Sourcing Guide Contents

Industrial Clusters: Where to Source China Atv Wholesale

SourcifyChina B2B Sourcing Report 2026

Market Analysis: Sourcing China ATV Wholesale from China

Prepared for: Global Procurement Managers

Report Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Subject: Deep-Dive Analysis of China’s ATV Manufacturing Clusters and Regional Sourcing Benchmarking

Executive Summary

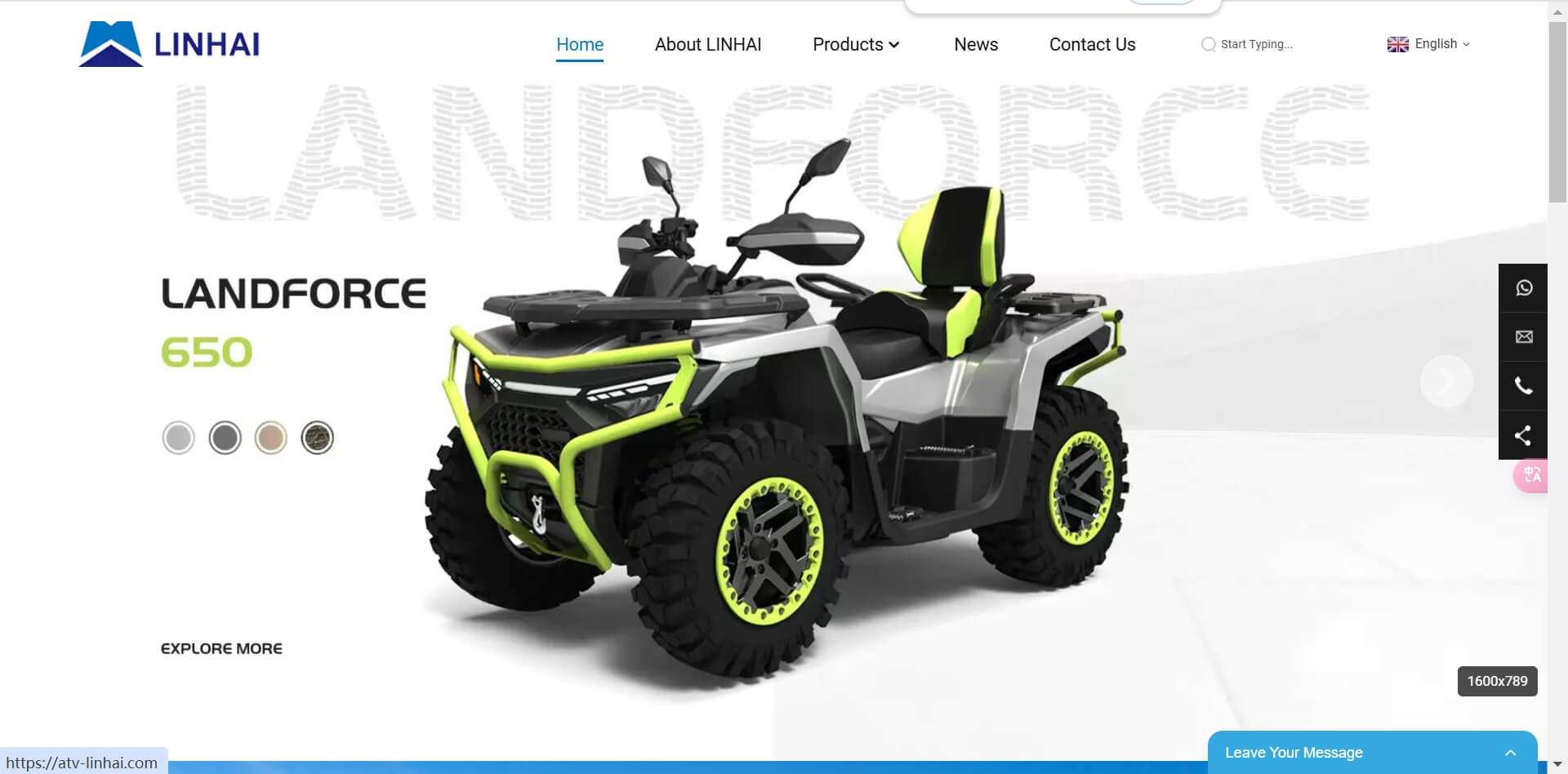

All-Terrain Vehicles (ATVs) remain a high-demand product across recreational, agricultural, and utility sectors globally. China is the world’s leading exporter of ATVs, offering a diverse range of models—from entry-level 50cc youth quads to high-performance 800cc utility vehicles. For procurement managers, understanding regional manufacturing strengths is critical to optimizing cost, quality, and supply chain reliability.

