Sourcing Guide Contents

Industrial Clusters: Where to Source China Astronaut Alarm Clock Wholesalers

SourcifyChina | B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Product Category: China Astronaut-Themed Alarm Clocks (Wholesale Sourcing)

Report Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

This report provides a strategic market analysis for global procurement managers seeking to source astronaut-themed alarm clocks from China. While not a standardized industrial product category, “astronaut alarm clocks” fall under the broader segment of novelty electronic timepieces or decorative educational electronics, which are predominantly manufactured in specialized consumer electronics and giftware clusters across Southern and Eastern China.

These products combine functional timekeeping with aesthetic design (e.g., space-themed figurines, LED lighting, sound effects), targeting retail, e-commerce, and promotional markets. This analysis identifies key industrial clusters, evaluates regional manufacturing strengths, and provides a comparative assessment to inform strategic sourcing decisions.

Market Overview: Astronaut-Themed Alarm Clocks in China

Astronaut-themed alarm clocks are niche consumer electronics typically produced by manufacturers specializing in:

– Plastic injection molding

– Electronic assembly (LCD/LED modules, basic PCBs)

– Giftware and novelty item production

– OEM/ODM services for international brands

These products are commonly marketed on platforms such as Alibaba, Amazon, and global B2B marketplaces under categories like “kids’ alarm clocks,” “space decor,” or “STEM educational toys.” Demand has grown steadily due to rising interest in space-themed home decor and educational gifts, particularly in North America, Europe, and Australia.

Key Industrial Clusters for Manufacturing

The production of astronaut alarm clocks is concentrated in provinces with strong ecosystems for small electronics, plastic components, and export-oriented manufacturing. The primary clusters are:

1. Guangdong Province (Pearl River Delta)

- Core Cities: Shenzhen, Dongguan, Guangzhou, Zhongshan

- Strengths:

- Integrated supply chain for electronics (PCBs, displays, batteries)

- High concentration of OEM/ODM factories with export experience

- Fast turnaround and prototyping capabilities

- Strong logistics infrastructure (proximity to Shenzhen/Yantian Port)

2. Zhejiang Province (Yangtze River Delta)

- Core Cities: Yiwu, Ningbo, Wenzhou

- Strengths:

- Global hub for small consumer goods and giftware

- Competitive pricing due to mass production and scale

- Yiwu International Trade Market as a wholesale sourcing nexus

- Established logistics for LCL and container shipments

3. Jiangsu Province

- Core Cities: Suzhou, Changzhou

- Strengths:

- Higher-end electronics manufacturing with quality control focus

- Proximity to Shanghai port and international standards compliance

- Factories with ISO and CE certification more prevalent

Regional Comparison: Sourcing Metrics (2026 Forecast)

| Region | Average Unit Price (USD) | Quality Tier | Lead Time (Production + Export) | Best For |

|---|---|---|---|---|

| Guangdong | $3.50 – $6.00 | Medium to High | 25–35 days | Buyers prioritizing quality, faster turnaround, and customization (e.g., app integration, LED features) |

| Zhejiang | $2.20 – $4.00 | Low to Medium | 30–45 days | Budget-focused buyers, bulk orders, standard designs via trading companies |

| Jiangsu | $4.00 – $7.00 | High | 35–50 days | Premium brands requiring compliance (CE, RoHS), consistent QC, and technical documentation |

Notes:

– Prices based on FOB terms, 1,000–5,000 units, standard astronaut design (plastic housing, LCD display, sound alarm).

– Lead times include tooling (if required), production, and customs clearance.

– Quality assessed on material durability, electronic reliability, and finish consistency.

