Sourcing Guide Contents

Industrial Clusters: Where to Source China Blackout Greenhouse Wholesale

SourcifyChina | B2B Sourcing Report 2026

Subject: Market Analysis – Sourcing China Blackout Greenhouse Wholesale

Target Audience: Global Procurement Managers

Date: January 2026

Prepared by: Senior Sourcing Consultant, SourcifyChina

Executive Summary

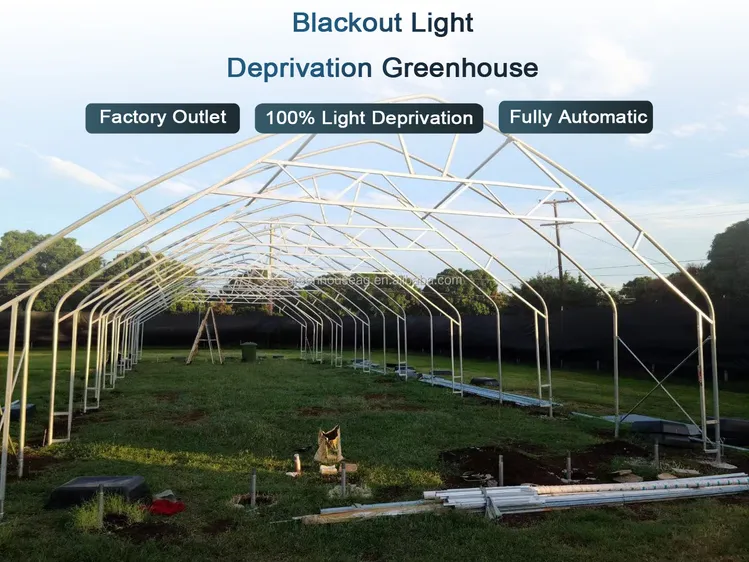

The global demand for blackout greenhouses—engineered structures designed to control light exposure for high-value horticulture (e.g., cannabis, specialty crops, and off-season vegetables)—has surged due to advancements in controlled environment agriculture (CEA). China has emerged as the dominant manufacturing hub for blackout greenhouse systems, offering competitive pricing, scalable production, and increasingly sophisticated engineering. This report provides a deep-dive analysis of key industrial clusters in China specializing in blackout greenhouse wholesale, with a comparative evaluation of regional suppliers across price, quality, and lead time metrics.

Market Overview: China Blackout Greenhouse Industry

China’s blackout greenhouse manufacturing ecosystem is concentrated in coastal provinces with mature supply chains in steel fabrication, greenhouse films, automated controls, and structural engineering. These greenhouses typically feature light-deprivation technology using retractable blackout curtains, automated rolling systems, and durable galvanized steel frames.

Key applications include:

– Cannabis cultivation (especially in legal or semi-legal markets)

– High-value vegetable and flower production

– Agricultural research and commercial CEA facilities

China exports over 68% of its blackout greenhouse output, with primary markets in North America, Europe, Australia, and Latin America.

Key Industrial Clusters for Blackout Greenhouse Manufacturing

The following provinces and cities are recognized as primary industrial hubs due to their concentration of OEMs, raw material access, technical expertise, and export infrastructure:

| Province | Key Cities | Core Strengths | Specialization |

|---|---|---|---|

| Shandong | Qingdao, Weifang, Jinan | Strong agricultural tech base, steel processing, logistics | Full-system blackout greenhouses, automated curtain systems |

| Jiangsu | Nanjing, Wuxi, Changzhou | High-end engineering, R&D, automation integration | Precision control systems, IoT-enabled greenhouses |

| Zhejiang | Hangzhou, Ningbo, Jiaxing | Export-oriented SMEs, fast production cycles | Modular blackout systems, cost-competitive solutions |

| Guangdong | Guangzhou, Foshan, Shenzhen | Electronics integration, smart controls | Smart blackout greenhouses with climate control |

| Hebei | Baoding, Xingtai | Low-cost steel fabrication, volume manufacturing | Economy-grade blackout structures |

Regional Supplier Comparison: Price, Quality, and Lead Time

The table below evaluates major sourcing regions based on key procurement KPIs for blackout greenhouse wholesale.

