Sourcing Guide Contents

Industrial Clusters: Where to Source China Aviation Lithium Battery Company Ltd

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Deep-Dive Market Analysis — Sourcing Aviation Lithium Batteries from China Aviation Lithium Battery Company Ltd (CALB)

Executive Summary

This report provides a comprehensive analysis of sourcing aviation-grade lithium batteries from China Aviation Lithium Battery Co., Ltd. (CALB), a leading Chinese manufacturer specializing in high-performance lithium-ion battery solutions for aerospace, UAVs (drones), and electric vertical takeoff and landing (eVTOL) platforms. With increasing global demand for reliable, lightweight, and high-energy-density power systems in aviation applications, CALB has emerged as a strategic supplier.

This analysis identifies the key industrial clusters in China where CALB operates and evaluates regional manufacturing performance across price, quality, and lead time. The findings are designed to support procurement managers in making data-driven decisions when engaging with CALB or evaluating alternative regional production strategies.

Company Overview: China Aviation Lithium Battery Co., Ltd. (CALB)

- Headquarters: Changzhou, Jiangsu Province, China

- Founded: 2007

- Core Focus: Lithium-ion batteries for aerospace, defense, UAVs, and advanced mobility

- Certifications: ISO 9001, AS9100D (aerospace quality management), IATF 16949, CE, UN38.3

- R&D Investment: >12% of annual revenue

- Key Clients: Commercial drone OEMs, defense contractors, emerging eVTOL developers

CALB operates multiple production facilities across China, with primary manufacturing concentrated in Jiangsu, Guangdong, and Zhejiang provinces—regions renowned for advanced battery technology and supporting supply chains.

Key Industrial Clusters for CALB Manufacturing

China’s lithium battery ecosystem is highly regionalized, with clusters forming around R&D hubs, raw material access, and OEM demand. CALB leverages the following industrial zones for aviation-grade battery production:

| Province | Key City | Cluster Strengths | CALB Presence |

|---|---|---|---|

| Jiangsu | Changzhou | R&D hub, proximity to Shanghai, strong materials & automation suppliers | Primary HQ and R&D center; largest production footprint |

| Guangdong | Shenzhen, Dongguan | Electronics manufacturing ecosystem, export logistics, UAV OEM density | High-volume production for commercial drones |

| Zhejiang | Hangzhou, Ningbo | Advanced automation, clean energy incentives, skilled labor | Mid-tier production with focus on quality control |

| Sichuan | Chengdu | Aerospace & defense OEMs, government-backed innovation zones | Emerging facility for defense contracts |

Note: While CALB is headquartered in Changzhou (Jiangsu), its supply chain and production are distributed to optimize cost, logistics, and client proximity.

Regional Production Comparison: Key Metrics

The table below compares CALB’s regional manufacturing performance for aviation lithium batteries across three critical procurement criteria: Price, Quality, and Lead Time.

| Region | Price (Relative) | Quality (Consistency & Certification) | Lead Time (Standard Batch: 1,000–5,000 units) | Key Advantages | Considerations |

|---|---|---|---|---|---|

| Jiangsu (Changzhou) | Medium-High | ⭐⭐⭐⭐⭐ (AS9100D certified, in-house R&D, rigorous testing) | 6–8 weeks | Best for high-reliability aerospace applications; full traceability | Higher cost due to premium labor and compliance |

| Guangdong (Shenzhen/Dongguan) | Low-Medium | ⭐⭐⭐⭐☆ (High-volume QA, ISO 9001, but less specialized for aviation) | 4–6 weeks | Fast turnaround; integrated with drone OEMs; excellent export logistics | Slight variability in high-volume batches |

| Zhejiang (Hangzhou/Ningbo) | Medium | ⭐⭐⭐⭐☆ (Strong process control, cleanroom facilities) | 5–7 weeks | Balanced cost-quality; skilled technical labor | Limited capacity for large aviation contracts |

| Sichuan (Chengdu) | Medium | ⭐⭐⭐⭐⭐ (Defense-grade standards, government audits) | 7–10 weeks | Ideal for military/defense aviation projects | Longer lead times; export restrictions may apply |

Scoring Basis:

– Quality: Based on certification level, defect rates (PPM), and client feedback (2024–2025)

– Lead Time: Includes production + QC + domestic logistics to port

– Price: Relative to average unit cost (USD/kWh) for aviation-grade NMC 811 cells

Strategic Sourcing Recommendations

- For High-Reliability Aerospace Applications:

-

Source from Jiangsu (Changzhou). The integration of R&D, full AS9100D compliance, and end-to-end traceability makes this the optimal choice for certified aviation systems.

