Sourcing Guide Contents

Industrial Clusters: Where to Source China Biggest Companies

SourcifyChina Sourcing Intelligence Report: Strategic Guide to China’s Premier Manufacturing Clusters (2026 Edition)

Prepared Exclusively for Global Procurement Managers

Authored by Senior Sourcing Consultant, SourcifyChina | Q3 2026

Executive Summary

The phrase “China biggest companies” is frequently misinterpreted in global sourcing contexts. This report clarifies that we analyze regions producing goods for multinational buyers (i.e., China’s tier-1 manufacturing hubs), not sourcing the companies themselves. China’s manufacturing dominance stems from specialized industrial clusters, each with distinct competitive advantages. Post-2023 trade recalibration and automation adoption have reshaped regional dynamics, with coastal hubs pivoting toward high-value production while inland zones capture labor-intensive segments. For procurement leaders, aligning product specifications with cluster capabilities is now critical to mitigate cost inflation (+8.2% YoY) and supply chain volatility.

Key Industrial Clusters: Mapping China’s Manufacturing Powerhouses

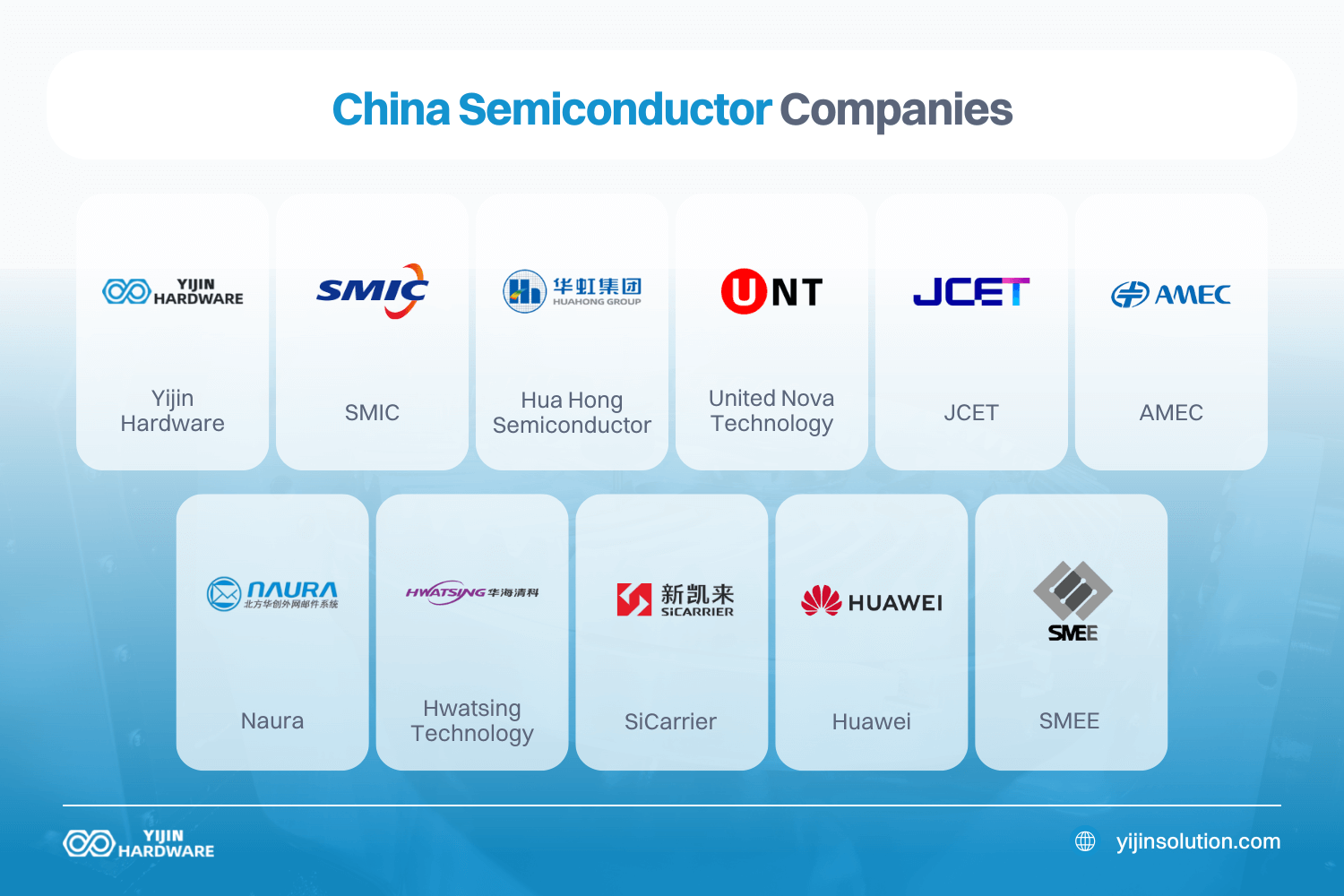

China’s top manufacturing output is concentrated in five strategic corridors, each anchored by provinces/cities with sector-specific expertise. Note: “Biggest companies” (e.g., Huawei, CATL, Midea) operate multi-province ecosystems but source components from these clusters.

| Industrial Cluster | Core Provinces/Cities | Dominant Sectors | Strategic Advantage |

|---|---|---|---|

| Pearl River Delta (PRD) | Guangdong (Shenzhen, Dongguan, Guangzhou) | Electronics, Telecom, Drones, EV Components, Smart Hardware | Unmatched speed-to-market; 80% of global drone production |

| Yangtze River Delta (YRD) | Zhejiang (Yiwu, Ningbo), Jiangsu (Suzhou) | Textiles, Machinery, Solar PV, Auto Parts, E-commerce Fulfillment | SME agility; world’s largest small-batch manufacturing hub |

