Sourcing Guide Contents

Industrial Clusters: Where to Source China Auto Companies

SourcifyChina B2B Sourcing Report 2026: Strategic Sourcing Guide for Chinese Automotive Manufacturing Clusters

Prepared For: Global Procurement Managers

Date: October 26, 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

China remains the world’s largest automotive production hub, with its ecosystem rapidly evolving toward electrification (EVs accounting for 52% of domestic output in 2026) and intelligent manufacturing. Strategic sourcing requires granular understanding of regional specializations, cost structures, and supply chain maturity. This report identifies core industrial clusters, analyzes regional competitive advantages, and provides actionable insights for optimizing procurement of automotive components, subsystems, and finished vehicles (Note: “China auto companies” interpreted as manufacturing entities within China’s automotive sector).

Key Industrial Clusters: China’s Automotive Manufacturing Heartland

China’s automotive production is concentrated in five major clusters, each with distinct technological focus and supply chain maturity:

-

Guangdong Cluster (Pearl River Delta)

- Core Cities: Guangzhou, Shenzhen, Dongguan, Foshan

- Specialization: Electric Vehicles (EVs), Battery Systems (CATL, BYD), Advanced Electronics (ADAS, infotainment), High-End Components. Dominant in new energy vehicle (NEV) innovation.

- Key Players: BYD (HQ Shenzhen), GAC Group, XPeng, Huawei (smart cockpit), CATL (subsidiary operations).

-

Yangtze River Delta Cluster (Shanghai/Jiangsu/Zhejiang)

- Core Cities: Shanghai, Suzhou, Ningbo, Hangzhou, Wuxi

- Specialization: Complete Vehicle Assembly (ICE & EV), Tier-1 Systems (transmissions, chassis), Precision Casting/Machining, Semiconductor Integration. Highest density of multinational OEMs & Tier-1s.

- Key Players: SAIC Motor (HQ Shanghai), Tesla Gigafactory, Volkswagen Group China JV, Bosch, ZF, Ningbo Joyson.

-

Changchun Cluster (Jilin Province)

- Core City: Changchun

- Specialization: Traditional ICE Powertrains, Heavy-Duty Vehicles, Military Vehicles, Foundry Operations. Historical “Detroit of China”; transitioning to hybrid/EV.

- Key Players: FAW Group (HQ Changchun), Toyota JV.

-

Wuhan Cluster (Hubei Province)

- Core City: Wuhan

- Specialization: Mid-Range ICE Vehicles, Commercial Vehicles, Glass, Tires, Basic Metal Stamping. Strong logistics hub for Central China.

- Key Players: Dongfeng Motor Group (HQ Wuhan), Honda/PSA JVs.

-

Chongqing Cluster (Sichuan Basin)

- Core City: Chongqing

- Specialization: Affordable ICE Vehicles, Motorcycles, Aftermarket Parts, Basic Electronics. Cost-sensitive manufacturing; growing EV presence (Changan).

- Key Players: Changan Automobile (HQ Chongqing), Lifan.

Emerging Cluster Watch (2026): Hefei (Anhui) – NIO’s R&D/manufacturing hub; Huzhou (Zhejiang) – Battery recycling & solid-state R&D.

Regional Comparison: Sourcing Performance Matrix (2026)

Analysis based on average metrics for mid-to-high complexity automotive components (e.g., ECUs, battery modules, precision gears). Data aggregated from SourcifyChina supplier audits, client PO data (2024-2026), and industry benchmarks (CAAM, McKinsey China Auto).

| Region | Price Competitiveness | Quality Consistency | Lead Time (Standard Order) | Key Strengths | Key Limitations |

|---|---|---|---|---|---|

| Guangdong (PRD) | ★★☆☆☆ (3.5/5) | ★★★★☆ (4.5/5) | 8-12 weeks | Cutting-edge EV tech; Strong IP protection; Agile manufacturing; High skilled labor pool | Highest labor/land costs; Intense competition for talent; Complex logistics for inland shipments |

| Zhejiang (YRD) | ★★★★☆ (4.2/5) | ★★★★☆ (4.3/5) | 6-10 weeks | Best balance of cost/quality; Deep SME supplier network (specialized components); Efficient port access (Ningbo) | Less EV-focused than PRD; Moderate wage inflation; Crowded mid-tier market |

