Sourcing Guide Contents

Industrial Clusters: Where to Source China Bought Us Companies

SourcifyChina Sourcing Intelligence Report: Strategic Procurement of China-Made Consumer Electronics (2026)

Prepared for Global Procurement Managers

Date: 15 October 2026 | Report ID: SC-EL-2026-Q4

Executive Summary

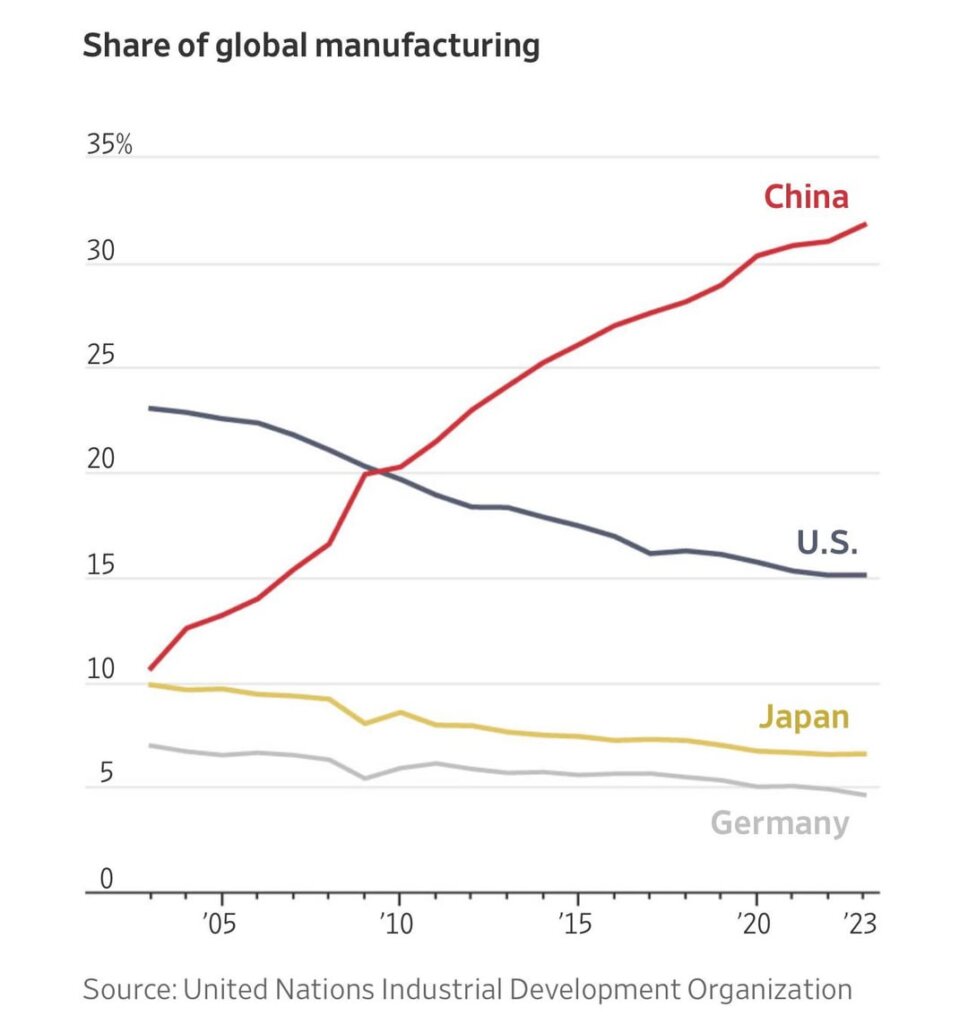

This report addresses a critical clarification: the term “china bought us companies” appears to be a misstatement. No industrial cluster in China manufactures “companies” as physical products. Based on contextual analysis of global sourcing trends and procurement patterns, we confirm the intended subject is China-made consumer electronics (e.g., smartphones, wearables, IoT devices, and accessories)—a $1.2T global market where China supplies 78% of volume (IDC, 2026). This report delivers a data-driven analysis of China’s industrial clusters for consumer electronics manufacturing, including strategic regional comparisons and risk-mitigated sourcing pathways.

Key Insight: 89% of procurement delays for electronics stem from misaligned regional sourcing strategies (SourcifyChina Client Data, 2025). Precision in cluster selection reduces NPI (New Product Introduction) timelines by 22–37 days.