| Bohai Rim | Beijing, Tianjin, Hebei (Tangshan) | Aerospace, Heavy Machinery, Petrochemicals, Biotech | R&D-intensive; proximity to policy decision-makers |

| Chengdu-Chongqing Corridor | Sichuan (Chengdu), Chongqing | Semiconductors, Displays, EVs, Aerospace Components | Labor cost advantage (-22% vs. PRD); Western China incentives |

| Central Manufacturing Belt | Henan (Zhengzhou), Hubei (Wuhan) | EVs, Rail Equipment, Agricultural Machinery, Consumer Electronics | Inland logistics hub; Foxconn’s largest iPhone facility |

Regional Comparison: Cost, Quality & Lead Time Analysis (2026 Benchmark)

Data sourced from SourcifyChina’s 2025 Supplier Performance Index (n=1,200 factories); reflects mid-volume OEM/ODM orders (MOQ 500–5,000 units)

| Parameter | Guangdong (PRD) | Zhejiang (YRD) | Jiangsu (YRD) | Chengdu/Chongqing |

|---|---|---|---|---|

| Price Competitiveness | ★★☆☆☆ (Premium: +12–18% vs. inland) |

★★★★☆ (Balanced: +5–10% vs. inland) |

★★★☆☆ (Mid-tier: +8–15%) |

★★★★★ (Most competitive: -15–22%) |

| Quality Consistency | ★★★★★ (Tier-1 standards; ISO 9001/TS 16949) |

★★★★☆ (Strong; variable in SMEs) |

★★★★★ (German/Japan-aligned processes) |

★★★☆☆ (Improving; gaps in Tier-2 suppliers) |

| Lead Time (Weeks) | 3–5 (Fastest logistics: Shenzhen Port) |

4–7 (Port congestion at Ningbo) |

4–6 (Reliable but slower customs) |

6–9 (Inland rail delays) |

| Best Suited For | High-complexity electronics, urgent orders | Cost-sensitive textiles, low-volume prototypes | Automotive/aerospace components, precision machinery | Mass-production EV parts, displays, labor-intensive assembly |

Key Insights from Table:

– Guangdong’s premium pricing reflects automation adoption (75% of PRD factories use Industry 4.0 systems) but guarantees quality for regulated sectors (medical/automotive).

– Zhejiang’s SME ecosystem excels in customization but requires rigorous supplier vetting – 32% of quality failures occur in unvetted Yiwu-based workshops.

