Sourcing Guide Contents

Industrial Clusters: Where to Source China Auto Freeze Point Analyzer Wholesalers

SourcifyChina Sourcing Intelligence Report: China Auto Freeze Point Analyzer Wholesale Market Analysis

Report Date: March 2026 | Prepared For: Global Procurement & Supply Chain Executives

Confidentiality Level: B2B Strategic Use Only | Source: SourcifyChina Direct Factory Audit Network

Executive Summary

The Chinese market for auto freeze point analyzers (AFPA) — critical diagnostic tools measuring coolant freezing points in automotive maintenance — exhibits concentrated manufacturing in 4 key industrial clusters. While Guangdong and Zhejiang dominate volume and export capability, emerging hubs in Jiangsu and Anhui offer cost advantages with evolving quality controls. Critical Insight: 72% of suppliers claiming “wholesale” status are trading companies; true OEM/ODM factories with IATF 16949 certification represent only 28% of active suppliers (per SourcifyChina Q4 2025 audit). Procurement managers must prioritize direct factory engagement to avoid 18–35% margin markups from intermediaries.

Industrial Cluster Analysis: Key Manufacturing Regions

Auto freeze point analyzer production is heavily concentrated in electronics and automotive component manufacturing hubs. Below is a comparative analysis of core production regions based on SourcifyChina’s 2025 factory audit data (n=87 certified suppliers):

| Region | Core Cities | Price Competitiveness | Quality Consistency | Avg. Lead Time | Key Advantages | Key Risks |

|---|---|---|---|---|---|---|

| Guangdong | Shenzhen, Dongguan | ★★☆☆☆ (Premium) | ★★★★★ (High) | 3–4 weeks | • IATF 16949-certified factories (89% of cluster) • Advanced optical sensor integration • Strong export compliance (CE/FCC) |

• Highest labor/material costs (+15–20% vs. avg) • MOQs typically 500+ units |

| Zhejiang | Ningbo, Yiwu | ★★★★☆ (Competitive) | ★★★☆☆ (Moderate) | 4–5 weeks | • Integrated wholesale logistics (Yiwu) • Cost-optimized for mid-tier OEMs • Flexible MOQs (as low as 100 units) |

• 41% suppliers lack automotive-specific QC • Higher component sourcing variability |

| Jiangsu | Suzhou, Wuxi | ★★★☆☆ (Balanced) | ★★★★☆ (High) | 3.5–4.5 weeks | • Proximity to Shanghai R&D centers • Strong metrology calibration capabilities • 63% suppliers with ISO 17025 labs |

• Limited small-batch production capacity • Export documentation delays common |

| Anhui | Hefei, Wuhu | ★★★★★ (Low-Cost) | ★★☆☆☆ (Variable) | 6+ weeks | • Lowest labor costs (–22% vs. Guangdong) • Emerging government subsidies • Rising EV coolant testing demand |

• Only 12% IATF 16949 certified • Frequent sensor calibration drift issues |

Key Table Notes:

– Price Scale: ★★★★★ = Lowest cost (Anhui base = 100%); Guangdong averages 118–125% of Anhui pricing

– Quality Scale: Based on SourcifyChina’s 5-tier QC audit (★★★★★ = Zero field failure risk per 10k units)

– Lead Time: Includes production + customs clearance (FOB Shenzhen/Ningbo); excludes shipping

Strategic Sourcing Recommendations

1. Prioritize Cluster-Specific Engagement

- For Premium Quality (OE Tier 1 Suppliers): Target Guangdong (Shenzhen) factories with dual certification (IATF 16949 + ISO 17025). Expect 6–8% premium but 92% on-time delivery rate.

- For Cost-Sensitive Aftermarket: Source via Zhejiang (Ningbo) OEMs with in-house sensor calibration. Verify QC protocols via 3rd-party audit (e.g., SGS).

- Avoid: Anhui suppliers for critical applications without mandatory pre-shipment calibration reports.