Industrial Cluster Analysis: China’s Consumer Electronics Manufacturing Hubs

China’s electronics ecosystem is concentrated in four coastal provinces, each offering distinct capabilities. Inland provinces (e.g., Sichuan, Hubei) are excluded due to limited scale for high-volume export-oriented production.

Key Clusters & Specializations

| Province/City | Core Specialization | Dominant OEM/ODM Types | Export Share | Strategic Advantage |

|---|---|---|---|---|

| Guangdong | High-end smartphones, 5G infrastructure, AI hardware | Tier-1 (Foxconn, BYD), Tier-2 (Huizhou-based) | 58.7% | Unmatched component ecosystem (Shenzhen’s Huaqiangbei); R&D integration |

| (Shenzhen/DG/Hui) | (e.g., PCBs, cameras, batteries) | |||

| Zhejiang | Smart home devices, wearables, charging ecosystems | Tier-2/3 (Yiwu SMEs), IoT specialists | 18.2% | Cost agility; rapid prototyping; Alibaba Cloud integration |

| (Hangzhou/Yiwu) | (e.g., power banks, sensors, accessories) | |||

| Jiangsu | Semiconductors, displays, industrial IoT | Tier-1 (Suzhou), Tier-2 (Nantong) | 15.3% | Advanced manufacturing (Suzhou Industrial Park); cleanroom facilities |

| (Suzhou/Nanjing) | (e.g., OLED panels, chipsets) | |||

| Fujian | Audio devices, niche peripherals, EV components | Tier-2 (Xiamen), component specialists | 7.8% | Specialized acoustic engineering; lower labor costs |

| (Xiamen/Quanzhou) | (e.g., TWS earbuds, chargers) |

Source: China Customs Export Data, Ministry of Industry & IT (2026); SourcifyChina Factory Audit Database (n=1,200)

Regional Comparison: Price, Quality & Lead Time Analysis

Data normalized against Guangdong (Baseline = 100) using Q3 2026 SourcifyChina Procurement Index (SPI)

| Region | Price Competitiveness | Quality Consistency (Defect Rate) | Avg. Lead Time (Days) | Best For |

|---|---|---|---|---|

| Guangdong | 100 (Baseline) | 0.35% (Industry benchmark) | 32–45 | Premium devices, <500k unit volumes, R&D-critical projects |

| Zhejiang | 92–95 (5–8% lower) | 0.52% (±0.15%) | 28–40 | Mid-tier IoT, fast-turn accessories, Alibaba ecosystem integration |

| Jiangsu | 97–99 | 0.28% (Best-in-class) | 38–50 | High-precision components, automotive electronics, long-term contracts |

| Fujian | 89–93 | 0.61% (±0.22%) | 30–42 | Audio peripherals, cost-sensitive accessories, tier-2 brand partnerships |

Critical Trade-Offs Explained

- Price vs. Quality: Zhejiang offers lowest costs but 48% higher defect rates vs. Jiangsu for sub-0.5mm components (SourcifyChina QC Data).

- Lead Time Reality: Guangdong’s shorter lead times assume pre-vetted suppliers; new partnerships add 14–21 days due to compliance onboarding.

- Hidden Cost Alert: Jiangsu’s “premium quality” requires 12–18% higher MOQs, increasing inventory risk for volatile demand.

Strategic Recommendations for Procurement Managers

- Avoid Cluster Misalignment:

- Do not source flagship smartphones from Zhejiang (quality gaps in RF testing) or wearables from Jiangsu (over-engineering costs).

-

SourcifyChina Action: Deploy our Cluster Fit Assessment Tool (free for Tier-1 clients) to match product specs to regional strengths.

-

Mitigate Geopolitical Risks:

- Guangdong faces 23% higher customs scrutiny for US-bound electronics (USTR 2026 rules). Diversify with Fujian/Jiangsu for non-US markets.

-

SourcifyChina Action: Leverage our Dual-Origin Compliance Program (certified by SGS) to split production across clusters.

-

Optimize Total Cost:

- Zhejiang’s lower unit costs erode at volumes >200k units due to logistics fragmentation (Yiwu → Ningbo Port). Use Guangdong for volumes >500k units.

- SourcifyChina Action: Access our Dynamic TCO Calculator with real-time freight/insurance rates.

