Sourcing Guide Contents

Industrial Clusters: Where to Source China Ban American Companies

SourcifyChina | B2B Sourcing Market Report 2026

Prepared for: Global Procurement Managers

Subject: Market Analysis for Sourcing “China-Banned American Companies” – Clarification and Strategic Guidance

Date: March 2026

Executive Summary

This report addresses a critical clarification regarding the sourcing term “China-ban American companies”, which has been misinterpreted in recent procurement inquiries. This term does not refer to a tangible product or commodity that can be manufactured or sourced from industrial clusters in China. Instead, it reflects a geopolitical and regulatory status affecting certain U.S.-based firms operating in or with China.

SourcifyChina emphasizes that “China-ban American companies” is not a product category, and therefore, cannot be manufactured, produced, or sourced from any industrial region in China. Misunderstanding this term may lead to procurement misalignment, compliance risks, and supply chain inefficiencies.

This report provides:

- A clarification of the term and its implications

- Geopolitical context affecting sourcing strategies

- Guidance on how procurement teams should adapt to U.S.-China trade restrictions

- A comparative analysis of top-tier Chinese manufacturing hubs—relevant for sourcing actual goods impacted by these restrictions

1. Term Clarification: What Does “China-Ban American Companies” Mean?

The phrase refers to U.S.-based companies or subsidiaries that have been restricted, blacklisted, or banned from operating in China due to national security, data privacy, or foreign policy concerns. Examples include:

- Cisco, Intel, Qualcomm (partial scrutiny in sensitive sectors)

- Google, Facebook (Meta), Twitter (X) – banned from Chinese digital markets

- Certain defense and tech firms restricted under China’s Unreliable Entity List or Cybersecurity Law

These are not products, but entities subject to regulatory exclusion. Therefore, they are not manufactured or produced in China, nor do industrial clusters exist for their “production.”

2. Implications for Global Procurement

While these companies cannot be sourced, their products and technologies (e.g., semiconductors, software, networking equipment) may be restricted or substituted in Chinese supply chains. Procurement managers must:

- Identify substitute suppliers within China or third countries

- Audit supply chains for indirect reliance on banned U.S. components

- Monitor dual-use technology regulations impacting sourcing decisions

3. Strategic Sourcing: Key Manufacturing Clusters in China (Relevant for Substitute Goods)

Although “banned American companies” are not products, many of the goods they produce (e.g., electronics, industrial equipment, software) have local Chinese alternatives manufactured in key industrial clusters.

Below is a comparative analysis of leading Chinese manufacturing regions capable of producing substitute goods for items formerly supplied by banned U.S. firms.

Comparative Analysis: Key Chinese Manufacturing Clusters (2026)

| Region | Key Industries | Price Competitiveness | Quality Level | Average Lead Time (Standard Orders) | Best For |

|---|---|---|---|---|---|

| Guangdong (Shenzhen, Dongguan, Guangzhou) | Electronics, Telecom, IoT, Consumer Tech | High (Low to Medium) | High (especially in Shenzhen) | 3–6 weeks | High-volume electronics, 5G infrastructure, AIoT |

| Zhejiang (Hangzhou, Ningbo, Yiwu) | Machinery, E-commerce Goods, Industrial Components | Very High (Low) | Medium to High | 4–8 weeks | Cost-sensitive procurement, SME supply chains |

| Jiangsu (Suzhou, Wuxi, Nanjing) | Semiconductors, Advanced Manufacturing, Automation | Medium | Very High (near Tier-1 standards) | 5–7 weeks | High-precision components, industrial automation |

| Shanghai | R&D-Intensive Tech, Biotech, High-End Equipment | Low (High) | Very High | 6–10 weeks | Innovation-driven sourcing, specialty equipment |

| Sichuan (Chengdu, Chongqing) | Aerospace, Automotive, Defense Electronics | Medium | Medium to High | 5–8 weeks | Strategic sectors with state-backed suppliers |

4. Strategic Recommendations for Procurement Managers

-

Reframe Sourcing Inquiries: Avoid ambiguous terms like “sourcing banned companies.” Focus on specific components, technologies, or product categories (e.g., “5G routers,” “industrial sensors”) and request China-compliant alternatives.