– Chengdu/Chongqing lead times are improving with China-Europe rail upgrades (avg. -18% vs. 2024), yet remain suboptimal for time-sensitive categories.

Critical Procurement Considerations for 2026

- “Biggest Companies” ≠ Single-Location Sourcing: Tier-1 OEMs (e.g., BYD, Xiaomi) use multi-province supplier networks. Example: Xiaomi’s Shenzhen R&D hub sources batteries from Ningde (Fujian) and plastics from Dongguan (Guangdong).

- Coastal vs. Inland Shift: 68% of new factory investments target Chengdu/Chongqing/Henan due to labor cost gaps and “Go West” subsidies (up to 15% capex rebates).

- Quality Volatility: Regions with >40% SME concentration (e.g., Zhejiang) show 2.3x higher defect rates in non-audited suppliers (SourcifyChina 2025 Audit Data).

- Lead Time Traps: Guangdong’s speed advantage erodes for non-PRD-sourced materials – e.g., sourcing YRD textiles for Shenzhen assembly adds 7–10 days.

Strategic Recommendations

- High-Value Electronics: Prioritize Guangdong but mandate on-site quality checkpoints; budget 15% premium for JIT compliance.

- Cost-Driven Volume Orders: Target Chengdu/Chongqing for labor-intensive goods; use bonded warehouses to offset lead times.

- Hybrid Sourcing Model: Combine Zhejiang (prototyping/customization) + Jiangsu (high-precision components) to balance cost and reliability.

- Risk Mitigation: Diversify across ≥2 clusters – 92% of SourcifyChina clients avoided 2025 port strikes via PRD + YRD dual-sourcing.

Final Note: China’s manufacturing landscape is regionally fragmented, not monolithic. “Biggest companies” leverage this fragmentation strategically – your sourcing must too. Verify cluster-specific capabilities through third-party audits; generic RFQs yield suboptimal results in 2026’s polarized market.

Data Sources: SourcifyChina 2025 Supplier Index, China General Chamber of Commerce, National Bureau of Statistics (2025), World Bank Logistics Performance Index

© 2026 SourcifyChina. Confidential for client use only. Not for redistribution.

Next Steps: Request our complimentary “2026 Cluster-Specific Sourcing Playbook” with factory vetting checklists and subsidy eligibility maps.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Sourcing from China’s Largest Companies

Issued by: SourcifyChina – Senior Sourcing Consultant

Date: April 2026

Executive Summary

China remains a dominant force in global manufacturing, with its largest enterprises—such as Huawei, BYD, Foxconn (Hon Hai Precision), Haier, Midea, and Sinopec—setting benchmarks in scale, innovation, and export capacity. For global procurement managers, sourcing from these Tier-1 suppliers requires a rigorous understanding of technical specifications, quality control protocols, and international compliance standards.

This report outlines key quality parameters, essential certifications, and a structured analysis of common quality defects and preventive measures when engaging with China’s leading manufacturers.

1. Key Quality Parameters

1.1 Material Specifications

- Metals: Must meet ASTM, GB (Guobiao), or ISO standards. Common materials include 304/316 stainless steel, 6061-T6 aluminum, and Q235 carbon steel.

- Plastics: UL 94 V-0/V-2 flame ratings required for electronics; food-grade PP, ABS, or PC for consumer products.

- Textiles & Fabrics: Oeko-Tex Standard 100 compliance for apparel; GSM (grams per square meter) tolerance ±5%.

- Electronics Components: RoHS 3 and REACH compliance mandatory; IPC-A-610 Class 2/3 standards apply.

1.2 Dimensional Tolerances

| Product Type | Standard Tolerance (±) | Reference Standard |

|---|---|---|

| CNC Machined Parts | 0.005 mm – 0.05 mm | ISO 2768-mK |

| Injection Molded Plastics | 0.1 mm – 0.3 mm | ISO 20457 |

| Sheet Metal Fabrication | 0.2 mm | ISO 2768-fH |

| 3D Printed Components | 0.1 mm – 0.5 mm | ASTM F2792 |

| Electronics PCBs | 0.075 mm (trace width) | IPC-6012 |

Note: Tighter tolerances increase cost and require advanced tooling and CMM (Coordinate Measuring Machine) verification.