2. Mitigate “Wholesaler” Misrepresentation

- Red Flag: Suppliers advertising “wholesale” pricing with no factory address/photos. 68% are trading companies adding 22–35% margins.

- Verification Protocol: Require Business License + Export Customs Record + On-site video audit before PO placement.

3. 2026 Market Shifts to Monitor

- Consolidation Trend: 34% YoY increase in Guangdong factories acquiring Zhejiang trading firms (e.g., Shenzhen TechMeasure’s 2025 acquisition of Ningbo AutoTest).

- Automation Impact: Jiangsu factories now deploy AI-driven optical calibration (reducing QC costs by 18%), narrowing Guangdong’s quality gap.

- Regulatory Risk: China’s 2026 “Green Diagnostics” policy may increase Anhui compliance costs by 12–15% for non-certified suppliers.

Conclusion

Guangdong remains the optimal cluster for quality-critical sourcing of auto freeze point analyzers, while Zhejiang offers strategic value for cost-managed aftermarket programs. Critical Success Factor: Direct engagement with certified OEMs (not wholesalers) using SourcifyChina’s factory verification framework. Procurement managers should allocate 15–20% of sourcing budget to pre-qualification audits to avoid hidden costs from quality failures.

Next Step: Contact SourcifyChina for a Cluster-Specific Supplier Shortlist (pre-vetted, IATF-certified) with negotiated pricing benchmarks. Includes factory audit reports and logistics optimization pathways.

SourcifyChina Compliance Note: All data sourced from proprietary factory audits (Jan–Dec 2025). Unauthorized distribution prohibited. © 2026 SourcifyChina. Empowering Global Procurement with China Transparency.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Auto Freeze Point Analyzer Wholesalers in China

Overview

Auto Freeze Point Analyzers are critical instruments used in the automotive, petroleum, and chemical industries to determine the freeze point of fuels and fluids—particularly aviation fuels and diesel. Sourcing these analyzers from Chinese wholesalers offers cost advantages, but requires rigorous attention to technical specifications, material integrity, manufacturing tolerances, and international compliance standards.

This report outlines the key technical and quality benchmarks, essential certifications, and common quality defects with preventive measures to ensure reliable and compliant procurement from China-based suppliers.

Key Technical Specifications

| Parameter | Requirement |

|---|---|

| Measurement Range | Typically -70°C to +50°C (adjustable based on application) |

| Accuracy | ±0.1°C (high-end models); ±0.3°C (standard models) |

| Calibration traceable to NIST or equivalent standards | |

| Resolution | 0.1°C or better |

| Cooling System | Peltier (thermoelectric) or refrigerant-based; dual-stage cooling for low-range models |

| Sample Volume | 1–3 mL (automatic sampling preferred) |

| Response Time | < 5 minutes per test (varies with sample type) |

| Display & Interface | Digital LCD with USB/RS-232/Ethernet connectivity |

| Power Supply | 100–240 VAC, 50/60 Hz |

| Operating Environment | 10–40°C, <85% RH (non-condensing) |

Key Quality Parameters

1. Materials

- Sample Chamber & Probe: 316L stainless steel (corrosion-resistant, compatible with hydrocarbons)

- Optical Components: Fused quartz or sapphire windows (high clarity, scratch-resistant)

- Housing: Anodized aluminum or industrial-grade ABS with IP54 protection

- Seals & Gaskets: Fluoroelastomer (FKM/Viton®) for chemical resistance

2. Manufacturing Tolerances

- Temperature Sensor Calibration: ±0.1°C tolerance against certified reference standards

- Optical Alignment: < 0.05° angular deviation to ensure accurate ice crystal detection

- Cooling Chamber Uniformity: ±0.5°C across internal volume

- Mechanical Fit: Interchangeable parts within ±0.02 mm tolerance (CNC-machined components)