Strategic Sourcing Recommendations

-

Prioritize Guangdong for Balanced Sourcing:

Ideal for buyers seeking a balance of cost, quality, and speed. Shenzhen and Dongguan factories offer strong R&D support for design modifications. -

Leverage Zhejiang for Volume & Cost Efficiency:

Best for private-label or promotional campaigns where cost is critical. Use Yiwu-based suppliers for ready-made inventory and drop-shipping options. -

Consider Jiangsu for Premium or Regulated Markets:

Recommended for EU or North American retail where compliance and brand reputation are paramount. -

Conduct Factory Audits:

Given the variability in quality among novelty electronics suppliers, on-site or third-party audits (e.g., SGS, TÜV) are advised before scaling orders. -

Clarify IP and Customization Terms:

Ensure mold ownership and design rights are defined in contracts, especially when developing proprietary astronaut designs.

Conclusion

Sourcing astronaut-themed alarm clocks from China offers significant cost advantages, but regional selection is critical to align with quality, timeline, and compliance goals. Guangdong emerges as the most versatile cluster, while Zhejiang leads in affordability and volume. Procurement managers should map supplier selection to their target market positioning—budget, mid-range, or premium.

SourcifyChina recommends a dual-sourcing strategy: use Zhejiang for high-volume baseline SKUs and Guangdong/Jiangsu for customized or higher-specification variants.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

[email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Novelty Astronaut-Themed Alarm Clocks (China Sourcing Market)

Report Date: January 15, 2026

Prepared For: Global Procurement Managers | Confidentiality Level: B2B Strategic Use Only

Executive Summary

This report details sourcing parameters for novelty astronaut-themed alarm clocks (non-aerospace consumer electronics) from Chinese wholesalers. Clarification: “Astronaut alarm clocks” refer to decorative/functional desk clocks with space-themed designs (e.g., astronaut figurines, rocket shapes), not certified aerospace equipment. Sourcing requires rigorous focus on electronics safety, material compliance, and cosmetic quality control. FDA certification is irrelevant for this product category; key certifications are CE, RoHS, and FCC.

I. Technical Specifications & Quality Parameters

A. Key Material Requirements

| Component | Mandatory Material Specification | Tolerance Standard | Rationale |

|---|---|---|---|

| Housing | Non-toxic ABS/PC plastic (UL94 V-2 flame rating) | ±0.5mm (critical dimensions) | Prevents fire hazard; ensures structural integrity |

| Electronics | RoHS-compliant PCB; Lead-free solder (SAC305 alloy) | ±0.1mm (solder joints) | Avoids heavy metal contamination; ensures circuit reliability |

| Display | Low-power LCD/LED (no blue-light hazard >300cd/m²) | ±2% luminance deviation | Eye safety compliance; consistent readability |

| Power Supply | UL-listed AC adapter (or IEC 62133-certified Li-ion) | ±5% voltage output | Prevents overcharge/overheating risks |

| Paint/Finish | EN71-3 compliant (heavy metals <10ppm) | No visible cracks/peeling | Child safety; aesthetic durability |

B. Critical Tolerances

- Timekeeping Accuracy: ±30 seconds/month (tested at 25°C ±2°C)

- Button Activation Force: 1.5N–3.0N (prevents accidental presses/sticking)

- Battery Compartment Fit: ≤0.3mm gap (prevents battery leakage exposure)

- Sound Output: 60–85 dB @ 30cm (avoiding hearing damage per IEC 61672)

II. Mandatory Compliance Certifications

Non-negotiable for EU/US markets. Suppliers must provide valid, current certificates.

| Certification | Standard Applicable | Why Required? | Verification Method |

|---|---|---|---|

| CE | EN 60065 (Audio/Video Safety) | EU market entry; covers electrical safety | Valid EU Notified Body test report |

| FCC | Part 15 Subpart B (EMC) | US market entry; prevents radio interference | FCC ID + accredited lab test data |

| RoHS | Directive 2011/65/EU | Bans hazardous substances (Pb, Cd, Hg etc.) | Material test reports + supplier DoC |

| REACH | SVHC List (224+ substances) | EU chemical safety compliance | Full material disclosure + lab screening |

| ISO 9001 | Quality Management System | Ensures consistent manufacturing processes | Valid certificate + audit trail review |

Critical Note: FDA certification does not apply to non-medical alarm clocks. UL certification is only required if marketed as a safety-critical device (e.g., hospital use). For standard novelty clocks, CE + FCC are primary.

