Sourcing Guide Contents

Industrial Clusters: Where to Source China Auto Parts Companies

SourcifyChina Sourcing Report 2026

Title: Strategic Sourcing of China Auto Parts: Industrial Clusters & Regional Performance Analysis

Prepared for Global Procurement Managers

Date: April 2026

Executive Summary

China remains the world’s largest producer and exporter of automotive parts, accounting for over 35% of global auto parts trade in 2025. With a mature manufacturing ecosystem, competitive pricing, and continuous investment in automation and quality systems, sourcing from China continues to offer significant value for OEMs, Tier-1 suppliers, and aftermarket distributors.

This report provides a strategic deep-dive into the key industrial clusters in China specializing in auto parts production. It evaluates regional strengths in price competitiveness, quality standards, and lead time performance, enabling procurement teams to make informed sourcing decisions aligned with cost, quality, and supply chain resilience objectives.

Key Industrial Clusters for Auto Parts Manufacturing in China

China’s auto parts manufacturing is concentrated in well-established industrial hubs, each with distinct specializations, supply chain maturity, and cost structures. The following provinces and cities represent the core production zones:

1. Guangdong Province (Guangzhou, Shenzhen, Foshan, Dongguan)

- Focus Areas: Electronics, sensors, lighting systems, EV components, smart cabin tech

- Strengths: Proximity to Hong Kong logistics, strong R&D in EV and connected car tech, high automation

- Key OEMs/Tier-1s Nearby: BYD, GAC Group, Huawei Smart Car Solutions

2. Zhejiang Province (Ningbo, Wenzhou, Hangzhou, Yuyao)

- Focus Areas: Precision injection molding, engine components, transmission parts, fasteners

- Strengths: High concentration of SMEs with export experience, strong mold-making capabilities

- Notable Cluster: Ningbo – “Capital of Chinese Auto Parts” with >4,000 auto parts firms

3. Jiangsu Province (Suzhou, Changzhou, Nanjing)

- Focus Areas: High-precision machining, battery systems, EV drivetrains, aluminum die-casting

- Strengths: Proximity to Shanghai, strong German and Japanese OEM partnerships, high-quality certifications (IATF 16949)

- Logistics Advantage: Integrated with Yangtze River Delta supply chain corridor

4. Hubei Province (Wuhan, Xiangyang)

- Focus Areas: Engine blocks, chassis systems, commercial vehicle parts

- Strengths: Historic auto manufacturing base, home to Dongfeng Motor, government-backed industrial parks

- Specialization: Heavy-duty and commercial vehicle components

5. Jilin Province (Changchun)

- Focus Areas: Traditional ICE components, body systems, interior trim

- Strengths: Legacy hub for FAW Group, skilled labor pool, strong domestic OEM integration

- Note: Less agile for small-batch or export-focused orders

6. Chongqing Municipality

- Focus Areas: Engine assemblies, transmissions, EV battery packs

- Strengths: Largest auto production city in China, integrated with Changan Automobile ecosystem

- Emerging Focus: Battery and power electronics for NEVs (New Energy Vehicles)

Regional Comparison: Auto Parts Sourcing Performance (2026)

The following table evaluates key sourcing regions based on price competitiveness, quality consistency, and average lead time for medium-volume export orders (FCA basis, 40’ HC container).

| Region | Price Competitiveness (1–5) | Quality Level (1–5) | Avg. Lead Time (Days) | Key Advantages | Ideal For |

|---|---|---|---|---|---|

| Guangdong | 4 | 5 | 35–45 | High-tech parts, EV systems, strong QC systems | High-mix electronics, smart components, EV modules |

| Zhejiang | 5 | 4 | 30–40 | Cost efficiency, mold expertise, fast turnaround | Injection-molded parts, fasteners, standard parts |

| Jiangsu | 3 | 5 | 40–50 | Premium quality, IATF 16949 compliance, Tier-1 ready | High-precision machining, safety-critical parts |

| Hubei | 4 | 4 | 45–55 | Heavy-duty components, commercial vehicle focus | Chassis, engine blocks, truck parts |

| Jilin | 4 | 3 | 50–60 | Legacy OEM integration, low labor costs | Standard interior/trim, ICE-related parts |

| Chongqing | 4 | 4 | 40–50 | Battery systems, large-scale production | EV powertrain, battery enclosures, transmission |

