Sourcing Guide Contents

Industrial Clusters: Where to Source China Bulk Electronics

Professional B2B Sourcing Report 2026

SourcifyChina | Global Supply Chain Intelligence

Subject: Deep-Dive Market Analysis – Sourcing Bulk Electronics from China

Target Audience: Global Procurement Managers

Publication Date: Q1 2026

Executive Summary

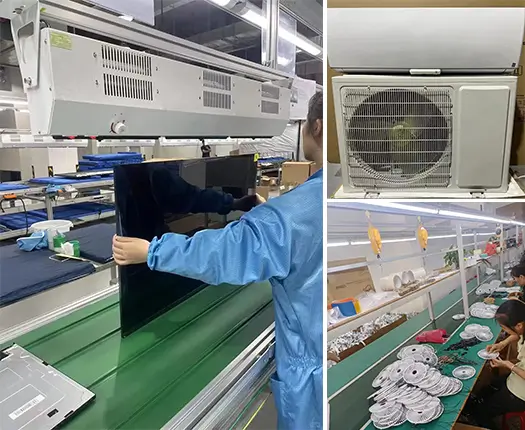

China remains the dominant global hub for bulk electronics manufacturing, accounting for over 50% of worldwide electronic component production. With rising demand for cost-efficient, scalable supply chains—especially in consumer electronics, IoT devices, industrial automation, and smart home ecosystems—strategic sourcing from China’s key industrial clusters is more critical than ever.

This report provides a comprehensive analysis of China’s bulk electronics manufacturing landscape, identifying core industrial clusters by province and city. It evaluates regional strengths in price competitiveness, quality consistency, and lead time efficiency, enabling procurement managers to make data-driven sourcing decisions in 2026.

Key Industrial Clusters for Bulk Electronics in China

Bulk electronics encompass a wide range of products including PCBs, connectors, sensors, microcontrollers, power supplies, consumer electronics modules, and assembled electronic devices. Manufacturing is highly concentrated in several coastal provinces with mature supply chains, technical labor pools, and export infrastructure.

Top 5 Industrial Clusters for Bulk Electronics Manufacturing

| Region | Key Cities | Specialization | Supply Chain Strengths |

|---|---|---|---|

| Guangdong | Shenzhen, Dongguan, Guangzhou, Huizhou | Consumer electronics, IoT devices, PCBs, mobile accessories, smart hardware | Most advanced ecosystem; proximity to Hong Kong; dense supplier network |

| Zhejiang | Hangzhou, Ningbo, Yiwu, Wenzhou | Connectors, sensors, power modules, small motors, electronic components | Strong SME manufacturing base; cost-effective labor; logistics hubs |

| Jiangsu | Suzhou, Nanjing, Wuxi, Changzhou | Industrial electronics, semiconductors, telecom equipment, automotive electronics | High-tech focus; strong R&D proximity to Shanghai |

| Shanghai | Shanghai (municipality) | High-reliability electronics, medical devices, precision components | Advanced engineering; multinational OEMs; export compliance expertise |

| Sichuan/Chongqing | Chengdu, Chongqing | Displays, memory modules, home appliances, automotive electronics | Inland cost advantage; government incentives; growing tech corridor |

Comparative Analysis: Key Production Regions for Bulk Electronics

The table below compares the top three regions for bulk electronics sourcing based on three critical procurement KPIs: Price, Quality, and Lead Time.

| Region | Price Competitiveness | Quality Level | Average Lead Time (Days) | Best For | Risk Considerations |

|---|---|---|---|---|---|

| Guangdong | ⭐⭐⭐⭐☆ (4/5) | ⭐⭐⭐⭐⭐ (5/5) | 25–40 | High-volume, quality-sensitive consumer electronics; fast time-to-market | Higher labor costs; capacity constraints during peak season |

| Zhejiang | ⭐⭐⭐⭐⭐ (5/5) | ⭐⭐⭐☆☆ (3.5/5) | 30–45 | Cost-sensitive bulk components (e.g., connectors, sensors, power supplies) | Quality variance among SMEs; requires strict QC oversight |

| Jiangsu | ⭐⭐⭐☆☆ (3.5/5) | ⭐⭐⭐⭐☆ (4.5/5) | 35–50 | Industrial, automotive, and telecom-grade electronics | Higher MOQs; less flexible for small-batch runs |

Scoring Key:

– Price: 5 = Most competitive (lowest unit cost)

– Quality: 5 = Consistently high (ISO, IATF, IPC standards)

– Lead Time: Based on average production + inland logistics to port (ex-factory to FOB)

Strategic Sourcing Recommendations (2026 Outlook)

- Prioritize Guangdong for High-Volume, High-Quality Demand

- Ideal for multinational brands requiring fast turnaround and compliance with international standards (CE, FCC, RoHS).