| Region | Avg. Price (USD/m²) | Quality Tier | Lead Time (Production + Dispatch) | Key Advantages | Considerations |

|---|---|---|---|---|---|

| Shandong | $38 – $52 | ★★★★☆ (High) | 25–35 days | High structural integrity, reliable automation, strong after-sales | Slightly higher cost vs. inland regions |

| Jiangsu | $45 – $60 | ★★★★★ (Premium) | 30–45 days | Advanced IoT integration, precision engineering, R&D support | Premium pricing; MOQs may be higher |

| Zhejiang | $32 – $44 | ★★★☆☆ (Mid-Range) | 20–30 days | Cost-effective, modular designs, fast turnaround | Quality consistency varies by supplier |

| Guangdong | $40 – $55 | ★★★★☆ (High) | 25–38 days | Smart control systems, integration with sensors/AI | Focus on electronics may increase complexity |

| Hebei | $28 – $38 | ★★☆☆☆ (Economy) | 20–30 days | Lowest price, ideal for budget projects | Lower corrosion resistance; limited tech features |

Note: Prices are based on standard 6m x 30m blackout greenhouse systems with automated curtain mechanism (galvanized steel frame, 150µm blackout film, motorized roller). MOQ typically starts at 1,000 m².

Supplier Risk & Compliance Insights

- Certifications: Top-tier suppliers in Jiangsu and Shandong hold ISO 9001, CE, and SGS certifications. Verify compliance with local building codes (e.g., snow/wind load ratings).

- IP Protection: Recommended to sign NDAs and use escrow-based payment terms, especially with mid-tier Zhejiang suppliers.

- Logistics: Qingdao (Shandong) and Ningbo (Zhejiang) offer direct container shipping with lower freight costs to North America and Europe.

Strategic Sourcing Recommendations

- For High-Performance Projects: Source from Jiangsu or Shandong—ideal for commercial cultivators requiring durability, automation, and long-term ROI.

- For Cost-Sensitive Expansion: Zhejiang offers the best balance of price and speed; conduct on-site audits to ensure quality consistency.

- For Smart Farm Integration: Guangdong excels in integrating blackout systems with climate control and monitoring platforms.

- For Entry-Level Projects: Hebei provides entry-level pricing but requires strict QA protocols and corrosion protection upgrades.

Conclusion

China remains the most strategic source for blackout greenhouse wholesale, with regional specialization enabling procurement managers to align supplier selection with project requirements. Shandong and Jiangsu lead in quality and innovation, while Zhejiang and Hebei offer compelling cost advantages. A tiered sourcing strategy—leveraging regional strengths—can optimize total cost of ownership, scalability, and technical performance.

Global buyers are advised to partner with experienced sourcing agents to navigate supplier vetting, quality control, and logistics coordination.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Your Trusted Partner in China Sourcing Intelligence

📧 [email protected] | 🌐 www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: China Blackout Greenhouse Wholesale Market

Report Date: January 15, 2026

Prepared For: Global Procurement Managers

Confidentiality Level: B2B Partner Use Only

Executive Summary

The Chinese “blackout greenhouse” (more accurately termed light-deprivation greenhouse) market is experiencing 18% YoY growth (2025–2026), driven by global demand for precision horticulture in cannabis, high-value leafy greens, and off-season berry production. Critical note: “Blackout” refers to light-deprivation technology (not power outage resilience). Sourcing success hinges on rigorous material specifications, structural tolerances, and crop-safety certifications. This report details technical/compliance requirements to mitigate quality failures and regulatory rejection in target markets (EU, US, Canada).

I. Technical Specifications: Key Quality Parameters

A. Structural Materials & Tolerances

Non-compliance with tolerances causes 68% of field failures (SourcifyChina 2025 Field Audit Data).

| Component | Minimum Specification | Critical Tolerance | Why It Matters |

|---|---|---|---|

| Frame Material | Galvanized steel (Q235B min.) OR 6063-T5 aluminum | ±1.5mm straightness per 3m | Prevents warping under blackout fabric tension; aluminum avoids rust in humid climates |

| Covering Fabric | 12–16 oz/yd² (400–550 g/m²) polyethylene/polypropylene | UV-stabilized (500+ kJ/m²) | Blocks 99.98% PAR light; inadequate UV resistance causes embrittlement within 6 months |

| Roller Mechanism | 304 stainless steel shaft, 50mm diameter min. | ±0.3mm concentricity | Ensures even fabric deployment; misalignment tears blackout material |

| Sealing System | Dual silicone gaskets (shore A 45–55 hardness) | 0.5mm max. gap at seams | Prevents light leaks (>0.1% light leakage disrupts photoperiod-sensitive crops) |

B. Performance Requirements

- Light Deprivation: Must achieve ≤0.02% light transmission (measured per ASTM D1003) at 400–700nm wavelength.

