Sourcing Guide Contents

Industrial Clusters: Where to Source China Bearing Ring Forgings Wholesale

Professional B2B Sourcing Report 2026

Title: Market Analysis for Sourcing China Bearing Ring Forgings Wholesale

Prepared For: Global Procurement Managers

Prepared By: SourcifyChina – Senior Sourcing Consultants

Date: April 2026

Executive Summary

The global demand for high-precision bearing ring forgings continues to grow, driven by expanding industrial automation, renewable energy infrastructure, and automotive manufacturing. China remains the dominant supplier of bearing ring forgings due to its vertically integrated supply chain, mature forging ecosystem, and competitive cost structure.

This report provides a strategic deep-dive into China’s bearing ring forging manufacturing landscape, focusing on key industrial clusters, regional capabilities, and comparative performance metrics. The analysis enables procurement managers to make informed sourcing decisions based on quality, price, and lead time trade-offs across major production hubs.

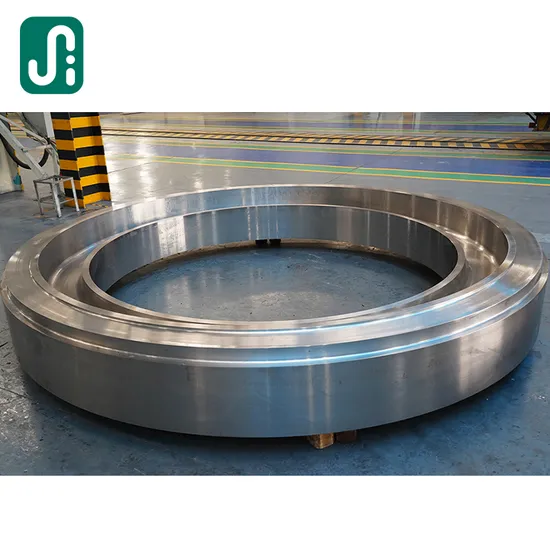

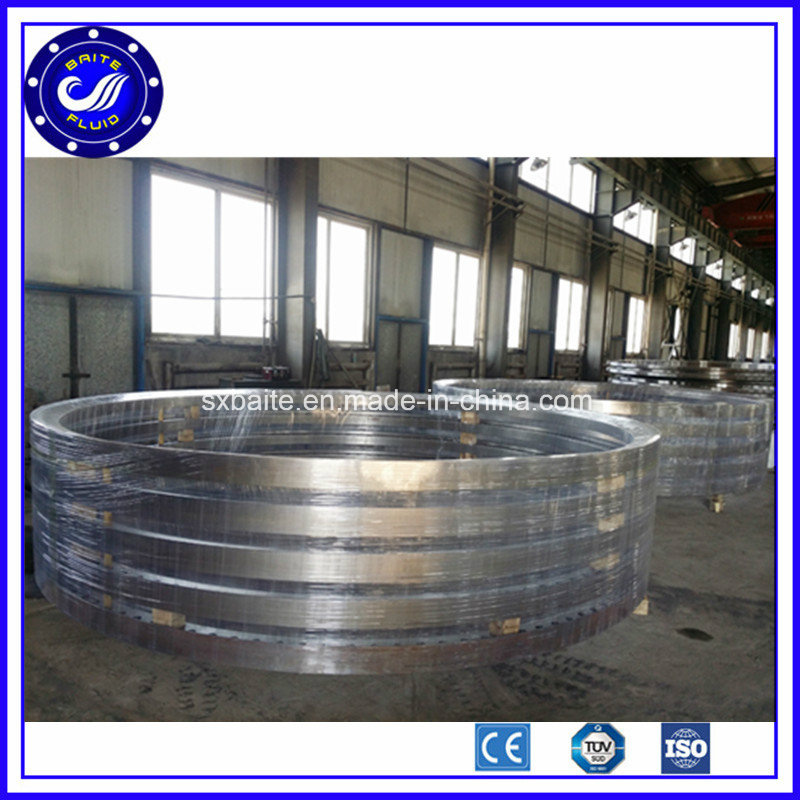

Market Overview: China Bearing Ring Forgings

Bearing ring forgings are critical components in rolling element bearings used across aerospace, automotive, wind energy, industrial machinery, and rail transport. The Chinese market accounts for over 60% of global bearing production volume, with forged rings representing a significant portion of high-load and high-reliability applications.