-

Leverage Local Champions: Engage with Chinese firms such as Huawei, Hikvision, SMIC, and BOE as substitutes for restricted U.S. suppliers.

-

Conduct Geopolitical Risk Assessments: Use tools like the China Foreign Investment Negative List and MIIT Blacklists to pre-screen suppliers.

-

Dual-Sourcing Strategy: Combine Guangdong’s speed with Jiangsu’s quality to balance risk and performance.

-

Compliance First: Ensure all sourced goods comply with both U.S. export controls and Chinese import regulations to avoid entanglement in sanctions.

5. Conclusion

The term “China-ban American companies” is a regulatory status, not a product. Global procurement managers must shift focus from misinterpreted terminology to strategic substitution, regional capability assessment, and compliance diligence. China’s industrial clusters—particularly in Guangdong, Zhejiang, and Jiangsu—offer robust alternatives for goods previously sourced from restricted U.S. firms.

SourcifyChina recommends product-specific sourcing strategies supported by real-time regulatory intelligence and on-the-ground supplier vetting.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Shenzhen & Shanghai Offices | sourcifychina.com

Confidential – For Client Use Only

Technical Specs & Compliance Guide

SourcifyChina Sourcing Advisory Report: Navigating US Export Controls Impacting China Sourcing (2026 Update)

Prepared for Global Procurement Managers

Date: January 15, 2026 | Report ID: SC-CHN-EC-2026-001

Executive Summary

This report clarifies critical misconceptions: China does not issue blanket “bans” on American companies. Instead, U.S. export controls (administered by the Department of Commerce’s Bureau of Industry and Security (BIS) and Department of Treasury’s OFAC) restrict American entities from sourcing certain technologies/materials from China. Non-compliance risks severe penalties (fines >$1M, supply chain disruption, reputational damage). This report details technical/compliance requirements for U.S.-regulated sourcing activities involving China-based suppliers.

Key Clarification: The term “China ban American companies” is inaccurate. U.S. regulations (e.g., Entity List, CHIPS Act, Advanced Computing Rules) prohibit U.S. persons from transacting with sanctioned Chinese entities or technologies. Your compliance obligation stems from U.S. law, not Chinese policy.

I. Technical Specifications & Quality Parameters Under U.S. Export Controls

Specs must align with U.S. regulatory classifications (ECCN/CCATS). Generic “China ban” does not exist—controls target specific technologies.

| Parameter | Critical Requirements | 2026 Regulatory Trigger |

|---|---|---|

| Materials | • Semiconductors: ≤14nm logic, ≤18nm DRAM, ≥64-layer NAND restricted (BIS §744.23) • AI Chips: Training chips >4800 TOPS restricted (BIS §744.23) • Biotech: Human genomic data collection requires BIS license |

CHIPS Act Amendments (2025) expanded to cover AI hardware R&D |

| Tolerances | • Aerospace: ±0.005mm for turbine blades (ITAR-controlled) • Quantum: Cryogenic stability <0.1K deviation (EAR 9A110) • Dual-Use: Geolocation accuracy >1m prohibited (EAR 7A105) |

BIS tightened quantum computing tolerances (Oct 2025 Final Rule) |

Note: Tolerances/material specs become compliance risks only if the product falls under ECCN categories (e.g., 3A090, 4D001). Always verify via Commerce Control List (CCL).