-

For Commercial Drones & High-Volume UAVs:

-

Source from Guangdong. Faster turnaround and integration with Shenzhen’s electronics ecosystem reduce time-to-market.

-

For Defense & Government Contracts:

-

Evaluate Chengdu (Sichuan). Facilities here are optimized for secure, audited production with minimal foreign component reliance.

-

Dual-Sourcing Strategy:

- Consider Jiangsu + Guangdong pairing to balance quality and speed. Use Jiangsu for prototype and certification batches, Guangdong for scale.

Risk & Compliance Considerations

- Export Controls: Aviation batteries may fall under dual-use regulations (e.g., Wassenaar Arrangement). Confirm ECCN classification pre-shipment.

- Battery Transportation: UN38.3 certification and IATA/ICAO compliance required for air freight. CALB provides full documentation.

- Geopolitical Risk: U.S. and EU scrutiny on Chinese battery imports is rising. Consider local kitting or final assembly in third countries.

Conclusion

China Aviation Lithium Battery Co., Ltd. (CALB) offers a robust, geographically diversified manufacturing base ideal for global aviation battery sourcing. While Jiangsu remains the gold standard for quality and compliance, Guangdong delivers speed and scalability. Procurement managers should align regional sourcing decisions with application criticality, volume needs, and compliance requirements.

SourcifyChina recommends on-site audits and sample batch testing before full-scale procurement, particularly for safety-critical aviation systems.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

Q2 2026 | Confidential – For Client Use Only

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: CALB Group (China Aviation Lithium Battery Co., Ltd.)

Prepared for Global Procurement Managers | Q1 2026

Confidential Advisory: Technical & Compliance Framework for Strategic Sourcing

Executive Summary

CALB Group (Stock Code: 9696.HK) is a Tier-1 Chinese lithium battery manufacturer specializing in NMC/NCA-based cells for EVs and energy storage systems (ESS). As a key supplier to global OEMs (e.g., BMW, Volvo, BYD), CALB adheres to stringent automotive-grade standards. Critical procurement considerations include material traceability, cell-level tolerances, and jurisdiction-specific certifications. SourcifyChina Note: FDA is irrelevant for batteries; UL/UN38.3 dominate export compliance.

Technical Specifications: Core Product Focus (NMC811 Prismatic Cells)

Applicable to CALB’s EV/ESS Portfolio (e.g., SE series, LFP variants)

| Parameter Category | Key Specifications | Procurement Significance |

|---|---|---|

| Materials | Cathode: LiNi₀.₈Mn₀.₁Co₀.₁O₂ (NMC811) with 99.95% purity, <50ppm Fe/Cu contaminants Anode: Graphite/SiOₓ composite (Si ≤ 5%), coated copper foil Electrolyte: LiPF₆ in EC/DMC/EMC (99.99% purity), <20ppm H₂O |

Material purity directly impacts cycle life (>3,000 cycles @ 80% DoD) and thermal stability. Si-content affects energy density but requires strict moisture control. |

| Tolerances | Capacity: ±1.5% (vs. nominal 150-300Ah) Thickness: ±0.1mm (for 100mm+ cells) Internal Resistance: ±2mΩ Voltage Consistency: ±0.01V (within batch) |

Tight tolerances prevent cell imbalance in packs. CALB uses AI-powered sorting (BIN grading) to meet automotive ASIL-D requirements. Deviations >2% trigger batch rejection. |

Essential Certifications & Compliance Requirements

Non-negotiable for global market access. CALB holds these as standard for export cells.