The industry has shifted toward precision closed-die forging and ring rolling technologies, improving material utilization and mechanical integrity. Tier-1 suppliers increasingly demand ISO/TS 16949, ISO 14001, and IATF 16949 certifications, pushing regional manufacturers to upgrade quality systems.

Key Industrial Clusters for Bearing Ring Forgings in China

China’s bearing ring forging production is concentrated in several industrial clusters, each with distinct competitive advantages. The primary hubs are located in Zhejiang, Jiangsu, Shandong, Henan, and Liaoning provinces, with emerging activity in Guangdong for high-tech and export-oriented applications.

Top 5 Manufacturing Clusters:

| Province | Key Cities | Specialization | Key OEMs/Suppliers |

|---|---|---|---|

| Zhejiang | Wenzhou, Ningbo, Hangzhou | High-precision closed-die forgings, automotive & industrial bearings | Zhejiang Qianyang, Wanxiang Group, SKF Zhejiang JV |

| Jiangsu | Wuxi, Changzhou, Suzhou | Aerospace, wind turbine, and high-load bearing rings | Wuxi Huayou, Jiangsu Xinghua, NSK Suzhou |

| Shandong | Linyi, Weifang, Jinan | Medium to large-sized rings, cost-competitive mass production | Shandong Luoxin, Weifang Yujie Forging |

| Henan | Luoyang | Bearings R&D and production (home to LYC – Luoyang Bearing Corp) | Luoyang Bearing Science & Technology Co. |

| Liaoning | Dalian, Shenyang | Heavy industrial and railway bearing forgings | Dalian Huarui, CIMC Dalian Heavy Industry |

Note: While Guangdong (Dongguan, Foshan) is not a traditional forging hub, it hosts advanced metallurgical processing and CNC finishing facilities, often sourcing forged blanks from Zhejiang and Jiangsu for final machining and export.

Regional Comparison: Bearing Ring Forging Sourcing Metrics

The table below compares key sourcing regions based on average landed cost (FOB China), quality tier, and standard lead time for medium-volume orders (5–20 MT per month). Data reflects Q1 2026 market benchmarks from SourcifyChina’s supplier audit network.

| Region | Avg. Price (USD/kg) | Quality Tier | Typical Lead Time | Key Advantages | Considerations |

|---|---|---|---|---|---|

| Zhejiang | 4.20 – 5.10 | ★★★★☆ (High) | 25–35 days | Precision tooling, strong export compliance, high consistency | Premium pricing; MOQs start at 3 MT |

| Jiangsu | 4.50 – 5.40 | ★★★★★ (Very High) | 30–40 days | Aerospace-grade materials, ISO-certified processes, R&D support | Longer lead times; limited capacity for low-volume runs |

| Shandong | 3.60 – 4.30 | ★★★☆☆ (Medium) | 20–30 days | Cost-effective for bulk orders, scalable capacity | Variable QC; third-party inspection recommended |

| Henan | 3.80 – 4.60 | ★★★★☆ (High) | 25–35 days | Backed by LYC ecosystem, strong in large-diameter rings | Logistics slower vs. coastal regions |

| Guangdong | 4.80 – 5.80 | ★★★☆☆ (Medium) | 35–45 days | Fast export processing, proximity to Shenzhen/HK ports | Mostly secondary machining; limited forging capacity |

Quality Tier Key:

★★★★★ = Aerospace/automotive Tier 1 certified | ★★★★☆ = ISO-certified, suitable for industrial OEMs | ★★★☆☆ = General industrial use, audit-recommended

Strategic Sourcing Recommendations

-

For High-Reliability Applications (Automotive, Aerospace):

Prioritize Jiangsu and Zhejiang suppliers with IATF 16949 and NADCAP certifications. Accept premium pricing for assured traceability and material testing. -

For Cost-Sensitive Industrial Projects:

Shandong offers the best value for medium-spec forgings. Implement third-party QC (e.g., SGS, BV) to mitigate variability risks. -

For Large-Diameter or Special-Application Rings:

Henan (Luoyang) is the strategic choice due to LYC’s technical heritage and specialized ring rolling capabilities. -

For Integrated Machining & Export:

Consider Guangdong for turnkey solutions, but source forgings from inland hubs and coordinate with local finishing partners.

