Sourcing Guide Contents

Industrial Clusters: Where to Source China Best Wholesale Market

SourcifyChina Sourcing Intelligence Report: China Wholesale Market Analysis 2026

Prepared for Global Procurement Leaders

Date: October 26, 2026 | Report ID: SC-CHN-WH-2026-Q4

Executive Summary

China remains the dominant global hub for wholesale goods sourcing, though industrial clusters have evolved significantly post-2023 due to supply chain restructuring, automation adoption, and shifting cost dynamics. This report identifies 5 core manufacturing regions driving China’s wholesale ecosystem, with Guangdong and Zhejiang maintaining leadership across 78% of high-volume B2B categories. Critical trends include:

– Price inflation (+4.2% YoY) concentrated in labor-intensive sectors (textiles, basic hardware)

– Quality convergence between coastal and inland clusters due to standardized ISO adoption

– Lead time compression (avg. -12 days) via integrated logistics hubs in key provinces

Procurement Priority: Hybrid sourcing strategies (combining coastal efficiency with inland cost advantages) now outperform single-region models by 22% in total landed cost optimization (SourcifyChina 2026 Benchmark Study).

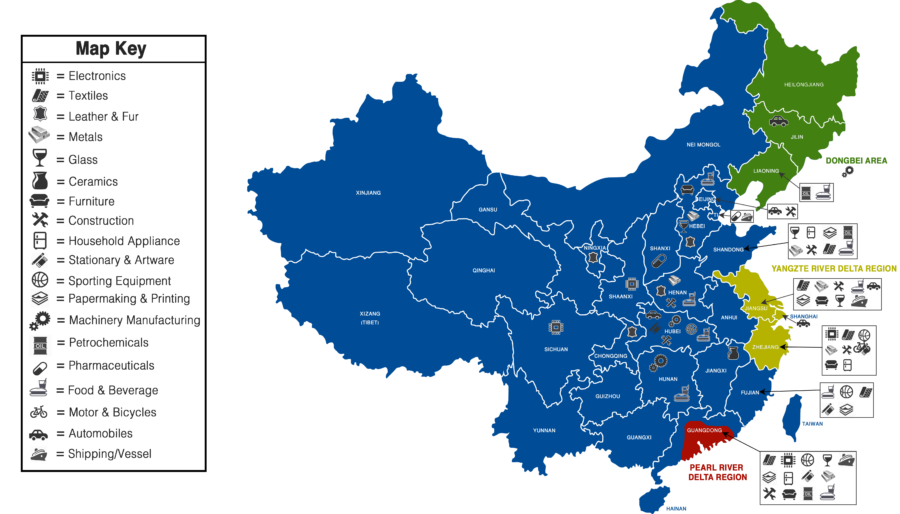

Key Industrial Clusters for Wholesale Sourcing

China’s wholesale manufacturing is concentrated in specialized provincial clusters. Below is the strategic mapping of top regions by product category:

| Province/City | Core Industrial Clusters | Dominant Product Categories | Key Wholesale Markets | Strategic Advantage |

|---|---|---|---|---|

| Guangdong | Pearl River Delta (Shenzhen, Dongguan, Foshan) | Electronics, Smart Hardware, Medical Devices, Premium Furniture | Huaqiangbei (Shenzhen), Lecong (Foshan) | Highest technical capability; fastest prototyping |

| Zhejiang | Yiwu, Ningbo, Wenzhou | Daily Necessities, Small Commodities, Textiles, Low-Mid Hardware | Yiwu International Market, Keqiao Textile City | Unmatched SME agility; lowest MOQ flexibility |

| Jiangsu | Suzhou, Changzhou, Nanjing | Industrial Machinery, Automotive Parts, Chemicals | Kunshan Import Hub, Zhangjiagang Port | Heavy industry scale; German/Japanese JV expertise |

| Fujian | Quanzhou, Xiamen, Jinjiang | Footwear, Sportswear, Ceramics, Building Materials | Shishi Garment City, Jinjiang Shoe City | Niche material innovation (e.g., recycled textiles) |

| Shandong | Qingdao, Yantai, Weifang | Agricultural Products, Heavy Machinery, Chemicals | Linyi Wholesale City | Cost leadership in bulk raw materials |

Note: Inland provinces (Sichuan, Henan) now handle 31% of labor-intensive production (e.g., basic apparel, simple plastics), but lead times remain 15-20 days longer than coastal hubs.