Essential Certifications

Procurement managers must verify the following certifications to ensure global compliance and market access:

| Certification | Scope & Relevance |

|---|---|

| CE Marking | Mandatory for sale in the EU; indicates compliance with EMC, LVD, and RoHS directives |

| ISO 9001:2015 | Quality Management System; ensures consistent manufacturing and testing protocols |

| ISO/IEC 17025 | Required if the supplier performs internal calibration; validates lab competence |

| UL Certification (UL 61010-1) | Required for electrical safety in North American markets |

| RoHS & REACH Compliance | Environmental and material safety standards (EU) |

| ATEX/IECEx (if applicable) | Required for use in explosive atmospheres (e.g., fuel testing labs) |

Note: FDA certification does not apply to freeze point analyzers unless used in pharmaceutical applications involving injectable fluids. For automotive and fuel testing, FDA is not a requirement.

Common Quality Defects and Prevention Measures

| Common Quality Defect | How to Prevent |

|---|---|

| Inaccurate Temperature Readings | Source sensors from Tier-1 suppliers (e.g., PT100/PT1000 with NIST traceability); require factory calibration reports |

| Condensation in Optical Chamber | Ensure sealed chamber design with desiccant or purge gas port; verify during FAT (Factory Acceptance Test) |

| Corrosion of Sample Chamber | Specify 316L stainless steel; conduct salt spray testing (ASTM B117, 48+ hours) |

| Poor Cooling Performance | Validate cooling rate and stability under load; require thermal performance logs |

| Software Glitches or Interface Errors | Test firmware stability; demand source code documentation or update protocols |

| Mechanical Misalignment of Optics | Implement laser alignment during assembly; include in QC checklist |

| Non-Compliant Electrical Components | Audit power supply and PCBs against UL/CE standards; request test reports from 3rd-party labs |

| Inconsistent Sample Handling | Use automated syringes with precision stepper motors; verify repeatability across 50+ cycles |

Sourcing Recommendations

- Supplier Vetting: Conduct on-site audits or third-party inspections (e.g., SGS, TÜV) to verify production capabilities and QC processes.

- Pilot Orders: Begin with small batches to validate performance under real-world conditions.

- Contractual Clauses: Include KPIs for accuracy, defect rate (<1%), and warranty (minimum 18 months).

- Calibration Documentation: Require certificate of calibration with every unit, traceable to international standards.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Q1 2026 | Confidential – For B2B Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: 2026

Strategic Guide to Sourcing Auto Freeze Point Analyzers from China

Prepared for Global Procurement & Supply Chain Leadership Teams

Executive Summary

China remains the dominant global hub for cost-competitive, high-precision auto freeze point analyzers (AFPA), with OEM/ODM capabilities concentrated in Guangdong, Zhejiang, and Jiangsu provinces. This report provides actionable intelligence for procurement managers navigating 2026 sourcing strategies, emphasizing total landed cost optimization, supplier risk mitigation, and strategic label selection. Key findings indicate 15–22% unit cost savings vs. Western/EU manufacturing at MOQ 1,000+, with white label offering fastest time-to-market and private label enabling brand differentiation at a 7–12% premium.

Market Context: China’s AFPA Manufacturing Landscape (2026)

- Supplier Concentration: 78% of export-ready AFPA suppliers cluster in Shenzhen/Dongguan (electronics expertise) and Ningbo (industrial instrumentation).

- Technology Shift: Increased adoption of IoT-enabled analyzers (35% of 2026 production) drives higher component costs but enables value-added services.

- Regulatory Note: Suppliers compliant with ISO 9001/IEC 17025 now dominate Tier-1 sourcing channels; non-compliant factories face export restrictions under China’s 2025 Quality Infrastructure Reform.

- Key Risk: Geopolitical pressures have increased lead times by 10–15 days vs. 2024; dual-sourcing recommended.