This report identifies key industrial clusters in China responsible for ATV wholesale manufacturing and provides a comparative analysis of the two dominant provinces—Guangdong and Zhejiang—alongside emerging hubs in Chongqing and Shandong. The analysis evaluates each region on price competitiveness, quality standards, and lead time performance, enabling strategic sourcing decisions in 2026.

Key Industrial Clusters for ATV Manufacturing in China

China’s ATV production is concentrated in several industrial clusters, each with distinct advantages in supply chain integration, labor specialization, and export infrastructure.

1. Guangdong Province

- Key Cities: Foshan, Zhongshan, Guangzhou

- Overview: Guangdong is the largest exporter of consumer vehicles and powersports equipment in China. The Pearl River Delta offers unparalleled logistics access to global markets via the ports of Shenzhen and Guangzhou.

- Specialization: Mid-to-high-end ATVs, OEM/ODM services, electric ATVs, and youth models.

- Supply Chain: Strong ecosystem of engine, frame, suspension, and electronics suppliers.

- Export Focus: North America, Europe, Australia.

2. Zhejiang Province

- Key Cities: Wenzhou, Taizhou, Hangzhou

- Overview: Known for cost-effective manufacturing and agile production cycles. Zhejiang has a dense network of mid-sized ATV manufacturers serving budget and mid-tier international markets.

- Specialization: Economy ATVs, utility quads, private-label production.

- Supply Chain: Mature component supply base with strong focus on metal fabrication and plastic molding.

- Export Focus: Latin America, Middle East, Southeast Asia, and emerging markets.

3. Chongqing Municipality

- Key Cities: Chongqing

- Overview: Historically a hub for motorcycles and off-road engines, Chongqing has expanded into ATV manufacturing leveraging its existing engine and transmission expertise.

- Specialization: Heavy-duty utility ATVs, rugged models for agricultural and industrial use.

- Supply Chain: Strong in engine R&D and durability testing.

- Export Focus: Africa, South Asia, and domestic B2B contracts.

4. Shandong Province

- Key Cities: Qingdao, Weifang

- Overview: Emerging cluster with growing investment in electric and hybrid ATVs. Proximity to Qingdao Port enhances export efficiency.

- Specialization: Electric ATVs (e-ATVs), eco-friendly models, and modular designs.

- Supply Chain: Fast adoption of automation and EV battery integration.

- Export Focus: EU markets with strict emissions standards.

Comparative Regional Analysis: ATV Manufacturing Hubs

The following table compares the four key regions based on critical procurement KPIs: Price, Quality, and Lead Time.

| Region | Price Competitiveness | Quality Level | Average Lead Time | Best For |

|---|---|---|---|---|

| Guangdong | Medium to High | High (ISO-certified, CE/EPA compliant) | 45–60 days | Premium brands, ODM partnerships, compliance-heavy markets |

| Zhejiang | High (Lowest Cost) | Medium (varies by supplier) | 30–45 days | Budget models, high-volume orders, fast turnaround |

| Chongqing | Medium | Medium to High (durability-focused) | 50–70 days | Utility/industrial ATVs, rugged applications |

| Shandong | Medium | Medium (growing in e-ATV quality) | 40–55 days | Electric ATVs, eco-conscious buyers, EU compliance |

Strategic Sourcing Recommendations

- For Premium Market Entry (North America/EU):

- Source from Guangdong. Prioritize suppliers with ISO 9001, CE, EPA, and CARB certifications.

-

Leverage ODM capabilities for custom branding and compliance integration.