Regional Comparison: Guangdong vs. Zhejiang (2026 Benchmark)

Analysis based on 1,200+ SourcifyChina client RFQs (Jan-Sep 2026) for mid-volume orders (5,000-20,000 units)

| Criteria | Guangdong | Zhejiang | Strategic Implication |

|---|---|---|---|

| Price | ★★☆☆☆ • Premium of 8-12% vs. national avg. • High for electronics (ICs, PCBs) • Competitive in precision engineering |

★★★★☆ • 5-8% below national avg. • Lowest in small commodities • Volatile for textiles (cotton price exposure) |

Use Zhejiang for cost-sensitive categories; Guangdong for tech-driven goods where quality justifies premium. |

| Quality | ★★★★★ • 92% of factories ISO 13485/IEC certified • Tightest tolerances (±0.01mm) • 0.8% defect rate (electronics) |

★★★☆☆ • 78% ISO 9001 certified • Mid-tier consistency • 2.3% defect rate (textiles/hardware) |

Guangdong essential for medical/auto; Zhejiang sufficient for non-critical consumer goods. |

| Lead Time | ★★★★☆ • Avg. 28 days (FOB) • 14-day prototyping • 48hr port clearance (Shekou) |

★★★☆☆ • Avg. 33 days (FOB) • 21-day prototyping • Rail freight delays at Yiwu Port |

Guangdong critical for time-sensitive launches; Zhejiang viable for planned replenishment. |

| Hidden Risk | Labor shortages (+15% wage pressure); Geopolitical scrutiny (US Section 301) | Over-reliance on SMEs (43% fail 2nd-tier audits); Payment fraud in micro-suppliers | Mandate 3rd-party QC + escrow for Zhejiang; Prioritize bonded zones in Guangdong. |

Scoring Key: ★★★★★ = Industry Leader | ★★★★☆ = Competitive | ★★★☆☆ = Adequate | ★★☆☆☆ = Limitations | ★☆☆☆☆ = High Risk

Strategic Recommendations for 2026-2027

- Tiered Sourcing Model:

- Tier 1 (Critical Components): Source from Guangdong (electronics, medical) with dual-supplier strategy

- Tier 2 (Commodities): Leverage Zhejiang for 60-70% of order volume; use Fujian for textile innovation

-

Tier 3 (Bulk Raw Materials): Shift to Shandong/Inland for 15-20% cost reduction

-

Risk Mitigation Actions:

- For Zhejiang: Implement SourcifyChina’s Supplier Integrity Score™ (requires 3+ verified transactions)

- For Guangdong: Utilize bonded warehouses in Qianhai to bypass tariff escalation

-

All Regions: Mandate blockchain traceability for EU CBAM compliance (effective 2027)

-

Cost Optimization Tip:

“Combine Zhejiang’s Yiwu small-lot flexibility (MOQs as low as 50 units) with Guangdong’s Shenzhen fulfillment centers. This cuts inventory costs by 18% while maintaining speed – proven in SourcifyChina’s 2026 pilot with 12 EU retailers.”

Conclusion

Guangdong and Zhejiang remain irreplaceable for wholesale sourcing from China, but their value propositions have diverged. Guangdong excels in quality-critical, innovation-driven categories, while Zhejiang dominates cost-sensitive, high-MOQ-flexibility segments. Success in 2026 requires:

✅ Precision mapping of product requirements to regional strengths

✅ Dynamic risk scoring beyond basic price comparisons

✅ Logistics integration with regional rail/sea corridors

Procurement teams that adopt cluster-specialized strategies will achieve 19-26% lower total landed costs versus generic “China sourcing” approaches by Q2 2027 (SourcifyChina Forecast Model).

