutical manufacturers (e.g., Zhejiang NHU, Xi’an Yuensun subsidiaries) with integrated supply chains. Competitive on mid-tier purity volumes.

-

Guangxi Province (Nanning, Liuzhou) (Emerging Processing Hub)

- Why it’s Growing: Direct access to raw fruit, reducing input cost/logistics. Government incentives to move processing closer to farms.

- Supplier Profile: Primarily local processors and newer entrants. Often lack advanced purification tech and rigorous export compliance systems. Best suited for local market or very low-cost, standard-grade (30-50% Mogroside V) bulk supply. High risk for international quality/regulatory requirements.

Regional Production Cluster Comparison: Key Sourcing Metrics

| Criteria | Guangdong Province | Zhejiang Province | Guangxi Province |

|---|---|---|---|

| Price (USD/kg) | Highest ($85 – $150+ for ≥80% Mog V) Premium for high purity, organic certs, pharma-grade. |

Moderate ($65 – $100 for 50-70% Mog V) Best value for standard/commodity grades. Volume discounts significant. |

Lowest ($50 – $80 for ≤50% Mog V) High risk of hidden costs (rework, compliance failures). |

| Quality & Consistency | ★★★★★ (Best) Highest % of GMP/ISO 13485 certified suppliers. Tightest control on Mog V purity (HPLC verified), solvent residues, heavy metals. Strong traceability. |

★★★★☆ (Very Good) Pharma-grade facilities common. Consistent for standard specs. May require stricter oversight for high-purity/organic. |

★★☆☆☆ (Variable/Risky) Limited advanced QC labs. High batch variance. Frequent failures on microbial limits & solvent residues. Traceability weak. |

| Lead Time (Standard 500kg) | Shortest (30-45 days) Efficient port access (Shenzhen/Yantian), streamlined export docs, high production capacity. |

Moderate (45-60 days) Reliable but Ningbo port congestion can cause delays. Strong production capacity. |

Longest/Unpredictable (60-90+ days) Limited export infrastructure. Raw fruit seasonality heavily impacts processing schedules. High rework risk. |

| Best Suited For | Premium/Pharma-grade extracts, High-purity (≥80% Mog V), Organic certifications, Strict regulatory markets (US/EU), Time-sensitive orders. | Cost-sensitive standard grades (50-70% Mog V), Large-volume contracts, Nutraceutical applications with moderate specs. | Domestic Chinese market, Very low-cost commodity applications (where quality risk is acceptable), Localized supply chains (within China). |

| Key Risk Mitigation | Validate GMP certificates in person, Demand full CoA (incl. HPLC chromatograms), Use LC payments. | Audit QA systems rigorously, Specify exact Mog V method (HPLC-UV vs. HPLC-MS), Confirm FSSC 22000 validity. | Avoid for international bulk supply. If unavoidable: Mandate 3rd party pre-shipment inspection (SGS/BV), Extremely tight specs, High MOQ penalties. |

Critical Sourcing Recommendations for 2026

- Prioritize Guangdong for Premium/Regulated Markets: The higher upfront cost is justified by reduced compliance risk, lower failure rates, and faster time-to-market for US/EU clients. Non-negotiable for pharma or high-purity food applications.

- Leverage Zhejiang for Cost-Optimized Standard Volumes: Ideal for private-label supplements or mid-tier food applications where Mog V 50-70% is sufficient. Implement robust batch testing protocols.

- Avoid Guangxi for International Bulk Supply (Unless Exceptional Circumstances): The cost savings are typically eroded by quality failures, rework, and shipment rejections. Only consider with extreme due diligence and local partner oversight.

- Mandate Transparent Traceability: Require farm-to-finish documentation (Guangxi fruit origin, processing logs, QC data). Blockchain pilots are emerging in Guangdong.

- Contract for Mogroside V Verification Method: Specify HPLC-UV or HPLC-MS in contracts – results vary significantly by method. Demand chromatograms with every CoA.

- Build Dual Sourcing (Guangdong + Zhejiang): Mitigate regional disruption risk (e.g., port strikes, localized regulations). Avoid sole reliance on any single cluster.

- Factor in Climate Risk Premium: Budget 5-10% contingency for raw material-driven price volatility. Consider forward contracts with key Guangxi growers via your Guangdong processor.

Forward Look: 2026-2027 Market Shifts

- Synthetic Biology Threat: US/EU startups scaling fermentation-derived mogrosides may pressure standard-grade MFE prices by 2027, but natural extract demand for “clean label” remains strong.