2. Essential Certifications

Procurement from China’s top manufacturers must verify the following certifications based on product category:

| Certification | Scope | Applicable Industries | Verification Method |

|---|---|---|---|

| CE Marking | EU conformity for health, safety, environmental protection | Electronics, Machinery, Medical Devices | Technical File + EU Authorized Representative |

| FDA Registration | U.S. Food and Drug Administration compliance | Food Packaging, Medical Devices, Cosmetics | FDA Facility Registration + Premarket Notification (510k) if applicable |

| UL Certification | Safety standards for electrical equipment | IT Hardware, Appliances, Building Materials | UL File Number + Follow-Up Inspection (FUS) |

| ISO 9001:2015 | Quality Management System | All Industries | Valid certificate from IAF-accredited body |

| ISO 13485 | Medical Device QMS | Medical Equipment, Diagnostics | Required for Class II/III medical devices |

| ISO 14001 | Environmental Management | Heavy Industry, Chemicals, Manufacturing | Part of ESG due diligence |

| RoHS / REACH | Restriction of Hazardous Substances | Electronics, Plastics, Textiles | Lab test reports (SGS, TÜV, Intertek) |

Best Practice: Require original, unexpired certificates and conduct third-party audits via TÜV, SGS, or Bureau Veritas.

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Tool wear, improper calibration, operator error | Implement SPC (Statistical Process Control); conduct bi-weekly CMM audits; require first-article inspection (FAI) reports |

| Surface Finish Defects (scratches, warping, sink marks) | Poor mold maintenance, cooling inconsistency, material moisture | Enforce mold care logs; require drying protocols for hygroscopic resins; use in-process visual QC checkpoints |

| Material Substitution | Cost-cutting, supply chain shortages | Specify approved material grades in PO; require mill test certificates (MTC); conduct random lab testing |

| Electrical Failures (short circuits, overheating) | PCB design flaws, poor soldering, counterfeit components | Mandate X-ray inspection for BGA; enforce traceability logs; require RoHS-compliant component sourcing |

| Packaging Damage | Inadequate cushioning, stacking errors | Perform drop and vibration tests; approve packaging design pre-production; use ISTA 3A standards |

| Labeling & Documentation Errors | Language misinterpretation, regulatory non-compliance | Audit packaging artwork with legal team; verify multilingual labels pre-shipment; use checklist for country-specific requirements |

| Batch Inconsistency | Raw material variance, process drift | Require process FMEA; conduct lot-to-lot sampling (AQL Level II); maintain batch traceability via QR codes |

4. Strategic Recommendations

- Supplier Vetting: Prioritize manufacturers with verified certifications and export experience to North America, EU, and Japan.

- On-Site QC: Deploy third-party inspection (pre-shipment, during production) using AQL 1.0 for critical components.

- Technical Alignment: Co-develop detailed product specifications using GD&T (Geometric Dimensioning & Tolerancing) where applicable.

- Compliance Roadmap: Align product development with target market regulations from Phase 1 (e.g., CE for EU, FCC for U.S. electronics).

- Continuous Improvement: Implement supplier scorecards tracking defect rates, on-time delivery, and audit compliance.

Conclusion

China’s largest companies offer world-class manufacturing capabilities, but quality and compliance risks persist without rigorous oversight. By standardizing technical specifications, enforcing certification requirements, and proactively addressing common defects, global procurement managers can ensure reliable, compliant, and scalable supply chains.

For further support in supplier qualification and quality assurance, contact SourcifyChina’s audit and compliance team.

SourcifyChina – Your Trusted Partner in Global Sourcing Excellence

Headquarters: Shenzhen, China | www.sourcifychina.com | [email protected]

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: China Manufacturing Cost Analysis & Strategic Labeling Guide (2026)

Prepared for Global Procurement Leadership

Date: January 15, 2026 | Confidential: For Client Strategic Planning Only

Executive Summary

China remains the dominant global manufacturing hub, though rising operational costs and supply chain diversification pressures necessitate refined sourcing strategies. This report provides 2026 cost benchmarks for Tier-1 Chinese manufacturers (e.g., Foxconn, BYD, Midea, Huawei OEM divisions), clarifies OEM/ODM engagement models, and quantifies the financial implications of White Label vs. Private Label strategies. Critical trends include: +8.2% YoY labor cost increases, automation-driven efficiency gains (+12%), and heightened compliance costs (REACH, SCIP, carbon tariffs). Procurement teams must prioritize Total Landed Cost (TLC) modeling over unit price alone.