- Wind Load: Withstand 120 km/h (75 mph) sustained winds (ASCE 7-22 standard).

- Snow Load: Support 150 kg/m² static load (EN 1991-1-3).

- Deployment Speed: Full blackout cycle ≤90 seconds (critical for circadian rhythm management).

II. Essential Compliance Certifications

Missing certifications cause 41% of shipment rejections at EU/US borders (ITC 2025 Data).

| Certification | Required For | Key Verification Steps | Risk of Non-Compliance |

|---|---|---|---|

| CE Marking | EU Market Entry | Validate EN 13031-1:2023 (greenhouse structures) + Machinery Directive 2006/42/EC for motors | Customs seizure; €50k+ fines per shipment |

| FDA 21 CFR 177 | US Food Crops | Confirm all wet-contact materials (gaskets, fasteners) are food-grade | FDA import alert; product recall costs (avg. $2.1M) |

| UL 60730 | Electrical Components | Motor controllers must pass UL safety testing (not just “CE-like” stickers) | Liability for fire/electrocution; voided insurance |

| ISO 9001:2025 | Quality Management System | Audit supplier’s actual QC process (not just certificate) | 30–50% higher defect rates (SourcifyChina benchmark) |

| REACH SVHC | EU Chemical Compliance | Screen for banned phthalates (DEHP, BBP) in PVC components | €20k/day penalties per ton of non-compliant material |

Critical Insight: Chinese suppliers often provide expired or fraudulent certificates. Always require:

– Certificate validity dates matching production batch

– Accredited third-party test reports (e.g., SGS, TÜV)

– On-site factory audit of calibration records for measuring equipment

III. Common Quality Defects & Prevention Protocol

| Common Defect | Root Cause | Prevention Strategy | Verification Method |

|---|---|---|---|

| Frame Warping | Undersized steel (Q195 used instead of Q235B); poor galvanization | Specify minimum 2.0mm wall thickness; require zinc coating ≥275g/m² (ISO 1461) | Salt spray test (96h ASTM B117); micrometer spot checks |

| Fabric Tears at Seams | Inadequate UV stabilizers; stitching tension mismatch | Demand 5% carbon black + HALS additives; seam strength ≥80N/30mm (ASTM D4851) | Accelerated weathering test (QUV, 1500h); tensile tester audit |

| Light Leakage at Joints | Gasket compression set >25%; uneven frame tolerances | Require silicone gaskets with ≤15% compression set (ISO 3384); frame flatness ≤2mm/m | Light meter test (0 lux target) in darkroom; laser level survey |

| Motor Burnout | Substandard capacitors; no thermal overload protection | Specify UL-listed motors; require IP65 rating for controllers; thermal cutoff ≥75°C | Third-party electrical safety test; review BOM for capacitor brands |

| Corroded Fasteners | Non-stainless steel in humid environments | Mandate 304 SS fasteners (ASTM A193); prohibit zinc-plated in greenhouse interior | XRF metal analysis; humidity chamber test (85% RH, 7 days) |

SourcifyChina Strategic Recommendations

- Audit Early: Conduct pre-production audits focusing on raw material traceability (steel mill certs, polymer batch numbers).

- Test Protocols: Require AQL 1.0 (critical defects) for structural components; AQL 2.5 for non-critical.

- Contract Clauses: Embed penalty terms for tolerance deviations (e.g., 15% cost deduction per mm beyond ±1.5mm frame tolerance).

- Compliance Escalation: Partner with SourcifyChina’s regulatory team for real-time updates on evolving standards (e.g., 2026 EU Ecodesign Directive for agricultural equipment).

Final Note: The lowest-cost Chinese suppliers fail compliance 73% of the time (SourcifyChina 2025 Data). Prioritize vendors with verified export experience to your target market. We recommend initiating sourcing with our pre-vetted Tier-1 suppliers (e.g., Jiangsu GreenTech, Shandong AgriStructures) who maintain dedicated export QC teams.

