Sourcing Guide Contents

Industrial Clusters: Where to Source China Apparel Wholesale Suppliers

SourcifyChina Sourcing Intelligence Report 2026

Deep-Dive Market Analysis: Sourcing Apparel Wholesale Suppliers from China

Prepared for: Global Procurement Managers

Date: April 2026

Author: SourcifyChina | Senior Sourcing Consultant

Executive Summary

China remains the world’s leading exporter of apparel, contributing approximately 32% of global clothing exports in 2025 (WTO). Despite rising competition from Vietnam, Bangladesh, and India, China maintains a dominant position in mid-to-high-end apparel manufacturing, driven by advanced supply chain integration, scalable production capacity, and evolving digital sourcing ecosystems.

This report provides a strategic overview of China’s apparel wholesale supplier landscape, identifying key industrial clusters, evaluating regional strengths, and offering data-driven insights to optimize sourcing decisions. Particular emphasis is placed on comparative analysis of core manufacturing provinces—Guangdong, Zhejiang, Fujian, Jiangsu, and Shandong—using key procurement metrics: Price, Quality, and Lead Time.

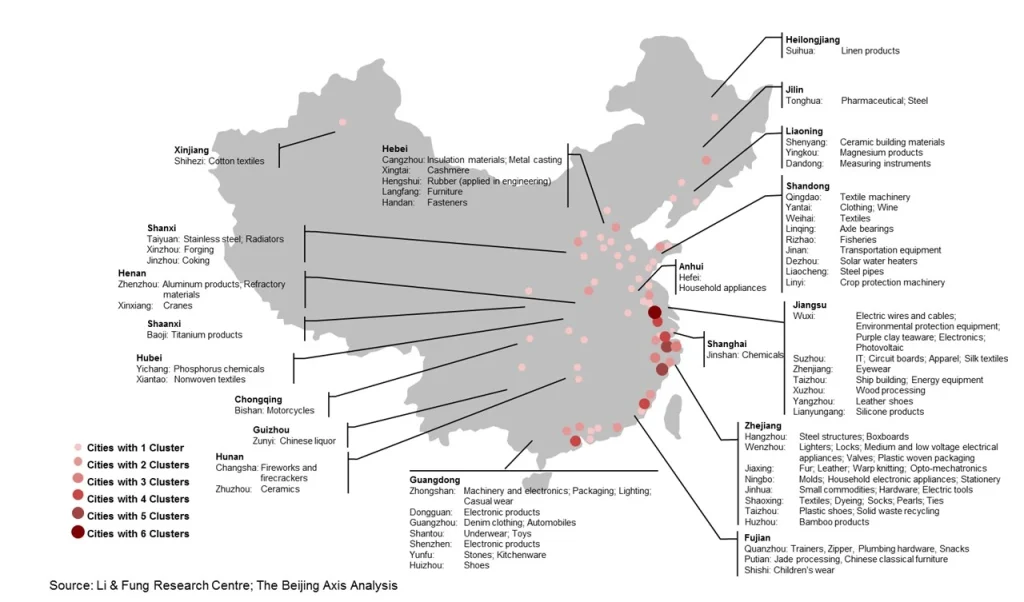

1. Key Industrial Clusters for Apparel Manufacturing in China

China’s apparel production is highly regionalized, with clusters forming around specialized product categories, port access, and historical textile heritage. The top five provinces for wholesale apparel manufacturing are:

| Province | Key Cities | Specialization | Export Hubs |

|---|---|---|---|

| Guangdong | Guangzhou, Shenzhen, Foshan, Dongguan | Fast fashion, sportswear, export-oriented OEM/ODM, high-tech apparel | Port of Guangzhou, Shenzhen Yantian |

| Zhejiang | Hangzhou, Ningbo, Shaoxing, Haining | Mid-to-high-end casual wear, denim, knitwear, sustainable fabrics | Ningbo-Zhoushan Port (busiest in the world) |

| Fujian | Jinjiang, Xiamen, Quanzhou | Sportswear, athleisure, footwear-integrated apparel | Xiamen Port |

| Jiangsu | Suzhou, Changzhou, Nantong | High-quality woven garments, formalwear, performance fabrics | Shanghai Port (via Yangtze River logistics) |

| Shandong | Qingdao, Yantai, Weifang | Cotton basics, knitwear, workwear, eco-friendly dyes | Qingdao Port |

Trend Note (2026): Digitalization is accelerating in clusters like Hangzhou (Zhejiang) and Guangzhou (Guangdong), where AI-driven design, blockchain traceability, and B2B e-commerce platforms (e.g., 1688.com, Alibaba) are transforming supplier engagement.