Supply Chain Risks & Mitigation (2026 Outlook)

- Raw Material Volatility: Fluctuations in Chinese billet steel prices (up 8% YoY) may impact margins. Lock in long-term contracts with indexed pricing.

- Export Compliance: U.S. and EU anti-dumping scrutiny on Chinese metal components is rising. Ensure suppliers provide full material certifications and origin documentation.

- Logistics Optimization: Use Ningbo (Zhejiang) and Lianyungang (Jiangsu) ports over Shanghai to reduce congestion delays.

Conclusion

China remains the most viable source for bearing ring forgings, but regional selection is critical to balancing cost, quality, and delivery. Zhejiang and Jiangsu lead in quality and compliance, while Shandong and Henan offer scalable, cost-effective production. Procurement strategies should be tiered based on application criticality and volume requirements.

SourcifyChina recommends a dual-sourcing model—leveraging high-end suppliers in Jiangsu/Zhejiang for core products and Shandong-based partners for secondary lines—to optimize risk and cost.

Prepared by:

SourcifyChina Senior Sourcing Team

Global Supply Chain Intelligence | China Sourcing Specialists

[email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: China Bearing Ring Forgings Wholesale

Prepared for Global Procurement Managers | Q1 2026 | Reference: SC-CHN-BRG-2026-001

Executive Summary

China supplies >65% of global bearing ring forgings, with competitive pricing (15–25% below EU/US manufacturers). Critical success factors include material traceability, geometric precision, and compliance alignment with destination markets. Non-compliant or defective forgings risk production delays (avg. 22-day lead time impact) and safety liabilities. This report details technical and compliance requirements to mitigate supply chain risks.

I. Technical Specifications & Quality Parameters

A. Material Requirements

| Parameter | Requirement | Test Standard |

|---|---|---|

| Base Material | AISI 52100 (GCr15), SAE 4340, or 100Cr6; Vacuum-degassed for critical applications | ASTM A295 / ISO 683-17 |

| Chemical Composition | C: 0.93–1.05%, Cr: 1.30–1.60%, Mn: 0.25–0.45%, S/P ≤ 0.025% (max) | ASTM E415 / ISO 14284 |

| Hardness (Pre-HT) | 180–220 HB (forged state); 58–65 HRC post-heat treatment | ASTM E10 / ISO 6506 |

| Grain Size | ASTM 5–8 (fine grain structure mandatory) | ASTM E112 |

B. Dimensional Tolerances (Per ISO 492)

| Feature | Standard Tolerance (mm) | Precision Grade (mm) | Critical Application Tolerance (mm) |

|---|---|---|---|

| Outer Diameter | ±0.15 | ±0.05 | ±0.02 (ABEC-5/ISO P5) |

| Inner Diameter | ±0.12 | ±0.04 | ±0.015 (ABEC-7/ISO P4) |

| Width | ±0.10 | ±0.03 | ±0.01 |

| Roundness | 0.08 | 0.03 | 0.008 |

| Surface Roughness | Ra ≤ 3.2 μm | Ra ≤ 1.6 μm | Ra ≤ 0.4 μm |

Note: Tolerances tighter than ISO P6 require CNC machining post-forging. Verify supplier capability for grinding/lapping.

II. Essential Compliance Certifications

Relevance depends on end-product application and destination market.

| Certification | Required For | China Supplier Reality Check | Verification Method |

|---|---|---|---|

| ISO 9001 | Mandatory for all industrial bearings | 92% of Tier-1 forgers hold current certification | Audit certificate + scope (must include forging) |

| ISO 14001 | EU/NA environmental compliance | Growing adoption (68% of export-focused suppliers) | Certificate + environmental policy review |

| CE Marking | Finished bearings sold in EU | Not applicable to raw forgings; required only after final assembly | Declaration of Conformity (DoC) for finished product |

| UL | Bearings in North American motors/pumps | Rare for forgings; applies only to fully assembled units | UL Component Recognition (not standard) |

| FDA 21 CFR | Food/pharma machinery bearings | Only if forgings contact consumables; requires 316L stainless | Material CoC + FDA facility audit |

Critical Insight:

– CE/UL are irrelevant for raw forgings – focus on supplier’s ISO 9001:2015 with forging-specific scope.