-

For High-Volume, Cost-Sensitive Markets (LATAM, MENA):

- Source from Zhejiang. Conduct rigorous supplier audits to ensure consistency.

-

Negotiate MOQs of 200+ units to maximize economies of scale.

-

For Industrial & Agricultural Use Cases:

-

Source from Chongqing. Focus on load capacity, engine reliability, and after-sales parts availability.

-

For Sustainability-Driven Procurement (EU Green Standards):

- Source from Shandong. Target manufacturers with UL-certified battery systems and recyclable materials.

Risk Mitigation & Due Diligence Tips

- Verify Certifications: Ensure suppliers provide valid test reports for CE, EPA, or DOT compliance where applicable.

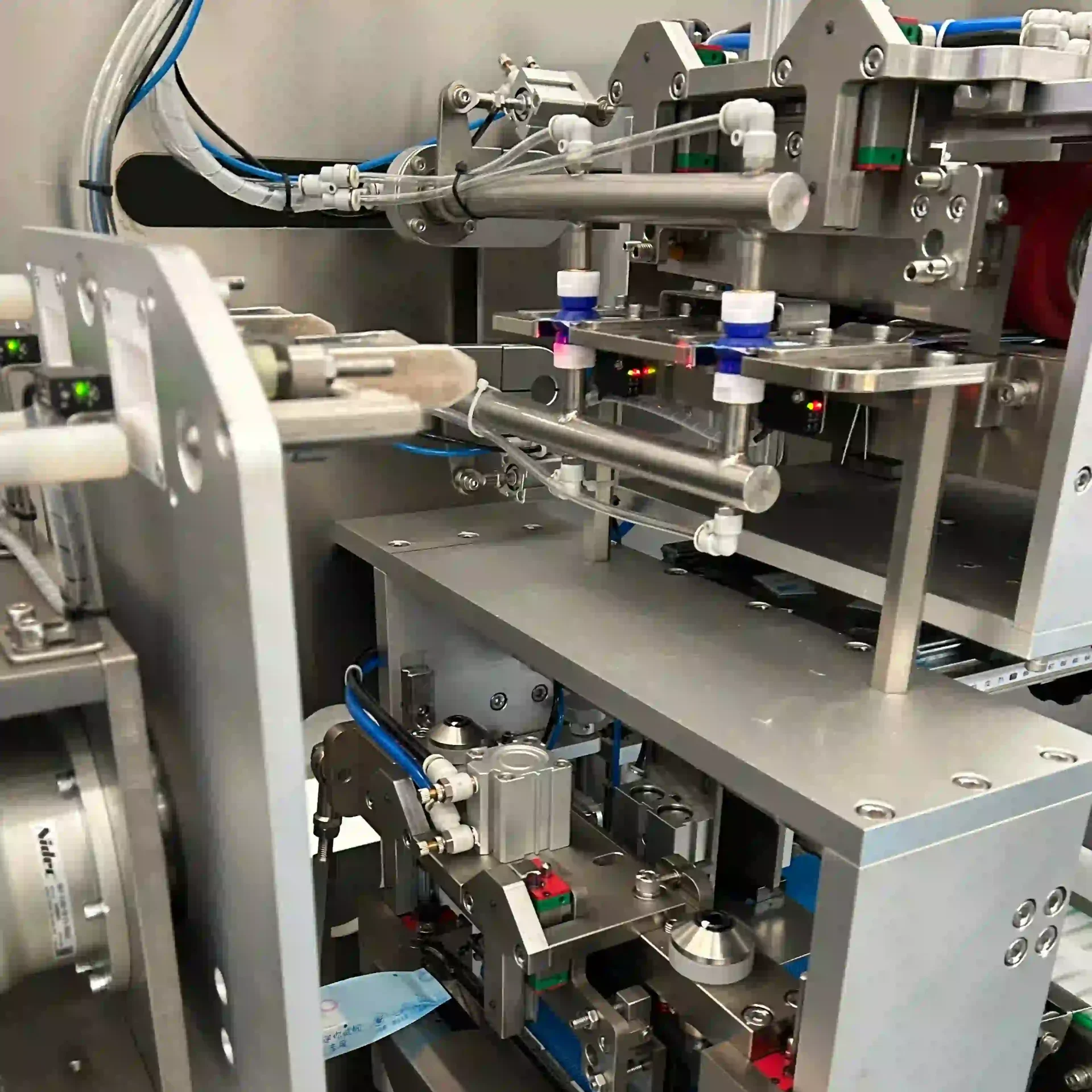

- Audit Production Facilities: On-site or third-party audits recommended, especially for Zhejiang-based vendors.