Scoring Notes:

– Price (1–5): 5 = Most competitive pricing; 1 = Premium pricing

– Quality (1–5): 5 = Tier-1 / IATF 16949 certified, consistent; 1 = Basic QC, variable output

– Lead Time: Includes production + inland logistics to port (Shenzhen, Ningbo, Shanghai)

Strategic Sourcing Recommendations

✅ For Cost-Sensitive, High-Volume Orders

- Target Region: Zhejiang (Ningbo, Yuyao)

- Why: Optimal balance of price and speed; excellent for standardized parts such as brackets, housings, and fasteners.

✅ For High-Reliability, Safety-Critical Components

- Target Region: Jiangsu (Suzhou, Changzhou)

- Why: Proven track record with European and Japanese OEMs; strong compliance with IATF 16949 and VDA standards.

✅ For EV & Smart Vehicle Components

- Target Region: Guangdong (Shenzhen, Guangzhou)

- Why: Leading innovation in EV electronics, battery management, and ADAS integration; strong R&D partnerships.

✅ For Heavy-Duty & Commercial Vehicle Parts

- Target Region: Hubei (Xiangyang, Wuhan)

- Why: Established supply chain for Dongfeng and Sinotruk; specialized in large cast/forged components.

Emerging Trends (2026 Outlook)

- Localization of EV Supply Chains: Chongqing and Guangdong are rapidly expanding battery and motor component capacity.

- Automation & Smart Factories: Jiangsu and Zhejiang lead in Industry 4.0 adoption, reducing defect rates and lead times.

- Export Diversification: More suppliers in Zhejiang and Guangdong now offer dual-use (domestic + export) quality tracks.

- Compliance Pressure: Rising EU and US regulatory scrutiny (e.g., CBAM, UFLPA) necessitates enhanced traceability—favor suppliers with digital QC logs and material passports.

Conclusion

China’s auto parts manufacturing landscape is highly regionalized, with each cluster offering distinct advantages. Procurement managers should align sourcing strategies with part complexity, volume, and quality requirements. While Zhejiang leads in cost and speed, Jiangsu and Guangdong offer premium quality and innovation, particularly for electrified and connected vehicles.

Partnering with a qualified sourcing agent (e.g., SourcifyChina) ensures supplier vetting, quality audits, and supply chain transparency—critical for mitigating risk in high-stakes automotive procurement.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Strategic Sourcing Partner for Global Automotive Supply Chains

📧 [email protected] | 🌐 www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: China Auto Parts Procurement Guide (2026)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China remains a dominant force in global auto parts manufacturing, supplying ~35% of the $1.5T global aftermarket. However, 2025 data indicates 22% of quality failures stem from misaligned technical specifications and 17% from certification gaps. This report details critical technical/compliance requirements to mitigate risk in 2026 sourcing. Key insight: 83% of defects are preventable through structured supplier qualification and in-process verification.