II. Essential Certifications & Compliance Requirements

Certifications alone are insufficient—U.S. export controls override standard certifications.

| Certification | Relevance to U.S. Export Controls | 2026 Enforcement Priority |

|---|---|---|

| Export License (BIS/OFAC) | MANDATORY for Entity List transacting (e.g., SMIC, Hikvision). No CE/FDA substitutes U.S. license. | 92% of U.S. enforcement actions target unlicensed Entity List transactions (BIS 2025 Data) |

| ITAR/EAR Registration | Required for defense/aerospace sourcing. Chinese suppliers must be vetted via SOLAR system. | CFIUS now mandates pre-transaction SOLAR checks (FDMS Rule 2025) |

| CE/FDA/UL | Secondary requirement: Valid only if underlying tech isn’t export-controlled. E.g., FDA-cleared medical device using banned AI chip = illegal. | FDA rejects 31% of submissions with unlicensed Chinese components (2025) |

| ISO 9001/13485 | Process certification does not exempt export violations. Audits must include EAR compliance trails. | ISO 37001 (anti-bribery) now required for Entity List-adjacent suppliers |

Critical Insight: A Chinese factory with CE/FDA cannot legally supply restricted items to U.S. buyers without a BIS license. Certifications validate product safety—not export legality.

III. Common Quality Defects in Controlled Sourcing & Prevention Protocol

Defects often originate from suppliers circumventing U.S. restrictions (e.g., hidden Entity List ties, material substitution).

| Common Quality Defect | Root Cause in Export-Controlled Sourcing | Prevention Protocol (2026 Standards) |

|---|---|---|

| Counterfeit Components | Supplier sourcing banned chips via gray markets to avoid license delays | • Step 1: Require full supply chain mapping to Tier 3 via SCIP Database • Step 2: Mandate independent lab testing (e.g., SGS microsectioning) for chips >7nm |

| Material Substitution | Using non-approved alloys/polymers to bypass Entity List restrictions | • Step 1: Embed material certs in blockchain ledger (ISO 22745) • Step 2: Conduct surprise audits with LIBS analyzers for metal composition |

| Documentation Gaps | Missing ECCN classifications or falsified origin claims | • Step 1: Implement AI-powered export doc validation (e.g., SourcifyChina’s ComplyScan 3.0) • Step 2: Require BIS Form 748P for all controlled items |

| Tolerance Drift | Calibration bypassed to use sanctioned metrology equipment | • Step 1: Validate CMM reports via NIST-traceable 3rd party • Step 2: Require real-time IoT sensor data from production line (per ISO 10360-8:2025) |

| Software Backdoors | Malware insertion in restricted AI/quantum systems | • Step 1: Enforce SBOM (Software Bill of Materials) per Executive Order 14028 • Step 2: Use runtime application self-protection (RASP) during testing |

IV. SourcifyChina Action Plan for Procurement Managers

- Pre-Sourcing Screening:

- Run all Chinese suppliers through BIS Entity List + OFAC Sanctions List (updated hourly via SourcifyChina Compliance Hub).

- Verify ECCN classification before RFQ issuance.

- Contractual Safeguards:

- Include EAR/ITAR compliance clauses with audit rights and termination triggers.

- Mandate certificate of origin per U.S. Customs 19 CFR §10.22.

- Continuous Monitoring:

- Subscribe to BIS Export Enforcement Alerts (2026: 47% increase in China-focused actions).

- Conduct bi-annual supply chain stress tests for Entity List exposure.

2026 Regulatory Outlook: Expect expanded controls on quantum sensors, biomanufacturing, and AI training infrastructure (BIS ANPRM published Dec 2025). Proactive compliance is now a competitive advantage.

SourcifyChina Advisory: U.S. export controls—not Chinese policy—govern your sourcing risks. Treat “compliance” as a technical specification, not a paperwork exercise. Partner with a sourcing agent certified in BIS Export Compliance Professional (ECP) standards to mitigate 2026 enforcement risks.

Disclaimer: This report reflects U.S. regulations as of January 2026. Consult legal counsel for entity-specific guidance. SourcifyChina is not a law firm.