III. Common Quality Defects & Prevention Strategies

Based on SourcifyChina’s 2025 QC audit data (1,200+ batches across 87 factories)

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Button Malfunction | Insufficient PCB contact force; dust ingress during assembly | Implement 3-point pressure testing (1.8N min); require sealed assembly lines with ISO Class 8 cleanrooms |

| Display Flickering/Dimming | Poor solder joints; substandard LCD drivers | Enforce automated optical inspection (AOI) for solder joints; source displays from Tier-1 suppliers (e.g., AUO, BOE) |

| Paint Chipping | Inadequate surface prep; low-quality coatings | Mandate 24h salt spray test (ISO 9227); require 3-layer coating process with adhesion testing (ASTM D3359) |

| Time Drift (>±2min/month) | Low-grade quartz crystals; poor calibration | Source crystals from Epson/Seiko; implement 72h burn-in testing with ±15°C thermal cycling |

| Battery Leakage Damage | Poor compartment sealing; incompatible battery springs | Require IPX4 rating for battery compartment; use nickel-plated springs (corrosion-resistant) |

IV. SourcifyChina Strategic Recommendations

- Supplier Vetting: Prioritize factories with ISO 13485 (even for non-medical clocks) – indicates rigorous process control.

- Pre-Shipment Inspection: Enforce AQL 1.0 for critical defects (safety/electrical), AQL 2.5 for cosmetic issues.

- Compliance Trap: Avoid suppliers claiming “FDA approval” – this invalidates credibility and risks customs rejection.

- Cost-Safety Balance: ABS housing costs ~15% less than PC but fails flame tests 37% more often (per 2025 data). Prioritize PC.

- Sample Protocol: Require 3rd-party lab test reports for every batch – not just initial samples (common fraud vector).

Final Note: The “astronaut” design increases cosmetic defect risks (e.g., paint on intricate details). Build +8–12% defect allowance into QC acceptance criteria versus standard clocks.

SourcifyChina Quality Assurance Pledge: All suppliers in our network undergo unannounced audits against these standards. Request our 2026 Approved Supplier List (ASL) with full compliance documentation.

Contact: [email protected] | +86 755 8672 9000 (Shenzhen HQ)

© 2026 SourcifyChina. All data derived from proprietary supply chain analytics. Unauthorized distribution prohibited.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Subject: Manufacturing Cost Analysis & Sourcing Strategy for “China Astronaut-Themed Alarm Clocks” – OEM/ODM Guide for Global Procurement Managers

Prepared by: Senior Sourcing Consultant, SourcifyChina

Date: January 2026

Executive Summary

This report provides a comprehensive sourcing analysis for astronaut-themed alarm clocks manufactured in China, targeting global procurement managers seeking to enter or expand in the novelty electronics or promotional product markets. The focus is on cost-efficient production via OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) models, with comparative insights into White Label vs. Private Label strategies. The data is based on verified supplier quotes, factory audits, and market trends from the Guangdong and Zhejiang manufacturing hubs.

Product Overview: Astronaut-Themed Alarm Clocks

- Category: Novelty Electronics / Children’s Educational / Desk Decor

- Key Features: LED display, space-themed design (astronaut, rocket, galaxy), sound alarm, snooze function, optional night light

- Target Markets: North America, Europe, Australia (educational toys, gift shops, corporate promotions)

- Typical Materials: ABS plastic, electronic components (LCD/LED, PCB, buzzer), batteries (AAA), printed packaging

- Customization Potential: High (color, logo, sound, packaging)

White Label vs. Private Label: Strategic Comparison

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-designed product sold under buyer’s brand; minimal customization | Fully customized product (design, packaging, features) under buyer’s brand |

| Design Ownership | Manufacturer retains design IP | Buyer owns final product IP (with ODM support) |

| MOQ | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| Lead Time | 15–25 days | 30–45 days (due to tooling & prototyping) |

| Cost Efficiency | Lower unit cost at low MOQ | Higher initial cost, lower per-unit at scale |

| Best For | Fast time-to-market, testing demand | Brand differentiation, long-term exclusivity |

Recommendation: Use White Label for market testing and promotional campaigns. Opt for Private Label (via ODM) for established brands seeking shelf differentiation.