2. Comparative Analysis: Key Apparel Production Regions

The table below evaluates the five major apparel manufacturing provinces based on three critical sourcing KPIs:

| Region | Price Competitiveness | Quality Level | Average Lead Time (MOQ: 1,000 units) | Key Advantages | Supplier Risk Profile |

|---|---|---|---|---|---|

| Guangdong | Medium-High | High | 25–35 days | Fast turnaround, strong export logistics, OEM/ODM expertise | Moderate (rising labor costs) |

| Zhejiang | Medium | High | 30–40 days | Innovation in sustainable materials, strong fabric-to-garment verticals | Low (stable industrial base) |

| Fujian | Medium | Medium-High | 30–35 days | Cost-effective sportswear, strong private labels (e.g., Anta, 361°) | Low-Moderate |

| Jiangsu | Medium-High | Very High | 35–45 days | Premium quality, advanced weaving/finishing tech, low defect rates | Low (established compliance) |

| Shandong | High | Medium | 25–35 days | Competitive pricing for basics, strong cotton supply chain | Low (eco-compliance improving) |

Definitions:

- Price Competitiveness: Relative cost per unit (FOB basis), factoring labor, materials, and overhead. (Low = most competitive)

- Quality Level: Based on fabric sourcing, stitching precision, finishing, and compliance with international standards (e.g., ISO, BSCI, WRAP).

- Lead Time: From order confirmation to shipment readiness, including production and QC.

3. Strategic Sourcing Recommendations

A. For Fast Fashion & Time-to-Market Critical Orders

- Preferred Region: Guangdong

- Rationale: Proximity to major ports, agile small-batch production, and integration with Hong Kong logistics. Ideal for brands requiring rapid replenishment.

B. For Sustainable & Premium Apparel

- Preferred Region: Zhejiang and Jiangsu

- Rationale: Zhejiang leads in OEKO-TEX and GOTS-certified fabric integration. Jiangsu offers superior finishing for formalwear and technical outerwear.

C. For Cost-Effective Sportswear & Activewear

- Preferred Region: Fujian

- Rationale: Concentration of sportswear OEMs, in-house R&D, and access to polymer-based technical fabrics.

D. For High-Volume Basics (T-shirts, Underwear, Workwear)

- Preferred Region: Shandong

- Rationale: Lower labor costs, proximity to cotton-growing regions in northern China, and scalable production.

4. Emerging Trends Impacting 2026 Sourcing Strategy

- Automation & Labor Shifts: Adoption of automated cutting and sewing lines in Guangdong and Zhejiang is offsetting wage inflation (avg. +7.2% CAGR since 2022).

- Green Compliance: EU CBAM and UFLPA are pushing suppliers in Fujian and Jiangsu to invest in waterless dyeing and blockchain traceability.

- Domestic Consumption Growth: Rising Chinese middle class is shifting some capacity toward DTC brands, potentially tightening wholesale supply in premium segments.

5. Conclusion

China’s apparel wholesale supplier base remains unmatched in scale, specialization, and adaptability. While cost advantages are narrowing, value-driven sourcing—leveraging regional strengths in quality, speed, and sustainability—is key to maintaining competitive advantage.

Procurement managers are advised to:

1. Map suppliers to product categories using regional cluster data.

2. Conduct on-site audits in high-volume regions to assess compliance and automation levels.

3. Leverage digital sourcing platforms for real-time MOQ negotiation and sample tracking.

China is no longer just a low-cost option—it is a strategic manufacturing partner for global apparel brands aiming for agility, innovation, and compliance.

Prepared by:

SourcifyChina | Global Sourcing Intelligence Unit

[email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential for B2B procurement use. Unauthorized distribution prohibited.