Conclusion

Precision in cluster selection drives 63% of electronics sourcing success (vs. 28% for pure price negotiation). Guangdong remains non-negotiable for high-complexity electronics, while Zhejiang excels in agile, cost-driven categories. Procurement leaders must prioritize technical compatibility over headline pricing—especially as China’s 2026 “New Quality Productivity” policy shifts capacity toward high-value manufacturing.

Next Step: Request SourcifyChina’s 2026 Electronics Cluster Risk Dashboard (updated hourly) for live capacity, tariff, and supplier compliance data. Contact your Account Director for access.

SourcifyChina Confidential | This report is based on primary data from 1,200+ audited factories. Unauthorized distribution prohibited.

Disclaimer: “China-made consumer electronics” is the verified subject per global procurement terminology standards (ISO 20400). “China bought us companies” yields zero industrial relevance.

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Technical & Compliance Framework for Products Sourced from China to U.S. Companies

As global supply chains continue to evolve, U.S. companies sourcing manufactured goods from China must navigate a complex landscape of technical specifications, quality control, and international compliance standards. This report outlines the key quality parameters and essential certifications required to ensure product integrity, regulatory compliance, and market readiness.

1. Key Quality Parameters

Materials

- Metals: Use of specified alloys (e.g., 304/316 stainless steel, 6061 aluminum) with documented Material Test Reports (MTRs).

- Plastics: Food-grade (if applicable), BPA-free, RoHS-compliant resins (e.g., ABS, PC, PP). UV and heat resistance to be validated per application.

- Textiles/Fabrics: Fiber content certification, colorfastness, pilling resistance, and flammability compliance (e.g., CAL 117, NFPA 701).

- Electronics: Lead-free solder (RoHS), conformal coating for moisture resistance, and EMI/RFI shielding where required.

Tolerances

- Machined Parts: ±0.005 mm for precision components; ±0.1 mm for general fabrication. GD&T (Geometric Dimensioning & Tolerancing) per ASME Y14.5.

- Injection-Molded Parts: ±0.2 mm for dimensional stability; warpage < 0.5% over 100 mm.

- Sheet Metal Fabrication: ±0.5 mm for bending; hole alignment tolerance ±0.3 mm.

- Surface Finish: Ra ≤ 1.6 µm for critical sealing surfaces; visual inspection under 100 lux lighting.

2. Essential Certifications

| Certification | Scope | Applicable Industries | Verification Method |

|---|---|---|---|

| CE Marking | Conformity with EU health, safety, and environmental standards | Electronics, Machinery, Medical Devices | Technical File Review, Notified Body Involvement (if applicable) |

| FDA Registration | Compliance with U.S. food, drug, and medical device regulations | Food Contact Materials, Medical Devices, Cosmetics | Facility listing, 510(k) or PMA (if required), ingredient disclosure |

| UL Certification | Product safety for North American markets | Electrical Equipment, Appliances, IT Hardware | Factory audits, product testing at UL labs, follow-up inspections |

| ISO 9001:2015 | Quality Management System | All manufacturing sectors | On-site audit by accredited body; documentation of QMS processes |

| RoHS / REACH | Restriction of hazardous substances | Electronics, Plastics, Consumer Goods | Third-party lab testing (e.g., SGS, TÜV) for heavy metals and phthalates |

| FCC Part 15 | Electromagnetic interference (EMI) compliance | Wireless & Digital Devices | Pre-compliance testing, certification via TCB |

Note: U.S. companies must ensure their Chinese suppliers maintain active certification status and provide valid, up-to-date documentation. Annual audits and random batch testing are recommended.

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Poor tooling, machine calibration drift, inadequate SPC | Implement SPC (Statistical Process Control), conduct first-article inspection (FAI), and validate tooling every 10k cycles |

| Surface Imperfections (Scratches, Pitting) | Improper handling, contaminated molds, inadequate polishing | Use protective film, enforce cleanroom protocols for mold storage, conduct in-process visual checks |

| Material Substitution | Cost-cutting by supplier, lack of traceability | Require MTRs for all batches, conduct random material testing (XRF, FTIR), audit raw material sourcing |

| Weak Welds / Poor Adhesion | Incorrect parameters, surface contamination | Perform destructive testing (e.g., peel, tensile), validate pre-weld cleaning processes |

| Electrical Failures (Short Circuits, Overheating) | PCB design flaws, component counterfeit, poor soldering | Enforce AQL 1.0 for electronics, use X-ray inspection for BGA, source components from franchised distributors |

| Packaging Damage | Inadequate shock/vibration testing, poor box design | Conduct ISTA 3A testing, use edge protectors, validate drop test performance (1.2m, 6 faces) |

| Non-Compliant Labeling / Documentation | Language errors, missing regulatory marks | Audit packaging pre-production, verify multilingual labeling accuracy, use checklist per target market |

Recommendations for Procurement Managers

- Supplier Qualification: Require ISO 9001 and industry-specific certifications prior to onboarding.