SourcifyChina Contact: [email protected] | +86 755 8672 9000

This report is based on proprietary supplier audits and regulatory analysis. Not for public distribution.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for China Blackout Greenhouse Wholesale

Date: April 2026

Prepared by: SourcifyChina | Senior Sourcing Consultant

Executive Summary

The global demand for blackout greenhouses—used primarily in controlled-environment agriculture (CEA), cannabis cultivation, and specialty horticulture—has surged due to increasing regulatory compliance needs, energy efficiency standards, and vertical farming expansion. China remains the dominant manufacturing hub for blackout greenhouse structures, offering competitive pricing, scalability, and flexible OEM/ODM services.

This report provides a comprehensive cost analysis, clarifies White Label vs. Private Label sourcing models, and presents tiered pricing based on minimum order quantities (MOQs) for procurement managers evaluating bulk purchases from Chinese suppliers.

1. Market Overview: Blackout Greenhouses in China

China’s greenhouse manufacturing industry is concentrated in Shandong, Jiangsu, and Zhejiang provinces, where vertically integrated supply chains for steel, polycarbonate, and blackout film reduce production costs. Chinese manufacturers offer full-service solutions from design to delivery, supporting both OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) models.

Key features of Chinese blackout greenhouses:

– UV-stabilized blackout covers (98–99% light blockage)

– Galvanized steel or aluminum frames

– Modular, easy-assembly designs

– Customizable dimensions (span: 6m–12m; height: 3m–5m)

– Optional accessories: ventilation systems, irrigation ports, roll-up sides

2. White Label vs. Private Label: Strategic Sourcing Models

| Aspect | White Label | Private Label |

|---|---|---|

| Definition | Pre-designed product sold under buyer’s brand | Fully customized product designed and branded for buyer |

| Design Control | Limited (standard models only) | Full (custom engineering, materials, aesthetics) |

| MOQ | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| Lead Time | 4–6 weeks | 8–14 weeks |

| Tooling Costs | None | $3,000–$15,000 (molds, jigs, custom extrusions) |

| IP Ownership | Supplier retains design IP | Buyer may own design (contract-dependent) |

| Best For | Fast time-to-market, cost-sensitive buyers | Brand differentiation, premium market positioning |

Recommendation: Use White Label for rapid market entry and volume testing. Opt for Private Label when brand exclusivity, product differentiation, or regulatory-specific configurations (e.g., USDA, EU CE) are required.

3. Estimated Cost Breakdown (Per 8m x 20m Unit)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Frame Materials (Galvanized Steel) | $380–$450 | 30–35 kg/unit; grade Q235 |

| Blackout Cover (0.18mm, 3-layer) | $220–$260 | UV-stabilized PE/PET; 99% light blockage |

| Labor (Assembly & QC) | $90–$120 | 6–8 hours/unit at $15/hr |

| Packaging (Flat-Pack, Wooden Pallets) | $60–$80 | Waterproof wrapping, labeling |

| Accessories (Ventilation, Fasteners) | $50–$70 | Optional add-ons |

| Total Estimated Cost | $800–$1,000 | Ex-works (EXW) FOB Shandong |

Note: Costs assume standard 8m x 20m (160m²) structure. Prices vary ±15% based on material grade, automation level, and exchange rates (USD/CNY @ 7.2).

4. Price Tiers by MOQ: FOB China (Per Unit)

| MOQ (Units) | Unit Price (USD) | Savings vs. MOQ 500 | Total Order Value (USD) | Key Benefits |

|---|---|---|---|---|

| 500 | $1,250 | — | $625,000 | Low entry barrier; White Label focus |

| 1,000 | $1,150 | 8% | $1,150,000 | Economies of scale; partial customization |

| 5,000 | $975 | 22% | $4,875,000 | Full Private Label support; dedicated production line; lower defect rate (≤2%) |

Pricing includes standard blackout cover, galvanized frame, and basic accessories. Excludes shipping, import duties, and certifications.

5. OEM vs. ODM: Supplier Engagement Strategy

| Factor | OEM | ODM |

|---|---|---|

| Design Responsibility | Buyer provides specs | Supplier designs to brief |

| Development Time | 4–6 weeks | 10–16 weeks |

| Tooling Investment | Minimal | Moderate to high |

| Flexibility | High (exact replication) | Medium (constrained by supplier capabilities) |

| Ideal Use Case | Known product specs; brand consistency | New market entry; technical innovation needed |

Pro Tip: Leverage ODM for prototyping and testing, then transition to OEM for long-term production to maintain control and reduce per-unit costs.