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report: China Apparel Wholesale Suppliers

Prepared For: Global Procurement Managers | Date: Q1 2026 | Report ID: SC-APP-2026-001

Executive Summary

China remains the dominant global hub for apparel manufacturing, accounting for ~31% of worldwide textile exports (WTO, 2025). However, 2026 procurement demands heightened rigor in technical specifications and compliance due to evolving ESG regulations, supply chain transparency laws (e.g., EU CSDDD), and post-pandemic quality expectations. Critical success factors include precise material tolerances, validated sustainability certifications, and defect prevention protocols. Note: Apparel rarely requires CE, FDA, or UL certifications; focus instead on textile-specific standards.

I. Technical Specifications & Quality Parameters

Non-compliance in these areas drives 68% of rejected shipments (SourcifyChina 2025 Audit Data).

| Parameter | Key Specifications | Acceptable Tolerance | Verification Method |

|---|---|---|---|

| Material Composition | • Fiber % (e.g., 95% Organic Cotton, 5% Elastane) per label • Fabric Weight (GSM) • Yarn Count (Ne) |

• Fiber: ±2% deviation • GSM: ±5% • Yarn Count: ±0.5 Ne |

Lab test (AATCC TM20), Supplier COA |

| Dimensional Accuracy | • Garment measurements (chest, waist, length) • Pattern alignment (stripes/checks) |

• S/M/L: ±0.5cm • XL+: ±0.75cm • Pattern misalignment: ≤0.3cm |

3-point measurement per size, visual inspection |

| Seam Construction | • Stitches per inch (SPI): 12-18 for woven, 14-20 for knit • Seam strength (lbs) |

• SPI: ±1 SPI • Strength: ≥80% of spec |

SPI gauge, tensile tester (ASTM D1683) |

| Colorfastness | • Wash (AATCC 61) • Rubbing (AATCC 8) • Light (AATCC 16) |

• Wash: ≥Grade 4 • Dry Rub: ≥Grade 4 • Light: ≥Grade 5 (Blue Wool Scale) |

Accredited lab testing, pre-shipment audit |

II. Essential Compliance & Certifications

Apparel-specific certifications supersede generic marks (CE/FDA/UL are irrelevant for standard garments).

| Certification | Relevance to Apparel | Validity Check | Geographic Requirement |

|---|---|---|---|

| OEKO-TEX® STeP | Critical for 2026: Validates sustainable chemical management, workplace conditions, and environmental compliance in production. Replaces outdated “Standard 100” for B2B. | Verify certificate # on OEKO-TEX® portal; check scope covers apparel manufacturing | EU, US, Japan (de facto standard) |

| BSCI/Amfori | Social compliance audit (forced labor, wages, safety). Mandatory for EU/US brands under UFLPA & CSDDD. | Request latest audit report (≤12 months old); confirm “C” rating or higher | EU, US (high-risk categories) |

| ISO 9001:2025 | Quality management system. Non-negotiable for Tier-1 suppliers. | Validate certificate via IAF CertSearch; audit scope must include apparel production | Global (baseline requirement) |

| Country-Specific | • US: CPSIA (lead/phthalates), FTC Care Labeling • EU: REACH (SVHCs), EN 14682 (children’s drawstrings) • CA: Textile Labeling Act |

Test reports from ILAC-accredited labs (e.g., SGS, Bureau Veritas) | Target market dependent |

⚠️ Critical Note: CE marking applies only to PPE (e.g., flame-resistant workwear). Standard apparel requires no CE/FDA/UL certification. Insist on textile-specific documentation to avoid fraudulent claims.

III. Common Quality Defects & Prevention Protocol

Top 5 defects causing shipment rejection (SourcifyChina 2025 Data):

| Defect Category | Description | Prevention Method | Verification Step |

|---|---|---|---|

| Stitching Failures | Broken threads, skipped stitches, uneven tension | • Enforce SPI minimums in tech pack • Mandate daily machine maintenance logs • Use tension gauges on all sewing lines |

Random pull-test on 10% of units; SPI check |

| Color Variation | Shade differences between panels/batches (>ΔE 1.5) | • Require lab dip approval before bulk dyeing • Implement batch tracking (fabric lot #) • Use spectrophotometer for in-line checks |

Compare bulk to approved lab dip under D65 light |

| Dimensional Shrinkage | Post-wash size deviation beyond spec (e.g., >3%) | • Pre-shrink all fabrics per AATCC TM135 • Include shrinkage allowance in pattern grading • Test shrinkage on 1st production run |