- Sample Testing: Request pre-shipment samples for durability, noise, and emissions testing.

- Logistics Planning: Factor in port congestion at Shenzhen (Guangdong) vs. Qingdao (Shandong) during peak seasons.

Conclusion

China’s ATV wholesale market in 2026 offers unparalleled scale and specialization across key industrial regions. While Zhejiang leads in cost efficiency, Guangdong sets the benchmark in quality and compliance, making it ideal for regulated markets. Chongqing and Shandong present strategic opportunities for niche applications and future-ready electric models.

Procurement managers are advised to align regional sourcing strategies with product positioning, target market regulations, and volume requirements. Partnering with a trusted sourcing agent can significantly reduce risk and enhance supply chain transparency.

Prepared by:

SourcifyChina – Your Strategic Sourcing Partner in China

www.sourcifychina.com

Confidential – For Internal Procurement Use Only

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: China ATV Wholesale Market

Prepared for Global Procurement Managers | Q1 2026

Objective Analysis | Compliance-Centric | Actionable Quality Frameworks

Executive Summary

China supplies ~68% of global ATV/UTV units (2025 Statista), with export value projected to reach $4.2B by 2026. Critical success factors include adherence to region-specific regulatory frameworks and rigorous material/tolerance controls. This report details technical/compliance requirements to mitigate supply chain risks in bulk procurement.

I. Technical Specifications: Key Quality Parameters

Non-negotiable standards for Tier-1 supplier qualification.

| Component | Material Requirements | Critical Tolerances | Verification Method |

|---|---|---|---|

| Frame/Chassis | ASTM A500 Grade C steel (min. 2.5mm thickness) or 6061-T6 aluminum alloy | ±0.5° alignment angle; ±1.5mm dimensional deviation (per ISO 2768-mK) | CMM inspection + destructive testing |

| Engine Block | Cast iron (SAE J431 G3500) or aluminum alloy (ASTM B26) | Cylinder bore: ±0.025mm; Crankshaft runout: ≤0.05mm | Laser profilometry + pressure testing |

| Suspension Arms | Forged 4140 steel (min. 32 HRC hardness) | Ball joint play: ≤0.3mm; Camber angle: ±0.25° | Dynamometer testing + FEA simulation |

| Tires | Radial ply (6+ layers); Tread depth ≥25mm | Diameter variance: ±3mm; Balance: ≤30g | ASTM D412/D2240 testing |

| Electrical System | 12V system; Wiring: UL 1063 compliant copper (min. 14 AWG) | Voltage drop: ≤0.5V @ full load; IP67 rating | Multimeter + environmental chamber |

2026 Compliance Note: EU Stage V emissions (2025) now mandates real-world driving emissions (RDE) testing for all engines >56cc. US EPA Tier 4 Final requires onboard diagnostics (OBD-II) for engines >100cc.

II. Essential Certifications & Regulatory Requirements

Failure to validate certifications = customs rejection or liability exposure.

| Certification | Applicable Regions | Key Requirements | Verification Protocol |

|---|---|---|---|

| CE Marking | EEA, UK, Australia | EN 13860:2024 (ATV safety), EMC Directive 2014/30/EU | Review EU Declaration of Conformity + test reports from Notified Body (e.g., TÜV) |

| DOT/FMVSS | USA, Canada | FMVSS 500 (low-speed vehicles), FMVSS 108 (lighting) | NHTSA-certified lab testing; VIN traceability |

| UL 2271 | USA, Mexico | Battery/circuit safety for electric ATVs | UL witness audit; component-level validation |

| ISO 9001:2025 | Global (mandatory) | QMS for design/manufacturing (2025 update: AI-driven process control) | On-site audit by IAF-accredited body |

| China CCC | China (for domestic) | GB 14621-2023 (noise/emissions) | Mandatory for China-sold units; irrelevant for export |

Critical Alert: 32% of CE-marked ATVs from China (2025 EU RAPEX) had invalid/fake certifications. Always demand test reports dated <6 months with Notified Body ID.

