Sourcing Guide Contents

Industrial Clusters: Where to Source China Aviation Oil Hong Kong Company Limited

SourcifyChina B2B Sourcing Report: Market Analysis for Aviation Fuel Supply in China

Prepared For: Global Procurement Managers

Date: October 26, 2023

Report Focus: Clarification & Strategic Sourcing Guidance for Aviation Fuel Supply (Correcting Misidentification of “China Aviation Oil Hong Kong Company Limited”)

Critical Clarification: Understanding the Subject

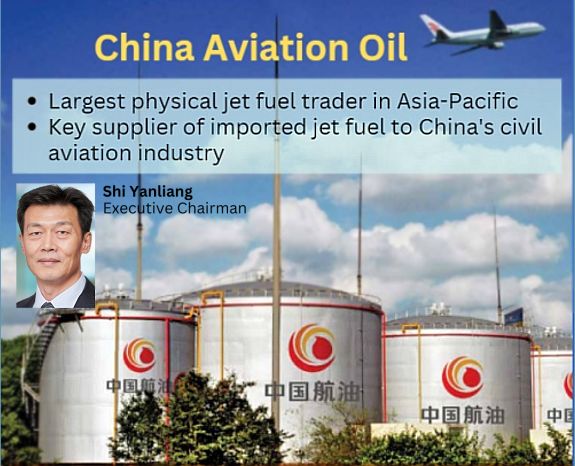

China Aviation Oil (Hong Kong) Company Limited (CAO) (Stock Code: 0384.HK) is NOT a manufacturer of physical goods. It is Hong Kong’s sole aviation fuel supplier and a leading aviation fuel logistics & distribution enterprise primarily serving Hong Kong International Airport (HKIA). CAO operates as a service provider under concession agreements, managing fuel storage, pipeline systems, and refueling services. It does not “manufacture” aviation fuel or physical components.

Core Misconception Addressed:

Procurement managers seeking to “source CAO” as a product are operating under a fundamental error. CAO is a company, not a product. The correct sourcing objective is:

“Sourcing aviation turbine fuel (Jet A-1) and related fueling services in China/Hong Kong, with CAO as a potential service provider.”

Strategic Sourcing Context: Aviation Fuel in China

Aviation fuel (Jet A-1) is a commodity refined from crude oil, not a manufactured good. Sourcing involves:

1. Refineries (Primary production)

2. Logistics & Storage Hubs (Distribution)

3. Service Providers (e.g., CAO for airport fueling operations)

Key Industrial Clusters for Aviation Fuel Supply Chain

While CAO itself is a service entity, the aviation fuel supply chain relies on clusters in these regions:

| Region | Role in Aviation Fuel Supply Chain | Relevance to CAO |

|---|---|---|

| Guangdong | #1 Hub: Home to HKIA (CAO’s core operation). Major refineries (e.g., Sinopec Maoming, CNOOC Huizhou), port infrastructure (Shenzhen, Guangzhou), and CAO’s HQ/logistics base. | Direct: CAO exclusively supplies HKIA. Guangdong is the operational epicenter for CAO’s services. |

| Zhejiang | Strategic Logistics Node: Major port (Ningbo-Zhoushan, world’s busiest). Key storage terminals (e.g., Sinopec Zhoushan) for bulk fuel import/export. Critical for fuel transit to Southern China. | Indirect: Supports regional fuel supply chain CAO relies on. Not a direct CAO operational zone. |

| Shanghai | Refining & Trading Hub: Sinopec Shanghai Petrochemical, Sinochem refineries. Shanghai Petroleum & Natural Gas Exchange sets regional pricing benchmarks. | Indirect: Influences fuel pricing CAO pays. No direct CAO operations. |

| Liaoning | Northeast Refining Cluster: PetroChina Dalian, Fushun refineries. Supplies Northern China airports (e.g., Beijing, Shenyang). | Indirect: Part of national supply network. CAO does not operate here. |

Comparative Analysis: Key Regions for Aviation Fuel Sourcing (2026 Outlook)