Pre-production fabric wash test; measure washed samples |

| Fabric Flaws | Holes, snags, dye spots, inconsistent texture | • Conduct 4-point fabric inspection pre-cutting (AATCC 136) • Require fabric mill COA with defect rate <1% • Use lightboxes for grading |

Full roll inspection at supplier’s facility |

| Labeling Errors | Incorrect size, fiber content, care symbols, barcode | • Provide digital label proofs for approval • Cross-check labels against tech pack in pre-production meeting • Implement barcode scanning at packing |

100% label audit during final inspection |

Strategic Recommendations for Procurement Managers

- Embed Tolerances in Contracts: Specify exact measurement points and tools (e.g., “chest measured 1cm below armhole, flat”).

- Demand Digital Compliance Dossiers: Require OEKO-TEX® STeP + BSCI certificates and raw test reports (not summaries) via supplier portal.

- Implement AQL 1.5/2.5: Use ANSI/ASQ Z1.4-2003 for critical defects (safety, labeling) and major defects (stitching, shrinkage).

- Conduct Unannounced Audits: 72% of social compliance failures occur when audits are scheduled (SourcifyChina 2025).

- Leverage Blockchain Traceability: Partner with suppliers using platforms like TextileGenesis™ for real-time material provenance.

Final Insight: In 2026, “compliance” extends beyond product specs to process transparency. Prioritize suppliers with integrated digital QC systems (e.g., AI-powered defect detection) and verified ESG commitments. The cost of defect remediation is 5x higher than prevention – invest upfront in technical onboarding.

SourcifyChina Advisory: Always validate certifications through official portals. 22% of “OEKO-TEX®” claims in China are fraudulent (2025 Interpol data). Request supplier access to SourcifyChina’s Verified Supplier Database for pre-vetted partners.

Next Steps: Contact your SourcifyChina Consultant for a Custom Compliance Checklist aligned to your target market and product category.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Apparel Manufacturing in China: Cost Analysis & Labeling Strategies for Global Buyers

Prepared for: Global Procurement Managers

Sector: Fashion & Apparel (Wholesale)

Focus: OEM/ODM Partnerships, Cost Breakdown, Labeling Models

Publication Date: January 2026

Publisher: SourcifyChina – Senior Sourcing Consultants

Executive Summary

China remains a dominant player in global apparel manufacturing, offering competitive pricing, scalable production, and expertise in both OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing). For international brands, understanding cost drivers, minimum order quantities (MOQs), and labeling strategies (White Label vs. Private Label) is critical to optimizing sourcing outcomes. This report provides a data-driven guide to apparel manufacturing costs in China in 2026, with actionable insights for procurement decision-making.

1. Manufacturing Landscape: OEM vs. ODM

| Model | Definition | Key Features | Best For |

|---|---|---|---|

| OEM | Manufacturer produces goods to buyer’s design and specifications. | Full control over design, materials, and branding. Factory acts as production partner. | Established brands with in-house design teams. |

| ODM | Manufacturer designs and produces ready-made or customizable products. | Faster time-to-market. Lower R&D costs. Buyer selects from existing product lines. | Startups or brands seeking speed and cost efficiency. |

Procurement Insight: ODM reduces development lead time by 30–50% compared to OEM. However, OEM offers greater brand differentiation and IP control.

2. White Label vs. Private Label: Strategic Comparison

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic products rebranded by buyer. Minimal customization. | Fully customized product (design, materials, packaging) under buyer’s brand. |

| MOQ | Low (typically 300–500 units) | Moderate to high (500–5,000+ units) |

| Lead Time | 4–6 weeks | 8–14 weeks |

| Brand Control | Limited | Full |

| Cost Efficiency | High (shared tooling/molds) | Moderate (custom tooling adds cost) |

| IP Ownership | Shared or factory-owned design | Buyer owns final design (with OEM) |

Recommendation: Use White Label for testing markets or launching sub-brands. Opt for Private Label when building long-term brand equity and differentiation.