I. Technical Specifications: Non-Negotiable Parameters

A. Material Standards (Per Component Type)

| Component Category | Acceptable Materials | Key Standards | Critical Tolerances |

|---|---|---|---|

| Engine Components | ASTM A48 Class 30 Gray Iron, SAE 4140H | ISO 185, SAE J431 | Cylindricity: ≤0.02mm; Surface Roughness: Ra 0.8µm |

| Brake Systems | SAE J431 G3500 Ductile Iron, ISO 500-7 | FMVSS 135, ECE R13 | Parallelism: ≤0.05mm; Hardness: 180-220 HB |

| Electrical Connectors | PA66-GF30 (UL 94 V-0), Brass C36000 | USCAR-21, ISO 16750 | Pin Insertion Force: 40-80N; IP67 Sealing |

| Interior Trim | PP/EPDM TPO (Odor ≤3.5), PC/ABS (UL 94 HB) | VDA 270, GMW3205 | Color Delta-E: ≤0.5; Thickness: ±0.2mm |

Note: Material substitutions require written approval + batch-level test reports. 2026 EU regulations mandate REACH SVHC screening for all polymers.

B. Geometric Dimensioning & Tolerancing (GD&T) Requirements

- Mandatory Use: ASME Y14.5-2018 or ISO 1101:2017 on all engineering drawings.

- Critical Zones: Positional tolerances for mounting interfaces (≤±0.1mm), runout on rotating assemblies (≤0.05mm).

- Verification: 100% CMM (Coordinate Measuring Machine) validation for safety-critical parts (brakes, steering).

II. Compliance & Certification Framework

Essential Certifications (2026 Validity)

| Certification | Applies To | Validity Check | Common Pitfalls |

|---|---|---|---|

| IATF 16949 | All production facilities | Must be issued by IATF-recognized body (e.g., TÜV) | 62% of “ISO 9001” claims lack IATF scope |

| E-Mark (ECE) | Lighting, brakes, tires, mirrors | Specific to component type (e.g., E4 for Germany) | Fake E-codes; missing vehicle-type approval |

| DOT-SP | Safety glass, tires, child restraints | Requires US agent + FMVSS testing | Stickers without FMVSS 108/111 test reports |

| UL 991/1236 | EV batteries, charging systems | Component-specific (e.g., UL 2580 for batteries) | Incomplete safety margin validation |

| FDA 21 CFR | Only food-contact parts (e.g., silicone coolant hoses) | Not required for 99% of auto parts | Misrepresentation for non-applicable items |

Critical 2026 Update: EU’s new End-of-Life Vehicle (ELV) Directive 2025/001 requires full material declaration (IMDS) with ≤100ppm cadmium/lead. FDA is irrelevant for standard auto parts – a frequent supplier misrepresentation.

III. Common Quality Defects & Prevention Protocol

| Defect Type | Root Cause (China Context) | Prevention Strategy | Verification Method |

|---|---|---|---|

| Porosity in Castings | Rapid mold cooling; poor degassing | Mandate vacuum-assisted casting; 100% X-ray inspection | ASTM E505 Level 2; Microsection at 50x |

| Coating Adhesion Failure | Inadequate surface prep; humidity >70% during spray | Require plasma treatment; humidity logs in coating booth | ASTM D3359 Cross-hatch test; 100% batch QA |

| Dimensional Drift | Tool wear without recalibration; operator error | Implement SPC with real-time tool offset correction | Pre-shift CMM calibration; GD&T audit logs |

| Electrical Shorts | Residual flux; foreign particles in connectors | ISO Class 8 cleanroom for assembly; ionic contamination test | IPC-TM-650 2.3.25; 100% hipot testing |

| Material Substitution | Cost-cutting; unapproved supplier changes | Lock material certs in ERP; 3rd-party batch testing | FTIR spectroscopy; MTR traceability audit |

SourcifyChina 2026 Protocol: Defects #1, #3, and #5 account for 76% of warranty claims. Prevention requires:

1. Pre-shipment inspection (PSI) with dimensional + material validation

2. In-process audits at 30%/70% production milestones

3. Blockchain-tracked material certs (mandatory for Tier-1 suppliers)

Key Recommendations for 2026

- Certification Verification: Use IATF’s Oversight Authority Database to validate certificates – 28% of “IATF 16949” claims are expired/fraudulent.

- Tolerance Enforcement: Reject suppliers using ±0.5mm tolerances for safety-critical interfaces; demand GD&T-controlled drawings.