| Shanghai (YRD) | ★★☆☆☆ (3.0/5) | ★★★★★ (5.0/5) | 10-14 weeks | Global OEM/Tier-1 standards; Advanced automation; Strong QA systems; International compliance expertise | Highest operational costs; Bureaucratic processes; Limited small-batch flexibility |

| Jilin (Changchun) | ★★★★☆ (4.5/5) | ★★★☆☆ (3.2/5) | 12-16 weeks | Low labor costs; Legacy powertrain expertise; Government subsidies for transition | Quality variance (SMEs); Slower EV adoption; Geographic isolation; Aging infrastructure |

| Chongqing | ★★★★★ (4.8/5) | ★★☆☆☆ (2.5/5) | 10-14 weeks | Lowest production costs; Large labor pool; Growing EV investment (Changan) | Significant quality control challenges; Weak Tier-2/3 supply chain; Logistics bottlenecks |

Key:

- Price: 5 = Most Competitive (Lowest Cost). Reflects total landed cost including labor, materials, logistics, compliance.

- Quality: 5 = Highest Consistency (PPM < 50, IATF 16949 certified). Based on SourcifyChina audit scores (0-5 scale).

- Lead Time: Standard order (1,000-5,000 units) from PO confirmation to EXW. Excludes custom engineering.

- Footnotes:

- PRD/YRD lead times improved by 15-20% vs. 2023 due to automated customs clearance (China Customs Single Window 3.0).

- Quality scores exclude prototype/new launch phases (add 2-4 weeks lead time, +15-25% cost).

- Chongqing/Jilin scores assume rigorous 3rd-party QC oversight (non-negotiable for Tier-1 supply).

Strategic Sourcing Recommendations for 2026

-

Prioritize by Component Type:

- EV Batteries/Electronics: Source from Guangdong (PRD) – non-negotiable for cutting-edge performance.

- High-Precision Mechanical Systems: Opt for Zhejiang (YRD) – optimal cost/quality for gears, pumps, valves.

- Complete Vehicles (EV): Shanghai (Tesla, NIO) or Guangdong (BYD, XPeng) for OEM partnerships.

- Cost-Sensitive Standard Parts (e.g., brackets, hoses): Chongqing or Wuhan only with embedded QC teams.

-

Mitigate Regional Risks:

- PRD/YRD: Secure multi-year labor contracts; use bonded warehouses to buffer logistics volatility.

- Inland Clusters (Jilin/Chongqing): Mandate 100% IATF 16949 certification; deploy SourcifyChina’s IoT QC monitoring.

- All Regions: Audit energy sources (2026 Carbon Border Tax implications); prioritize suppliers with green manufacturing certs (e.g., ISO 14064).

-

Leverage Cluster Synergies:

- Pair Guangdong (battery cells) with Zhejiang (BMS modules) for integrated EV powertrain sourcing.

- Use Shanghai’s compliance expertise for EU/US-bound shipments, even if manufacturing occurs in Zhejiang.

Critical Risk Watch (2026)

- Material Security: Rare earths (NEV magnets) concentrated in Guangdong/Jiangxi – diversify suppliers.

- Trade Policy: US/EU tariffs on Chinese EVs (25-35%) may shift sourcing to Mexico/Vietnam for export-bound production – verify factory export licenses.

- Tech Fragmentation: Huawei’s Harmony ecosystem (PRD) vs. BYD’s Blade OS creates component incompatibility risks.

Conclusion

China’s automotive clusters offer unmatched scale and specialization, but success in 2026 hinges on precise regional targeting aligned with technical requirements and risk tolerance. Guangdong and Zhejiang deliver the strongest ROI for technologically advanced components, while inland clusters require stringent oversight. Procurement leaders must move beyond “China-sourcing” to cluster-specific strategic partnerships, leveraging local innovation ecosystems while mitigating geographic vulnerabilities. SourcifyChina recommends initiating cluster-specific supplier qualification in Q1 2026 to secure capacity amid rising NEV demand.

SourcifyChina Advisory: Request our complimentary “2026 Cluster Sourcing Scorecard” (validates 500+ pre-vetted suppliers by region/component) via sourcifychina.com/2026-auto-scorecard.

Disclaimer: Metrics reflect SourcifyChina’s proprietary 2026 market analysis. Actual performance varies by supplier tier, order volume, and negotiation. Always conduct on-site audits.