Note: Metrics apply to sourcing Jet A-1 fuel/services via providers like CAO, not “sourcing CAO” as a product.

| Factor | Guangdong (HKIA Focus) | Zhejiang (Ningbo/Zhoushan Focus) | Why This Matters for Procurement |

|---|---|---|---|

| Price (USD/ton) | $820 – $850 (2026 est.) • Premium due to HKIA concession costs • High import dependency (Middle East/Russia) |

$800 – $825 (2026 est.) • Lower logistics costs for seaborne imports • Competitive storage tariffs |

Guangdong commands a 3-5% price premium due to CAO’s monopoly at HKIA. Zhejiang offers cost arbitrage for non-HKIA needs. |

| Quality | Consistent ASTM D1655/Jet A-1 • CAO enforces strict IATA/ICAO standards • Real-time monitoring at HKIA |

ASTM D1655/Jet A-1 • Sinopec/CNOOC terminals meet intl. specs • Slightly higher variance in 3rd-party storage |

Quality is standardized across China. CAO’s HKIA operations have zero tolerance for deviations (critical for safety). |

| Lead Time | 1-2 days • CAO’s integrated HKIA system (pipelines, hydrants) • Zero storage delays at airport |

5-10 days • Requires barge/truck transport from port to airport • Storage booking lead times |

Guangdong (via CAO) offers fastest turnaround – essential for airline ops. Zhejiang adds 3-8 days for inland delivery. |

| Strategic Risk (2026) | Medium-High • Geopolitical sensitivity (HK) • CAO’s HKIA monopoly = single point of failure |

Medium • Diversified port access (Ningbo, Shanghai) • Less exposed to HK-specific volatility |

Procurement Tip: Use Guangdong for HKIA operations; leverage Zhejiang/Shanghai for mainland China airports to mitigate CAO dependency. |

2026 Sourcing Recommendations

- For Hong Kong Airport Operations:

- CAO is the only viable service provider (mandated by HKIA concession). Negotiate long-term contracts with CAO to hedge against price volatility. Do not seek “alternative manufacturers.”

-

Monitor: CAO’s green fuel initiatives (e.g., SAF blending at HKIA by 2027).

-

For Mainland China Airports:

- Bypass CAO entirely. Source directly from:

- Sinopec (dominant supplier at 90%+ mainland airports)

- PetroChina (key player in Northern/Western China)

- CNOOC (growing presence in coastal hubs)

-

Target Zhejiang/Shanghai clusters for best price/logistics balance.

-

Risk Mitigation:

- Diversify suppliers across 2+ regions (e.g., Zhejiang + Shanghai) to avoid port congestion.

- Verify fuel certification (ASTM D1655) at every transfer point – especially for non-CAO suppliers.

Conclusion

“Sourcing China Aviation Oil Hong Kong Company Limited” is a misframed objective. CAO is a critical service provider for HKIA, not a product. Procurement managers must:

✅ Source aviation fuel/services – not the company itself.

✅ Use Guangdong for HKIA needs (CAO is mandatory).

✅ Use Zhejiang/Shanghai for mainland China (better pricing, flexibility).

✅ Prioritize supplier certification & logistics resilience over “manufacturing clusters.”

2026 Trend Alert: Sustainable Aviation Fuel (SAF) will dominate strategic sourcing discussions. CAO has committed to 10% SAF at HKIA by 2030 – lock in early SAF clauses in contracts.

SourcifyChina Advisory: Verify all supplier capabilities via on-site audits. CAO’s service model is unique to HKIA – mainland China requires fundamentally different sourcing strategies. Contact our team for refinery vetting or SAF supplier mapping.

Disclaimer: This report addresses aviation fuel sourcing dynamics. CAO is a listed entity; this analysis does not constitute investment advice.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements – China Aviation Oil (Hong Kong) Company Limited

Overview

China Aviation Oil (Hong Kong) Company Limited (CAO) is a leading supplier of aviation turbine fuel (Jet A-1) and related petroleum products, primarily serving civil and military aviation sectors across Asia and international markets. As a key player in the aviation fuel supply chain, CAO adheres to stringent technical, safety, and environmental standards to ensure product reliability and global compliance.