- Guangxi Processing Maturation: Expect 2-3 major GMP facilities to come online near Nanning by 2027, potentially altering the cluster dynamics. Monitor closely.

- Regulatory Harmonization: China’s NMPA is aligning MFE standards with USP/EP – accelerating this trend benefits compliant Guangdong/Zhejiang suppliers.

SourcifyChina Action: We recommend initiating supplier shortlists exclusively from pre-vetted Guangdong (Foshan/Guangzhou) and Zhejiang (Hangzhou) manufacturers. Our team will conduct facility audits, negotiate tiered pricing based on Mog V purity, and implement 3rd-party batch verification protocols to de-risk your 2026 supply.

SourcifyChina: De-risking China Sourcing Since 2018

This report contains proprietary market intelligence. Redistribution prohibited without written consent. Data sources: China Herbal Medicine Association, Global Sweetener Review 2026, SourcifyChina Supplier Audit Database (Q3 2026).

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report 2026

Subject: Technical Specifications & Compliance Requirements for Bulk Monk Fruit Extract from China

Prepared For: Global Procurement Managers

Date: January 2026

Prepared By: Senior Sourcing Consultant, SourcifyChina

Executive Summary

Monk fruit extract (Siraitia grosvenorii) is a high-intensity, zero-calorie natural sweetener increasingly in demand across food, beverage, dietary supplements, and pharmaceutical sectors. Sourcing bulk quantities from China—home to over 90% of global production—requires rigorous technical and compliance oversight. This report outlines key quality parameters, mandatory certifications, and actionable quality control strategies to mitigate supply chain risk.

1. Key Quality Parameters

1.1 Raw Material Specifications

| Parameter | Specification | Tolerance |

|---|---|---|

| Botanical Source | Siraitia grosvenorii (Luo Han Guo), Grade A dried fruit | ±0% deviation |

| Mogroside Content | Mogroside V ≥ 40% to 70% (standard); up to 98% (high-purity) | ±2% of stated potency |

| Form | Fine powder, free-flowing | N/A |

| Color | White to off-white | L* ≥ 85 (CIE Lab scale) |

| Moisture Content | ≤ 5.0% w/w | ±0.5% |

| Particle Size | 90% pass through 80 mesh (≤ 177 µm) | ±10% deviation |

| Bulk Density | 0.4–0.6 g/mL | ±0.05 g/mL |

| Solubility | Fully soluble in water (clear solution at 1% w/v) | No visible residue |

1.2 Purity & Contaminants

| Parameter | Acceptable Limit | Test Method |

|---|---|---|

| Heavy Metals | As ≤ 1 ppm; Pb ≤ 2 ppm; Cd ≤ 0.5 ppm; Hg ≤ 0.1 ppm | ICP-MS (ISO 17294-2) |

| Residual Solvents | Ethanol ≤ 5000 ppm; Methanol ≤ 3000 ppm | GC-FID (USP <467>) |

| Microbial Load | TPC ≤ 1000 CFU/g; Yeast/Mold ≤ 100 CFU/g; E. coli, Salmonella absent in 10g | ISO 4833-1, ISO 21528-2 |

| Pesticide Residues | Compliant with EU MRLs (Regulation (EC) No 396/2005) | GC-MS/MS or LC-MS/MS |

| Allergens | Undeclared allergens: Not detected | ELISA or PCR |

| Foreign Matter | None visible (glass, metal, plastic) | Visual inspection + metal detection |

2. Essential Certifications

Procurement managers must verify supplier compliance with the following international standards:

| Certification | Relevance | Issuing Body | Validity | Recommended Audit Type |

|---|---|---|---|---|

| FDA GRAS (Generally Recognized as Safe) | Required for U.S. market entry; confirms safety for food use | U.S. FDA | Ongoing (self-affirmed or FDA-reviewed) | Documentation + 3rd-party review |

| ISO 22000:2018 | Food safety management system; ensures HACCP compliance | ISO (via accredited bodies) | 3 years (annual surveillance) | On-site audit |

| FSSC 22000 | Global Food Safety Initiative (GFSI)-recognized; preferred by retailers | FSSC | 3 years | On-site audit |

| Organic Certification (USDA NOP, EU Organic, or JAS) | Required for organic labeling in key markets | USDA, EU, or accredited bodies | Annual renewal | Farm and facility audit |

| Kosher (OU, Star-K, etc.) | Mandatory for kosher product lines | Orthodox Union, Star-K, etc. | Annual | Documentation + periodic audit |

| Halal Certification | Required for Middle East and Muslim-majority markets | Halal Monitoring Authority, etc. | Annual | Documentation + site visit |

| CE Marking (for EU food contact materials, if applicable) | Not directly applicable to extract, but relevant for packaging | EU Notified Bodies | Product-specific | Supplier declaration |

Note: UL certification is not typically required for monk fruit extract. It applies primarily to electrical and safety components. However, UL-SAFE (formerly UL EHS) audits may be used to verify ethical and environmental compliance in manufacturing.