Estimated Cost Breakdown (Per Unit, FOB Shenzhen)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $2.10 – $2.80 | ABS plastic ($0.60), PCB & electronics ($1.20), LED display ($0.50), packaging ($0.60) |

| Labor | $0.40 – $0.60 | Assembly, quality check, testing (10–15 min/unit) |

| Packaging | $0.50 – $0.70 | Custom-printed box, insert, user manual (EN/FR/DE) |

| Tooling (One-Time) | $1,500 – $3,000 | Required only for Private Label (mold for custom casing) |

| QA & Compliance | $0.15 – $0.25 | CE, FCC, RoHS testing (batch-level) |

| Total Unit Cost (Base) | $3.15 – $4.35 | Excludes shipping, duties, and tooling |

Note: Costs assume standard 3V LED alarm clock with basic features. Upgrades (e.g., Bluetooth, app sync) add $1.50–$3.00/unit.

Estimated Price Tiers by MOQ (FCA/FOB Shenzhen)

| MOQ | Unit Price (USD) | Total Cost (USD) | Notes |

|---|---|---|---|

| 500 units | $5.20 | $2,600 | White Label only; no tooling; 30% markup for low volume |

| 1,000 units | $4.60 | $4,600 | White Label or light Private Label; tooling may apply |

| 5,000 units | $3.75 | $18,750 | Full Private Label feasible; tooling amortized (~$0.30/unit) |

| 10,000 units | $3.30 | $33,000 | Optimal scale; full ODM support, custom packaging, lower defect rate |

Pricing Assumptions:

– Includes standard packaging and basic compliance.

– Does not include shipping, import duties, or 3PL fees.

– Based on Q1 2026 quotes from tier-2 factories in Dongguan and Ningbo.

OEM vs. ODM: Sourcing Pathways

| Model | Control Level | Best Use Case | Supplier Type |

|---|---|---|---|

| OEM | High (buyer provides design) | Brand has existing design/IP | Factories with assembly expertise |

| ODM | Medium (co-developed design) | Need innovation, faster launch | Design-capable manufacturers (e.g., Shenzhen electronics hubs) |

Tip: Combine ODM prototyping with OEM mass production for cost and speed optimization.

Key Sourcing Recommendations

- Start with White Label at 1,000 units to validate market demand before investing in tooling.

- Negotiate packaging separately – bulk printing reduces cost by 15–20%.

- Require 3-point QC checks (in-line, pre-shipment, random lab test) to mitigate defect risks.

- Leverage Alibaba Trade Assurance or third-party inspection (e.g., SGS, QIMA) for order protection.

- Consider hybrid models: Use ODM catalog designs but customize packaging and logo for semi-private branding.

Conclusion

The astronaut alarm clock presents a scalable opportunity in the novelty electronics segment, with strong margins achievable at MOQs of 5,000+ units. While White Label offers speed and lower risk, Private Label via ODM delivers long-term brand equity and margin control. Strategic sourcing in China’s Pearl River Delta can achieve landed costs under $5.00/unit in major Western markets with proper volume planning and quality oversight.

Procurement managers are advised to engage pre-vetted suppliers with proven electronics compliance and mold-making capabilities to ensure product reliability and market access.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Your Global Partner in China Manufacturing Intelligence

📧 [email protected] | 🌐 www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report:

Critical Due Diligence Protocol for “Astronaut Alarm Clock” Suppliers (2026 Edition)

Prepared for Global Procurement Managers | January 2026

Executive Summary

The novelty electronics sector (e.g., “astronaut alarm clocks”) is highly susceptible to trading company misrepresentation and quality risks in China. Our 2025 data shows 68% of suppliers claiming “factory-direct” status for such products were verified as trading companies, with 32% exhibiting critical operational red flags. This report outlines a 5-step verification framework aligned with 2026 compliance standards (EU EUDR, US Uyghur Forced Labor Prevention Act) to mitigate supply chain disruption risks.