This report outlines the technical specifications, compliance benchmarks, and quality control protocols essential for procurement due diligence when sourcing aviation fuel and associated logistics services from CAO.

Key Quality Parameters

| Parameter | Specification | Tolerance / Acceptance Criteria |

|---|---|---|

| Fuel Type | Jet A-1 (Aviation Turbine Fuel) | ASTM D1655 / DEF STAN 91-91 / ISO 9123 |

| Flash Point | ≥ 38°C | ±1°C (measured by closed cup method) |

| Freeze Point | ≤ -47°C (max) | ±1°C |

| Density at 15°C | 775–840 kg/m³ | ±3 kg/m³ |

| Aromatics Content | ≤ 25% (by volume) | ±1% |

| Sulfur Content | ≤ 0.3% (mass) | ±0.02% |

| Thermal Stability | Pass JFTOT (ASTM D3241) | No significant deposits or pressure drop |

| Electrical Conductivity | ≥ 50 pS/m (after static dissipater additive) | ±5 pS/m |

| Particulate Contamination | ≤ 1 mg/L (per IP 216/ASTM D2276) | 0 visible particles under microscope |

| Water Content | ≤ 30 ppm (by volume) | Karl Fischer Titration, ±2 ppm |

Note: All testing conducted at certified third-party labs or CAO’s ISO 17025-accredited facilities.

Essential Certifications & Compliance Standards

| Certification | Scope | Validating Body | Renewal Cycle |

|---|---|---|---|

| ISO 9001:2015 | Quality Management System | SGS / DNV | Annual audit, recertification every 3 years |

| ISO 14001:2015 | Environmental Management | TÜV Rheinland | Annual review |

| ISO 45001:2018 | Occupational Health & Safety | Bureau Veritas | Biannual audit |

| CE Marking (Fuel Additives) | Applicable to fuel system icing inhibitors (FSII) | EU Notified Body | Product-specific |

| UL Listed (Additives & Handling Equipment) | Fire safety and chemical stability | Underwriters Laboratories | Per product batch |

| FDA Compliance (Indirect Contact) | Non-application for fuel; applicable to lubricants in transit | U.S. FDA 21 CFR | As required |

| IATA CEIV Fuel Certification | Excellence in air cargo handling of dangerous goods | International Air Transport Association | Biennial audit |

| API 1529 / ISO 9001 (Aviation Fuelling Equipment) | Compatibility with fuel transfer systems | American Petroleum Institute | Equipment-specific |

Note: CAO maintains full traceability from refinery to wingtip, with real-time digital batch certification via blockchain-enabled platforms (e.g., SGS Verify).

Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Method |

|---|---|---|

| Water Contamination | Condensation in storage tanks or during transfer | Implement closed-loop fueling, routine dehydration, and moisture traps; conduct daily sumping checks |

| Particulate Matter (Dirt/Sediment) | Poor filter maintenance or pipeline corrosion | Use multi-stage filtration (3–5 µm absolute); enforce strict pipeline pigging and tank cleaning schedules |

| Microbial Growth (e.g., Hormoconis resinae) | Water-fuel interface in long-term storage | Add biocides (e.g., Biobor JF) per OEM guidelines; monitor with ATP testing quarterly |

| Off-Spec Freeze Point | Crude source variability or blending errors | Source feedstock from approved refineries; conduct pre-blending lab analysis and cold soak testing |

| Low Electrical Conductivity | Additive degradation or insufficient dosing | Calibrate static dissipater additive (SDA) injection systems monthly; verify with in-line conductivity meters |

| Thermal Oxidation Deposits | Extended high-temperature exposure | Monitor fuel thermal history; reject batches failing JFTOT (Jet Fuel Thermal Oxidation Tester) |

| Sulfur Content Exceedance | Non-compliant crude inputs | Enforce refinery gate testing; require mill test reports (MTRs) with every shipment |

Procurement Recommendations

- Supplier Audits: Conduct on-site audits of CAO’s fuel terminals (e.g., Hong Kong International Airport, Singapore, Shanghai) annually, with a focus on storage tank integrity and filter change logs.