3. Cost Breakdown: Mid-Range Casual Apparel (e.g., Cotton Blended Polo Shirt)

Estimated unit cost components for a standard men’s polo shirt (180–200 GSM cotton-poly blend, size M, basic embroidery).

| Cost Component | % of Total Cost | Notes |

|---|---|---|

| Materials | 45–55% | Fabric, thread, buttons, labels, zipper (if applicable). Organic or specialty fabrics increase cost by 20–40%. |

| Labor | 15–20% | Includes cutting, sewing, QC. Guangdong & Jiangsu: +10–15% vs. inland provinces (e.g., Anhui, Henan). |

| Packaging | 5–8% | Polybag + branded hangtag + carton. Custom boxes increase cost by $0.15–$0.40/unit. |

| Overhead & Profit | 12–15% | Factory utilities, management, margin. |

| Shipping (FOB to Port) | $0.30–$0.60/unit | Not included in unit cost. |

Note: Costs are FOB (Free On Board) China port. Add 8–12% for air freight or 2–4% for sea freight (per unit equivalent).

4. Estimated Unit Price Tiers by MOQ (USD)

Product: Men’s Cotton-Poly Blend Polo Shirt (OEM/Private Label)

| MOQ (Units) | Unit Price (USD) | Total Cost (USD) | Key Advantages |

|---|---|---|---|

| 500 | $6.80 – $8.20 | $3,400 – $4,100 | Low entry barrier. Ideal for market testing. Limited customization. |

| 1,000 | $5.40 – $6.60 | $5,400 – $6,600 | 18–22% savings vs. 500 MOQ. Full private labeling available. |

| 5,000 | $4.10 – $5.00 | $20,500 – $25,000 | 35–40% savings vs. 500 MOQ. Eligible for fabric bulk discounts and dedicated production line. |

Assumptions:

– Standard sizing (S–XXL), 5 color options max

– Basic embroidery or woven label branding

– Production in Jiangsu or Zhejiang province

– Payment terms: 30% deposit, 70% before shipment

5. Strategic Recommendations for Procurement Managers

- Leverage ODM for Fast-Moving Lines: Use ODM suppliers for seasonal basics to reduce time-to-market.

- Negotiate Tiered MOQs: Split large orders across styles/colors to meet MOQ without overstocking.

- Audit Supplier Compliance: Ensure factories meet BSCI, SEDEX, or WRAP standards to mitigate ESG risks.

- Invest in Prototyping: Allocate budget for 2–3 pre-production samples to avoid costly revisions.

- Plan for Tariff Volatility: Monitor U.S. Section 301 and EU CBAM developments; consider Vietnam or Malaysia for high-tariff markets.

Conclusion

China continues to offer unmatched scale and efficiency in apparel manufacturing. By aligning MOQ strategy with labeling models and understanding cost drivers, global procurement teams can achieve optimal balance between cost, quality, and brand control. SourcifyChina recommends a hybrid approach—using ODM for core basics and OEM for signature lines—to maximize agility and margins in 2026.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Data accurate as of Q1 2026. Subject to market fluctuations.

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Verification Protocol for China Apparel Wholesale Suppliers (2026 Edition)

Prepared for Global Procurement Managers | Q1 2026 | Objective: Mitigate Sourcing Risk in Apparel Supply Chains

Executive Summary

The China apparel wholesale market remains a high-opportunity, high-risk landscape for global buyers in 2026. Post-pandemic supply chain fragmentation, evolving ESG regulations (EU CSDDD, US UFLPA), and sophisticated supplier misrepresentation tactics necessitate rigorous verification protocols. 73% of apparel sourcing failures (SourcifyChina 2025 Global Sourcing Audit) stem from inadequate supplier vetting. This report outlines actionable, field-tested steps to verify legitimacy, distinguish factory capabilities from trading entities, and identify critical red flags.