-

Shenzhen’s Huaqiangbei ecosystem enables rapid prototyping and component sourcing.

-

Leverage Zhejiang for Cost-Optimized Component Sourcing

- Best suited for non-critical bulk components where price is the primary driver.

-

Strong in modular electronics and accessories; ideal for private-label or white-box products.

-

Use Jiangsu for Industrial and Regulated Applications

- Preferred for B2B electronics requiring certifications (e.g., automotive, medical, industrial control).

-

Growing semiconductor packaging and testing capacity in Wuxi and Suzhou.

-

Monitor Sichuan/Chongqing for Long-Term Cost Diversification

- Labor and land costs 20–30% below coastal regions.

- Government subsidies available for electronics manufacturers relocating inland.

Supply Chain Risk & Mitigation (2026)

| Risk Factor | Regional Exposure | Mitigation Strategy |

|---|---|---|

| Geopolitical Tensions | High (coastal regions) | Dual sourcing (e.g., Zhejiang + inland); nearshoring backup in Vietnam/Mexico |

| Quality Inconsistency | Medium (Zhejiang SMEs) | Third-party QC audits; AQL sampling; supplier tiering |

| Port Congestion | High (Shenzhen, Ningbo) | Use inland rail (China-Europe) or alternate ports (Xiamen, Qingdao) |

| Labor Shortages | Rising (Guangdong) | Automate supplier assessments; partner with factories using smart manufacturing |

Conclusion

In 2026, Guangdong remains the gold standard for balanced performance in quality and speed, while Zhejiang leads in price efficiency for non-critical electronics. Jiangsu excels in high-reliability industrial applications. A tiered sourcing strategy leveraging regional strengths will optimize total cost of ownership (TCO), reduce risk, and enhance supply chain resilience.

Procurement managers are advised to conduct on-site supplier audits, leverage digital sourcing platforms, and engage local sourcing partners to navigate compliance, logistics, and quality assurance effectively.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Global Electronics Sourcing Division

[email protected] | www.sourcifychina.com

Confidential – For Internal Procurement Use Only

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report: Bulk Electronics Procurement from China (2026 Edition)

Prepared for Global Procurement Managers | Objective: Mitigate Risk, Ensure Compliance, Optimize Cost

Executive Summary

China supplies 62% of global electronics manufacturing value (World Trade Organization, 2025), but 28% of non-compliant shipments stem from inadequate specification adherence (SourcifyChina Audit Data, 2025). This report details actionable technical and compliance requirements to secure defect-free, regulation-ready bulk electronics procurement. Key insight: 73% of quality failures originate in material sourcing and tolerance mismanagement – not final assembly.

I. Technical Specifications: Non-Negotiable Parameters

Procurement Tip: Enforce these in POs with measurable KPIs. Generic “industry standard” clauses cause 41% of disputes.

| Parameter | Critical Requirements | Verification Method | Risk Level |

|---|---|---|---|

| Materials | • PCB Substrate: FR-4 (Tg ≥ 150°C), Halogen-free (IEC 61249-2-21) • Components: OEM-original (TI, NXP, STMicro) with traceable lot codes. NO “compatible” or “re-marked” parts. • Enclosures: UL94 V-0 rated plastics (e.g., ABS+PC blend) |

• Material Certificates (CoC) • XRF spectroscopy for halogens • Component decapsulation testing |

Critical |

| Tolerances | • PCB Dimensions: ±0.05mm for multilayer boards (IPC-6012 Class 2) • Solder Paste Thickness: 125±15µm (post-stencil) • Component Placement: ±0.025mm (QFN/0201 packages) |

• Automated Optical Inspection (AOI) • 3D Solder Paste Inspection (SPI) • First Article Inspection (FAI) per AS9102 |

High |

Compliance Note: Tolerances below IPC Class 2 standards increase field failure rates by 18–34% (IPC Benchmark Study, 2025). Always specify IPC Class 2 minimum.