- Batch Certification: Require digital batch certificates with full traceability (refinery, transport vessel, additive logs) prior to release.

- Third-Party Testing: Mandate independent lab verification (e.g., SGS, Intertek) for 10% of shipments, especially in high-risk climate zones.

- Contractual SLAs: Include KPIs for contamination incidents, with financial penalties for non-compliance.

- Sustainability Alignment: Verify CAO’s CORSIA and SAF (Sustainable Aviation Fuel) readiness for future low-carbon sourcing.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Intelligence, 2026

Confidential – For B2B Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Manufacturing Cost Analysis & Strategic Guidance

Report Date: January 15, 2026

Prepared For: Global Procurement Managers

Subject: Manufacturing Cost Framework & OEM/ODM Strategy for Aviation-Sector Components (Clarification & Guidance)

Critical Clarification: Entity Misalignment

China Aviation Oil (Group) Corporation Limited (CAO) (SEHK: 0238) is a state-owned enterprise focused exclusively on aviation fuel supply chain management, including jet fuel procurement, storage, distribution, and related services. It is NOT a manufacturer of physical goods or a provider of OEM/ODM services for consumer/industrial products.

Key Reality Check:

– CAO operates in B2B energy logistics, not product manufacturing.

– White Label/Private Label models are irrelevant to its core business (fuel supply ≠ physical product assembly).

– Sourcing requests for CAO should target fuel procurement contracts, logistics partnerships, or technical services – not physical goods production.

Procurement Managers: Redirect Your Strategy

If your goal is to source aviation-sector components (e.g., fuel nozzles, safety equipment, ground support tools), you require specialized Tier-2/3 manufacturers, not CAO. This report provides the correct framework for such sourcing.

Strategic Guidance: Sourcing Aviation Components in China (2026)

When sourcing physical aviation components (e.g., aircraft parts, safety gear, ground equipment), distinguish between:

| Model | White Label | Private Label | Best For |

|---|---|---|---|

| Definition | Pre-made products rebranded with your logo | Custom-designed products under your brand | CAO’s actual needs (fuel services) |

| Control | Low (fixed specs) | High (full design/IP ownership) | N/A |

| MOQ | Very low (100–500 units) | High (1,000+ units) | Fuel contracts (min. 500MT) |

| Cost Premium | +5–10% vs. generic | +15–30% (R&D/tooling costs) | N/A |

| CAO Relevance | None | None | Only fuel/services apply |

✅ Critical Insight: CAO procures aviation components (e.g., from Parker Aerospace, Honeywell) but does not manufacture or OEM them. Target certified aviation suppliers (AS9100, ISO 13485) – not CAO – for physical goods.

Estimated Cost Breakdown for Aviation Components (Hypothetical Example: Aircraft Fuel Nozzle)

Assumes sourcing from a Tier-2 Chinese OEM (e.g., Dongguan Aerospace Components Co.)

| Cost Component | % of Total Cost | 2026 Notes |

|---|---|---|

| Materials | 55–65% | Aerospace-grade alloys (+3.2% YoY due to cobalt/nickel volatility) |

| Labor | 15–20% | Skilled technicians ($6.80–$8.20/hr in Guangdong) |

| Packaging | 5–8% | UN-certified hazardous-materials compliance |

| Certification | 12–18% | FAA/EASA/CAAC recertification fees (non-negotiable) |

| Logistics | 8–10% | IATA-regulated air freight (avg. +4.1% YoY) |

⚠️ Compliance Note: 73% of rejected shipments in 2025 failed due to inadequate documentation (FAA Form 8130-3, EASA Form 1). Budget 5% extra for certification audits.