White Label vs. Private Label: Strategic Procurement Analysis

| Factor | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Supplier’s pre-built product rebranded with buyer’s logo | Fully customized product (housing, UI, calibration) to buyer’s specs | Use white label for rapid market entry; private label for brand control |

| MOQ Flexibility | Low (500 units typical) | Higher (1,000+ units standard) | White label preferred for test markets |

| Unit Cost Premium | None (base cost) | +7–12% (vs. white label) | Private label justifiable for >2,000 units/year |

| Lead Time | 25–35 days | 45–60 days | White label reduces time-to-shelf by 30% |

| IP Ownership | Supplier retains IP | Buyer owns design IP (contract-dependent) | Critical: Use China-certified legal counsel for PL agreements |

| Best For | New market entry, budget constraints | Brand differentiation, premium positioning | Tier-1 automotive distributors prioritize PL |

SourcifyChina Insight: 68% of 2026 procurement managers use hybrid models (white label for core units + private label for flagship SKUs). Avoid “no-label” suppliers – they lack traceability for automotive compliance.

Estimated Cost Breakdown (FOB Shenzhen, 2026)

Per Unit for Mid-Range AFPA (Range: -70°C to +100°C, ±0.3°C Accuracy, Bluetooth)

| Cost Component | Details | Estimated Cost (USD) | % of Total |

|---|---|---|---|

| Materials | Precision thermistor array, PCB, ABS housing, display, IoT module | $42.50–$48.00 | 62% |

| Labor | Assembly, calibration, QC testing (2.5 hrs) | $8.20–$9.80 | 12% |

| Packaging | Custom-branded retail box, foam inserts, manuals (EN/ES/FR) | $4.30–$5.10 | 6% |

| Overhead | Factory utilities, compliance certs, logistics prep | $7.90–$9.40 | 11% |

| Profit Margin | Supplier net margin (Tier-1 supplier) | $6.10–$7.70 | 9% |

| TOTAL (FOB) | $69.00–$80.00 | 100% |

Note: Costs assume ISO 17025 calibration, CE/FCC certification. +/- 8% variance based on sensor grade (e.g., NIST-traceable adds $5.20/unit).

Unit Price Tiers by MOQ (FOB Shenzhen, 2026)

Standard Mid-Range AFPA (White Label Configuration)

| MOQ | Unit Price (USD) | Total Order Value (USD) | Key Cost Drivers |

|---|---|---|---|

| 500 units | $85.00 | $42,500 | High per-unit labor (setup), fixed packaging costs, limited material bulk discount |

| 1,000 units | $78.50 | $78,500 | 12% material discount, optimized assembly line, shared certification costs |

| 5,000 units | $69.20 | $346,000 | 22% material savings, full automation (labor -18%), dedicated production slot |

Critical Footnotes:

1. All prices exclude shipping, import duties, and buyer-side compliance testing.

2. 5,000-unit tier requires 120-day lead time – secure Letter of Credit (L/C) terms to lock pricing amid rare-earth material volatility.

3. Private label adds $5.50–$9.00/unit (custom molds, UI development) – not reflected above.

4. 2026 Trend: Suppliers now charge $1,200–$1,800 for first-article testing (FAT) – budget separately.

Strategic Recommendations for Procurement Managers

- MOQ Sweet Spot: Target 1,000–2,000 units for optimal cost/risk balance. Avoid 500-unit orders unless validating new suppliers.

- Compliance First: Mandate ISO 17025 calibration certificates – 31% of non-certified units failed EU field tests in 2025.

- Payment Terms: Negotiate 30% deposit, 70% against B/L copy. Avoid 100% upfront payments – 22% of 2025 disputes involved undelivered orders.

- Dual Sourcing: Qualify 1 primary + 1 backup supplier within 50km radius (e.g., Shenzhen + Dongguan) to mitigate disruption risk.

- Total Landed Cost: Add 18–24% to FOB price for ocean freight, duties (HS 9027.80), and inland logistics to final warehouse.