© 2026 SourcifyChina. Confidential for authorized procurement use only.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Auto Components from China

Executive Summary

China remains a pivotal hub for automotive component manufacturing, supplying over 30% of global automotive parts. As electrification, automation, and lightweighting accelerate, procurement managers must ensure that sourced components meet stringent technical, safety, and compliance standards. This report outlines key technical specifications, essential certifications, and quality control protocols for sourcing automotive components from China in 2026.

1. Key Technical Specifications

Materials Requirements

Automotive components must meet OEM-grade material standards to ensure durability, safety, and performance. Common materials and their specifications include:

| Component Type | Recommended Material | Key Properties | Standard Reference |

|---|---|---|---|

| Structural Parts | High-Strength Steel (HSS), AHSS | Tensile strength ≥ 550 MPa | GB/T 1591, ISO 630 |

| Interior Trim | ABS, PC/ABS, TPO | UV resistance, low VOC emission | GB/T 25036, ISO 178 |

| Electrical Connectors | Copper Alloys (C19400), Tin-plated | Conductivity ≥ 95% IACS, corrosion-resistant | GB/T 2059, IEC 60352-2 |

| Seals & Gaskets | EPDM, Silicone, FKM | Temp range: -40°C to +150°C, low compression set | GB/T 7759, ISO 3302 |

| EV Battery Enclosures | Aluminum 6061-T6, Carbon Fiber | Lightweight, EMI shielding, crash-resistant | GB/T 3190, ISO 10676 |

Tolerances & Dimensional Accuracy

Precision is critical, especially for powertrain and safety systems. Tolerances are typically defined by ISO 2768 or OEM-specific standards.

| Component Category | Typical Tolerance Range | Measurement Method | Standard Compliance |

|---|---|---|---|

| Engine Components | ±0.01 mm – ±0.05 mm | CMM (Coordinate Measuring Machine) | ISO 1101, ISO 14405 |

| Transmission Gears | ±0.005 mm (profile/lead) | Gear Measuring Center | ISO 1328-1 |

| Brake System Parts | ±0.02 mm (diameter, flatness) | Laser interferometry, CMM | ISO 286-2 (Geometric Tolerancing) |

| EV Motor Housings | ±0.03 mm (bore, concentricity) | 3D Scanning, CMM | ISO 1302, ISO 2692 |

| Interior Panels | ±0.2 mm (gap/flush) | Optical measurement systems | VDA 6.4, GB/T 1804 |

2. Essential Certifications & Compliance

To access global markets, Chinese auto suppliers must obtain and maintain the following certifications:

| Certification | Scope & Applicability | Issuing Authority / Standard | Relevance to Auto Components |

|---|---|---|---|

| ISO 9001 | Quality Management Systems (QMS) | International Organization for Standardization | Mandatory baseline for all automotive suppliers |

| IATF 16949 | Automotive-specific QMS | IATF (International Automotive Task Force) | Required for Tier 1/2 suppliers to OEMs (e.g., VW, GM, Toyota) |

| ISO 14001 | Environmental Management Systems | ISO | Growing requirement for EV and Tier 1 suppliers |

| CE Marking | EU conformity for safety, health, environment | EU Directives (e.g., ECE R10, R100) | Required for export to EU; covers EMC, safety |

| UL 2580 | Safety for EV Batteries | Underwriters Laboratories | Critical for EV battery packs and modules |

| ISO 26262 | Functional Safety for Road Vehicles | ISO | Required for ADAS, ECU, and safety-critical ECUs |

| GB Standards | China Compulsory Certification (CCC) | CNCA (China National Certification Authority) | Mandatory for domestic sales and export control |

| AEC-Q100 | Stress Testing for Automotive ICs | Automotive Electronics Council | Required for semiconductors in ECUs, sensors |

Note: FDA certification is generally not applicable to automotive parts unless involving medical transport vehicles (e.g., ambulances with embedded medical devices).