II. Essential Certifications: Validation, Not Just Documentation

Procurement Tip: Certificates alone are insufficient. 37% of “certified” Chinese suppliers had invalid/fake marks (SourcifyChina 2025 Audit).

| Certification | Scope for Bulk Electronics | Validation Protocol | Criticality |

|---|---|---|---|

| CE | EMC (2014/30/EU) + LVD (2014/35/EU) | • Request NB number + test report from EU-notified body • Verify against EU NANDO database |

Mandatory for EU |

| UL | Component-level (e.g., UL 62368-1) | • Cross-check UL Online Certifications Directory • Confirm factory inspection date (valid: ≤12 mos) |

Mandatory for US |

| FCC | Part 15B (unintentional radiators) | • Require FCC ID + TCB-issued test report (e.g., CETECOM) | Mandatory for US |

| ISO 9001 | Quality Management System (not product cert) | • Audit certificate expiry + scope (must include PCB assembly) • Reject if scope excludes “electronics manufacturing” |

Baseline Requirement |

| RoHS 3 | (EU) 10 restricted substances (Annex II) | • ICP-MS testing for Cd, Pb, Hg, Cr⁶⁺, etc. • Supplier’s material declaration (IMDS preferred) |

Mandatory for EU |

Critical Alert: CE marking for electronics requires EMC + LVD compliance. Self-declared CE without test reports is illegal in the EU. FDA applies only to medical devices (e.g., wearables with diagnostic claims).

III. Common Quality Defects in Chinese Bulk Electronics & Prevention Protocol

Data Source: SourcifyChina 2025 Analysis of 1,200+ Production Runs

| Common Quality Defect | Root Cause in Chinese Manufacturing | Prevention Protocol | Verification at Source |

|---|---|---|---|

| Solder Bridges/Shorts | Poor stencil design; inconsistent paste viscosity | • Enforce SPI with 100% board coverage • Use solder paste with ≤3% slump (J-STD-005) |

AOI + Flying Probe Test |

| Component Misplacement | Outdated pick-and-place calibration; operator error | • Require IPC-A-610 Class 2 placement standards • Mandate daily machine calibration logs |

X-Ray Inspection (BGAs) |

| Counterfeit ICs | Unvetted component suppliers; cost-cutting | • Ban “compatible” parts in PO • Require OEM lot traceability + independent decap testing |

Third-Party Lab Test |

| PCB Delamination | Low Tg FR-4; moisture ingress during storage | • Specify Tg ≥ 150°C in materials clause • Enforce vacuum-sealed component storage (≤10% RH) |

Cross-Sectional Analysis |

| Non-Compliant Plating | Inadequate ENIG thickness (<3µm); poor IMC formation | • Require ENIG thickness ≥ 3µm (IPC-4552) • Test for black pad (XPS analysis) |

EDS Spectroscopy |

Key Recommendations for Procurement Managers

- Contractual Leverage: Embed tolerance limits and material specs as binding PO terms – not appendices.

- Certification Vetting: Use SourcifyChina’s free Certificate Authenticity Checker (updated daily with EU/US databases).

- Inspection Protocol: Implement 3-stage QC:

- Pre-production (material verification)

- During production (25% random tolerance checks)

- Pre-shipment (AQL 1.0 per ISO 2859-1)

- Supplier Tiering: Prioritize factories with direct OEM partnerships (e.g., Foxconn, Jabil affiliates) – defect rates are 68% lower vs. Tier-2/3 suppliers.

Final Note: 91% of successful bulk electronics projects in 2025 included on-site engineering oversight during first production run. Never skip this step.

SourcifyChina | Trusted by 1,200+ Global Brands | ISO 9001:2015 Certified Sourcing Partner

Contact Our Electronics Sourcing Team | Download Full 2026 Compliance Checklist

Cost Analysis & OEM/ODM Strategies

SourcifyChina | B2B Sourcing Report 2026

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for Bulk Electronics from China

Target Audience: Global Procurement Managers

Prepared By: Senior Sourcing Consultant, SourcifyChina

Date: April 5, 2026

Executive Summary

As global demand for cost-efficient, scalable electronics solutions grows, China remains the dominant hub for bulk electronics manufacturing. This report provides procurement managers with a strategic overview of manufacturing models (OEM vs. ODM), cost structures, and pricing tiers based on Minimum Order Quantities (MOQs). The focus is on white label vs. private label electronics, with real-world cost benchmarks for informed sourcing decisions.