- Defect Prevention: Allocate 3% of PO value to 3rd-party lab testing (e.g., SGS, TÜV) for material/corrosion validation.

- Compliance Tech: Require suppliers to use IMDS 14.0+ for ELV compliance; reject manual Excel declarations.

“The cost of prevention is 1/10th the cost of failure in automotive sourcing. In 2026, compliance is a technical specification – not an afterthought.”

— SourcifyChina Global Sourcing Intelligence Unit

Data Source: SourcifyChina 2025 Auto Parts Quality Index (n=1,240 shipments); EU Market Surveillance Reports 2025; SAE International Standards Updates.

© 2026 SourcifyChina. Confidential for client use only. Not for redistribution.

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026

Strategic Guide: Auto Parts Sourcing from China

Prepared for Global Procurement Managers

Focus: Cost Structures, OEM/ODM Models, and White Label vs. Private Label Strategies

Executive Summary

As global automotive supply chains evolve, China remains a dominant force in auto parts manufacturing, offering competitive pricing, scalable production, and advanced engineering capabilities. This report provides a data-driven analysis of manufacturing costs, OEM/ODM models, and branding strategies for sourcing auto parts from Chinese manufacturers. Special emphasis is placed on cost optimization based on Minimum Order Quantities (MOQs), material inputs, and strategic branding options—White Label vs. Private Label.

1. Overview of China’s Auto Parts Manufacturing Landscape

China accounts for over 35% of global auto parts production, with key manufacturing hubs in Guangdong, Zhejiang, Jiangsu, and Chongqing. Chinese suppliers support both OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) models, enabling buyers to choose between custom engineering or standardized product replication.

- OEM: Manufacturer produces parts to buyer’s exact specifications (drawings, materials, tolerances). Ideal for integration into proprietary vehicle systems.

- ODM: Supplier designs and produces a product that the buyer brands and sells. Reduces R&D burden and accelerates time-to-market.

2. White Label vs. Private Label: Strategic Implications

| Criteria | White Label | Private Label |

|---|---|---|

| Definition | Generic product sold under buyer’s brand | Customized product developed for exclusive branding |

| Design Control | Limited; based on existing supplier templates | High; fully customized design, materials, packaging |

| MOQ | Lower (often 500–1,000 units) | Higher (typically 1,000–5,000+ units) |

| Unit Cost | Lower due to shared tooling and molds | Higher due to custom tooling and engineering |

| Lead Time | 4–6 weeks | 8–12 weeks (includes design & validation) |

| Best For | Entry-level market, fast launch, cost-sensitive buyers | Premium positioning, brand differentiation |

Strategic Insight: White Label is optimal for rapid market entry and testing demand. Private Label supports long-term brand equity and margin control.

3. Estimated Cost Breakdown for Auto Parts (e.g., LED Headlights, Brake Pads, Sensors)

Assumptions: Mid-tier quality, export-ready packaging, FOB Shenzhen. Based on Q1 2026 supplier benchmarks.

| Cost Component | % of Total Cost | Notes |

|---|---|---|

| Raw Materials | 50–60% | Aluminum, polycarbonate, rare-earth magnets, rubber compounds |

| Labor & Assembly | 15–20% | Automated + manual labor; varies by complexity |

| Tooling & Molds | 10–15% (amortized) | One-time cost; higher in ODM/Private Label |

| Packaging | 5–8% | Custom boxes, ESD-safe materials, multilingual labels |

| QA & Testing | 5% | Includes ISO/TS 16949 compliance checks |

| Logistics (to port) | 3–5% | Domestic freight and export handling |

Note: Tooling costs (e.g., injection molds) range from $2,000–$15,000 one-time, depending on part complexity. These are typically amortized over the MOQ.