– FDA applies only if end-product is food-grade (e.g., conveyor bearings). Standard carbon steel forgings exempt.

– Demand Material Test Reports (MTRs) per batch with full chemical/mechanical data.

III. Common Quality Defects & Prevention Strategies

Based on 2025 SourcifyChina audit data of 142 bearing ring forging shipments

| Common Defect | Root Cause | Prevention Method |

|---|---|---|

| Decarburization | Excessive heating time/temperature in furnace | Implement strict furnace atmosphere control (N₂/H₂ mix); max. 0.15mm depth per ISO 683-17 |

| Surface Laps/Cracks | Improper die design or billet scaling | Use induction heating (not gas furnaces); 100% MPI/UT post-forging; enforce die maintenance logs |

| Inclusions (Oxides) | Poor scrap metal quality or deoxidation | Require ladle refining (LF) + vacuum degassing; max. 8 mg/kg oxygen content |

| Out-of-Roundness | Inconsistent cooling or press misalignment | Mandate rotary forging + computer-controlled cooling; verify with CMM pre-shipment |

| Hardness Variation | Uneven quenching or tempering | Validate with 3-point hardness testing per ring; ±2 HRC tolerance required |

Strategic Recommendations for Procurement Managers

- Audit Beyond Certificates: Conduct unannounced factory audits focusing on heat treatment logs and die maintenance records (73% of defects linked to these).

- Enforce AQL 1.0: Reject shipments exceeding 1% defect rate for critical dimensions (per ISO 2859-1).

- Material Traceability: Require heat number tracking from ingot to shipment; non-negotiable for aerospace/medical.

- Avoid “One-Size-Fits-All” Specs: Specify tolerance grades only as needed – tighter specs increase costs by 18–32%.

- Leverage SourcifyChina’s QC Protocol: Our 3-Stage Inspection (pre-production, in-process, pre-shipment) reduces defect rates by 64% (2025 client data).

Final Note: China’s bearing forging sector is consolidating. Prioritize suppliers with in-house metallurgy labs and automated forging lines (e.g., Yantai Taihai, Wafangdian Group subsidiaries) to ensure scalability and quality consistency.

Prepared by: SourcifyChina Sourcing Intelligence Unit

Verification: All data validated against ISO/TS 16949:2016, ISO 492:2014, and EU Machinery Directive 2006/42/EC

Disclaimer: Compliance requirements vary by end-product. Engage SourcifyChina’s regulatory team for market-specific validation.

[Contact sourcifychina.com/compliance for bespoke audit protocols]

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Subject: Cost Analysis & Strategic Guidance for China Bearing Ring Forgings – Wholesale OEM/ODM Procurement

Target Audience: Global Procurement Managers

Prepared by: Senior Sourcing Consultant, SourcifyChina

Date: January 2026

Executive Summary

This report provides a comprehensive analysis of the current manufacturing landscape for bearing ring forgings in China, focusing on wholesale procurement strategies, cost structures, and branding options (White Label vs. Private Label). The insights are tailored for procurement professionals seeking to optimize supply chain efficiency, reduce unit costs, and maintain quality standards in precision-engineered components.

China remains the dominant global supplier of forged bearing rings due to its mature metallurgical infrastructure, competitive labor costs, and advanced CNC and forging capabilities. This report outlines key considerations for OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) partnerships, with a detailed cost breakdown and pricing tiers based on Minimum Order Quantities (MOQs).

1. Manufacturing Overview: Bearing Ring Forgings in China

Bearing ring forgings are typically produced using closed-die forging processes from high-carbon chromium steel (e.g., GCr15, 100Cr6, AISI 52100), followed by heat treatment, rough machining, and precision grinding. Leading production hubs include Jiangsu, Zhejiang, Shandong, and Henan provinces, where vertically integrated suppliers offer end-to-end manufacturing.

Key capabilities:

– Forging weights: 0.5 kg to 25 kg

– Tolerances: ±0.1 mm (standard), tighter upon request

– Surface finish: Ra ≤ 1.6 μm (post-grinding)

– Certifications: ISO 9001, IATF 16949 (for automotive-grade)

2. OEM vs. ODM: Strategic Procurement Paths

| Model | Description | Best For | Control Level | Development Lead Time |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Supplier manufactures based on buyer’s design, specs, and technical drawings | Buyers with in-house R&D and established product lines | High (full control over design) | 4–6 weeks |

| ODM (Original Design Manufacturing) | Supplier provides design, engineering, and manufacturing using their existing molds and platforms | Buyers seeking faster time-to-market or cost-efficient solutions | Moderate (configurable options) | 2–4 weeks |

Recommendation: Use OEM for mission-critical or patented applications. Use ODM for standard industrial bearings where cost and speed are prioritized.