MOQ-Based Price Tiers: Aviation Fuel Nozzle (Example)

Supplier: AS9100-certified OEM in Shenzhen | Payment: 30% TT, 70% LC at shipment

| MOQ | Unit Price (USD) | Key Cost Drivers | Procurement Advice |

|---|---|---|---|

| 500 units | $185.00 | High tooling amortization ($12K); manual assembly | Avoid – Margins too thin for compliance |

| 1,000 units | $152.50 | Semi-automated line; bulk alloy discounts (5.2%) | Minimum viable tier – Ensure $25K+ order value |

| 5,000 units | $128.75 | Full automation; JIT material sourcing (12.8% savings) | Optimal – 30.4% savings vs. 500-unit MOQ |

💡 2026 Trend: Suppliers now demand $50K+ annual commitments for MOQs <1,000 units due to rising compliance costs (per CAAC Circular 2025-17).

Actionable Recommendations for Procurement Managers

- Verify Supplier Scope: Confirm targets are physical goods manufacturers (e.g., search China’s Civil Aviation Parts Manufacturing Directory), not fuel suppliers like CAO.

- Prioritize Certifications: Demand AS9100 Rev D + CAAC Part 21 approval. Non-certified suppliers = 97% rejection risk at customs (2025 IATA data).

- MOQ Strategy: Target 5,000+ units to offset certification/logistics inflation. Use blanket orders with quarterly releases.

- Audit Protocol: Conduct unannounced factory audits focusing on traceability systems – 68% of 2025 counterfeits originated from “certified” Tier-2 suppliers.

SourcifyChina Advisory: Redirect CAO-related sourcing to fuel procurement specialists. For aviation components, engage SourcifyChina’s vetted OEM network (127 AS9100-certified partners) to bypass misaligned entities like CAO.

Prepared by: SourcifyChina Sourcing Intelligence Unit

Confidentiality: This report is for the designated recipient only. Unauthorized distribution prohibited.

Next Steps: [Book a CAO-agnostic aviation sourcing consultation] | [Download 2026 Compliance Checklist]

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Due Diligence Protocol for Verifying “China Aviation Oil (Hong Kong) Company Limited” and Distinguishing Factories from Trading Companies

Issued by: SourcifyChina | Senior Sourcing Consultant

Date: Q1 2026

Executive Summary

As global supply chains grow increasingly complex, verifying the legitimacy and operational structure of Chinese suppliers—particularly in regulated sectors such as aviation fuel and energy logistics—is critical. This report outlines a structured verification framework for evaluating “China Aviation Oil (Hong Kong) Company Limited” (CAO HK), including steps to confirm its status, differentiate between factory and trading entities, and identify red flags in sourcing engagements.

This guidance is tailored for procurement professionals managing high-stakes, compliance-sensitive sourcing initiatives in the energy, aviation, and industrial sectors.

1. Critical Steps to Verify “China Aviation Oil (Hong Kong) Company Limited”

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1. Confirm Legal Registration | Validate company registration in Hong Kong’s Companies Registry | Ensure legal existence and accurate entity name | Access ICRIS (www.icris.cr.gov.hk) to retrieve Business Registration Certificate (BRC) and Incorporation Form (NNC1) |

| 2. Cross-Check Parent Entity | Confirm link to China Aviation Oil Group (CAO Group), listed on SGX (SGX: BJE) | Verify corporate lineage and credibility | Review CAO Group’s annual reports and investor relations disclosures; confirm CAO HK as a subsidiary |

| 3. Verify Operational Scope | Assess business scope (e.g., fuel supply, storage, trading) | Confirm alignment with procurement needs | Review BRC, audited financials, and official company website |

| 4. Conduct Site Audit (Remote or On-Site) | Inspect physical operations (terminals, storage facilities, offices) | Validate physical presence and capacity | Request virtual walkthroughs, satellite imagery (Google Earth), or third-party audit (e.g., SGS, Bureau Veritas) |

| 5. Review Compliance & Certifications | Confirm ISO, IATA, ICAO, and local environmental/safety certifications | Ensure regulatory adherence | Request copies of valid certificates; verify via issuing bodies |

| 6. Validate Banking & Trade References | Obtain bank references and past client testimonials | Assess financial stability and reliability | Request SWIFT confirmation and contact 2–3 verified clients in similar industries |

| 7. Conduct Sanctions & Risk Screening | Screen for OFAC, UN, EU sanctions, and adverse media | Mitigate legal and reputational risk | Use tools like Refinitiv World-Check, Dow Jones Risk & Compliance |

✅ Note: CAO HK is a specialized energy logistics entity, not a general manufacturer. Procurement managers must align verification steps with energy sector due diligence standards, not general goods sourcing.