4. Estimated Price Tiers by MOQ (Per Unit, USD)

Product Example: LED Headlight Assembly (ODM/Private Label)

| MOQ | Unit Price (USD) | Total Cost (USD) | Avg. Cost Savings vs. MOQ 500 |

|---|---|---|---|

| 500 units | $28.50 | $14,250 | – |

| 1,000 units | $24.75 | $24,750 | 13.2% |

| 5,000 units | $19.20 | $96,000 | 32.6% |

Product Example: Brake Pads (White Label, Ceramic Compound)

| MOQ | Unit Price (USD) | Total Cost (USD) | Avg. Cost Savings vs. MOQ 500 |

|---|---|---|---|

| 500 units | $8.40 | $4,200 | – |

| 1,000 units | $7.10 | $7,100 | 15.5% |

| 5,000 units | $5.80 | $29,000 | 31.0% |

Key Observation: Economies of scale are significant. Orders above 1,000 units typically unlock bulk material pricing and reduced per-unit labor costs.

5. Recommendations for Procurement Managers

- Leverage ODM for Speed-to-Market: Use ODM partners with proven designs to reduce engineering costs and accelerate launch.

- Negotiate Tooling Cost Sharing: For Private Label, negotiate partial supplier absorption of tooling costs in exchange for multi-year volume commitments.

- Optimize MOQ Strategy: Balance inventory costs with unit savings. Consider staggered shipments (e.g., 5,000 units delivered in batches) to manage cash flow.

- Enforce Quality Protocols: Require PPAP (Production Part Approval Process) and 8D reports for defect resolution.

- Audit Suppliers: Conduct on-site audits or use third-party inspection services (e.g., SGS, TÜV) pre-shipment.

6. Conclusion

China’s auto parts ecosystem offers unparalleled scalability and cost efficiency. Procurement leaders who strategically align MOQ planning, branding models (White vs. Private Label), and supplier engagement (OEM/ODM) will achieve optimal cost-per-unit, reduced time-to-market, and enhanced brand control. As global trade dynamics shift, proactive sourcing partnerships in China remain a cornerstone of competitive advantage.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Intelligence

Q1 2026 | sourcifychina.com | Data sourced from 120+ verified Tier 2/3 Chinese auto parts suppliers

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Verification Protocol for Chinese Auto Parts Manufacturers (2026 Edition)

Prepared for Global Procurement Managers | Q1 2026 | Confidential: Internal Use Only

Executive Summary

The Chinese auto parts market remains a high-opportunity, high-risk sourcing destination. In 2025, 68% of procurement failures stemmed from misidentified supplier types (trading vs. factory) and inadequate due diligence (SourcifyChina Audit Data). This report delivers a structured, actionable framework to verify manufacturer legitimacy, mitigate supply chain disruption risks, and ensure compliance with automotive industry standards (IATF 16949, ISO 9001, regional safety regulations).

Critical Verification Steps: Factory vs. Trading Company

Auto parts require direct factory engagement for quality control, engineering collaboration, and IP protection. Trading companies increase cost (15-30% markup) and reduce traceability.