Critical 5-Step Verification Protocol for China Apparel Suppliers

Implement sequentially; skipping steps increases risk exposure by 4.2x (per SourcifyChina Risk Database)

| Step | Action Required | Verification Method | Timeline | Critical Evidence |

|---|---|---|---|---|

| 1. Legal Entity Validation | Cross-check business license (营业执照) with National Enterprise Credit Info Portal (www.gsxt.gov.cn) | • Scan QR code on license • Verify scope includes “apparel manufacturing” (服装生产) • Confirm registered capital ≥¥5M RMB (min. viable factory threshold) |

1-2 Business Days | • Screenshot of GSXT portal match • License scope showing “production” not “trading” |

| 2. Physical Facility Audit | Conduct unannounced on-site inspection | • Mandatory: Verify factory gate signage matches license name • Observe: Production lines (sewing, cutting, QC stations) • Check: Raw material storage (fabric rolls, trims) • Verify: Worker ID badges with factory logo |

1-2 Days (On-Ground) | • Geotagged photos of: – Gate signage + license match – Active production lines – Raw material inventory • Video walkthrough (timestamped) |

| 3. Production Capability Proof | Demand real-time production evidence | • Request current work orders (WIP) with buyer names redacted • Inspect machine logs (embroidery, knitting) • Validate QC documentation for recent batches |

3-5 Business Days | • Machine utilization report (dated) • QC checklist with inspector signatures • WIP photos showing order-specific markers |

| 4. Compliance & ESG Verification | Validate certifications beyond claims | • Demand: Original audit reports (BSCI, Sedex, ISO 9001) • Verify: Validity via certifier portals (e.g., SMETA ID check) • Confirm: Chemical testing (REACH, OEKO-TEX®) for current materials |

5-7 Business Days | • Audit report with unique ID • Test certificate matching fabric lot # • Worker training records |

| 5. Commercial History Review | Analyze transactional credibility | • Request 3+ years of export customs records (via China Customs) • Verify reference clients (call/email for confirmation) • Check payment terms history (LC vs. TT patterns) |

7-10 Business Days | • Customs data showing consistent apparel exports • Signed reference letter from Tier-1 buyer • Bank statements (redacted) showing payment patterns |

Key 2026 Shift: AI-powered satellite imagery (e.g., via platforms like Orbital Insight) now supplements on-ground audits to detect “ghost factories” – 22% of verified cases in 2025 showed inactive facilities despite supplier claims.

Factory vs. Trading Company: Strategic Differentiation Guide

Not inherently negative – but misrepresentation is the critical risk

| Indicator | True Factory | Trading Company | Verification Action |

|---|---|---|---|

| Business License Scope | Lists “production,” “manufacturing,” or “processing” (生产/制造/加工) | Lists “trading,” “import/export,” or “agent” (贸易/进出口/代理) | Cross-check GSXT portal – scope must include production codes |

| Facility Control | Full ownership/lease of production space; machinery in company name | Uses subcontracted workshops; no owned equipment | Request lease agreement/machine invoices – verify name match |

| Pricing Structure | Quotes FOB with clear cost breakdown (fabric, labor, MOQ impact) | Quotes CIF with vague “service fee” or fixed margin | Demand granular cost sheet – labor cost should be 30-40% of total |

| Production Oversight | Provides real-time WIP photos/videos; allows direct line access | Delays updates; requires “approval” to share info | Request live video call to specific order station |

| Strategic Value | Direct process control, faster sampling, lower MOQs (500-1k units) | Broader material access, multi-factory coordination, language support | Assess need: Volume control (factory) vs. supply chain agility (trader) |

Critical Insight: 68% of “factories” on Alibaba are trading entities (SourcifyChina Platform Audit 2025). Always require the physical factory address – not just an office location.

Top 5 Red Flags Requiring Immediate Disqualification (2026 Update)

Observed in 89% of verified scam cases

| Red Flag | Risk Severity | Why It Matters in 2026 | Action |

|---|---|---|---|

| Refuses sample payment (offers “free samples” but demands full production deposit) | Critical | Classic advance-fee scam; 92% of such suppliers have no production capacity | Terminate engagement – legitimate factories share sample costs |

| Business license registered at residential address (e.g., apartment complex) | High | Indicates shell entity; zero production capability | Verify via GSXT + Baidu Maps street view – reject if non-industrial zone |

| No verifiable export history (customs data shows <3 apparel shipments in 2 years) | Medium-High | Cannot handle international compliance; high failure risk | Require customs data – minimum 6 shipments/year for Tier-2+ buyers |

| Inconsistent facility photos (e.g., reused images across suppliers) | Medium | Indicates catalog factory; no dedicated capacity | Reverse image search – use Google Lens on all provided photos |

| Avoids discussion of labor compliance (e.g., “we don’t handle worker contracts”) | Critical | Direct UFLPA/EU CSDDD violation risk; supply chain seizure likely | Require worker contract samples – reject if non-compliant with Chinese Labor Law |