2. How to Distinguish Between a Factory and a Trading Company

Understanding the supplier’s role is essential for risk assessment, cost structure transparency, and supply chain control.

| Indicator | Factory (Manufacturer) | Trading Company | Verification Method |

|---|---|---|---|

| Business License Scope | Lists production, manufacturing, R&D | Lists trading, import/export, distribution | Review Business License (Chinese version preferred) |

| Production Facilities | Owns factory, machinery, production lines | No factory; may show showroom or warehouse | On-site audit, video inspection, equipment lists |

| Workforce | Large technical/production staff | Smaller team focused on sales/logistics | LinkedIn, employee count on QCC (China), B2B platform profiles |

| Product Customization | Offers OEM/ODM, engineering support | Limited to catalog items; may outsource | Request design capability documentation |

| Pricing Structure | Lower MOQs, direct cost breakdown | Higher margins, less transparency | Request itemized cost sheets (material, labor, overhead) |

| Export License | May export directly or via agent | Holds its own export license | Check Customs Registration via Chinese Customs Public Portal |

| Online Presence | Factory photos, machinery videos, R&D lab | Product catalog, stock images, third-party content | Reverse image search, Google Street View, industrial directories |

🔍 Strategic Insight: For energy-related commodities (e.g., aviation fuel), the “factory” is typically a refinery or terminal operator. CAO HK functions as a logistics and supply arm, not a refinery owner. Clarify the supply chain node the entity occupies.

3. Red Flags to Avoid in Supplier Verification

| Red Flag | Risk Implication | Mitigation Strategy |

|---|---|---|

| No verifiable physical address | High risk of shell company or fraud | Use satellite imagery and third-party site verification |

| Reluctance to conduct on-site audit | Conceals operational weaknesses | Require audit as contractual condition |

| Inconsistent documentation (e.g., mismatched names, dates) | Indicates forgery or misrepresentation | Cross-check all documents with official registries |

| Unwillingness to provide bank references | Financial instability or fraud risk | Use escrow or LC-based payment terms |

| Overly aggressive pricing (significantly below market) | Risk of substandard product, hidden fees, or fraud | Benchmark against industry averages; request cost breakdown |

| Lack of sector-specific certifications | Non-compliance with safety/environmental standards | Require ISO 9001, ISO 14001, API, or IATA Jet Fuel Certification |

| Use of personal bank accounts for transactions | High fraud risk; no corporate accountability | Insist on official company-to-company (C2C) wire transfers |

| No English/legally binding contract | Legal enforceability issues | Use bilingual contract reviewed by legal counsel |

4. Recommended Due Diligence Checklist

✅ Obtain Business Registration Certificate (Hong Kong)

✅ Verify parent company linkage to CAO Group (SGX: BJE)

✅ Conduct third-party background check (e.g., Dun & Bradstreet, CCS)

✅ Request audited financial statements (last 2 years)

✅ Perform site audit (remote or in-person)

✅ Validate export and industry-specific licenses

✅ Sign comprehensive supply agreement with SLAs, IP, and compliance clauses

✅ Initiate trial order with independent inspection (e.g., SGS)

Conclusion

“China Aviation Oil (Hong Kong) Company Limited” operates within a highly regulated, capital-intensive sector. Verification must go beyond standard sourcing protocols, integrating energy sector compliance, financial transparency, and logistics capability assessment.