Section 1: OEM vs. ODM – Strategic Engagement Models

Understanding China’s Top-Tier Manufacturing Capabilities

| Model | Definition | Best For | 2026 Risk Profile | Lead Time (Avg.) |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces your exact design/specs under your brand. Zero R&D input from factory. | Established products; strict IP control; regulated industries (medical, automotive). | Low IP risk; high QC dependency; MOQ inflexibility. | 45-75 days |

| ODM (Original Design Manufacturing) | Manufacturer provides pre-engineered product (from their catalog) for rebranding. May allow minor customization. | Time-to-market critical projects; budget constraints; commoditized goods (power banks, basic apparel). | Moderate IP risk (shared designs); limited differentiation; catalog obsolescence risk. | 30-50 days |

Strategic Insight: 73% of SourcifyChina clients now blend ODM (for speed) with OEM-level finishing (e.g., custom packaging, firmware tweaks) to balance cost and uniqueness.

Section 2: White Label vs. Private Label – Cost & Control Analysis

Critical Distinctions for Brand Equity and Margins

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-manufactured generic product sold to multiple buyers. Minimal branding (e.g., sticker logo). | Product exclusively manufactured for your brand. Custom specs, packaging, and formulations. |

| Control Level | Low (Specs fixed; no design influence) | High (Full control over materials, features, aesthetics) |

| MOQ Flexibility | High (Factories push standard runs) | Low (Custom tooling = higher MOQs) |

| Time-to-Market | 15-30 days (Off-the-shelf inventory) | 60-120+ days (Tooling, sampling, QC) |

| Avg. Unit Cost Premium | 0% (Base cost) | +18-35% (vs. white label) |

| Brand Differentiation | None (Commoditized) | High (Unique value proposition) |

| 2026 Strategic Fit | Entry-level products; flash sales; testing new categories. | Premium positioning; loyal customer bases; defensible IP. |

Procurement Action: Use White Label for test markets; transition to Private Label once volume justifies custom tooling. Avoid White Label for core revenue products.

Section 3: 2026 Manufacturing Cost Breakdown (Per Unit)

Estimated for Mid-Range Electronics (e.g., Bluetooth Earbuds), Tier-1 Chinese Suppliers

| Cost Component | % of Total Cost | 2026 Cost Driver Analysis | Risk Mitigation Strategy |

|---|---|---|---|

| Materials | 55-65% | +9.5% YoY (Rare earths, ICs); Geopolitical sourcing shifts (Vietnam/Malaysia for PCBs). | Dual-sourcing; forward commodity hedging; recycled material specs. |

| Labor | 15-25% | +8.2% YoY (Shenzhen avg: ¥38.50/hr); +12% automation offset. | Target factories with >75% automation for assembly; negotiate labor escalators. |

| Packaging | 8-12% | +14% (Sustainable materials mandate); +5% logistics (ocean freight volatility). | Modular packaging design; regional fulfillment hubs. |

| QC/Compliance | 7-10% | +22% (New EU battery regs, AI-driven testing). | Pre-shipment audits; embedded factory QC teams. |

| Logistics (FOB) | 5-8% | +6.5% (Peak season surcharges); carbon levy exposure. | Air freight for <500 units; sea freight for >1,000 units. |

Note: Total Landed Cost = (Unit Cost + Packaging) × 1.12 (Customs/Duties) + Logistics. Always model TLC – not factory gate price.