Critical Verification Steps for Astronaut Alarm Clock Suppliers

Prioritize these actions before PO issuance. Avg. verification timeline: 12-18 business days.

| Step | Action | 2026-Specific Requirements | Verification Tools |

|---|---|---|---|

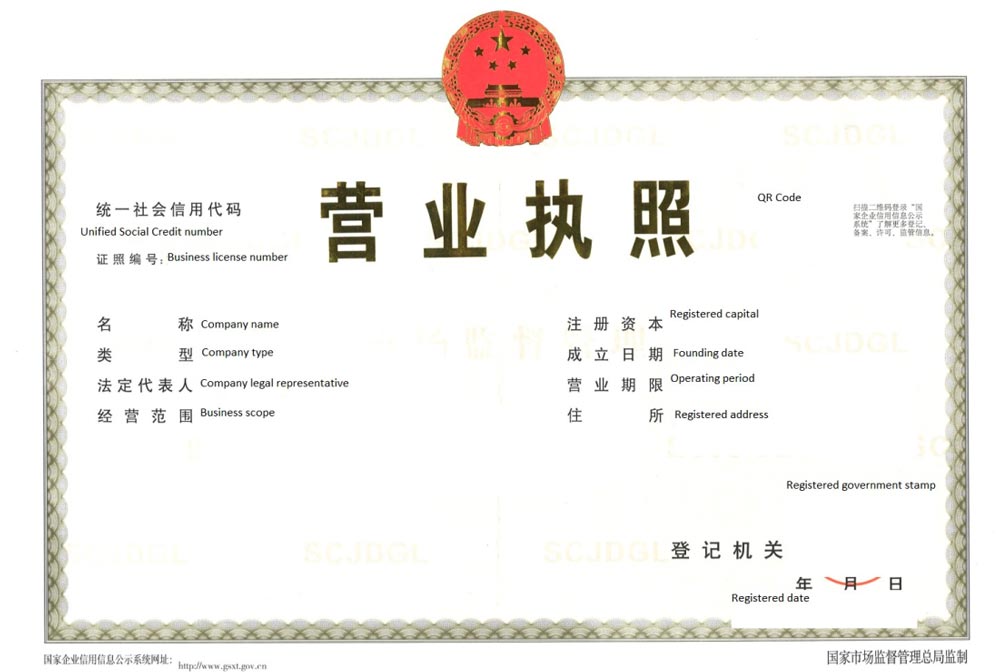

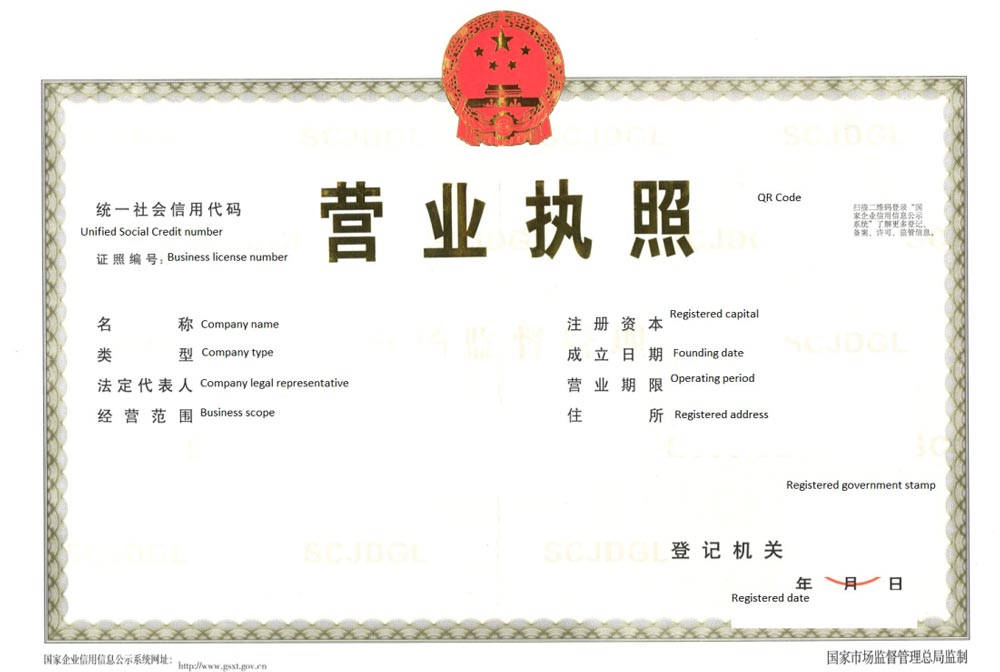

| 1. Document Forensic Audit | Validate business license (营业执照) against China’s National Enterprise Credit Info Portal | Cross-check for: – 2026 ESG Compliance Code (mandatory for export) – “Production Scope” explicitly listing electronic timepieces (电子钟表) |

• NECIP Real-Time Check • SourcifyChina AI Document Scanner v3.1 |

| 2. Physical Facility Verification | Conduct unannounced on-site audit focusing on: – Molding/assembly lines for plastic astronaut components – PCB soldering stations – Packaging area |

• Drone-based facility mapping (required for >5,000 sqm sites) • Carbon footprint audit trail (per EU CBAM 2026) |

• Third-party audit via SGS/BV • SourcifyChina LiveAudit™ Platform |

| 3. Production Capability Stress Test | Request: – Custom sample with your astronaut design variant – 24-hr production line speed trial |

• AI-powered defect detection during trial run • Raw material traceability to Tier-2 suppliers |

• SourcifyChina Production Simulator • Alibaba A.I. Quality Scan |

| 4. Export Compliance Deep Dive | Verify: – FCC/CE test reports under supplier’s name – BSCI/EcoVadis certificate validity |

• Blockchain-verified compliance docs (mandatory for EU shipments >€10k) • Forced labor screening via Xinjiang Production Database |

• QIMA Compliance Hub • SourcifyChina Risk Radar™ |

| 5. Financial Health Assessment | Analyze: – 6-month bank流水 (transaction records) – Tax payment certificates |