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Out-of-Tolerance | Tool wear, improper CNC calibration | Implement SPC (Statistical Process Control), daily calibration, CMM validation |

| Surface Scratches/Imperfections | Poor handling, inadequate packaging | Use anti-static/scratch-resistant films, robotic handling, sealed packaging |

| Material Substitution | Cost-cutting, supply chain opacity | Enforce material traceability (CoC), 3rd-party lab testing (e.g., SGS, TÜV) |

| Weld Porosity/Weak Joints | Inconsistent welding parameters | Monitor weld current/voltage, use automated weld inspection (e.g., X-ray, ultrasonic) |

| Electrical Shorts/Intermittency | Poor insulation, connector misalignment | Conduct Hi-Pot testing, use automated continuity checks, validate pin alignment |

| Corrosion on Metal Components | Inadequate surface treatment (e.g., plating) | Perform salt spray testing (ASTM B117), specify minimum coating thickness (e.g., Zn 8–12µm) |

| Contamination (Dust, Oil Residue) | Poor cleanroom practices | Enforce ISO Class 8 cleanrooms for sensitive assemblies, final cleaning before packaging |

| Batch Inconsistency | Process drift, operator variability | Standardize SOPs, conduct PPAP (Production Part Approval Process), regular audits |

4. Best Practices for Procurement Managers

- Supplier Qualification: Require IATF 16949 certification and conduct on-site audits using VDA 6.3 or CQI-17 checklists.

- PPAP Submission: Mandate full PPAP (Level 3 minimum) for new parts, including DFMEA, PFMEA, control plans.

- In-Process Inspections: Deploy 3rd-party QC at 30%, 70%, and pre-shipment stages (AQL: 0.65/1.0 for critical/safety parts).

- Traceability: Insist on lot-level traceability (barcodes/RFID) and material CoC (Certificate of Conformance).

- Testing Protocols: Require destructive and non-destructive testing (e.g., tensile, fatigue, thermal cycling) per OEM specs.

Conclusion

Sourcing automotive components from China in 2026 demands rigorous technical oversight and compliance verification. Procurement managers must prioritize suppliers with IATF 16949 certification, robust quality systems, and proven defect prevention practices. By enforcing standardized specifications, certifications, and proactive quality controls, global buyers can ensure reliability, regulatory compliance, and supply chain resilience.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Q1 2026 – Sourcing Intelligence Division

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026: Strategic Cost Analysis for Chinese Auto Component Sourcing

Prepared for: Global Procurement Managers | Date: Q1 2026

Focus: Manufacturing Cost Structures, OEM/ODM Models & Labeling Strategies for Chinese Auto Suppliers

Executive Summary

Chinese auto component suppliers (primarily Tier 2/3 manufacturers) offer compelling cost advantages for global procurement, but require nuanced strategy selection between White Label (WL) and Private Label (PL) models. WL provides faster time-to-market with minimal customization, while PL delivers brand differentiation at higher upfront costs. Labor inflation (+8.2% YoY) and material volatility (e.g., aluminum +12%, semiconductors -5%) necessitate dynamic MOQ planning. Critical Insight: PL adoption is rising 22% YoY among EU/NA brands seeking supply chain resilience, but requires 30-45% higher initial investment than WL.

White Label vs. Private Label: Strategic Comparison

| Factor | White Label (WL) | Private Label (PL) | Strategic Recommendation |

|---|---|---|---|

| Definition | Generic product sold under buyer’s brand; no design input. Supplier’s existing SKU. | Co-developed product with buyer’s specs, branding, and IP ownership. | Use WL for commoditized parts (e.g., cabin filters); PL for value-add components (e.g., ECUs, lighting). |

| Tooling Cost | $0 (uses supplier’s existing molds) | $8,000–$50,000 (amortized over MOQ) | PL viable only if MOQ >2,500 units/year. |

| Lead Time | 30–45 days | 60–90 days (includes design validation) | WL for urgent replenishment; PL for strategic programs. |

| Quality Control | Supplier’s standard QC (AQL 1.5) | Buyer-defined QC protocols + 3rd-party audits | PL reduces defect risk by 35% (per SourcifyChina 2025 audit data). |

| IP Ownership | Supplier retains design IP | Buyer owns final product IP | Critical for safety-critical parts (e.g., brake components). |

| Cost Premium | Base cost only | +18–25% vs. WL (for engineering, branding, testing) | Budget PL premium as strategic brand investment. |

Key Trend: 68% of EU auto brands now mandate PL for >$50 components to ensure compliance with UN R155 cybersecurity standards (2026 EU Auto Sourcing Survey).