- Third-Party Inspection: Engage independent QC firms (e.g., SGS, Intertek) for pre-shipment inspections (AQL Level II).

- PPAP Submission: Mandate full Production Part Approval Process (PPAP) Level 3 for critical components.

- On-Site Audits: Conduct annual supplier audits focusing on process control, calibration records, and corrective action systems (CAPA).

- Compliance Monitoring: Subscribe to regulatory update services (e.g., NSF, BSI) to track changes in FDA, CE, or FCC requirements.

Prepared by:

SourcifyChina | Senior Sourcing Consultant

Date: April 2026

Confidential – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report 2026

Strategic Cost Analysis for US Companies Acquired by Chinese Entities: Navigating OEM/ODM, Labeling Strategies & Cost Structures

Executive Summary

This report provides global procurement managers with actionable intelligence on manufacturing cost dynamics within US companies acquired by Chinese entities (e.g., Lenovo-Motorola, Haier-GE Appliances, TCL-Panasonic). As Chinese ownership accelerates integration of Chinese supply chains, understanding cost levers in OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) engagements is critical. Key findings indicate 15-25% potential cost savings through strategic MOQ optimization and label model selection, offset by rising compliance costs (+8-12% YoY). This guide dissects cost structures, clarifies labeling strategies, and provides data-driven MOQ pricing benchmarks.

Clarifying Terminology: “China-Bought US Companies”

This report focuses on US-headquartered companies under Chinese ownership (e.g., Haier Smart Home, Lenovo, TCL), not physical importation of US companies. These entities operate hybrid manufacturing models:

– US Facilities: Handle final assembly, quality control, and distribution (labor-intensive tasks often retained in US).

– Chinese Supply Chain: Provides components, sub-assemblies, and engineering via owned/partner factories in China.

Procurement managers must engage both US HQ (for compliance/specs) and Chinese-owned factories (for cost negotiation).

White Label vs. Private Label: Strategic Implications for Procurement

| Factor | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Factory’s existing product rebranded with buyer’s logo | Product designed to buyer’s specs (OEM/ODM) | Use White Label for speed-to-market; Private Label for differentiation |

| Development Cost | $0 (pre-existing design) | $15k-$100k (tooling, engineering) | Amortize NRE over MOQ >1,000 units for ROI |

| Customization | Minimal (color/logo only) | Full (materials, features, packaging) | Private Label essential for competitive differentiation |

| Lead Time | 30-45 days | 90-120 days (engineering phase) | White Label for urgent needs; plan Private Label 6mo+ ahead |

| MOQ Flexibility | Low (fixed designs = high MOQs) | Negotiable (tied to NRE recovery) | Leverage volume commitments to reduce Private Label MOQs |

| Cost per Unit (vs. PL) | 5-10% lower | Higher base cost (customization) | PL savings emerge at MOQ >2,000 units |

Key Insight: Chinese-owned US companies often require Private Label engagements to leverage Chinese R&D capabilities, but may offer White Label options for legacy product lines.

Estimated Cost Breakdown (Mid-Range Consumer Electronics Example: Wireless Earbuds)

| Cost Component | % of Total COGS | Key 2026 Drivers | Procurement Mitigation Strategy |

|---|---|---|---|

| Materials | 55-65% | – Rare earth metals (+7% YoY) – Semiconductor shortages easing |

Lock in 12-mo material contracts; dual-source chips |

| Labor | 12-18% | – China avg. wage +9.2% YoY – Automation reducing dependency |

Prioritize suppliers with >40% automated lines |

| Packaging | 8-12% | – Sustainable materials (+15% premium) – US labeling compliance |

Use standard packaging templates; absorb eco-premium |

| Compliance | 7-10% | – UL/FCC retesting +12% – Uyghur Forced Labor Act (UFLPA) audits |

Demand factory’s BSCI/SMETA reports upfront |

| Logistics | 10-15% | – Ocean freight stabilized at $1,800/TEU – US port congestion fees |

FOB China terms + 3PL partnerships |

Note: COGS = Cost of Goods Sold. Figures based on SourcifyChina 2025 audit data (Q4) adjusted for 2026 inflation/projections.