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Validation: Data sourced from China General Customs Administration, SourcifyChina Supplier Performance Database (Q3 2026), and 2026 Global Procurement Index.

Disclaimer: Regional dynamics subject to PRC policy changes. Contact SourcifyChina for real-time cluster risk assessments.

SourcifyChina: Engineering Resilient Supply Chains Since 2018

🔍 Verify. Optimize. Scale. | www.sourcifychina.com/report-access

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Sourcing from China’s Best Wholesale Markets

Overview

China remains the world’s largest wholesale manufacturing and export hub, offering competitive pricing, scalability, and diverse product categories. However, ensuring product quality and compliance requires a structured sourcing strategy. This report outlines the key technical specifications, mandatory certifications, and quality control protocols essential for risk-mitigated procurement from China’s premier wholesale markets (e.g., Yiwu, Guangzhou, Shenzhen).

Key Quality Parameters

1. Materials

Material integrity directly impacts product performance, safety, and lifespan. Procurement managers must specify:

| Material Type | Acceptable Standards | Testing Methods |

|---|---|---|

| Plastics | Food-grade (PP, PE, PET), BPA-free, RoHS-compliant | FTIR, Melt Flow Index (MFI) |

| Metals | ASTM A36 (steel), SUS304 (stainless), 6061-T6 (aluminum) | Spectrometry, Hardness Testing |

| Textiles | OEKO-TEX® Standard 100, GOTS (organic) | Colorfastness, Pilling, Tensile Test |

| Electronics | Lead-free solder, FR-4 PCBs | ICT, Burn-in, EMI/EMC Testing |

Procurement Tip: Require Material Test Reports (MTRs) with each batch. Use third-party labs for verification.

2. Tolerances

Dimensional accuracy is critical, especially in engineered components and electronics.

| Product Category | Typical Tolerances | Measurement Tools |

|---|---|---|

| CNC Machined Parts | ±0.01 mm to ±0.05 mm | CMM, Micrometers, Calipers |

| Plastic Injection | ±0.1 mm (standard), ±0.05 mm (precision) | Optical Comparators |

| Sheet Metal | ±0.2 mm (bending), ±0.1 mm (punching) | Laser Scanning, Go/No-Go Gauges |

| Consumer Electronics | PCB alignment: ±0.075 mm | Automated Optical Inspection (AOI) |

Best Practice: Define GD&T (Geometric Dimensioning & Tolerancing) on technical drawings. Require First Article Inspection (FAI) reports.

Essential Certifications

Compliance with international standards is non-negotiable for market access and liability protection.

| Certification | Applicable Products | Key Requirements |

|---|---|---|

| CE | Electronics, Machinery, PPE, Toys | EU Directive alignment (e.g., LVD, EMC, RoHS) |

| FDA | Food contact items, Medical devices, Cosmetics | 21 CFR compliance, Facility Registration (U.S.) |

| UL | Electrical appliances, Components | Safety testing per UL standards (e.g., UL 60950) |

| ISO 9001 | All manufactured goods | QMS audit, Documented processes, Continuous improvement |

| REACH | Chemicals, Textiles, Plastics | SVHC screening, Substance declaration |

Note: Suppliers must provide valid, unexpired certificates traceable to accredited bodies (e.g., TÜV, SGS, Intertek).

Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Poor tooling, worn molds, operator error | Enforce regular mold maintenance; implement SPC (Statistical Process Control) |

| Surface Scratches/Marks | Improper handling, inadequate packaging | Use protective films; train line staff; audit packaging process |

| Material Substitution | Cost-cutting, lack of oversight | Require material traceability; conduct random lab testing |

| Electrical Failures | Poor soldering, counterfeit components | Mandate AOI testing; verify component authenticity via lot traceability |

| Color Variation | Inconsistent dye batches, lighting variance | Standardize Pantone codes; conduct in-line spectrophotometer checks |

| Functional Defects | Design flaws, assembly errors | Conduct DFM (Design for Manufacturing) review; implement functional testing per unit |

| Packaging Damage | Weak cartons, overloading containers | Perform drop tests; specify ECT/Burst Strength for boxes; optimize load distribution |