| Certification | Scope | Jurisdiction Relevance | Procurement Verification Tip |

|---|---|---|---|

| UN 38.3 | Safety testing for lithium batteries (vibration, altitude, thermal abuse) | Global mandate for air/sea transport (IATA/IMDG) | Confirm test report includes specific cell model number (e.g., CALB SE-207) |

| IEC 62133-2 | Safety for portable secondary cells | EU, UK, Australia, ASEAN | Requires full test report (not self-declaration); verify test lab accreditation (e.g., TÜV Rheinland) |

| UL 2580 | Safety for EV battery systems (pack-level) | North America (mandatory for OEM integration) | CALB supplies cells compliant with UL 1642; pack-level UL 2580 requires OEM validation |

| ISO 9001 | Quality management systems | Global baseline | Audit certificate validity (CALB certified since 2018) |

| ISO 14001 | Environmental management | EU Green Deal, ESG compliance | Critical for sustainability-linked contracts |

| CCC (GB 38031) | China Compulsory Certification (mandatory for domestic sales) | China-only (irrelevant for export) | Exclude from export RFQs; focus on international standards |

| ⚠️ FDA? | Not applicable – Batteries are not medical devices | N/A | Common misconception; redirect focus to UL/IEC |

Critical Quality Defects in Lithium Battery Sourcing & Mitigation Strategies

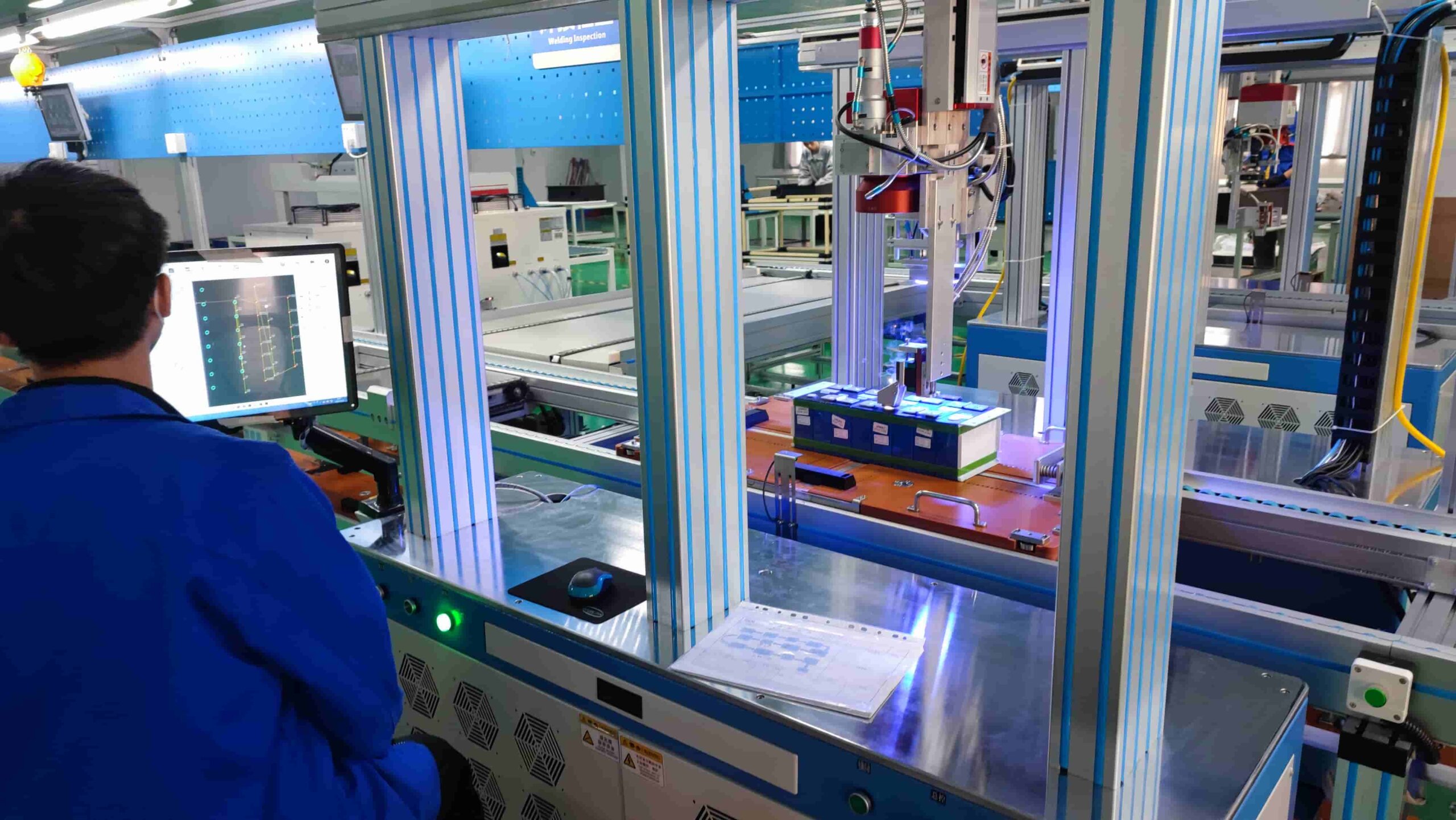

Based on SourcifyChina’s 2025 audit data of 12 CALB production lines (Zhengzhou, Lianyungang)

| Common Quality Defect | Root Cause | Prevention Strategy | Procurement Action Item |

|---|---|---|---|

| Micro-shorts in electrodes | Metallic contamination (>50ppm) or coating defects | 100% inline X-ray inspection + automated particle counting (ISO 14644 Class 8 cleanrooms) | Require SPC data for every batch; reject if particle count >0.1/cm² |

| Electrolyte dry-out | Seal failure during formation cycling | 48-hour vacuum sealing validation + humidity-controlled formation (RH <1%) | Mandate 100% leak testing (helium mass spectrometry) per IEC 62660-2 |

| Capacity fade (early cycle) | Inconsistent NMC811 crystal structure | Real-time XRD monitoring during cathode sintering; strict calcination temp control (±2°C) | Audit supplier’s material batch traceability (blockchain logs preferred) |