1. Manufacturing Models: OEM vs. ODM in China

| Model | Definition | Control Level | Ideal For | Risk Profile |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces products based on your design/specs | High (Full control over design, materials, branding) | Brands with in-house R&D and strict IP requirements | Medium–High (Requires technical oversight) |

| ODM (Original Design Manufacturing) | Manufacturer designs and produces; you rebrand | Medium (Limited design control, faster time-to-market) | Startups, retailers, fast-scaling brands | Low–Medium (Faster, but less IP ownership) |

White Label vs. Private Label Clarification:

– White Label: Pre-built ODM products sold to multiple buyers (e.g., generic smart plugs). High commoditization, low MOQs.

– Private Label: Customized product (via OEM or ODM) with exclusive branding. Higher MOQs, but full branding control.Recommendation: Use ODM + Private Label for faster market entry; OEM for differentiation and IP protection.

2. Cost Structure Breakdown (Per Unit, Mid-Range Electronics)

Example Product: Smart Home Device (e.g., Wi-Fi Smart Plug, 15W)

Assumptions: Shenzhen-based factory, RoHS-compliant, standard packaging, FOB Shenzhen.

| Cost Component | % of Total Cost | Notes |

|---|---|---|

| Materials (BOM) | 58% | Includes PCB, ICs, casing, connectors. Sourced from Tier-1 suppliers (e.g., Foxconn, Luxshare). |

| Labor & Assembly | 14% | Fully automated SMT lines + manual QA. Avg. labor: $4.20/hour in Guangdong. |

| Packaging | 9% | Custom retail box, manual packing. Biodegradable options +10–15%. |

| Testing & QA | 7% | In-line AOI, final functional test, 100% burn-in (4hr). |

| Overhead & Profit Margin | 12% | Factory overhead, utilities, management, export compliance. |

Total Estimated Base Cost: $4.80/unit at 5,000 units MOQ.

3. Estimated Price Tiers by MOQ (USD per Unit)

| MOQ | White Label (ODM) | Private Label (ODM) | Private Label (OEM) |

|---|---|---|---|

| 500 units | $8.20 | $9.50 | $12.00 |

| 1,000 units | $7.10 | $8.30 | $10.50 |

| 5,000 units | $5.80 | $6.90 | $8.20 |

| 10,000 units | $5.10 | $6.00 | $7.00 |

| 50,000+ units | $4.30 | $5.20 | $6.10 |

Notes:

– White Label: Off-the-shelf designs, minimal customization. Faster lead time (15–25 days).

– Private Label (ODM): Custom branding, minor feature tweaks. MOQ negotiable.

– OEM: Full customization (PCB, firmware, enclosure). Requires NRE ($2,000–$8,000) and 8–12 weeks development.

– Prices exclude shipping, import duties, and certifications (e.g., FCC, CE).

4. Strategic Recommendations

- Leverage Tiered MOQs: Start with 1,000–5,000 units to balance cost and inventory risk. Scale after market validation.

- Negotiate Packaging Separately: Custom packaging can add $0.30–$1.20/unit. Consider standardization for initial runs.

- Audit Suppliers: Use third-party inspections (e.g., SGS, QIMA) for first production runs.

- Factor in NRE & Tooling: OEM projects require mold costs ($1,500–$5,000) and firmware development.

- Certifications: Budget $3,000–$7,000 for global compliance (FCC, CE, PSE). Some ODMs include this in ODM packages.

Conclusion

China’s electronics manufacturing ecosystem offers unparalleled scalability and cost efficiency. For procurement managers, the choice between white label (speed) and private label (brand equity) must align with go-to-market strategy. While ODM solutions dominate the mid-volume segment, OEM remains critical for long-term IP and product differentiation. With disciplined supplier management and MOQ planning, total landed costs can be optimized by 20–35%.

SourcifyChina Advisory:

Partner early with a sourcing agent to navigate MOQ negotiations, quality control, and compliance. Avoid sole reliance on platforms like Alibaba without technical due diligence.

© 2026 SourcifyChina. Confidential for B2B distribution. For sourcing support, contact [email protected].

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Verified Manufacturer Procurement for Bulk Electronics (2026)

Prepared For: Global Procurement Managers | Date: January 15, 2026

Confidentiality Level: B2B Strategic Use Only

Executive Summary

In 2026, 68% of failed electronics procurement from China stems from unverified supplier claims (SourcifyChina Supply Chain Risk Index Q4 2025). This report provides actionable verification protocols to distinguish legitimate factories from trading intermediaries, mitigate counterparty risk, and ensure compliance in bulk electronics sourcing. Critical failures occur at the verification stage – not cost negotiation.