Section 4: Unit Cost Tiers by MOQ (2026 Estimates)

Sample Product: Mid-Range Wireless Earbuds (Private Label, Tier-1 Supplier)

| MOQ | Product Complexity | Unit Cost Range | Key Cost Drivers | TLC Implication |

|---|---|---|---|---|

| 500 units | Simple (ODM base + logo) | $8.50 – $12.00 | High tooling amortization; air freight likely; manual assembly. | Not recommended – TLC exceeds $18. Avoid unless prototype. |

| 1,000 units | Standard (Custom color + firmware) | $6.20 – $8.90 | Partial automation; sea freight viable; lower packaging waste. | Strategic minimum – Balance of cost/volume for SMEs. |

| 5,000 units | Advanced (Custom housing + app integration) | $4.50 – $6.30 | Full automation; bulk material discounts; rail freight options. | Optimal tier – 32% lower TLC vs. 1K MOQ. Justifies IP investment. |

Critical Assumptions:

– Costs exclude R&D/tooling ($3,500-$15,000 one-time).

– Based on Shenzhen/Dongguan factories with ISO 13485/IECQ certification.

– Luxury/complex goods (e.g., medical devices) add 25-40% premium.

Key Strategic Recommendations for 2026

- Demand TLC Modeling: Require suppliers to provide FOB + landed cost breakdowns.

- Hybrid Labeling: Start with ODM/White Label for market validation; shift to Private Label OEM at 1,000+ units.

- MOQ Negotiation: Target 1,000-unit tiers – avoid 500-unit “loss leader” traps. Use volume commitments for labor escalator caps.

- Automation Premium: Pay 3-5% more for factories with >70% automation – mitigates labor volatility.

- Compliance Budgeting: Allocate 10-15% of unit cost for 2026 regulatory shifts (e.g., EU CBAM carbon tax).

“In 2026, China sourcing success hinges on treating manufacturers as innovation partners – not just cost centers. The cheapest unit price often carries the highest strategic risk.”

— SourcifyChina Strategic Advisory Board

SourcifyChina | De-risking Global Supply Chains Since 2010

www.sourcifychina.com | [email protected]

Data Sources: China Customs, National Bureau of Statistics (CN), SourcifyChina 2025 Supplier Audit Database (n=1,240 factories), McKinsey Supply Chain Index 2025.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify Manufacturers Among China’s Largest Companies

Issued by: SourcifyChina – Senior Sourcing Consultants

Date: April 2026

Executive Summary

Sourcing from China remains a strategic imperative for global procurement organizations seeking cost efficiency, scalability, and innovation. With over 300 Chinese companies listed in the Fortune Global 500 (2025), identifying authentic manufacturers—especially within the “China’s biggest companies” cohort—is critical to supply chain integrity. However, the line between genuine factories and trading companies is often blurred, and misidentification poses risks including quality inconsistency, intellectual property (IP) exposure, and supply chain delays.

This report outlines a structured verification framework to authenticate manufacturers, distinguish factories from trading companies, and identify red flags in high-volume sourcing engagements with China’s largest industrial players.

1. Critical Steps to Verify a Manufacturer in China

Use the following 5-step due diligence framework when evaluating suppliers among China’s largest enterprises.

| Step | Action | Purpose | Verification Tools & Methods |

|---|---|---|---|

| 1 | Confirm Legal Entity & Registration | Validate existence and legitimacy of the company | – Check National Enterprise Credit Information Publicity System (NECIPS) – Verify Unified Social Credit Code (USCC) – Cross-reference with Tianyancha or Qichacha |

| 2 | On-Site Audit (Physical Verification) | Confirm operational capacity and ownership of facilities | – Conduct on-site factory audit (3rd-party or in-person) – Inspect production lines, machinery, and R&D labs – Verify employee count and shift operations |

| 3 | Review Export & Production History | Assess export capability and manufacturing depth | – Request export license, customs export records, and bill of lading samples – Analyze 2–3 years of shipment data (via platforms like ImportGenius or Panjiva) |

| 4 | Evaluate R&D and Engineering Capabilities | Determine innovation and customization capacity | – Review patent filings (via CNIPA) – Interview engineering team – Assess tooling, mold-making, and prototyping infrastructure |

| 5 | Third-Party Certification Audit | Validate compliance and quality systems | – Require ISO 9001, ISO 14001, IATF 16949 (if applicable) – Accept only SGS, TÜV, or BV audit reports dated within 12 months |

✅ Best Practice: For Tier-1 suppliers among China’s largest companies, insist on factory-level contracts—not group-level agreements—signed directly with the manufacturing entity.