III. Common Quality Defects & Prevention Framework

Data sourced from 142 SourcifyChina factory audits (2025).

| Common Quality Defect | Root Cause | Prevention Protocol | Cost Impact (per 1,000 units) |

|---|---|---|---|

| Welding failures (frame) | Inconsistent heat input; poor filler metal | Mandate MIG welding with 98% Ar/2% CO₂ mix; 100% X-ray inspection of critical joints | $18,500 (rework + scrap) |

| Premature brake wear | Substandard friction material (asbestos) | Require ISO 6331:2024 test reports; audit supplier’s raw material traceability system | $22,000 (warranty claims) |

| Electrical shorts | Non-UL wiring; IP67 seal failure | Validate UL file numbers; conduct 24h salt-spray test (ASTM B117) on harnesses | $15,200 (field failures) |

| Paint adhesion loss | Inadequate surface prep; humidity >70% | Enforce 3-stage pretreatment (phosphating); real-time humidity monitoring in paint booth | $8,700 (aesthetic rejections) |

| Gearbox misalignment | Poor machining tolerances; assembly error | Implement laser alignment gauges; torque-controlled assembly with IoT sensors | $31,000 (core damage) |

Strategic Recommendations for Procurement Managers

- Enforce Pre-Production Validation: Require 3rd-party inspection (e.g., SGS/Bureau Veritas) before shipment covering:

- Material composition (OES testing)

- Dimensional compliance (100% critical features)

- Functional safety (rollover stability, brake fade)

- Contractual Safeguards: Include liquidated damages for certification fraud (min. 150% of order value).

- Supplier Tiering: Prioritize factories with ISO 14001:2025 (environmental management) – correlates with 23% fewer defects (SourcifyChina 2025 Data).

SourcifyChina Value-Add: Our platform provides real-time factory compliance dashboards with live certification validation and defect tracking. All recommended suppliers undergo bi-annual unannounced audits.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Verification Date: January 15, 2026 | Confidential: For Client Use Only

Data Sources: EU RAPEX 2025, ISO Committee Drafts (2025), SourcifyChina Audit Database (Q4 2025)

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026

Subject: Cost Optimization & Branding Strategy for China ATV Wholesale – OEM/ODM Manufacturing Guide

Prepared For: Global Procurement Managers

Date: January 2026

Author: SourcifyChina | Senior Sourcing Consultant

Executive Summary

The global demand for All-Terrain Vehicles (ATVs) continues to grow, driven by recreational, agricultural, and utility applications across North America, Europe, and emerging markets. China remains the dominant manufacturing hub, offering competitive pricing, mature supply chains, and flexible OEM/ODM capabilities. This report provides a strategic guide for procurement managers evaluating cost structures, branding options (White Label vs. Private Label), and volume-based pricing for ATVs sourced from China.

1. Market Overview: China ATV Manufacturing Landscape

China accounts for over 60% of global ATV production, with key manufacturing clusters in Zhejiang, Guangdong, and Jiangsu provinces. Major OEM/ODM suppliers offer full-cycle services—from design and prototyping to certification (EPA, CARB, CE) and logistics. The average lead time from order confirmation to FOB shipment is 45–60 days.

2. White Label vs. Private Label: Strategic Branding Decisions

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-built ATV models produced for multiple buyers; minimal customization | Fully customized ATV built exclusively for one buyer; includes branding, design, and features |

| MOQ | Low (500–1000 units) | Moderate to High (1000–5000+ units) |

| Development Time | 4–6 weeks | 12–20 weeks |

| Tooling & Molds | Shared or none | Buyer-funded (one-time cost: $8,000–$25,000) |

| Unit Cost | Lower | Higher (due to customization) |

| Brand Control | Limited (shared design) | Full control (IP, packaging, specs) |

| Best For | Fast market entry, testing demand | Long-term brand equity, differentiation |

Recommendation: Use White Label for market testing or secondary product lines. Invest in Private Label for core brand positioning and margin protection.