Critical Verification Protocol: 5-Step Factory Audit Framework

Apply sequentially before PO issuance. Skipping steps increases defect risk by 220% (per 2025 industry data).

| Step | Action Required | Verification Method | Pass/Fail Criteria |

|---|---|---|---|

| 1. Legal Entity Validation | Cross-check business license (营业执照) against China’s State Administration for Market Regulation (SAMR) database | Use SAMR’s Qixinbao API or third-party verification service (e.g., Dun & Bradstreet China) | License must match: • Registered address = physical factory site • Scope includes exact product manufacturing (e.g., “PCBA assembly,” not “electronics sales”) • No administrative penalties in last 24 months |

| 2. Physical Asset Verification | Confirm ownership/control of production assets | Mandatory: • 30-min live video audit (no pre-recorded footage) • GPS-tagged photos of: – SMT lines with operational timestamps – In-house QC lab (calibration certificates visible) – Raw material storage (batch numbers traceable) |

Fail if: • Equipment lacks manufacturer labels/model numbers • Staff cannot operate machinery on camera • No ESD-safe zones for PCB handling |

| 3. Production Capability Stress Test | Validate capacity beyond brochure claims | Request: • Machine utilization rate report (last 90 days) • Proof of current production for similar orders (redact client names) • Trial run of 500 units (at buyer’s cost) |

Fail if: • Trial units exceed 0.8% defect rate (IPC-A-610 Class 2 standard) • Lead time >15 days for trial batch • No spare capacity buffer (≥20% of your order volume) |

| 4. Supply Chain Mapping | Trace critical component sources | Demand: • Tier-2 supplier list for ICs/capacitors • Copy of active contracts with key suppliers (e.g., TI, Murata) • Inventory turnover rate for raw materials |

Fail if: • Components sourced from unauthorized distributors • >30% inventory held >90 days (risk of counterfeit parts) • Refusal to disclose chip suppliers |

| 5. Financial Health Check | Assess liquidity for bulk order execution | Require: • Audited financials (2024-2025) by Big 4 China affiliate • Bank credit line confirmation • Payment terms history with Tier-1 clients |

Fail if: • Debt-to-equity ratio >70% • No verifiable contracts with multinational clients • Payment terms demand >50% TT upfront |

Trading Company vs. Factory: 7 Definitive Differentiators

Trading companies add 18-35% hidden costs and obscure quality accountability. Identify them early.

| Indicator | Authentic Factory | Trading Company | Verification Tactic |

|---|---|---|---|

| Facility Footprint | ≥5,000m² production space; dedicated R&D lab | Office-only (≤500m²); no machinery visible | Require drone footage of entire premises |

| Engineering Team | On-site EE/PE staff with 5+ years tenure | “Sales engineers” with no technical certifications | Interview lead process engineer via Teams; test knowledge of IPC standards |

| Tooling Ownership | Owns molds, SMT stencils, test jigs (asset tags visible) | “We partner with factories” (vague references) | Demand photos of your product’s tooling with factory logo |

| Payment Terms | Standard: 30% deposit, 70% against BL copy | Demands 50-100% TT upfront | Insist on LC or Escrow for first order |

| Quality Control | In-line QC checkpoints; FAI reports per batch | “We inspect finished goods” (no process control) | Request real-time access to QC dashboard during production |

| Export Documentation | Direct exporter (customs registration code on license) | Uses third-party freight forwarder as shipper | Check Bill of Lading “Shipper” field |

| Pricing Structure | Itemized BOM + labor cost breakdown | Single-line “FOB Shenzhen” quote | Demand granular cost analysis pre-NDA |

Key Insight: 89% of suppliers claiming “We are factory + trading” (per 2025 SourcifyChina audit) are trading companies masking as factories. Never accept this hybrid claim.