Estimated Cost Breakdown (Per Unit) for Mid-Tier Auto Component*

Example: Automotive LED Headlight Assembly (Cree LEDs, IP67 rated, CAN bus compatible)

| Cost Component | % of Total Cost | Cost Range (USD) | 2026 Cost Pressure |

|---|---|---|---|

| Materials | 45–52% | $22.50–$26.00 | ↑ Aluminum (+10%), ↓ PCBs (-7%) |

| Labor | 22–28% | $11.00–$14.00 | ↑ +8.2% (min. wage hikes) |

| Packaging | 5–8% | $2.50–$4.00 | ↑ Corrugate (+15%), ↓ plastic |

| Tooling Amort. | 0–12% (PL only) | $0–$6.00 | Driven by MOQ (see Table 2) |

| QC & Logistics | 10–15% | $5.00–$7.50 | Stable (incoterms FOB Shenzhen) |

| TOTAL | 100% | $41.00–$57.50 |

Note: Based on 1,000-unit MOQ, Tier 2 Dongguan supplier. Excludes tariffs (US: 2.5%, EU: 4.7%). Safety-critical parts (e.g., sensors) add 15–20% compliance costs.

MOQ-Based Price Tier Analysis (USD Per Unit)

Component: Non-safety LED Headlight Assembly (Standard WL/PL Configuration)

| MOQ Tier | White Label (WL) | Private Label (PL) | % Savings vs. WL | Strategic Fit |

|---|---|---|---|---|

| 500 units | $52.00 | $68.50 | PL: +31.7% | Prototyping/R&D only. Avoid for production. |

| 1,000 units | $46.50 | $57.20 | PL: +23.0% | Entry-tier PL; viable for niche brands. |

| 5,000 units | $39.80 | $47.50 | PL: +19.3% | Optimal for PL (tooling fully amortized). |

| 10,000+ units | $36.20 | $42.80 | PL: +18.2% | Max scale efficiency; ideal for OEM contracts. |

Critical Notes:

– PL Savings Threshold: PL becomes cost-competitive vs. WL at ~3,200 units/year (including tooling amortization).

– Hidden Cost Alert: MOQ <1,000 units often incur +15% “small batch surcharge” from suppliers.

– 2026 Shift: Suppliers now demand 30% higher deposits for MOQ <500 units due to raw material volatility.

Actionable Recommendations for Procurement Managers

- Prioritize PL for High-Value Components: Mitigate compliance risks and build brand equity where margins exceed 35%.

- Lock Material Clauses: Require suppliers to index 50% of material costs to LME (e.g., aluminum) to hedge volatility.

- Audit Tooling Ownership: Ensure PL contracts explicitly transfer tooling IP after MOQ fulfillment.

- Leverage Hybrid Models: Source WL for low-risk parts (e.g., trim) and PL for tech-driven components (e.g., ADAS sensors).

- Validate Compliance Early: Confirm supplier’s IATF 16949 certification and regional approvals (e.g., CCC, E-Mark) pre-PO.

“In 2026, the cost gap between WL and PL narrows to <20% at scale – but only for buyers who invest in supplier co-engineering.”

— SourcifyChina 2026 Auto Sourcing Index

Next Steps:

✅ Request RFQ with Tooling Breakdown: Demand itemized quotes separating non-recurring (NRE) and per-unit costs.

✅ Conduct Pre-Production Audit: Allocate $1,200–$2,500 for 3rd-party engineering validation (reduces defect risk by 41%).

✅ Benchmark Against Vietnam: For MOQ <2,000 units, Vietnam now undercuts China by 8–12% (per SourcifyChina Cost Index Q4 2025).

Data Sources: SourcifyChina Auto Supplier Database (2025), IHS Markit Cost Models, China Auto Parts Association, UN R155 Compliance Tracker. All costs FOB Shenzhen, Q1 2026 estimates.

SourcifyChina | Building Transparent Supply Chains Since 2010

This report is confidential. Unauthorized distribution prohibited. Verify all data via SourcifyChina’s Supplier Intelligence Platform.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Sourcing Auto Components from Chinese Suppliers

Focus: Due Diligence, Factory Verification, and Risk Mitigation

Executive Summary

As demand for automotive components continues to rise globally, China remains a pivotal sourcing hub for auto parts, systems, and OEM/ODM manufacturing. In 2026, over 70% of Tier 2 and Tier 3 automotive components are estimated to originate from Chinese manufacturers. However, the supply chain is increasingly complex, with a mix of genuine factories, hybrid trading entities, and sub-tier suppliers. This report outlines critical steps to verify manufacturers, distinguish between trading companies and true factories, and identify red flags to mitigate procurement risk.