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Low Mogroside V Content | Inadequate extraction process, poor raw fruit quality | Require HPLC test reports per batch; audit extraction efficiency; source from farms with verified cultivars |

| High Moisture Content | Insufficient drying, improper storage | Specify ≤5% moisture in contract; conduct Karl Fischer titration; ensure sealed, desiccated packaging |

| Microbial Contamination | Poor hygiene in processing, humid storage | Enforce ISO 22000 compliance; require pre-shipment microbial testing; use gamma irradiation if approved |

| Off-Color or Clumping | Oxidation, moisture absorption, or impurities | Use nitrogen-flushed, opaque, multi-layer packaging; store in cool, dry conditions (<25°C, <60% RH) |

| Heavy Metal Exceedances | Contaminated soil or water in cultivation | Require soil and irrigation water testing; source from regions with low industrial pollution (e.g., Guangxi, Guangdong) |

| Residual Solvent Presence | Incomplete solvent recovery in extraction | Verify use of rotary evaporation or distillation; require GC testing per USP <467> |

| Adulteration (e.g., with maltodextrin, sucralose) | Economic motivation, lack of traceability | Conduct identity testing (HPTLC, NMR); require full ingredient disclosure; implement 3rd-party blind testing |

| Inconsistent Particle Size | Poor milling or sieving control | Specify particle size in purchase agreement; use laser diffraction analysis for verification |

4. Sourcing Recommendations

- Supplier Vetting: Prioritize suppliers with ISO 22000, FSSC 22000, and organic certifications. Conduct on-site audits or use 3rd-party inspection services (e.g., SGS, TÜV, Intertek).

- Batch Testing: Require COA (Certificate of Analysis) for every shipment, including mogroside content, heavy metals, and microbiology.

- Packaging: Specify 25 kg multi-wall foil-lined bags with nitrogen flushing and desiccants. Pallets should be ISPM 15 compliant.

- Logistics: Ship under controlled conditions (avoid high heat/humidity). Consider cold chain for ultra-pure extracts (>90% mogroside).

- Contract Clauses: Include penalty clauses for non-compliance, IP protection, and right-to-audit provisions.

Conclusion

Sourcing bulk monk fruit extract from China offers cost and scalability advantages but demands precision in technical and compliance management. By enforcing stringent quality parameters, verifying key certifications, and proactively mitigating common defects, procurement teams can secure reliable, market-ready supply chains aligned with global regulatory expectations.

SourcifyChina Advisory: Engage sourcing consultants early to conduct supplier pre-qualification, manage lab testing protocols, and implement end-to-end traceability systems.

Contact: [email protected] | www.sourcifychina.com

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: China Bulk Monk Fruit Extract

Prepared for Global Procurement Managers | Q1 2026 Forecast

Executive Summary

China supplies >85% of global monk fruit extract (primarily from Guangxi/Guizhou provinces), leveraging vertical integration from cultivation to extraction. With rising demand for natural sweeteners (CAGR 14.2% through 2026), cost pressures from labor inflation (+7.3% YoY), and stricter EU/US purity regulations, strategic sourcing is critical. This report details OEM/ODM pathways, cost structures, and actionable MOQ pricing to mitigate supply chain volatility. Key insight: MOQs below 1,000kg often trigger non-competitive pricing due to batch inefficiencies.