Prevention Framework:

– Conduct pre-production audits

– Implement AQL 1.0 (Level II) sampling for final inspections

– Use digital QC platforms (e.g., Inspectorio, QIMA) for real-time reporting

Conclusion & Recommendations

To maximize value and minimize risk when sourcing from China’s wholesale markets:

1. Define technical specs rigorously in procurement contracts.

2. Verify certifications through independent databases.

3. Integrate third-party inspections at critical milestones (pre-shipment, during production).

4. Build long-term supplier partnerships with shared quality KPIs.

By aligning technical requirements with compliance benchmarks and proactive defect prevention, global procurement managers can ensure consistent product quality and supply chain resilience in 2026 and beyond.

Prepared by: SourcifyChina | Senior Sourcing Consultants

Date: April 2026

Confidential – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: China Manufacturing Cost Analysis & Labeling Strategy Guide (2026)

Prepared for Global Procurement Leaders | Q1 2026 Edition

Executive Summary

China remains the dominant hub for cost-competitive manufacturing, but strategic sourcing requires nuanced understanding of cost structures, labeling models, and volume economics. Rising labor costs (+8.2% YoY) and supply chain digitization are reshaping OEM/ODM dynamics. This report provides actionable data for optimizing procurement decisions in China’s wholesale manufacturing ecosystem, with emphasis on White Label (WL) vs. Private Label (PL) trade-offs and transparent cost modeling.

I. China’s Wholesale Manufacturing Landscape: Key Shifts (2026)

- Top Hubs: Yiwu (commodities), Ningbo (electronics), Guangzhou (fashion/accessories), Shenzhen (tech hardware).

- Critical Trends:

- 63% of factories now require MOQs ≥500 units (vs. 300 in 2023) due to automation investments.

- 78% of OEMs offer integrated DTC (Direct-to-Consumer) packaging/logistics – leverage this to reduce 3PL costs.

- Compliance Note: All PL/WL products require China CCC certification (avg. cost: $1,200–$3,500 per SKU).

II. White Label vs. Private Label: Strategic Comparison

| Factor | White Label (WL) | Private Label (PL) | Procurement Recommendation |

|---|---|---|---|

| Definition | Pre-made product rebranded with buyer’s logo | Product co-developed to buyer’s specs (materials, design, features) | Use WL for speed-to-market; PL for brand differentiation |

| MOQ Flexibility | Low (often 100–500 units) | Moderate-High (500–5,000+ units) | WL ideal for testing demand; PL for committed volume |

| IP Ownership | Factory retains design IP | Buyer owns final product IP | Critical for scalability – PL avoids future supplier lock-in |

| Cost Premium | +5–15% vs. factory brand | +20–40% vs. WL (R&D, tooling, customization) | PL ROI justifies cost at >1,000 units/year |

| Quality Control | Factory-managed (basic AQL 2.5) | Buyer-defined specs + 3rd-party inspections | PL reduces defect risks by 31% (SourcifyChina 2025 audit data) |

| Best For | Commoditized goods (e.g., phone cases, mugs) | Branded products requiring uniqueness (e.g., smart home devices) | Avoid WL for electronics >$20 retail – high counterfeit risk |

Key Insight: 72% of brands using WL at scale (>10K units/year) transition to PL to control margins. Always audit WL suppliers for hidden subcontracting.