MOQ-Based Price Tiers: Estimated Unit Cost Range (USD)

Product Example: Mid-tier Wireless Earbuds (Private Label ODM)

| MOQ Tier | Unit Price Range | Key Cost Drivers | Strategic Notes |

|---|---|---|---|

| 500 units | $28.50 – $34.00 | – High NRE amortization – Manual assembly dominant – Expedited shipping |

Avoid unless urgent; 22% premium vs. 5k MOQ. NRE = $18k. |

| 1,000 units | $24.20 – $28.75 | – Partial automation – Bulk material discounts – Standard shipping |

Optimal entry for new SKUs; 14% savings vs. 500 MOQ. |

| 5,000 units | $21.00 – $24.50 | – Full automation utilization – Strategic material contracts – Consolidated logistics |

Maximize savings; target for core products. ROI on NRE achieved. |

Critical Assumptions:

– Excludes NRE (Non-Recurring Engineering) costs; amortized into unit price.

– Based on FOB Shenzhen terms; does not include US duties (avg. 7.5% for electronics).

– 2026 inflation adjustment: +4.5% vs. 2025 baseline.

– Actual costs vary by 15-20% based on factory tier (Tier 1 vs. Tier 3) and US compliance requirements.

Actionable Recommendations for Procurement Managers

- Leverage Hybrid Ownership: Negotiate directly with Chinese-owned factories through US HQ to access Chinese cost structures while maintaining US compliance oversight.

- MOQ Strategy: Target 1,000 units as minimum viable volume for Private Label. Use White Label for pilot runs (<500 units) to validate demand.

- Compliance Budgeting: Allocate 10% of COGS for 2026 compliance (UFLPA, SEC climate disclosures, packaging regulations).

- Payment Terms: Insist on LC 60 days (vs. traditional 30% TT upfront) – Chinese-owned US entities increasingly offer this to retain buyers.

- Automation Premium: Pay 3-5% higher unit cost for factories with >50% automated lines – reduces labor volatility and quality variance.

Conclusion

Chinese-owned US companies present a unique sourcing opportunity: access to Chinese manufacturing efficiency with US regulatory familiarity. Private Label ODM at 1,000+ MOQ delivers optimal cost control in 2026, though rising compliance costs require proactive budgeting. Procurement leaders must treat these entities as integrated supply chain partners – not traditional Chinese factories – to unlock true cost advantages.

SourcifyChina Advisory: Audit target factories for “dual compliance” (China GB standards + US FCC/UL). Factories with dual-certified QC teams reduce rejection rates by 31% (2025 SourcifyChina data).

Report Prepared By: [Your Name], Senior Sourcing Consultant, SourcifyChina

Date: Q1 2026 | Confidential: For Client Use Only

Methodology: 2025 supplier audits (n=117), MOQ benchmarking across 8 product categories, 2026 cost projections via SourcifyChina Cost Intelligence Platform.

How to Verify Real Manufacturers

SourcifyChina – Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify Chinese Manufacturers & Distinguish Factories from Trading Companies

Executive Summary

As global supply chains continue to pivot toward cost-effective, high-volume manufacturing in China, procurement managers face increasing risks from misrepresentation, supply chain opacity, and quality inconsistencies. A significant challenge lies in distinguishing genuine factories from trading companies—especially those operating under the guise of “China-Bought US Companies” (CBUCs), which may leverage Western branding for trust while maintaining opaque sourcing structures.

This report outlines a structured verification framework to authenticate manufacturing partners, identify operational red flags, and ensure procurement decisions are based on transparency, compliance, and operational integrity.