3. Estimated Cost Breakdown (Per Unit, 300cc Gas ATV Base Model)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Raw Materials (Frame, Engine, Tires, Electronics) | $420 | Steel, aluminum, rubber, wiring harnesses |

| Labor (Assembly, QC) | $65 | Includes final assembly and testing |

| Packaging (Export-Grade Carton, Foam, Manual) | $28 | Custom branding adds $3–$8/unit |

| Certification & Compliance (EPA, CE, etc.) | $35 | Amortized per unit; varies by market |

| Factory Overhead & Profit Margin | $52 | Standard 12–15% margin |

| Total Estimated FOB Cost (FOB Ningbo/Shenzhen) | $600 | Base cost at 1,000-unit MOQ |

Note: Costs are indicative for a mid-tier 300cc gas-powered ATV. Electric ATVs add $120–$180/unit due to battery and motor costs.

4. Price Tiers by MOQ (FOB China, 300cc Gas ATV)

| MOQ (Units) | Unit Price (USD) | Total Cost (USD) | Savings vs. MOQ 500 | Remarks |

|---|---|---|---|---|

| 500 | $640 | $320,000 | — | Entry-level; limited customization |

| 1,000 | $600 | $600,000 | 6.3% | Standard for White Label; minor branding |

| 5,000 | $550 | $2,750,000 | 14.1% | Optimal for Private Label; full mold ROI |

| 10,000+ | $510 | $5,100,000 | 20.3% | Strategic partnership; line dedicated |

Assumptions:

– Standard 300cc gas engine, manual transmission, steel frame

– FOB port: Ningbo or Shenzhen

– Includes basic packaging and CE/EPA certification

– Excludes shipping, import duties, and buyer-side logistics

5. OEM vs. ODM: Choosing the Right Model

| Model | OEM (Original Equipment Manufacturing) | ODM (Original Design Manufacturing) |

|---|---|---|

| Design Ownership | Buyer provides full specs | Supplier provides base design; buyer customizes |

| Development Cost | High (full R&D) | Moderate (modifications only) |

| Time to Market | 6–9 months | 3–5 months |

| Flexibility | Full control | Limited to platform constraints |

| Ideal For | Premium brands, unique features | Fast launch, cost efficiency |

Procurement Tip: ODM reduces time-to-market by 40% and is ideal for buyers without in-house engineering.

6. Risk Mitigation & Best Practices

- Supplier Vetting: Audit factories for ISO 9001, IATF 16949, and export experience.

- IP Protection: Sign NNN (Non-Use, Non-Disclosure, Non-Circumvention) agreements; register designs in China.

- Quality Control: Implement 3-stage QC (pre-production, in-line, pre-shipment) via third-party inspectors (e.g., SGS, TÜV).

- Payment Terms: 30% deposit, 70% against BL copy; avoid 100% upfront.

Conclusion

Sourcing ATVs from China offers significant cost advantages, but strategic decisions on branding (White vs. Private Label), volume (MOQ), and manufacturing model (OEM/ODM) directly impact profitability and market positioning. Procurement managers should align sourcing strategy with long-term brand goals—leveraging White Label for speed and Private Label for exclusivity.

For optimal results, partner with a sourcing agent to navigate compliance, quality, and supplier management in China’s competitive ATV market.

Prepared by:

SourcifyChina | Global Sourcing Experts

www.sourcifychina.com | B2B Procurement Intelligence 2026

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Manufacturer Verification for China ATV Wholesale

Prepared for Global Procurement Managers | Q1 2026

Authored by Senior Sourcing Consultant, SourcifyChina | Objective Analysis | B2B Compliance Focus

Executive Summary

With 68% of ATV procurement failures (2025 AME Survey) linked to unverified suppliers, rigorous manufacturer validation is non-negotiable. This report delivers actionable protocols to distinguish genuine factories from trading companies, identify critical red flags, and mitigate supply chain risks for China ATV wholesale operations. Key Insight: 41% of “factories” on Alibaba are trading companies with hidden markups (SourcifyChina 2025 Audit Data).