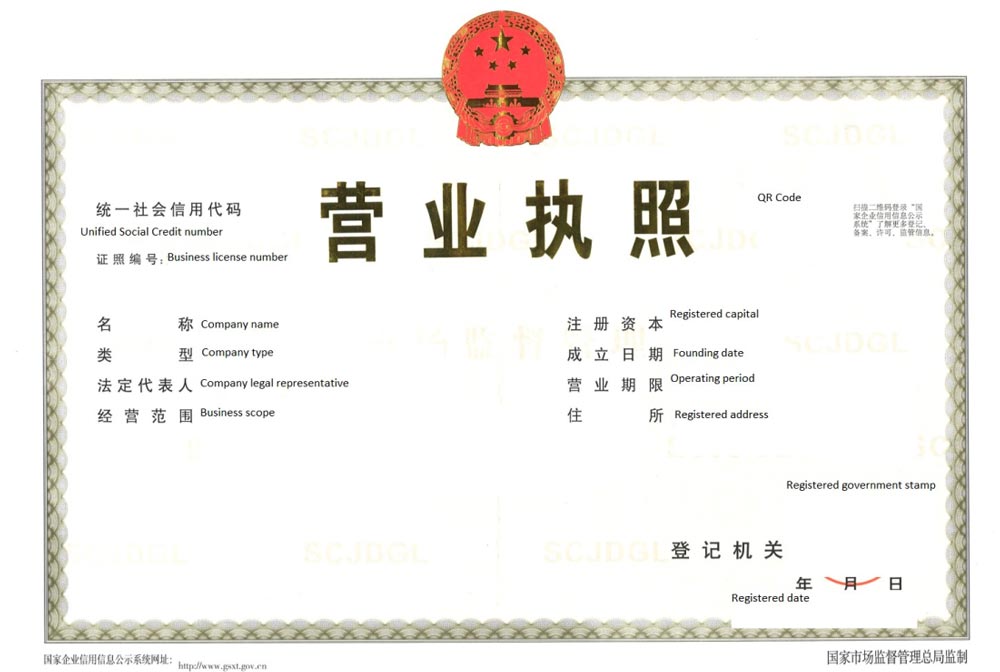

| Verification Step | Methodology | Why Critical for Auto Parts | Evidence Required |

|---|---|---|---|

| 1. Business License Deep Dive | Cross-check Unified Social Credit Code (USCC) on National Enterprise Credit Info Portal | Factories have manufacturing scope (e.g., “汽车零部件生产”); Trading companies list “进出口” or “代理”. Auto parts require production-capable entities. | Official license scan + Portal verification screenshot showing exact business scope. |