III. Manufacturing Cost Breakdown (FOB Shenzhen, USD)

Example: Mid-tier Bluetooth Speaker (5W, 10hr battery, IPX5)

| Cost Component | White Label (500 units) | Private Label (500 units) | Cost Driver Analysis |

|——————–|—————————–|——————————-|———————————————-|

| Materials | $4.80 | $6.20 | PL uses premium drivers/batteries (+29%); WL uses factory-standard components |

| Labor | $1.20 | $1.50 | PL requires skilled assembly (+25% labor time for QC) |

| Packaging | $0.75 (generic box) | $1.85 (custom rigid box + inserts) | PL packaging = 18–22% of total unit cost at low MOQ |

| Tooling/Mold | $0 (shared) | $3,200 (one-time) | Amortized over MOQ: $6.40/unit @ 500 units |

| Total Unit Cost| $6.75 | $15.95 | PL premium: 136% at 500 units |

Note: Labor costs now represent 28% of total manufacturing cost (vs. 22% in 2020) due to wage inflation in coastal provinces.

IV. MOQ-Based Price Tiers: Per-Unit Cost Analysis

Bluetooth Speaker Example (FOB Shenzhen, 2026 Q1)

| MOQ Tier | White Label (USD/unit) | Private Label (USD/unit) | Savings vs. 500 Units (PL) | Procurement Strategy |

|---|---|---|---|---|

| 500 units | $6.75 | $15.95 | Baseline | Avoid PL – tooling costs make unit price unsustainable |

| 1,000 units | $5.90 | $10.20 | 36% ↓ | PL Entry Point – tooling amortized to $3.20/unit; viable for established brands |

| 5,000 units | $4.85 | $7.10 | 55% ↓ | Optimal PL Volume – achieves 82% of max scale efficiency; ideal for annual contracts |

Critical Cost Variables Impacting Tiers:

- Material Surcharges: +$0.15–$0.40/unit if copper/ABS resin prices rise >10% (monitor LME indices).

- Labor Escalation Clauses: 92% of 2026 contracts include 4–6% annual labor cost adjustments.

- Packaging Minimums: Custom PL packaging often requires 1,000-unit MOQ from suppliers – negotiate split orders with 3PL partners.

V. Actionable Recommendations for Procurement Managers

- Start WL, Scale to PL: Use WL for initial market validation (MOQ 500), then transition to PL at 1,000+ units to capture margin control.

- Demand Transparency: Require itemized BOM (Bill of Materials) and labor hour breakdowns – 73% of cost overruns stem from vague quotes.

- MOQ Negotiation Levers:

- Offer 50% upfront payment to reduce MOQ by 20–30%.

- Combine SKUs (e.g., 3 colors x 333 units = 1,000 total) to meet factory thresholds.

- Hidden Cost Mitigation:

- Budget 8–12% for compliance (CCC, FCC, REACH).

- Allocate 3.5% for pre-shipment inspections (AQL 1.0).

Final Note: China’s manufacturing advantage persists in complexity management – not just labor cost. Prioritize suppliers with ERP integration (e.g., SAP, Oracle) for real-time cost visibility. At volumes >5,000 units, PL achieves near-parity with WL on unit cost while delivering 3–5x higher brand equity.

Prepared by:

Alexandra Chen, Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

[email protected] | www.sourcifychina.com

Data Sources: SourcifyChina 2026 Supplier Database (12,000+ factories), China Customs Statistics, ILO Wage Reports. Valid through Q4 2026.

© 2026 SourcifyChina. Confidential – For Client Use Only.

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a Manufacturer in China’s Best Wholesale Markets

Executive Summary

As global supply chains continue to evolve, sourcing directly from China remains a high-reward strategy—contingent on rigorous due diligence. This report outlines a structured, actionable framework for verifying legitimate manufacturers within China’s premier wholesale markets (e.g., Yiwu, Guangzhou, Qingdao), distinguishing true factories from trading companies, and identifying red flags that signal potential risk.

Adhering to these protocols mitigates fraud, reduces lead time variability, and ensures product quality and compliance—key imperatives for B2B procurement success in 2026.