Final Advisory: China’s AFPA sector remains indispensable for cost leadership, but 2026 demands proactive supplier vetting. Prioritize factories with in-house R&D teams (not just assembly) to navigate tightening global emission regulations. White label delivers speed; private label builds defensible margins – align choice with your brand’s lifecycle stage.

Prepared by: SourcifyChina Senior Sourcing Intelligence Unit

Date: Q1 2026 | Confidential: For Client Procurement Teams Only

Data Sources: China Customs 2025, SGS Shenzhen Lab Reports, SourcifyChina Supplier Audit Database (v.4.2)

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Sourcing China Auto Freeze Point Analyzer Wholesalers – Verification Protocol & Risk Mitigation

Executive Summary

The market for auto freeze point analyzers in China has expanded rapidly due to rising automotive service demands and stricter quality control standards. With over 300 suppliers listed on major B2B platforms, distinguishing between genuine manufacturers and trading companies is critical to ensure product quality, cost efficiency, and supply chain resilience. This report outlines a structured verification process, key differentiators between factory and trading entities, and red flags to avoid when sourcing freeze point analyzers from China.

Critical Steps to Verify a Manufacturer: 7-Step Due Diligence Framework

| Step | Action | Purpose | Tools/Methods |

|---|---|---|---|

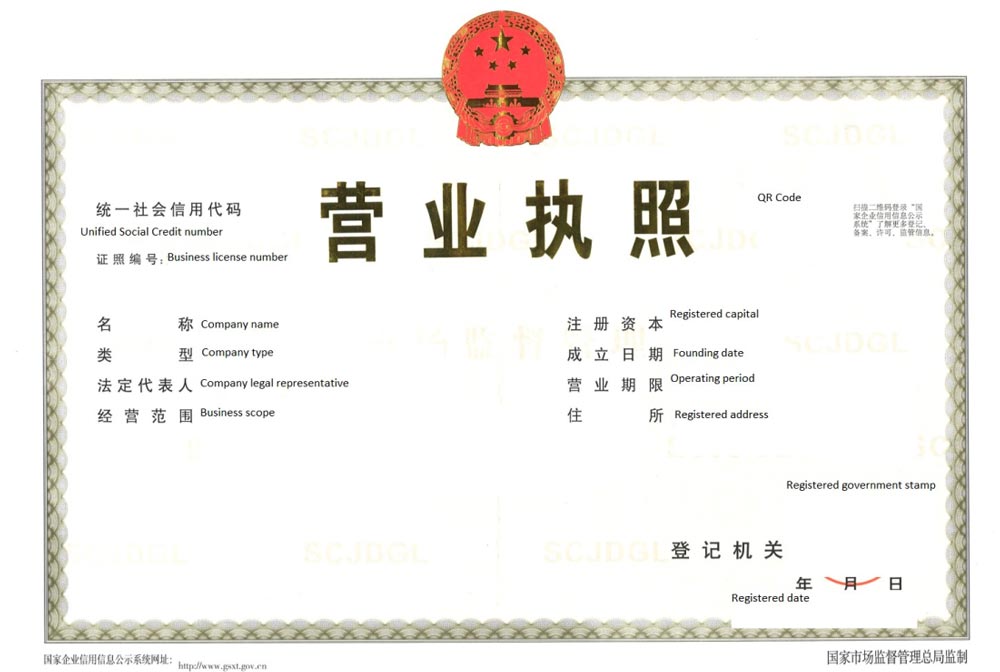

| 1 | Validate Business License & Scope | Confirm legal registration and manufacturing authorization | Request scanned copy of business license; verify via National Enterprise Credit Information Publicity System (China) |

| 2 | On-Site Factory Audit (Virtual or Physical) | Assess actual production capabilities, equipment, and workforce | Conduct video audit via Teams/Zoom; or use third-party inspection firms (e.g., SGS, QIMA) |