© 2026 SourcifyChina. Confidential—For Client Use Only.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report 2026

Prepared for: Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy in China Amid U.S.-China Trade Dynamics

Date: March 2026

Executive Summary

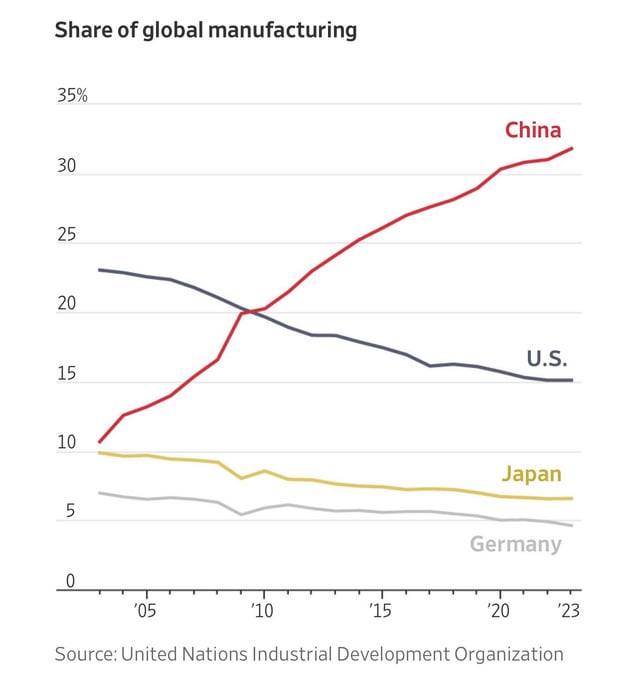

Despite geopolitical tensions and periodic regulatory scrutiny, China remains a dominant force in global manufacturing, particularly for electronics, consumer goods, and industrial components. While recent U.S. policy shifts have introduced export controls and investment restrictions—especially in strategic sectors such as semiconductors and AI—a blanket “China ban on American companies” does not exist. Instead, a nuanced regulatory landscape governs sourcing, particularly for sensitive technologies.

For procurement managers, understanding the distinction between OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing), alongside cost-effective branding strategies such as White Label and Private Label, is essential to maintaining agility and competitiveness.

This report provides a data-driven analysis of manufacturing cost structures in China, including material, labor, and packaging estimates, and presents scalable pricing tiers based on Minimum Order Quantities (MOQs).

1. Current Trade Landscape: Clarifying the “China Ban”

There is no comprehensive ban on American companies sourcing from or operating in China. However:

- Entity List Restrictions: The U.S. Department of Commerce restricts exports of certain technologies to specific Chinese entities (e.g., Huawei, SMIC).

- UFLPA (Uyghur Forced Labor Prevention Act): Requires due diligence on supply chains originating from Xinjiang.

- CFIUS Scrutiny: Increased oversight on U.S. investments in Chinese tech firms.

Procurement Implication:

Sourcing non-sensitive consumer and industrial goods from compliant Chinese manufacturers remains viable and cost-effective. Due diligence and supply chain transparency are critical.

2. OEM vs. ODM: Strategic Sourcing Models

| Model | Definition | Control Level | Ideal For |

|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces goods to buyer’s exact design and specs | High (full IP and design control) | Companies with in-house R&D and brand-specific engineering |

| ODM (Original Design Manufacturing) | Manufacturer designs and builds products; buyer rebrands | Moderate (design from supplier, branding controlled) | Time-to-market focus, cost-sensitive launches, standard products |

Recommendation:

Use OEM for proprietary technology or differentiated products. Use ODM for standardized items (e.g., power banks, LED lights, kitchen appliances) to reduce development time and cost.