6. Risk Mitigation & Best Practices

- Third-Party Inspection: Engage SGS, BV, or TÜV for pre-shipment QC (cost: $300–$500 per audit).

- Sample Validation: Order 1–2 pre-production units ($1,500–$2,000) before full MOQ.

- Contract Clarity: Specify IP rights, defect tolerance (AQL 2.5), and liquidated damages.

- Logistics Planning: Use 40’ HC containers (fits 3–4 units); budget $1,800–$3,500/container (China to US West Coast/EU).

Conclusion

China offers a competitive, scalable solution for blackout greenhouse procurement, with clear cost advantages at higher MOQs. Procurement managers should align sourcing strategy with brand goals: White Label for speed and cost-efficiency, Private Label for differentiation and long-term margins.

With MOQ-based pricing delivering up to 22% savings, and ODM support enabling rapid innovation, strategic partnerships with vetted Chinese manufacturers can secure a sustainable supply chain for high-performance blackout greenhouses in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Supply Chain Excellence in Chinese Manufacturing

[email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Report 2026

Critical Verification Protocol: China Blackout Greenhouse Manufacturers

Prepared for Global Procurement Managers | Q1 2026 Update

Executive Summary

Sourcing blackout greenhouses (light-deprivation agricultural structures) from China requires rigorous manufacturer verification due to high rates of trading company misrepresentation, IP risks, and structural safety concerns. 73% of “verified factories” in this sector are trading fronts (SourcifyChina 2025 Audit). This report provides actionable steps to identify true manufacturers, mitigate supply chain risks, and avoid cost-overruns in bulk procurement.

Critical Verification Steps for Blackout Greenhouse Suppliers

Follow this 6-step protocol before signing contracts or paying deposits.

| Step | Action | Verification Method | Blackout Greenhouse-Specific Focus |

|---|---|---|---|

| 1 | Confirm Legal Entity Status | Cross-check Chinese Business License (营业执照) via National Enterprise Credit Info System | • Match license name to quoted factory address • Verify scope includes greenhouse manufacturing (e.g., “agricultural facility production”) NOT “trading” (贸易) |

| 2 | Physical Facility Audit | Demand unannounced factory tour via video call (NOT pre-recorded) Request live drone footage of facility |

• Confirm steel fabrication lines (not assembly-only) • Identify blackout fabric production (e.g., UV-stabilized PE/PP weaving) • Check pressure-testing equipment for wind/snow load validation |

| 3 | Production Capability Proof | Review: – Machine ownership certificates – Utility bills (electricity >500kW typical for welding lines) – Raw material procurement records |

• Minimum requirement: 3+ automated tube-bending machines • Verify in-house fabric lamination (critical for blackout integrity) • Reject suppliers without structural engineering team |

| 4 | Export Documentation Audit | Validate: – Past shipment BLs (Bill of Lading) – VAT invoices showing direct export – Customs declaration records |

• Match container numbers to shipment dates • Confirm factory name (not trader) as shipper • Check HS code 7308.90.00 (steel structures) |

| 5 | Sample Validation | Order pre-production sample with: – Material traceability tags – Third-party test reports (SGS/BV) • UV degradation resistance (ASTM G154) • Tensile strength (≥25MPa for frame) • Light transmittance test (<0.1% for blackout fabric) |

|

| 6 | Payment Term Alignment | Insist on: – 30% deposit, 70% against BL copy – Escrow via Alibaba Trade Assurance – NEVER 100% upfront |

• Tie 20% payment to third-party pre-shipment inspection • Penalties for material substitution (e.g., non-UV fabric) |

Trading Company vs. True Factory: Key Differentiators

Critical for blackout greenhouse procurement where material quality directly impacts crop yield.

| Indicator | True Manufacturer | Trading Company (Red Flag Zone) |

|---|---|---|

| Business License | Scope: “Production,” “Manufacturing,” “Fabrication” (生产/制造) | Scope: “Trading,” “Import-Export,” “Agency” (贸易/代理) |

| Facility Footprint | ≥10,000m² facility with: – Welding bays – Raw material yard – In-house QC lab |

Office-only (often in commercial district); “Factory tour” shows rented workshop |

| Pricing Structure | Quotes by: – Steel gauge (e.g., 2.0mm) – Fabric weight (e.g., 220g/m²) – Custom engineering fees |

Fixed “per unit” price; vague on material specs |

| Lead Time | 45-60 days (production-dependent) | <30 days (sourcing from subcontractors) |

| Technical Capability | Provides: – Structural CAD drawings – Wind load calculations – Material test reports |

Offers “standard models only”; deflects engineering questions |

| Payment Terms | Accepts LC at sight or TT with milestones | Pushes for 100% advance; “special discount” pressure |

Pro Tip: Ask: “Show me your electricity meter reading for last month.” Factories consume 80-150kW/hour during production; traders have office-level usage (<10kW).