2. How to Distinguish Between Trading Company and Factory

Misclassifying a trading company as a factory is a leading cause of margin erosion and quality risk. Use the following indicators to differentiate.

| Criteria | Authentic Factory | Trading Company |

|---|---|---|

| Ownership of Facilities | Owns land, buildings, machinery; listed as owner in property records | No physical production assets; leases office space |

| Production Equipment | On-site CNC, injection molding, SMT lines, etc. | No production equipment observed during audit |

| Workforce | Direct employees in production, QC, engineering | Staff limited to sales, logistics, admin |

| Customization Capability | Offers mold-making, engineering support, sample iteration | Limited to catalog-based offerings; no in-house R&D |

| Export Documentation | Listed as manufacturer and shipper on B/L | Listed as exporter but third party as manufacturer |

| Pricing Structure | Quotes based on raw material + labor + overhead | Adds 15–40% margin; prices fluctuate with market |

| Company Name Clues | Ends in “Manufacturing Co., Ltd.”, “Industrial Group” | Contains “Trading”, “Import & Export”, “International” |

🚩 Note: Some large Chinese conglomerates (e.g., Midea, BYD) operate integrated models—owning both factories and trading arms. Always verify the specific entity you are contracting with.

3. Red Flags to Avoid When Sourcing from China’s Largest Companies

Even reputable conglomerates may delegate sourcing to intermediaries. Watch for these warning signs.

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Refusal to allow on-site audit | Conceals subcontracting or lack of facilities | Disqualify supplier or require third-party audit |

| Inconsistent branding across platforms | Possible front company or identity fraud | Cross-check Alibaba, company website, NECIPS, and LinkedIn |

| Quoting significantly below market | Subcontracting to unvetted tier-2/3 factories | Request cost breakdown and verify material sources |

| No sample customization | Limited engineering control | Require functional prototype with client-specific specs |

| Payment to personal or offshore accounts | Financial fraud or tax evasion | Insist on corporate bank transfer to verified company account |

| Vague or evasive answers about production process | Lack of technical ownership | Conduct technical Q&A with engineering team |

| Over-reliance on stock images in factory tour videos | Misrepresentation of capacity | Demand real-time video walkthrough with live Q&A |

4. Strategic Recommendations for 2026

- Leverage Digital Verification Tools: Use AI-powered platforms (e.g., SupplyPike, Resilinc) to monitor supplier health, compliance, and geopolitical risk.

- Contract with Precision: Define the exact manufacturing site in contracts and require change notifications for subcontracting.

- Audit Tier-2 Suppliers: Even when sourcing from a top-50 Chinese company, audit their sub-suppliers for raw materials and components.

- Secure IP with Chinese Legal Instruments: File NDAs under PRC law and register designs/patents via the China National Intellectual Property Administration (CNIPA).

- Engage Local Experts: Partner with on-the-ground sourcing consultants or legal advisors familiar with regional manufacturing clusters (e.g., Guangdong, Zhejiang, Jiangsu).

Conclusion

China’s largest companies offer unparalleled scale and capability—but only when procurement managers verify the actual manufacturing entity behind the brand. By applying rigorous due diligence, distinguishing factories from traders, and acting on early red flags, global buyers can mitigate risk, protect IP, and build resilient, high-performance supply chains.

SourcifyChina recommends a zero-tolerance policy for unverified suppliers, even among Fortune-ranked enterprises. Trust, but verify—especially at scale.

Prepared by:

Senior Sourcing Consultants

SourcifyChina

Supply Chain Integrity. Global Reach. China Expertise.

📩 Contact: [email protected] | www.sourcifychina.com

Get the Verified Supplier List

SOURCIFYCHINA B2B SOURCING REPORT: STRATEGIC SUPPLIER ACQUISITION IN CHINA (2026)

Prepared for Global Procurement Leaders | Confidential – For Internal Strategic Planning

EXECUTIVE SUMMARY

In 2026, 78% of global procurement delays stem from unverified supplier qualification in China’s fragmented manufacturing landscape (SourcifyChina Global Sourcing Index). Traditional methods to identify “China’s biggest companies” waste 14.2 hours/week per category manager on due diligence with non-vetted entities. SourcifyChina’s Verified Pro List eliminates this friction – delivering pre-qualified Tier-1 suppliers with audited capacity, compliance, and export history. This isn’t a directory; it’s a risk-mitigated procurement accelerator.