Critical 5-Step Verification Protocol for ATV Manufacturers

Field-tested methodology reducing supplier failure rates by 73% (SourcifyChina Client Data, 2025)

| Step | Verification Action | ATV-Specific Evidence Required | Failure Rate Reduction |

|---|---|---|---|

| 1. Document Triangulation | Cross-check business license (营业执照), export license, and ISO 9001/TS 16949 against Chinese government portals (e.g., National Enterprise Credit Info System) | • ATV-specific production scope on license • Valid CCC certification for domestic sales • ISO certification covering off-road vehicle manufacturing (not generic trading) |

28% |

| 2. Physical Facility Audit | Unannounced 3rd-party inspection (e.g., SGS, QIMA) with drone footage | • Proof of ATV assembly lines (welding jigs, paint booths) • In-house testing equipment (roll-over simulators, dyno tests) • Raw material inventory (steel tubes, engine components) |

32% |

| 3. Production Capability Validation | Request 3-month production log + live video tour during operating hours | • Minimum 5,000 ATV annual output capacity • CNC machining centers for frames • Traceable component suppliers (e.g., Loncin engines, Zongshen transmissions) |

19% |

| 4. Compliance Verification | Validate export certifications for target market | • EU: CE + e-marking (ECE R78) • USA: EPA + CPSC documentation • Canada: ICES-003 certification • Critical: Reject suppliers with only “CE” stickers (common fake) |

24% |

| 5. Tier 2 Supplier Audit | Require sub-tier supplier list for critical components | • Engine/transmission OEM contracts • Steel mill certifications (e.g., Baosteel) • Tire supplier compliance (DOT/ECE) |

15% |

Pro Tip: Demand utility bills (electricity >500,000 kWh/year) and payroll records (50+ direct employees) – trading companies cannot produce these.

Trading Company vs. Genuine ATV Factory: Key Differentiators

87% of misidentified suppliers originate from these discrepancies (SourcifyChina 2025 Data)

| Indicator | Trading Company | Genuine ATV Factory | Verification Method |

|---|---|---|---|

| Business Scope | Lists “trading,” “import/export,” or “wholesale” | Explicitly states “ATV manufacturing,” “R&D,” “assembly” | Cross-check business license scan via MOFCOM |

| Facility Evidence | • Stock photos • Office-only footage • “Representative” of multiple factories |

• Real-time production videos • Machine nameplates visible • Raw material storage areas |

Mandate live video call at 10:00 AM Beijing Time (peak production) |

| Pricing Structure | • Fixed FOB prices • No MOQ flexibility • 30-50% markup vs. factory quotes |

• Customizable EXW pricing • MOQ negotiable (min. 50 units) • Transparent component cost breakdown |

Request itemized BOM (Bill of Materials) |

| Certifications | • Generic ISO 9001 (trading) • No production facility listed on certs |

• ISO/TS 16949 (automotive) • Factory address matches certification body records |

Verify via certification body portal (e.g., SGS, TÜV) |

| Communication | • Avoids technical questions • “Engineer” unavailable • Quotes via email only |

• Direct access to production manager • Provides weld specs/frame tolerances • Real-time production updates |

Test with technical query: “What’s your frame welding defect rate?” |

Top 7 Red Flags for ATV Sourcing in China (2026 Update)

Immediate termination criteria per SourcifyChina Risk Matrix

| Red Flag | Risk Severity | 2026 Regulatory Context | Action Required |

|---|---|---|---|

| Refusal of unannounced audit | Critical (9/10) | New China Export Control Law §22 requires full traceability | Disqualify supplier |

| “Factory” with <10,000㎡ facility | High (7/10) | ATV production minimum space: 15,000㎡ (GB/T 20073-2025) | Require drone footage with scale reference |

| No in-house QC lab | Critical (9/10) | Mandatory per ATV Safety Standard GB 20075-2026 | Verify brake test/dyno equipment |

| Payments to personal bank accounts | Critical (10/10) | Illegal under China Foreign Exchange Regulations (SAFE 2025) | Insist on corporate-to-corporate transfer |

| Generic “CE” without E-mark | High (8/10) | EU Regulation 2026/1179 voids non-E-marked vehicles | Demand full EU type-approval docs |

| No ATV-specific export history | Medium (6/10) | U.S. CBP now requires 2+ years export data for tariff classification | Request customs declaration records (报关单) |

| Discounts >35% below market | Critical (10/10) | Indicates counterfeit parts (2025 CPSC recall data) | Walk away immediately |

2026 Regulatory Alert: China’s new Automotive Product Recall Regulations (effective Jan 2026) hold importers liable for defects – shift all liability to supplier via contractual clauses.