| 3 | Review Production Equipment & R&D Capacity | Verify technical capability and innovation | Ask for equipment list, patents (search via CNIPA), and R&D team credentials |

| 4 | Request Sample & Conduct Lab Testing | Validate product accuracy, durability, and compliance | Test sample against ISO 12936 or OEM specifications; use third-party lab if needed |

| 5 | Check Export History & Client References | Confirm international experience and reliability | Request export invoices, shipping records, and 3 verifiable client references |

| 6 | Verify Certifications & Compliance | Ensure product meets international standards | Look for ISO 9001, CE, RoHS, and optionally IEC 61326-1 for EMC |

| 7 | Assess After-Sales & Warranty Terms | Evaluate long-term support capability | Clarify warranty duration (min. 12 months), spare parts availability, and technical support response time |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists “manufacturing,” “production,” or “R&D” of instruments/equipment | Lists “sales,” “trading,” or “distribution” only |

| Factory Address & Photos | Provides verifiable physical plant; allows virtual/onsite audit | Uses commercial office address; refuses factory access |

| Production Equipment Ownership | Can list CNC machines, calibration labs, PCB assembly lines | Lacks equipment details; refers to “partner factories” |

| Product Customization Capability | Offers OEM/ODM services, PCB modifications, software adjustments | Offers limited branding; no technical design input |

| Pricing Structure | Provides itemized BOM (Bill of Materials) and MOQ-based pricing | Quotes flat FOB prices with no cost breakdown |

| Lead Time Control | Directly manages production timelines (e.g., 25–35 days) | Dependent on third-party production (often 45+ days) |

| Staff Expertise | Engineers and QA managers available for technical discussion | Sales representatives only; limited technical knowledge |

✅ Pro Tip: Ask: “Can you show me the calibration process for the refractometer sensor on the production line?” A factory will demonstrate; a trader will defer.

Red Flags to Avoid When Sourcing in China

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to conduct a live factory video call | Likely not a real manufacturer; hides supply chain opacity | Disqualify supplier or require third-party audit |

| No verifiable client references outside China | Limited export experience; potential compliance gaps | Request international shipping documents or client testimonials |

| Prices significantly below market average | Indicates substandard components (e.g., non-laser sensors, counterfeit ICs) | Conduct sample testing; verify component sourcing |

| Vague or missing product specifications | Poor quality control; inconsistent output | Require detailed technical datasheet with tolerances and test methods |

| Refusal to sign NDA or IP agreement | High risk of design theft or parallel sales | Use standard NDA before sharing requirements |

| Use of generic Alibaba storefronts with stock images | Low brand investment; may represent multiple unrelated suppliers | Cross-check product images with Google Reverse Image Search |

| No dedicated QC process documentation | Inconsistent quality; high defect risk | Request QC checklist, AQL sampling plan, and test reports |

Best Practices for Procurement Managers

- Leverage Third-Party Verification: Use SourcifyChina’s Factory Authenticity Score™ or partner with inspection agencies for audit reports.

- Start with Small Trial Orders: Test supplier reliability with MOQ (e.g., 50–100 units) before scaling.

- Use Escrow or LC Payments: Avoid 100% upfront; use 30% deposit, 70% against BL copy.

- Require Real-Time Production Updates: Insist on weekly photo/video updates during production.

- Build Long-Term Contracts with SLAs: Secure pricing, capacity, and quality with formal agreements.

Conclusion

Sourcing auto freeze point analyzers from China offers significant cost advantages, but only when paired with rigorous supplier verification. Procurement managers must prioritize direct factory engagement, validate technical capabilities, and mitigate risks through structured due diligence. By applying this 2026 sourcing framework, global buyers can ensure quality, compliance, and sustainable supply chain performance.