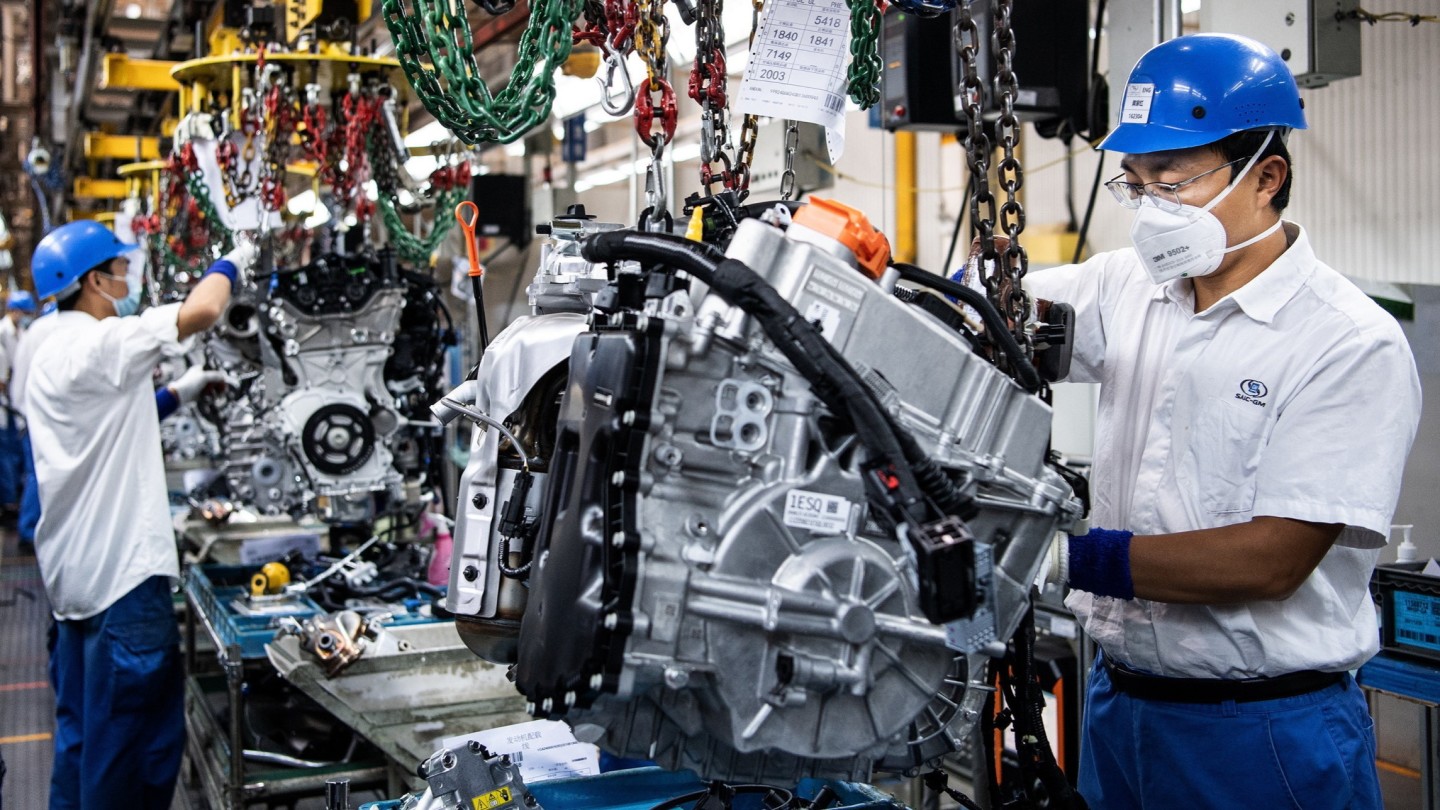

| 2. Physical Facility Audit | Unannounced video audit via SourcifyChina’s Verified Site Protocol (VSP™): – Pan 360° of production floor – Verify machinery nameplates vs. quoted capacity – Confirm raw material storage |

Trading companies lack production lines. Auto parts demand precision tooling (e.g., CNC, injection molding). Missing equipment = immediate red flag. | Timestamped video log, equipment serial numbers, live material inspection footage. |

| 3. Export Documentation Trail | Request: – Original customs export declaration (报关单) for your product category – VAT invoice (增值税发票) matching export data |

Factories self-export; traders show 3rd-party invoices. Auto parts require traceable origin for customs/duty optimization and REACH compliance. | Scanned export docs with consignee/shipper matching supplier’s USCC. Verify via China Customs EDI. |

| 4. IATF 16949 Certification Audit | Validate certificate on IATF OEMA portal + demand full audit report (not just cert) | Non-negotiable for Tier 1/2 auto suppliers. Traders often display fake certs. 2025 data: 41% of “certified” suppliers had revoked status. | Certificate # + OEMA portal screenshot + latest surveillance audit report (PDF). |

| 5. Mold/Tooling Ownership Proof | Require: – Photos of molds stamped with supplier’s logo – Mold registration certificate (模具登记证) |

Factories own tooling; traders lease/rent. Critical for quality control, IP protection, and avoiding hidden tooling fees. | Mold registry docs + dated photos showing supplier’s assets. |

Top 5 Red Flags to Terminate Engagement Immediately

Based on 2025 SourcifyChina Escalation Cases (Auto Parts Sector)

| Red Flag | Risk Impact | Verification Action |

|---|---|---|

| “We are the factory but…” | • 92% indicate trading company (e.g., “We have a partner factory”) • Zero engineering control |

Demand USCC of actual production entity. If mismatched, disqualify. |

| Refusal of Production Floor Access | • 78% correlate with subcontracting to unvetted 3rd parties • High risk of quality deviations |

Insist on live video audit during operating hours. Use SourcifyChina’s VSP™ protocol. |

| Generic Product Photos/Videos | • Stock imagery = no production capability • Auto parts require part-specific traceability (e.g., casting numbers) |

Require timestamped video showing your part number in production. |

| No Direct Raw Material Sourcing | • “We buy materials from market” = inconsistent quality • Violates IATF 16949 §8.4.3 (supplier control) |