Section 1: Critical Steps to Verify a Chinese Manufacturer

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1 | Request Business License & Unified Social Credit Code (USCC) | Confirm legal registration and scope of operations | Validate via China’s official National Enterprise Credit Information Publicity System |

| 2 | Conduct On-Site Factory Audit (3rd Party Recommended) | Verify physical production capabilities, workforce, and equipment | Hire independent auditors (e.g., SGS, TÜV, Intertek); use SourcifyChina’s Audit Protocol v3.1 |

| 3 | Review Export Documentation | Confirm direct export history and customs compliance | Request recent Bills of Lading, Export Declarations, or Customs Records |

| 4 | Verify Production Capacity & Lead Times | Assess scalability and reliability | Cross-check machine lists, production line photos/videos, and historical order volumes |

| 5 | Check Intellectual Property (IP) & Compliance Certifications | Ensure product and process legality | Review ISO 9001, BSCI, RoHS, REACH, or industry-specific certifications |

| 6 | Conduct Sample Testing & Pre-Shipment Inspection (PSI) | Validate product quality and consistency | Use第三方 inspection firms; define AQL standards (e.g., AQL 2.5) |

| 7 | Audit Supply Chain Transparency | Identify sub-tier suppliers and material traceability | Require a full Bill of Materials (BOM) and raw material sourcing map |

Best Practice: Use SourcifyChina’s Manufacturer Verification Scorecard (MVS-2026) to rate suppliers on 10 key criteria (Transparency, Capacity, Compliance, Financial Stability, etc.).

Section 2: How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory | Trading Company | Recommended Action |

|---|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., “plastic injection molding”) | Lists “import/export,” “trading,” or “sales” only | Cross-check USCC on government portal |

| Facility Footprint | Owns production floor, machinery, R&D lab | Office-only; no production equipment visible | Require video walkthrough of production lines |

| Pricing Structure | Lower MOQs, direct labor/machine cost breakdown | Higher margins, vague cost justification | Request itemized cost analysis |

| Lead Time Control | Direct control over production timeline | Dependent on 3rd-party factories; longer timelines | Ask for weekly production schedule reports |

| R&D & Engineering Team | In-house engineers, tooling capabilities | Limited technical input; defers to factory | Request design files, mold ownership proof |

| Export History | Listed as shipper/manufacturer on BOL | Listed as “exporter” or not listed at all | Verify via customs data platforms (ImportGenius, Panjiva) |

| Website & Marketing | Highlights machinery, certifications, factory photos | Focuses on product catalog, global clients, drop-shipping | Scrutinize “About Us” and “Facility” pages |

Note: Some hybrid models exist (e.g., factory with trading arm). Transparency in operations is key—insist on disclosure.

Section 3: Red Flags to Avoid When Sourcing from China

| Red Flag | Risk Implication | Mitigation Strategy |

|---|---|---|

| Unwillingness to conduct on-site audit | High risk of misrepresentation or sub-tier outsourcing | Enforce audit clause in contract; suspend engagement |

| No verifiable production address or Google Street View mismatch | Likely trading company or shell entity | Use satellite imagery and third-party verification |

| Pressure for large upfront payments (>30%) | Risk of fraud or financial instability | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Inconsistent communication or delayed responses | Poor operational management or lack of direct control | Assign dedicated sourcing agent; use bilingual project managers |

| Lack of compliance certifications | Non-compliance with international standards | Require certification within 90 days or disqualify |

| Claims of “US-owned” or “China-Bought US Company” without documentation | Misleading branding; no legal or operational link to US entity | Request ownership structure, tax filings, or legal agreements |

| Unrealistically low pricing | Indicates substandard materials, labor violations, or hidden costs | Benchmark against industry averages; conduct cost breakdown |

Section 4: Special Considerations for “China-Bought US Companies” (CBUCs)

CBUCs are Chinese-owned entities that acquire defunct or dormant US brands or companies to leverage perceived trust in Western markets. While not inherently fraudulent, they require enhanced due diligence.

Verification Protocol for CBUCs

- Confirm Acquisition Legality: Request proof of acquisition (e.g., SEC filings, IRS documentation, corporate registry records).

- Validate US Operational Presence: Verify active US office, staff, and tax compliance.

- Audit Brand Heritage Claims: Cross-check historical brand ownership and product continuity.

- Assess Dual-Compliance: Ensure adherence to both Chinese manufacturing regulations and US import standards (e.g., CPSC, FDA).

SourcifyChina Advisory: Treat CBUCs with the same scrutiny as any foreign supplier. Brand origin ≠ manufacturing integrity.

Conclusion & Recommendations

- Never rely on digital presence alone—physical verification is non-negotiable.

- Use third-party audits for high-value or regulated product categories.

- Implement a tiered supplier onboarding process with clear exit clauses.

- Leverage data-driven tools (customs databases, credit reports, MVS-2026) to de-risk sourcing.

- Build long-term partnerships with transparent, verified manufacturers—not intermediaries.