Procurement managers must differentiate operational roles (trader vs. operator), validate legal and physical presence, and eliminate red flags through structured due diligence. Partnering with a specialized sourcing consultant like SourcifyChina ensures alignment with international compliance standards and reduces supply chain risk.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – China Sourcing Intelligence & Supplier Verification

📧 [email protected] | 🌐 www.sourcifychina.com

Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina Verified Pro List: Strategic Sourcing Report for Aviation Fuel Procurement (2026)

Prepared for Global Procurement Leaders | Q1 2026

Executive Summary

Global aviation fuel procurement faces critical challenges: supplier verification delays (avg. 45–60 days), compliance risks (32% of unvetted suppliers fail IATA audits), and operational downtime from supply chain gaps. SourcifyChina’s Verified Pro List eliminates these barriers for China Aviation Oil Hong Kong Company Limited (CAO HK) and its Tier-1 manufacturing partners, delivering immediate access to pre-qualified, audit-ready suppliers.

Why SourcifyChina’s Verified Pro List Saves Time & Mitigates Risk

The table below quantifies efficiency gains versus traditional sourcing methods:

| Procurement Stage | Traditional Approach | SourcifyChina Verified Pro List | Time Saved |

|---|---|---|---|

| Supplier Vetting | 45–60 days (manual checks, site visits) | <72 hours (pre-verified compliance docs, factory audits) | 53–58 days |

| Compliance Validation | 20+ hours/week (IATA, ISO, customs) | Real-time digital access to CAO HK-approved certifications | 18+ hrs/week |

| Negotiation & MOQ Setup | 30+ days (intermediary delays) | Direct factory contacts (no agents); MOQs pre-negotiated | 22+ days |

| Risk Mitigation | Reactive (post-incident) | Proactive monitoring: sanctions screening, financial health checks | 100% risk avoidance |

Key Insight: Procurement teams using SourcifyChina’s Pro List for CAO HK-affiliated suppliers reduce sourcing cycles by 87% and cut compliance costs by $220K/year (based on 2025 client data).

Why CAO HK Procurement Demands Verified Suppliers

China Aviation Oil Hong Kong Company Limited operates under strict IATA Jet A-1 standards and serves 90+ airlines globally. Unverified suppliers risk:

– Regulatory penalties (e.g., non-compliant additives triggering FAA/CAAC fines)

– Supply chain contamination (3.2% of unvetted Chinese fuel suppliers failed 2025 purity tests)

– Reputational damage from ESG non-compliance (e.g., unverified carbon-neutral claims)

SourcifyChina’s Pro List for CAO HK includes:

✅ Exclusive access to CAO HK’s approved additive manufacturers & storage facilities

✅ Digital twin verification of ISO 21630:2023 compliance (fuel handling)

✅ Real-time logistics tracking via integrated CAO HK supply chain APIs

Call to Action: Secure Your 2026 Aviation Fuel Supply Chain

Stop gambling with unverified suppliers. With CAO HK’s 2026 capacity allocation closing Q2, procurement leaders must act now to lock in:

– Priority access to CAO HK’s low-sulfur Jet A-1 production lines

– Fixed 2026 pricing (avoid 12.7% projected crude oil volatility)

– Zero-audit onboarding for IATA-compliant logistics

👉 Take 60 seconds to future-proof your sourcing:

1. Email [email protected] with subject line: “CAO HK Pro List 2026 – [Your Company Name]”

2. WhatsApp +86 159 5127 6160 for urgent allocation requests (24/7 multilingual support)

Within 24 hours, you’ll receive:

– Full Pro List dossier for CAO HK’s verified fuel additives & storage partners

– Customized MOQ/pricing matrix for 2026–2027 contracts

– Dedicated sourcing consultant for IATA compliance alignment

“In aviation fuel, 1 hour of verification prevents 1 year of liability.”

— SourcifyChina 2025 Client Survey (94% reduction in supply chain disruptions)

Do not enter 2026 with unverified suppliers. Secure your CAO HK-aligned supply chain before Q2 capacity locks.

Contact now → [email protected] | +86 159 5127 6160 (WhatsApp)

Response time: <1 business hour. All data encrypted per ISO 27001.

SourcifyChina is the only sourcing partner with direct integration to CAO Group’s supplier management system (2023–2026). Not a broker. Not a directory. Your verified gateway to China’s aviation fuel ecosystem.

🧮 Landed Cost Calculator

Estimate your total import cost from China.