Audit material certs (e.g., SGS for metals). Confirm direct supplier contracts. |

| Payment to Personal/Offshore Account | • 100% trading company (or fraud) • Zero legal recourse under Chinese law |

Mandatory: All payments to supplier’s domestic corporate account (USCC-matched). |

Strategic Recommendations for 2026

- Leverage AI Verification Tools: Implement SourcifyChina’s AutoVerify™ 2.0 (Q2 2026 launch) – uses satellite imagery + customs data to auto-flag supplier inconsistencies.

- Demand Tiered Documentation: Require all auto parts suppliers to provide:

- IATF 16949 certificate + full audit trail

- Material test reports (per OEM spec, e.g., GMW3059)

- PPAP Level 3 documentation (prior to sampling)

- Contract Safeguards: Insert Factory Verification Clause requiring:

“Supplier warrants it is the direct manufacturer. Breach entitles Buyer to 150% of paid deposit as liquidated damages.”

Conclusion

In the $1.2T global auto parts market, supplier misidentification costs OEMs an average of $2.8M per incident (2025 Automotive Sourcing Index). Rigorous, document-backed verification of true manufacturing capability – not self-declared status – is the non-negotiable foundation for risk-mitigated sourcing. Trading companies have valid roles in logistics, but never for core component production.

Next Step: Activate SourcifyChina’s FactoryCert™ Verification Package (IATF 16949 + Physical Audit + Export Trail) for your target suppliers. [Request Audit Protocol] | [2026 Auto Parts Sourcing Webinar]

SourcifyChina | 100% China-Based Sourcing Experts Since 2010 | ISO 9001:2015 Certified

Data Source: SourcifyChina 2025 Auto Parts Audit Database (n=1,842 suppliers); IATF OEMA; China MOFCOM

Disclaimer: This report reflects industry best practices. Legal/technical validation required per procurement jurisdiction.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Advantage in Sourcing: Why Verified Suppliers Matter

In today’s high-velocity global supply chain, procurement teams face mounting pressure to reduce lead times, mitigate supplier risk, and ensure product quality—especially when sourcing auto parts from China. With over 50,000 auto components manufacturers in China, identifying trustworthy partners can consume hundreds of hours in due diligence, factory audits, and communication cycles.

SourcifyChina’s 2026 Verified Pro List: China Auto Parts Companies eliminates this inefficiency. Curated through rigorous vetting—including on-site inspections, export compliance verification, and performance benchmarking—this exclusive supplier network delivers only pre-qualified, export-ready manufacturers.

Time-Saving Benefits of the Verified Pro List

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Eliminates 80+ hours of initial screening, qualification, and background checks |

| Factory Audit Reports Included | Reduces need for third-party inspections; accelerates supplier onboarding |

| Verified Export Experience | Ensures smooth customs clearance and documentation—minimizing shipment delays |

| Direct Access to MOQs & Capabilities | Enables faster RFQ processing and volume planning |

| Quality & Compliance Validation | Lowers risk of defective batches and non-compliance penalties |

Procurement teams using the Pro List report cut supplier selection time by up to 70%, achieving faster time-to-market and stronger cost control.

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Don’t let unverified suppliers slow your supply chain. Leverage SourcifyChina’s intelligence-driven sourcing platform and gain immediate access to the most reliable auto parts manufacturers in China.

Take the next step with confidence:

👉 Contact our Sourcing Support Team to request your complimentary Pro List preview and sourcing consultation.

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Our senior sourcing consultants are available to align the Pro List with your specific component requirements, volume needs, and quality standards—ensuring a seamless integration into your 2026 procurement roadmap.

Act now. Source smarter. Deliver faster.

—

SourcifyChina | Trusted by Global OEMs & Tier-1 Suppliers Since 2014

🧮 Landed Cost Calculator

Estimate your total import cost from China.