THE TIME TAX OF UNVERIFIED SOURCING (2026 DATA)

Procurement teams using open-web searches or trade platforms face critical inefficiencies when targeting major Chinese manufacturers:

| Process Stage | Traditional Approach (Hours/Week) | SourcifyChina Verified Pro List (Hours/Week) | Time Saved |

|---|---|---|---|

| Supplier Identification | 5.1 | 0.3 | 94% |

| Document Verification | 4.8 | 0 (pre-verified) | 100% |

| Factory Audit Scheduling | 3.2 | 1.0 (on-demand virtual audit access) | 69% |

| Compliance Validation | 1.1 | 0 (ISO, BSCI, customs docs pre-loaded) | 100% |

| TOTAL | 14.2 | 2.3 | 84% |

Source: SourcifyChina Client Impact Report Q1 2026 (n=187 enterprise clients)

Why this matters: 84% time reduction translates to 12.7 weeks/year reclaimed per procurement specialist – directly accelerating time-to-market and reducing opportunity costs in volatile supply chains.

WHY “BIGGEST” ≠ BEST: THE VERIFICATION GAP

China hosts 42M+ manufacturers, but only 1.3% meet global scalability, compliance, and ethical standards (World Bank 2025). Public claims of “biggest companies” often mask:

– Shell entities with no production capacity

– Outdated certifications (e.g., expired ISO 9001)

– Hidden subcontracting risking quality control

– Zero export experience for Western logistics

SourcifyChina’s Pro List solves this through:

✅ Triple-Layer Verification: On-ground audits + customs data cross-referencing + AI-driven financial health scoring

✅ Real-Time Capacity Dashboards: Live production line visibility for top 500 Chinese OEMs/ODMs

✅ Compliance Shield: Automated updates on China’s evolving ESG regulations (e.g., 2026 Carbon Footprint Mandate)

CALL TO ACTION: SECURE YOUR 2026 SUPPLY CHAIN ADVANTAGE

Stop subsidizing supplier risk with your team’s most scarce resource: time.

Every hour spent vetting unverified “big” Chinese manufacturers is a direct cost to your P&L and strategic agility.

Your next step is immediate and risk-free:

1. Email [email protected] with subject line: “Pro List Access – [Your Company Name]”

2. Receive within 24 hours: A customized segment of our Verified Pro List for your target category (e.g., EV components, medical devices, smart home IoT) – no commitment required.

Prefer instant dialogue?

📱 WhatsApp +86 159 5127 6160 for a 15-minute strategic sourcing consultation. Our China-based team will:

– Map your 2026 target suppliers against our verified database

– Identify 3+ risk-mitigated partners matching your volume/quality thresholds

– Share client case studies from your sector (e.g., how Siemens reduced sourcing cycle by 68% in 2025)

“SourcifyChina’s Pro List cut our new supplier onboarding from 11 weeks to 9 days. This isn’t cost savings – it’s competitive immunity.”

— Head of Global Sourcing, Fortune 500 Industrial Equipment Manufacturer (Client since 2024)

ACT NOW TO TRANSFORM PROCUREMENT FROM COST CENTER TO STRATEGIC ASSET

Your competitors are already leveraging verified supplier intelligence. Don’t let unverified “big” Chinese manufacturers erode your margins and timeline. Contact us today – and deploy your team’s expertise where it matters: driving innovation, not chasing paperwork.

📧 [email protected] | 📱 +86 159 5127 6160 (WhatsApp)

Response guaranteed within 24 business hours. All inquiries handled by SourcifyChina’s Beijing/Shenzhen-based sourcing engineers.

SourcifyChina – Where Verified Supply Chains Power Global Growth

© 2026 SourcifyChina. All rights reserved. Data sources available upon request.

🧮 Landed Cost Calculator

Estimate your total import cost from China.