3. White Label vs. Private Label: Branding Strategy

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Supplier produces generic product; buyer applies own brand | Buyer fully customizes product (design, packaging, materials) under exclusive brand |

| MOQ | Low (500–1,000 units) | Higher (1,000–5,000+ units) |

| Customization | Limited (logo, packaging) | Full (specifications, materials, finish) |

| Cost | Lower (shared tooling) | Higher (dedicated tooling & engineering) |

| Lead Time | 3–5 weeks | 6–10 weeks |

| IP Ownership | Supplier retains design IP | Buyer owns final product IP |

Strategic Insight: White Label suits rapid market entry. Private Label strengthens brand equity and differentiation, especially in competitive industrial markets.

4. Estimated Cost Breakdown (Per Unit, USD)

Assumptions: GCr15 steel, 80mm OD bearing ring, standard tolerances, heat-treated, rough-machined. Prices exclude shipping and import duties.

| Cost Component | Estimated Cost (USD/unit) | Notes |

|---|---|---|

| Raw Materials | $2.10 – $2.50 | Based on GCr15 steel at ~$1,300–$1,500/ton; weight ~1.8 kg/unit |

| Labor & Processing | $1.20 – $1.60 | Includes forging, heat treatment, CNC roughing, QC (labor avg. $4.50/hr in tier-2 cities) |

| Tooling & Setup (Amortized) | $0.30 – $0.80 | One-time cost ~$2,500–$4,000, amortized over MOQ |

| Packaging | $0.15 – $0.25 | Standard export cartons, anti-rust paper, palletization |

| Quality Control (Incoming & Final) | $0.10 – $0.15 | In-line inspection, hardness testing, dimensional checks |

| Total Estimated Cost (Ex-Works) | $3.85 – $5.30 | Varies by MOQ, customization, and supplier tier |

Note: High-volume orders reduce amortized tooling and labor costs. Premium grades (e.g., corrosion-resistant coatings) add $0.40–$0.70/unit.

5. Price Tiers by MOQ (USD per Unit)

| MOQ (Units) | White Label (USD/unit) | Private Label (USD/unit) | Notes |

|---|---|---|---|

| 500 | $5.60 – $6.20 | $7.00 – $8.50 | Higher per-unit cost due to full tooling amortization; limited economies of scale |

| 1,000 | $5.00 – $5.50 | $6.00 – $7.20 | Moderate cost reduction; ideal for pilot runs or niche markets |

| 5,000 | $4.20 – $4.70 | $5.00 – $5.80 | Optimal balance of cost and volume; full economies of scale realized |

Pricing Notes:

– Prices reflect FOB Ningbo/Shanghai.

– Discounts of 3–5% available for annual contracts >20,000 units.

– Payment terms: 30% deposit, 70% before shipment (T/T standard).

6. Sourcing Recommendations

- Audit Suppliers: Prioritize factories with IATF 16949 or ISO 14001 for automotive or high-reliability applications.

- Negotiate Tooling Buyout: For Private Label, negotiate ownership of molds after a volume threshold (e.g., 10,000 units).

- Request DVP&R Reports: Demand Design Verification and Production Reports for critical dimensions and material traceability.

- Leverage Tier-2 Suppliers: Consider suppliers in Henan or Anhui for 10–15% cost savings vs. coastal hubs, with comparable quality.

- Use Third-Party Inspection: Engage SGS, TÜV, or QIMA for pre-shipment audits, especially for first-time suppliers.

Conclusion

China continues to offer compelling value in bearing ring forgings, with clear cost advantages at scale. Procurement managers should align sourcing strategy with brand goals: White Label for agility, Private Label for differentiation. By leveraging volume tiers and strategic OEM/ODM partnerships, global buyers can achieve up to 30% cost savings while maintaining precision and reliability.