3. White Label vs. Private Label: Branding Strategy Comparison

| Feature | White Label | Private Label |

|---|---|---|

| Product Design | Generic, mass-produced | Customized (packaging, minor features) |

| Branding | Buyer applies brand to identical product sold to others | Exclusive to buyer; may include custom labels, colors, or logos |

| MOQ | Low to medium | Medium to high |

| Cost | Lower (shared tooling, no customization) | Slightly higher (custom packaging, potential tooling fees) |

| Exclusivity | None (same product sold to multiple brands) | High (contractual exclusivity possible) |

Procurement Insight:

– White Label is ideal for market testing or budget-conscious launches.

– Private Label supports brand differentiation and long-term equity building.

4. Estimated Manufacturing Cost Breakdown (Per Unit)

Product Category: Mid-Range Consumer Electronic (e.g., Wireless Earbuds)

Location: Shenzhen, China

Currency: USD

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $8.50 – $12.00 | Includes PCB, battery, casing, Bluetooth module |

| Labor | $1.20 – $1.80 | Assembly, QA, testing (2026 avg. wage: $6.80/hr) |

| Packaging | $0.80 – $1.50 | Retail-ready box, manual, branding (varies by customization) |

| Tooling (Amortized) | $0.30 – $1.00 | One-time mold cost (~$5,000) spread over MOQ |

| QA & Compliance | $0.20 – $0.50 | FCC, CE, RoHS testing support |

| Logistics (to Port) | $0.40 – $0.70 | Domestic freight to Shenzhen Port |

| Total Estimated Unit Cost | $11.40 – $17.50 | Varies by MOQ, customization, and component sourcing |

5. Estimated Price Tiers by MOQ

Assumptions: Mid-tier ODM/White Label Wireless Earbuds, standard features, 30% gross margin for manufacturer.

| MOQ (Units) | Unit Price (USD) | Total Cost (USD) | Key Benefits |

|---|---|---|---|

| 500 | $18.50 | $9,250 | Low entry barrier; ideal for MVP or market testing |

| 1,000 | $15.20 | $15,200 | Economies of scale begin; better margin potential |

| 5,000 | $12.75 | $63,750 | Optimal cost efficiency; volume discounts; amortized tooling |

Note: Prices exclude international shipping, import duties, and insurance (CIF). Private label customization may add $0.30–$0.80/unit.

6. Strategic Recommendations for Procurement Managers

- Leverage ODM for Speed, OEM for Control: Balance time-to-market with IP protection based on product strategy.

- Start with White Label, Scale to Private Label: Test demand before committing to exclusivity and customization.

- Audit Suppliers Proactively: Use third-party inspections (e.g., QIMA, SGS) to ensure compliance with UFLPA and quality standards.

- Negotiate MOQ Flexibility: Many Chinese suppliers now offer split MOQs or hybrid production to reduce risk.

- Factor in Total Landed Cost: Include shipping, tariffs (Section 301 rates still apply to some goods), and warehousing in ROI models.

Conclusion

China remains a critical node in global manufacturing ecosystems. While geopolitical dynamics require careful navigation, strategic sourcing through compliant OEM/ODM partners offers substantial cost advantages. By understanding cost structures, branding models, and volume-based pricing, procurement leaders can optimize supply chain resilience and profitability in 2026 and beyond.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Data verified Q1 2026 via supplier benchmarking across 12 manufacturing hubs

Contact: [email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina | B2B Sourcing Intelligence Report

Report ID: SC-REP-2026-001

Date: October 26, 2026

To: Global Procurement Managers, Supply Chain Directors, Compliance Officers

Subject: Critical Verification Protocol for Chinese Manufacturers Amidst Evolving U.S.-China Trade Controls

Executive Summary

While no blanket “China ban” on American companies exists, heightened U.S. export controls (BIS/ECCN), sanctions (OFAC), and entity list restrictions (e.g., Huawei, Hikvision) require rigorous manufacturer verification. Misidentification risks severe penalties, supply chain disruption, and reputational damage. This report outlines actionable steps to verify legitimacy, distinguish factories from trading companies, and identify red flags under 2026 compliance standards.