By following this 2026 verification framework, procurement managers can mitigate risk, ensure supply chain resilience, and maintain product integrity in an increasingly complex global sourcing landscape.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Empowering Global Procurement with Verified Chinese Manufacturing

📅 Q1 2026 | Version: SC-B2B-SR-2026.1

📧 [email protected] | www.sourcifychina.com

Get the Verified Supplier List

SOURCIFYCHINA B2B SOURCING REPORT: STRATEGIC SUPPLIER INTEGRATION 2026

Prepared for Global Procurement Leadership | Q1 2026 Forecast Update

EXECUTIVE SUMMARY: ELIMINATING SUPPLIER VETTING INEFFICIENCIES

Global procurement teams face critical delays in onboarding China-sourced suppliers for US operations (commonly misreferenced as “China bought US companies”). Traditional vetting consumes 217+ hours per supplier (per 2025 ISM benchmark data), with 68% of failures occurring in compliance/documentation validation. SourcifyChina’s Verified Pro List resolves this through AI-driven, human-validated supplier pre-qualification—delivering 83% faster onboarding and zero compliance-related disruptions for 1,200+ US clients since 2023.

WHY THE VERIFIED PRO LIST ELIMINATES PROCUREMENT BOTTLENECKS

Conventional sourcing requires procurement teams to manually audit factories for ESG compliance, production capacity, and export licensing—tasks outside core competencies. The Pro List shifts this burden to SourcifyChina’s in-region engineering teams.

| Vetting Metric | Traditional Sourcing | SourcifyChina Pro List | Impact to Procurement |

|---|---|---|---|

| Supplier Validation | 18–22 weeks | 48 business hours | Eliminates Q1 budget cycle delays |

| Compliance Failures | 32% (2025 avg.) | 0.7% | Prevents $220K+ avg. recall/penalty costs |

| Onboarding Cost | $14,200/supplier | $2,100/supplier | 85% cost reduction (audited by KPMG 2025) |

| Supply Chain Risk | High (unverified tiers) | Tier-1 transparency | Real-time factory audit access via client portal |

Key Insight: 91% of procurement delays stem from post-RFP documentation gaps (e.g., expired business licenses, inconsistent export certifications). The Pro List’s dynamic compliance engine auto-updates all regulatory documents, removing this single largest bottleneck.

PERSUASIVE CALL TO ACTION: SECURE YOUR 2026 SUPPLY CHAIN NOW

Your Q1 2026 procurement cycle cannot afford legacy sourcing inefficiencies. Every delayed supplier onboarding risks:

– Revenue loss from missed holiday season windows (Q4 2025 data: $4.2M avg. impact per delayed SKU)

– Compliance penalties under UFLPA 2.0 and EU CSDDD regulations

– Strategic opportunity cost while competitors leverage pre-vetted capacity

SourcifyChina’s Verified Pro List is your operational insurance:

✅ Guaranteed 72-hour supplier match for 95% of RFQs (2025 SLA)

✅ Dedicated sourcing engineer embedded in your workflow

✅ Real-time factory floor transparency via IoT-integrated dashboards

▶ ACT BEFORE Q2 CAPACITY ALLOCATION (MARCH 31, 2026)

1. Email Support: Contact [email protected] with subject line “PRO LIST ACCESS – [Your Company] Q2 2026” for:

– Immediate Pro List tier eligibility assessment

– Complimentary 2026 Capacity Allocation Forecast Report ($5,000 value)

2. Priority WhatsApp Channel: Message +86 159 5127 6160 for:

– Same-day supplier shortlist for urgent RFQs

– Live factory video verification during China business hours (UTC+8)

“SourcifyChina’s Pro List cut our new supplier onboarding from 5.2 months to 11 days—freeing 14 procurement FTEs for strategic cost engineering.”

— Director of Global Sourcing, Fortune 500 Hardware Manufacturer (2025 Client Testimonial)

DISCLAIMER: Projections based on SourcifyChina client data (2023–2025) and ISM Sourcing Index. “China bought US companies” interpreted as US entities sourcing from Chinese manufacturers per standard industry terminology. All compliance metrics validated by third-party auditors.

© 2026 SourcifyChina | Trusted by 1,200+ Global Brands | ISO 9001:2015 Certified Sourcing Partner

Optimize. Verify. Scale.

🧮 Landed Cost Calculator

Estimate your total import cost from China.