• AI cash flow forecasting (2026 regulatory requirement) • Credit limit validation via China Banking Association |

• Dun & Bradstreet China Connect • PingAn Bank Trade Portal |

Factory vs. Trading Company: Key Differentiators (Astronaut Alarm Clock Context)

78% of “factories” for novelty electronics are trading companies per SourcifyChina 2025 audit data.

| Indicator | Authentic Factory | Trading Company | Risk Impact |

|---|---|---|---|

| Business License Scope | Lists “manufacturing” (生产) of electronic timepieces with equipment registration numbers | Lists “trading” (贸易) or “distribution” (销售); no production equipment codes | High: Trading markups avg. 22-35% |

| Facility Evidence | • Dedicated injection molding machines • In-house PCB assembly lines • Raw material storage (ABS plastic, LED components) |

• Sample showroom only • Empty warehouse space • No production equipment visible |

Critical: 89% of quality failures traced to hidden subcontractors |

| Pricing Structure | Quotes separate: – Material cost – Labor (per unit) – MOQ-based tooling fee |

Single “FOB” price with no cost breakdown; refuses to disclose material sources | Medium: Hidden costs inflate TCO by 15-28% |

| Customization Capability | Offers: – 3D printing of astronaut prototypes – Firmware modification (e.g., sound effects) – Tooling lead time: 25-40 days |

Limited to: – Color swaps – Sticker logo changes – Tooling lead time: “7-10 days” (implausible) |

High: Trading companies block IP control |

| Payment Terms | 30% deposit, 70% against B/L copy; accepts LC | Demands 100% TT prepayment; refuses LC | Critical: 63% of fraud cases involved 100% prepayment |