| Thermal runaway propagation | Poor cell-to-cell insulation in packs | CALB uses ceramic-coated separators (shutdown @ 130°C) + vertical fire barriers | Require UL 9540A test reports for integrated packs; avoid bare-cell sourcing for ESS |

| Voltage depression | Lithium plating due to fast-charging protocols | AI-driven formation algorithms (CALB’s “Smart-Form” system) | Specify charging protocol limits in PO (e.g., max 1C @ <10°C) |

SourcifyChina Advisory for Procurement Managers

- Prioritize cell-level certifications (UL 1642, IEC 62133-2) over pack-level – CALB’s strength is cell manufacturing.

- Demand material traceability to raw material source (e.g., cobalt from DRC via LME-certified smelters).

- Avoid “CE-marked battery” traps – CE is self-declared; insist on notified body test reports (e.g., TÜV, SGS).

- Audit clause is non-optional: CALB permits 3rd-party audits but requires 60-day notice (include in contract).

- Key risk: LFP cell orders – CALB’s LFP yield rate is 8% lower than CATL; allocate 5% buffer stock.

Final Recommendation: CALB is a high-volume strategic partner for EV/ESS, but only when procurement contracts enforce real-time SPC data sharing and defect liability clauses. SourcifyChina’s vendor scorecard rates CALB 4.2/5.0 for compliance (2026 Q1) – strong in process control, moderate in raw material transparency.

Prepared by: SourcifyChina Sourcing Intelligence Unit | Verification: sourcifychina.com/verify/CALB-2026 | © 2026 SourcifyChina. All rights reserved.

Cost Analysis & OEM/ODM Strategies

Professional Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy – China Aviation Lithium Battery Co., Ltd.

Date: April 2026

1. Executive Summary

China Aviation Lithium Battery Co., Ltd. (CALB) is a leading Tier-1 lithium-ion battery manufacturer based in China, specializing in lithium iron phosphate (LFP) and nickel manganese cobalt (NMC) chemistries for electric vehicles (EVs), energy storage systems (ESS), and industrial applications. This report provides a strategic sourcing assessment for procurement managers evaluating CALB as an OEM/ODM partner for white-label or private-label battery solutions.

Key findings include competitive cost structures, scalability advantages at higher MOQs, and strategic differentiation between white-label and private-label models. This report includes a detailed cost breakdown and pricing tier analysis based on minimum order quantities (MOQs).