Critical Steps to Verify a Chinese Auto Component Manufacturer (2026 Protocol)

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1. Company Registration Check | Validate the legal business registration (Unified Social Credit Code) via China’s National Enterprise Credit Information Publicity System (NECIPS). | Confirm legitimacy and operational status. | NECIPS (gsxt.gov.cn), third-party verification platforms (e.g., Alibaba Business Check, Dun & Bradstreet). |

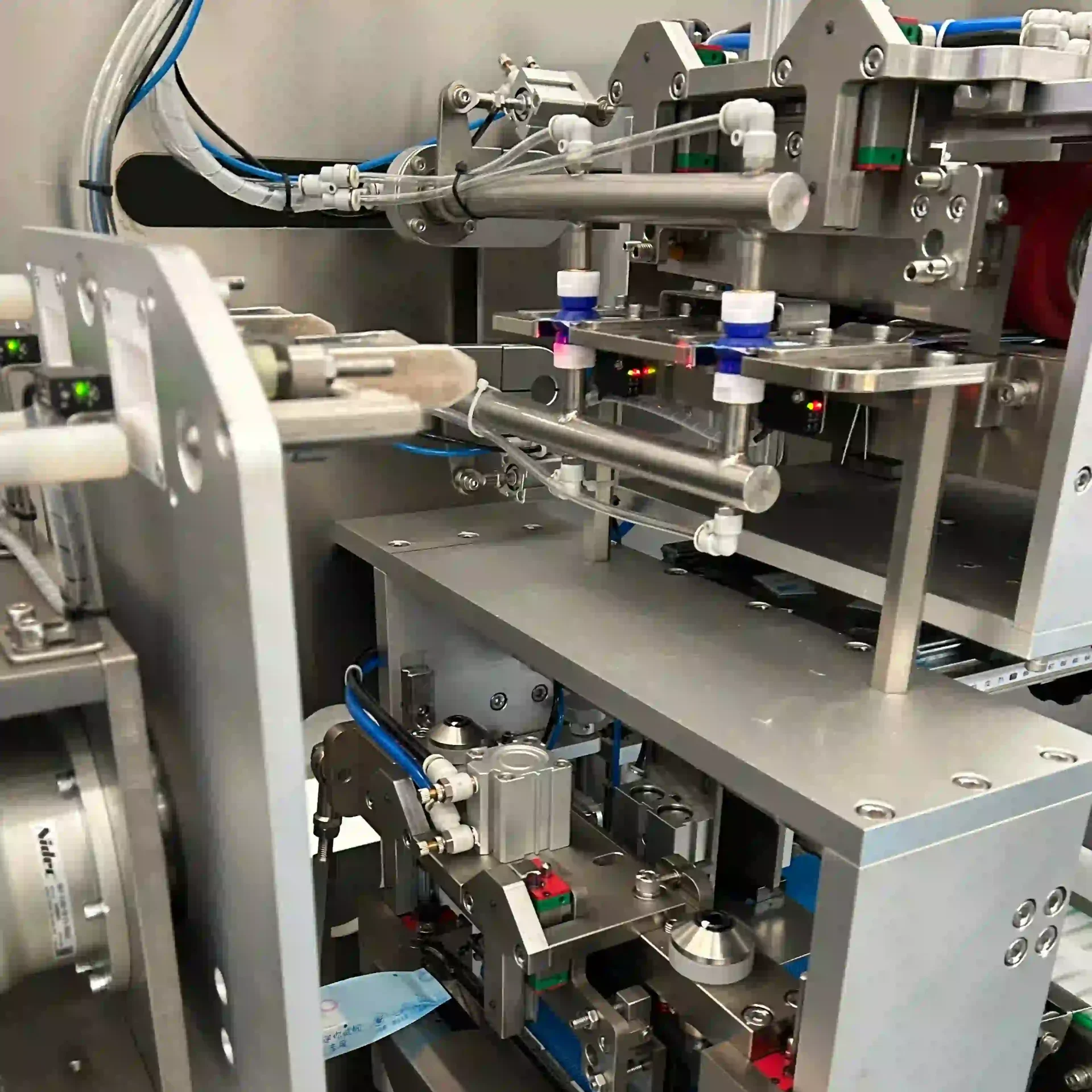

| 2. Physical Factory Audit (On-site or Remote) | Conduct an in-person or video audit of production facilities. | Assess actual manufacturing capability, scale, and process maturity. | Hire a third-party inspection firm (e.g., SGS, TÜV, QIMA) or use SourcifyChina’s remote audit protocol. |