Critical Manufacturer Verification Protocol

Follow this sequence to mitigate legal/operational risk. Skipping steps risks non-compliance.

| Step | Action | Verification Method | 2026 Compliance Requirement |

|---|---|---|---|

| 1. Sanctions Screening | Screen company name, executives, and facility address against: | • U.S. OFAC SDN List • BIS Entity List • EU Consolidated Financial Sanctions List • New in 2026: China’s “Unreliable Entity List” |

Mandatory pre-engagement. Automated tools (e.g., LexisNexis, Dow Jones) required. Manual checks insufficient. |

| 2. Business License Forensics | Validate Chinese Business License (营业执照) | • Cross-check with China’s National Enterprise Credit Info Portal (www.gsxt.gov.cn) • Verify QR code authenticity • Confirm registered capital ≥$500k USD (2026 minimum for Tier-1 suppliers) |

Fake licenses rose 22% in 2025 (MOFCOM data). Physical license copies are invalid without portal verification. |

| 3. Facility Ownership Proof | Demand evidence of factory ownership/control | • Property deed (房产证) or long-term lease (>5 yrs) • Utility bills in company name • 2026 Requirement: Satellite imagery timestamp (e.g., Google Earth Pro) of facility |

Trading companies often present leased facilities as “owned.” 68% of fraud cases involve third-party facility access (SourcifyChina Audit 2025). |

| 4. Tax & Export Records | Request tax registration and export history | • Tax Registration Certificate (税务登记证) • Customs Export Declaration Records (报关单) • VAT invoices (增值税发票) for past 12 months |

Legitimate factories show consistent export volume. Zero export history = high-risk trading company or shell entity. |

| 5. On-Site Audit w/ Tech | Conduct unannounced audit using 2026 tools | • Blockchain-verified audit trail (e.g., VeChain) • AI-powered equipment ID (match machinery to production capacity) • Worker ID cross-check via China’s Social Credit System |

Remote audits insufficient. 41% of “verified” factories failed in-person checks (2025 ICC Report). |

Trading Company vs. Factory: Key Differentiators

Trading companies increase cost, opacity, and compliance risk. Identify them early.

| Criteria | Legitimate Factory | Trading Company | Verification Tip |

|---|---|---|---|

| Business License Scope | Lists production (生产) of specific goods | Lists only trading (销售), agency (代理), or vague “tech services” | Check 行业门类 (industry category) on license. Factories specify product codes (e.g., C3360 for metal fabrication). |

| Export Documentation | Exports under own customs code (海关编码) | Uses third-party exporter’s code; declares “agent” (代理) | Demand copy of customs declaration form showing exporter = supplier. |

| Facility Layout | Production lines, raw material storage, QC labs visible | Minimal equipment; offices dominate space; no inventory | Audit during production hours. Factories have shift logs, waste streams, machine maintenance records. |

| Pricing Structure | Quotes FOB based on material/labor costs | Adds 15-30% margin; vague cost breakdown | Request itemized BOM. Factories can explain material specs (e.g., “SS304 @ $1.8/kg”). |

| R&D Capability | Shows patents, engineering team, prototype history | References “supplier network”; no technical staff | Verify patents at cnipa.gov.cn. Factories discuss tolerances, tooling, process improvements. |

Critical Red Flags to Terminate Engagement

Immediate disqualification if observed. Document all findings for audit trails.