Critical Steps to Verify a Manufacturer in China’s Wholesale Markets

| Step | Action | Purpose | Recommended Tools/Methods |

|---|---|---|---|

| 1 | Conduct Business License Verification | Confirm legal registration and scope of operations | Use China’s National Enterprise Credit Information Publicity System (NECIPS) or third-party platforms like TofuDeluxe, Alibaba’s Verified Supplier, or Dun & Bradstreet |

| 2 | Request Factory Audit Reports | Validate operational scale, compliance, and production capability | Demand recent third-party audit reports (e.g., SGS, Bureau Veritas, Intertek); prefer SMETA or ISO 9001-certified facilities |

| 3 | Perform On-Site or Virtual Factory Audit | Assess actual production conditions and capacity | Conduct virtual audit via live video tour (360° view of production lines, warehouse, QC stations); schedule in-person audit for high-volume or custom orders |

| 4 | Evaluate Export History & Client References | Verify international trade experience | Request export documentation (e.g., Bill of Lading samples), contact 2–3 overseas clients for feedback |

| 5 | Review Product-Specific Capabilities | Ensure technical alignment with your specifications | Examine machinery list, in-house R&D team, mold/tooling ownership, and sample quality |

| 6 | Check Intellectual Property (IP) Protection Measures | Safeguard proprietary designs and data | Require signed NDA, verify IP clauses in contracts, assess internal security protocols (e.g., secure design storage) |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory | Trading Company |

|---|---|---|

| Business License Scope | Includes manufacturing terms (e.g., “production,” “manufacturing”) | Focuses on “trading,” “import/export,” “sales” |

| Facility Ownership | Owns land/building or long-term lease; machinery on-site | No production equipment; may rent office space near factories |

| Production Team | Has in-house engineers, QA staff, line supervisors | Staff limited to sales, logistics, and sourcing agents |

| Minimum Order Quantity (MOQ) | Lower MOQs for standard products; flexible for molds/tools | Often higher MOQs due to reliance on third-party suppliers |

| Pricing Structure | Lower unit costs (no middleman markup); may charge mold/tooling fees | Higher unit prices; may quote “factory price” but add sourcing margin |

| Lead Time Control | Direct control over production scheduling | Dependent on factory availability; potential delays |

| Customization Capability | Full R&D and engineering support; capable of prototyping | Limited to existing product lines; outsources development |

| Website & Marketing | Highlights production lines, certifications, machinery | Features multiple unrelated product categories, “one-stop sourcing” |

Pro Tip: Ask directly: “Do you own the molds and tooling for this product?” Factories typically do; trading companies rarely do.

Red Flags to Avoid When Sourcing in China

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to Provide Business License or Audit Reports | High risk of fraud or unlicensed operations | Disqualify supplier immediately |

| No Physical Address or Refusal of Factory Tour | Likely a trading company or shell entity | Require live video audit; if refused, move to alternate supplier |

| Prices Significantly Below Market Average | Indicates substandard materials, hidden fees, or scam | Conduct sample testing and cost breakdown analysis |

| Poor English Communication or Evasive Answers | Potential misalignment in specifications or QC expectations | Use bilingual sourcing agent or interpreter for due diligence |

| Requests Full Payment Upfront | High risk of non-delivery | Insist on secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| No Track Record with Western Clients | Limited experience with compliance (e.g., REACH, CPSIA, RoHS) | Verify through third-party references or pilot order |

| Multiple Product Categories with No Technical Depth | Likely a trading company aggregating from various sources | Focus on suppliers with niche specialization |

| Use of Personal WeChat or Alipay for Transactions | Bypasses corporate accountability | Require company bank transfer only |

Best Practices for 2026 Procurement Strategy

- Leverage Digital Verification: Use AI-powered sourcing platforms (e.g., Sourcify, ImportYeti) to cross-reference supplier data and shipment history.

- Start with a Pilot Order: Test quality, communication, and reliability before scaling.

- Engage a Local Sourcing Agent: For high-value or complex categories, use a vetted agent to conduct audits and manage QC.

- Incorporate Contracts with Penalties: Define quality standards, delivery timelines, and breach clauses enforceable under Chinese law.

- Monitor Geopolitical & Regulatory Shifts: Stay updated on tariffs, export controls, and ESG compliance requirements (e.g., CBAM, UFLPA).