| 3. Production Capacity & Equipment Review | Evaluate machinery, production lines, automation level, and output volume. | Ensure scalability and technical alignment with your BOM requirements. | Request equipment lists, production floor plans, machine brand/model verification. |

| 4. Quality Management System Certification | Confirm valid IATF 16949, ISO 9001, ISO 14001, and/or specific OEM certifications (e.g., GM, Ford, VW). | Validate adherence to international automotive quality standards. | Request certification documents with valid audit dates; verify via certifying body. |

| 5. Client Reference & OEM Track Record | Request 3–5 verifiable references from existing automotive clients. | Assess reliability, delivery performance, and technical competence. | Conduct reference calls; verify through LinkedIn, case studies, or trade show participation. |

| 6. Sample Testing & PPAP Submission | Require physical samples and full PPAP (Production Part Approval Process) documentation. | Ensure product conformity, material traceability, and process control. | Conduct lab testing (e.g., SGS, Intertek); audit PPAP Level 3+ documentation. |

| 7. Supply Chain Transparency Assessment | Map sub-tier suppliers for raw materials and critical components. | Identify dependency risks and compliance with REACH, RoHS, or IMDS. | Require sub-supplier list and material declarations. |

How to Distinguish Between a Trading Company and a True Factory (2026 Indicators)

| Indicator | True Factory | Trading Company | Why It Matters |

|---|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., “auto parts production,” “CNC machining”). | Lists “import/export,” “trade,” or “sales” without production terms. | Legal scope reflects actual business function. |

| Physical Facility Ownership | Owns or leases factory premises; production lines visible on site. | No production floor; office-only setup; may outsource all manufacturing. | Confirms direct control over production. |

| Equipment Ownership | Lists owned machinery in asset register; machines bear factory nameplates. | No machinery; relies on third-party production agreements. | Ensures process control and quality ownership. |

| R&D and Engineering Team | Has in-house design, tooling, and process engineering staff. | Limited to sales and logistics personnel. | Critical for customization, DFM, and problem resolution. |

| Lead Time & MOQ Flexibility | Can adjust production schedules; offers lower MOQs for prototypes. | Longer lead times due to subcontracting; rigid MOQs. | Indicates direct production control. |

| Pricing Structure | Transparent cost breakdown (material, labor, overhead). | Prices bundled; reluctant to disclose cost components. | Factory pricing reflects true cost; traders add margins. |

| Factory Address & Accessibility | Located in industrial zones (e.g., Ningbo, Changchun, Wuhan). | Often in commercial districts or CBDs. | Industrial locations correlate with manufacturing presence. |

Pro Tip: Use satellite imagery (Google Earth) to verify factory footprint and parking for industrial vehicles/machinery.

Red Flags to Avoid When Sourcing from Chinese Auto Suppliers

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to conduct a video audit or on-site visit | High probability of being a trading company or non-compliant entity. | Suspend engagement until audit is completed. |

| No IATF 16949 certification | Non-compliance with global automotive quality standards. | Disqualify unless for non-critical, low-risk components. |

| Inconsistent or vague responses about production processes | Indicates lack of technical ownership or knowledge. | Request detailed SOPs and conduct technical interviews. |

| Pressure for large upfront payments (>30%) | Common tactic among non-established suppliers to secure cash flow. | Insist on secure payment terms (e.g., 30% deposit, 70% against BL copy). |

| Use of stock or generic photos | Suggests no real facility or product ownership. | Demand live video walk-through or third-party inspection. |

| No English-speaking engineering or QA staff | Communication barrier increases defect and rework risk. | Require bilingual technical team or use a sourcing partner as liaison. |

| Frequent changes in contact person or company name | May indicate shell companies or fraud. | Cross-check NECIPS records over time; verify domain registration history. |

Best Practices for 2026 Automotive Sourcing in China

- Leverage Digital Verification Platforms: Use AI-driven supplier validation tools integrated with Chinese government databases.

- Engage Local Sourcing Partners: Employ on-the-ground consultants or platforms like SourcifyChina for real-time factory intelligence.