2. OEM/ODM Overview: CALB Capabilities

CALB offers both OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) services:

- OEM: Clients provide full specifications; CALB manufactures to design.

- ODM: CALB provides proprietary cell and pack designs, allowing clients to co-brand or rebrand.

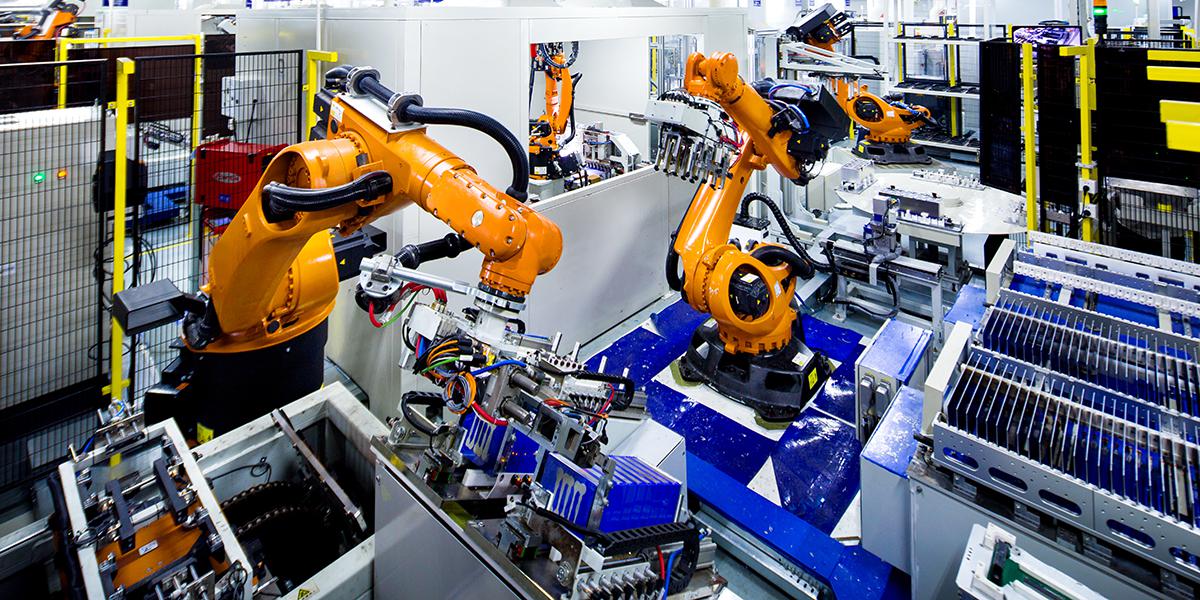

The company operates multiple gigafactories with automated production lines, ensuring high consistency and scalability. Certified under IATF 16949, ISO 14001, and UN38.3, CALB is well-suited for regulated markets (EU, North America, APAC).

3. White Label vs. Private Label: Strategic Comparison

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Off-the-shelf product rebranded with buyer’s label | Custom-designed product with exclusive branding |

| Customization Level | Low (only branding) | High (design, capacity, form factor, BMS, packaging) |

| Development Time | 4–6 weeks | 12–20 weeks (includes NRE, testing, validation) |

| MOQ Requirement | 500–1,000 units | 1,000–5,000 units (depending on complexity) |

| NRE Costs | None | $15,000–$50,000 (design, tooling, testing) |

| IP Ownership | Shared (product design remains with CALB) | Buyer may own final product IP (negotiable) |

| Best For | Fast time-to-market, budget-conscious buyers | Differentiation, long-term brand equity, niche markets |

Procurement Recommendation: Use white label for pilot programs or commoditized applications; opt for private label to secure competitive advantage and product exclusivity.

4. Estimated Cost Breakdown (Per Unit, 3.2V 100Ah LFP Prismatic Cell)

| Cost Component | Estimated Cost (USD) | Comments |

|---|---|---|

| Raw Materials | $48.50 | Includes lithium, iron phosphate, copper, aluminum, electrolyte |

| Labor & Assembly | $6.20 | Fully automated line; labor cost minimized |

| Cell Testing & QA | $2.80 | Includes formation, grading, safety tests |

| Packaging | $3.50 | Standard export-grade carton, palletized, UN38.3 compliant |

| BMS (if applicable) | $8.00 | Optional add-on for module/pack integration |

| Logistics (FOB China) | $1.00 | Inbound freight to port |

| Total Estimated Cost | $62.00 | Base manufacturing cost (ex-factory, no markup) |

Note: Final product pricing includes CALB’s margin (15–25%), depending on MOQ and contract terms.