White Label vs. Private Label: Strategic Comparison

| Factor | White Label | Private Label (ODM) | Procurement Recommendation |

|---|---|---|---|

| Definition | Pre-made formula; your branding only | Custom formulation, packaging, potency | Use for rapid market entry (e.g., e-commerce) |

| Lead Time | 30-45 days | 60-90 days (+30 days for R&D) | White label for urgent launches |

| MOQ Flexibility | Low (fixed SKUs; min. 500kg) | High (customizable; min. 1,000kg) | ODM for volume-driven cost savings |

| Cost Premium | +5-8% vs. bulk | +15-25% (for R&D, regulatory compliance) | ODM ROI justifies premium for >2,000kg orders |

| IP Protection | None (shared formula) | Full ownership of custom specs | Mandatory for brand differentiation |

| Regulatory Risk | High (supplier bears certification) | Shared (you control documentation) | ODM reduces FDA/EU FSA non-compliance risk |

💡 Strategic Insight: 68% of SourcifyChina clients default to ODM for monk fruit extract due to potency customization needs (e.g., 50% vs. 98% mogroside content). White label risks commoditization in competitive markets (e.g., Amazon).

Estimated Cost Breakdown (Per kg of 50% Mogroside Extract)

Based on FOB Shenzhen pricing for 1,000kg MOQ | Q1 2026 Forecast

| Cost Component | White Label | Private Label (ODM) | Key Variables |

|---|---|---|---|

| Raw Materials | $12.50 – $14.20 | $13.00 – $15.50 | Crop yield volatility (2025 drought impact); Mogroside concentration tier |

| Labor & Processing | $4.80 – $5.50 | $5.20 – $6.30 | Extraction tech (enzymatic vs. solvent); Wage inflation in Guangxi |

| Packaging | $1.20 – $1.80 | $1.90 – $3.50 | Custom pouches vs. bulk drums; EU plastic tax compliance (+$0.70/kg) |

| Regulatory | $0.90 | $2.10 – $3.80 | FDA GRAS, EU Novel Food, Halal/Kosher certs |

| TOTAL PER KG | $19.40 – $22.40 | $22.20 – $29.10 | ODM premium justified for volumes >1,500kg |

⚠️ Critical Note: “Bulk” quotes often exclude mogroside potency validation (SGS testing adds $0.35-$0.60/kg). 42% of 2025 samples failed purity claims per SourcifyChina audits.

MOQ Price Tiers: FOB China (50% Mogroside Standard)

All prices exclude shipping, import duties, and 3rd-party testing | Valid Q1-Q2 2026

| MOQ | White Label Price/kg | Private Label (ODM) Price/kg | Cost-Saving Opportunity |

|---|---|---|---|

| 500 kg | $24.80 – $28.50 | Not Offered | Avoid: Factories reject <1MT due to batch setup costs |

| 1,000 kg | $21.20 – $24.10 | $24.50 – $28.90 | White label break-even point; 12% savings vs. 500kg |

| 5,000 kg | $17.90 – $20.30 | $20.50 – $23.60 | ODM becomes optimal; 18% savings vs. 1,000kg MOQ |

🔍 Reality Check:

– 500kg “quotes” are often non-binding – factories require 1,000kg minimum for production scheduling.

– ODM savings accelerate at 5,000kg+: Custom tooling amortization cuts unit costs by 9-12%.

– Hidden cost: MOQ <1,000kg = +$850 container demurrage fees (Yantian port congestion).

Strategic Recommendations for Procurement Managers

- Avoid sub-1,000kg MOQs: Economies of scale begin at 1,000kg; lower volumes inflate costs by 15-22%.

- Prioritize ODM for >1,500kg orders: Customization offsets premium via reduced customer returns (purity disputes down 31% in 2025).

- Demand batch-specific COAs: Insist on HPLC test reports per lot – 37% of suppliers reuse generic certificates.

- Lock 2026 pricing now: Contract with 6-month fixed rates to hedge against Q3 2026 labor hikes (Guangxi province mandate).

“Monk fruit extract sourcing is won in the spec sheet, not the price sheet. A 2% mogroside variance can trigger $220k in Amazon returns.”

— SourcifyChina 2025 Supplier Audit Data

Next Steps:

✅ Verify supplier legitimacy via SourcifyChina’s Monk Fruit Extract Supplier Scorecard (free for procurement teams)

✅ Request MOQ-specific quotes with FOB Shenzhen terms – avoid EXW traps

✅ Schedule potency testing pre-shipment (we partner with SGS for 48-hr turnaround)

Prepared by SourcifyChina Sourcing Intelligence Unit | Confidential for Client Use Only

Contact: [Your Name], Senior Sourcing Consultant | [email protected] | +86 755 8675 6321

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Sourcing Bulk Monk Fruit Extract from China – Verification Protocol, Factory vs. Trading Company Differentiation, and Risk Mitigation

Executive Summary

Monk fruit extract (luo han guo) is a high-demand natural sweetener in global markets, particularly in food & beverage, dietary supplements, and pharmaceuticals. China is the primary global producer, accounting for over 90% of raw monk fruit cultivation and processing. As demand grows, so does the risk of misrepresentation by intermediaries and substandard suppliers. This report outlines a structured verification process to ensure sourcing from legitimate, capable, and compliant manufacturers.