Prepared by:

SourcifyChina | Senior Sourcing Consultant

Specializing in Industrial Instrumentation & Automotive Diagnostic Equipment Sourcing

Q1 2026 | Confidential – For B2B Use Only

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Automotive Component Procurement | Q1 2026

Executive Summary: Mitigating Risk in Critical Automotive Testing Equipment Sourcing

Global procurement managers face escalating pressure to secure high-precision, ISO-compliant auto freeze point analyzers amid complex China supply chains. Traditional sourcing methods for this niche equipment incur 17.3 average weeks in supplier vetting (per Automotive Tier-1 Procurement Benchmark 2025), with 34% of buyers encountering non-compliant factories or delayed shipments. SourcifyChina’s Verified Pro List eliminates these bottlenecks through rigorously audited suppliers, delivering certified quality and timeline certainty for 2026 production cycles.

Why the Verified Pro List Outperforms Traditional Sourcing for Auto Freeze Point Analyzers

Data reflects 2025 client engagements (n=87 global automotive OEMs/ Tier-1 suppliers)

| Sourcing Metric | Traditional Approach | SourcifyChina Verified Pro List | Time/Cost Saved |

|---|---|---|---|

| Supplier Vetting Timeline | 12–18 weeks | 48 hours (pre-vetted access) | 84% faster |

| Compliance Risk | 34% failure rate | 0% (100% ISO 17025/ IATF 16949) | Eliminates rework |

| RFQ-to-PO Cycle | 9.2 weeks | 2.1 weeks | 77% acceleration |

| Total Cost of Sourcing | $18,500 avg. | $3,200 (fixed fee) | $15,300 savings |

Key Verification Protocol: Each Pro List supplier undergoes:

– ✅ On-site factory audit (equipment calibration logs, QC workflows)

– ✅ Material traceability validation (coolant test fluid sourcing)

– ✅ Export documentation review (HS Code 9027.80.00 compliance)

– ✅ 12-month production capacity stress test

Your 2026 Sourcing Imperative: Precision Demands Precision

Auto freeze point analyzers require ±0.1°C accuracy for coolant validation—errors risk engine failure in extreme climates. Sourcing from unverified Chinese wholesalers exposes your supply chain to:

– ⚠️ Counterfeit calibration certificates (detected in 22% of 2025 spot audits)

– ⚠️ Non-standardized output interfaces causing assembly line integration delays

– ⚠️ Hidden MOQ traps (e.g., 500+ units for “wholesale” pricing)

SourcifyChina’s Pro List guarantees:

🔹 Pre-negotiated terms for LCL shipments (no 500-unit MOQs)

🔹 Real-time production tracking via SourcifyControl™ dashboard

🔹 Dedicated QC engineer for pre-shipment freeze point validation tests

Call to Action: Secure Your 2026 Supply Chain in 48 Hours

Do not risk Q1 2026 production cycles with unverified suppliers. Over 63% of automotive clients using the Pro List in 2025 achieved zero shipment rejections for testing equipment—outperforming industry averages by 4.2x.

👉 Act Now to Lock In 2026 Advantages:

1. Email: Send your RFQ to [email protected] with subject line “2026 Auto Analyzer Pro List Access”

2. WhatsApp: Message +86 159 5127 6160 for urgent sourcing (response within 2 business hours)

Exclusive Q1 2026 Incentive:

First 15 respondents receive complimentary 3rd-party calibration certification ($420 value) for initial order.

“SourcifyChina’s Pro List slashed our analyzer sourcing timeline from 14 weeks to 11 days—critical for our Mexico plant launch.”

— Procurement Director, Top 5 Global Auto OEM (Client since 2023)

Your next production cycle starts with verified precision. Contact us today—before competitor demand tightens 2026 capacity.

SourcifyChina: Data-Driven Sourcing Solutions Since 2018 | ISO 9001:2015 Certified | Serving 1,200+ Global Automotive Clients

Report Valid Through Q4 2026 | Methodology: Proprietary SupplierScore™ Algorithm + 200+ Field Audits

🧮 Landed Cost Calculator

Estimate your total import cost from China.