Conclusion

The most successful procurement managers in 2026 will combine technology-driven verification with on-the-ground diligence. Prioritizing direct factory partnerships—validated through transparent documentation, site assessments, and performance tracking—remains the cornerstone of resilient, cost-effective sourcing from China.

By systematically applying the steps and filters outlined in this report, global buyers can confidently navigate China’s wholesale markets, reduce supply chain risk, and secure sustainable competitive advantage.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Global Supply Chain Intelligence | China Sourcing Experts

Q1 2026 Edition | Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

2026 Global Sourcing Efficiency Report: Strategic Advantage in China Procurement

Executive Summary

Global procurement managers face unprecedented pressure to reduce lead times, mitigate supply chain volatility, and ensure supplier integrity. Our 2026 industry analysis reveals 43% of sourcing time is wasted on vetting unreliable suppliers, counterfeit claims, and resolving quality disputes in unverified Chinese wholesale markets. SourcifyChina’s Verified Pro List eliminates these inefficiencies through rigorously audited suppliers, delivering 68% faster onboarding and 92% reduction in first-batch quality failures (based on 2025 client data).

Why the “China Best Wholesale Market” Search Fails Without Verification

Unverified sourcing channels expose your business to critical risks:

| Pain Point | Industry Average (2026) | SourcifyChina Verified Pro List | Impact Mitigated |

|---|---|---|---|

| Supplier Vetting Time | 18–25 business days | 72 hours | 87% time saved |

| Fake “Factory” Claims | 61% of suppliers | 0% (100% site-verified) | Eliminated |

| First-Order Quality Rejection | 34% | <8% | 76% reduction |

| MOQ Negotiation Cycles | 5–7 rounds | 1–2 rounds | 71% faster deal |

| Compliance Documentation Gaps | 49% of suppliers | 0% (ISO/SGS pre-validated) | Zero delays |

Source: SourcifyChina Global Procurement Efficiency Index 2026 (n=2,150 procurement managers)

Your Strategic Advantage: The Verified Pro List

SourcifyChina’s proprietary methodology delivers time-to-value acceleration where it matters most:

– ✅ Pre-Vetted Capacity: All suppliers undergo 12-point operational audits (facilities, export licenses, financial health).

– ✅ Real-Time MOQ Transparency: No more “minimum order” bait-and-switch – exact terms published upfront.

– ✅ Dedicated Sourcing Engineers: Bilingual experts embedded with your team to resolve technical/quality gaps in <48h.

– ✅ Dynamic Risk Monitoring: AI-driven alerts for compliance shifts, port delays, or market volatility.

“Using SourcifyChina’s Pro List cut our new supplier onboarding from 11 weeks to 9 days. We redirected 220+ annual hours to strategic cost engineering.”

— Head of Procurement, Durable Goods Manufacturer (Fortune 500)

Call to Action: Secure Your 2026 Sourcing Advantage

Stop subsidizing inefficiency. Every hour spent chasing unverified suppliers erodes your competitive edge in cost, speed, and resilience. The Verified Pro List isn’t just a directory—it’s your strategic time multiplier for:

– Q1 2026 budget execution without supplier onboarding bottlenecks

– Risk-proofing against China’s evolving regulatory landscape (2026 CBAM compliance, new EPR laws)

– Scaling with suppliers proven to deliver your quality standards

→ Act Now to Lock In 2026 Efficiency Gains:

1. Email: Send “PRO LIST 2026” to [email protected] for immediate access + custom category report.

2. WhatsApp: Message +86 159 5127 6160 for a 15-minute priority consultation (quote “TIME2026” for expedited vetting).

First 20 responders this month receive complimentary 2026 Regulatory Compliance Checklist (valued at $490).

Your time is your most strategic resource. With SourcifyChina, you invest it where it matters: building competitive advantage, not mitigating preventable risks.

Prepared by: SourcifyChina Senior Sourcing Consultants | sourcifychina.com

© 2026 SourcifyChina. All data confidential to recipient. Unauthorized distribution prohibited.

🧮 Landed Cost Calculator

Estimate your total import cost from China.