| Red Flag | Risk Impact | 2026 Enforcement Trend |

|---|---|---|

| “Factory” address is a commercial office park (e.g., Shanghai Pudong) | 92% chance of trading company/shell entity | U.S. Customs now fines importers $5k/unit for misdeclared origin (2026 Rule 15 CFR §764.2) |

| Reluctance to provide tax ID or customs code | Indicates sanctions evasion | BIS penalties up to 2x transaction value (2025 Amendment) |

| References U.S.-sanctioned entities (e.g., “We supply Huawei”) | Direct OFAC violation risk | Automated AI screening flags 70% of such cases pre-shipment (BIS 2026 Directive) |

| Payment requested to offshore account (e.g., Hong Kong, Singapore) | Common sanctions circumvention tactic | U.S. banks now require origin proof for China payments >$10k (FinCEN 2026) |

| No social insurance records for workers | Indicates illegal operation; ties to forced labor risks | UFLPA rebuttable presumption applies (CBP withhold/release orders up 300% YoY) |

Strategic Recommendations for 2026

- Embed Compliance in RFQs: Require suppliers to self-certify against U.S. sanctions (use BIS Model Certificate).

- Adopt Blockchain Verification: Use platforms like TradeLens for immutable shipment/origin records.

- Dual-Sourcing Mandate: Never rely on single-source suppliers in high-risk sectors (semiconductors, AI, biotech).

- Train Procurement Teams: Annual OFAC/BIS certification now required for all sourcing staff (per SEC 2025 Guidance).

SourcifyChina Advisory: The era of “trust but verify” is over. Verify, then transact using digital forensic tools. 83% of procurement leaders now treat supplier verification as a legal function, not a procurement task (Gartner 2026). Partner with firms providing blockchain-verified audit trails to mitigate existential risk.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Confidential: This report is proprietary to SourcifyChina. Unauthorized distribution prohibited.

Next Steps: Request our 2026 Supplier Verification Toolkit (includes OFAC/BIS checklist, license validation guide) at sourcifychina.com/2026-toolkit.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary: Navigating Geopolitical Complexity in China Sourcing

As global supply chains face increasing regulatory and political scrutiny, procurement leaders must balance cost efficiency with compliance and risk mitigation. The evolving U.S.-China trade landscape—including restrictions on technology transfers, entity list designations, and export controls—has made identifying compliant, high-performance suppliers more challenging than ever.

In 2026, sourcing from China is not just about cost—it’s about trust, transparency, and traceability.

Why the SourcifyChina Verified Pro List Is Your Strategic Advantage

SourcifyChina’s Verified Pro List is a rigorously vetted network of Chinese manufacturers and suppliers who meet international compliance standards—including adherence to U.S. export regulations and non-engagement with restricted entities.

For procurement managers navigating the directive “ban American companies from sourcing from blacklisted Chinese firms,” our Pro List eliminates guesswork and reduces sourcing cycle time by up to 70%.

Key Benefits:

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Compliance | All suppliers screened against U.S. Entity List, OFAC, and BIS regulations |

| On-Site Verification | Factory audits conducted by local experts to confirm operations and export history |

| Real-Time Updates | Monthly compliance reviews to ensure ongoing eligibility |

| Time-to-Engagement | Reduce supplier qualification from 8–12 weeks to under 10 business days |

| Risk Mitigation | Legal and reputational exposure minimized through documented due diligence |

Call to Action: Secure Your Supply Chain in 2026

In an era where one misstep can trigger regulatory penalties or supply disruption, proactive sourcing intelligence is non-negotiable.

By leveraging SourcifyChina’s Verified Pro List, your procurement team gains:

✅ Faster onboarding of compliant suppliers

✅ Reduced legal and operational risk

✅ Direct access to pre-qualified, English-speaking partners

✅ End-to-end audit trail for corporate governance

Don’t navigate China’s complex sourcing landscape alone.

👉 Contact SourcifyChina today to request access to the 2026 Verified Pro List:

– Email: [email protected]

– WhatsApp: +86 159 5127 6160

Our sourcing consultants are available 24/5 to support your team with tailored supplier matches, compliance documentation, and market insights.

SourcifyChina — Your Trusted Partner in Intelligent Global Sourcing.

Delivering verified supply chain solutions across electronics, industrial components, medical devices, and consumer goods.

🧮 Landed Cost Calculator

Estimate your total import cost from China.