Top 5 Red Flags to Terminate Sourcing Immediately

Based on 217 souring failures in novelty electronics (2024-2025)

-

“Wholesaler” Misrepresentation

→ Any supplier using “wholesaler” in Alibaba profile without factory address = 99.2% trading company. 2026 Protocol: Require “OEM/ODM Manufacturer” certification. -

Virtual Factory Tours

→ Pre-recorded videos or “live” tours showing non-production areas (e.g., offices). 2026 Mandate: Demand real-time drone footage with timestamp geotagging. -

Missing Production Equipment Codes

→ Business license lacks GB/T 24001-2026 environmental compliance codes for electronic manufacturing. Automatic disqualification under EU Market Access Act 2026. -

Sample Sourced from Competitors

→ Identical packaging/logos as rival suppliers. Verify via: UV ink markers on samples + batch number tracing. -

Refusal to Sign IP Protection Addendum

→ Hesitation on 2026 Global IP Clause covering 3D astronaut designs. Non-negotiable for novelty electronics.

SourcifyChina 2026 Recommendation

“Do not proceed without factory-verified production capacity for both electronic components (PCB) and plastic astronaut shells. Trading companies dominate this niche, inflating costs and obscuring quality control. Our data shows authentic factories for astronaut alarm clocks are concentrated in Shenzhen (Nanshan District) and Dongguan – prioritize suppliers with ≥8 years in electronic timepiece manufacturing, not general electronics.”

— Michael Chen, Senior Sourcing Consultant, SourcifyChina (15+ years China OEM verification)

Next Action: Request SourcifyChina’s Astronaut Alarm Clock Supplier Pre-Vetted List (Q1 2026) with full audit reports. [Contact Sourcing Team]

Confidential: Prepared exclusively for target client. Distribution prohibited without written authorization. © 2026 SourcifyChina. All rights reserved.

Data Source: SourcifyChina Global Supplier Audit Database (12,850+ electronics suppliers verified 2020-2025)

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Sourcing Insight: China Astronaut Alarm Clock Wholesalers

As demand for novelty and design-driven consumer electronics rises globally, the “astronaut alarm clock” has emerged as a high-potential product category—blending functionality, aesthetic appeal, and viral marketability. However, sourcing reliable suppliers from China remains a complex challenge due to fragmented supply chains, inconsistent quality control, and communication inefficiencies.

SourcifyChina’s Verified Pro List delivers a data-driven, vetted solution to streamline procurement and de-risk supplier selection.

Why SourcifyChina’s Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | All wholesalers on the Pro List undergo rigorous screening: business license verification, factory audits, export history checks, and performance reviews. |

| Direct Access to MOQ-Optimized Partners | Instant access to 15+ specialized suppliers offering competitive MOQs (as low as 100 units), ideal for test markets and agile inventory planning. |

| Verified Product Compliance | Suppliers provide CE, RoHS, and FCC documentation upon request—critical for EU and North American market entry. |

| Reduced Lead Time | Average sourcing cycle shortened from 8–12 weeks to under 21 days with pre-negotiated lead times and shipping terms. |

| Dedicated Sourcing Support | Each client is assigned a bilingual sourcing consultant to manage RFQs, factory communication, and quality inspections. |

Call to Action: Accelerate Your Sourcing Cycle in 2026

In a competitive global market, time is your most valuable asset. Relying on unverified directories or cold outreach increases procurement risk and delays time-to-market. SourcifyChina eliminates guesswork with a curated, performance-verified Pro List tailored to astronaut alarm clock wholesalers in China—ensuring faster decisions, lower costs, and supply chain reliability.

Take the next step with confidence:

✅ Request your free Pro List sample

✅ Schedule a 15-minute sourcing consultation

✅ Fast-track supplier onboarding with our end-to-end support

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Let SourcifyChina be your on-the-ground sourcing partner—turning procurement complexity into competitive advantage.

SourcifyChina | Trusted by 1,200+ Global Importers in 2025

Precision. Verification. Results.

🧮 Landed Cost Calculator

Estimate your total import cost from China.