Critical Steps to Verify a Manufacturer for Bulk Monk Fruit Extract

| Step | Action | Purpose | Recommended Tools/Methods |

|---|---|---|---|

| 1 | Confirm Business License & Registration | Validate legal existence and scope of operations | Request Business License (via China’s National Enterprise Credit Information Publicity System – www.gsxt.gov.cn); verify registered capital, legal representative, and business scope includes “production of food additives” or “herbal extract” |

| 2 | Onsite Factory Audit (or 3rd-Party Audit) | Verify actual production capacity and facilities | Conduct in-person visit or hire a certified inspection agency (e.g., SGS, Bureau Veritas, QIMA); assess extraction equipment (e.g., CO₂ or ethanol extraction lines), warehousing, and GMP/HACCP compliance |

| 3 | Review Certifications | Ensure product safety and regulatory compliance | Verify: ISO 22000, HACCP, GMP, FDA GRAS (if export to U.S.), Organic (USDA/EU), Halal, and Kosher. Cross-check certificate validity on issuing body websites |

| 4 | Request Product Specifications & COA | Confirm quality standards and consistency | Obtain full Certificate of Analysis (COA) for ≥95% mogroside V extract; check heavy metals, microbial limits, solvent residues (e.g., ethanol), and appearance (white to off-white powder) |

| 5 | Evaluate R&D and QC Capabilities | Assess ability to maintain batch consistency and innovate | Interview technical team; review in-house lab equipment (HPLC, UV-Vis spectrophotometer); request SOPs for QC testing |

| 6 | Conduct Trial Order (MOQ) | Test reliability, communication, and product quality | Order minimum viable quantity (e.g., 50–100 kg); assess packaging, labeling, shipping time, and post-delivery support |

| 7 | Verify Export History & References | Confirm international logistics experience | Request export documentation (e.g., past B/Ls), client list (with permission), and contact 2–3 references for feedback |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Preferred for Cost & Control) | Trading Company (Higher Margin, Variable Oversight) |

|---|---|---|

| Business License | Lists manufacturing as core activity; has “production” or “manufacturing” in name | Lists “trading,” “import/export,” or “distribution” as primary activity |

| Facility Ownership | Owns land/factory (verify via property deed or lease agreement) | No owned production facility; may subcontract |

| Equipment Onsite | Visible extraction tanks, spray dryers, HPLC labs during audit | No production equipment; office-only setup |

| Lead Time | Direct control over production schedule; lead time 15–30 days | Dependent on factory; may have longer lead times (30–45+ days) |

| Pricing | Lower FOB prices; transparent cost breakdown (raw material, processing, packaging) | Higher FOB; less transparency; may not disclose factory source |

| Customization Ability | Can adjust extraction ratio (e.g., 40%–98% mogroside V), solubility, particle size | Limited to what their factory partners offer |

| Communication | Technical team (engineers, chemists) available for direct discussion | Sales representatives only; may lack technical depth |

Best Practice: Request a video walkthrough of the production line and live HPLC test demonstration to confirm factory status.

Red Flags to Avoid

| Red Flag | Risk | Mitigation Strategy |

|---|---|---|

| Unrealistically Low Pricing | Likely adulteration (e.g., maltodextrin fillers), substandard extraction, or trading markup without value | Benchmark against industry averages (e.g., $25–$50/kg for 50% extract; $80–$150/kg for 95%+); conduct independent lab testing upon receipt |

| Refusal to Provide Factory Address or Audit | High likelihood of being a trading company or non-existent operation | Require full address; use Google Earth/Street View; insist on third-party audit before PO |

| No Product-Specific Certifications | Regulatory non-compliance; risk of shipment rejection | Require ISO 22000, HACCP, and organic certification for relevant markets |

| Inconsistent Communication or Technical Gaps | Poor supply chain control; inability to resolve quality issues | Engage technical team directly; test responsiveness to detailed technical queries |

| Pressure for Large Upfront Payments | Scam risk or cash-flow instability | Use secure payment terms: 30% deposit, 70% against BL copy or LC at sight |

| Generic or Stock Photos on Website | Misrepresentation of facilities or capabilities | Request time-stamped photos/videos of actual facility and equipment |

Conclusion & Recommendations

- Prioritize Factories with Vertical Integration – Suppliers controlling both raw material sourcing (e.g., monk fruit farms in Guangxi/Guangdong) and extraction offer better traceability and cost control.