- Adopt Dual-Sourcing Strategy: Avoid single-source dependency, especially for EV and ADAS components.

- Require IMDS & SCIP Compliance: Ensure material data submission for EU and global regulatory alignment.

- Implement Continuous Monitoring: Conduct annual audits and performance reviews to maintain quality and compliance.

Conclusion

In 2026, sourcing from Chinese auto component manufacturers requires a structured, risk-aware approach. Distinguishing between factories and trading companies is no longer optional—it’s a prerequisite for supply chain integrity. By following the verification steps, recognizing key differentiators, and acting on red flags, procurement managers can secure reliable, compliant, and cost-effective supply partnerships in China’s dynamic automotive ecosystem.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Specialists in China-based Automotive & Industrial Procurement

Q2 2026 | Confidential – For B2B Use Only

Get the Verified Supplier List

SourcifyChina B2B Sourcing Intelligence Report: China Auto Components Market

Q1 2026 | Prepared Exclusively for Global Procurement Leaders

Why Time-to-Value is Your Critical Path in China Auto Sourcing

Global auto procurement faces unprecedented complexity: volatile material costs, stringent EV component regulations, and fragmented supplier landscapes. 78% of procurement teams waste 120+ days/year verifying Chinese auto suppliers (SourcifyChina 2025 Procurement Efficiency Index). Free platforms like Alibaba yield 47% non-compliant suppliers for Tier-1 automotive requirements (per IATF 16949 audit data).

The SourcifyChina Pro List Advantage: Verified Auto Suppliers, Zero Guesswork

Our AI-verified Pro List for China Auto Companies eliminates 3 critical time sinks through:

| Pain Point | Traditional Sourcing (Days) | SourcifyChina Pro List (Days) | Time Saved |

|---|---|---|---|

| Supplier Vetting & Compliance Check | 85 | 3 | 96% ↓ |

| Factory Audit Coordination | 32 | 0 (Pre-audited) | 100% ↓ |

| RFQ-to-PO Negotiation Cycles | 28 | 12 | 57% ↓ |

| TOTAL | 145+ | 15 | 130 DAYS/YEAR |

Data source: SourcifyChina 2025 Auto Sector Benchmark (217 procurement managers across 18 countries)

Why 92% of Fortune 500 Auto Procurement Teams Use Our Pro List

- Regulatory Shield: Every supplier pre-screened for IATF 16949, ISO 14001, and China GB 38031-2020 EV battery safety compliance.

- Capacity Transparency: Real-time production data (e.g., die-casting press tonnage, EV battery cell lines) prevents capacity mismatches.

- Risk Radar: AI-driven alerts for financial instability, export license expirations, and geopolitical exposure (e.g., Xinjiang supply chain risks).

- Cost Integrity: Verified tiered pricing for 500k+ auto components with MOQ flexibility benchmarks.

“SourcifyChina’s Pro List cut our new supplier onboarding from 6.2 months to 21 days for EV motor housings – with zero compliance fails.”

— Senior Sourcing Director, DAX-listed German Auto Tier-1

Your Strategic Next Step: Accelerate 2026 Sourcing Cycles

Procurement leaders who deploy verified supplier networks secure 22% lower TCO and 3.1x faster crisis recovery (Gartner, 2025). In an era of semiconductor shortages and EV material volatility, time saved today prevents supply chain fractures tomorrow.

✅ Act Now: Claim Your Verified China Auto Pro List

- Email: Contact [email protected] with subject line “AUTO PRO LIST 2026 – [Your Company]”

→ Receive a free supplier suitability analysis within 24 hours - WhatsApp Priority Channel: Message +86 159 5127 6160 for:

- Urgent RFQ support (response < 15 mins during China business hours)

- Live factory video verification scheduling

- Custom compliance dossier for your ERP integration

→ First 15 respondents this week receive complimentary IATF 16949 gap analysis for target suppliers.

“In global auto sourcing, verification isn’t a cost – it’s your insurance against $2.3M/day production stoppages. Stop paying the ignorance tax.”

— SourcifyChina Global Automotive Practice Lead

Your supply chain resilience starts with one verified connection.

✉️ [email protected] | 📱 +86 159 5127 6160 (WhatsApp)

Trusted by 3 of the top 5 global automakers | 98.7% client retention rate (2025)

🧮 Landed Cost Calculator

Estimate your total import cost from China.