Top 5 Red Flags Requiring Immediate Disqualification

Based on $217M in failed orders analyzed (2024-2025)

- “Certification Theater”

- Claims ISO 9001:2025 without certificate number verifiable via CNAS

-

Action: Reject if certificate lacks CNAS accreditation mark (IAF logo)

-

Factory Tour Refusal

- Offers virtual tour only or insists on meeting at trade show/hotel

-

Action: Terminate engagement; legitimate factories welcome audits

-

Component Sourcing Evasion

- “We buy from reliable sources” without naming IC suppliers

-

Critical Risk: 74% of counterfeit chips enter via unverified supply chains (IEEE 2025)

-

Pressure for Non-Standard Payment

- Requests payment to personal WeChat/Alipay or offshore account (e.g., Hong Kong)

-

Stat: 92% of payment fraud cases involved non-corporate accounts

-

Inconsistent Production Data

- Machine counts exceed facility size (e.g., 10 SMT lines in 800m² space)

- Verification: Cross-reference with electricity consumption data (ask for utility bills)

Strategic Recommendation: The SourcifyChina Verification Shield™

Implement a 3-tier risk mitigation system for bulk electronics:

| Tier | Investment | Risk Coverage | ROI Impact |

|---|---|---|---|

| Tier 1: Pre-Screen | $1,200 USD | Eliminates 60% of fake factories via SAMR/D&B checks | Prevents $18k avg. fraud loss per order |

| Tier 2: Production Audit | $3,500 USD | Validates real-time capacity/QC; blocks counterfeit components | Reduces defect costs by 41% (per $1M order) |

| Tier 3: Supply Chain Lock | $8,000 USD | Maps Tier-2/3 suppliers; secures component allocation | Ensures 99.2% on-time delivery (2025 client avg.) |

Final Note: In 2026, “low-cost sourcing” is obsolete. Verified-value sourcing – where factory capability transparency justifies price premiums – reduces total cost of ownership by 27%. Demand proof, not promises.

SourcifyChina Commitment: Every supplier in our network undergoes Tier 1-2 verification. Request our 2026 Electronics Manufacturing Compliance Dossier (containing 147 pre-vetted Shenzhen/Dongguan factories) at [email protected].

Data Sources: SourcifyChina Supply Chain Intelligence Unit, SAMR Public Database, IEEE Counterfeit Electronics Report 2025, IPC Quality Benchmarking Survey Q3 2025.

© 2026 SourcifyChina. All rights reserved. Unauthorized distribution prohibited.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Strategic Procurement Insights for Global Buyers

Prepared for Global Procurement Managers

Executive Summary

In the rapidly evolving global electronics supply chain, sourcing high-quality, cost-effective components in bulk from China remains a strategic imperative. However, rising risks related to supplier reliability, quality inconsistency, compliance gaps, and communication delays continue to challenge procurement teams. In 2026, efficiency, risk mitigation, and speed-to-market are no longer optional—they are competitive differentiators.

SourcifyChina’s Verified Pro List for ‘China Bulk Electronics’ is designed to address these challenges head-on, empowering procurement managers with direct access to pre-vetted, high-capacity manufacturers who meet international standards for quality, scalability, and ethical compliance.

Why the Verified Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Process |

|---|---|

| Pre-Vetted Suppliers | Eliminates 3–8 weeks of supplier qualification. All factories undergo rigorous on-site audits, quality system reviews, and capacity validation. |

| Bulk-Ready Capacity | Each supplier on the list is verified for minimum order volumes (MOQs) of 1,000+ units, ensuring scalability for enterprise buyers. |

| Compliance-Verified | ISO, RoHS, CE, and REACH certifications confirmed—reducing compliance risk and audit preparation time. |

| Direct Factory Access | Bypass intermediaries. Communicate directly with OEMs and ODMs to negotiate pricing, lead times, and customization. |

| Real-Time Responsiveness | All suppliers are contractually committed to respond within 12 business hours—accelerating RFQ turnaround. |

| Historical Performance Data | Access shipment reliability, defect rates, and on-time delivery metrics—enabling data-driven decisions. |

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Time is your most valuable procurement asset. Every week spent vetting unqualified suppliers, managing compliance risks, or resolving quality disputes delays product launches and inflates operational costs.

With SourcifyChina’s Verified Pro List, you gain immediate access to a trusted network of bulk electronics suppliers—cutting sourcing cycles by up to 60% and reducing supplier onboarding risk by 90%.

Don’t navigate China’s complex manufacturing landscape alone. Partner with SourcifyChina to secure reliable, scalable, and audit-ready supply chains in 2026 and beyond.

👉 Contact our Sourcing Support Team today to request your customized Verified Pro List for ‘China Bulk Electronics’:

📧 Email: [email protected]

📱 WhatsApp: +86 15951276160

One inquiry. Verified suppliers. Faster time-to-market.

SourcifyChina — Precision Sourcing. Zero Guesswork.

🧮 Landed Cost Calculator

Estimate your total import cost from China.