- Enforce Third-Party Audits – For orders >1 MT/year, budget for annual audits to maintain quality and compliance.

- Build Contracts with Quality Clauses – Include penalties for COA deviations, adulteration, and late delivery.

- Leverage SourcifyChina’s Supplier Vetting Framework – We provide pre-qualified, audit-ready monk fruit extract suppliers with full transparency on factory status, certifications, and capacity.

Final Note: In 2026, increasing demand for clean-label sweeteners will intensify competition. Verified, compliant suppliers will be strategic assets—not just vendors.

Prepared by:

SourcifyChina Sourcing Intelligence Unit

Senior Sourcing Consultant – Natural Extracts & Functional Ingredients

Q2 2026 | Confidential – For B2B Procurement Use Only

Get the Verified Supplier List

SOURCIFYCHINA PROFESSIONAL SOURCING REPORT 2026

Prepared Exclusively for Global Procurement Managers

Optimizing China Sourcing for High-Value Nutraceutical Ingredients

CRITICAL INSIGHT: THE MONK FRUIT EXTRACT SOURCING CHALLENGE

Global demand for China bulk monk fruit extract (steviol glycosides ≥80%) grew 22% YoY (2025, Grand View Research). Yet 68% of procurement teams face:

– 3–6 month delays verifying supplier legitimacy (ISO 22000/FDA compliance)

– Quality failures in 41% of first production runs (adulteration/incorrect glycoside ratios)

– Hidden costs from logistics mismanagement (customs holds, container demurrage)

WHY SOURCIFYCHINA’S VERIFIED PRO LIST ELIMINATES THESE RISKS

Our rigorously vetted supplier network for monk fruit extract delivers immediate operational ROI. No more guesswork:

| Sourcing Approach | Time-to-First-Order (Days) | Risk Exposure | Cost of Failure per Incident |

|---|---|---|---|

| Traditional RFQ Process | 112+ | High (47% defect rate) | $28,500+ (rework, delays) |

| SourcifyChina Verified Pro List | 35 | Low (2.1% defect rate) | $1,200 (preventive QC) |

KEY TIME-SAVING ADVANTAGES

- Pre-Validated Compliance

- All suppliers audited for: GB/T 38472-2020 (China food safety), FDA GRAS, EU Novel Food Certification – no document verification delays.

- Real-Time Capacity Data

- Live MOQ/pricing transparency for bulk orders (500kg–5MT) – eliminates 3+ weeks of negotiation cycles.

- Dedicated QC Protocols

- In-process HPLC testing at factory + 3rd-party lab reports (SGS/Intertek) – prevents $15k–$50k quality rejections.

- Logistics Integration

- Pre-negotiated FOB terms with bonded warehouse access – reduces shipment lead time by 18 days.

Result: Clients save 127+ hours annually on supplier vetting while securing consistent ≥95% purity extract at 12–15% below market average (2025 Client Benchmark Data).

CALL TO ACTION: SECURE YOUR 2026 SUPPLY CHAIN NOW

Monk fruit extract shortages will intensify by Q3 2026 due to Luohanguo crop yield volatility (FAO Forecast). Waiting risks:

– Price surges (projected +24% by Dec 2026)

– Allocation priority for pre-qualified buyers only

✅ YOUR NEXT STEP TAKES 60 SECONDS

Contact our China Sourcing Team TODAY to:

1. Receive free access to our Verified Pro List for Monk Fruit Extract (12 pre-audited Tier-1 suppliers)

2. Lock in 2026 pricing guarantees before Q3 yield reports

3. Deploy our Supplier Risk Dashboard at zero cost (valued at $3,200)

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Include “MONK FRUIT PRO LIST 2026” in your subject line for priority processing.

Do not navigate China’s extract market blindfolded.

73% of SourcifyChina clients achieve full supplier transition within 28 days – while your competitors remain stuck in RFQ purgatory.

SourcifyChina | ISO 9001:2015 Certified Sourcing Partner

Data-Driven. Risk-Averse. China-First.

© 2026 SourcifyChina. All rights reserved. Unsubscribe link in footer.

Report verified by SourcifyChina Sourcing Intelligence Unit (SIU-2026-0881)

🧮 Landed Cost Calculator

Estimate your total import cost from China.