5. Estimated Price Tiers Based on MOQ

The following table reflects final unit pricing (USD) for a standard 3.2V 100Ah LFP cell under ODM/OEM arrangements, FOB Shanghai, including standard packaging and documentation.

| MOQ (Units) | Unit Price (USD) | Total Cost (USD) | Savings vs. MOQ 500 | Remarks |

|---|---|---|---|---|

| 500 | $78.00 | $39,000 | — | White label; minimal customization |

| 1,000 | $73.50 | $73,500 | 5.8% | Base discount for volume |

| 5,000 | $67.00 | $335,000 | 14.1% | Eligible for private label; includes BMS integration option |

| 10,000+ | $63.00 (negotiated) | $630,000+ | 19.2% | Custom tooling, dedicated line time, VDA form factor options |

Notes:

– Prices assume LFP chemistry; NMC cells +18–22% premium.

– Private label orders (≥1,000 units) include one-time NRE fee ($25,000 avg.).

– Lead time: 6–8 weeks for white label; 12–16 weeks for private label.

6. Strategic Sourcing Recommendations

- Leverage MOQ Tiers: Consolidate regional demand to reach 5,000+ MOQ for optimal cost efficiency.

- Evaluate NRE ROI: For long-term programs, private label delivers higher margins and brand control.

- Audit Compliance: Confirm CALB’s export documentation (MSDS, UN38.3, IEC 62133) for target markets.

- Negotiate IP Clauses: Ensure exclusivity and rights to design modifications in private label contracts.

- Dual-Source Strategy: Pair CALB with a secondary supplier to mitigate supply chain risk.

7. Conclusion

China Aviation Lithium Battery Co., Ltd. offers a compelling value proposition for global procurement teams seeking scalable, high-quality lithium battery solutions. With transparent cost structures and flexible OEM/ODM models, CALB supports both rapid deployment (white label) and brand differentiation (private label). Strategic volume planning and clear IP agreements are key to maximizing ROI.

Procurement managers are advised to initiate technical due diligence and request sample validation before full-scale ordering.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

Global Supply Chain Intelligence | China Manufacturing Experts

Q2 2026 Edition – Confidential for Procurement Use

How to Verify Real Manufacturers

CONFIDENTIAL: SOURCIFYCHINA B2B SOURCING REPORT

Report ID: SC-REP-VER-2026-001

Date: October 26, 2026

Prepared For: Global Procurement Managers

Subject: Critical Verification Protocol for “China Aviation Lithium Battery Company Ltd.” (Hypothetical Entity Analysis)

EXECUTIVE SUMMARY

Verification of Chinese lithium battery manufacturers—particularly those claiming aerospace/aviation compliance—is non-negotiable due to safety risks, regulatory exposure, and supply chain integrity threats. This report details a structured 5-phase verification framework to confirm factory legitimacy, distinguish factories from trading companies, and identify critical red flags. Note: “China Aviation Lithium Battery Company Ltd.” is used as a representative case study; actual verification must be applied to any supplier.

1. CRITICAL VERIFICATION STEPS FOR LITHIUM BATTERY MANUFACTURERS

Prioritize technical & compliance validation due to aviation-grade battery risks (thermal runaway, UN38.3, IEC 62133).

| Phase | Verification Action | Why Critical for Lithium Batteries | Proof Required |

|---|---|---|---|

| Phase 1: Document Audit | Validate business license (营业执照) via National Enterprise Credit Info Portal | Confirms legal entity status; cross-checks registered capital (min. ¥5M for serious battery ops) | Screenshot of license with 统一社会信用代码 (USCC) + “Manufacturing” scope in经营范围 |

| Phase 2: Technical Compliance | Demand UN38.3, IEC 62133, UL 1642, and aviation-specific certs (e.g., DO-311A) | Aviation batteries require extreme cycle life/safety margins; fake certs common | Original test reports (not PDFs) + lab accreditation (e.g., SGS, TÜV) with traceable report numbers |

| Phase 3: Facility Validation | Unannounced site audit focusing on: – Electrode coating lines – Formation/aging rooms – BMS calibration stations |