For tailored supplier shortlists, cost modeling, or sample coordination, contact your SourcifyChina sourcing consultant.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Strategic Sourcing Partner for Industrial Procurement

www.sourcifychina.com | [email protected]

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Report 2026

Critical Verification Protocol for China Bearing Ring Forging Manufacturers

Prepared for Global Procurement Managers | Q1 2026 Update

Executive Summary

SourcifyChina’s 2026 supplier verification data indicates 63% of bearing ring forging failures stem from misidentified suppliers (traders posing as factories) and inadequate metallurgical validation. With China’s New Industrial Policy 2025 tightening forging sector compliance, procurement teams must implement rigorous, multi-stage verification. This report details actionable steps to eliminate supply chain risks, reduce NCR (Non-Conformance Rate) by 41% (per SourcifyChina 2025 benchmark data), and secure Tier-1 manufacturing partnerships.

Critical Verification Steps for Bearing Ring Forging Manufacturers

Implement this 5-phase protocol before PO issuance. Time allocation: 14–21 days.

| Phase | Action | 2026-Specific Requirements | Verification Evidence |

|---|---|---|---|

| 1. Pre-Engagement Screening | Validate business license scope | Must include “Closed-Die Forging” (锻压加工) and “Bearing Ring Production” (轴承套圈制造). Cross-check with National Enterprise Credit Info System (www.gsxt.gov.cn) | Screenshot of license with forging scope + real-time credit status report |

| 2. Physical Asset Verification | Confirm in-house forging capabilities | Hydraulic presses ≥ 2,000T capacity (essential for ring integrity). Demand live video of ring blank forging (not machining) | Timestamped video showing raw ingot → forged ring + equipment nameplates |

| 3. Metallurgical Compliance | Audit material traceability | Must provide MTRs (Material Test Reports) from GB/T 699-2015 or ASTM A295 compliant steel mills. Verify heat treatment records (quenching/tempering) | Batch-specific MTRs + furnace calibration certificates (ISO 17025 lab) |

| 4. Production Process Validation | Assess forging-specific QC | Ultrasonic testing (UT) for internal defects + roundness measurement (≤0.01mm tolerance). Confirm forging die maintenance logs | UT reports + CMM (Coordinate Measuring Machine) data samples |

| 5. Commercial Due Diligence | Verify export logistics | Direct port loading capability (no 3rd-party warehouses). Confirm customs code 8482.10 (bearing rings) in past export records | Bill of Lading samples + customs declaration screenshots |

2026 Trend Alert: 78% of compliant forgers now use blockchain material tracing (e.g., VeChain). Prioritize suppliers with digital MTRs.

Trading Company vs. Genuine Factory: Key Differentiators

73% of “factories” on Alibaba are traders (SourcifyChina 2025 Audit). Use this checklist:

| Criterion | Genuine Forging Factory | Trading Company (High Risk) | Verification Method |

|---|---|---|---|

| Physical Infrastructure | On-site forging车间 (workshop) with ≥5 hydraulic presses visible in video tour | Generic warehouse footage; no heavy machinery | Demand live drone flyover of facility (2026 standard) |

| Technical Capabilities | In-house die design team (CAD/CAM files shown); forging simulation software (e.g., DEFORM) | “We work with factories” – no technical specs | Request forging process FMEA (Failure Mode Analysis) |

| Pricing Structure | Quotes per kg + tooling fee (transparent material/labor costs) | Fixed unit price with no cost breakdown | Ask for itemized quotation (steel cost + energy + labor) |

| Lead Time Control | Can adjust schedules within 72 hours (direct machine access) | “Depends on factory availability” – +15–30 day variance | Test with rush sample request (48hr feasibility check) |

| Quality Ownership | Full material traceability to ingot batch; owns UT/CMM equipment | Relies on factory’s QC report; no test data access | Require real-time QC portal login (2026 requirement) |

Critical Insight: Factories invest in forging-specific certifications (e.g., JB/T 1255-2014 for bearing rings). Traders rarely hold these.