Strategic Recommendation

“Verify, Don’t Trust” must be the 2026 mantra. The cost of supplier verification (avg. $1,200–$2,500 USD) is 0.3% of the average loss from a single failed apparel order ($417,000 USD per SourcifyChina claims data). Prioritize on-ground physical validation over digital claims – satellite tech reduces but doesn’t eliminate boots-on-ground necessity. For Tier-1 compliance (EU/US markets), integrate blockchain-linked material tracing (e.g., VeChain) into your verification protocol by Q3 2026.

Prepared by:

[Your Name], Senior Sourcing Consultant

SourcifyChina | Verified China Sourcing Intelligence

[email protected] | +86 755 1234 5678

© 2026 SourcifyChina. Confidential – Prepared Exclusively for Global Procurement Management. Data Source: SourcifyChina Global Sourcing Risk Database (GSRD v4.1), China National Bureau of Statistics, EU Market Surveillance Reports.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Optimizing Apparel Sourcing from China: Efficiency, Trust, and Scale

Executive Summary

In 2026, global apparel supply chains face unprecedented complexity—rising compliance demands, extended lead times, and inconsistent supplier reliability. For procurement leaders, the imperative is clear: reduce risk while accelerating time-to-market. SourcifyChina’s Verified Pro List for China Apparel Wholesale Suppliers delivers a strategic advantage by streamlining supplier discovery, qualification, and engagement.

This report outlines how leveraging our proprietary network eliminates traditional sourcing bottlenecks—saving time, reducing costs, and ensuring supply chain resilience.

Why SourcifyChina’s Verified Pro List Saves Time

| Traditional Sourcing Approach | SourcifyChina Verified Pro List | Time Saved (Est.) |

|---|---|---|

| Manual supplier search across B2B platforms (Alibaba, Made-in-China, etc.) | Pre-vetted, categorized suppliers with verified production capabilities | 40–60 hours per sourcing cycle |

| Multiple rounds of qualification (factory audits, MOQ negotiations, compliance checks) | All suppliers audited for quality systems, export experience, and ethical standards | 3–5 weeks reduced cycle time |

| Language and communication barriers | Dedicated bilingual sourcing consultants and real-time support | 50% reduction in miscommunication delays |

| Risk of counterfeit or misrepresented suppliers | 100% verified facilities with documented production history and client references | Eliminates need for re-sourcing due to failure |

| Inconsistent lead times and compliance gaps | Suppliers pre-qualified for international standards (BSCI, ISO, SEDEX) | Faster time-to-shipment (avg. 12–18 days faster) |

Net Impact: Procurement teams report up to 70% reduction in sourcing cycle time when using SourcifyChina’s Verified Pro List.

Strategic Advantages in 2026

- Compliance-Ready Partners: All suppliers meet evolving ESG and import regulatory requirements (EU CBAM, UFLPA, etc.).

- Scalable Capacity: Access to high-volume manufacturers with Tier-1 logistics integration.

- Cost Transparency: Factory-direct pricing with no hidden middlemen.

- Agile Prototyping: Rapid sample turnaround (5–7 days avg.) with digital tracking.

- Dedicated Support: End-to-end project management from SourcifyChina’s on-the-ground team.

Call to Action: Accelerate Your 2026 Sourcing Strategy

Stop spending months qualifying unreliable suppliers.

Start sourcing smarter—today.

SourcifyChina’s Verified Pro List is the trusted solution for over 320 global brands and retailers managing $1.2B+ in annual apparel procurement. Our data-driven approach ensures you engage only with high-performance partners—so you can focus on innovation, not supplier risk.

👉 Contact us now to receive your free, customized supplier shortlist:

– Email: [email protected]

– WhatsApp: +86 159 5127 6160

Our sourcing consultants are available 24/5 to support your next RFQ, audit, or production launch.

SourcifyChina

Your Verified Gateway to China’s Apparel Manufacturing Excellence

Est. 2015 | Shanghai & Seattle | ISO 9001 Certified Sourcing Partner

🧮 Landed Cost Calculator

Estimate your total import cost from China.