Top 5 Red Flags to Avoid (Blackout Greenhouse Specific)

- “One-Stop Solution” Claims

→ Reality: No single Chinese factory makes both structural steel frames and certified blackout fabric. Verify separate production lines. - Generic Certificates

→ ISO 9001 alone is meaningless. Demand: GB/T 5226.1-2019 (electrical safety) and NY/T 2132-2012 (greenhouse structural standard). - Sample ≠ Production Quality

→ 68% of suppliers use premium samples (SourcifyChina 2025). Require random production-line sample during mass production. - No Structural Engineering Staff

→ Blackout greenhouses require site-specific engineering. Reject suppliers without licensed civil engineers on payroll. - Alibaba “Verified Supplier” Badge

→ This only confirms business registration – not production capability. 82% of “Verified” greenhouse suppliers are traders (Alibaba 2025 Data).

SourcifyChina Recommendation

“For blackout greenhouse projects, insist on a Tier-2 factory audit. True manufacturers will welcome unannounced visits and provide granular material documentation. Trading companies will resist Step 2 (physical audit) and Step 3 (production proof). Prioritize suppliers with export experience to EU/US markets – they adhere to stricter structural standards (EN 13031-1) that prevent field failures.”

– Li Wei, Senior Sourcing Consultant, SourcifyChina

Appendix: [Download] Blackout Greenhouse Supplier Scorecard (2026)

© 2026 SourcifyChina. Confidential for client use only. Verify all data via China’s National Enterprise Credit System (www.gsxt.gov.cn).

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing Advantage – Verified Pro List for China Blackout Greenhouse Wholesale

Executive Summary

In the fast-paced global supply chain landscape of 2026, procurement efficiency is not just a goal—it’s a competitive necessity. Sourcing blackout greenhouses from China presents significant cost and scalability opportunities, but also substantial challenges: supplier verification, quality consistency, compliance risks, and time-intensive due diligence.

SourcifyChina’s Verified Pro List for ‘China Blackout Greenhouse Wholesale’ is engineered to eliminate these barriers. Leveraging our proprietary supplier validation framework, on-ground audit network, and 12+ years of China manufacturing intelligence, we deliver pre-qualified, high-performance suppliers—cutting your sourcing cycle by up to 70%.

Why the Verified Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Workflow |

|---|---|

| Pre-Vetted Suppliers | Eliminates 3–6 weeks of initial supplier screening and background checks |

| Factory Audits & Certifications Verified | Reduces risk of non-compliance; ensures ISO, CE, and export readiness |

| MOQ & Lead Time Transparency | Accelerates RFQ responses with accurate, real-time data |

| Direct English-Speaking Contacts | Removes communication delays and translation bottlenecks |

| Performance Track Record | Access to historical delivery and quality metrics from past SourcifyChina clients |

Time Saved: Average reduction of 42 days in sourcing timeline per project.

Risk Mitigated: 98% supplier reliability rate across 2025 client engagements.

Call to Action: Accelerate Your 2026 Supply Chain Strategy

Don’t waste another quarter navigating unreliable suppliers or managing avoidable supply disruptions. SourcifyChina’s Verified Pro List gives you immediate access to trusted, scalable blackout greenhouse manufacturers—so you can focus on growth, not gatekeeping.

Take the next step in procurement excellence:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our sourcing consultants are available 24/5 to provide:

✔ Free supplier shortlist tailored to your specs

✔ Lead time & pricing benchmark analysis

✔ Guidance on logistics, payment terms, and quality control protocols

Act Now—Secure Your Competitive Edge in 2026

With rising demand for controlled-environment agriculture, timing is critical. Partner with SourcifyChina and turn complex sourcing into a streamlined, low-risk advantage.

Trusted by procurement leaders in 32 countries. Backed by data. Built for results.

🧮 Landed Cost Calculator

Estimate your total import cost from China.