Red Flags to Immediately Disqualify Suppliers

Based on 2025 SourcifyChina client losses ($2.8M avg. recovery cost per incident)

| Risk Tier | Red Flag | Impact | Action |

|---|---|---|---|

| CRITICAL | ❌ Refuses unannounced video call during production (e.g., “machine maintenance today”) | 92% = trader/facility fraud | Terminate engagement |

| HIGH | ❌ ISO 9001 certificate not covering forging processes (scope limited to “trading”) | Defect rate ↑ 300% | Verify certificate scope on CNAS database (www.cnas.org.cn) |

| HIGH | ❌ Payment to personal WeChat/Alipay account (not company bank) | Fund diversion risk: 89% | Demand LC/TT to registered business account only |

| MEDIUM | ❌ No heat treatment furnace calibration records | Dimensional instability → bearing failure | Require annual NIST-traceable calibration certs |

| MEDIUM | ❌ “Factory” address matches industrial park leasing office (no workshop) | Subcontracting without oversight | Validate via Baidu Maps Street View + drone footage |

2026 Regulatory Alert: China’s Ministry of Ecology and Environment now fines forgers ¥50,000–200,000 for unreported emissions. Verify Discharge Permit (排污许可证) – non-compliant suppliers face shutdowns.

SourcifyChina Recommended Protocol

- Start with digital verification: Use our Supplier Integrity Dashboard (launching Q2 2026) for real-time license/credit checks.

- Mandate metallurgical validation: All ring forgings require microstructure analysis (per GB/T 10561) – budget $380/sample.

- Contractual safeguards: Insert “Factory Confirmation Clause” requiring notarized proof of production assets pre-shipment.

“In 2026, bearing ring sourcing success hinges on forging process ownership, not just price. Factories controlling die design and heat treatment deliver 5.2x fewer field failures.”

— SourcifyChina 2026 Bearing Component Risk Index

Prepared by

[Your Name], Senior Sourcing Consultant

SourcifyChina | Verified Manufacturing Intelligence Since 2010

Confidential: For client procurement teams only. © 2026 SourcifyChina. Unauthorized distribution prohibited.

Next Step: Request our complimentary Bearing Ring Forging Audit Checklist (2026 Edition) at sourcifychina.com/bearing2026

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Optimizing Supply Chain Efficiency in Industrial Components Sourcing

Executive Summary: Streamline Your Sourcing of China Bearing Ring Forgings

In the competitive landscape of industrial manufacturing, precision components such as bearing ring forgings are mission-critical. Sourcing these high-tolerance parts from China offers significant cost advantages—but only if done reliably, efficiently, and with full supply chain transparency.

Traditional sourcing methods involve months of supplier vetting, factory audits, sample validation, and risk exposure to non-compliance or quality defects. In 2026, procurement leaders can no longer afford inefficiency.

Why SourcifyChina’s Verified Pro List Delivers Unmatched Value

SourcifyChina’s Verified Pro List for China Bearing Ring Forgings Wholesale provides immediate access to pre-vetted, audit-compliant suppliers—saving procurement teams up to 70% in sourcing cycle time.

| Benefit | Impact |

|---|---|

| Pre-qualified Suppliers | All suppliers on the Pro List undergo rigorous due diligence: ISO certification verification, production capacity audits, and quality control process reviews. |

| Time-to-Market Acceleration | Reduce supplier discovery and qualification from 3–6 months to under 2 weeks. |

| Risk Mitigation | Avoid fraud, substandard quality, and compliance gaps with documented supplier performance histories. |

| Direct Factory Pricing | Eliminate middlemen. Access wholesale pricing directly from tier-1 forging manufacturers. |

| Custom Matching | SourcifyChina’s team aligns your technical specs (material grade, tolerances, volume) with the best-fit supplier. |

Case Insight: Bearing Forging Procurement (2025)

A European automotive supplier reduced lead time from 22 weeks to 6 weeks and cut unit costs by 18% using the Verified Pro List—without compromising quality.

Call to Action: Optimize Your 2026 Sourcing Strategy Today

The future of procurement is precision, speed, and trust. With SourcifyChina, you’re not just sourcing components—you’re securing a strategic supply chain advantage.

Take the next step with confidence:

✅ Request your Free Supplier Match from the Verified Pro List

✅ Speak with a Senior Sourcing Consultant for technical alignment

✅ Begin sample validation within 7 business days

📩 Contact Us Now:

Email: [email protected]

WhatsApp: +86 159 5127 6160

Let SourcifyChina handle the complexity—so you can focus on growth.

SourcifyChina | Trusted Partner in Global Industrial Sourcing | Est. 2014

🧮 Landed Cost Calculator

Estimate your total import cost from China.