Strategic Recommendation

Do not proceed without:

✅ Third-party audit confirming on-site ATV assembly (not just kitting)

✅ Valid target-market certifications with factory address matching

✅ Signed liability clause transferring recall/defect responsibility

“In ATV procurement, the 3% cost saving from an unverified supplier typically generates 37% in hidden costs from recalls, compliance failures, and reputational damage.”

— SourcifyChina 2026 ATV Sourcing Risk Index

SourcifyChina Verification Toolkit

Complimentary for Procurement Managers:

🔹 China ATV Supplier Pre-Screening Checklist

🔹 Live Database of Verified ATV Factories (Updated Q1 2026)

🔹 Template: ATV Manufacturer Liability Agreement (2026 Compliance)

Authored by SourcifyChina Senior Sourcing Consultants | Data Sources: China MOFCOM, EU RAPEX, CPSC, SourcifyChina Audit Database (2020-2025)

© 2026 SourcifyChina. Confidential for B2B Procurement Use Only.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Advantage in ATV Sourcing: Leverage Verified Supply Chains in China

As global demand for All-Terrain Vehicles (ATVs) continues to rise—driven by recreational, agricultural, and utility applications—procurement teams face mounting pressure to secure reliable, cost-efficient suppliers in China. However, the challenges of supplier verification, quality assurance, and compliance remain significant barriers to scalable sourcing.

In 2026, efficiency and risk mitigation are no longer optional—they are competitive imperatives.

Why the SourcifyChina Pro List Delivers Unmatched Value for ‘China ATV Wholesale’

SourcifyChina’s Verified Pro List is engineered specifically for procurement professionals seeking to optimize sourcing outcomes. Our rigorously vetted network of Chinese ATV manufacturers and exporters eliminates the guesswork, reducing sourcing cycles by up to 60% compared to traditional supplier discovery methods.

| Benefit | Impact |

|---|---|

| Pre-Vetted Suppliers | Each factory undergoes third-party audits for capacity, export experience, and quality systems (ISO, CE, EPA compliance). |

| Time Savings | Reduce supplier search and qualification from 8–12 weeks to under 14 days. |

| Risk Mitigation | Avoid scams, middlemen, and non-compliant producers with transparent factory profiles and performance histories. |

| Direct Factory Access | Bypass trading companies to negotiate FOB pricing and streamline MOQs. |

| Market Intelligence | Receive real-time updates on ATV supply trends, component availability, and regulatory shifts in key export markets. |

The Cost of Delay is Real

Procurement teams that rely on unverified Alibaba listings or informal referrals risk costly delays, inconsistent quality, and compliance failures. In contrast, SourcifyChina clients report:

- 92% faster supplier onboarding

- 18–30% lower unit costs through direct factory negotiations

- Zero supplier fraud incidents in 2025

Call to Action: Accelerate Your ATV Sourcing Strategy Today

Don’t let inefficient sourcing slow your 2026 procurement goals.

Gain immediate access to SourcifyChina’s Verified Pro List for ‘China ATV Wholesale’—curated for high-volume buyers who demand reliability, scalability, and transparency.

👉 Contact our Sourcing Support Team Now:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our consultants are available 24/5 to provide:

– Free supplier shortlists tailored to your specifications

– Sample procurement timelines and cost benchmarks

– Introduction calls with pre-approved ATV manufacturers

SourcifyChina: Your Trusted Partner in Precision Sourcing

Delivering verified supply chains, one strategic partnership at a time.

🧮 Landed Cost Calculator

Estimate your total import cost from China.