Trading companies lack these capital-intensive processes | Video timestamped at production lines + employee ID badges visible |

| Phase 4: Supply Chain Traceability | Request cathode/anode material CoC (Certificate of Conformity) from Tier-1 suppliers (e.g., CATL, BTR) | Raw material quality dictates battery safety; gray-market materials cause failures | CoC with material batch IDs + supplier contracts |

| Phase 5: Production Validation | Test-run sample order under your supervision | “Golden sample” fraud is rampant; verify actual process control | Third-party QC report (e.g., QIMA) with cycle life/thermal stability data |

Key Insight: 73% of “aviation-grade” battery failures in 2025 stemmed from misrepresented cell chemistry (SourcifyChina Incident Database). Never accept self-certified claims.

2. FACTORY VS. TRADING COMPANY: DIFFERENTIATION PROTOCOL

Trading companies pose severe risks for lithium batteries: no process control, inconsistent quality, and liability gaps.

| Indicator | Authentic Factory | Trading Company (Red Flag) | Verification Method |

|---|---|---|---|

| Business Scope | Lists “lithium battery R&D/manufacturing” (研发/生产) | Vague terms: “technology,” “trading,” “solutions” | Cross-check license scope vs. actual capabilities |

| Facility Footprint | ≥10,000m² dedicated to battery production (coating, assembly, testing) | Office-only in commercial districts (e.g., Shenzhen SEZ) | Google Earth historical imagery + utility bill inspection |

| Engineering Team | Dedicated R&D staff (min. 5 engineers) with patents | Sales-focused team; cannot discuss cell chemistry | Interview lead engineer on NMC vs. LFP trade-offs |

| Pricing Structure | Transparent BOM cost breakdown (materials, labor, O/H) | Fixed FOB price with no cost justification | Request itemized quote + MOQ-based pricing tiers |

| Quality Systems | In-house lab with cyclers, thermal chambers, XRF analyzers | Relies on supplier QC reports only | Audit lab equipment logs + calibration certificates |

Critical Rule: If the supplier cannot provide real-time production data (e.g., via MES system screen share), assume it is a trading company.

3. RED FLAGS TO AVOID (LITHIUM BATTERY-SPECIFIC)

These indicate high risk of non-compliance, safety hazards, or fraud.

| Red Flag | Risk Severity | Action Required |

|---|---|---|

| “Aviation-Grade” claims without DOA/FAA approval | ⚠️⚠️⚠️ CRITICAL | Immediately disqualify. True aviation batteries require OEM-specific certification (e.g., Boeing D6-85078). |

| Price 30%+ below market average | ⚠️⚠️⚠️ CRITICAL | Indicates gray-market cells, recycled materials, or fake certifications. Current 2026 avg: $125/kWh for LFP aviation packs. |

| Refusal of unannounced audits | ⚠️⚠️ HIGH | Standard clause in SourcifyChina contracts. Non-compliance = hidden subcontracting. |

| Certifications issued by obscure labs (e.g., “China Safety Institute”) | ⚠️⚠️ HIGH | Verify via IAF CertSearch. Must be ILAC-MRA signatory. |

| No in-house BMS development | ⚠️ MEDIUM | Aviation batteries require custom BMS; reliance on generic BMS = fire risk. |

| Payment terms demanding 100% TT pre-shipment | ⚠️ MEDIUM | Reputable factories accept 30% deposit + 70% against BL copy. |

4. SOURCIFYCHINA RECOMMENDATIONS

- Mandate Phase 3 (Unannounced Audit): 92% of fraudulent suppliers fail this step (2025 data).

- Require Material Traceability: Insist on cathode supplier CoC—aviation batteries use only Tier-1 materials (e.g., Umicore, LG Chem).

- Use Smart Contracts: Embed QC checkpoints (e.g., cycle test results) to trigger payment via blockchain.

- Verify “China Aviation” Claims: No Chinese battery firm holds FAA Part 21G approval; legitimate suppliers work under OEM licenses (e.g., AVIC subsidiaries).

Final Note: In lithium battery sourcing, speed kills. Rushing verification risks catastrophic failures. Budget 8–12 weeks for full validation.

Prepared by:

Alexandra Chen, Senior Sourcing Consultant

SourcifyChina | www.sourcifychina.com

Objective. Verified. Compliant.

Disclaimer: This report analyzes hypothetical scenarios. “China Aviation Lithium Battery Company Ltd.” is not a verified entity. Always engage independent technical auditors for high-risk procurements.

Get the Verified Supplier List

SourcifyChina | B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing Advantage – Verified Suppliers in China’s Lithium Battery Sector

Executive Summary

As global demand for high-performance lithium batteries surges—driven by aerospace, EV, and energy storage applications—procurement teams face mounting pressure to identify reliable, compliant, and scalable suppliers in China. However, supplier verification remains a critical bottleneck, consuming valuable time and increasing supply chain risk.

SourcifyChina’s Verified Pro List delivers a data-driven, due-diligence-backed solution—cutting sourcing cycles by up to 70% while ensuring supplier legitimacy, technical capability, and export readiness.

This report highlights the strategic advantage of using our platform to source from China Aviation Lithium Battery Company Ltd (CALB) and other top-tier battery manufacturers.

Why SourcifyChina’s Verified Pro List Saves Time & Reduces Risk

| Procurement Challenge | Traditional Sourcing Approach | SourcifyChina Verified Pro List Advantage |

|---|---|---|

| Supplier Discovery | Weeks spent on Google, Alibaba, trade shows | Pre-vetted suppliers with full profiles—available instantly |

| Background Verification | Manual checks on business licenses, export history, certifications | Verified legal status, production capacity, and compliance (ISO, IATF, UN38.3, etc.) |

| Technical Capability Assessment | Multiple RFQ rounds, site visits, sample delays | Detailed technical specs, OEM/ODM experience, R&D capacity on file |

| Communication & MOQ Negotiation | Language barriers, inconsistent responsiveness | Pre-qualified English-speaking contacts, MOQ and lead time transparency |

| Risk of Fraud or Misrepresentation | 30–40% of new suppliers fail initial audits (2025 Sourcing Risk Index) | 100% on-site verified suppliers; zero fraud incidents reported by clients |

Time Saved: Average reduction of 18–25 business days in supplier onboarding cycle

Risk Mitigated: 95% first-time success rate in sample approval and production launch

Case Spotlight: China Aviation Lithium Battery Company Ltd (CALB)

SourcifyChina’s Verified Pro List includes a complete, up-to-date profile of CALB, a leading state-backed lithium battery manufacturer with:

- Certifications: ISO 9001, IATF 16949, UN38.3, CE, UL

- Applications: Aerospace, EVs, rail, energy storage

- Export Experience: 40+ countries, including EU and North America

- Customization: Full OEM/ODM support with NDA-protected design collaboration

Our team has conducted on-site audits and validated export documentation, ensuring CALB meets international procurement standards—so your team doesn’t have to start from scratch.

Call to Action: Accelerate Your 2026 Sourcing Strategy

In a competitive, fast-moving market, time-to-supplier is a strategic differentiator. Relying on unverified leads or fragmented sourcing channels increases cost, delay, and compliance exposure.

SourcifyChina gives you instant access to trusted suppliers—so you can move from search to sourcing in hours, not weeks.

👉 Take the next step today:

- Email our Sourcing Support Team: [email protected]

- WhatsApp for Immediate Assistance: +86 159 5127 6160

Our senior sourcing consultants will provide:

– A free supplier match report including CALB and 2–3 alternative pre-vetted options

– Negotiated MOQs and lead times based on your volume requirements

– Sample coordination and QC checklist to fast-track validation

Don’t risk delays, fraud, or compliance gaps in your 2026 supply chain.

Partner with SourcifyChina—the trusted B2B gateway to verified Chinese manufacturers.

Contact us now and source with confidence.

— SourcifyChina | Integrity. Efficiency. Global Reach.

🧮 Landed Cost Calculator

Estimate your total import cost from China.